Recently, the General Department of Taxation recently issued Decision 1326/QD-TCT* approving the 2023 specialized inspection plan with a list of 42 enterprises subject to inspection in many different business fields, of which many especially businesses in the city. HCM and City. Hanoi.

Together Bizzi Find out the list of 42 businesses about to face tax disputes!

4 groups of businesses are subject to tax inspection

The Ministry of Finance issued Official Dispatch No. 10039/BTC-TTr on orientation and guidance on developing a financial inspection and examination plan in 2023. Below are businesses subject to tax inspection:

Businesses have large tax refunds

The Ministry of Finance has requested the General Department of Taxation to strengthen strict management of value-added tax refunds, in order to minimize policy profiteering causing losses to the state budget. To do this, information technology and Artificial Intelligence (AI) are applied to collate, check and manage invoice usage.

Enterprises in high-risk industries

Enterprises in high-risk industries such as oil and gas, petroleum, electricity, telecommunications, banking, securities, insurance, financial leasing, real estate, pharmaceuticals, infrastructure, Industrial parks, lottery companies, port service businesses, construction, production and trading of construction materials, enterprises exploiting and trading sand and gravel in river beds, gold mining, are all recognized by the industry. Enhance tax inspection according to the direction of the Ministry of Finance.

Enterprises have high risks regarding invoices, with signs of using illegal invoices

Enterprises that have risk information from customs authorities and enterprises that enjoy tax exemptions and reductions according to Tax Laws and Agreements are all subject to monitoring and inspection.

Enterprises with large tax revenues and related transaction activities

Groups, corporations, and companies that have generated large amounts of tax revenue or large-scale enterprises that have not been inspected or examined for many years are also subjects that need attention in inspection work. and tax audit.

In addition, tax inspection and examination will also focus on businesses with related transaction and transfer pricing activities; Enterprises incurring capital transfer, brand transfer, project transfer, division, merger; as well as businesses with loss-making business results for many years. The goal of the entire tax industry is to ensure correct, sufficient and timely collection of taxes, fees and other revenues to contribute to the state budget.

42 businesses will be subject to tax inspection in 2023

The General Department of Taxation has just issued Decision 1326/QD-TCT approving the 2023 specialized inspection plan for many businesses.

Specifically, based on Decision 970/QD-TCT dated July 14, 2023 on Tax Inspection Process, tax authorities select taxpayers to plan and conduct inspections at the taxpayer's headquarters. Tax payment will be based on the risk ranking results from high to low and will not overlap with taxpayers selected to be included in the inspection plan; Combined with consideration and selection of taxpayers who have not been inspected or tax audited for more than 5 years.

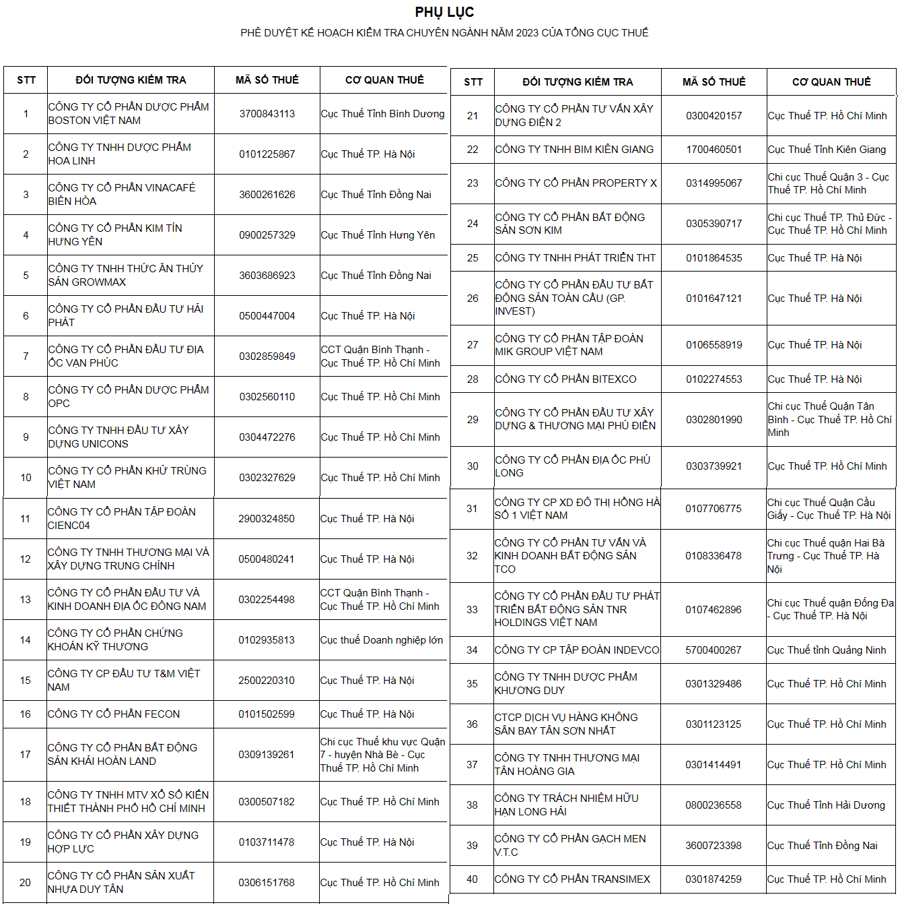

The General Department of Taxation recently issued Decision 1326/QD-TCT* approving the 2023 specialized inspection plan with a list of 42 enterprises subject to inspection in many different business fields, of which the most are businesses. career in the city. HCM and City. Hanoi.

* Effective date: August 30, 2023

In the field of real estate, there are names of a series of businesses such as Hai Phat Investment Joint Stock Company, Van Phuc Real Estate, Dong Nam Real Estate, Khai Hoan Land, TCO Real Estate Consulting and Trading Joint Stock Company...

A number of construction enterprises are also on this list including Vietnam's No. 1 Hong Ha Urban Construction Joint Stock Company, Unicons Construction Investment Company Limited, Cienco 4 Group Joint Stock Company, Trung Chinh Trading and Construction LLC, Hop Luc Construction Joint Stock Company, Electricity Construction Consulting Joint Stock Company 2…

In the field of pharmaceuticals and cosmetics, there are a number of businesses such as: Boston Vietnam Pharmaceutical, Hoa Linh Pharmaceutical Company Limited, OPC Pharmaceutical, Khuong Duy Pharmaceutical...

Customers can refer to the list of businesses subject to tax inspection here:

List of 42 businesses

Stages of tax inspection of 42 businesses

Tax authorities base on the results of risk analysis by applying information technology or risks from professional analysis and information from actual tax management work to determine the content and scope of inspection and examination. tax... Tax inspection at the taxpayer's headquarters will include two stages.

State 1

Before conducting an inspection at the taxpayer's headquarters, the procedure requires the issuance of an inspection decision. The decision on tax inspection at the taxpayer's headquarters must be sent to the taxpayer within a maximum of 3 working days from the date of issuance of this decision. In case the tax authority or department that does not directly manage the taxpayer performs an inspection, they must send a copy to the tax authority or department that directly manages the taxpayer, acting as the contact point for transfer. Go to relevant departments to perform inspection.

Before announcing the inspection decision, the inspection team leader must assign team members to perform the inspection according to the contents recorded in the inspection decision. This procedure ensures that testing is carried out systematically and effectively.

If during the inspection it becomes necessary, the inspection decision may be annulled, postponed, or suspended, or adjusted if it is proven that the declared tax amount is correct and the tax amount has been paid. payment is enough.

In case the taxpayer continues to operate business and make normal tax declaration but does not receive or intentionally avoids complying with the tax authority's inspection decision, the inspection team will make a record of the violation. according to the provisions of Article 15 of Decree 125/2020/ND-CP.

Based on the administrative violation record, the inspection team will report to the agency that issued the inspection decision to consider sanctioning administrative violations and applying tax management measures (if any). At the same time, tax-related steps will be implemented according to the provisions of Article 14, Article 15 and Article 16 of Decree 126/2020/ND-CP.

An administrative violation record must be made, and in case the violator or representative of the violating unit is not present, or intentionally evades or for objective reasons they do not sign the record, the record must be made. The copy must be signed by a representative of the commune or ward government at the place where the violation occurred, or at least one witness confirms. In case there is no confirmation from the authorities or witnesses, the specific reason for this situation should be clearly stated in the administrative violation record.

Phase 2

The inspection process at the taxpayer's headquarters includes the following tasks:

- Announcement of tax audit decisions

- Carry out inspection at the taxpayer's headquarters

- Prepare tax inspection records

- Processing inspection results at the taxpayer's headquarters

- Record audit logs

- Supervise the inspection team

- Monitor and urge implementation of post-inspection results

In cases where taxpayers and tax authorities both have databases and information technology applications to work via electronic transactions and work online, the inspection process can be carried out through electronic transactions. through these methods or combine different working methods, depending on the specific situation.

Follow Bizzi to quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam