Digital transformation is no longer just a technology story, but a complex problem. business cost management, cash flow, and the company's decision-making capabilities.

This article by Bizzi will help CFOs and leaders understand the true nature of digital transformation, what enterprise digital transformation is, see real-world examples of successful digital transformations in Vietnam, and know where to start to create real value.

What is digital transformation in business?

Digital transformation in businesses is a comprehensive restructuring of operating, management, and decision-making models based on data and digital technology, aiming to optimize costs, reduce risks, and enhance competitiveness – it's not just about installing software. From a financial management perspective, digital transformation in businesses cannot be simply understood as "buying more tools." The essence of digital transformation lies in changing how businesses operate and make decisions, in which technology only plays a activating role.

A true digital transformation model always includes four closely interconnected components: process, data, governance, and people. If a business only digitizes its data while maintaining its old processes, it is merely accelerating an inefficient system.

The ultimate goal of digital transformation is decision velocity – the speed and quality of decisions. When expense, invoice, and accounts receivable data are updated in real-time and seamlessly connected, CFOs no longer have to make decisions based on delayed reports or fragmented data.

In practical implementation, Bizzi acts as a decision-support system for finance and accounting. Instead of processing expenses, invoices, and accounts payable using multiple separate systems, Bizzi helps standardize all financial data into a unified flow, thereby creating a foundation for faster decision-making. and under control.

Understanding the concept correctly is the first step, but to avoid confusion during implementation, it's necessary to clearly distinguish what digital transformation in business is and how it differs from conventional digitalization.

See more articles about Resolution 68: Opportunity to cut 30% costs thanks to digital transformation and electronic invoices here

What is digital transformation in business and how is it different from digitalization?

Digital transformation in business involves using data and technology to change how businesses generate revenue, control costs, and make decisions; whereas digitalization only involves converting information from paper to digital form.

Three concepts are often confused:

- Digitization: Convert paper data to digital files.

- Digitalization: Digitize existing processes to work faster and with fewer errors.

- Digital Transformation: Change the way businesses operate and make decisions based on data.

The key lies in the output. Digitization generates data, but digital transformation creates value. When the business model doesn't change, KPIs aren't tied to finance and cash flowHowever, the deployment of the technology will not have a long-term impact.

At this level, Bizzi doesn't replace ERP – which excels at recording and accounting. Bizzi stands at the control and decision-making layer, where ERP often fails to address real-time issues: where costs are incurred, where risks lie, and when financial decisions need to be made.

Once the fundamentals are understood, the next question for leaders is always: what value does digital transformation bring to the business?

What value does digital transformation create for businesses?

Digital transformation helps businesses reduce operating costs, accelerate cash flow, control risks, and improve decision quality through real-time data and core process automation.

From a financial perspective, the greatest value of digital transformation is demonstrated through cash flow. When Accounts Receivable and Accounts Payable processes are digitized and automated, businesses can shorten turnaround times. DSO, optimize DPO and improve the Cash Conversion Cycle.

Recipe DSO = (Accounts Receivable / Revenue) × 365 This shows that simply shortening the collection period by a few days significantly improves cash flow. Similarly, the Cash Conversion Cycle directly reflects the financial performance of a business.

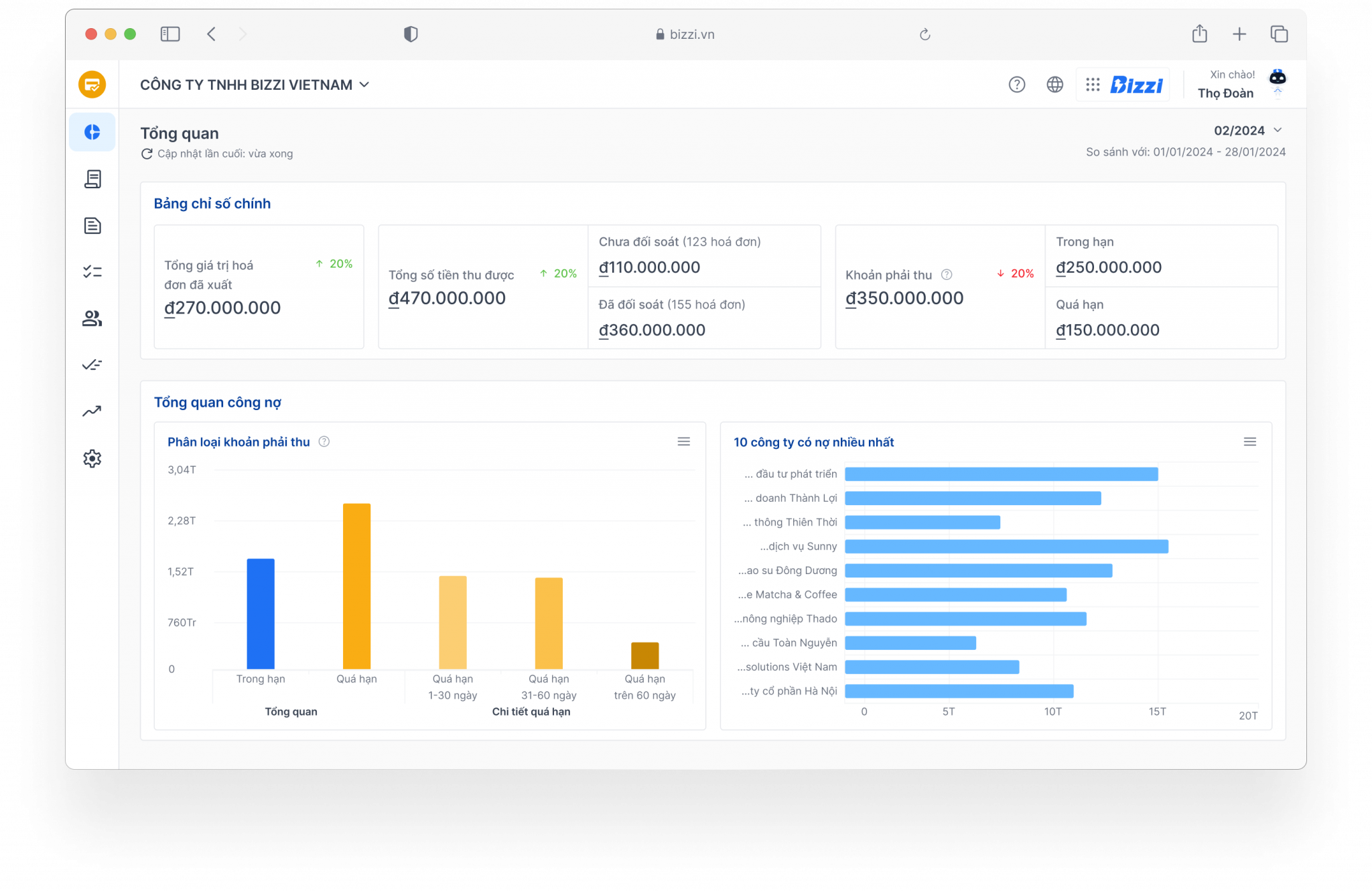

Bizzi assists CFOs in controlling these metrics through modules such as ARM and Expense. Accounts receivable are tracked by age, reminders are sent according to scenarios, and it connects directly with invoice data. On the expense side, Bizzi helps control costs before they arise, instead of dealing with them at the settlement stage.

Once the value proposition is clear, the next challenge is determining the right roadmap for digital transformation to avoid failure.

Standard three-stage roadmap for digital transformation in businesses.

Phase 1: Data Standardization – the Foundation of All Decisions

Target: Create Single Source of Truth for data that directly impacts money and risk.

Common business problems

- Expenses, invoices, and accounts payable are scattered across emails, Excel spreadsheets, ERP systems, and bank records.

- The same number can be interpreted differently by each department.

- Leaders make decisions based on data that lags behind by 2–4 weeks.

What should businesses do?

- Standardize the categories: supplier, cost center, project, cost type.

- Establish consistent recording rules (period, status, owner).

- Link data to the original document for traceability when needed.

Value created

- Reduce controversy over the data.

- Shorten the time it takes to finalize the numbers.

- This lays the groundwork for future dashboards and forecasts.

In practice, many businesses implement a layer of document collection and reconciliation (invoices, payment requests, accounts payable) before pushing data into a data warehouse or dashboard. Systems like Bizzi are often used at this stage to reduce discrepancies right from the input stage, rather than correcting errors at the end of the period.

Phase 2: Process automation – control before money leaves the business

Target: Reduce manual operations, prevent risks. before when expenses arise or payments are delayed.

Common problem

- Costs can only be controlled after they have been spent.

- Accounts receivable are tracked manually, and payment reminders are often delayed.

- Approval via email/Excel → bottlenecks, lack of audit trail.

What should businesses do?

- Automated workflow: expenditure proposal → approval → accounting → payment.

- Control by budget and limits, not just based on documents.

- Track accounts receivable by aging and collection scenarios.

Value created

- Reduce cost losses.

- Shorten DSO, control DPO.

- Reduce reliance on human memory.

At this stage, businesses often use Bizzi Expense to control expenses before they are incurred and Bizzi ARM to track accounts payable in real time. The key point isn't about "automating for speed," but rather... Control your finances before making a payment decision..

Phase 3: Rebuilding the governance and decision-making model

Target: Transform the controlled data into management signals for leaders.

What should businesses do?

- Build dashboards based on decision-making questions (not on existing data).

- Set up exception-based alerts.

- Connect Budget – Actual – Forecast for early forecasting.

Value created

- Leaders see the deviations early and intervene promptly.

- The CFO is shifting from a "reporting" to a "directing" role.

Once cost and liability data have been controlled in the earlier stages, the dashboard and FP&A become truly reliable. This is why many businesses implement dashboards after standardizing operational data across platforms like Bizzi, before connecting to EPM/FP&A.

Examples of digital transformation in businesses by department.

In reality, effective digital transformation programs rarely begin with pure technology. The majority of successful Vietnamese businesses start from scratch. departments where data, costs, and risks are most concentrated., especially in finance, accounting, and operations. These are the points of direct contact with cash flow, capital efficiency, and the CFO's ability to control.

An example of digital transformation in finance and accounting.

In the finance and accounting sector, digital transformation often begins with automating invoice processing, cost control, and accounts receivable management. Instead of manual data entry and end-of-period reconciliation, data is digitized from the outset, reducing errors and shortening closing times.

From a management perspective, CFOs are most concerned with whether financial data supports decision-making. Metrics such as DSO (Days Sales Outstanding), budget deviations, and document processing cycle time directly reflect the efficiency of financial operations. When these metrics are monitored in real time, CFOs can detect risks early instead of dealing with the consequences.

In this model, Bizzi acts as the input data control layer:

- Bizzi Bot automates the collection and standardization of invoice data, reducing reliance on manual entry.

- Bizzi Expense controls costs according to budget and cost centers right from the point of incurrence, limiting budget overruns at the end of the period.

- Bizzi ARM supports real-time tracking of accounts receivable and cash flow, enabling CFOs to proactively manage DSO instead of relying solely on past reports.

Digital transformation in finance and accounting therefore not only helps to "get things done faster," but more importantly, it helps to... Do it right from the start.This creates a reliable data foundation for IFRS, auditing, and financial planning.

Examples of digital transformation in sales and operations.

In sales and operations, digital transformation focuses on connecting data between market demand and internal capabilities. Businesses implement CRM, forecasting, and supply chain tracking systems to improve predictability and reduce operational delays.

When sales, inventory, and operational data are continuously updated, businesses can:

- More accurate demand forecasting

- Reduce unnecessary inventory.

- Minimize supply chain disruptions.

The key is linking operational data with financial data. When revenue, expenses, and inventory are viewed on the same data plane, CFOs and COOs can jointly assess performance instead of each department having its own separate report. This is the foundation for businesses to shift from departmental management to value-based management.

These departmental digital transformation approaches are not just theoretical; they have already been implemented. This is clearly demonstrated through the successful digital transformation of businesses in Vietnam., from manufacturing and finance to large-scale infrastructure.

Successful digital transformation businesses in Vietnam

Successful digital transformation businesses in Vietnam all begin by addressing specific management problems, implementing a clear roadmap, and measuring results using financial, operational, or customer experience KPIs – rather than simply investing in technology in a scattered manner.

Case 1: Vietnam Electricity Group (EVN) – Integrated Digital Transformation and Data Management

Vietnam Electricity Group (EVN) is implementing a comprehensive digital transformation program for the period 2021–2025 with clear objectives: To become a digital enterprise by 2025Given its unique role in operating national-scale infrastructure, EVN approaches digital transformation in the following way: Integration – Synchronization – Data-centric, instead of simply digitizing each step individually.

Digital transformation at EVN is being implemented simultaneously across the entire value chain, from internal management to production, business, and investment in construction, aiming to improve operational efficiency and the quality of public services.

EVN has identified five priority areas, with data and technology playing a fundamental role:

- Business & Customer Service: 100% electricity services are provided online at level 4, with approximately 90% customers conducting transactions on digital platforms. Cashless payments are widely implemented, helping to reduce operating costs and enhance user experience.

- Electricity production and grid operation: EVN has digitized all transmission grid equipment and more than 80% 110kV grids. AI, IoT, and drone technologies are being applied to monitor, inspect, and repair, thereby enhancing the safety and reliability of the power system.

- Internal management: The e-office system, digital signatures, and digital human resource management platform have been implemented across the entire corporation, helping to standardize processes and increase transparency in governance.

- Construction investment: Projects are managed in a digital environment, and EVN is stepping up investment in unmanned substations to reduce long-term operating costs and improve control capabilities.

- Telecommunications – IT: Information technology infrastructure is developed as a core platform, supporting seamless data connectivity between member units and the operating system.

Thanks to the implementation of integrated and large-scale digital transformation, EVN has achieved many important results:

- Improving the operational efficiency of the national power grid.

- Significantly improve the quality of customer service.

- Reduce reliance on manual processes in management and investment.

- Enhance the ability to monitor, analyze, and make data-driven decisions.

EVN is recognized as one of the pioneering and most outstanding state-owned enterprises in digital transformation.This demonstrates that even large, complex organizations can successfully transform when they have a clear data strategy and implementation roadmap.

Case 2: Rang Dong – Transforming Production and Data Platforms

Since 2020, Rang Dong Light Bulb and Thermos Flask Joint Stock Company has embarked on its digital transformation journey with a clear objective: Break away from the traditional manufacturer model and reposition yourself as a high-tech enterprise.Digital transformation at Rang Dong is not being implemented as a single IT project, but rather as a whole. comprehensive restructuring strategy, closely linked to long-term growth and competitiveness.

Instead of fragmented digitalization, Rang Dong chose a systematic approach, focusing on its data platform and core technology capabilities:

- The "dual transformation" strategy (Digital and Green): Combining digitalization in production and management with a sustainable development orientation, focusing on energy-saving and environmentally friendly products.

- The 6-step transformation roadmap: Step-by-step modernization of infrastructure, standardization of processes, enhancement of R&D capabilities, and application of technology throughout the entire value chain.

- Building an ecosystem of smart solutions: Developing Smart Home, Smart City, and Smart Farm platforms based on GS-HCL lighting technology, expanding the role of data from factories to urban areas and daily life.

- Collaborating with major technology partners: Collaborating with Viettel Solutions to modernize digital infrastructure, ensuring scalability, security, and data interoperability.

Digital transformation at Rang Dong has yielded clear results in both operations and business:

- Revenue retention sustained high growth during the period 2020–2023

- In 2023 alone, Revenue increased by more than 20% compared to 2022

- The company has set the following goals for 2030:

- Revenue achieved 25,000 billion VND

- Average income 2,000 USD/person/month

Currently, Rang Dong is continuing to restructure its governance model in the following direction: data-centric and artificial intelligence (AI)Data not only serves for reporting, but also becomes the foundation for production decisions, product development, and ecosystem expansion.

From a traditional manufacturing business, Rang Dong is gradually transforming itself into... Vietnamese technology companieswhere growth is driven by data, technology, and long-term innovative thinking.

Case 3: VPBank – Data Banking and Digital Products

VPBank is one of the pioneering banks in digital transformation in Vietnam, with a clear direction: Building a bank that operates on data and technology.Instead of simply digitizing the transaction channel, VPBank was honored in 2025 as... Outstanding digital transformation businesses At the Vietnam Digital Awards, recognition was given for a well-structured and in-depth digital transformation strategy.

Instead of focusing solely on digital banking applications, VPBank chose to Simultaneously transform products, operations, and labor productivity., based on artificial intelligence and big data.

VPBank's digital transformation journey revolves around leveraging data to optimize user experience and operational efficiency:

- AI applications and the GenAI ecosystem (ezGenAI): VPBank has developed its internal GenAI platform, applying conversational artificial intelligence (CAIP) in customer service. As a result, response times have been shortened from approximately 15 minutes to just 6–10 seconds, while employee productivity has increased by 20–30%.

- VPBank NEO digital banking platform: VPBank NEO serves as a comprehensive digital transaction platform, allowing customers to open accounts online (eKYC) and conduct most financial transactions without visiting a branch.

- Digital transformation in the business-to-business (B2B) segment: Digital banks are deeply digitizing the financial processes for businesses, from opening accounts and transactions to granting credit. Flexible product packages are designed, including attractive account numbers, free transactions, high-limit corporate cards (up to 500 million VND), and quick unsecured loan packages.

- Automate and personalize operations: VPBank utilizes Big Data and Cloud technologies for internal management, process automation, and personalized customer experiences based on real-world behavior and needs.

VPBank's digital transformation strategy has yielded many clear benefits:

- Optimize operating costs and reduce manual tasks.

- Enhance the customer experience across both personal and business channels.

- Increase labor productivity and resource utilization efficiency.

- Strengthening its position among the leading dynamic and financially stable banks in Vietnam.

Digital transformation at VPBank goes beyond application development, aiming for a data-centric banking model where technology and AI support decision-making, product design, and risk management. This is the foundation that helps VPBank maintain its innovation pace and competitiveness in the long term.

In summary, the examples of successful digital transformation businesses in Vietnam mentioned above all share a commonality: they are not about "applying a lot of technology," but rather about applying technology to solve real-world problems and measuring effectiveness using financial/operational KPIs.

What are some frequently asked questions about digital transformation in business?

Below is a summary of frequently asked questions related to the content of digital transformation for businesses.

Is digital transformation for businesses expensive?

Costs depend on scope and roadmap. Properly planned DX (Dynamic Development Plan) leads to long-term cost savings through reduced waste and improved cash flow.

How can we measure the ROI of accounting automation?

ROI is measured by reducing cycle time, minimizing errors, and improving metrics such as DSO, DPO, and working capital.

Is ERP sufficient for financial digital transformation?

ERP is necessary but not sufficient. Businesses need additional layers of control and decision-making, like Bizzi, to handle real-time processes.

Does DX help businesses get loans more easily?

Transparent financial data and a clear audit trail help businesses improve their credibility with banks.

Conclude

Understanding what digital transformation in businesses truly is helps companies avoid a common mistake: investing in technology without creating value. Analyzing examples of digital transformation in businesses reveals that the essence of digital transformation lies not in the software itself, but in how businesses make data-driven decisions.

Examples of digital transformation in Vietnamese businesses reveal a clear common thread: whether in manufacturing, retail, banking, or public services, digital transformation always begins at the most fundamental bottlenecks – where costs are incurred, risks accumulate, and cash flow is directly affected. Therefore, finance and accounting is not just one department involved in digital transformation, but often the central axis of the entire process.

Throughout this journey, Bizzi has played a particularly important role for accountants at the operational level and CFOs at the management level. By standardizing, automating, and connecting financial data, Bizzi helps businesses transform digital transformation from a slogan into a real competitive advantage.

- Standardizing expense, invoice, and accounts receivable data into a single source creates the foundation for a data-driven organization.

- Automate core financial processes such as invoice processing, expense control, accounts receivable reconciliation, and 3-way matching, thereby reducing errors and shortening cycle time.

- Connecting financial data with management metrics such as DSO, DPO, and Cash Conversion Cycle helps CFOs directly monitor the impact of operations on cash flow.

- Maintaining a continuous audit trail supports compliance, accountability, and enhances credibility when working with tax authorities, auditors, or banks.

More importantly, Bizzi doesn't replace human roles in digital transformation, but rather frees accountants from manual tasks to focus on analysis, while providing CFOs with a true decision-support system. As a result, digital transformation in business goes beyond simply "digitizing processes," becoming a long-term competitive advantage.

To receive personalized solutions tailored to your business, register here: https://bizzi.vn/dang-ky-dung-thu/