During the operation process, many individual business households or individual business households have encountered difficulties in declaring and paying taxes. Some common misunderstandings seem small, but if not handled promptly, can lead to serious consequences such as: be subject to tax arrears, late payment penalties, or business suspension.

The article below will show 5 typical misconceptions, and at the same time provide solutions to help businesses proactively prevent risks.

1. Assuming that there is no need to pay tax if revenue is less than 100 million VND/year

Many businesses, especially small businesses, believe that revenue is all they need. under 100 million VND/year then no need to declare or pay any taxesHowever, such understanding is incomplete and can easily lead to risks in tax audits.

As prescribed in Article 3, Circular 40/2021/TT-BTC, business individuals with revenue of 100 million VND/year or less Areas not required to pay VAT and personal income tax, but does not mean exemption from all tax obligations.

If an individual has multiple businesses, the revenue will be cumulative to determine the threshold of 100 million VND. In addition, in some special cases such as doing business through e-commerce platforms, with revenue from many different locations, the tax authority has the right to apply actual revenue estimates to check

Potential risks:

- Subject to VAT and personal income tax arrears: If the tax authority discovers that the actual revenue of a business household exceeds the threshold of 100 million VND (whether from one or more sources), you will be charged the resulting tax.

- Penalties for false declaration: Even if unintentional, misidentifying your taxable income can result in you being penalized for filing a false report.

Solutions for business households:

- Determine taxable revenue accurately and completely: Calculate the revenue from all the businesses you are involved in.

- Total revenue from all sources: If you have multiple sources of income, add them up to determine the correct revenue threshold of 100 million VND.

- Keep records and store documents carefully: Fully recording sales transactions and storing invoices and documents will be important evidence when tax authorities inspect.

2. Only calculate revenue based on actual amount collected (after discount, rebate)

Some business households think that they only need to declare the revenue part. net of discounts and promotions is sufficient – similar to the accounting method of a regular business.

According to Article 2, Circular 40/2021/TT-BTC, taxable revenue is the total amount of goods and services sold according to selling price before discount. Meaning:

- Taxable revenue is the value on the output invoice or contract: Regardless of how much money you actually receive.

- Promotions must comply with the provisions of the Commercial Law: If the promotion is not implemented properly, the discounts may not be accepted for tax purposes.

Potential risks:

- Tax authorities determined higher revenue: The tax authority will base on the listed price or the selling price on the invoice to determine revenue, resulting in you being charged tax on the discounted revenue.

- Penalties for late payment and false declaration: If this situation persists over multiple filing periods, you may be subject to penalties for late filing and incorrect tax filing.

Solutions for business households:

- Clearly account for discount programs: When there is a promotion, make sure there are full contracts, valid coupons and clear accounting.

- Declare revenue according to listed price or invoice price: Always declare the correct original price of products and services, without deducting discounts when calculating tax.

3. Arbitrarily declaring a tax rate lower than the prescribed rate

Many businesses do not clearly understand the tax rates applicable to each field, so self-reported experience or refer to unofficial information, leading to incorrect tax declaration.

Circular 40/2021/TT-BTC clearly stipulates VAT and personal income tax rates for each industry. For example:

- Food service: VAT 3%, PIT 1.5%

- Sales of goods: VAT 1%, PIT 0.5%

- Services without accompanying goods: VAT 5%, PIT 2%

Arbitrarily applying the wrong tax rate, even without intentional fraud, is considered an act. false declaration and may be subject to prosecution and penalties.

Potential risks:

- Tax difference to be collected: The tax authority will proceed to collect the outstanding tax due to the incorrect application of the rate during the period of operation.

- Penalties for false declaration and late payment: You will be fined from 10% to 20% on the incorrect tax amount, plus interest for late payment of tax.

Solutions for business households:

- Compare actual industries with the list in Circular 40: Please accurately identify your business line and compare it with the corresponding business line list in the appendix of Circular 40.

- Notify tax authorities when there is a new business line: If you start a new business, notify the tax authorities for guidance on applicable tax rates.

- Regularly update new tax policies: Be proactive in monitoring and updating the latest tax legal documents to avoid applying mistakes or outdated information.

4. Doing business through multiple channels but only declaring 1 source of revenue

In the digital age, many businesses not only have traditional stores but also expand their sales activities through online channels such as social networks and e-commerce platforms. Some people mistakenly believe that declaring revenue from one of these channels is enough, or that e-commerce platforms are responsible for paying a portion of the tax.

However, according to Decree 126/2020/ND-CP and Circular 40/2021/TT-BTC:

- Tax authorities have the right to collect information from many sources: Including e-commerce platforms, banks, e-wallets, shipping units and other stakeholders.

- All revenue from all channels must be fully declared: Whether it is cash, bank transfer, cash on delivery (COD) or revenue from e-commerce platforms, all must be recorded and declared.

- Tax deduction by e-commerce platforms only applies to some cases: And does not completely replace the individual's obligation to declare and pay taxes.

Potential risks:

- Data reconciliation and discrepancy collection: Tax authorities can easily compare data from different sources and spot discrepancies in your declared revenue.

- Severe penalties if found guilty of tax evasion: If you are found to have intentionally understated your revenue, you may be subject to heavier penalties and be found guilty of tax evasion.

Solutions for business households:

- Record total sales revenue from all channels: Track and record all sales from your brick-and-mortar stores, online sales channels, social media, and e-commerce platforms.

- Regularly check with stakeholders: Compare your recorded revenue with information from shipping carriers, payment platforms, and banking data to ensure accuracy.

5. Not understanding the regulations on deduction and tax refund when having input invoices

Another misunderstanding that many business households have is that they have the right to deduct VAT or claim a refund on input invoices (for example, invoices for purchasing raw materials, renting premises, etc.) similar to enterprises.

However, according to current legal regulations:

- Business households declaring tax according to the lump-sum method are not allowed to deduct VAT. The lump sum method is a form of tax payment based on a fixed revenue and tax level determined by the tax authority.

- VAT refund only applies to organizations or individuals who declare tax using the deduction method. and must meet certain conditions.

- In many cases, input invoices of business households are only counted as business expenses. to determine taxable income for personal income tax, but does not have the effect of directly reducing VAT liability.

Potential risks:

- Wrongly recording expenses and arbitrarily deducting input tax: Arbitrary deduction of VAT when not qualified will be excluded by tax authorities during inspection.

- No effective financial control: Misunderstanding the nature of taxes can lead to you not properly assessing your business performance.

Solutions for business households:

- Clearly distinguish the tax declaration form currently applied: Determine whether you are filing your taxes using the lump sum method or the bookkeeping method.

- Do not arbitrarily deduct VAT if you are not subject to: Only businesses that declare using the deduction method have this right.

- Use input invoices to manage costs: Instead of trying to reduce your VAT liability, use input invoices to track and manage business expenses effectively.

Businesses need to proactively improve their understanding of taxes to avoid risks.

Tax arrears and administrative penalties not only affect cash flow and business costs, but also create unnecessary problems with tax authorities. Most errors often stem from a lack of understanding or access to unofficial information about tax obligations.

To proactively avoid these risks, businesses should:

- Regularly update the latest legal documents on tax.

- Learn carefully about the form of tax declaration and payment appropriate to your business line.

- Ensure full declaration of revenue from all sales channels.

- Record and store invoices and documents clearly and carefully.

- Proactively consult professional tax or accounting advisors with any questions.

Business support solutions: B-invoice and Bizzi

To minimize tax risks and improve invoice management efficiency, business households and small businesses can use specialized support tools such as:

1. B-invoice electronic invoice system: Comprehensive solution for issuing and managing invoices

In the context of strong digital transformation and the application of electronic invoices becoming an inevitable trend, B-invoice B-invoice has emerged as a comprehensive electronic invoice system, designed to meet all the needs of issuing, managing and checking invoices of business households and small businesses. B-invoice not only fully complies with the standards and regulations of the General Department of Taxation but also brings many superior features, helping to simplify accounting processes and improve operational efficiency.

Outstanding features of B-invoice:

- Issue valid electronic invoices, quickly and easily: With an intuitive and user-friendly interface, B-invoice allows users to quickly create and issue electronic invoices with just a few simple steps. The system supports a variety of invoice templates according to regulations, and also allows businesses to customize their logos and some displayed information to increase brand recognition.

- Automatically synchronize data with accounting software: B-invoice has the ability to integrate and synchronize data smoothly with popular accounting software on the market such as MISA, FAST, helping accountants save data entry time and minimize errors in the data reconciliation process.

- Store invoices securely and easily: All electronic invoices issued via B-invoice are securely stored on a standard server system, ensuring data security and integrity. Users can easily look up, search and issue invoices according to various criteria such as time, invoice number, customer name, tax code, etc.

- Sign directly on the invoice: B-invoice integrates the feature of digital signature directly on the invoice, making the invoice issuance process faster and more convenient than ever. Users can use USB Token or remote digital signature depending on their needs.

- Send electronic invoices to customers via email/SMS: Once issued, e-invoices can be sent directly to customers' email addresses or phone numbers quickly and professionally, saving printing and shipping costs.

- Summary report on invoice usage: The B-invoice system provides detailed summary reports on invoice usage, helping businesses easily monitor, manage and make more effective business decisions. Reports include the number of invoices issued, invoice status, revenue over time, etc.

- Manage customer information and products/services: B-invoice allows users to manage customer lists and product/service categories scientifically, making the invoice creation process quick and consistent.

- Support multiple payment methods: B-invoice can integrate with many online payment gateways, facilitating customers in payment and helping businesses recover debts quickly.

With the above outstanding advantages, B-invoice is not only a simple tool to support the issuance of electronic invoices but also a comprehensive solution to help business households and small businesses optimize the invoice management process, save costs and ensure compliance with legal regulations on electronic invoices.

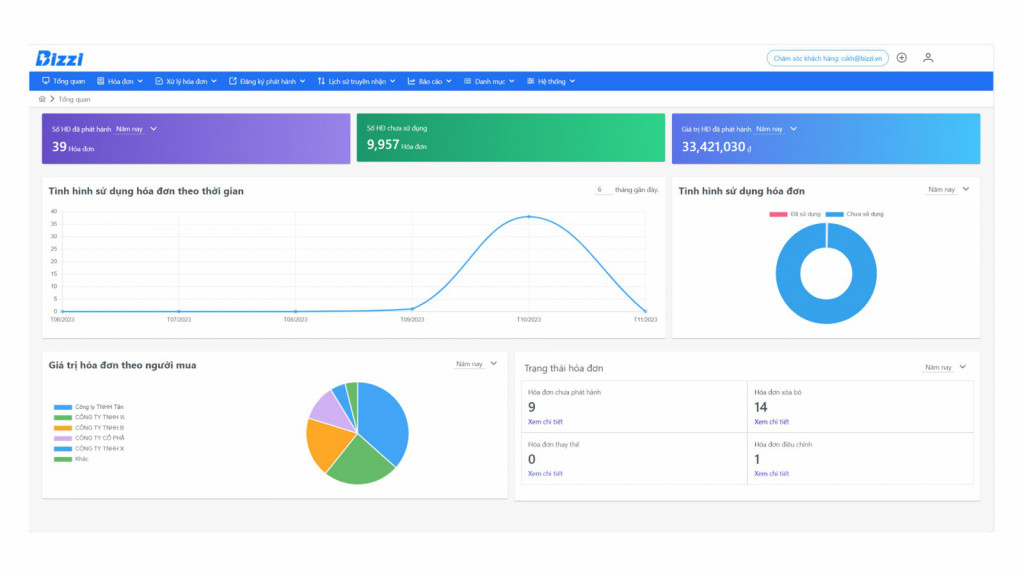

2. Bizzi input invoice processing solution: Automate accounting processes and cost control

Bizzi is the first automated input invoice processing platform in Vietnam, applying artificial intelligence (AI) to provide a smart solution, helping businesses and small businesses thoroughly solve the difficulties in managing purchase invoices. Bizzi not only helps save time and effort for accountants but also improves the accuracy, transparency and cost control of businesses.

Bizzi's outstanding features:

- Automatically read and extract data from invoices (PDF/XML): With advanced AI technology, Bizzi is capable of automatically identifying and extracting important data from input invoices in various formats (PDF, XML), completely eliminating time-consuming and error-prone manual data entry.

- Compare information with supplier data and accounting systems: Bizzi automatically compares invoice information with stored supplier data and data in the business's accounting system, helping to detect discrepancies early and ensure information consistency.

- Warning about duplicate invoices, incorrect tax codes, invalid invoices: The Bizzi system is equipped with smart algorithms to detect duplicate invoices, invoices with incorrect tax codes or other invalid signs, helping businesses avoid tax risks and legal issues.

- Connect API with popular accounting systems (MISA, FAST, ...): Bizzi has the ability to easily connect and integrate with popular accounting software such as MISA, FAST and many other systems via API, helping to automatically transfer input invoice data into accounting books quickly and accurately.

- Centralized storage and real-time invoice tracking: All incoming invoices after being processed through Bizzi will be centrally stored on a secure cloud platform, allowing users to easily access, search and track the status of each invoice in real time.

- Cost analysis report: Bizzi provides detailed analysis reports on input costs, helping businesses have a more comprehensive and in-depth view of their cost structure, thereby making more effective financial management decisions.

- Strengthening internal control capabilities: With Bizzi, all input invoices are recorded, controlled and approved according to a clear process, helping to increase transparency and responsibility in business cost management.

Bizzi is not only an invoice processing tool but also a powerful assistant that helps businesses and small businesses optimize accounting processes, effectively control costs and minimize risks related to input invoices. This is an indispensable solution in the digital transformation journey and enhances the competitiveness of businesses in the current context.

In short, in the context of invoice management becoming increasingly important and complex, the application of technological solutions such as the B-invoice electronic invoice system and the Bizzi input invoice processing solution not only helps businesses and small businesses comply with legal regulations but also optimizes financial management processes, saves time, minimizes errors and improves overall business performance. Discover and leverage the power of technology to take your business to the next level.