In a volatile economic environment, the role of the Chief Financial Officer (CFO) has become more important than ever. They are not only the “keeper of the keys”, but also the strategist, the one who steers the financial ship of the enterprise through the storms. Inflation, fluctuating interest rates, unpredictable markets… all pose significant challenges to the set a budgetSo how can CFOs build flexible budgets, ensure resilience, and drive growth during uncertain times?

Join Bizzi to explore budgeting strategies for CFOs in the article below!

1. Budgeting Strategy: Understanding the Economic Pulse

Before embarking on budgeting, it is essential that CFOs grasp the big picture of the economy. This requires a keen sense of analyzing macroeconomic trends, from interest rates and inflation to technological breakthroughs such as AI. According to a survey by Deloitte, the biggest “ripples” that CFOs are concerned about today are geopolitics (56%) and the general economic situation (41%). Accurately predicting the impact of these factors on business operations will help CFOs make informed strategic decisions.

Understanding the current economic environment is more than just crunching numbers and forecasting. It is about building a system of continuous monitoring and analysis, keeping up with the latest developments and assessing their impact on the business. CFOs need to build strong relationships with economists, research organizations and reliable sources of information to get a comprehensive and multi-dimensional view.

This also means that businesses need to pay attention to market fluctuations that can affect supply chains, customer behavior, and other factors.

2. Flexible Thinking: Set up an “adaptive” budget

In a world of constant change, rigid, year-end budgets are becoming obsolete. CFOs need to build flexibility into their financial frameworks to quickly adapt to unexpected changes. Monthly or quarterly forecasts, along with robust contingency plans, will help businesses be more proactive in adjusting spending, reallocating resources, and seizing new opportunities. According to Gartner, 72% CFOs prioritize budget flexibility to respond to a volatile economy.

Agility is not just about adjusting the numbers in the budget, but also about building a flexible budgeting process that allows the business to quickly adapt to changes. This requires close coordination between departments, continuous communication, and the ability to make quick decisions. Agile budgeting tools and technologies, such as financial planning software and data analytics, also play an important role in helping CFOs manage budgets effectively during uncertain times.

3. Combine “synergy”

Choosing between a top-down and bottom-up budgeting approach can have a major impact on resource allocation. The top-down approach helps ensure that the budget is focused on the organization’s strategic goals, but may overlook the specific needs of individual departments. Conversely, the bottom-up approach provides a more detailed view, but can be time-consuming and can easily lead to departments requesting too many resources.

The optimal solution is to combine both methods, ensuring both strategic and detailed information from the grassroots.

Combining these two approaches requires balance and close coordination between departments. CFOs need to establish a clear budgeting process that allows departments to participate in decision-making while ensuring that these decisions are aligned with the organization’s strategic goals. Transparency and mutual trust are key to ensuring the success of this approach.

4. Data “weapon” in hand

In the digital age, data has become a “gold mine” for CFOs. Organizations that know how to effectively utilize data in budgeting can achieve a profit increase of 5-6%. Advanced data analysis tools help CFOs quickly analyze information and make informed financial decisions.

Effective use of data requires CFOs to build a comprehensive and reliable data system. This includes collecting, processing and analyzing data from a variety of sources, while ensuring the accuracy and security of the data. CFOs need to invest in modern data analysis tools and technologies, and build a team of experts capable of effectively exploiting and analyzing data.

5. “Collective strength” from every department

Budgeting is not just the job of the CFO or the board, but a shared responsibility of the entire organization. In times of uncertainty, the people who carry out day-to-day operations are the most valuable resource. Encouraging open communication across departments will provide a holistic view of resource needs, as well as potential risks and opportunities. Research shows that collaboration can increase sales by up to 27%, demonstrating the enormous benefits of integrating information from all levels of the organization.

Creating an open and participatory work environment is a prerequisite for successful budgeting. CFOs should hold regular meetings, discussions, and group activities to provide opportunities for everyone to share their opinions and contribute ideas. Transparency and trust are key to ensuring the success of this approach.

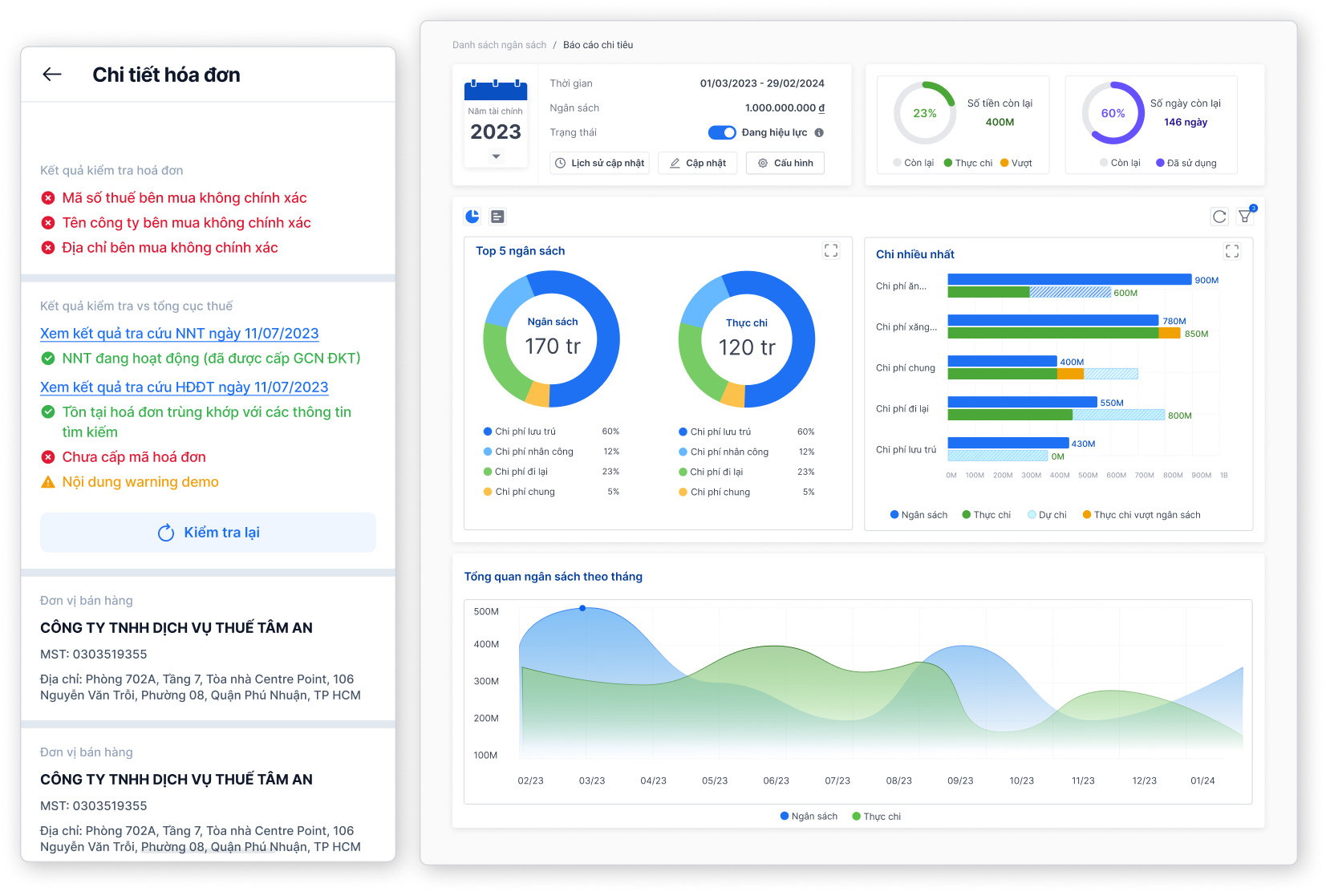

Bizzi Expense: Optimize budgeting and control

In the context of increasingly complex businesses requiring tight cost management, Bizzi Expense was born as a comprehensive solution, helping businesses develop a budgeting strategy to optimize spending and save time. With Bizzi Expense, CFOs can:

Flexible budget planning:

- Bizzi Expense offers a smart budget planning tool, allowing CFOs to build different budget scenarios based on different economic assumptions.

- Easily track differences between budget and actual spending, allowing for timely adjustments when necessary.

Tight control of spending:

- Bizzi Expense digitizes the expense approval process, ensuring all expenses are controlled within the approved budget.

- Automated alert systems help CFOs detect and prevent over-budget spending.

- Helps to allocate cash flow in and out based on budget, estimated expenditure and actual expenditure in detail.

Integrates with existing systems: Bizzi Expense easily integrates with your business's existing systems, simplifying your expense management process and saving you time.

With Bizzi Expense, CFOs can improve budgeting and control efficiency, thereby making accurate financial decisions and optimizing business performance.

Budgeting in uncertain times is a major challenge for CFOs, requiring strategic vision and the ability to adapt. By understanding the economic environment, building agility, leveraging the power of data, and engaging all departments, CFOs can lead their businesses through the storm and create sustainable success.

The role of the CFO today is not just about managing the numbers, but also about empowering teams to act strategically. A budget built on collaboration and collective responsibility will be a solid “launch pad” for the growth of the business. The CFO needs to be a leader, an inspiration, and someone who brings people together to achieve a common goal.