When using accounting ERP software, there are some important notes to ensure efficiency and avoid risks. These include: Clearly define the needs and goals of the business when using ERP, then choose a reputable and experienced supplier.. Training of personnel using the software is also important to ensure smooth implementation and operation.

This article by Bizzi will point out important notes when using ERP Accounting software so that businesses can make the most appropriate choice.

What is ERP Accounting Software?

Software ERP Accounting is an important module within the overall enterprise resource planning (ERP) system. Its core function is to manage the organization's finances and accounting activities effectively.

In any business, almost all activities and operations arising in the production and business process are closely related to finance and accounting, so this subsystem plays a key and vital role.

The highlight of accounting ERP software is the data connection and synchronization; ensuring the accuracy and synchronization of financial information. Data is synthesized and updated quickly, in real-time, providing a panoramic view and helping the management make timely and accurate decisions.

Main functions of accounting ERP software

Accounting ERP software optimizes and automates many important financial operations, providing a centralized platform for efficient cash flow and process management. Key features include:

- Ledger Management: The software supports the maintenance of a centralized general ledger that serves as a platform for recording and tracking all of an organization's financial transactions. This functionality allows for the creation of multiple accounts, journal entries, and provides real-time visibility into financial status.

- Cost and budget control:

- Set up budgets by department or project to control spending.

- Monitor actual spending against allocated budget and automatically alert when overspending.

- Automatic and flexible spending approval system by level, department or spending type, helping to speed up the request approval process.

- Track expenses in real-time and generate detailed reports on spending by category, department, or project.

- Establish and enforce spending policies to ensure compliance with company regulations.

- Business expense management (Bizzi Travel): Supports automatic flight booking, manages business expenses (hotel, transportation, food), sets spending limits and approves business trips in advance. Automatically records ticket bookings in business expenses and warns when exceeding budget.

- Allow employees to submit expense requests before expenses are incurred and track request status.

- Ability to attach spending to specific projects or tasks for easy tracking and reporting.

- Invoice processing and management:

- Automatically process incoming invoices using RPA and AI technology to upload, check and reconcile invoices.

- Automatically reconcile invoice details with purchase orders (POs) and warehouse receipts (GRs) in real time to detect discrepancies.

- Verify the supplier is valid by checking the tax code and status of operation on the tax system.

- Automatically record and store input invoices with a minimum storage period of 10 years.

- Warning of risky invoices from suppliers showing signs of abnormality.

- Create electronic invoices according to tax authority regulations (XML/PDF format) and allow customizing invoice templates.

- Support mass invoice issuance and direct connection to tax authority system to authenticate invoices.

- Easily look up invoices by multiple criteria and manage invoice status (issued, sent, paid, canceled or adjusted).

- Integrate API with ERP & Accounting systems to synchronize data.

- Debt management:

- Monitor and reconcile accounts receivable, including key metrics like days sales outstanding (DSO) and debt aging reports.

- Automatically record and track debts of each customer and supplier.

- Provides alerts when debt is nearing maturity or shows signs of being overdue.

- Create an automated debt reminder process based on a scenario via email or text message.

- Reconcile debts and create detailed reports on the business's debt situation.

- Fixed asset management: The system helps track detailed information about each asset from acquisition to disposal, including purchase date, original value, supplier, location, usage status, and maintenance history. The software automatically calculates asset depreciation using different methods and helps plan maintenance effectively.

- Tax management: Simplify tax-related procedures by automatically calculating taxes payable based on real-time transaction data. The system also helps businesses stay up to date with the latest tax law changes.

- Multi-currency, multi-company support: For businesses operating internationally or with multiple branches, the software supports recording transactions in multiple currencies, automatically accounting for exchange rate differences and generating consolidated financial reports for the entire group.

- Financial reporting and analysis: Automatically aggregate financial data, analyze it, and generate detailed, comprehensive reports such as balance sheets, income statements, and cash flow statements. Real-time data analysis combined with visualization tools helps managers make decisions based on accurate and reliable data.

Benefits of using ERP Accounting Software

Applying ERP accounting software brings many benefits. benefit significant for businesses, specifically:

- Optimize accounting processes: Significantly reduce errors due to manual data entry and automate many operations such as revenue and expenditure accounting, customer debt reconciliation, and integrated invoice issuance functions. This helps save time and operating costs, while reducing pressure on accounting staff, helping them focus on control work instead of data entry.

- Automatic data linking, increased accuracy: Accounting software in the ERP system has the ability to automatically connect data with all departments, ensuring accuracy and synchronization of financial information across the system.

- Real-time management report updates: With centralized management data, financial reports, cash flow forecasts and other management reports are automatically updated in detail. This allows managers to view reports at any time, supporting quick decision making.

- Easily compare, review and alert budgets: All information is aggregated on one system to save time in data reconciliation and comparison, early detection of errors for timely updates. The software also provides budget warnings when transactions exceed the allowed limit.

- Support for effective business strategy: Provides tools for planning, budgeting, and forecasting based on available data, making it easy for administrators to manage and adjust financial plans, forecast financial fluctuations, and manage organizational budgets.

- Higher data security: ERP provides a full range of administrative functions on a single system, minimizing the need for third-party integration, thereby ensuring better information security. These systems often have strict security layers and hierarchical authorization forms to prevent unauthorized access and information leakage.

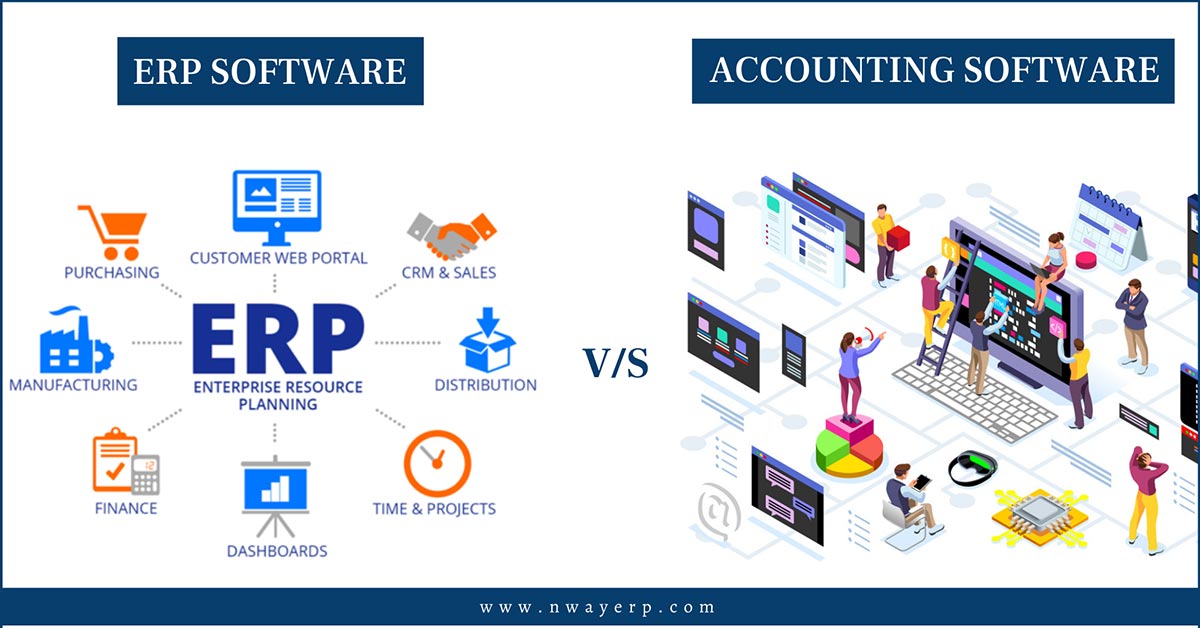

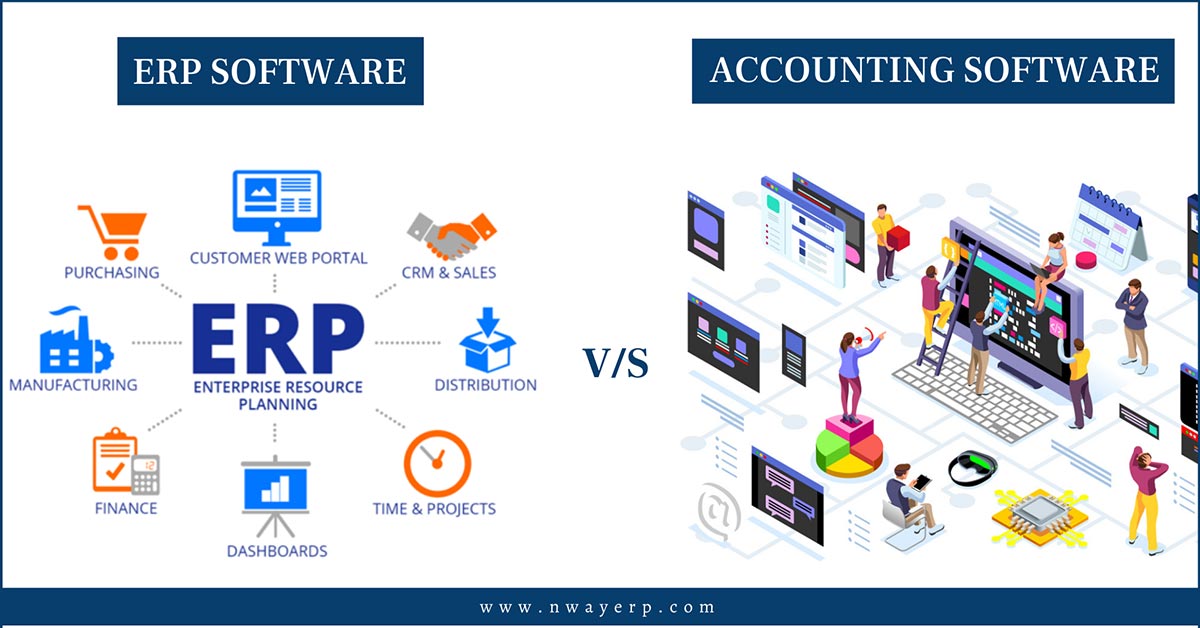

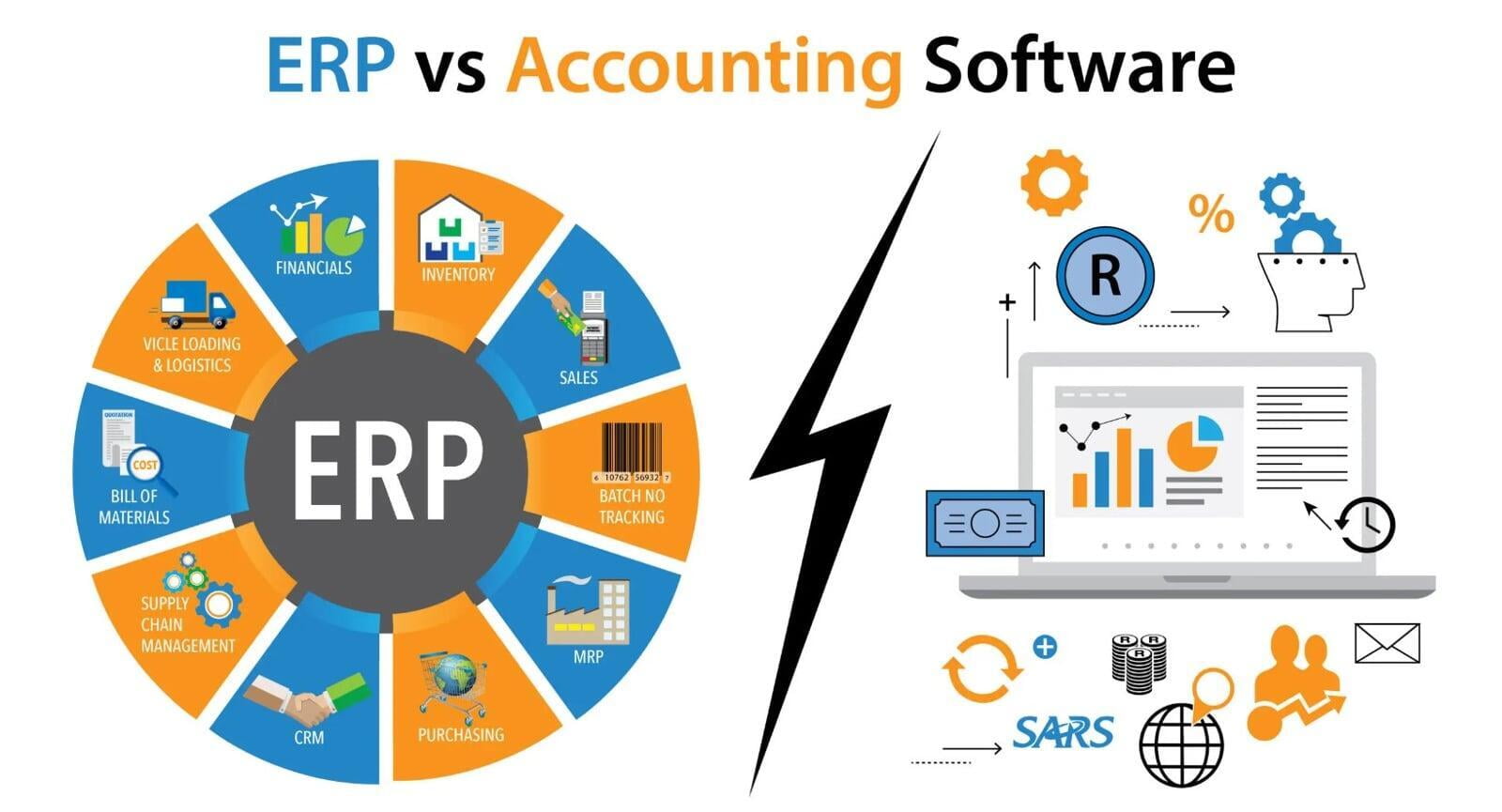

Comparing ERP accounting software and independent accounting software

While both types of software support financial management, they have significant differences:

- Scope of use:

- Accounting ERP Software: As a subsystem of the overall ERP system, it is designed to serve comprehensive business management, including accounting, human resource management, warehouse management, production management, sales, and supply chain management.

- Independent accounting software: Focuses only on the basic functions of accounting such as bookkeeping, financial reporting and asset management.

- Real-time reporting capabilities:

- Accounting ERP Software: With a centralized database, data connectivity from all departments is possible. Any data updates will be reflected immediately across the entire system, so reports are always updated in real time.

- Independent accounting software: Data is often stored locally on individual computers or servers, leading to potential data discrepancies and difficulty updating reports in real time.

- Level of process automation and efficiency:

- Accounting ERP Software: Provide advanced business process automation tools, such as order processing, billing, and automated reporting, to increase efficiency and reduce errors.

- Independent accounting software: The level of automation is lower and usually only automates a few basic operations.

- Scalability and integration:

- Accounting ERP Software: Highly scalable to accommodate business growth, from adding new modules to customizing functionality. Tightly integrated with other business functions such as production, sales and human resources management.

- Independent accounting software: Difficult to scale or customize to new needs, and difficult or impossible to integrate with other business functions.

- Reporting and analysis system:

- Accounting ERP Software: Provide analytical tools, detailed, comprehensive, multi-dimensional information reports, helping managers make decisions based on accurate and reliable data.

- Independent accounting software: Usually only provides basic accounting and financial reports.

- Expense:

- Accounting ERP Software: With advanced features and benefits, accounting ERP often has a higher initial investment cost than standalone accounting software.

- Independent accounting software: Low investment cost.

Factors to consider when choosing Accounting ERP Software

To choose the accounting ERP software that best suits your business needs, consider the following factors:

- Business scale: Businesses need to consider their current size (number of employees, revenue, scale of operations) and the scalability of the software to accommodate future growth.

- Field of operation and professional requirements: Each industry has its own unique accounting and financial management requirements. Businesses should choose accounting software that has experience in the field of operation and has features that are suitable for specific business processes. The software should meet basic accounting requirements such as bookkeeping, financial reporting, asset management, taxes, and advanced features such as financial forecasting and cost analysis.

- Supplier reputation: Choose a reputable accounting ERP software provider with many years of experience in the market. A good provider needs to have a professional support and training system to ensure that businesses can deploy and use the system effectively.

- Easy to use: Accounting software needs to have a user-friendly and intuitive interface to minimize employee training time and help managers analyze data quickly.

- Compatibility and updates: Ensure compatibility between accounting ERP software and other systems in use in the enterprise (such as warehouse management, sales management, production management, human resource management) to create connectivity and seamlessness in administration. In addition, the software needs to be regularly updated with new versions to ensure stability and efficiency.

Effectively exploiting ERP Accounting Software in enterprises

To maximize Benefits of ERP Software Accountants and businesses need to pay attention:

- Intensive staff training: Ensure that all staff are properly and continuously trained on how to use the software effectively and correctly, as this directly affects the business's operations and financial reporting.

- Tight data control and security: Conduct regular audits to ensure the accuracy and security of data in accounting software. Tight data controls help businesses avoid information security risks and ensure seamless business operations.

- Integrated optimization: Take full advantage of the software's integration capabilities with other business management systems (such as sales, purchasing, and inventory management software) to create seamless information flows and automate business processes. This eliminates duplicate data entry and improves overall efficiency.

- Use add-ons and advanced features: Explore and apply special software features, such as capital connection capabilities or integrated corporate credit card management, to enhance cash flow and expense management. This helps businesses get the most value from the solution.

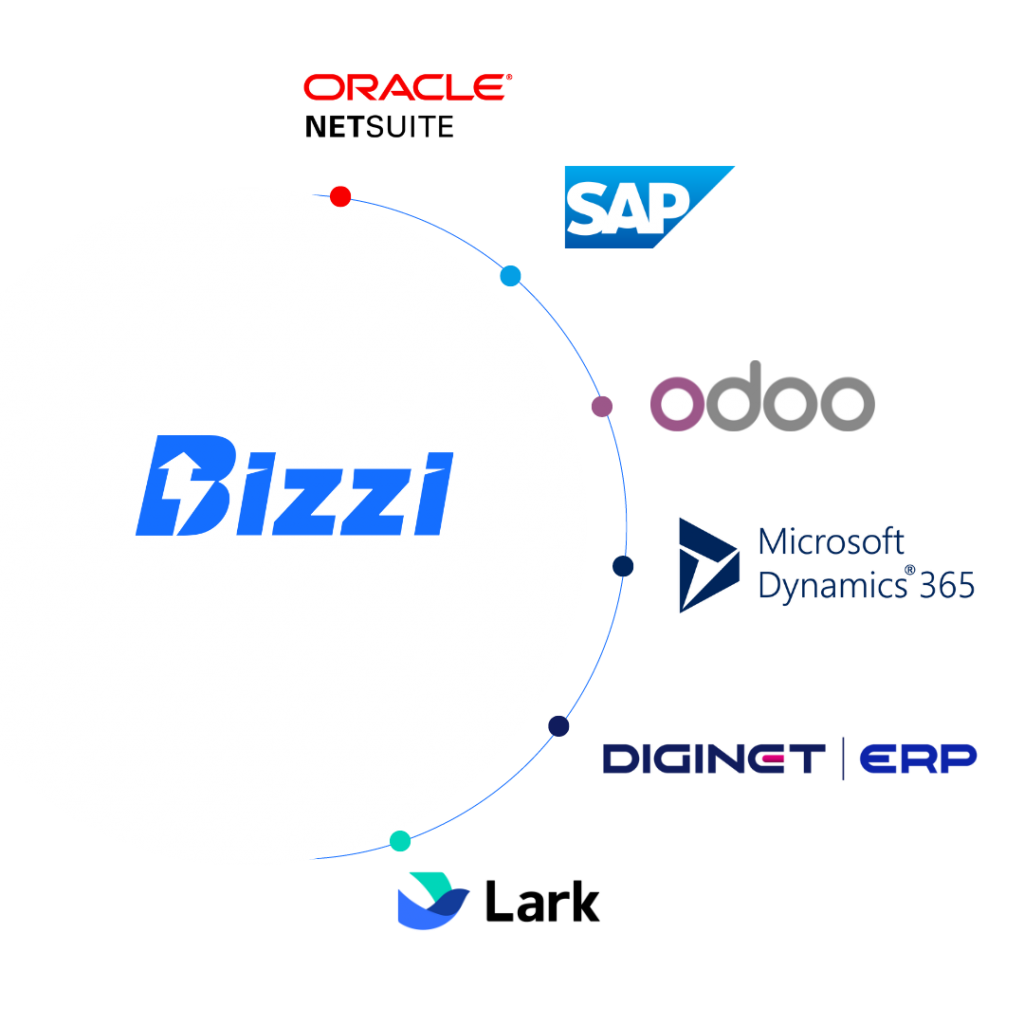

Among the solutions available in the market today, Bizzi is one of the few accounts payable automation platforms. Bizzi capable ERP system integration Fit with your business needs!

Bizzi Flexible integration with multiple ERP systems leading ERP solutions, including open source ERP solutions (such as Odoo) and other systems (e.g. Oracle NetSuite, SAP, Microsoft Dynamics 365 Finance), help businesses optimize their invoice processing and financial management processes. This integration allows invoice data to be automatically updated into the ERP system, minimizing errors and saving users time and effort.

Advantages of integrating Bizzi with ERP:

- Process automation: Bizzi helps automate steps in the invoice processing process, from data extraction to input into the ERP system, reducing manual work and increasing efficiency.

- Data synchronization: Invoice data is seamlessly synchronized with the ERP system, giving businesses an overview and accurate view of their financial situation.

- Save time and money: Automation and synchronization save time and reduce costs associated with manual invoice processing.

- Increase accuracy: Minimizing human intervention helps reduce errors in invoice processing, ensuring data accuracy.

- Integrates with multiple systems: Bizzi is capable of integrating with many popular ERP systems such as SAP, Oracle NetSuite, Microsoft Dynamics 365 and Odoo, making it easy for businesses to choose and deploy the right solution.

- Rapid deployment: Bizzi is designed to be quick and easy to deploy, without causing significant disruption to your business's existing workflows.

Example of integration between Bizzi and accounting ERP software::

- Integration with SAP: Helps optimize input invoice processing and accounts payable management.

- Integration with Odoo: Helps businesses manage invoices and related processes efficiently, minimizing system disruption.

In short, Bizzi is not only an invoice processing automation solution, but also a flexible integration tool, helping businesses optimize financial processes and improve operational efficiency.

Conclude

Above are the contents related to ERP accounting software, covering the functions, benefits as well as the notes to be aware of when deploying the software. In the context of businesses needing accurate, timely, transparent data to make decisions, integrating accounting in ERP instead of using separate accounting software is extremely necessary.

In addition, to maximize the effectiveness of the accounting ERP part, businesses should combine additional automated management solutions to optimize the financial center that operates the entire business.

When combining accounting ERP software with the Bizzi automation platform, Businesses can reduce invoice processing time, improve cost control and increase operational efficiency. To get expert advice on solutions and custom design of functions to suit your business needs, register to schedule a demo here: https://bizzi.vn/dat-lich-demo/