With tax authorities increasingly tightening invoice management through centralized data systems, many businesses find themselves in a situation where they receive Notice requesting explanation risk invoice, even though the actual transaction was completely real. The preparation A properly formatted, professional, and legally sound explanatory letter for risk invoices. This has become a decisive factor in protecting businesses' right to deduct taxes and legitimate expenses.

This article summarizes... 5 most common sample letters of explanation for risky invoices encountered in practice.It also provides a detailed analysis of business requirements, legal risks, and how businesses can proactively manage invoice risks from the outset.

Why do businesses need to explain risky invoices?

In modern tax administration, invoice explanation is no longer a mere formality. It is a formal confirmation step between the business and the tax authorities to prove the transaction. The transaction was genuine, supported by valid documentation, and not intended to defraud the tax authorities..

Failure to provide an explanation, or providing an unsatisfactory explanation, can lead to serious consequences for businesses, such as:

- Input VAT is not deductible.

- Expenses disallowed during corporate income tax settlement.

- Subject to back taxes, administrative penalties, and even expanded investigations.

Therefore, A letter explaining the risks associated with invoices is a crucial "legal shield" for businesses. during tax audits.

What is a risk invoice?

"Risk invoice" is not a term directly defined in the Tax Administration Law or its guiding documents. In fact, it is the term used by the tax authorities to describe it. invoices showing signs of irregularitiesThis was discovered through the centralized tax data management system (TMS – Tax Management System).

Commonly considered risky invoice indicators include:

- The invoice is pending or its status is not fully displayed on the system.

- The seller has ceased operations, abandoned their business address, or belongs to the high-risk business category.

- The transaction value is unusually large compared to the size and industry of the business.

- There is a data discrepancy between the electronic invoice, the tax declaration form, and the tax administration data.

One important point that many businesses and even many competitor articles often overlook is The "risk scoring" mechanism of the TMS systemThe tax authorities do not assess risk on a case-by-case basis for each individual invoice. Risk scoring is based on transaction sequences, disclosure behavior, and the relationships between related parties.Therefore, a valid invoice can still be classified as risky if it is part of an unusual transaction chain.

When do tax authorities request businesses to provide explanations for risky invoices?

Businesses usually have to create Tax explanation letter regarding risky invoices in the following cases:

- Receive notifications by Form 01/THKHĐ

- The invoice is subject to inspection and verification.

- The company's tax declaration data does not match the tax management system.

- The seller is on the list of high-risk businesses in terms of taxation.

These requirements are made based on the following: Decree 123/2020/ND-CP, Circular 78/2021/TT-BTC and guidelines from the General Department of Taxation.

Why is a letter explaining the nature of a high-risk invoice particularly important?

An explanatory letter is not just for "getting the answer over with," but rather... official legal evidence This document presents the company's viewpoint and profile. The content of the letter directly affects the following:

- Is input VAT deductible?

- Are these expenses considered deductible expenses when settling corporate income tax?

- The level of penalties if the tax authorities discover violations.

A well-prepared document, with complete supporting evidence and a logical presentation, will benefit the business. Significantly reduces the risk of penalties or expanded inspections..

5 Sample Letters Explaining Commonly Encountered Invoice Risks

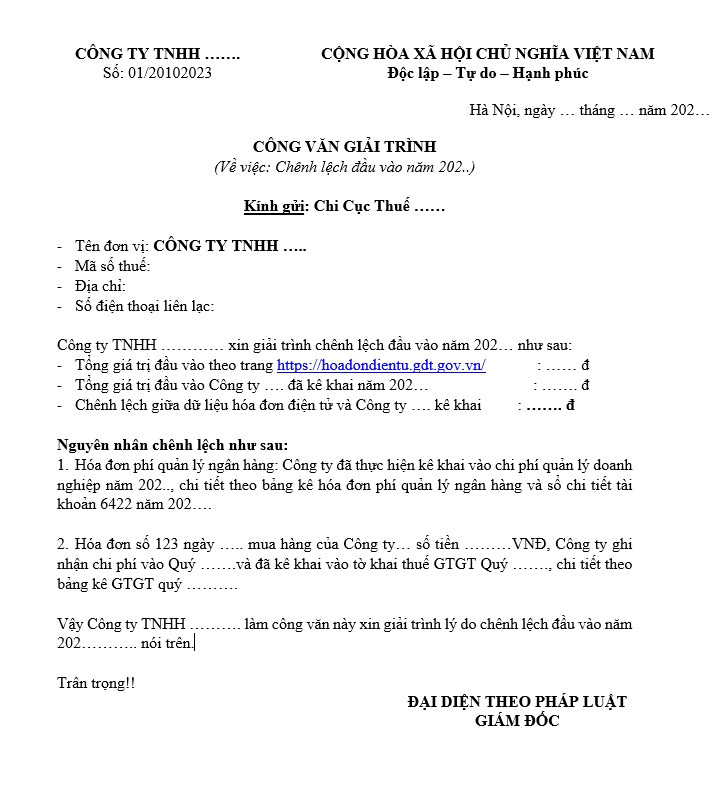

Template 1: Letter of Explanation for Basic Risk Invoices

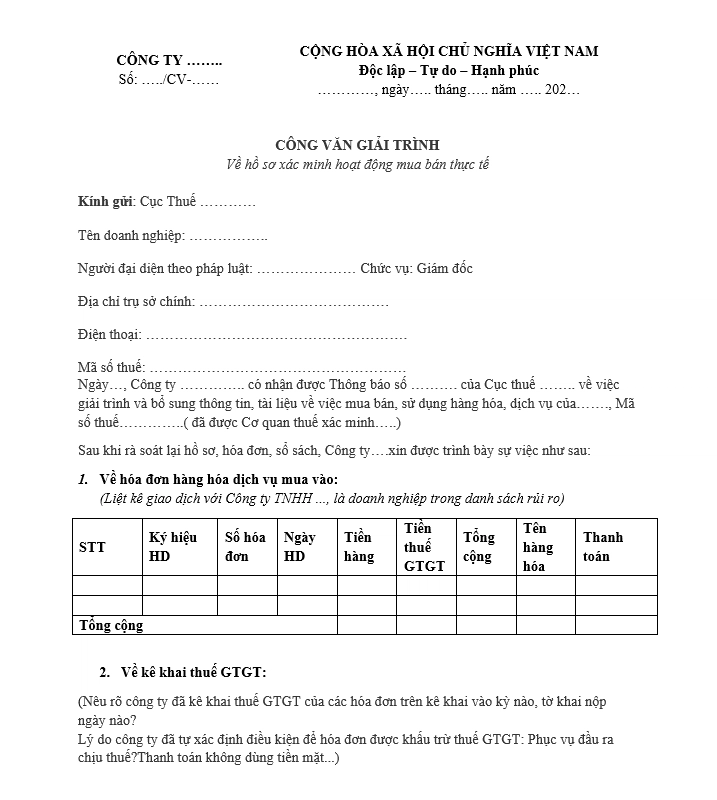

This form is used when a business receives a notification to verify input invoices. The letter should include complete business information, invoice information, a brief description of the actual transaction, and a list of accompanying documents such as contracts, warehouse receipts, and payment vouchers.

The most important aspect of this design is A clear link between invoice, transaction, and supporting document.Avoid vague explanations that might prompt the tax authorities to request additional information.

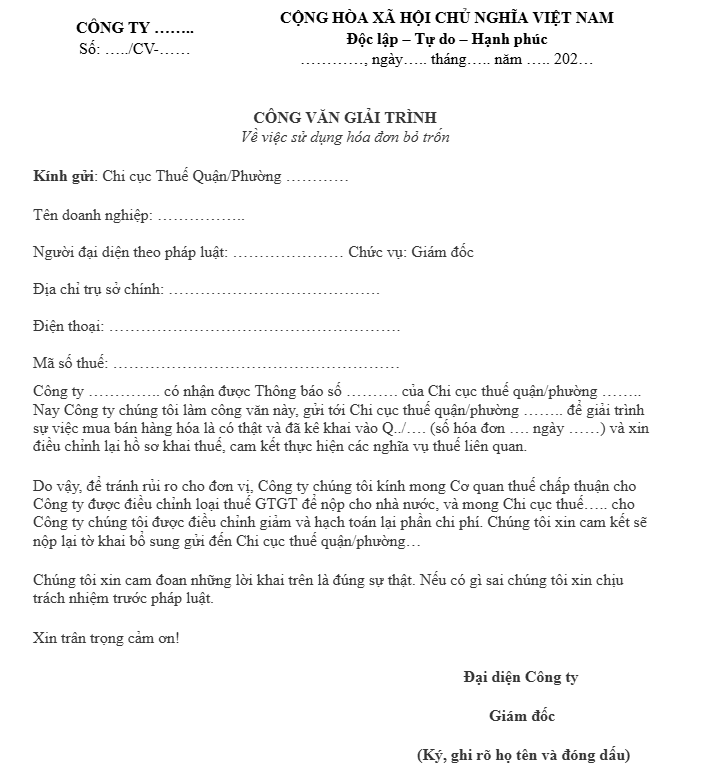

Form 2: Letter of explanation regarding verification of actual buying and selling activities.

This form applies when the tax authorities suspect a transaction did not actually occur. Businesses need to prove the entire buying and selling process through a set of documents including contracts and appendices, warehouse receipts or acceptance reports, bank payment documents, and original invoices.

The points that are usually scrutinized in this case are consignee, shipping documents, and the correct matching between the Purchase Order (PO), Gross Mass (GR), and Invoice..

Form 3: Letter regarding the handling of illegal invoices

In cases where invoices are flagged as violations, such as fictitious invoices, incorrect tax identification numbers, or invoices that do not exist in the system, businesses need to provide a very careful explanation. The letter must clearly demonstrate a willingness to cooperate, show no signs of intentional tax evasion, and provide sufficient grounds for the tax authorities to consider an appropriate penalty.

This content is directly related to Article 203 of the Penal CodeTherefore, particular caution is needed in the way it is expressed.

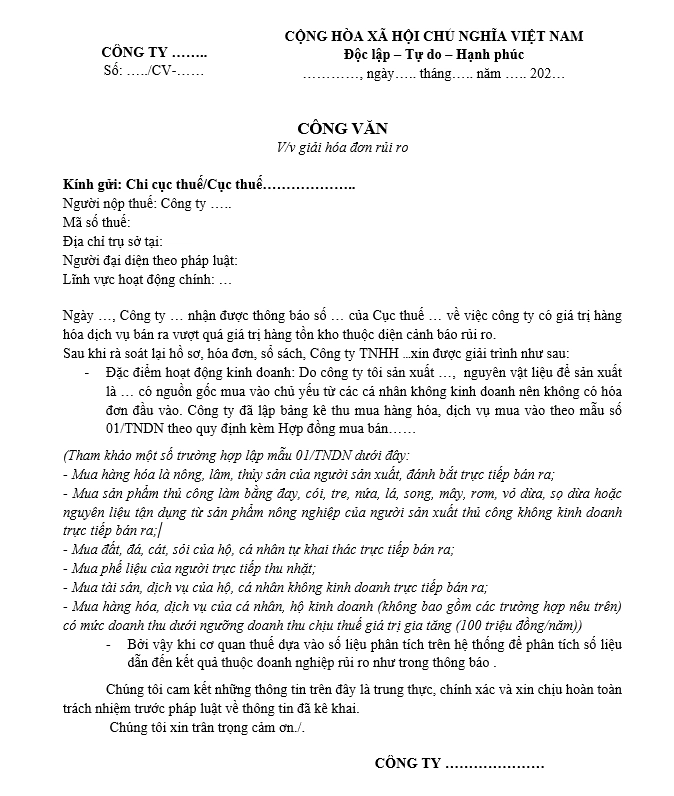

Form 4: Letter of explanation regarding invoices from businesses that have absconded or ceased operations.

This is the highest risk scenario. The business must prove that the transaction occurred. before the seller absconds or ceases operations.The most valuable documents include signed delivery receipts, bills of lading or shipping schedules, contracts, and appendices showing delivery schedules.

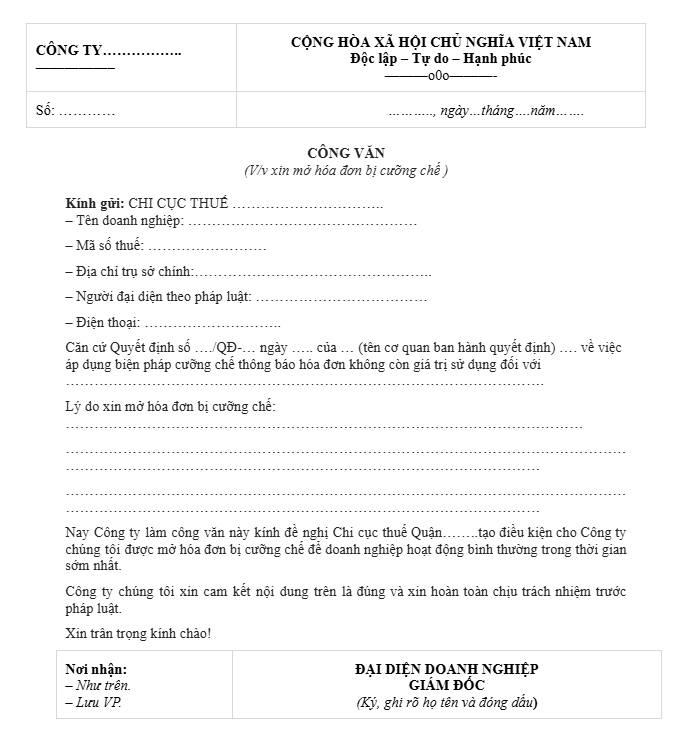

Form 5: Letter requesting the opening of invoices that are under enforcement action.

When a business is suspended from using invoices but has fulfilled its tax obligations, the official letter should be prepared based on the following: Decree 125/2020/ND-CP and Circular 80/2021/TT-BTCThe content should clearly state that the tax obligations have been resolved, along with supporting tax payment documents and a commitment to continued compliance.

Essential content for any letter explaining risky invoices (Detailed analysis from the tax authority's perspective)

During the inspection, the tax authorities Do not read official documents in a formal, administrative manner., which can be evaluated logically:

Can the business prove that the transaction was genuine, legal, and reasonable?.

Therefore, a letter explaining the risk invoice meets the requirements. It's not enough to just cover all the necessary areas; it must also be "focused on the right priorities for inspection."Below is a detailed analysis of each required content category.

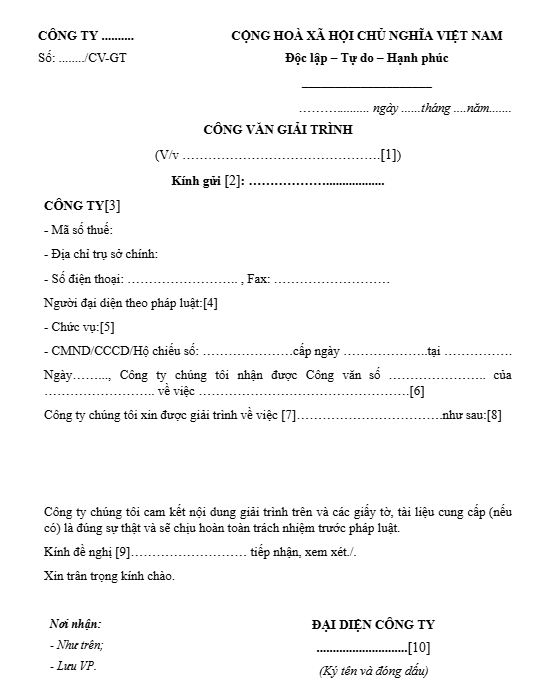

1. Business Information – Establishing the Legal Status of the Presenting Party

This section is not simply for "filling in the blanks," but aims to... Clearly establish the party responsible for legal liability. Regarding the explanation.

The official document must include the following information:

- Corporate tax code

- The business name is as registered.

- Head office address

- Legal representative (or legally authorized person)

- Contact information: phone number, email

Important operational notes: The information in the official document must perfect match With tax registration data and data on the TMS system, even a small discrepancy (e.g., initials, old address) can cause the document to be judged as invalid. inconsistentThis led to a request for further explanation.

2. Information on suspicious invoices – Accurately identify the entity under investigation.

The tax authorities don't conduct "general" audits, but rather thorough inspections. each specific invoiceTherefore, businesses need to clearly identify the invoices that are required to be explained.

Information to include:

- Some bills

- Invoice symbol

- Invoice date

- Pre-tax value, VAT, total payment amount

- Seller's name and tax code

An important point that is often overlooked: If you need to explain multiple invoices at the same time, you will need to... List them in a table or item by item.Avoid grouping multiple invoices together in a vague description. Such grouping can easily lead tax authorities to misjudge the situation. Unable to control each specific transaction..

3. Description of the actual transaction – The “backbone” of the explanatory letter

This is the most important part and also the part that The competitor usually writes the most superficially..

The tax authorities need to know more than just that "a transaction occurred," they need to answer these questions:

- This transaction How does it happen??

- Who performed it??

- Where, when, and how?

Businesses need to clearly describe:

- Who delivers – who receives?: Name of department or individual representing both sides

- Delivery/Service Location

- Product specifications / service content

- Quantity – progress – completion date

Business note: The transaction description must suitable for the business sectorThis includes the size of the business and the invoice value. A large transaction with a very vague description is a sign that tax authorities may suspect the transaction did not actually occur.

4. Supporting documents – A standard checklist to prove the transaction is genuine.

Explanatory letter It is invalid without valid supporting documents.Essentially, an official document is just a statement; The new document is proof..

The supporting documents should be clearly listed in the letter, including:

- Contracts and contract addendums Specify the terms of sale, value, and scope of work.

- Minutes of acceptance / handover Proof that goods or services have been completed and received.

- Warehouse release form – warehouse receipt form Applies to goods and materials.

- Payment documents Payment authorization forms, bank statements; cashless payments are preferred.

- Look up partner tax code information. Proof that the counterparty exists and is operational at the time of the transaction.

- Bank statement Show the actual cash flow, avoiding suspicion of fraudulent payments.

- Email exchange, PO – GR (Purchase Order – Goods Receipt) This is a group of documents. Very valuable but often overlooked.This helps demonstrate that the entire transaction process is continuous and logical.

Points of particular interest to the tax authorities: The Connection between PO – GR – InvoiceIf these three data points don't match in terms of quantity, timing, or value, the likelihood of being assessed as risky is very high.

5. Legal Commitment – Establishing Responsibility and Goodwill for Cooperation

The commitment is not merely a formality, but a commitment. Statement of legal liability of the business.

The commitment statement should clearly state:

- The business is fully responsible for accuracy, honesty of the explained information

- Commit cooperate in providing additional documents and records. if requested by the tax authorities

- Commitment to comply with tax and invoicing regulations.

Important Note: Avoid using statements that "evade responsibility" or blame the seller. The presentation should reflect this. goodwill, cooperation, and proactive transparency. This will significantly reduce the risk of receiving a negative evaluation during the review process.

A standard explanation letter for a risk invoice isn't about which "template" to use, but rather about:

- Present the correct logic for the tax authority's audit.

- The close link between invoices, transactions, and supporting documents.

- Clearly demonstrating the responsibility and willingness of businesses to cooperate.

If businesses only fill out the form for the sake of appearances, the official letter is very likely to be returned or require further explanation, prolonging the process and increasing unnecessary tax risks.

Legal risks of failing to properly explain risk invoices.

In fact, The biggest risk doesn't lie in whether or not the business receives the notification., which lies in the fact Does the explanatory letter have sufficient capacity to "defend the transaction" before the tax authorities?.

A poorly written explanation, lacking supporting documents, or misrepresenting the main point can jeopardize the case. The situation escalated from administrative checks to severe penalties, and even referred cases to investigative agencies..

1. Risks of administrative penalties under Decree 125 – More than just "fines"

According to Decree 125/2020/ND-CPThe use of illegal or fraudulent invoices may be subject to penalties. from 15 to 50 million VND.

However, The monetary penalty is only the tip of the iceberg of the risk..

In practice, tax authorities often apply additional remedial measures, include:

- Forced cancellation of the infringing invoice.

- Mandatory repayment of incorrectly deducted or refunded taxes.

- Revise all relevant declaration documents.

It is worth noting that vCanceling or rejecting an invoice affects more than just one tax period., which can lead to:

- Adjusting multi-period settlements

- Expand the scope of the audit to include other invoices and suppliers.

Common reasons for severe penalties: The explanatory letter failed to prove the actual transaction, or the accompanying documents were not convincing enough for the tax authorities.

2. Criminal risk under Article 203 of the Penal Code – A risk threshold that businesses often underestimate.

When the tax authorities notice signs intentionally using illegal invoicesThe records may be Transfer to the investigative agency according to Article 203 of the Penal Code.

This is an extremely important boundary between administrative error and criminal liability.

For individuals

- Fines up to 500 million VND

- Or Imprisonment penalties of up to 7 years.

For commercial legal entities

- Fines up to 10 billion VND

- Or Temporary suspension of operations

The key point in practice:

The investigating agency did not base its decision solely on the invoice, but also on... complete explanatory documents For evaluation:

- Businesses have goodwill for cooperation or not

- There are signs Concealing and falsifying documents or not

- Is the explanatory letter logical, consistent, and supported by evidence, or is it merely a formality?

An explanatory letter Writing carelessly, copying generic templates., or avoiding responsibility can become major disadvantage when the case is being reviewed from a criminal perspective.

3. Cost and tax risks – Direct and long-term financial losses

Even if the incident not subject to severe penalties or criminal prosecution., businesses can still bear the burden huge financial losses If the explanation is unsatisfactory.

Specifically:

Invalid expense

- Costs associated with risk invoices will Not included in deductible expenses.

- This leads to increase taxable income

- This will lead to increase the amount of corporate income tax payable.

For businesses with low profit margins, having expenses disallowed can be detrimental. This directly impacts cash flow and business results for the entire year..

Input VAT is excluded.

- Input VAT related to risk invoices Not deductible

- Businesses must Pay additional VAT.

- Late payment penalties may arise over time.

This is direct financial damageNegotiations or adjustments are impossible if the explanatory documents are not sufficiently convincing.

4. Chain reaction risk – Consequences that many businesses do not anticipate.

One very real but often overlooked consequence is chain reaction risk.

When businesses:

- Explanation not satisfactory

- Rated as high risk

Tax authorities tend to:

- Expand the scope of inspection.

- Review other suppliers

- Re-evaluate the entire invoice control process of the business.

This causes businesses to:

- It takes a lot of time to explain things repeatedly.

- Increased pressure on the accounting and finance department.

- This will affect the company's reputation in subsequent audits.

Letter of explanation regarding risky invoices This is not a standard administrative procedure., but rather:

- Legal documents establishing responsibility

- This is the basis for tax authorities to assess the goodwill and risk level of a business.

- The deciding factor is whether to stop at administrative penalties or escalate to more serious risks.

Providing proper explanations not only helps businesses "pass audits," but also protects them from long-term tax and legal risks.

5 common mistakes that cause explanatory letters to be returned or require additional information.

In reality, many explanatory letters... not immediately rejectedbut was asked multiple additional explanationsThis prolongs the process, increases the level of risk, and leads to the business being perceived as having "poor invoice control."

The reason isn't that the business "has no transactions," but rather... The explanation was not focused on the inspection's core issue.Here are the 5 most common mistakes.

1. Data mismatch between the electronic invoice and the TMS system.

This is the most common and also the most dangerous mistake, because it is directly related to the tax authority's risk management system.

Common symptoms:

- The company provided an explanation consistent with its internal records.

- But the invoice data on the TMS system is:

- Date difference

- Value deviation

- Seller information discrepancies

Real life example: The business explained that the invoice was issued in March, but the TMS system recorded the invoice as being adjusted or replaced in April. The official letter did not mention this change → the tax authority requested further explanation because inconsistent data.

Why was it returned? Tax authority prioritize system dataIf the letter does not clearly explain the discrepancies between the company's records and the TMS, it will be considered invalid. lack of evidence.

2. Failure to clearly disclose the origin and context of the transaction.

Many official documents only state generally: "The business has engaged in purchase and sale transactions according to the contract…"

While what the tax authorities need is:

- This transaction Where to begin?

- How do these needs arise?

- Why did the company choose that supplier?

Real life example: The invoice is for a large sum, but the official letter doesn't explain why the business needed to purchase those goods/services at that particular time, nor does it mention the relevant business context. The tax authorities are evaluating the transaction. lack of rationality, requesting further explanation.

The core mistake: They only prove "having documents," but they don't provide proof. business logic of the transaction.

3. Missing or unclear presentation of shipping documents.

With commodity transactions, Shipping documents are a very important link.However, it is often overlooked by businesses.

Common symptoms:

- There are contracts, invoices, and warehouse receipts.

- But there is none:

- Bill of Lading

- Receipt and delivery record

- Documents proving that the goods have actually moved.

Real life example: A business purchased goods of significant value from another province, but the official letter did not include any shipping documents. The tax authorities suspected the goods were not actually delivered and requested additional shipping documentation.

Why is the risk high? No shipping documents available → Transaction proof chain break → The invoice is easily perceived as not having actually been incurred.

4. Failure to mention the legal status of the counterparty at the time of the transaction.

Numerous official documents Focus only on explaining the situation from the business side., but forgetting one crucial element: the operating status of the seller at the time the transaction occurred..

Common symptoms:

- The current partner has ceased operations/absconded.

- The official document did not specify:

- At the time of the transaction, was the counterparty operational?

- Is there a way to look up the tax identification number (MST) or verify the operational status?

Real life example: The company made the purchase in June, but the partner absconded in September. The official document did not specify this timeframe, leading the tax authorities to suspect the transaction occurred when the partner was already at risk → requesting further explanation.

The key point: Business Simply prove the legal partner at the time of the transaction.However, if not specified, the tax authorities will assume it is a risk.

5. Using overly general template content that isn't personalized to the specific case.

This is a very common mistake businesses make:

- Download sample official documents online.

- Fill in the information carelessly.

- No adjustments will be made on a case-by-case basis, regardless of the specific situation.

Common symptoms:

- The content is generic, identical to many other official documents.

- It doesn't mention the "risk points" that the tax authorities are scrutinizing.

Real life example: The official letter only stated: "The business affirms that the transaction is genuine and fully documented," but it did not explain why the invoice was flagged as risky, nor did it directly respond to the contents of the tax authority's notice → it was requested to provide further explanation.

Why is it underrated? The tax authorities consider this to be a superficial explanationThis does not demonstrate control over and understanding of the company's records.

How businesses can reduce invoice risk and optimize cost control processes.

In reality, most invoice risks are related to this. No issues arose during the explanation phase., which has appeared from very early in the process of receiving and processing input invoicesWhen businesses only discover risks at the time they receive notification from the tax authorities, any action taken is reactive, time-consuming, and carries potential legal risks.

To reduce accountability pressure, businesses need to Shift from a "proactive problem-solving" mindset to a "proactive control" mindset., starting right from the invoice receiving stage.

1. Standard invoice verification procedure of the Finance and Accounting Department

An effective invoice control process typically includes the following core steps:

First of all, accountants need to... Look up the supplier's tax identification number (TIN). To determine whether a partner legally exists. This not only checks legal information but also helps to identify high-risk businesses early on.

Next is Check the seller's operational status. at the exact time the transaction occurred. This is crucial because later, the business will need to prove that the transaction took place before the partner ceased operations or absconded.

Then, the invoice needs to be Three-dimensional matching PO – GR – InvoiceThis step helps to detect early discrepancies in quantity, value, and timing – factors that often cause invoices to be flagged as risky in the tax management system.

Accountants also need to Verify the validity of electronic invoices.This includes required information, digital signatures, invoice status, and data displayed on the tax system.

Finally, it is necessary assess the value of the transactionThis involves detecting cases with unusual values compared to the scale, frequency, or industry of the business. This is a crucial element in the tax authority's risk scoring mechanism.

If these steps are fully implemented from the outset, much of the bill risk can be mitigated. Preventing it before it goes into the books..

2. These "early warning signs" are often overlooked.

In actual operation, there are many signs of risk. not an immediate violationHowever, it was a "red flag" in the tax authority's assessment.

For example, a supplier Changing tax identification numbers or legal information multiple times in a short period of time. This is a sign that needs close monitoring. Similarly, the sudden change of legal representativeThis, especially in new businesses or those with high-value transactions, also carries inherent risks.

Another sign that is often overlooked is Delivery without clear shipping documents.This is especially important for inter-provincial or high-value transactions. Without this documentation, the chain of transaction proof can easily break during the explanation process.

Besides, large cash payments This is also a factor that makes invoices more likely to be classified as risky, as they do not show a transparent flow of money.

These signs, if only discovered when preparing to give an explanation, are already too late. They need to be identified. right in the process of daily invoice verification.

Instead of fragmented manual checks, many businesses now choose to digitize their invoice control processes to mitigate risks from the outset.

What support does Bizzi provide in the invoice control process?

In practical workflows, Bizzi supports businesses in many key areas:

As soon as the invoice is generated, the system can Automatically download and categorize input invoices.This helps accountants avoid missing invoices and reduces reliance on manual operations.

Bizzi support Three-way reconciliation of PO – GR – InvoiceThis helps detect discrepancies in quantity, value, or timing early on, before the invoice is processed.

The system also allows Check the supplier's tax identification number directly on the tax system.This helps accountants determine the operational status of a counterparty at the time of the transaction.

When Bizzi detects an invoice that is risky or shows signs of irregularities, it will early warningThis helps businesses proactively address issues before the tax authorities request explanations.

All relevant documents such as contracts, minutes, input/output slips, and payment documents are included. centralized storageThis helps to extract explanatory records quickly and consistently.

Practical benefits for businesses using Bizzi

By implementing Bizzi into their invoice control process, businesses can:

- Limit risky invoices right from the initial receipt stage, instead of processing them only after notification.

- Significantly reduce the time required to prepare explanatory documents.

- Reduce manual errors when reconciling invoices and documents.

- Control costs in a transparent, consistent, and systematic manner.

More importantly, the business is moving from a state of passive response luxurious Proactively manage tax risks..

Real-life case

In a real-world scenario, the business receives Notification Form 01 requests explanation of risk invoices. This involves several high-value input invoices. Thanks to the entire invoice history, purchase orders (POs), general ledgers (GRs), and payment documents already stored and reconciled on Bizzi, the accounting department only needs to extract the correct relevant documents and complete the explanatory letter. within a single workday.

If businesses continued to use the traditional manual method, they could spend days reviewing documents from various sources and face the risk of missing information when submitting explanations.

Frequently Asked Questions about Risk Bills

Are risk invoices tax-deductible?

Have, if the business can explain the actual transactions that occurred. and have sufficient valid documentation. If no explanation is provided or the explanation is unsatisfactory, the input VAT may be disallowed.

How long do I have to respond to Form 01 Notification?

The deadline for a response is clearly stated in the notification. Usually 5–10 business daysDelayed or failure to respond within the specified timeframe increases the risk of adverse consequences.

If the seller absconds, are the costs still deductible?

Maybe, if it can be proven that the transaction occurred before the seller absconded. and complete and valid transaction records.

Which documents are most valuable when giving an explanation?

No single case file is the deciding factor. Most importantly, the application documents must be logically consistent.Specifically: contracts, acceptance testing, payment, transportation, and reconciliation of Purchase Order (PO) – Grand Finale (GR) – Invoice.

Is submitting a hard copy mandatory?

Normally Submitting an electronic copy is sufficient.However, the tax authorities may request a paper copy in the event of a thorough audit or inspection.

Conclude

A letter explaining the cost of invoices is not just an administrative procedure., which is an important step that helps businesses Protecting tax interests and minimizing legal risks.A properly prepared and professionally executed document can help businesses avoid having expenses and taxes disallowed and minimize potential negative consequences after an audit.

However, explanations are merely a "consequences-handling" measure. In the long run, businesses need to build a solid foundation. Proactive invoice control processThis aims to detect and address risks right from the initial submission stage, instead of waiting until the tax authorities request an explanation.

If the business wants This reduces accountability pressure, shortens processing time, and allows for more effective invoice risk control.Consider using Bizzi to automate the most critical steps in your accounting and finance process: Invoice reconciliation, risk warning, and centralized document storage..