Account system according to Circular 99/2025 The shift towards greater flexibility and management focus is becoming a major concern for many CFOs. However, the real challenge doesn't lie in this. Accounting system according to Circular 99/2025 (download) for reference, or to find a Accounting system according to Circular 99 (Excel file) online, but it boils down to a more fundamental question: How can we safely convert existing accounting data to the new chart of accounts without disrupting KPIs or breaking internal controls?.

This article approaches the issue from the CFO's perspective, focusing on organizational structure and transformation. Accounting system according to Circular 99/2025 In an ERP environment, this helps businesses both comply with new standards and maintain the continuity of management reporting.

What is the accounting system according to Circular 99/2025?

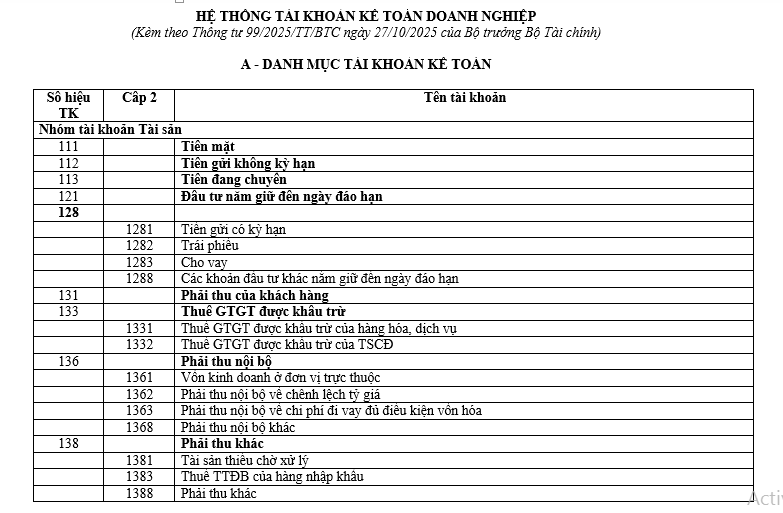

The accounting system under Circular 99/2025/TT-BTC is a framework for classifying accounting transactions that helps businesses record, summarize, and control financial data uniformly. This is the foundation that directly affects the accuracy of reports and the indicators that CFOs use to make decisions.

For the CFO, the accounting system is not a "list of accounting codes," but rather... How businesses structure financial data. Right from the start, every financial decision – from cost control and cash flow management to profit margin assessment – is built on data that has been properly categorized.

Required data sequences always follow a fixed logic: accounting documents → Journal entry → General ledger → Reports → CFO metrics → DecisionIf the accounting system is designed incorrectly, the entire chain of accounts will be wrong, even if the business uses "standard" accounting software.

The key point is: The CFO doesn't make decisions on accounting entries., which makes decisions based on classified data. The accounting system is the "data classification brain" of the business. Therefore, Circular 99 is not just a change in accounting form, but a Changes to the structure of financial data for management purposes..

Bizzi appeared as Pre-entry control layerThis helps to classify and control documentary data right from the start, before it enters the accounting system.

Transition: To implement it correctly, the CFO needs to clearly define the scope and timing of when this accounting system will take effect.

When was the TT99 account system implemented and for which financial period?

The accounting system under Circular 99/2025 applies to fiscal years beginning on or after January 1, 2026. Businesses need to clearly define the cut-over period to avoid incorrect recording and discrepancies in comparative data.

CFOs need to make a clear distinction. validity of the document and applicable financial periodApplying the wrong accounting system between periods will cause data to become "mixed," leading to discrepancies when comparing annual reports – a risk often only discovered after the books have been closed.

Applying the wrong benchmark not only creates accounting risks, but also Financial KPIs lose their meaning.This forces businesses to make retroactive adjustments or provide complex explanations.

Bizzi helps businesses control generated data on a periodic basis, preventing situations where data is lost. New documents but accounting using the old system.Once the correct application threshold has been determined, the next step is to understand the account system structure to avoid incorrect mapping.

What do you need to understand about the TT99 account system structure?

The TT99 accounting system is organized at multiple levels, allowing businesses to record data from aggregate to detailed levels. Choosing the right level of detail helps meet accounting requirements while also serving cost management, accounts receivable/payable management, and analysis for the CFO.

Each account level represents a data resolutionOverly detailed data can become cluttered and difficult to manage; overly rough data analysis can hinder the ability to analyze costs by department, project, or cost center. The CFO needs to answer one core question: What level of detail is sufficient for making a decision? The accounting system should only be detailed enough to serve control and analysis purposes, not just to "make the books look good".

Bizzi Expense This allows costs to be linked by budget, department, or project, helping CFOs achieve the necessary level of detail without having to open a vast array of accounting accounts.

How should the TT99 account system Excel file be used correctly?

The TT99 accounting system Excel file should be used as a lookup and mapping tool, not as the original legal source. Businesses need to standardize the file structure to facilitate safe ERP conversion and import. Excel is suitable for Look up, map old and new accounts, and check balances. During the transition period, the biggest risk is using files "copied from the internet" that have been modified, lack proper classification, or have incorrect categorization logic.

More importantly, Excel is insufficient for managing long-term change. As operational data grows, relying solely on Excel creates control gaps. Bizzi Bot reduces reliance on Excel by automatically categorizing and coding documents right from the input.

Checklist for reviewing the Excel file containing the account system before use.

Before using the TT99 chart of accounts Excel file, businesses need to check the source, version, structure, and consistency. This checklist helps reduce the risk of importing the wrong categories and incorrectly accounting for accounts.

- Is the file source clear and up-to-date?

- All necessary account levels are available.

- The username and account code were manually edited.

- Is the column structure suitable for import? ERP

- There is a log to track file changes.

- Someone is responsible for approving the final file.

Why is it easy to cause data discrepancies when switching from Circular 200 to Circular 99?

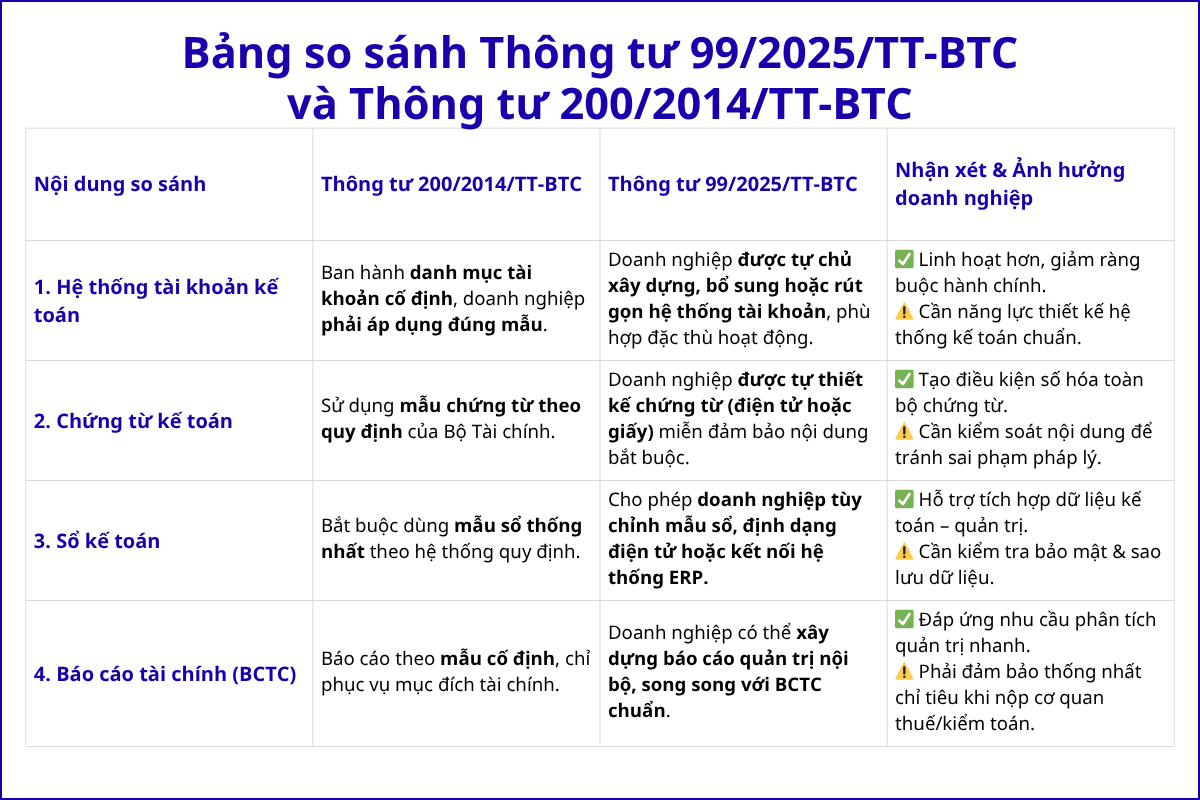

Transitioning from Circular 200 to Circular 99 can easily lead to discrepancies because many accounts change their recording nature, not just their names. Without a clear mapping process, businesses can easily have inaccurate balances and lose the ability to compare reports. The problem isn't changing the account code, but rather... Separation – Merging – Change of NatureThese changes directly affect cash, debt, and expenses, leading to deviations in management indicators if left unchecked.

Bizzi helps control input data during the conversion phase, reducing the risk of misclassification right from the document stage.

Playbook data mapping when switching to TT99

Playbook mapping from TT200 to TT99 is a process of converting accounts and historical balances according to the split-merge-check balance rule, aiming to maintain data accuracy and reliable reporting. It begins with a mapping table, transferring balances according to agreed-upon rules, and checking the principles. Debt = Credit Before going live, any discrepancies must be resolved before commissioning.

Bizzi Bot helps reduce document classification errors during the transition period, minimizing the need for mass corrections later on.

How does the separation of deposits under Circular 99 affect the liquidity ratio?

Separating demand deposits and time deposits helps to accurately reflect liquidity, but it may alter the Quick Ratio. CFOs need to understand that this is a classification change, not a change in actual cash flow. CFOs need to clearly explain to management that the ratio changes due to presentation, not a decrease in cash flow.

Bizzi ARM helps CFOs track cash flow and accounts payable in real time alongside accounting reports.

What controls need to be implemented when mapping the TT99 accounting system into ERP?

Mapping the account system according to Circular 99/2025 Integrating into ERP is not about importing account categories, but rather the setup process. Accounting rules – approval flow – recording authorizationIf the CFO only goes as far as "add accounts to ERP," the biggest risk is incorrect accounting entries that are technically flawed but form-specific, leading to discrepancies in management reports and prolonged closing times. This is a crucial aspect of implementation. Comparison of the accounting systems in Circular 200 and Circular 99This is because the two standards have different ways of classifying costs, cash flows, and detailed accounts.

One fact: many CFOs do research before applying. Circular 99/2025 is the version Download Circular 99/2025/TT-BTC to study and develop accounting rules, but only read the standards. Failure to establish operational control procedures. That's no different than "reading it and then putting it aside."

From a control perspective, mapping TT99 into ERP needs to be viewed through three layers:

- First, control the accounting logic. When the CFO poses the problem Comparing Circular 99 and Circular 200The biggest difference will be the way expenses and cash flows are grouped for management reporting. Without clearly defined accounting rules, the ERP system will record the correct accounts, but... Misuse of administrative purposes.

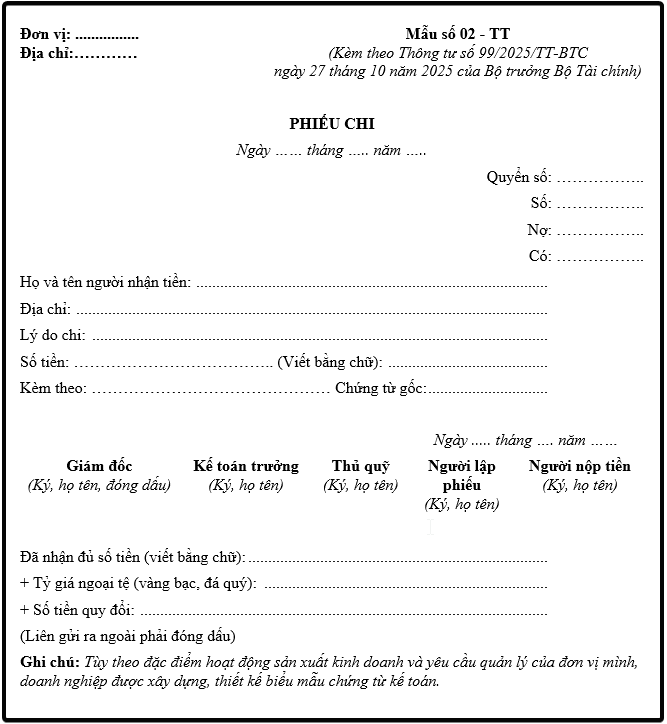

- Secondly, control the right to record and the timing of recording. The CFO needs to ensure: who is allowed to create the document, who is allowed to approve it, and at what stage the data is actually pushed to the ledger. This is where integration is crucial. Download Circular 99/2025/TT-BTC To compare the rule with reality.

- Third, control the input data before it enters the ERP system. If invoices, expenses, and liabilities are entered before being standardized according to requirements. Circular 99/2025In that case, the ERP system will record errors faster.

Bizzi plays the role of a Prior to ERP: Operational and Financial Control LayerAll costs, invoices, and accounts payable are standardized according to Circular 99 rules from the outset, correctly linked to accounts, cost centers, and approval flows before synchronization to the ERP system. As a result, data entering the accounting system is "correct from the source," significantly reducing adjusting entries and shortening closing time.

30-Day Checklist for CFOs Applying Circular 99/2025

Instead of implementing Circular 99 in a "big bang" fashion, CFOs should divide it into 30-day timelineEach stage has a designated person responsible, checkpoints, and supporting tools.

- Days 1–7: Shaping the control framework

The CFO and Chief Accountant review all current accounts and compare them with the requirements in the documents. Circular 99/2025 (usually starting with Download Circular 99/2025/TT-BTC (for comparison) and identify accounts that need adjustment. The result at this stage is a detailed comparison between the account structure of Circular 200 and Circular 99.

Bizzi is set up in parallel to standardize the expense-invoice-accounts receivable flow according to the new structure, allowing CFOs to see the actual data generated before it is entered into the ERP system.

- Days 8–15: Setting up rules and assigning permissions

During this phase, the CFO approves the accounting rules according to the new standard, links accounts to the business subsystem, and locks the old rules. Comparing Circular 99 and Circular 200Bizzi supports the implementation of these rules at the operational level, reducing the pressure of complex ERP configuration.

- Days 16–23: Parallel run & error checking

This is where real-world operational data reveals potential problems: KPI discrepancies, cost allocation mismatches, cash flow misclassification, etc. CFOs must compare reports against both the old and new Circular 99 standards to ensure consistency. Bizzi helps trace the details of each transaction to explain the reasons for discrepancies, instead of just looking at the total figures.

- Days 24–30: Finalize the model and conduct internal training.

After the discrepancies are addressed, the CFO finalizes the model and trains the relevant departments. At this point, Bizzi acts as a tool to monitor progress and compliance, ensuring the new process is not only correct on paper but also works in practice.

Frequently Asked Questions for CFOs Regarding the Implementation of Circular 99/2025

Below is a summary of some frequently asked questions regarding the accounting system outlined in Circular 99/2025.

- Should the entire business be converted to Circular 99 at once?

No. For businesses that already have ERP, it's advisable to migrate in stages or run parallel within a period to manage KPI risks. - Will implementing Circular 99 deviate from the KPIs committed to the Board of Directors?

It's possible, if the logic for classifying costs changes. The issue isn't about avoiding bias, but about... Explain the cause of the deviation. and normalize the baseline. - How is historical data processed?

Retroactive adjustments should be avoided. The CFO should only map historical data at an aggregate level for comparison purposes, preventing confusion within the accounting system. - Does the current ERP system need an upgrade?

It's usually not necessary right away. The problem lies in the rules and input data. ERP upgrades should only be a step after the TT99 process has stabilized. - What are the biggest risks of implementing Circular 99?

It's not that it violates standards, but rather... loss of operational control This is due to expanded recognition rights but a lack of intermediate control layers. - Is internal control more complicated?

Conversely, if implemented correctly, Circular 99 provides more realistic control. The condition is that the CFO must redesign the approval and accountability flow. - How long does it take to see the real benefits?

Typically, after 2–3 reporting periods, when the data has stabilized and the management reports accurately reflect business operations. - At what stage of life is Bizzi suitable?

From the very beginning, Bizzi helped the CFO control the data and progress of Circular 99 implementation before everything became "frozen" in the ERP system.

Conclude

From a CFO's perspective, the chart of accounts under Circular 99/2025 should not be simply understood as a new list of accounts to replace the old one. Simply finding an Excel file of the chart of accounts under Circular 99 or downloading and directly importing it into the ERP system carries significant risks: the structure may be correct, but the underlying management principles are flawed.

Transitioning to a new accounting system requires CFOs to view issues at the data and control level. The key is not whether "there are enough accounts according to Circular 99," but rather how those accounts are linked to costs, cash flow, KPIs, and approval flows in actual operations. Without redesigning accounting rules and recognition authority, the accounting system under Circular 99 will only increase accounting complexity without providing any management value.

A safe transition roadmap must ensure: input data is standardized before being entered into the ERP system, accounts are mapped according to business logic rather than just by name, and management reports remain comparable across transition periods. This is crucial for CFOs to correctly implement the accounting system according to Circular 99/2025 while avoiding the risk of KPI discrepancies or prolonged closing times.

In practice, cost, invoice, and accounts receivable control platforms like Bizzi act as a pre-ERP control layer, helping to standardize data according to the chart of accounts structure as per Circular 99/2025 right from the initial stages. As a result, CFOs can not only "apply" Circular 99, but also better control, make faster decisions, and maintain the stability of the company's financial system.

To experience the features of the solution and receive personalized advice for your business, register to schedule an appointment here: https://bizzi.vn/dang-ky-dung-thu/