SAP accounting software supports international accounting standards (IFRS) and local regulations. Understanding the functions helps accountants ensure legal compliance and avoid risks when reporting financial information. The following article by Bizzi will provide detailed information about this solution, giving advice on how to optimize costs and operations when applying SAP accounting software.

SAP accounting software concept

SAP accounting software is a comprehensive enterprise resource planning (ERP) system that integrates all financial and accounting processes into a single platform, helping to standardize data and improve management efficiency.

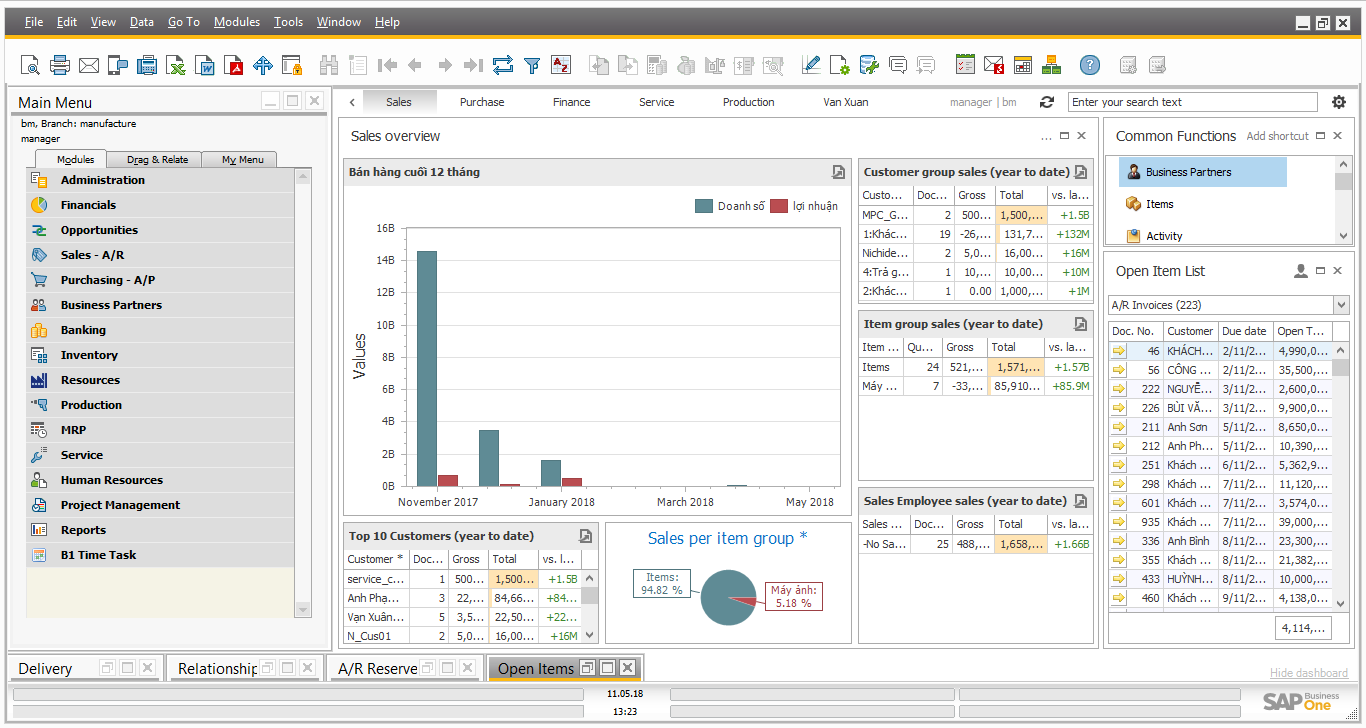

Overview of SAPP accounting software ecosystem

The software's main subsystems include cash flow management, accounting and finance, helping to optimize capital resources and make accurate decisions.

The most popular SAP accounting software versions today

The most popular versions today include SAP S/4HANA (for large enterprises), SAP ECC (for large, complex enterprises, especially in industries such as manufacturing, retail, and service trade), SAP Business ByDesign (for medium-sized enterprises) and SAP Analytics Cloud (for data analysis). Each version of SAP accounting software has different features and target customers.

The role of the SAP FICO (Financial Accounting & Controlling) subsystem

SAP FICO is one of the most important subsystems in the SAP ERP system, considered the financial “heart” of the enterprise. The role of FICO is demonstrated through the following main aspects:

- Handle all financial and accounting transactions

- FICO covers all financial accounting (FI) activities such as: revenue and expenditure accounting, accounts receivable, accounts payable, fixed assets, general ledger, financial reports.

- At the same time, the Controlling (CO) section supports tracking costs, revenue, cost centers, and internal orders, helping businesses manage effectively.

- Direct connection to other subsystems

- FICO links data with MM (material management), SD (sales), PP (production)... to create a seamless data flow.

- Thanks to this, any transaction that occurs (purchase, sale, production, payment) is immediately reflected in the financial accounting system.

- Providing data for management accounting and decision making

- FICO not only records financial data but also analyzes and reports on costs, profits, cash flows, and budgets.

- Businesses can rely on CO data to evaluate the effectiveness of each department, product, and project → thereby making accurate strategic decisions.

- Ensure compliance with laws and accounting standards

- FICO is designed to meet international accounting standards (IFRS) and local regulations (VAS, GAAP).

- The system supports the creation of financial reports according to standards, serving auditors, tax authorities and related parties.

- Increase transparency and efficiency of financial management

- Thanks to centralized data, SAP FICO helps businesses monitor their financial situation in real-time.

- Minimize errors, fraud and enhance internal control through rigorous accounting and approval processes.

Benefits and core functions of SAP accounting software

Below is a summary of the benefits and functions of SAP accounting software. Mastering this section helps managers know how to take advantage of technological solutions to solve problems for their businesses.

Outstanding benefits for businesses

- Optimize and automate financial processes

-

-

- SAP helps automate most accounting operations: from recording invoices, processing payments, reconciling debts to reporting.

- Seamless process helps reduce manual work, limit errors and save time for the finance and accounting department.

-

- Smart, multi-level Chart of Accounts

-

-

- SAP allows building a multi-level accounting system, flexible according to management requirements.

- Businesses can easily manage finances by subsidiary, department, project or product, while still ensuring consolidated data across the group.

-

- Real-time, transparent and accurate data

-

-

- All transactions arising from purchases, sales, and production are instantly updated into the financial system.

- Administrators can monitor cash flow, debt, expense, profit reports in real time, thereby making quick and accurate decisions.

-

- Multinational financial management

-

- SAP supports multi-currency, multi-language and multi-accounting standards (VAS, IFRS, US GAAP…).

- This is a great advantage for corporations and businesses with branches in many countries, helping to consolidate reports and ensure compliance with local laws.

Main accounting functions of SAP accounting software

SAP accounting software is an ERP/accounting solution with high implementation costs. Understanding the functions helps businesses maximize the value of the system, avoiding waste when only using a small part of the features.

- General Ledger (FI): Is the center for recording all financial transactions of the business.

-

- Direct integration with other subsystems (purchasing, sales, production, etc.) ensures synchronous and accurate data.

- Support in preparing financial statements, balance sheets, and income statements according to international and local standards.

- Accounts Receivable & Payable (AR & AP) Management: Help businesses limit bad debt risks and optimize working capital turnover.

-

- Accounts Receivable (AR): Manage sales invoices, customer debts, track payment deadlines, and automatically remind debtors.

- Accounts Payable (AP): Manage purchase invoices, supplier debts, payment plans, and cash flow control.

- Fixed asset accounting and automatic depreciation

- Record and track the entire asset life cycle from purchase, depreciation, transfer to liquidation.

- Automatically calculate depreciation using multiple methods (straight line, declining balance, by production…), meeting accounting and tax requirements.

- Bank accounting and transaction reconciliation

- Manage deposits, loans, and bank payments.

- Integrated bank reconciliation function, ensuring correct match between accounting data and actual transactions.

- Budget management and cost control

- Set up and monitor budgets by department, project, and cost center.

- Compare actual costs with budget, give overrun warnings, thereby helping to manage finances closely and proactively.

- Management Accounting (Controlling – CO): Cost and profit analysis

-

- Track costs by cost center, profit center, product, or project.

- Analyze profit margins, break-even points, and departmental performance.

- Provide key data to management in strategic decision making.

Which businesses should use SAP accounting software?

SAP accounting software is a powerful solution for businesses that want to standardize financial processes, optimize management, and increase transparency in business operations. SAP can meet the diverse needs of many industries, but will maximize efficiency for large-scale businesses, complex operations, or those in a period of strong growth.

Below are the business groups should prioritize deploying SAP accounting software:

Instructions on core operations on SAP accounting software

Below is a summary of information about the accounting core on SAP software:

Chart of Accounts

SAP Business One allows setting up a structured chart of accounts system. multi-level marketing (Group → Account → Sub-account), suitable for each industry.

- Users can create new accounts, classify them as assets, liabilities, equity, revenue or expenses.

- Feature control account Helps link modules (customer debt, supplier debt) with the ledger, ensuring data consistency.

Accounting Process for Income and Expenditure (Incoming & Outgoing Payments)

- Incoming Payments: Record cash receipts from customers via cash, bank transfer, or credit card. SAP automatically reconciles accounts receivable.

- Outgoing Payments: Pay suppliers or other expenses. The system supports multiple payment methods, with limit control and approval functions.

- Integrated cash flow reporting helps managers track Cash Flow Statement in real time.

Fixed Asset Lifecycle

SAP Business One fully supports the fixed asset lifecycle:

- Capitalization: Record the value of new purchases or upgrade investments.

- Depreciation Run: Automatically calculate and allocate monthly/yearly depreciation using multiple methods (straight line, declining balance…).

- Retirement (Liquidation): Record the remaining value upon liquidation or transfer, and update the ledger.

Period-End General Accounting Transactions

- Salary cost accounting & cost allocation: SAP allows automatic allocation of costs by department, project or cost code.

- Exchange rate difference assessment: Recalculate foreign currency liabilities at the end-of-period exchange rate and automatically adjust to the general ledger.

Operational “Blind Spots”: The 3 Biggest Challenges When Using Software

SAP accounting software is considered a high-end ERP solution, integrating many modules. financial management, production, sales, logistics, human resources… in a single system. However, along with that power comes high implementation costs, strict requirements on infrastructure and human resources. Unlike common accounting software that only needs to be “installed and used”, SAP requires a deep configuration process to suit the specific business processes of each enterprise.

If the business does not fully understand the management problem, or lacks information about the software, the SAP implementation process can easily lead to many "blind spots" that cause waste of costs and hinder operational efficiency. Below are the 3 biggest challenges that businesses often encounter:

SAP accounting software is considered a high-end ERP solution, integrating many modules of financial management, production, sales, logistics, human resources, etc. in a single system. However, along with that power comes high implementation costs and strict requirements on infrastructure and human resources. Unlike common accounting software that only requires "install and use", SAP requires a deep configuration process to suit the specific business processes of each enterprise.

If the business does not fully understand the management problem, or lacks information about the software, the SAP implementation process can easily lead to many "blind spots" that cause waste of costs and hinder operational efficiency. Below are the 3 biggest challenges that businesses often encounter:

Process Bottlenecks Due to Repetitive Manual Tasks

Although SAP is built for optimization and automation, the reality is that many businesses still let their accounting departments manually process thousands of invoices, reconcile accounts receivable, and approve payments step by step.

This not only puts enormous pressure on human resources, but also inadvertently “freezes” the potential of an expensive ERP system, turning it into a complex data entry tool instead of an intelligent automation platform.

Hidden Operating Costs & High Risk of Failure

To maintain operations on SAP, businesses often need a team of highly skilled accountants. However, most of their time is "trapped" in tasks that can be automated such as data entry, checking invoices or reconciling books.

This is a large sunk cost, not to mention the risk of errors in the data entry process that will directly affect the accuracy of financial reports, leading to audit and legal compliance consequences.

Difficulty in Flexible Integration with Suppliers & Banks

One of the common “blind spots” of SAP is the ability to integrate seamlessly with external systems. Synchronizing electronic invoice data from suppliers or automating payment processes with banks is still fragmented.

This lack of connectivity forces accountants to upload and download data multiple times, which is prone to errors and reduces processing speed, contrary to the expectation of complete connectivity of ERP.

Bizzi: Advanced automation solution, powering up SAP accounting software

Accounting Software SAP (like SAP S/4HANA) is a powerful platform for financial management and business operations. However, many processes in SAP still requires manual operation, time consuming and prone to error.

Bizzi designed as “intelligent automation layer” SAP support, helping businesses Upgrade your ERP system to a fully automated level but no need to change current processes.

Bizzi is easily configured to suit existing accounting and purchasing processes, and integrates directly with SAP through Open API, file integrations or custom data templates.

So, Businesses can integrate Bizzi to harness the power of automation, comprehensive ERP system integration without changing the way you work.

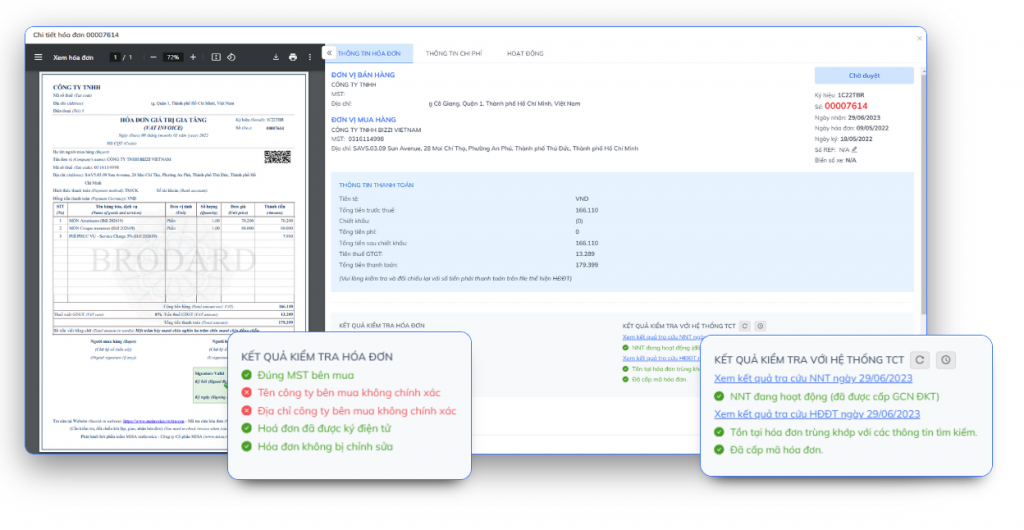

Solving the Invoicing Problem: Accounts Payable Automation (AP Automation)

The manual invoice processing process is often causing workflow bottlenecks and loss of cost controlWith Bizzi, businesses can remove 100% manual input and optimize AP processes.

Core technology:

- RPA (Robotic Process Automation) combine WHO to automatically perform all manual operations.

- 3-way match: Invoice – Purchase Order (PO) – Goods Receipt (GR).

- Automatically load, check, extract data and send to SAP in standard format.

Outstanding benefits:

- Synchronize data directly to SAP → no need for manual data entry.

- Reduce 80% invoice processing time, shorten payment cycle.

- Increase transparency and reduce data errors almost completely.

For example: A manufacturing company receives thousands of invoices each month. Instead of the accounting team manually entering each document, Bizzi automatically scans, reconciles, and updates SAP within minutes, freeing up staff to focus on financial analysis.

Optimize Expense & Travel Management

Operating costs and regular travel expenses difficult to control, waste can easily arise if there is a lack of transparency. Bizzi offers a modern management system, closely connected with SAP to ensure budget compliance.

Main features:

- Real-time budget management, monitor each expense as it occurs.

- Automatic disbursement approval process, integrating multiple levels of approval in one platform.

- Support business trip planning, manage employee expenses anytime, anywhere.

Benefit:

- Instant alerts when expenditure exceeds budget.

- Increase transparency and compliance in expense management.

- Reduce approval time, increase work performance.

For example: Employees send requests for payment of business expenses via Bizzi, the system automatically checks the department budget and sends it directly to the manager for approval, then synchronizes the data to SAP.

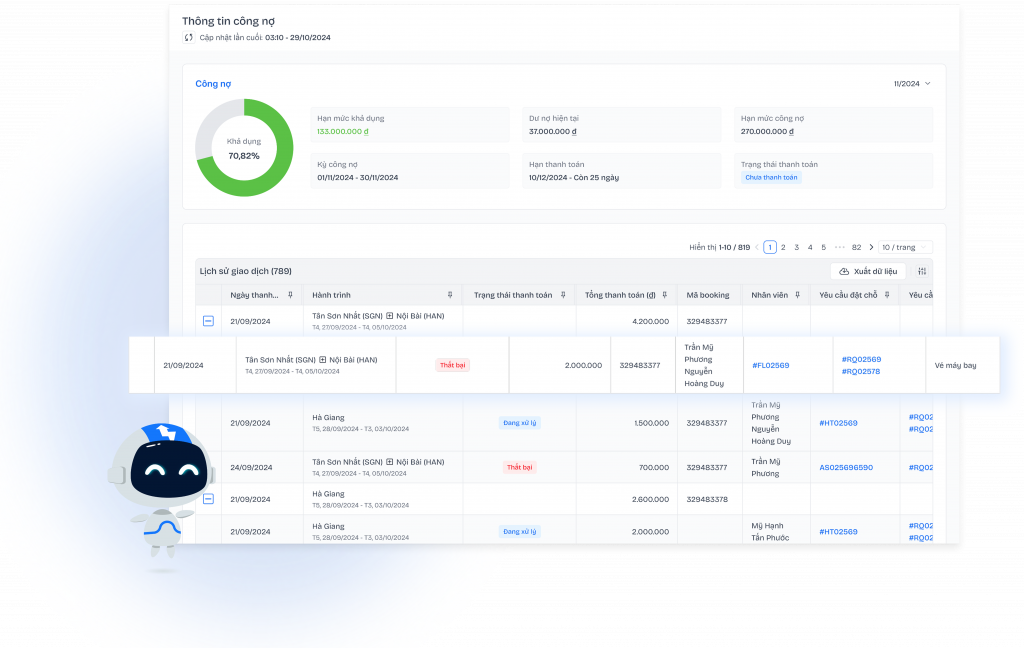

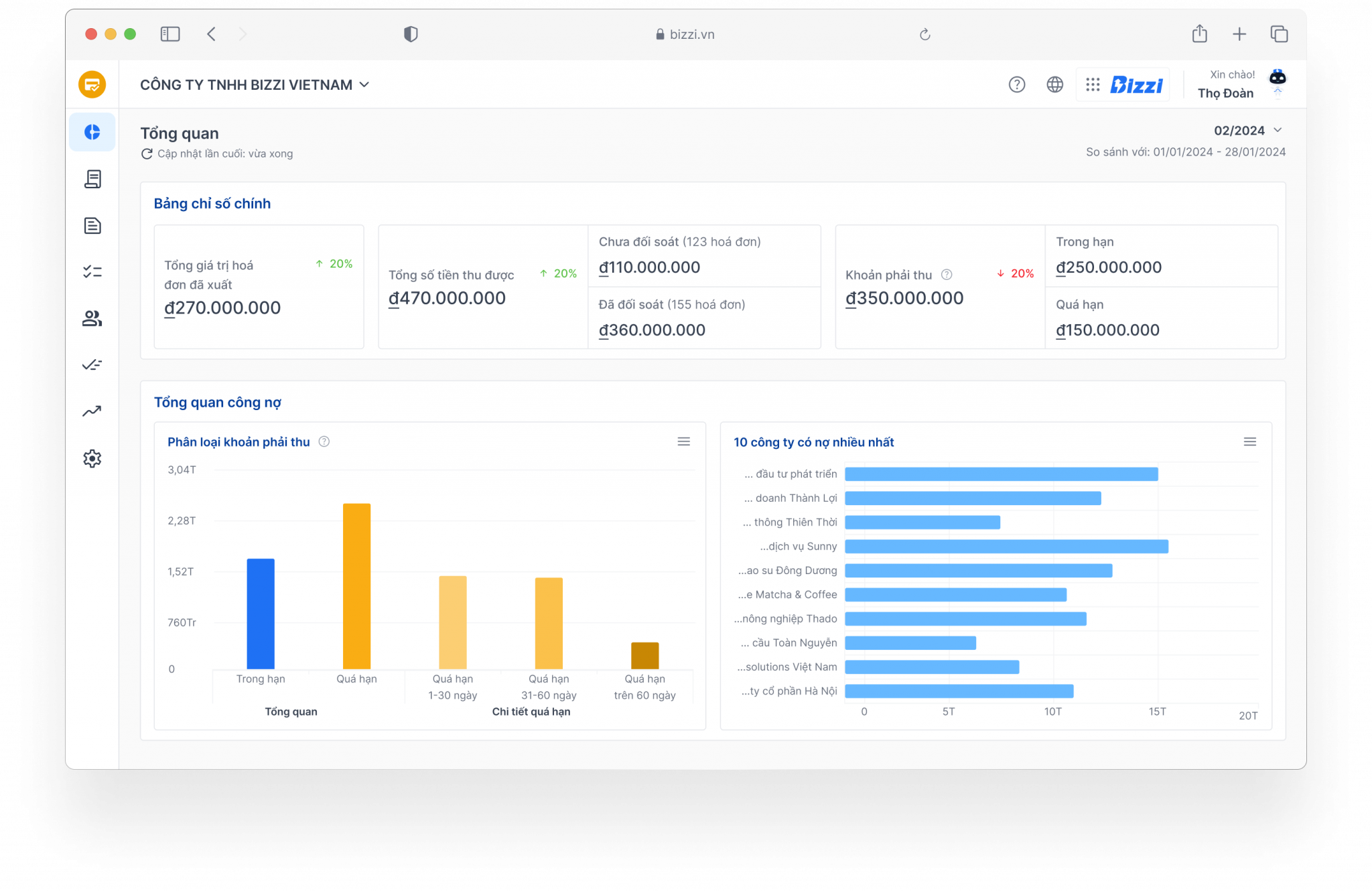

Automated Account Receivable Management (ARM)

Debt is an important factor that directly affects cash flow and solvency of the business. Bizzi helps businesses Fully automatic debt monitoring, reminders and reconciliation.

Outstanding features:

- Automatic debt reminders via email, SMS, Zalo, or other integrated channels.

- Real-time debt monitoring, reducing bad debt risk.

- Accurately reconcile SAP accounts receivable and actual payments.

Benefit:

- Reduce cash flow loss, improve debt collection rates.

- Support accurate debt reporting, support CFO and chief accountant to make quick decisions.

- Direct integration into SAP, ensuring seamless data.

Based on the above strengths, Bizzi helps businesses overcome many common challenges when implementing SAP:

| SAP Challenge | How Bizzi helps |

| High cost and implementation time when manually processing invoices, expenses, and debts | Automate these processes → reduce processing time, reduce required manpower. |

| Data errors during manual data entry, data conversion, or invoice entry | Open API + file integration + custom file templates help standardize input data, reduce errors. |

| Resistance to process change when internal adjustments are required | Bizzi allows flexible configuration to existing processes, reducing drastic changes and making them more acceptable. |

| Security & Compliance Requirements in Financial Systems | Bizzi is committed to secure data sharing and regulatory compliance when integrating with SAP. |

| Limited experience in complex ERP implementations | Having previous case studies supports the proof; Bizzi has the ability to connect legacy, on-premise, cloud systems – meaning experience with a wide range of systems. |

From Task Automation to Smart Financial Management: The Role of Bizzi

Bizzi is not only an invoice data entry automation tool, but also acts as a "smart financial management assistant" for businesses thanks to the following 3 core elements:

Provide accurate, real-time spending data to the SAP system

Bizzi does not stop at digitizing invoices but also ensures that all spending data is recorded accurately and in real-time. Thanks to that, the SAP system always reflects the financial situation at all times, helping the management have a solid foundation to control cash flow, optimize budgets and meet audit requirements.

Help CFOs free up resources to focus on analysis and strategic planning

Instead of leaving the accounting team “buried” in manual data entry, reconciliation or approval, Bizzi automates this entire process. That helps CFOs and Finance departments free up time, shifting their focus from task processing to data analysis, forecasting and strategic planning, in line with their role in leading business growth.

Seamless integration, increasing ROI on ERP system investment

Bizzi acts as a “smart link” between SAP and suppliers, banks and external platforms. This seamless integration not only eliminates duplicate data entry but also increases the efficiency of SAP usage, thereby helping businesses maximize ROI on their already large ERP investment.

Choosing & Implementing SAP Accounting Software Effectively

Implementing SAP accounting software is not simply installing a technology tool, but a strategic project that directly affects the entire financial management and business operations system. Therefore, businesses need to consider carefully both the selection and implementation stages.

Which businesses should use SAP?

SAP is not the choice for every business, but is especially suitable for organizations that:

- Manufacturing: requires complex supply chain management, control of raw materials and production costs.

- Retail: need large scale inventory, sales, cash flow and real-time reporting management systems.

- Multinational: operating in multiple markets with multi-currency, multi-language, multi-international accounting standards management requirements.

- Fast growing businesses: need an ERP platform that is robust enough to scale without being limited by the size of the current system.

5-Step Implementation Process for Vietnamese Enterprises

- Survey & assess current situation: analyze current needs, processes, and financial bottlenecks.

- Implementation planning: determine scope, budget, roadmap, KPIs to be achieved.

- System customization: set up Chart of Accounts, configure FI/CO modules to suit industry specifics.

- Testing & Training: Run tests on real data and train accounting and finance teams.

- Operation & continuous improvement: put into official use, monitor and fine-tune to keep the system suitable for business development.

3 Vital Notes When Deploying SAP Accounting Software

- Choosing a reputable implementation partner: SAP requires experience and in-depth knowledge, so choosing an incompetent partner will increase costs and prolong progress.

- Define clear goals: it is not effective to fully deploy all modules. Businesses need to focus on key goals and avoid "overdoing it".

- Continuous staff training: SAP is complex and requires high precision. If staff are not well trained, the system will have difficulty in maximizing its value and will easily fall into the "rut" of manual operation.

Cost & Reputable SAP Implementation Partners in Vietnam

Below is reference information on SAP implementation costs as well as some reputable implementation partners in Vietnam — helping you have a more realistic view before choosing.

Key Factors Affecting SAP Implementation Costs

SAP implementation often requires a large investment, which includes many factors:

- License cost: depends on the number of users, deployed modules and business type.

- Consulting & Implementation Fees: paid to the implementation partner to survey, design, customize and install the system.

- Internal personnel costs: businesses need an accounting – IT team to participate in the project, both for testing and for taking over operations.

- Maintenance & Upgrade Costs: SAP needs periodic updates to accommodate changes in accounting standards, technology and business needs.

List of Some Reputable SAP Accounting Software Implementation Partners

In Vietnam, there are many units that have experience in implementing SAP for large and multi-industry enterprises:

- FPT IS: SAP's strategic partner with many large-scale projects in the fields of manufacturing, banking and telecommunications.

- Beetech: excels in implementing SAP Business One for small and medium sized businesses.

- CMC TS: has strength in IT infrastructure combined with ERP implementation.

- ITG Technology: specializes in integrated ERP, has many SAP projects for manufacturing and distribution businesses.

Businesses should choose implementation partners based on practical experience in the industry, post-implementation support capabilities, and suitability to current scale and budget.

Frequently Asked Questions (FAQ) About SAP Accounting Software

Is SAP accounting software suitable for SME businesses?

Yes. SAP Business One (SAP B1) is designed specifically for small and medium-sized enterprises (SMEs), with lower investment and implementation costs than SAP S/4HANA. B1 provides full accounting, inventory management, sales and reporting functions, suitable for SMEs that are expanding in scale.

Does SAP comply with Vietnamese Accounting Standards (VAS)?

Yes. SAP implementation partners in Vietnam often configure the system to comply with Vietnamese Accounting Standards (VAS), while still supporting IFRS for businesses with international operations. This helps businesses meet domestic legal requirements while being ready for global integration.

What are the main differences between SAP B1 and SAP S/4HANA?

- SAP Business One (B1): Targeted at SMEs, quick deployment, low cost, focusing on basic operations such as accounting, warehouse, sales, CRM.

- SAP S/4HANA: For large corporations, supporting complex operations globally, capable of real-time data processing with In-memory Database technology, deeply integrating subsystems such as production, supply chain, human resources, and financial analysis.

Conclude

With the above information, it can be seen that accounting software SAP is a powerful ERP system, but success doesn't stop with implementation. The key to maximizing ROI lies in automating manual financial processes, which is where specialized solutions like Bizzi come in handy.

Sign up for a free consultation from Bizzi to discover automation solutions that can help you save costs and improve performance today: https://bizzi.vn/dang-ky-dung-thu/