Managing and issuing airline ticket invoices seems simple but directly affects the costs, taxes and financial transparency of the business. Small errors such as incorrect tax codes, incorrect information, or late invoice issuance can cause huge losses and tax risks.

This article by Bizzi will reveal to you the solution to manage airline ticket invoices in particular and invoices in general in a strict, standardized way and limit errors that cause impact.

Why is issuing airline ticket invoices important in business?

In business, air tickets for business purposes are considered as reasonable and valid expenses if there are full documents according to tax regulations. This is especially important because it is a condition for calculating reasonable expenses and tax deductions.

In order for airfare costs to be included in deductible expenses when determining corporate income tax and deducting VAT, businesses are required to have valid invoices, including:

- Correct business information: company name, address, correct tax code

- Issue invoices on time as prescribed (within valid time period)

- Proof of business purpose (business decision/ approval email/ itinerary)

If not met, the cost will be disqualified — the business will not be able to calculate the reasonable cost, nor will it be able to deduct VAT, leading to an increase in the amount of tax payable.

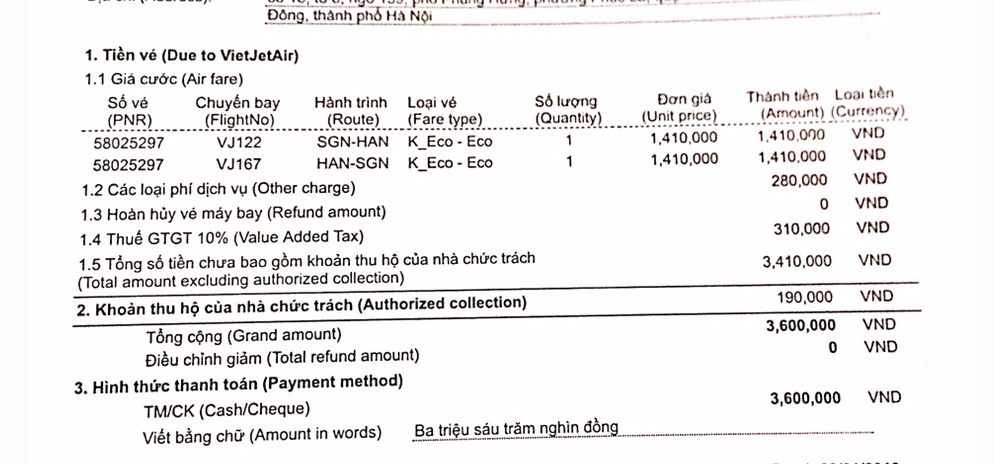

Real life example

An accountant booked a domestic business trip flight for an employee. However:

- When issuing an invoice, the supplier entered the wrong company tax code.

- And late invoice issued nearly 2 months after flight date

Result:

- When settling taxes, business trip expenses are completely eliminated.

- Businesses are not allowed to calculate reasonable expenses, not allowed to deduct taxes, causing losses of tens of millions of dong.

- Accountants spend time explaining and reprocessing documents.

Are airline tickets VAT invoices and when are they considered valid?

Not all airline tickets are VAT invoices.

- Airline tickets (electronic tickets / e-tickets) are not VAT invoices in nature, but only transportation documents / proof of service.

- To deduct taxes and calculate reasonable expenses, businesses are required to have VAT electronic invoices issued by airlines or legal agents in accordance with regulations.

E-ticket is only part of the document set, not a replacement for invoice.

When is an airline ticket considered a valid document?

An electronic airline ticket is considered valid for accounting purposes when accompanied by the following complete set of documents:

| Ingredient | Role |

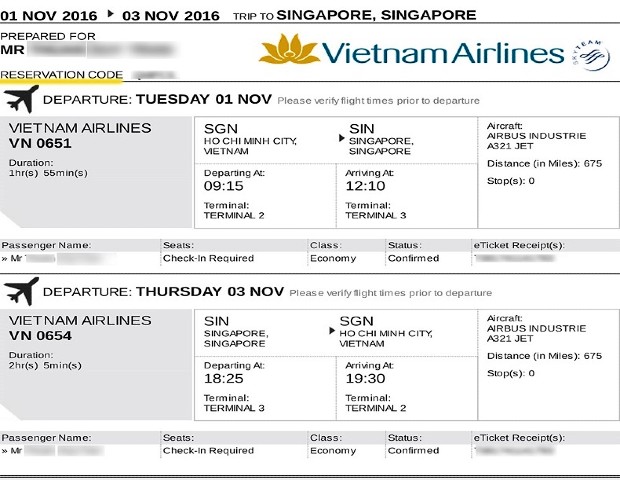

| Electronic ticket (E-ticket) | Confirm itinerary, flight date, flyer |

| Boarding pass (recommended) | Proof of service used |

| VAT electronic invoice | Documents for tax deductions and recording reasonable expenses |

| Decision/Email of assignment | Proof of work purpose |

| Valid payment information (bank transfer/company card/personal card with settlement) | Proof of payment in accordance with regulations |

Conditions for electronic tickets to be considered valid accounting documents

According to accounting & tax regulations, e-tickets are only valid when:

- Full itinerary information: passenger name, flight route, flight date, booking code, ticket number

- Have clear payment information

- Matches the information on the electronic invoice

- Electronic invoices must:

- Correct tax code, company name, address

- Export on time as prescribed

- Belong to a legitimate supplier

If the electronic invoice is missing, VAT will not be deducted and expenses may be excluded when settling.

Distinguish: Electronic ticket - Electronic invoice - Accounting document

E-tickets, e-invoices and accounting documents differ in their purpose of use and scope of application.

| Criteria | Electronic ticket (E-ticket) | VAT electronic invoice | Accounting documents |

| Nature | Confirm shipping service | Legal documents recording revenue & taxes | Costing documents |

| Tax effects | No tax deduction | Valid for VAT & CIT deduction | Proof of expenses |

| Have business tax code | Optional | Obligatory | Yes/No depending on the process |

| Export deadline | Before or immediately after flight date (depending on airline/agent) | According to the invoice regulations | After completing the documents |

| Is it cost effective? | Are not | If eligible | If the purpose of the work is correct |

| Related entities | Passenger name, itinerary, booking code | Tax code, company name, amount, tax, date of export | Email dispatch, payment, work report |

Airline tickets are not subject to VAT invoices and are only considered valid expenses when accompanied by an electronic invoice with full business information. Missing or incorrect invoices will result in no tax deduction and may be excluded from the tax settlement.

Who is allowed to issue airline ticket invoices and what are the responsibilities of each party?

Here's a breakdown of who is allowed to invoice airline tickets and what each party is responsible for — helping accountants and businesses stay informed to avoid tax and cost risks.

Who is allowed to issue airline ticket invoices?

The person/party authorized to issue airline ticket invoices must be a legal and tax-registered service provider. Businesses should clearly understand the responsibilities of each party to avoid having expenses excluded and losing tax deduction rights.

1. Airlines

For example: Vietnam Airlines, Vietjet Air, Bamboo Airways, Vietravel Airlines, ANA, Singapore Airlines…

- Have the right to issue VAT invoices for air transport services.

- Issue invoices directly to customers if purchasing directly on the website/airline ticket office.

- Responsible for invoice content (tax, business information, amount...)

2. Official airline ticket agent (IATA/authorized by the airline)

- Allowed VAT invoice Airline ticket sales service if valid business registration & tax registration.

- Depending on the model:

- Invoice shipping revenue (if fully authorized by the manufacturer)

- Or just export service charge invoice, and the shipping bill is issued by the carrier.

3. OTA (Online Travel Agency / online booking platform)

For example: Traveloka, Booking, Agoda, Vntrip, Mytour…

- If OTA is only a payment intermediary: the invoice will be issued by the airline or OTA's partner agent.

- If OTA sells and collects money directly: OTA can issue service fee invoices, while the airline issues the tickets.

4. Ticket purchasing businesses

- No right to issue airline ticket invoices.

- Only have the right to request the seller to issue a VAT invoice with correct business information.

5. How to determine who must issue an airline ticket invoice in each case

Airline ticket invoices must be issued by a legal, tax-registered airline or agent/OTA.

| In case of booking tickets | Who issues the airline ticket invoice? | Is there a service charge invoice? |

| Buy directly on the company's website | Airlines | Are not |

| Buy at authorized level 1 dealer | Freight forwarding agent or carrier (depending on the mechanism) | There may be |

| Buy from small dealers/collaborators | Freight forwarding company | Agent only charges service fee |

| Buy through OTA like Traveloka | OTA's affiliated agency or carrier | OTA can issue service fee invoices |

| Buy via Booking/Agoda (foreign) | Often Are not with Vietnamese VAT invoice | International payment invoice email available |

| Buy with voucher/personal card | Invoices can still be issued if tax code is provided. | Must make additional internal settlement |

6. Important notes for businesses buying tickets via apps (Traveloka, Booking, Agoda)

To effectively buy tickets via app for businesses, it is necessary to pay attention to Information security, thorough checking of passenger and flight information, selection of reputable applications, and establishment of clear booking policies. Businesses should also compare ticket prices from many airlines to optimize costs and take advantage of the airlines' loyalty programs.

Traveloka

- If the ticket is sold by the airline through Traveloka → the airline issues a VAT invoice

- Traveloka only issues service fee invoices (if any)

- Tax code must be requested right from the booking step.

Booking & Agoda

- Not a professional airline ticket sales platform, most of them do not support issuing Vietnamese VAT invoices

- Provide international payment invoice, but not valid for VAT deduction

- Only use as a deductible expense if:

- Proof of work purpose

- Valid payment

- No VAT deduction required

When should I issue an airline ticket invoice to avoid being charged on time?

Below are details on when to issue airline ticket invoices to avoid miscalculations, along with legal bases and practical notes for businesses.

Legal basis for the time of invoice issuance

According to Decree 123/2020/ND-CP (issued October 19, 2020, effective July 1, 2022) on invoices and documents:

- Article 9 provides for time of invoice as follows:

- For service provision: “is the time of completion of service provision regardless of whether payment has been received or not”.

- In case of collecting money before or during service provision: "the time of invoice issuance is the time of collection" (except for some cases such as only deposit or advance payment).

- For services that arise regularly and require data reconciliation, such as air transport: the time of invoice issuance is the time when data reconciliation between the parties is completed, but no later than the 7th day of the month following the month in which the service is provided. or no later than 07 days from the end date of the convention period.

Thus, for airline tickets belonging to transportation services, when making invoices, the airline (or agent) must base on the time of service completion/payment collection or reconciliation completion (if any) to make invoices on time.

Actual timetable for each airline

Below is a table of deadlines that some Vietnamese airlines have recorded according to public information; when purchasing tickets, businesses should pay attention to the deadlines of each airline:

Note: The time limit of “72 hours”, “48-72 hours” is the practice announced by the airline, not a general standard regulation. The law only stipulates “no later than 07 days of the following month” in case of reconciliation. Ticket purchasing businesses need to check the airline/agent’s own policy.

Risks of late issuance of airline ticket invoices

Businesses that purchase tickets but have invoices issued late (beyond the airline's deadline or do not meet the time limit according to Article 9) will be able to:

- Invoice is rejected by the company or agent → loss of VAT deduction certificate or loss of deductible expenses.

- Tax authority audit → airfare expenses may be rejected due to lack of valid invoice at the right time.

- Penalties for invoice violations (if the seller issues invoices late/does not issue invoices) may be imposed according to tax regulations.

Businesses will lose the right to deduct VAT, leading to increased costs and heavier taxes.

Recommendations for accounting firms

When buying airline tickets for business: ask the airline/agent to issue an invoice. as soon as possible, preferably within the time limit announced by the carrier (e.g. 72 hours) and before the month of service is over.

- Check information such as: booking code, itinerary, company name, tax code, address to provide to the airline immediately when issuing the invoice.

- Store airline ticket documents + boarding pass + electronic invoices to prepare for tax audit.

- If buying tickets through an agent/OTA, clearly identify who issues the invoice and within what time period to avoid "late issuance".

- Follow each airline's policy updates as actual times may vary.

How is VAT calculated for airline tickets and when is it deductible?

Here's the lowdown on VAT on airline tickets: how it's calculated and when it's deductible — including legal explanations, examples & practical notes.

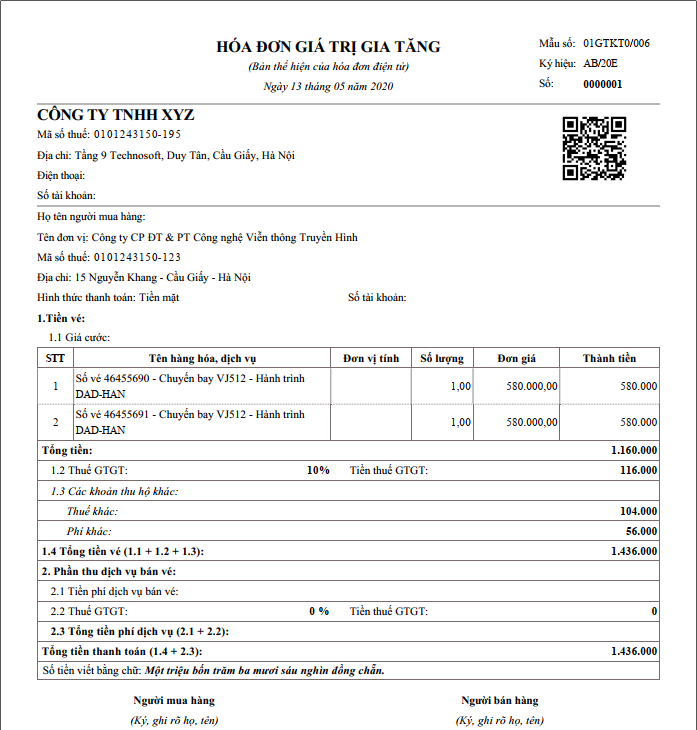

1. Domestic air tickets – Tax rate 10%

- Flights taking off and landing in Vietnam → VAT 10% applies

- Issue VAT invoice with tax rate 10% on ticket price + service fee + surcharge (if any)

Note: Airport tax, security fee, screening fee, international airport fee... are not taxable → not included in VAT.

2. International air tickets – Tax rate 0%

- Applicable to international flights departing from Vietnam to foreign countries

- VAT 0% according to preferential policy for international transportation services

- The invoice will show VAT = 0%

Example: Ticket Hanoi – Bangkok: VAT 0%

3. Collection fee (airport tax, security fee)

- Belong to the group not subject to VAT

- Displayed separately on invoice, VAT not included

4. Connecting tickets, international tickets with domestic flights

Connecting tickets with domestic and international legs purchased by businesses through the app are subject to VAT rate 0% for the entire international journey if they meet the conditions of international transport services, i.e. the international leg is the main part. However, the domestic leg entirely on the same ticket will be subject to tax rate 10%, shown on a separate invoice or clearly divided in the general invoice.

| Case | VAT applies | Note |

| Hanoi – Ho Chi Minh City – Singapore (one ticket, several tickets) | 0% | For the ultimate purpose of international transport |

| Hanoi – Ho Chi Minh City (purchased separately), then Ho Chi Minh City – Singapore | HN–HCM: 10% / HCM–SIN: 0% | Because they are considered two independent transactions |

| Singapore – Ho Chi Minh City – Hanoi (international tickets to Vietnam) | 0% | All international journeys should be VAT 0% |

5. Why do accountants often make mistakes when declaring VAT for international air tickets?

Accountants often make mistakes when declaring VAT for international air tickets due to confusion between the 0% tax rate for international transportation services and the 10% tax rate for other related services such as service fees and ticket refund fees. In addition, complex accounting such as determining the validity of documents, processing input and output invoices, and distinguishing between agent commissions and service fees are also causes of errors.

| Common mistakes | Reason | Consequence |

| Declaring VAT deduction for international tickets | Misconception that all tickets include VAT | Incorrect indicators on the declaration, must be adjusted |

| Do not separate the collection fee when accounting. | Combine all to calculate tax | Incorrect cost accounting |

| Not understanding the rule “one ticket – one journey” | Combine VAT 10% for domestic leg in international itinerary | Tax authorities classify VAT and fine for false declarations. |

| Don't know international invoice = VAT 0% | Think the invoice lacks VAT → request to change the invoice | Time consuming to process documents |

When is the issuance of an airline ticket invoice considered a reasonable expense?

According to the provisions of the Law on Corporate Income Tax (CIT) and Circular 78/2021/TT-BTC, airfare costs are considered reasonable expenses when meeting 3 conditions at the same time:

1. Actual costs incurred

- Serving the production and business activities of the enterprise.

- Have a business trip decision, approval email, work schedule or documents proving the purpose.

2. Have legal invoices and documents

- Valid electronic invoice or VAT invoice: correct company name, tax code, address.

- Attached is E-ticket, boarding pass, contract and related documents.

3. Cashless payment for bills > 20 million

- Transfer, payment via company card, employee card (with payment and refund table).

- No cash payment is allowed if the total value of one payment > 20,000,000 VND (including tax).

4. Illustrative table of 4 situations for accounting for airline ticket costs

Below are four common situations for accounting for airline ticket costs.

| Situation | Invoice terms | Pay | Are corporate income taxes included? | Note the profile |

| Buy directly from the manufacturer / dealer | Have a valid e-invoice | Transfer / card | Have | Need E-ticket + boarding pass |

| Buy online website/app | The airline or agent/OTA issues the invoice | Transfer / e-wallet | Have | Clarify who issues the invoice to avoid late issuance |

| Employees buy themselves - businesses pay in advance | Invoice issued with company name and tax code | Personal card → Business refund | Have | Required: refund regulations + work decision |

| Tickets for foreign experts | Invoice name of company | Bank payment | Have | Have a labor contract/service contract |

Bizzi Travel & Expense – Solution to automate the entire process of booking and issuing airline tickets & managing business expenses

Managing business travel expenses using Excel, email, or manually collecting them from each employee exposes businesses to many risks:

- Missing invoice/lost document

- Wrong tax code, wrong business name

- Late invoice issuance (48–72 hours overdue) → loss of deduction rights

- Insufficient set of work documents (invoice – E-ticket – boarding pass – work decision)

- Disjointed and difficult to control approval process

- Unable to compare "estimated expenditure - actual expenditure"

To thoroughly solve these problems, Bizzi Travel & Expense Provides a comprehensive suite of features that help businesses standardize and automate the entire expense lifecycle – from booking, approval, receipt to settlement.

Bizzi fully supports the T&E process:

- Create a job proposal

- Automated approvals by process & budget

- Book tickets according to business travel policy

- Automatically receive invoices from the company/agent

- Reconciliation of E-ticket – boarding pass – invoice

- Automatically generate work reports & refund settlement

→ A single platform helps businesses manage the entire Travel & Expense Policy.

Where do businesses get airline ticket invoices and what is the process?

Airline ticket invoices are important documents for businesses to account for expenses and deduct VAT. However, many accountants are still confused when they need to get invoices from airlines, agents or OTA platforms. Below are detailed instructions to help businesses proactively get the correct - sufficient - timely.

1. How to get electronic invoices from each airline

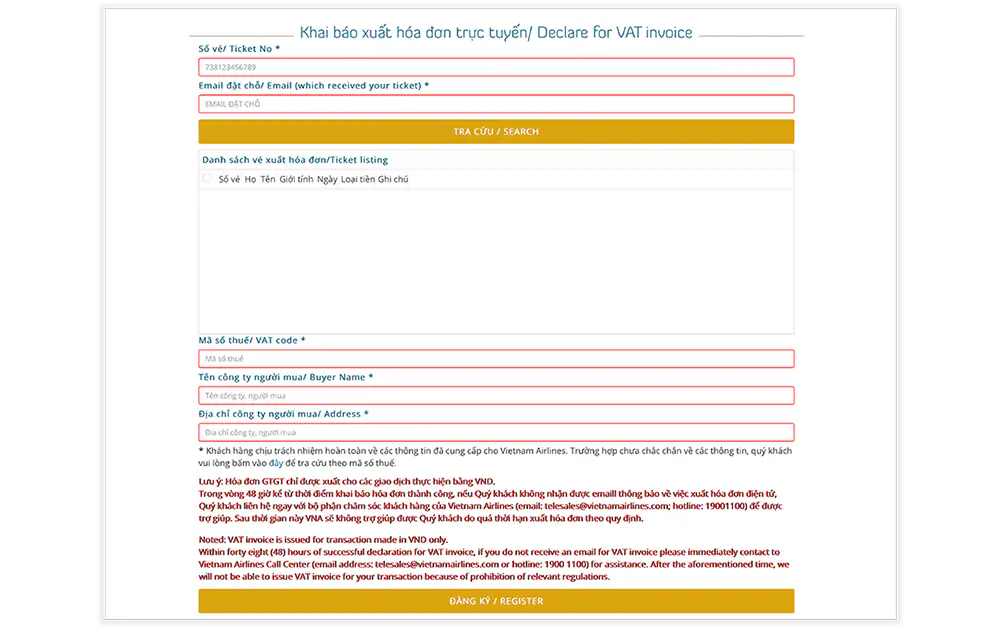

Vietnam Airlines

- Invoices can be obtained on the website or via email.

- Required information: Business tax code, reservation number (PNR), invoice email, flight itinerary.

- Note: Invoice is generated after payment is completed.

Vietjet Air

- “Invoice” section on Vietjet website.

- Invoice request deadline: 48 hours from payment.

- Only support one-time invoice issuance → wrong tax code must be canceled and re-issued according to separate process.

Bamboo Airways

- Online invoicing portal on Bamboo website.

- Deadline: within 72 hours of ticket purchase completion.

- You need to enter the email used for payment and the business tax code.

2. Get an invoice when purchasing through a ticket agent

- Agents are authorization to issue invoices and has its own electronic invoice system.

- When making payment, businesses need to:

- Provide full tax code and email information

- Check the correct information on the invoice before declaring.

Note: Even if purchased from an agent, the invoice must still show full itinerary information, ticket code, and passenger information.

3. Get invoice when purchasing via OTA (Traveloka, Booking, Agoda, ...)

| Situation | Who issues the invoice? | Note |

| OTA is just an intermediary, the company does the work. | Airlines | Businesses must go to the company gate themselves to get the invoice. |

| OTA sells full service packages and collects money directly | OTA | Invoice issued by OTA, not airline ticket invoice |

| International tickets paid in foreign currency | Subject to transaction terms | Attach payment documents and booking confirmation |

Practical note: Traveloka usually no VAT invoice for airline tickets, accountants must get it themselves at the company based on PNR.

4. Checklist of information needed to prepare for invoice issuance

| Information | Obligatory? |

| Corporate tax code | ✔ |

| Email to receive invoice | ✔ |

| Reservation Number (PNR) or Ticket Code | ✔ |

| Full name of the flyer | ✔ |

| Payment documents (bank, card) | ✔ when total value > 20 million |

| Flight itinerary & flight date | ✔ |

5. Automate the process of getting & checking invoices

If a business manages many working documents, manual work can easily cause:

- Lost invoice, missing invoice

- Wrong Tax Code

- Fail to meet invoice deadline → lose deduction rights

👉 Bizzi Expense support:

- Automatically retrieve invoices from emails and attachments

- Legal standard XML file comparison

- Warning of incorrect information (tax code, business name, invoice date)

The solution helps businesses reduce risks, costs, and time for document control.

Process invoices when tickets are changed, refunded, canceled or have incorrect information

During the course of work, flight changes, ticket refunds, or changes to booking information occur frequently. Accountants need to understand how to properly process invoices to avoid expense exclusions or incorrect tax declarations.

1. When changing tickets → need to issue a replacement invoice

In case of changing itinerary, flight date, ticket class... but still use flight service, the company or agent will:

- Issue replacement airline ticket invoices (new invoices replace all old invoices)

- Old invoices will be no longer valid but still have to store

The replacement invoice content must clearly state:

- Invoice number and symbol replaced

- New value of ticket after exchange

2. When refunding tickets → create an adjustment invoice

If the passenger does not use the service and is refunded:

- Enterprises receive adjusted invoices (recorded) or refund adjustment records

- The adjusted value can be completely negative or partially negative (after deducting penalty fees).

Note:

- Pursuant to Circular 78/2021 & Decree 123/2020: refunding tickets cannot cancel the original invoice if declared → must be adjusted.

3. When the information is incorrect (passenger name, tax code, email...)

- Changing the content does not change the value of money → use additional adjustment invoice (information)

- Change value → invoice adjustment increase/decrease accordingly

Wrong MST is a serious error and often results in cost exclusion if not corrected promptly.

4. Explanation of the “yin/yang” recording pattern in the adjustment invoice

| Invoice type | Value sign | Applicable cases |

| Adjustment down | Minus (-) | Refund tickets, reduce service value |

| Adjust up | Positive (+) | Differences arise when changing tickets |

| Adjust information | No yin/yang | Change name, tax code, itinerary without changing price |

When declaring taxes, accountants must enter negative values to offset in the period of occurrence.

For example:

- Ticket purchased 3,000,000 → fully → adjusted invoice recorded -3,000,000

- Ticket exchange fee increased by 500,000 → adjusted invoice recorded +500,000

How to declare and account for airline ticket costs according to accounting standards

Airline ticket costs are a regular expense in businesses, especially in sales activities, internal work, training, and working with partners. In order for costs to be calculated properly and VAT deducted properly, accountants need to follow the correct declaration and accounting procedures.

1. Declaring VAT for airline ticket invoices

Only applicable for domestic tickets with VAT 10%

Declare in the index:

- [23] – Goods and services purchased during the period

- [25] – Deductible VAT

International tickets (VAT 0%) → include in item [26] – Purchased services are not deductible

2. Store documents properly

Many businesses only keep PDF files and are excluded from tax audits because:

- PDF is not the original invoice

- The original electronic invoice must be an XML file.

3. Accounting for air ticket costs

Usually use 3 main accounts:

- Debt 642, 641

- Debt 133

- There are 111/112/331

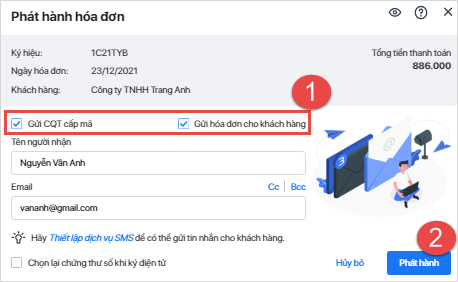

4. Bizzi supports automatic accounting

If your business uses Bizzi Expense or Bizzi Invoice:

- Automatically read and check XML invoices

- Identify domestic / international tickets / collection fees

- Check work documents - boarding pass - refund

- Automatically generate accounting entries via API to ERP (SAP, Oracle, Bravo, Fast, Misa...)

Reduce 80% data entry time – limit VAT declaration errors

How to automate the process of issuing airline ticket invoices and reconciliation?

For businesses with high frequency of work, manually collecting, storing, comparing and accounting for airline ticket invoices is time-consuming and prone to errors. Automating the process is a solution to help reduce tax risks, ensure the validity of documents and save operating costs.

- The suggested procedure is as follows:

Booking tickets → Receive ticket & invoice emails → System automatically collects & reads XML data

→ Check validity & error warning → Compare with work information

→ Automatically generate accounting entries → Synchronize with accounting software / ERP

first. Automatically collect invoices

- Scan emails by domain or keyword (PNR, e-ticket, invoice…)

- Automatically download XML & PDF invoices and categorize by flight/employee/cost center

- Support pulling invoices from sources: Vietnam Airlines – Vietjet – Bamboo – Agent – OTA

2. Automatically check and compare documents

Self-verification system:

| Checklist | Authentic content |

| Invoice validity | Correct format NĐ123 – TT78 |

| Business Tax Code | Compare national MST DB |

| Cash value & VAT | Price deviation detection |

| Boarding pass | Matching ticket usage |

| Work decision & refund | Employee Matching – Trip |

Alert yourself when:

- Near expiration date 48h/72h invoice issuance

- Wrong Tax Code

- International tickets incorrectly declared VAT

- Missing boarding pass

3. How does Bizzi support automation?

- Automatically get invoices from email

- Check – invoice – boarding pass – refund

- Identify the adjustment / replacement / refund invoice

- Generate automatic accounting entries for ERP transfer

- Invoice deadline warning 48–72 hours

- Electronic invoices are stored in a single place with an intuitive display list for easy management and access.

Bizzi provides solutions to help businesses avoid tax deductions and audit risks

FAQ – Frequently asked questions when issuing airline ticket invoices

1. Can I issue an invoice after the flight date?

Yes, but must be within the time limit allowed by the company/agent and comply with Article 9 of Decree 123/2020/ND-CP: The time to issue an invoice is when the service is completed or when the payment is collected.

Actual duration:

| Company | Time required for invoice issuance |

| Vietnam Airlines | 72 hours |

| Bamboo Airways | 72 hours |

| Vietjet Air | 48 hours |

If the above deadline is exceeded, the invoice cannot be re-issued, resulting in non-deduction and expense rejection.

2. Can I combine multiple people on one bill?

Yes. Businesses can. combine multiple passengers into one bill if placed in the same a reservation number (PNR) and joint payment.

Note:

- Must write the correct name of each passenger

- The description section clearly states the itinerary – flight number – flight date.

3. Are international tickets subject to VAT?

- International ticket VAT = 0%

- Collection fee (airport tax / airport security fee): tax-free

- International tickets with connecting domestic flights are still valid. Apply 0% for the whole trip

Many accountants declare VAT incorrectly, leading to incorrect VAT declarations.

4. Is a digital signature required to issue an airline ticket invoice?

According to the regulations on electronic invoices under Decree 123, invoices issued by airlines/agents have been digitally signed directly on the XML file, without the need to print and sign additional stamps.

PDF is just a representation, XML is the original invoice.

5. Is there a tax deduction for buying tickets through foreign apps (Traveloka, Booking, Agoda)?

VAT can only be deducted when the app/agent issues a valid VAT invoice in Vietnam (with Vietnamese tax code & XML file). If the invoice is from a foreign organization without a Vietnamese tax code → VAT cannot be deducted and expenses can only be calculated if proven to serve production and business purposes.

6. How to check if the airline ticket invoice is valid?

Checklist:

- There is a standard XML file NĐ 123

- The MST is correct and exists in the tax system.

- Invoice status is still valid (not adjusted / canceled)

- Correct VAT (10% domestic / 0% international / no collection fee)

- Match booking – itinerary – boarding pass – payment

Bizzi supports automatic checking of XML invoices, warnings of incorrect MST, incorrect VAT, late export, and missing documents.

Conclude

Airline ticket invoices seem simple, but in fact, they are one of the groups of documents that are most likely to be wrong, missing, and rejected during tax audits. Understanding the regulations on invoice issuance time, valid conditions, and how to handle exchange, refund, and cancellation situations is a must for every business.

In the context of businesses having many business trips, many ticket booking sources and large volume of invoices, Automate the process of getting - checking - reconciling airline ticket invoices not only helps:

- Minimize errors & fraud risks

- Ensure complete and correct set of valid documents

- Increase tax compliance – audit

- Significantly saves processing time for accounting

but also helps businesses control their operating budgets better and operate their finances more transparently.

Applying automated solutions like Bizzi Travel & Expense is an inevitable step to standardize expense management and protect tax benefits for businesses. Register here to receive advice from experts on expense management solutions specifically for your business! https://bizzi.vn/dat-lich-demo/