In an increasingly dynamic business environment, business travel to meet partners, customers and attend professional events has become an indispensable part. However, along with the increase in travel comes the need to manage expenses effectively and transparently. Travel Expense Report (T&E Report) is a tool to support businesses in controlling expenses, ensuring compliance with internal regulations and optimizing budgets.

The article below will provide a comprehensive guide to expense reporting, from the concept, importance, to modern methods to simplify and automate this process.

What is a travel expense report?

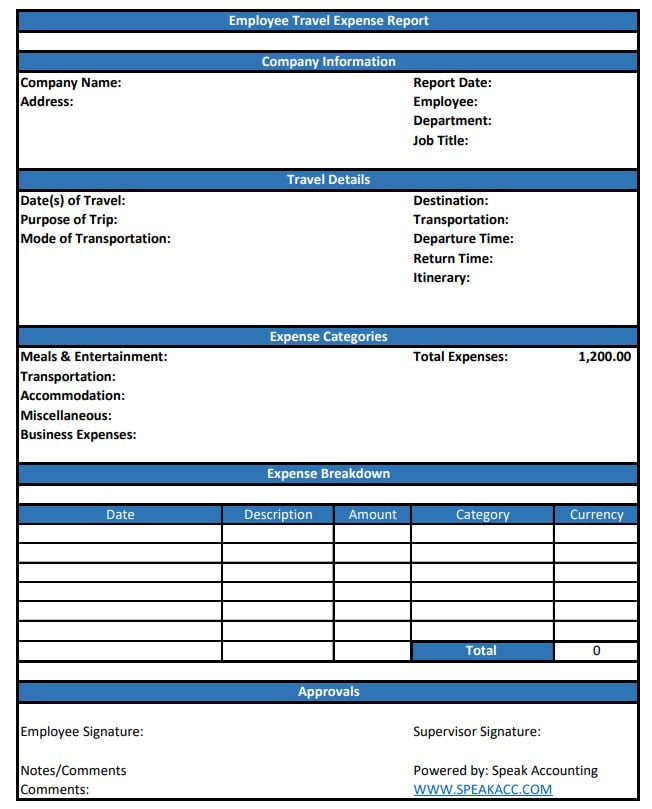

Travel Expense Report (T&E Report) is a document that details the expenses incurred during a business trip. These documents help companies track business travel expenses and organize expenses for compliance and tax purposes. A per diem report includes expenses such as airfare, hotels and lodging, car rentals, and other incidental expenses. A per diem report is also known as a travel expense report or travel expense report.

Reports also include receipts or other proof of purchase to verify the accuracy and business necessity of each expense.

There is an increasing need for business travel to conferences, client meetings or offsite meetings to maintain business growth.

According to the Global Business Travel Association, with 71% travel buyers indicating an increase in business bookings through 2024. However, as costs continue to rise, calculating the actual return on investment becomes important to evaluate the effectiveness of trips. Expense reporting plays a key role in controlling budgets and making the most of available funds.. They help track where and how spending is done against a business's travel budget.

Key elements of a business expense report

In a typical T&E report, the employee provides the following information:

- Employee Information: Include name, title, department and contact information.

- Trip details: Include location, date and purpose of the trip.

- Expense categories: These are different groups of costs that arise during the trip, for example:

- Means of transport: Such as plane tickets, train tickets, car rental costs and gas fees.

- Accommodation: Includes hotel and Airbnb rental costs.

- Meal

- Entertainment

- Other work related costs.

- Specific costs in each category: List specific spending items and the amount spent on each item.

- Total: Total cost of all expenses during the trip.

Additionally, the source also indicates that each listed expense should include the following details:

- Transaction date.

- Purchase cost.

- Cost Description.

- Supplier Name.

- Payment method (e.g. business travel, credit cards, etc.).

- Receipt or detailed invoice for each expense. Reports also include receipts or other proof of purchase to verify the accuracy and business necessity of each expense.

Why is expense reporting important?

While expense reports can sometimes seem like tedious administrative work, they are important financial records. Here are four reasons why they are important:

- Budgeting and expense tracking: If your organization is over budget for travel, you can use business intelligence data from T&E reports to find cost savings opportunities. Additionally, trip expense reports help finance departments track spending trends to more accurately forecast travel budgets. Per diem reports are essential for controlling budgets and making the most of available funds. They help you track where and how you are spending against your corporate travel budget.

- Comply with travel policies and guidelines: When employees submit T&E reports as part of their expense tracking and travel reimbursement process, finance departments can ensure compliance with the organization’s T&E policy. This helps reduce errors and helps employees get reimbursed faster, ultimately making them happier and more productive.

- Tax preparation: Generally, business-related expenses—including travel reimbursement—are tax-deductible. However, the IRS and many other tax agencies require detailed receipts or other proof of purchase for each transaction to qualify for these deductions in the event of an audit.

- Fraud protection: Requiring detailed receipts for every transaction listed on an employee’s travel expense report also helps reduce expense fraud. With your company policy in place, your team knows they need to provide complete documentation to be reimbursed.

What are the benefits of automating expense reporting?

Implementing a travel expense reporting process allows you to better control and understand your team’s travel spending. While tracking expenses with paper reports or digital spreadsheets may seem simple and cost-effective at first, manually filling out and reviewing T&E reports can lead to errors and waste valuable time—causing problems for employees when claiming expenses if there are system delays.

Automating expense reporting offers many benefits, although it can be costly depending on the software and size of the organization:

- Simplify your overall expense reporting process.

- Provides real-time visibility into cost data.

- Eliminate manual paperwork through the feature of receiving and automatically processing invoices

- Ensure compliance with T&E policy thanks to AI scanning.

- Track distance traveled automatically

- Automatic expense classification.

- Allows setting up custom expense policies.

- Integrates with HR and accounting software.

- Enable automated approval workflows, help Faster reimbursement for staff

In summary, expense reporting is an essential tool for businesses to manage travel expenses, ensure compliance, support tax compliance, and prevent fraud. Automating this process offers many benefits in terms of efficiency and control.

Best practices for tracking and automating Per diem reporting:

Here are some strategies to simplify the process of tracking and automating travel expense reporting:

- Simplify the expense reporting process: Keeping the expense reporting process as simple as possible makes it easier for employees to submit reports in compliance with company travel policies, thereby reducing the time it takes for finance to review and collect missing information.

- Encourage consistent booking practices: Instruct employees to use approved corporate travel management platforms to ensure expenses are not spread across multiple platforms not designed for corporate travel bookings.

- Digitize policies and principles: Create a digital copy of your travel policy for employees to easily access in case of questions. Even if you're not ready to invest in expense management software, you can create a standardized travel expense report template that includes a link to the policy.

- Invest in the right tools: When ready to automate with expense management software, make sure the software has the necessary capabilities, integrates with existing tools, allows for the incorporation of travel policies, creates workflows, and automatically scans receipts.

- Take advantage of corporate cards: Consider offering a corporate credit card so employees don’t have to pay expenses upfront, reduce the risk of expense fraud, control spending, and save time. Corporate cards collect real-time transaction data, eliminating the need for complex expense reporting and reimbursement processes.

In reality, many businesses are still struggling with manual expense processing:

- Employees spend a lot of time making reports and collecting invoices.

- The accounting department worked hard to review and check documents.

- It is difficult for management to control arising costs, especially with small expenses.

- Risk of loss, error, and fraud is hidden in every step of processing.

Therefore, modern businesses are gradually automation business trip fee process, from book flight tickets, Expense declaration, approve arrive accounting - to Optimized operation, risk reduction and financial control tighter

This is also the reason Bizzi Solution was born — helping businesses digitize the entire business expense process in an easy way. fast, transparent and efficient.

Bizzi – Solution to optimize business expense process for modern businesses

In a context of increasing travel costs and stricter compliance requirements, automating the expense reporting process is no longer just an option, but has become an essential need for businesses to effectively manage their finances.

Bizzi offers a comprehensive platform that helps businesses automate and tightly control the end-to-end expense workflow:

- Book flights and hotels directly on the system: Helps employees easily plan business trips, ensures transparent pricing and synchronizes costs right from the service booking stage.

- Set up work policies: Businesses can set up regulations in advance such as maximum spending levels for each type of expense (airfare, hotel, taxi, meal, etc.), and approval processes decentralized by role and department.

- Manage business trip allowances by department, rank and work location: The system automatically alerts when expenses exceed budget, are not included in the budget plan or approved spending categories, helping to prevent uncontrolled spending and ensure compliance with company policies.

- Flexible approval process: Set up a flexible expense approval process that allows managers or authorized persons to approve expenses by department, personnel level, or work requirements at a specific location. This process helps ensure expenses are properly checked and approved and prevents unreasonable expense approvals.

- Easy to declare and create proposals: When an employee receives an electronic invoice from a supplier via email, the Bizzi system will automatically retrieve the invoice and push it to the mobile application. Here, the invoice is checked. tax validity, at the same time automatically reconciles with travel expense policy installed. Then, the employee simply selects the invoice and creates request payment of expenses directly from the app, no manual input required.

- Automatic accounting and reimbursement: Approved expense reports will automatically connect to the accounting system, minimizing manual operations and shortening reimbursement time for employees.

- Real-time expense reportingManagers can track business expenses by individual, department, or project, helping to control budgets and make quick decisions.

- Flexible integration with the enterprise's internal ERP, accounting, and HR systems.

Bizzi not only helps businesses Reduce 50-70% business trip processing time but also Increase transparency, compliance and cost savings significant

Sign up for a free trial now at: https://bizzi.vn/dang-ky-dung-thu/

With Bizzi, your business can:

✅ Reduce up to 80% of time spent processing business expense reports.

✅ Increase 100% ability to control travel expenses.

✅ Ensure compliance with internal cost policies and tax regulations.

✅ Improve employee experience, reduce response waiting time.

✅ Significantly reduce operating costs for finance and human resources departments.

Expense reporting is not only an administrative step for each trip, but also a key factor in controlling budgets, ensuring compliance, and protecting businesses from fraud. When these processes are automated, businesses not only save time, but also improve accuracy and operational efficiency.

With the solution to digitize the cost reporting process of Bizzi, businesses can automatically receive invoices, check validity, classify expenses and approve payments right on the mobile platform. Expense management becomes more transparent, faster and easier than ever, allowing the finance department to focus more on strategic tasks instead of manual processing.

Let Bizzi help you modernize your cost management process, optimize resources and create a solid foundation for sustainable growth of your business.

Sign up for a free trial now at: https://bizzi.vn/dang-ky-dung-thu/

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam

- Youtube: https://www.youtube.com/@bizzivietnam