Surely Chief Financial Officers (CFOs) are struggling with the myriad challenges in today's volatile economic context.

According to the latest 1Q25 CFO report from Gartner, the three biggest “bottlenecks” facing CFOs are: how to “tighten the belt” without stifling growth, how to retain and attract financial talent, and improve data governance to fully exploit the potential of the digital age.

So, what is the key to overcoming these challenges and reshaping the financial “face” of businesses in 2025 and beyond? Let’s find out together. Bizzi Explore key strategies recommended by Gartner.

Index

ToggleThree Big “Bottlenecks” and Solutions from Gartner in CFO Report

Gartner's CFO report not only "names" the challenges, but also offers practical "remedies" to help CFOs "heal". These are:

- Reduce costs without compromising growth: In a volatile global economy, cost cutting is inevitable. However, without a proper strategy, this can hinder business growth.

- Retaining and attracting financial talent: The financial job market is fiercely competitive, especially for digital talent. Retaining and attracting talent requires CFOs to have an effective human resource management strategy.

- Improve data governance: Data is considered a “gold mine” for businesses, especially in the AI era. Effective data management helps CFOs make informed decisions and maximize the potential of AI.

Gartner has released its 2025 cost management strategies that focus on three key pillars: cost management, talent management, and technology.

Cost Management: “Tighten Your Belt” Smartly

Businesses should consider ways to cut costs without hurting growth. In today’s environment, cutting costs is inevitable. However, without a proper strategy, this can hinder the growth of the business.

Instead of passively cutting costs, CFOs need to proactively build a culture of cost savings across the enterprise.

Talent Management: “Keeping Talent, Nurturing the Future”

The financial job market is fiercely competitive, especially for digital talent. Retaining and attracting talent requires CFOs to have an effective human resource management strategy.

- Invest in developing management skills for financial managers.

- Build a work environment where employees feel respected and appreciated.

Technology: “Data is gold, AI is the key”

Data is considered a “gold mine” for businesses, especially in the AI era. Effective data management helps CFOs make informed decisions and maximize the potential of AI.

- Build a solid data governance infrastructure to support AI adoption.

- Leverage the CFO's expertise and leadership to drive data governance.

Cost Management Strategy 2025: “Cut your coat according to your cloth”

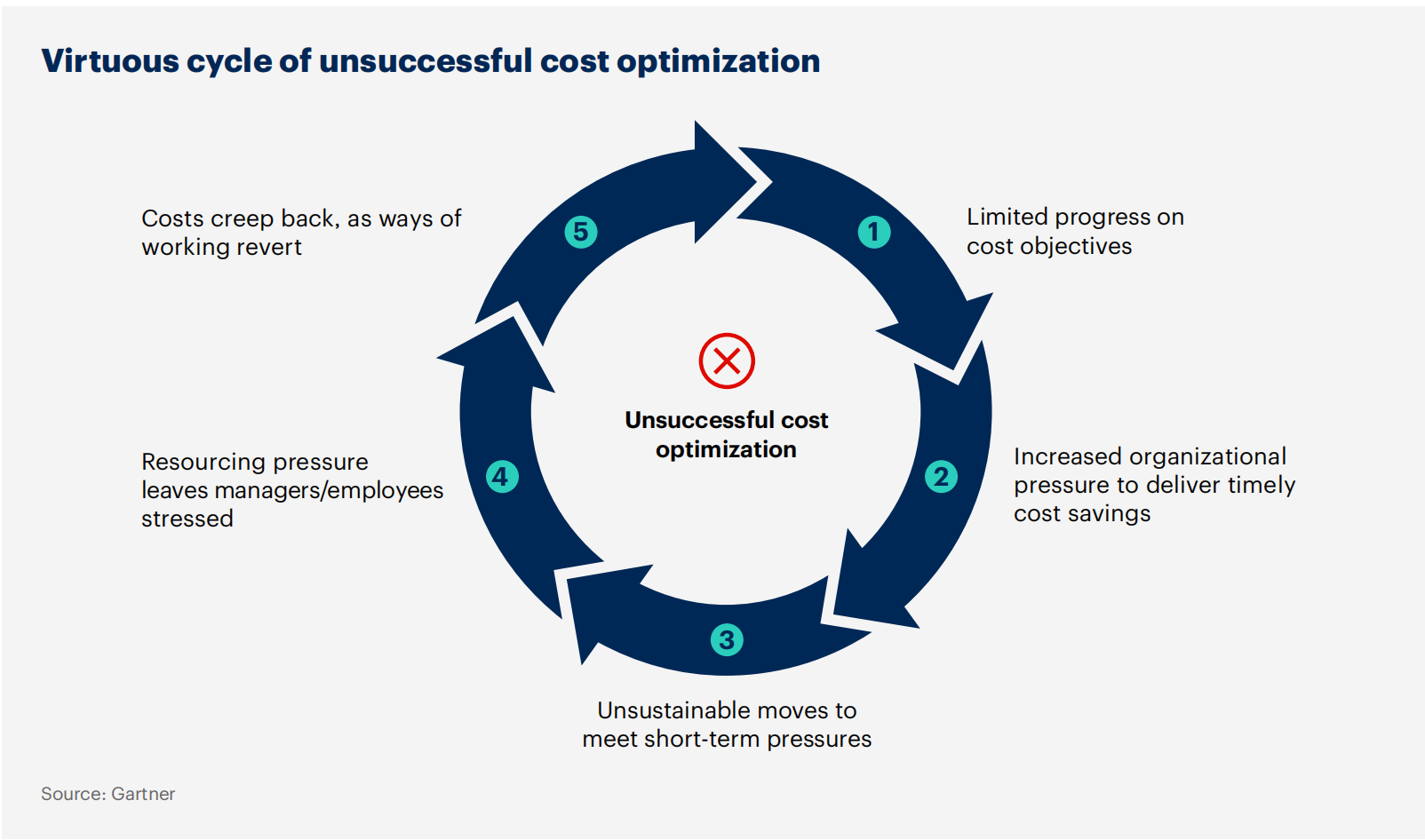

Cutting costs does not mean blindly tightening your belt, but rather “cutting your coat according to your cloth”, optimizing every penny of capital to bring the highest value.

Corporate culture acts as an “operating system” that governs all employee behavior and decisions. Therefore, building a cost-optimized culture is not only a strategy, but also a “compass” that helps businesses overcome difficulties and achieve sustainable growth.

To build a successful cost optimization culture, CFOs can apply the following strategies.

- Linking cost targets to personal benefits: Create a strong link between corporate cost targets and employee benefits by linking bonuses to cost savings.

- Raising awareness of economic value: Provide in-depth training on economics and shareholder value to help employees, especially those outside of finance, understand the importance of cost savings.

- Build a “compass” for cost cutting: Clearly define acceptable and unacceptable behaviors in cost cutting, ensuring transparency and fairness.

- Focus on long-term cost savings: Prioritize cutting unnecessary operating expenses and non-cash costs.

- Avoid the “double-edged sword” of short-term cost cutting: Be wary of temporary cost-cutting measures, as they can have negative long-term consequences, such as reduced employee morale and unexpected costs.

Balancing cost cutting and growth promotion

One of the biggest challenges for CFOs is how to “tighten their belts” to get through difficult times while “injecting capital” to drive growth and seize new opportunities? To do this, CFOs need to have strategic vision and the ability to make smart decisions.:

- Focus on investments that deliver the highest value.

- Look for opportunities to optimize processes and improve operational efficiency.

- Invest in new technologies and solutions to drive growth.

>> Read more: CFO's Guide: The Future of Accounts Payable (AP)

Talent Management Strategy 2025: “Talent is a valuable asset”

Attracting and retaining talent is one of the top priorities for every business. Especially in the financial sector, where change is constant, having competent and passionate talent is more important than ever. Gartner, in its 1Q25 report, emphasized the role of building talent management capabilities, considering it the key to “unlocking” talent potential and creating sustainable competitive advantage.

CFOs need to focus on:

- Improve the quality of management team: Invest in training and development of management skills for the leadership team, especially in talent management and development.

- Building an attractive working environment: Create a work environment where employees feel respected, empowered and have the opportunity to grow.

- Clearly identify the required competencies: Collaborate with relevant departments to identify what competencies the management team lacks and which competencies are most important to achieving the business's goals.

- Set clear performance assessment criteria: Build a transparent performance assessment framework that helps employees understand the company's expectations.

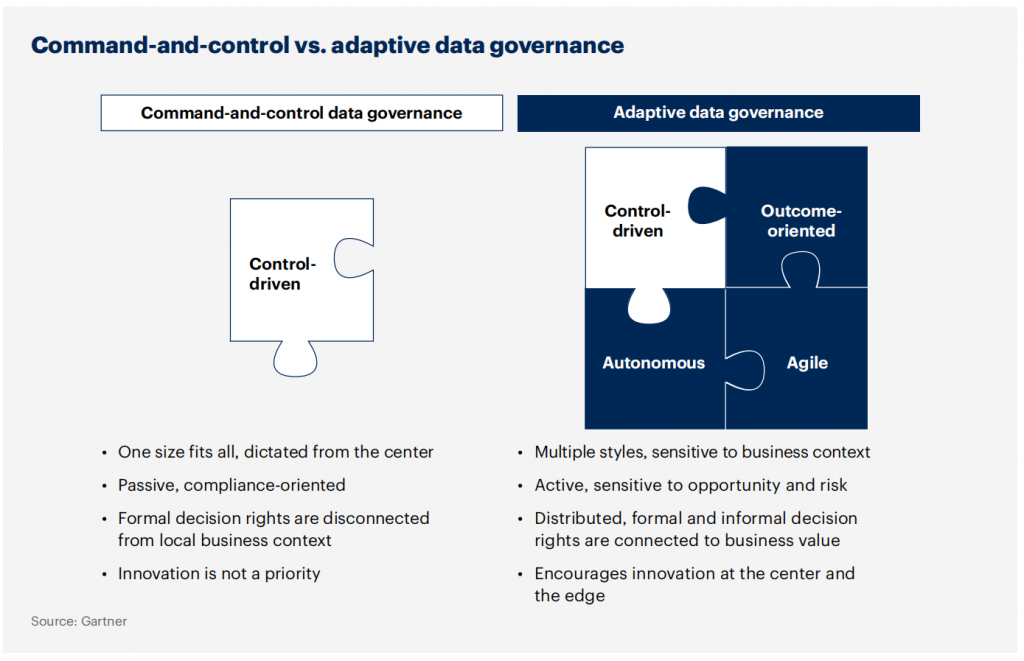

Data Governance: “Turning Data into Power”

In the digital age, data is considered the “gold mine” of businesses. CFOs play an increasingly important role in data governance, especially as more and more CFOs take on responsibility for data and business analytics.

To fully harness the power of data, CFOs need to:

- Act as a leader in data governance: With deep knowledge of the organization's data and senior leadership status, the CFO is best suited to lead data governance.

- Raise awareness of the benefits of data governance: Clearly communicate the benefits of data governance to stakeholders, and address common questions and concerns.

- Delegate responsibility to data managers: Once a data governance system is in place, the CFO should delegate some responsibilities to the data steward to ensure efficiency and sustainability.

- Collaborate with CIO and Chief Data Officer: Discuss and evaluate the organization's current data governance approach and make appropriate adjustments and improvements.

Bizzi Expense: A "powerful assistant" to help CFOs create an optimal cost management system

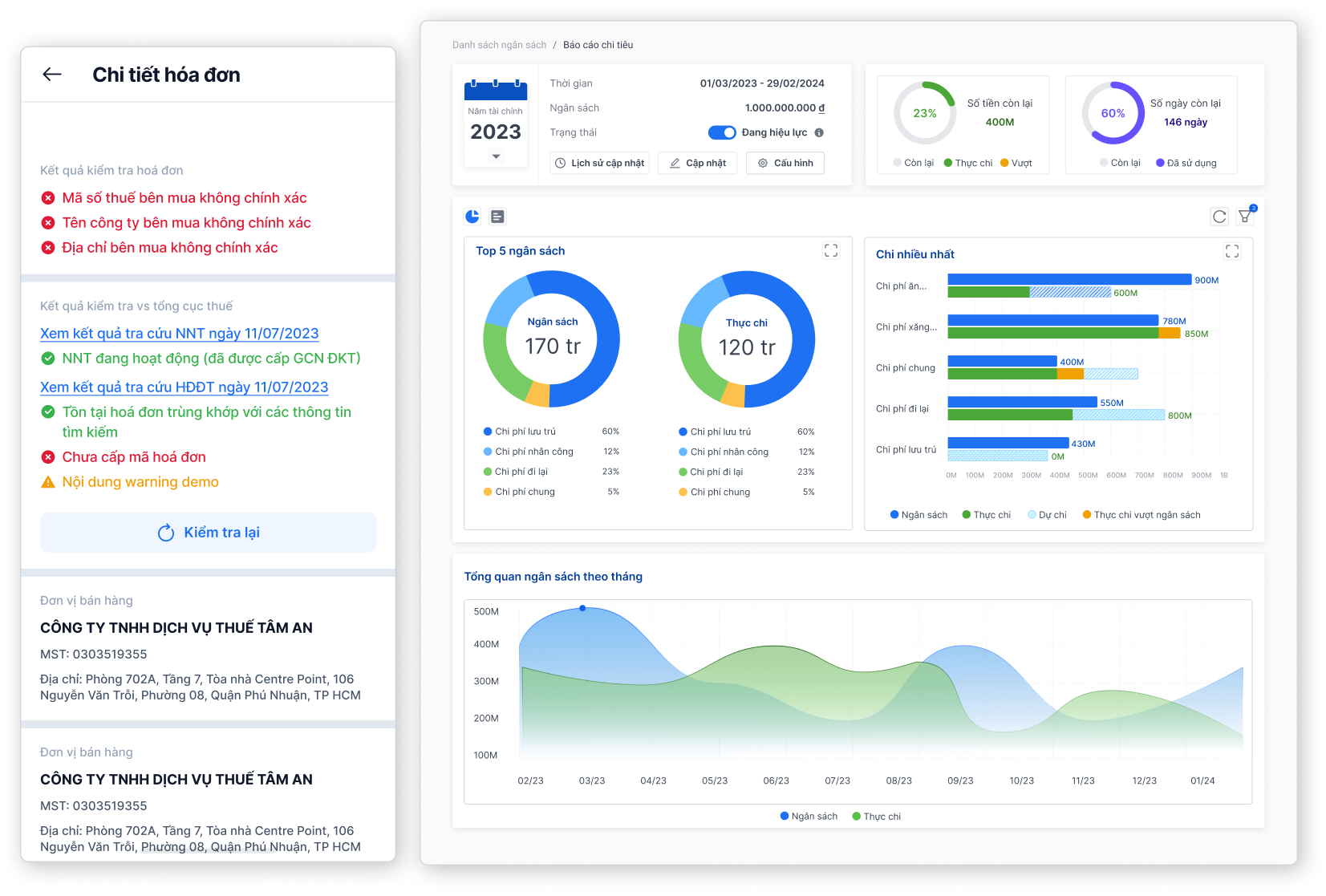

In the journey to conquer financial challenges, CFOs are not alone. Bizzi Expense has emerged as a “powerful assistant”, providing comprehensive solutions to help businesses build an effective cost control and optimization system. With Bizzi Expense, CEOs immediately have the “weapon” to take the initiative in financial management, helping businesses make a breakthrough:

- Smart budget planning: Bizzi Expense provides accurate financial forecasting tools, helping CFOs plan detailed budgets for all activities, from revenue estimates, labor and material costs to payroll. This is a solid basis for monitoring actual performance and adjusting budgets flexibly.

- Tight cash flow control: Bizzi Expense's cash flow control system helps CEOs closely monitor all expenses, allocate cash flow based on budget, forecast and actual expenditure, ensuring transparency and efficiency.

- In-depth cost analysis: Bizzi Expense automatically compiles periodic expense reports, analyzes spending trends, and compares recent periods, helping CFOs grasp a comprehensive financial picture and make informed decisions.

- Effective internal management: Bizzi Expense digitizes internal management processes, helping to continuously review and update all activities over time, expense categories, departments, projects, etc. The process is streamlined, easy to use, and creates a cost management mindset among all employees.

With Bizzi Expense, CEOs no longer have to worry about financial management. A solid management system helps businesses optimize costs, improve operational efficiency and break through in a competitive market.

In summary, Gartner's 1Q25 CFO Report paints a comprehensive picture of the challenges and opportunities that CFOs will face in 2025. By adopting the recommended strategies, CFOs can overcome difficulties, reshape their roles, and create a strong financial future for their businesses.

Monitor Bizzi To quickly receive the latest information: