Accounts receivable accounting is the work of recording, tracking, reconciling and managing all receivables from customers, payables to suppliers, as well as advances, prepayments, advances, loans... arising in financial and production activities.

To clearly understand the concept of accounts receivable accounting as well as related content such as accounts receivable accounting operations, follow the article below by Bizzi which will provide a comprehensive and detailed perspective.

What is accounts receivable?

Concept of Accounts Receivable Accounting

Is the process of recording, checking and managing a business's receivables and payables. Including tracking debts from customers, receivables from suppliers and performing related transactions such as payments and collections. In English, Accounts receivable is called Accounting Liabilities.

Understanding what accounts receivable is is an important part of corporate financial management. This position can be a specialized department in large enterprises or a general accountant in small and medium enterprises, who understands the operations of accounts receivable.

What is the classification of accounts receivable?

Accounts receivable accounting is divided into two main groups:

Accounts Receivable: The amount of money a business is waiting to receive from a customer after providing products or goods but has not yet received full payment.

- Track the money that customers, partners, etc. owe the business.

- Including: Deferred sales debt, Customer receivables, Advance receivables, Overdue debt collection

📌 Commonly used accounting accounts: 131 – Trade receivables, 138 – Other receivables

Accounts Payable: The amount of money a business needs to pay a supplier or third party for goods, materials, or equipment that has not been fully paid for.

- Track the debts your business owes to suppliers, employees, financial institutions, etc.

- Including: Deferred purchase debt, Short-term and long-term loans; Payments to contractors and suppliers; Advance payments to sellers

Commonly used accounting accounts: 331 – Trade payables, 338 – Other payables, 341 – Long-term borrowings

In addition, accounts receivable accounting transactions are also classified into short-term (payment term not exceeding 12 months or less than one production or business cycle) and long-term (remaining payment term is 12 months or more or more than one production or business cycle).

What is the role of accounts receivable in business?

In a business, the accounts receivable department plays a particularly important role, specifically as follows:

| Role | Meaning |

| Effective cash flow management | Understand cash flow in and out, from there make a plan to pay or collect debt on time

Advise management on financial status and strategic direction. |

| Reflect the financial situation correctly | Provide honest data, support accurate financial reporting

Track how much money your business owes to customers and how much money your business owes to suppliers. |

| Minimize the risk of bad debt | Track debt in detail, early warning of bad or overdue debt

Optimize financial resources by prioritizing debt collection and payment. Control cash flow in and out, forecast future income and expenses. |

| Optimize payment process | Automate supplier payment processes, control payment timing and terms |

| Ensuring legal compliance | Reconciliation - confirm timely debt, avoid errors in auditing and tax settlement |

What does an accounts receivable position do?

Below is a summary of the work and operations of accounts receivable accounting, applied in manufacturing, trading or service enterprises:

Track and record accounts receivable

- Record customer receivables according to contracts and sales invoices

- Monitor periodic debt collections, detect overdue debt

- Prepare monthly/quarterly customer debt reconciliation table

- Send debt collection letters or assist the sales department in debt collection

Related accounts: 131 (Trade receivables), 138 (Other receivables)

Track and account for accounts payable

- Record payables to suppliers from purchase invoices, POs, contracts

- Track payment deadlines, schedule payments weekly/monthly

- Reconcile accounts receivable with suppliers, check valid input invoices

- Control advances, prepayments, and refunds to employees or suppliers

Related accounts: 331 (Trade Payables), 338 (Other Payables)

Manage and process invoices and debt documents

- Check all documents related to debt transactions: contracts, invoices, delivery notes, receipts/payments...

- Storing, classifying and periodically comparing documents for auditing and tax purposes

What is debt reporting and analysis?

- Prepare detailed reports on Receivables/Payables for each customer/supplier; Report on due and overdue debts

- Update reports for management and general accounting

- Support for preparing financial reports on short-term and long-term debts

Support for auditing, tax settlement and internal

- Provide debt reconciliation tables and related documents to auditors and tax authorities

- Handle debt discrepancies, verify end-of-period debt with partners

What are Accounts Receivable accounts and what should be noted?

Below are important accounts receivable accounting accounts that accounts receivable accountants need to master when performing accounts receivable accounting operations:

Accounts Receivable

- Account 131 (Accounts receivable): Track and report on amounts the business needs to collect from customers and partners arising from sales, services or loans.

Can be classified into sub-accounts such as: Customer receivables (Account 1311), Receivables for deferred payment sales (Account 1312), Receivables for installment sales (Account 1313), Receivables for undelivered sales (Account 1314), Other receivables (Account 1318).

- Account 141 (Advance/Refund): Track advances or refunds within the business.

Can be classified into sub-accounts such as: Advances for employees (Account 1411), Advances for units in the enterprise (Account 1412), Refunds for employees (Account 1413), Refunds for units in the enterprise (Account 1414).

- Account 138 (Other receivables): Manage receivables that are not included in the main receivable accounts.

Can be classified into sub-accounts such as: Unpaid rental fee (Account 1381), Unrefunded deposit (Account 1382), Unreceived compensation (Account 1383), Unpaid salary (Account 1384), Other receivables (Account 1388).

- Account 136 (Internal receivables): Manage debts arising between the parent company and branches or between internal units.

Can be classified by sub-accounts such as: Receivables of branch A (Account 1361), Receivables of branch B (Account 1362), Receivables of branch C (Account 1363), Receivables of parent company (Account 1368).

Accounts Payable

- Account 331 (Accounts Payable): Tracks debts that businesses must pay to suppliers, banks or related parties when purchasing goods, services or borrowing capital.

Can be classified into sub-accounts such as: Accounts payable to sellers (Account 3311), Accounts payable to banks (Account 3312), Accounts payable to employees (Account 3313), Other accounts payable (Account 3318).

- Account 338 (Other payables and receivables): Tracks payables or receivables arising outside the scope of Account 331, related to other obligations.

Can be classified into sub-accounts such as: Corporate income tax payable (Account 3381), VAT payable (Account 3382), Personal income tax payable (Account 3383), Social insurance, health insurance, unemployment insurance payable (Account 3384), Other payables and payables (Account 3388).

- Account 336 (Internal payables): Manage debts arising between the parent company and branches or between internal units.

Bizzi – Digital solution and optimization of accounts receivable accounting

Not only is it necessary to understand the nature of accounts receivable accounting, but the application of technology to accounts receivable management is becoming increasingly urgent in the context of businesses facing large amounts of data, fast transaction speeds and increasing demands for financial transparency. Applying technology not only reduces the burden on the accounting department, but also helps businesses control risks, optimize resources and improve financial efficiency comprehensively.

Today, Bizzi Expense is one of the leading tools to help businesses streamline and automate their cost management, debt collection and payment processes.

About Accounts Receivable – Accounts Receivable Accounting Management Solution

With Bizzi, businesses can:

Automatic customer debt tracking

- Synchronize data from sales systems (ERP, CRM…) to update debts in real time

- Warning of due and overdue debts

- Analyze payment history to predict collectibility

Automate the debt reconciliation process

- Connect contract data, output invoices, receipts to automatically reconcile

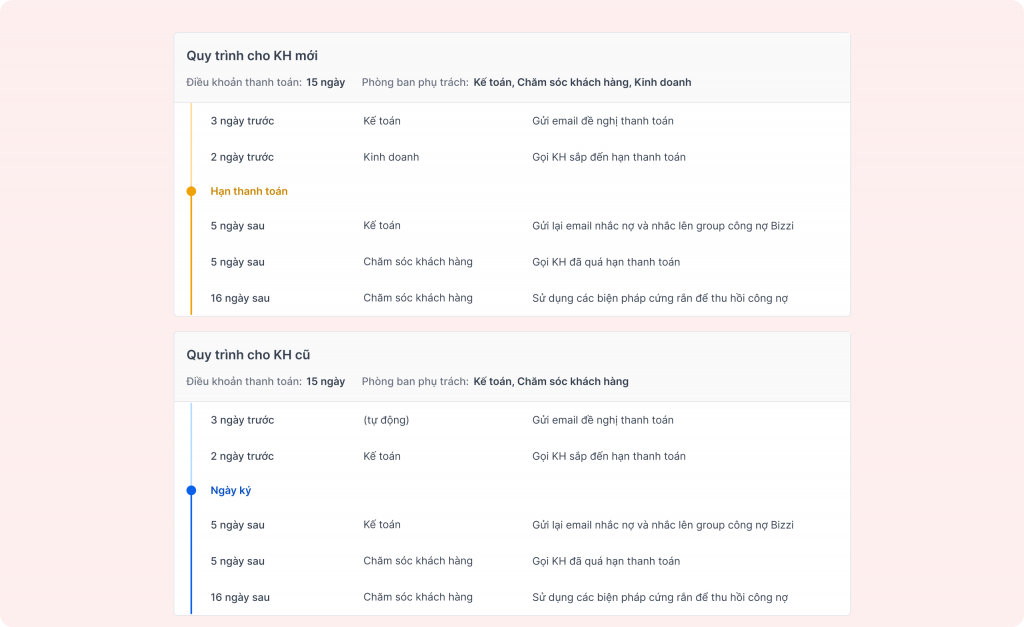

- Support sending debt reminder emails to customers according to payment policy

About accounts payable – Processing input invoices and managing costs

Automatic processing of input invoices: Use Bizzi Bot technology (RPA + AI) to:

- Automatically download electronic invoices from email/portal

- Extract and check invoice information (tax code, date, amount, item code...)

- Check valid invoices, avoid tax risks

PO – GR – Invoice reconciliation: Automatically compare invoices with purchase orders (PO) and warehouse receipts (GR) to reduce loss, ensure correct purchase price, and correct contract conditions

Project and budget cost management

- Set spending limits for each department/project

- Automatically reject over-budget payment requests

- Early warning when about to exceed cost limit

Full connectivity with accounting and ERP systems: Bizzi provides API integration with systems:

- Accounting (MISA, Fast, Bravo, SAP…), simplifying accounts receivable accounting operations

- ERP Business Management

- Automatically synchronize debt, invoice, payment data

What are the outstanding benefits of using Bizzi for accounts receivable?

| Benefit | Meaning |

| Save 80% in invoice processing time | No need for manual entry, reducing errors in performing accounts receivable accounting operations |

| Ensuring validity – transparency | Real-time invoice reconciliation |

| Improve cash flow management efficiency | Comprehensive and accurate debt tracking |

| Risky debt warning | Limit bad debt and handle it promptly |

| System Link | No gap between Finance – Accounting – Purchasing departments |

Conclude

Above is all the information related to the concept of what is accounts receivable accounting as well as instructions on handling accounts receivable accounting transactions. In general, accounts receivable accounting is an important part of the financial accounting system of an enterprise, a core factor ensuring financial transparency and stable cash flow for the enterprise.

Errors in accounts receivable accounting can cause serious consequences for businesses, not only financially but also affecting reputation, legality and operations. Therefore, accounts receivable accounting must ensure high accuracy. The solution for businesses is to standardize processes - automate operations - use digital technology to manage accounts receivable effectively, transparently and safely.

To avoid debt loss and improve efficiency in cash flow control, register to use Bizzi's solution suite immediately. Reduce 80% of time and 50% of processing, checking, reconciling, and data entry costs related to payables management. Bizzi will help businesses control revenue and expenditure, optimize capital flow in one platform.

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/