On June 24, 2023, the Tax Authority issued a written list of 524 businesses that need to monitor risks in using invoices. This series of businesses is concentrated in two areas, Ho Chi Minh City and Hanoi.

Index

ToggleThe General Department of Taxation announced 524 risky businesses about VAT invoices

On May 16, 2023, the General Department of Taxation issued Official Letter 1798/TCT-TTKT 2023 on reviewing and handling illegal invoices. Accordingly, the General Department of Taxation requested to continue to review and follow the instructions and directions in Official Letter 129/TCT-TTKT in 2022 and Official Letter 133/TCT-TTKT in 2022 to promptly report all contents. in accordance with regulations.

Specifically, the General Department of Taxation asked Tax Departments to focus on reviewing the sales invoices of 524 businesses.

LIST OF 524 ENTERPRISES WITH TAX RISKS

The letter includes the attached appendices with the following contents:

- Appendix No. 1: Announcement of a list of 524 enterprises at risk of VAT invoices.

- Appendix 2: List of use invoices of 524 enterprises that have declared VAT and CIT.

- Appendix No. 3: Summary of results of tax review and handling for the use of invoices of 524 enterprises.

- 524 businesses were targeted by tax authorities for invoice fraud

>> See more: How to deal with the purchase invoice of a runaway business?

In order to review and handle tax on illegal acts of buying and selling invoices, the General Department of Taxation requires Tax Departments to:

(1) Continue to review and follow the guidance and direction of the General Department of Taxation in Official Letter 129/TCT-TTKT dated November 9, 2022, Official Letter 133/TCT-TTKT dated November 23, 2022 to keep up with Timely report all contents to the General Department of Taxation in accordance with regulations.

(2) In addition, the Tax Departments focused on reviewing the sales invoices of 524 enterprises mentioned above.

– In case it is discovered that an enterprise under the tax authority has used its invoice out of 524 enterprises, the enterprise shall be requested to clarify the use of the invoice for VAT deduction/VAT refund. included in the cost of calculating CIT, legitimate goods bought floating, smuggled.

Request the Tax Department based on actual violations and regulations in legal documents to promptly handle tax according to regulations or consolidate dossiers, transfer to the police agency for handling according to regulations. law.

– The Tax Department directly manages tax for enterprises on the list of 524 enterprises, conducts a review, if it is discovered that the enterprise has issued sales invoices to businesses in other localities that have been issued in 2020, in 2021. , in 2022, if the electronic invoice data of the General Department of Tax is not included in the e-invoice data, promptly send a written notice to the relevant tax authority, enter the information on the invoice verification application for coordination. screening, reviewing and handling according to regulations.

Report on the results of review and handling of tax violations and general invoices according to Appendix 2 and Appendix 3 attached. Official Letter 1798/TCT-TTKT in 2023, send a paper copy to the General Department before June 30, 2023.

According to the Law Library

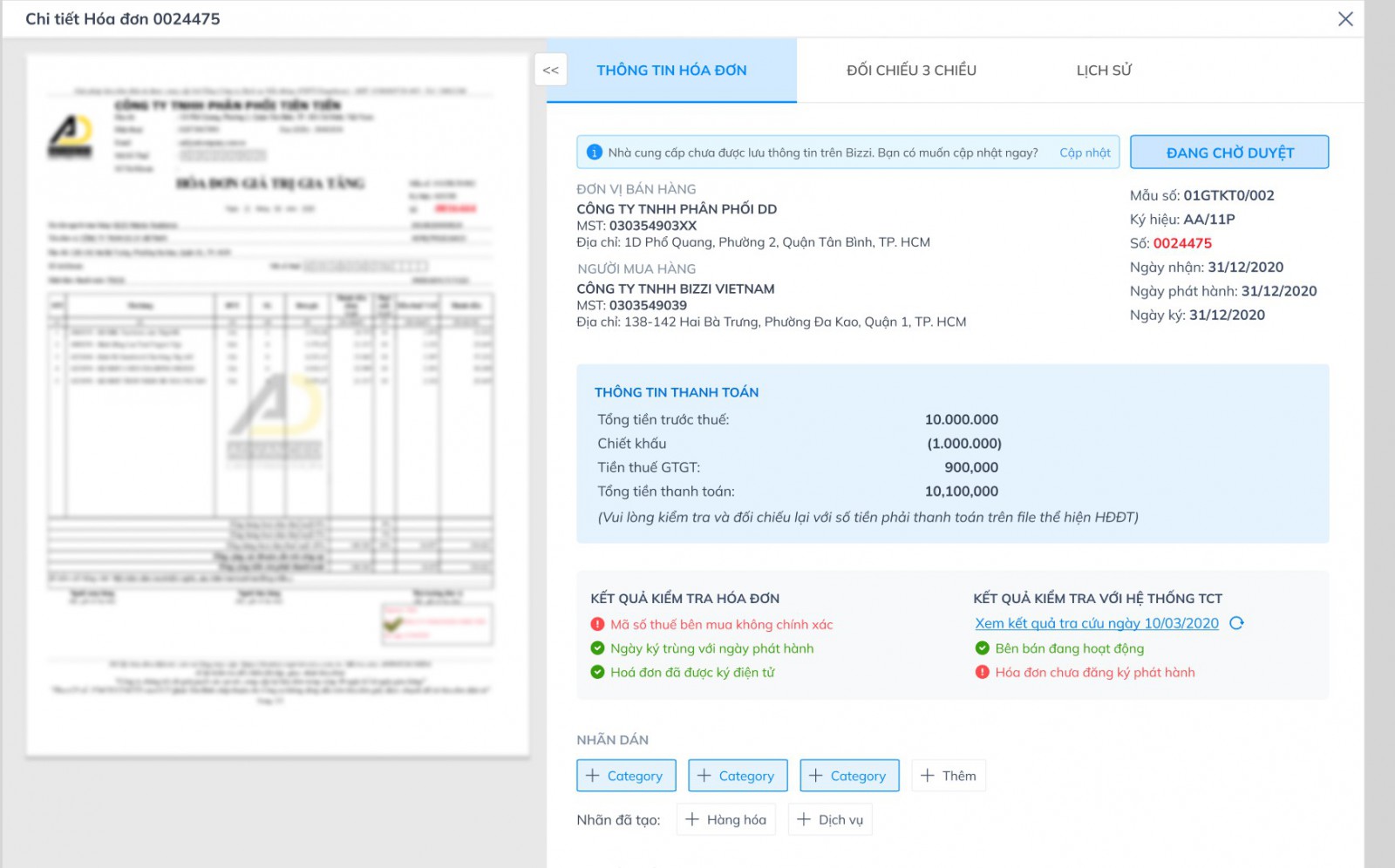

Bizzi supports reviewing invoices issued by 524 risky businesses

In order to accompany and support customers who are using Bizzi's services to reduce risks, customers wishing to review the list of issued invoices belonging to the above 524 businesses, please send inquiry information to Bizzi's customer care team:

Applying advanced technology, Bizzi's automatic invoice processing software (IPA) helps businesses Automatically check the status and synchronize invoices with the system of the General Department of Taxation, quickly detect invoices. incorrect invoices and send timely warnings to help businesses ensure the legal validity of invoices. The software quickly processes only 10s/each invoice with the ability to store invoices scientifically, safely and securely for up to 10 years.

Software to automatically process input invoices Bizzi IPA

In addition, the software also supports businesses to synchronize order data and warehouse receipts from accounting software / ERP system to Bizzi and support accounting for accounting systems. All invoices are centrally stored and managed on an easy searchable system. Besides, the system supports automatically extracting invoice data according to the standard excel file format of each type of accounting software.

According to Bizzi's statistics, on average, a business will spend from 5,000 VND to 8,000 VND/invoice if done manually. If a business uses Bizzi's digital transformation solution for accounting, this cost is only about 1,000 VND/invoice, Bizzi saves at least 50% in costs for the business, which means only 1-2 employees are needed to handle the process. physical.

With Bizzi bot, the risk level is minimized with an almost absolute accuracy of 99.9%. Bizzi is one of the few software on the market that can check the reasonableness and validity of digital signatures and digital certificates.

Besides, the jobs that need 2-3 people to handle, now just need Bizzi to be able to balance the entire accounting department with 24/7/365 productivity without taking time off. Therefore, it can be said that Bizzi contributes to reducing work pressure for accounting staff if before, businesses often needed 2-3 employees to perform repetitive tasks. Now, it only takes Bizzi and 1 employee to be able to handle jobs with higher efficiency.

Currently, Bizzi has been trusted and used by +1200 large enterprises and corporations such as Tiki, GS25, Circle K, PNJ, P&G, VNG, Grab, Ikea, Sabeco, Pharmacity, etc.

Follow Bizzi to quickly receive the latest information: