Managing outsourcing costs is an essential part of modern business management. It not only saves costs but also protects the business from legal risks, improves operational efficiency and supports strategic decision making.

This article by Bizzi will provide more important information about the nature of outsourcing costs so that leaders can grasp and adjust the most effective way to manage outsourcing costs.

What are outsourcing costs and why are they difficult to control?

Outsourcing Cost is the cost that a business pays to a third party (individual/service unit) to perform tasks that the business cannot undertake itself or is ineffective in doing itself.

For example: hiring a marketing agency, hiring transportation, hiring IT support, hiring security, hiring temporary staff, hiring market research, etc.

In many Vietnamese businesses, especially SMEs and fast-growing businesses:

- Outsourcing costs are increasing rapidly, accounting for a large proportion of total operating costs.

- The service approval and acceptance process often lacks standardization, depends heavily on manual work (email, excel, zalo, ...), and lacks technological intervention - specifically psoftware cost management

- Invoicing & service performance reconciliation are often opaque, based on the feelings of the person in charge.

- Data is scattered across departments → no overall view to evaluate effectiveness.

Reasons for difficulty in controlling outsourcing costs:

| Reason | Problem description |

| No measurement standards (KPIs) | Many outsourcing services are descriptive in nature (branding, marketing, research, etc.) and their effectiveness is difficult to quantify. |

| Decentralized approval process | Each department works with suppliers on its own → CFO does not fully understand the scope and reasons for spending. |

| Contracts and invoices are not synchronized | Data is scattered on email / excel / personal folder → difficult to synthesize and compare. |

| Supplier overlap | It is possible to hire multiple units to do the same job but there should be no duplication of effort. |

| Pay later – get results first | Evaluation after service is completed → easily leads to irrecoverable waste. |

| Lack of transparency in acceptance | Evaluation is based on the project manager's gut feeling, not on performance metrics. |

Classification of outsourcing costs in business

Outsourcing costs can be classified from several perspectives to facilitate more effective management and control:

| Cost group | Specific examples | Management characteristics |

| Accounting - Tax | Tax declaration, financial statements, auditing, accounting software | Valid invoice and acceptance report required |

| Human Resources (HR Outsourcing) | Payroll, headhunting, training | Service contracts and employment contracts must be distinguished. |

| Marketing / Agency | SEO, advertising, content, KOL | Easy to incur costs outside the contract |

| IT / SaaS | Server maintenance, software rental, website development | Multiple recurring payments per user/month |

| Logistics / Outsourced Manufacturing | OEM processing, 3PL, transportation | Volatile based on fuel and surcharges |

| Legal / consulting / auditing | Lawyer, M&A, strategy | Difficult to quantify financial performance |

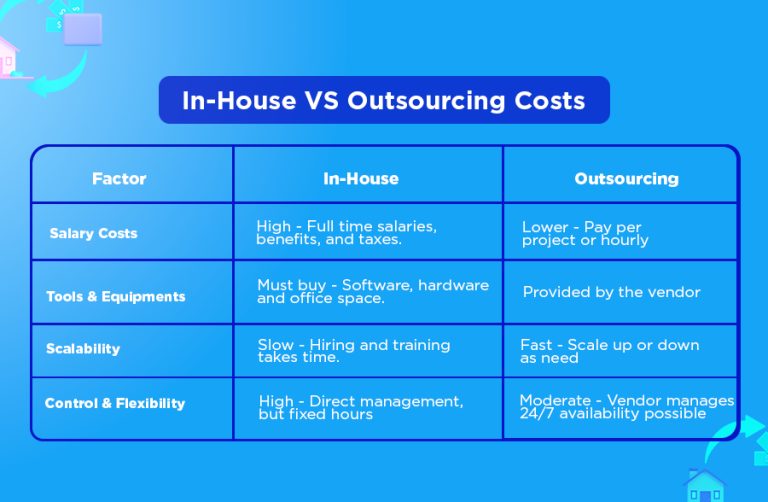

The difference in managing outsourced and internal costs

Outsourcing costs are the costs a business pays an outside party to perform a part of the work or service that the business does not undertake itself, or that it would be costly and inefficient to do itself. Internal costs are costs incurred when a business do the work yourself with own resources: human resources, tools, materials, assets, internal time.

When to use 2 types expense This?

| Outsourcing costs are appropriate when | Internal costs are appropriate when |

| Need speed and expertise immediately | Able to do more effectively on their own |

| Seasonal or project-based work | Repetitive, long-term work |

| No initial investment in assets & human resources | Want to control quality and security |

| Cost optimization in rapid expansion phase | Have strong internal systems and capabilities |

- Outsourcing costs help accelerate, add expertise and flexibly expand but difficult to control effectively and easy to waste without a transparent governance system.

- Internal costs more stable and cost-controllable but can be less flexible and costly in the long run if the job is not your core strength.

In short, the best business is to combine both, depending on the level of strategy and value created for the organization.

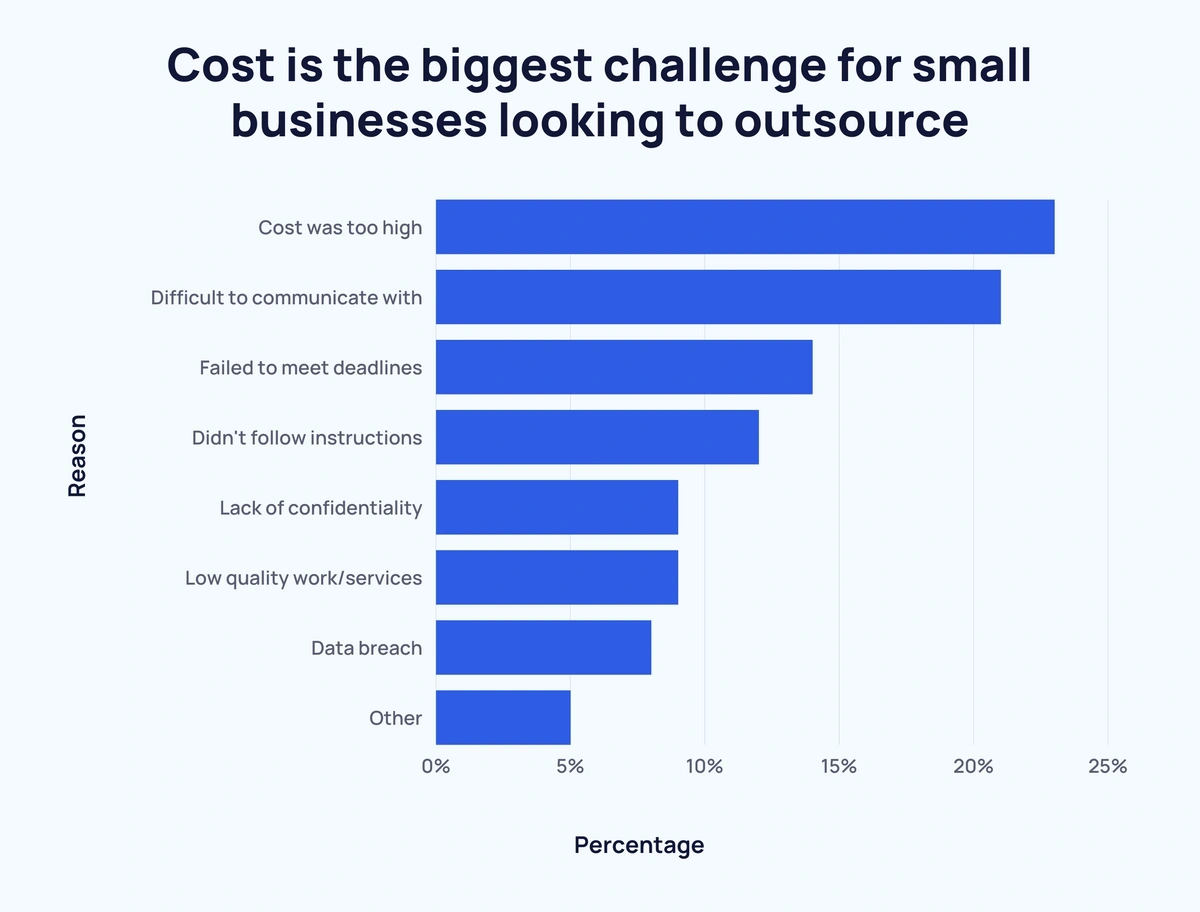

5 reasons why outsourcing costs are rising

Outsourcing costs increase, even beyond control, often for many reasons.

1. Lack of standards for evaluating and measuring effectiveness (vague KPIs)

- Outsourced services are usually accepted based on emotional instead of figures.

- No clear evaluation criteria leads to spending a lot of money but the results are not commensurate.

2. Fragmented approval process – lack of transparency

- Departments work independently and contract with many different vendors.

- Fragmented data, CFO only sees the total amount, not knowing specifically who is spending it and for what purpose.

- Easy to duplicate or overspend.

3. Over-reliance on vendors

- No internal capacity to control, monitor, or have alternatives.

- Vendors increase prices, expanding scope (scope creep) that is difficult for businesses to refuse or reevaluate.

4. Lack of planning and budget forecasting

- Outsourcing according to arising needs or when there is a "busy job", leading to:

- Urgent service at high price

- Not optimizing available internal resources

- There is no historical data to accurately budget.

5. Loose acceptance & low actual performance

- No deliverable measurement and control process.

- Failure to check the correctness of costs incurred at each stage.

- Paying and then discovering the results are not as expected → waste and difficult to recover.

Tax risks when outsourcing costs are not valid

Below is a detailed analysis of tax risk When outsourcing costs are not properly implemented, combined with regulations from Decree 123/2020/ND-CP and common errors to note.

- According to Decree 123/2020/ND-CP, outsourcing costs only be considered reasonable when there is enough:

- Have a service contract: clearly stating the work content, value, and implementation period.

- There is a record of acceptance / handover: confirming the service has been performed, quality, results.

- Valid VAT invoice: meets the invoice requirements according to tax regulations.

- Non-cash payment documents (for each item > 20 million VND).

If any one of these conditions is missing, the expense may be considered ineligible for deduction in determining taxable income.

- Common mistakes when managing outsourcing costs:

- Cash or advance payment without reconciliation, no non-cash payment documents for amounts > 20 million.

- VAT invoices received later than the accounting period, recorded in the wrong period leading to cost discrepancies for that period.

- When hiring an individual (not an organization) but the business does not deduct 10% personal income tax according to regulations.

Violations in the management of outsourcing costs regarding tax may result in tax collection + administrative fines from 20 to 50 million VND or loss of the right to deduct input VAT.

Strategies in managing outsourcing costs

Good management of outsourcing costs not only helps reduce costs but also improves overall business efficiency. Businesses need data transparency – process control – KPI evaluation – continuous negotiation.

Step 1 – Identify outsourcing needs and scope

- Make or Buy Analysis to compare in-house vs outsourcing costs & efficiencies.

- Only outsource when:

- Does not affect core competence.

- Ability to measure output performance (deliverable, SLA, clear KPI).

- Total outsourcing cost (including supervision) < 80% equivalent internal cost.

- Determine scope of work (Scope), timeline, output, acceptance standards.

Step 2 – Set a budget and control your spending ceiling

Estimate by: department / project / service type.

Apply Zero-Based Budgeting → each expense must have a clear justification.

The budget structure includes:

- Fixed costs (retainer)

- Variable costs (performance-based / volume)

- Contract management & supervision costs

Track Budget vs Actual in real time using Bizzi / ERP / Dashboard.

Step 3 – Select & negotiate supplier

Collect at least 03 quotes to determine market benchmark.

Include anti-incurrence clauses in the contract:

- Price Cap – cost cap.

- Binding KPIs (efficiency, progress, quality).

- SLA & Service Credit – discount/compensation if targets are not met.

Negotiate flexible payment terms of 30–45 days to optimize cashflow.

Step 4 – Monitoring, acceptance and payment

Apply 3-Way Match Process: Contract/PO – Acceptance – Invoice.

Pay only when:

- Contract/PO with valid approval.

- Acceptance of work within scope (Scope & KPI).

- Valid invoice, value & tax match.

Retain Retention 5–10% for long-term service to ensure quality.

Step 5 – Evaluate effectiveness and renegotiate

Evaluate supplier performance according to 3 KPI groups:

- Financial KPIs: ROI, Cost per deliverable, Budget variance %.

- Operational KPIs: SLA, On-time %, Quality score.

- Value KPI: Business impact (revenue, speed, internal team efficiency).

Periodic reports quarterly / 6 months to decide:

- Continue – Extend – Renegotiate – Change vendor – In-house

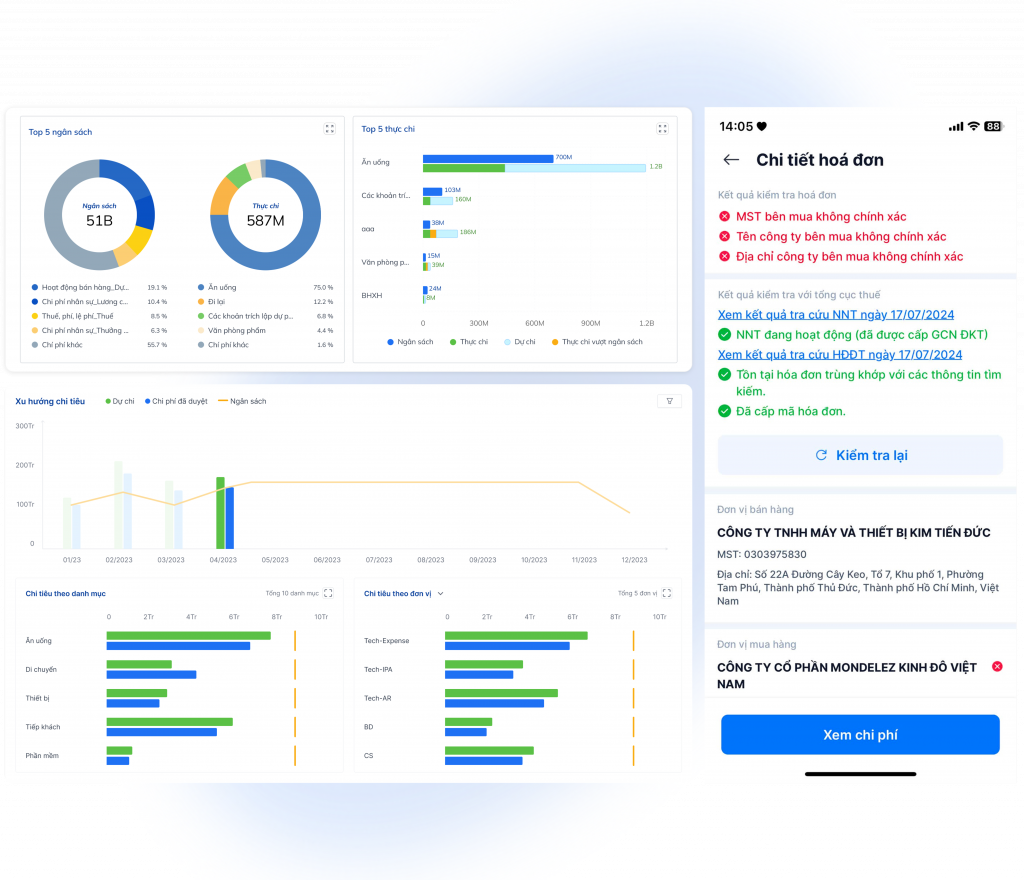

Outsourcing cost control solution with Bizzi

Bizzi provides a comprehensive expense management solution for businesses, automating processes from incoming invoice processing to budget control and expense approval. Key features of Bizzi include AI-powered invoice processing automation, real-time expense budget management, intelligent expense policy and approval process setup, as well as business travel expense management and full integration with ERP systems.

1. Bizzi Expense – Control outsourcing costs from the source

main feature

- Set up an outsourcing budget according to department / project / service type

- Each outsourcing payment request requires complete attachment of:

- Service contract

- Minutes of acceptance / handover

- Electronic bill

- Smart multi-level approval

- Department Head → Accountant → CFO (depending on configuration)

- Automatic budget overage warning & real-time volatility tracking

- Store standard tax compliance documents

→ Easy access during inspection and audit

Benefit

- Transparency from the very beginning of the proposal

- Prevent unnecessary costs before they occur

- Reducing tax risks and budget losses

2. Bizzi IPA – Automated Outsourcing Invoice Processing with AI

Technology

- RPA + OCR + AI read electronic invoices, extract data automatically

- 3-Way Match

- PO – GR – Invoice

- Error detection: duplicate invoice, wrong tax rate, wrong supplier code, wrong amount

Legal check of supplier

- Automatically verify Tax Code – operating status – Supplier risk

- Invalid vendor warning / tax risk

ERP integration

- 2-way synchronization with SAP, Oracle, Bravo, Fast, MISA, Odoo,…

3. Dashboard & Smart Reports

Track outsourcing costs from multiple perspectives:

- Supplier

- Project / Department

- Service type

- Valid invoice rate

- Cost over budget

- Quarterly Outsourcing ROI

Automatic warning

- Contract is about to expire / due for renegotiation

- Service costs suddenly increase abnormally

- Invoice with wrong period, wrong data, wrong format

In short, Bizzi helps businesses find ways to manage costs intelligently and optimally through automated processes to achieve the following goals:

- Reduce loss costs

- Tax transparency & compliance

- Data-driven decision making

Case Study on How to Manage Outsourcing Costs

Learning some specific case studies about outsourcing costs that often arise in businesses will help you see that when applying management principles + technology, costs will be optimized, risks will be reduced and business operating efficiency will increase.

1. Outsource Marketing Agency

Background

- Businesses hire agencies to carry out lead generation marketing campaigns for their sales teams.

- 6-month contract, Retainer fee model + KPI Bonus/Penalty.

Key Specifications & Terms

| Category | Regulations |

| KPI | 200 MQLs/month |

| Price Cap | 300 million/month |

| Effective evaluation | CPL, Conversion Rate, Revenue Impact |

| Penalty | Reduce 10% fee if KPI is not achieved |

Results & Lessons

- Effective control by model ROI-Based, reduced 18% CPL after 3 months.

- Avoid unnecessary cost increases with price caps and penalties.

2. IT Outsourcing

Background

- Hire an external dev team to do an internal software project for 4 months.

- Time & Material Contract with Cap.

Control process

| Element | Describe |

| Acceptance model | By Sprint (2 weeks/time) |

| Handover documents | Source code, technical documentation, IP rights |

| Cost Control | Bizzi automatically reconciles timesheets – invoices – contracts |

| Pay | According to completed and accepted output |

Result

- Avoid unnecessary overtime.

- Shorten the time for accounting to process 65% records.

3. Logistics – 3PL

Background

- Hire a full-service logistics provider for e-commerce.

- Shipping costs fluctuate according to fuel prices.

Cost control clause

| Element | Describe |

| SLA | On-time delivery rate ≥ 98% |

| Penalty | If violated >3 times/month → fine 3% total fee |

| Price adjustment | Index according to gasoline prices to avoid unstable fluctuations |

| Acceptance documents | Delivery receipt + full transport documents |

| Accounting | Account 627 – General manufacturing costs |

Result

- Reduced return rate from 4% to 1.7%.

- Average cost per unit decreased by 12%.

FAQ – Frequently asked questions in outsourcing cost management

A summary of the most common outsourcing cost management issues.

1. Are outsourcing costs tax deductible?

Yes, outsourcing costs are included in reasonable expenses and deductible for corporate income tax, if fully meeting the conditions according to tax regulations:

- Arising from production and business activities.

- Have valid invoice (electronic invoice).

- Payment by bank transfer for bills from 20 million or more.

- There are contracts and acceptance records based on actual work.

2. What documents are required for valid outsourcing costs?

A complete set of documents usually includes:

- Contract or PO

- Minutes of acceptance / handover

- Electronic bill

- Volume spreadsheet / timesheet (if service is by hour or output)

- Approval decision of competent authority

3. How to control outsourcing costs by department?

Businesses often apply:

- Set up budgets by department or project

- Track Budget vs Actual monthly or real-time

- Multi-level approval process

- Measurement tools by service type / vendor / time

Can be effectively controlled by Bizzi Expense or AP/Expense modules in ERP.

4. Which software helps control outsourcing costs effectively?

Some popular solutions:

- Bizzi Expense – budget control, payment request approval, contract & invoice management.

- Bizzi IPA – automatically read invoices, 3-way reconciliation PO–GR/Timesheet–Invoice.

- SAP, Oracle, MISA, Bravo – if the business has implemented ERP.

5. How to measure outsourcing ROI accurately?

Outsourcing ROI measurement formula: ROI = (Value created – Total outsourcing costs) / Total outsourcing costs

Indicators to be evaluated:

- Finance: Cost per Deliverable, Cost Saving, Revenue Growth

- Operate: SLA, On-time %, Quality score

- Value: time saved, long term impact

6. When should you insource instead of outsourcing?

Should be brought back in-house When:

- Work is the core competency of the business.

- Total outsourcing cost > 80% equivalent internal cost.

- Processes that require tight control or high data security.

- Supplier fails to meet KPIs consistently.

Conclude

Managing outsourcing costs is not just about reducing costs, but also about controlling – measuring – optimizing the entire spending lifecycle. Bizzi helps CFOs and finance teams manage outsourcing costs comprehensively, from planning, approval, payment to performance evaluation, ensuring transparency – compliance – real savings.

- Transparency, reduced risk and cost loss

- Save accounting time, optimize cash flow

- Make decisions based on accurate data

Benefits of applying Bizzi solution in optimizing outsourcing cost management:

- Standardization process

- 3-Way Match (Contract – Acceptance – Invoice)

- Clear budget, multi-level approval

- Transparent Contracts & SLAs

- Legal compliance & tax documentation

- Valid invoice, cashless payment

- Full acceptance report & contract

- Reduce the risk of tax arrears and administrative fines

- Automation by technology

- Budget management, approval, automatic invoice reconciliation

- Dashboard to track KPI, ROI, and cost overruns

Experience Bizzi – a solution that helps CFOs and accountants automatically control outsourcing costs, ensuring transparency, compliance and real savings: https://bizzi.vn/dat-lich-demo/