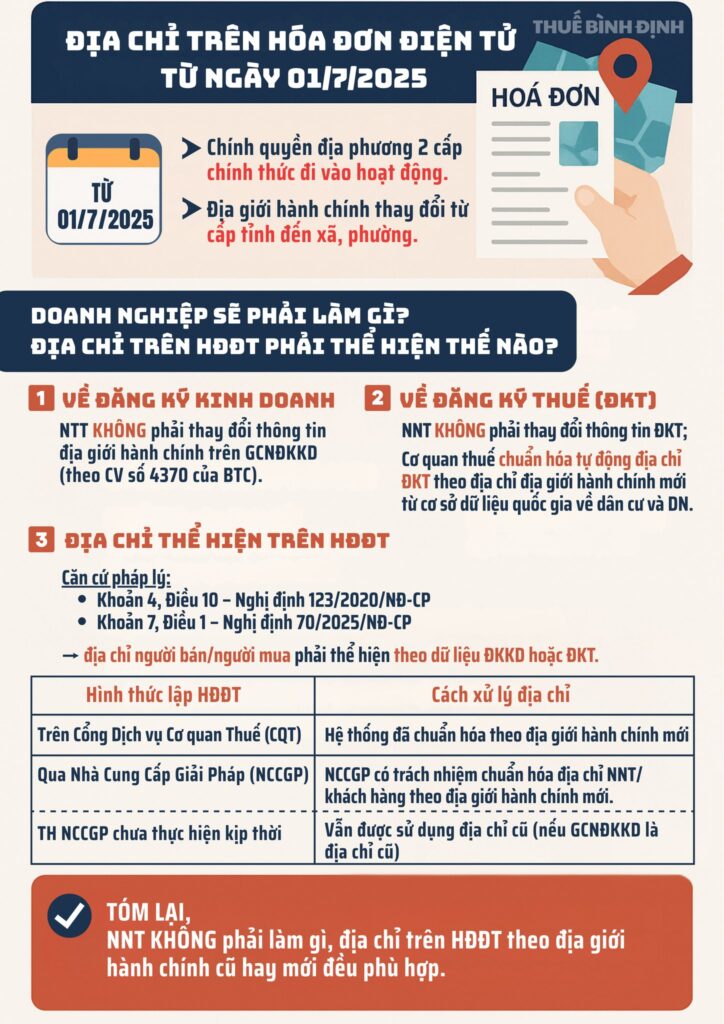

From July 1, 2025, Vietnam will officially reorganize its administrative apparatus according to a 2-level model (province - commune), sharply reducing the number of provinces, districts and communes according to the administrative reform plan 2024-2025. Next is an important question for businesses and business households: Is it necessary to adjust the address on the invoice when the administrative boundaries change?

To clarify this issue, Bizzi would like to quote and analyze the latest guidance from the Tax Department XIII, one of the direct tax management units in localities with changes in administrative units. This information will help businesses and business households have an accurate view and make appropriate adjustments in their invoice issuance activities.

1. Legal basis and guidance from tax authorities

According to the guidance from the Tax Department XIII, the merger of administrative units will lead to changes in the names of localities. However, it is important to note that taxpayers are not required to change the address on the Business Registration Certificate immediately when there is a change in the name of the administrative unit due to the merger.

This means that, during the transition period after the merger, businesses and business households can still use the Business Registration Certificate with the address according to the old administrative unit. This creates favorable conditions for units to maintain business operations without being interrupted by administrative procedures related to changing registration information.

2. What do tax authorities say about changing address?

Regarding the address on the electronic invoice, the guidance from the Tax Department XIII also clarifies that taxpayers can be flexible in recording the address according to the new or old administrative unit. Specifically:

- In case of registering the address according to the old administrative unit: Enterprises and business households can still continue to use the address registered on the Business Registration Certificate and used before the administrative unit merger. This is especially useful in the early stages after the merger, when information about the new address may not be fully updated on the relevant systems.

- In case of recording the address according to the new administrative unit: If the enterprise or business household has completed the procedures for changing business registration information or wants to update the address on the invoice according to the new name of the administrative unit, then recording the address according to the new administrative unit is completely appropriate.

Automatic updates in tax system

Many tax departments across the country, including the Ho Chi Minh City Tax Department (Area 2), have issued official notices affirming:

- The tax authority will proactively update the new administrative address in the system.

- Businesses are not required to change their billing address immediately.

Does not affect the validity of the invoice

If the invoice still shows the address according to the old administrative unit but is consistent with the business registration license, it is still considered valid.

Enterprises can use the tax authority's notice to explain when necessary.

3. When should a business proactively change its address?

Although not required, businesses still have the right to edit business registration information. Common cases:

- Adjusting records: when performing other procedures such as changing name, business line, adding/deleting business location.

- Investment requirements, new license registration: in processes requiring exact matching between business registration and commercial transactions.

- Professional update: to avoid confusion, create neatness in relationships with partners and customers.

- Refer to Official Dispatch 4370/BTC-DNTN (April 17, 2025): Enterprises are not required to change their registration address when administrative boundaries change, but can register if desired.

4. Procedures for updating address according to new administrative unit

Enterprises can carry out procedures to change their address at the Business Registration Office where their headquarters are located, or through the National Business Registration Portal.

The profile includes:

- Notice of change of business registration content

- Decisions and meeting minutes (for LLCs and joint stock companies)

Note:

- Processing time: 03 working days

- Fee: Free according to Decree 01/2021/ND-CP

5. Solution for businesses that have not updated their address yet

During the time before adjusting the new address on the license:

- Businesses can still issue invoices with the old address.

- Prepare a written notice from the tax authority to explain when requested by the partner.

- Proactively update information on website, email signature, internal forms to ensure consistency

6. List of 20 regional tax offices

Currently, the whole country has 20 Tax Departments according to Decision 381/QD-BTC of the Ministry of Finance.

| STT | Unit name | Management area | Head office |

|---|---|---|---|

| first | Regional Tax Department I | Hanoi, Hoa Binh | Hanoi |

| 2 | Regional Tax Department II | Ho Chi Minh City | Ho Chi Minh City |

| 3 | Regional Tax Department III | Hai Phong, Quang Ninh | Hai Phong |

| 4 | Regional Tax Department IV | Hung Yen, Ha Nam, Nam Dinh, Ninh Binh | hung Yen |

| 5 | Regional Tax Department V | Bac Ninh, Hai Duong, Thai Binh | Hai Duong |

| 6 | Regional Tax Department VI | Bac Giang, Lang Son, Bac Kan, Cao Bang | Bac Giang |

| 7 | Regional Tax Department VII | Thai Nguyen, Tuyen Quang, Ha Giang | Thai Nguyen |

| 8 | Tax Department Region VIII | Vinh Phuc, Phu Tho, Yen Bai, Lao Cai | Phu-Tho |

| 9 | Tax Department Region IX | Son La, Dien Bien, Lai Chau | Son La |

| 10 | Tax Department of Region X | Thanh Hoa, Nghe An | Nghe An |

| 11 | Tax Department Region XI | Ha Tinh, Quang Binh, Quang Tri | Ha Tinh |

| 12 | Tax Department Region XII | Hue, Da Nang, Quang Nam, Quang Ngai | Danang |

| 13 | Tax Department Region XIII | Binh Dinh, Phu Yen, Khanh Hoa, Lam Dong | Khanh Hoa |

| 14 | Tax Department Region XIV | Gia Lai, Kon Tum, Dak Lak, Dak Nong | Dak Lak |

| 15 | Tax Department of Region XV | Ninh Thuan, Binh Thuan, Dong Nai, Ba Ria - Vung Tau | Ba Ria – Vung Tau |

| 16 | Regional Tax Department XVI | Binh Duong, Binh Phuoc, Tay Ninh | Binh Duong |

| 17 | Regional Tax Department XVII | Long An, Tien Giang, Vinh Long | Long An |

| 18 | Tax Department of Region XVIII | Tra Vinh, Ben Tre, Soc Trang | Ben tre |

| 19 | Tax Department Region XIX | An Giang, Dong Thap, Can Tho, Hau Giang | Can Tho |

| 20 | Tax Department of Region XX | Kien Giang, Ca Mau, Bac Lieu | Kien Giang |

In Resolution 08-NQ/DUBTC, the Standing Committee of the Party Committee of the Ministry of Finance directed the rearrangement of tax branches and regional State Treasuries to manage them in line with provincial administrative units.

Accordingly, in the near future, 20 regional Tax Departments and State Treasuries will be reorganized into 34 Tax Departments and State Treasuries of provinces and centrally-run cities.

7. Frequently Asked Questions

Here are some frequently asked questions:

- Is there a penalty for an invoice with an old address? No. The tax authority confirmed that this is not an administrative violation if the information is still correct according to the business registration certificate.

- Is it necessary to update the address without changing the headquarters? Not required. The administrative merger only changes the location, not the actual headquarters.

- Does not updating affect tax refunds and tax settlements? No. The tax management system has automatically updated the new administrative address.

- Is there a fee for changing address? According to Decree 01/2021/ND-CP, there is no fee and the processing time is fast (3 working days).

The merger of administrative units from July 1, 2025 does not require businesses to change their invoice addresses. However, businesses should consider updating to synchronize the information system, avoiding problems in transactions, partners and other administrative procedures.

To ensure legal compliance and ease of working with stakeholders, businesses can proactively make changes if necessary.

Bizzi hopes that the above information will help businesses and business households answer questions related to changing the address on invoices when there is a merger of administrative units. Understanding the legal regulations will help businesses operate effectively and avoid unnecessary risks. If you have any other questions, do not hesitate to contact Bizzi for more detailed support and advice.