By 2025, the role of the Chief Financial Officer (CFO) in the technology industry has changed dramatically. They are no longer simply financial managers but have become strategic leader, navigating a rapidly evolving landscape driven by AI-powered automation, economic volatility and growing ESG responsibilities.

This article explores the key themes shaping the role of the technology CFO in the coming year, based on insights from leading industry CFOs.

From financial manager to business architect:Today's CFO must play the role of business architect, overseeing not only cash flow but also product development, human resources strategy and regulatory compliance.

Index

ToggleTechnology CFO: Driving Technology Integration and Automation

Automation has become a foundation of financial strategy, goes beyond being a time-saver. From AI-powered forecasting to real-time cash flow insights, automation is reshaping the way finance leaders operate. With research showing that 70% of Fortune 500 companies’ software was developed two decades or more ago, fast-growing companies have an advantage in adopting new technologies.

Martin Raißle, VP of Finance & Operations at ChartMogul, sees automation as a competitive advantage: “My goal for 2025 is to ensure all of our tools are set up to support automation. Many tools already are, but finance tools often focus on local compliance requirements first. While that’s important, it shouldn’t hold us back from achieving new efficiencies.”

However, technology CFOs are moving beyond simple automation and toward predictive financial intelligence. This includes automatic financial reporting (e.g. AI-powered tools that generate real-time cash flow insights), smart forecast (AI analyzes spending patterns and predicts future revenue) and Automate risk assessment (AI model detects transaction abnormalities, reducing fraud risk).

Thomas Andersen, CFO at Tellu, highlights the growing adoption of automation: “We have always had a goal of automating repetitive financial processes, and fortunately, there are more and more tools to help us do this, including Power BI, no-code tools, and various SaaS tools that enhance and automate our operations.” A CFO at a SaaS company can integrate AI-based tools to automate financial planning and forecasting (FP&A), improving budget accuracy.

Improve Interdepartmental Collaboration

In 2025, finance leaders will no longer be just number crunchers, but also business support person, ensuring that every department operates efficiently, profitably and in line with the company's growth strategy. Successful CFOs bridge the gap between finance and operations, driving collaboration across the entire organization..

Olga Tintore, CFO at NumberEight, reflects this trend: “Finance is no longer a standalone function. We are actively collaborating with other departments, bringing financial expertise into their decision-making processes. This promotes a shared understanding of our financial goals and ensures everyone is rowing in the same direction.”

According to Gartner, companies that foster strong collaboration see engagement increase by 63% and turnover decrease by 25%. Cross-functional collaboration is proving to be a game changer for finance teams.

Technology CFOs must now collaborate with engineering teams to track cloud infrastructure costs, implementing FinOps best practices to prevent budget overruns. For example, introduce automated cloud cost monitoring to reduce AWS/GCP costs without compromising performance.

Felipe Tunnell, CFO at Revieve, further emphasizes the benefits of cross-collaboration: “Finance can’t operate in isolation—our job is to support the business, not just report on it. A big focus of mine is making financial information more accessible and useful across teams.

That means bringing finance into key decision-making processes early, ensuring transparency about how resource allocation aligns with company goals, and fostering a culture where finance is viewed as a partner, not just a gatekeeper.”

Strategic Growth Planning in Times of Economic Turbulence

CFOs are bracing for a tumultuous year. According to Deloitte, 56% CFOs see geopolitics as top concern, followed by economic instability (43%). With global trade tensions, inflation risks and evolving regulations, financial leaders must rethink their approach to strategic growth.

Many finance leaders are closely monitoring these developments and adjusting their financial strategies accordingly. However, there are also reasons to be optimistic, as regulatory changes could lead to a rebound in M&A activity.

To navigate these uncertain times, Sam Maldonado, VP of Finance at Holded, outlines a balanced strategy: “We prioritize financial resilience by controlling costs, optimizing cashflow, and leveraging data-driven insights to inform decision-making. At the same time, we identify high-potential growth areas that align with our mission, core strengths, and customer needs.”

As CFOs focus on financial resilience, they must also prepare for another challenge, the growing wave of ESG and regulatory compliance requirements.

Balancing Regulatory Compliance and Innovation

Environmental, Social and Governance (ESG) considerations are increasingly central to financial strategy. The financial sector is facing increasing scrutiny, particularly in areas such as cryptocurrencies where clear regulations are still evolving.

“CoinGate’s top priority for 2025 is to secure a MiCA (Markets in Crypto Assets) license. This commitment underscores our dedication to promoting stability, transparency, and increased consumer protection in the crypto industry,” said Sergej Orlovskij, CFO at CoinGate.

ESG is no longer just an investor priority but a compliance requirement. By 2025, European regulations will require mid-sized and large tech companies to report on their carbon emissions, social impact, and governance policies. For CFOs, this means:

- Legal risks: Failure to meet ESG disclosure standards can result in fines and negative investor backlash.

- Competitive advantage: Companies with strong ESG initiatives are attracting more investment capital and customer trust.

This is also one opportunity to make a positive impact. Some tech companies will prioritize using technology to support social good, focusing on impact rather than just financial returns.

Mark Beakhouse, CFO at Wegrow, sees this potential: “In 2025, we plan to leverage Wegrow as a ‘Tech for Good’ by partnering with NGOs and social enterprises to help them scale their best practices. Unlike our corporate clients, where return on investment is measured in cash, we seek to help them maximize their impact on their core mission.”

Investing in Skills Development

The rapidly evolving business landscape requires continuous learning and adaptation. Skill building is one of the key drivers of retaining top talent, with Generative AI plays an increasingly important role in personalized learning and development.

Christopher Clark, CFO at Positive Support Group, echoes this focus on modernization, noting their priorities are “embracing technology to eliminate spreadsheets” and “implementing AI where we can in accounting and payments processes to later replicate in other areas.” In 2025, if CFOs want their employees to stay relevant, they will not only teach them how to use AI, but also how to how to use it effectively.

This makes sense not only from a financial perspective, but also from a leadership perspective. One of the top motivators for employees is to upgrade their skills so they can stay in demand, and if employers are willing to invest in them, their loyalty is likely to increase. For CFOs, the priority is not just to adopt AI, but to ensure their teams know how to use it effectively, minimizing risk while maximizing productivity.

Optimize your accounting and finance department with automation solutions from Bizzi

In the context of 2025, financial automation is no longer optional but has become a must to maintain competitive advantage.

As a result, the role of the Chief Financial Officer (CFO) is becoming more strategic than ever. How can CFOs leverage solutions like Bizzi to optimize the operations of their accounting and finance departments?

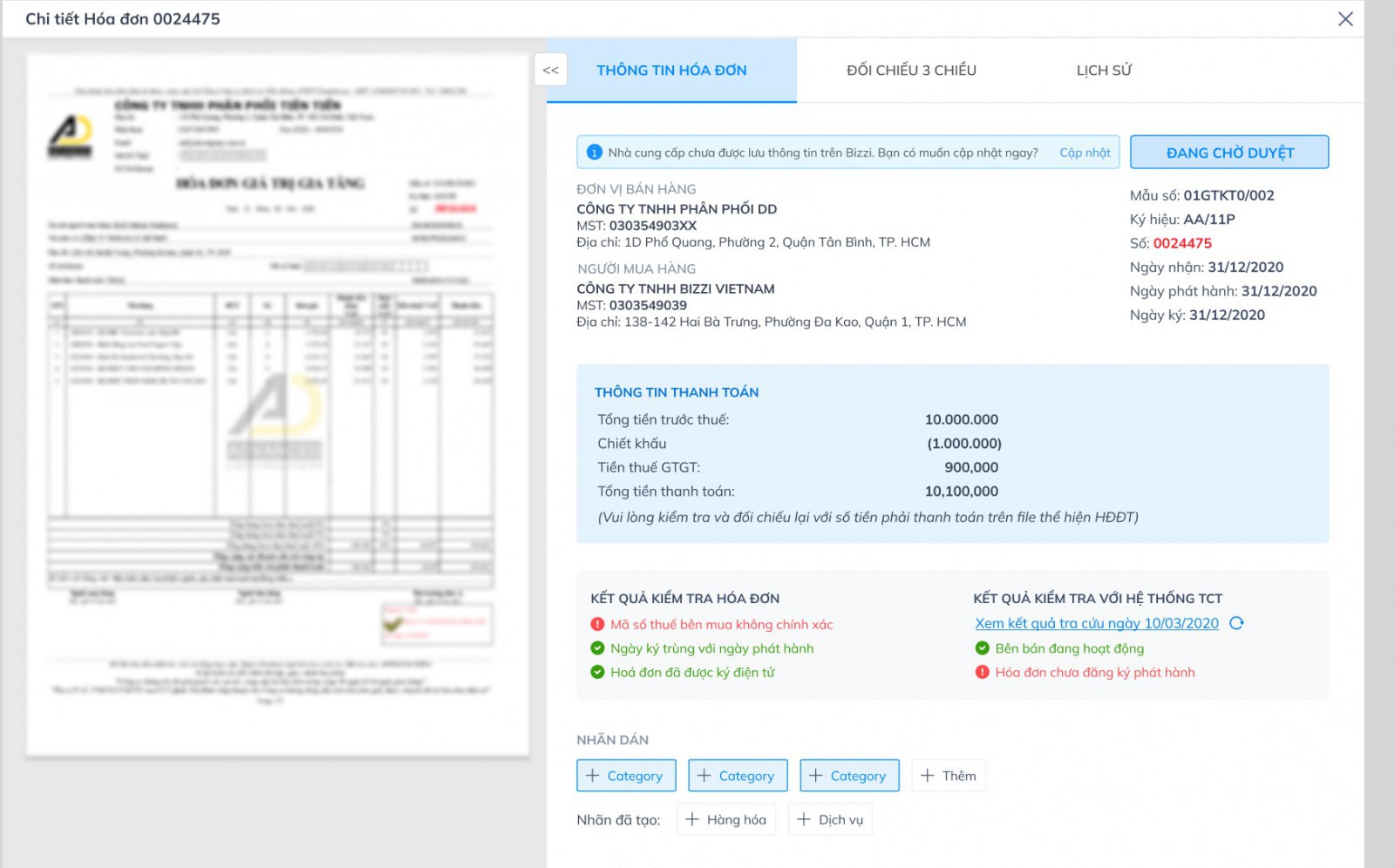

One of the important trends is the shift to predictive financial intelligence, with AI tools generated Real-time cash flow insights and intelligent forecasting. In this context, the solution Automatically process input invoices Bizzi's emerged as a powerful assistant.

Bizzi Bot uses RPA technology combines AI to automate invoice uploading, checking and reconciliation. As a result, CFOs can free their accounting teams from time-consuming manual tasks, Reduced processing time by up to 50%, and focus on more in-depth analytical activities.

Feature Automatic invoice reconciliation – PO in real time help early detection of errors, ensuring the accuracy of financial data and risk reduction error The data collected from this automated process provides the CFO with Insight into Spending, helping you make better financial decisions in challenging economic times.

Besides, Expense Management (Bizzi Expense) is a comprehensive solution that helps CFOs effectively control business expenses. In particular, the importance of the CFO's role in ensure efficient operation of all parts. With Bizzi Expense, the entire process Create payment requests and approve digitalized travel expenses, hospitality, shopping, etc.. This brings about the transparent and efficient in cost management, helping CFOs have a clear view of the business's cash flow.

Furthermore, the feature Budget management Allow CFO set up budget and financial regulations for each department, at the same time Track actual spending, budgeted spending and variances in real time. In context economic instability, this ability to tightly control costs becomes extremely important. Bizzi Expense not only helps the accounting and finance department work more efficiently but also facilitates close cooperation between departments through a common expense management platform.

In 2025, technology CFOs will be more than just financial managers; they will be architects of digital transformation, champions of AI, and drivers of sustainable growth. Those who successfully balance innovation and resilience will shape the future of finance leadership.

In particular, CFOs can leverage the power of automation solutions from Bizzi, especially Invoice Processing Automation and Expense Management (Bizzi Expense), to optimize workflows, improve operational efficiency, strengthen financial control, and make strategic decisions based on accurate and timely data.

This is the key for CFOs to not only be financial managers but also business architects, leading businesses to overcome challenges and seize opportunities in the digital age.

Source: Cledara

Monitor Bizzi To quickly receive the latest information: