In the modern context, "sustainability" in a company's business activities is often accompanied by ESG (Environmental, Social, and Governance) indicators, roughly understood as commitments to accompany and develop sustainably. of business in 3 aspects: Environment, Society and governance. So why do CFOs and Finance Controllers of businesses need to care about this issue? Let's find out together Bizzi Please!

What is ESG reporting and why is it important for businesses?

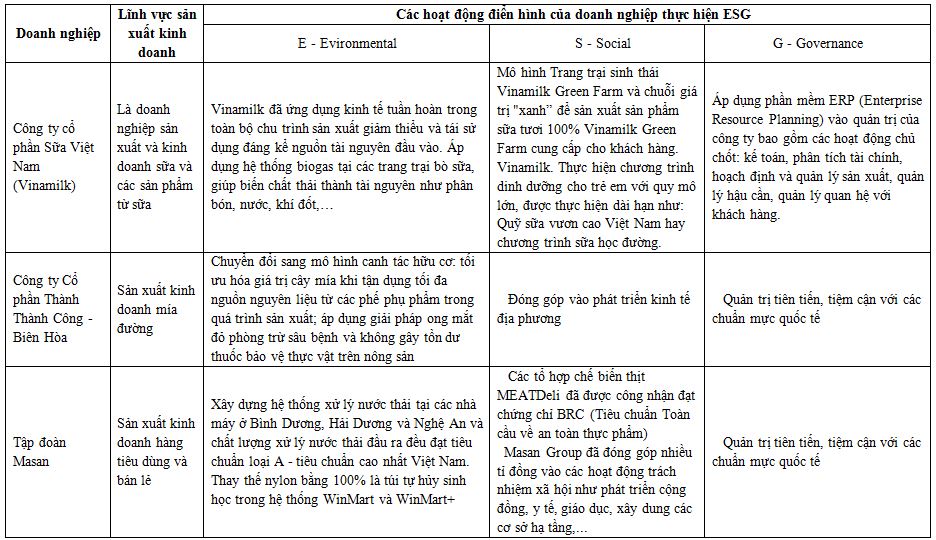

Institutional investors when researching and choosing companies to invest in often have to consider both financial and non-financial factors, in which ESG is a very important non-financial factor for long-term investment. At the same time, changes in the expectations of consumers and service customers as well as changes in public policy for businesses also force business owners, CFOs and finance controllers to pay attention to three key factors: New aspect – ESG:

- E – Environment: carbon emissions, water and waste management, raw material supply, impacts from climate change

- S – Social (Society): Diversity, equity and inclusion, labor management, data security and privacy, community relations

- G – Governance: Corporate governance, business ethics, intellectual property rights protection

Investors and potential business partners of businesses will look at ESG as a door leading to the company's future. ESG reports and indicators are also important factors that show a company's overall business picture, and ESG reports can lay the foundation for an inspiring story about a business's impact on the world. . Incorporating the three ESG factors into an integrated report and overall corporate strategy sends the message that the company is taking the necessary steps to increase long-term viability and profitability.

Those are also things investors want to see in their long-term portfolios.

ESG – Mandatory trend in the financial market

ESG can be understood as investing in businesses that are responsible to society and the environment instead of just focusing on profits. Examples of ESG come from simple actions of businesses such as production activities that use a lot of energy, businesses have optimization plans, saving 20-30% of input energy while reducing costs, while reducing emissions in the context that Vietnam is a country with a high emission rate.

Or for export businesses, shrimp heads after processing, instead of being thrown away, can be used as fertilizer or keratin to circulate and increase cash flow.

For textile and garment enterprises that use a lot of labor, how to improve the working environment to ensure the mental health and life of employees to ensure that they rarely miss work and minimize recruitment costs.

Achieving this achievement is not simple, implementing ESG requires a lot of time and resources, from hiring consulting partners, to disseminating it to each member unit, implementing environmental protection targets, Human development, business management. In addition to financial reports, businesses must have an annual ESG index report, which takes 6-8 months.

According to vtv.vn, FDI inflows to Vietnam are increasing, most of them are concerned about ESG. If they come and we are not ready, sometimes we lose the opportunity. And when we are ready, even if we have not yet fully applied it, we can still fully welcome this capital flow.

Some difficulties ashng ESG development of Vietnamese businesses

Firstly, having many sets of standards and indicators to evaluate the sustainable development of businesses in Vietnam brings many benefits in evaluating and monitoring ESG management aspects (Environment, Society, Governance). treatment). However, at the same time, this also creates complexity and difficulty for businesses when choosing and applying these standards. Diversity in standards and indicators can lead to ambiguity and loss of consistency in assessing corporate ESG.

Second, implementing an ESG program requires investment in resources and skills from businesses. Businesses need to evaluate, monitor and report on ESG indicators periodically and in detail. This may require improving information systems, finances, and internal administration. In particular, the adoption of new technology and process improvements can require large investments. For businesses with limited finances and resources, implementing an ESG program can be difficult.

Third, improper management of an ESG program can pose risks to the business. Lack of consistency and failure to meet ESG standards can lead to failure to build reputation and trust from the community, customers, and investors. Poorly managed ESG can also increase legal and financial risks for businesses. To avoid these risks, businesses need to have close coordination in implementing the ESG program and ensure integrity and transparency in this process.

In short, ESG management requires professionalism, resource investment, and determination on the part of the business. To be successful in implementing an ESG program, businesses need to identify specific goals, coordinate well throughout the company, and periodically evaluate and monitor. To help businesses move towards sustainable development, along with building incentive mechanisms and creating conditions for independent evaluation organizations to operate well in Vietnam, it is necessary to continue to strengthen training activities. Improve ESG management capacity for businesses in the market.

So how much cost should be allocated for ESG activities, how much cost should be spent on ESG index reporting and what kind of consulting units are needed... are also important items that CFOs and Finance Controllers need. understand the future to easily manage business costs.

Let's read the next issue to learn more about this information!

Join Bizzi to update trends, share experiences, and connect with opportunities for finance and accounting leaders at:

Follow Bizzi to quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam

- Youtube: https://www.youtube.com/@bizzivietnam