In today's fiercely competitive environment, effective supply chain management is a major challenge for businesses. Supply chain finance Not only is it a financial solution, but it is also an important tool to help businesses overcome these difficulties.

The article will analyze in detail the importance of supply chain finance and how it helps businesses achieve their business goals.

1. What is a supply chain?

1.1. Supply chain concept

Supply Chain is a system of organizations, people, activities, information and resources involved in the production and distribution of products or services from suppliers to customers.

An efficient supply chain not only ensures on-time delivery but also helps optimize costs, minimize waste and enhance customer satisfaction.

Illustration:

To illustrate, let us take the example of a mobile phone. The supply chain of this phone includes:

- Raw material supplier: Provides components such as screens, chips, batteries, etc.

- Manufacturer: Assembles components into finished products.

- Distributor: Distributes products to retail stores.

- Retailer: Sells products to consumers.

1.2. The importance of supply chain for business

An efficient supply chain is critical to business success. A good supply chain helps businesses:

- Cost optimization: Minimize inventory costs, transportation costs, increase labor productivity.

- Improve product quality: Strictly control product quality at every stage in the chain.

- Quickly respond to market needs: Flexibly change production to meet customer needs.

Building brand reputation: Ensuring products reach customers on time and with quality.

1.3. Factors affecting the supply chain:

- Customers: Customer needs, expectations and buying behavior.

- Supplier: Ability to supply raw materials, product quality, price.

- Manufacturer: Production process, technology, production capacity.

- Distributor: Distribution network, sales channels, customer service.

- Business environment: Policy, law, competition, technology.

1.4. Challenges in supply chain management:

- Supply chain complexity: As the number of participants increases, relationships become more complex.

- Disruption risk: Unexpected events such as natural disasters, epidemics, and geopolitical conflicts can disrupt supply chains, affecting business operations.

- Market volatility: Customer needs change rapidly, business environment factors are unstable.

- Competitive pressure: Competition is increasingly fierce, requiring businesses to continuously improve and innovate.

- Technology: Rapid technological developments place new demands on supply chain management.

- Systems Integration: Connect and integrate different information systems within the supply chain to ensure information is shared effectively.

Effective supply chain management is a key factor for business success in today's competitive business environment. By understanding the influencing factors, challenges and development trends, businesses can build a sustainable, flexible and efficient supply chain.

2. What is supply chain finance?

2.1. Definition of supply chain finance

Supply Chain Finance is a financial solution that connects parties in the supply chain – suppliers, buyers and financial institutions – to improve cash flow and minimize liquidity risk.

Instead of relying solely on equity, businesses can leverage supply chain financing to ensure timely payments to suppliers while maintaining stable operations.

It can be said that supply chain finance connects the parties in the chain, including suppliers, buyers and financial institutions, creating an efficient financial ecosystem.

2.2. Development history and trends

Supply Chain Finance has been around since the 1990s and is becoming increasingly popular around the world. In Vietnam, Supply Chain Finance is also being interested in and applied by many businesses. With the development of technology, Supply Chain Finance is becoming simpler and more effective, thanks to digital platforms and artificial intelligence.

In a supply chain, businesses often face the problem of delayed payments, leading to a shortage of working capital. Supply chain finance solves this problem by providing quick capital to suppliers, helping them maintain stable production and business operations.

2.3. The role of Supply chain finance for business

Supply Chain Finance (SCF) plays an important role in boosting business operations. SCF not only helps improve cash flow and reduce finance costs, but also brings many other benefits:

- Helps businesses improve cash flow: By shortening the time it takes to collect receivables, Supply Chain Finance helps businesses free up working capital, increase their ability to pay short-term debts and invest in other business activities.

- Reduced finance costs: Supply chain finance often has more competitive interest rates than traditional forms of borrowing, helping businesses save on finance costs.

- Increase business competitiveness: Businesses can take advantage of capital from Supply Chain Finance (SCF) to invest in technology, expand production, improve product quality, thereby increasing competitiveness in the market.

- Improve supply chain management efficiency: SCF helps businesses closely manage receivables and payables, optimize payment processes, thereby improving the operational efficiency of the entire supply chain.

- Building sustainable partnerships: SCF enables businesses in the supply chain to cooperate more closely, increase trust and create added value for both parties.

- Ensuring supply chain stability: SCF helps minimize default risks, ensures stable supply, and helps businesses maintain continuous production and business operations.

- Enhanced adaptability to market fluctuations: SCF provides flexible capital, helping businesses quickly adapt to market changes and seize new business opportunities.

- Supporting SMEs: SCF is especially useful for SMEs, helping them access capital more easily, reducing their financial burden.

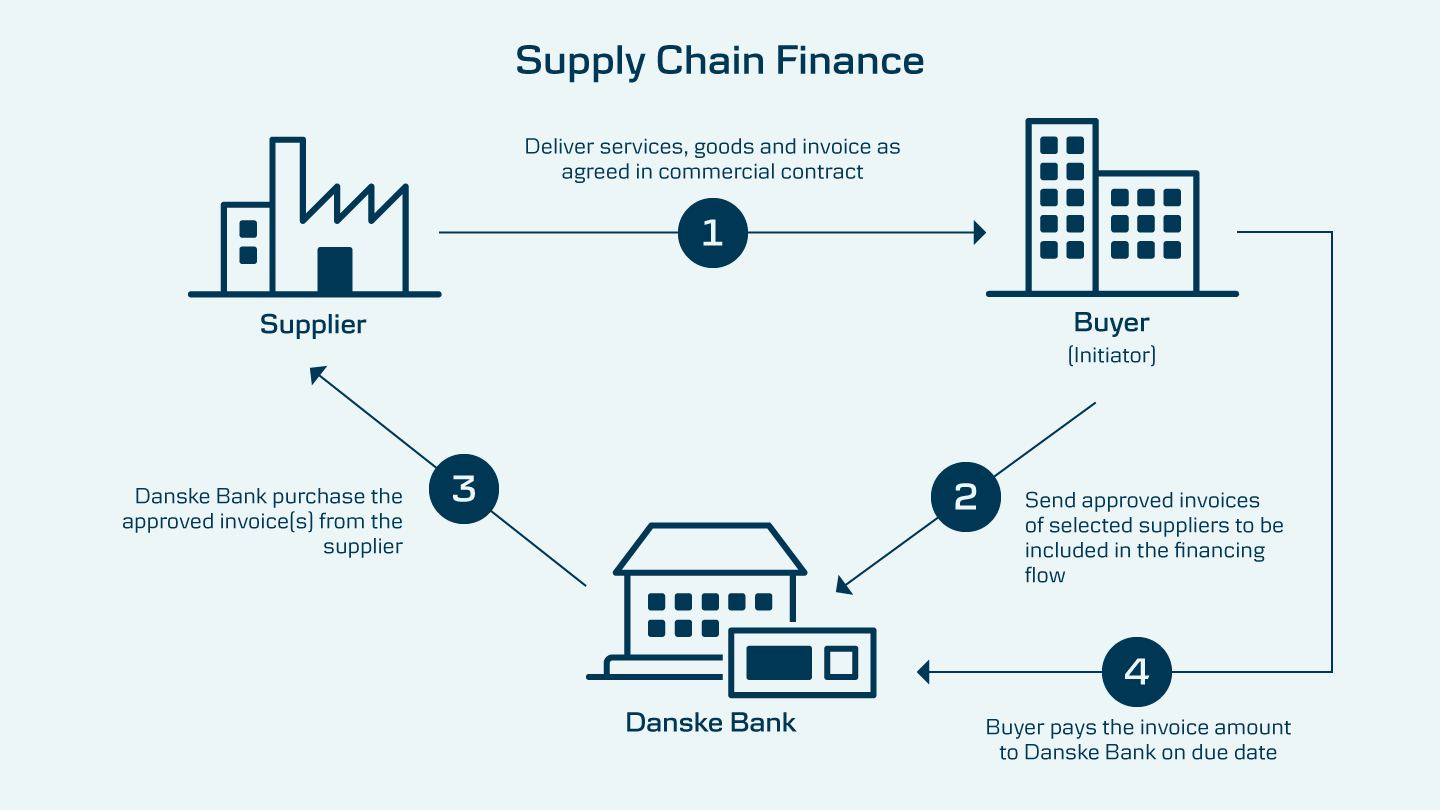

3. How Supply Chain Finance Works

Basic Model of Supply Chain Finance

Supply chain finance works by converting undue receivables into working capital for businesses in the supply chain. The process typically involves the following steps:

- Ordering and production: The purchasing business places an order with the supplier and the supplier proceeds to produce or supply the goods/services.

- Issue invoice: After completing the order, the supplier will issue an invoice to the purchasing business.

- Financing Request: A supplier may request a financial institution to provide financing prior to the invoice due date.

- Appraisal and approval: The financial institution will appraise the application, assess the creditworthiness of the parties involved and approve the loan.

- Disbursement: Once approved, the financial institution will disburse the committed amount to the supplier.

- Payment: When the payment is due, the purchasing business will pay the financial institution.

- Interest Payment: The supplier will pay interest to the financial institution as agreed.

Role of the parties involved:

- Purchasing businesses: Guarantee payment to financial institutions when due, can negotiate more flexible payment terms with suppliers.

- Suppliers: Get capital early, improve cash flow, reduce credit risk.

- Financial Institutions: Provide capital, earn interest on loans, manage credit risk.

4. Benefits of Supply Chain Finance for all parties

For suppliers:

- Improve cash flow: Get cash sooner, help maintain stable production and business operations, invest in production expansion.

- Credit risk mitigation: The risk of customer non-payment is transferred to the financial institution.

- Increased competitiveness: Can meet larger orders, reducing financial costs.

For purchasing businesses:

- Improve supplier relationships: Build strong partnerships, increase negotiation power on prices and payment terms.

- Cost optimization: Can delay payments, reducing financial costs.

- Improve supply chain management efficiency: Manage payables more efficiently, minimizing the risk of production disruption.

For the economy:

- Promote economic growth: Increase production and business activities, create more jobs.

- Improve capital efficiency: Increase capital circulation in the economy.

- Support for small and medium enterprises: Help small and medium enterprises access capital more easily.

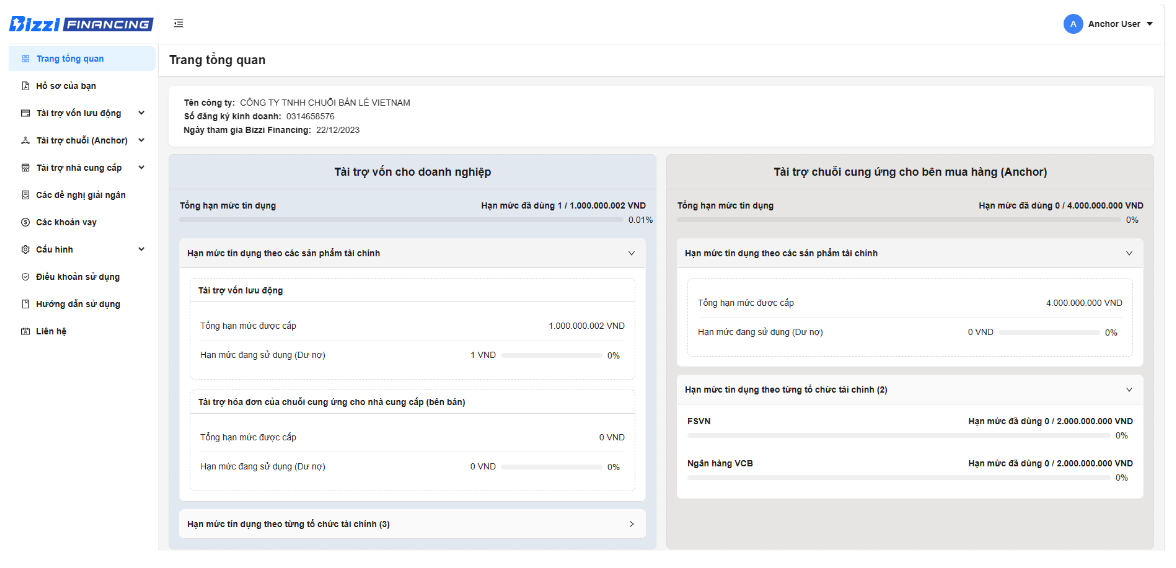

Supply Chain Finance Solutions for Businesses – Bizzi Financing

Bizzi Financing is a professional financial institution, a pioneer in providing flexible and effective supply chain financing solutions for businesses in Vietnam. With many years of experience and deep understanding of the market, we are committed to accompanying businesses, supporting to solve financial challenges and promoting sustainable development.

Why choose Bizzi Financing?

- Flexible financial solutions: Bizzi Financing offers a wide range of SCF products, suitable for the financial needs of each business, from small and medium enterprises to large corporations.

- Fast and simple process: Registration and approval procedures are optimized, helping businesses access capital quickly.

- Competitive interest rates: Bizzi Financing is committed to providing customers with preferential interest rates and reasonable service fee packages.

- Experienced team of experts: Bizzi Financing's team of experts is always ready to advise and support customers throughout the service usage process.

- Modern technology: Bizzi Financing applies advanced technology to manage and process information, helping the transaction process take place quickly and transparently.

Register for Bizzi Financing information here: https://finance.bizzi.vn/

Benefits of using Bizzi Financing's SCF service:

- Improve cash flow: Get capital sooner, helping businesses maintain stable production and business operations.

- Enhance competitiveness: Can participate in large projects, quickly meet customer needs.

- Financial risk mitigation: Credit risk is transferred to the financial institution.

- Cost optimization: Reduce financial costs compared to traditional forms of borrowing.

- Building sustainable partnerships: Bizzi Financing always accompanies customers, supporting business development.

If your business is looking for an effective financial solution to promote growth, contact Bizzi Financing immediately for the best advice and support.

In a volatile global economy, effective supply chain management and the use of appropriate financing solutions are crucial to the success of a business. Bizzi Financing offers a modern and efficient option, especially for SMEs. Don’t let finance be a barrier; learn about supply chain financing solutions for sustainable development.

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam