Circular 99/2025/TT-BTC marks the biggest change to the corporate accounting system in over a decade, officially replacing Circular 200 from January 1, 2026. Beyond adjusting the chart of accounts, Circular 99 shifts the focus from "accounting record-keeping" to data control, document transparency, and financial decision-making support.

This article helps CFOs understand Circular 99/2025, compares Circular 99 and Circular 200 from a management perspective, analyzes changes to the accounting system, and suggests a roadmap for preparing data for a safe transition.

What is Circular 99/2025/TT-BTC and when does it come into effect?

Circular 99/2025/TT-BTC is a document issued by the Ministry of Finance stipulating a new accounting regime for enterprises, completely replacing Circular 200. The Circular takes effect from January 1, 2026, and applies to all enterprises in Vietnam.

Legally, Circular 99 is a sub-document under the 2015 Accounting Law, specifically defining how businesses organize, record, and control accounting data. The "business accounting system" here refers not only to record entries but also to a comprehensive control framework encompassing documents, accounts, ledgers, and financial reports.

A key point for CFOs to note is that the effective date of January 1, 2026, does not mean that preparations can be delayed. Changes to account structure, historical data, and internal control regulations, if not prepared in advance, will create risks of data discrepancies, inaccurate comparative reporting, and significant pressure when going live.

To understand why Circular 99 has such a far-reaching impact, it is necessary to clarify the scope of this circular's application.

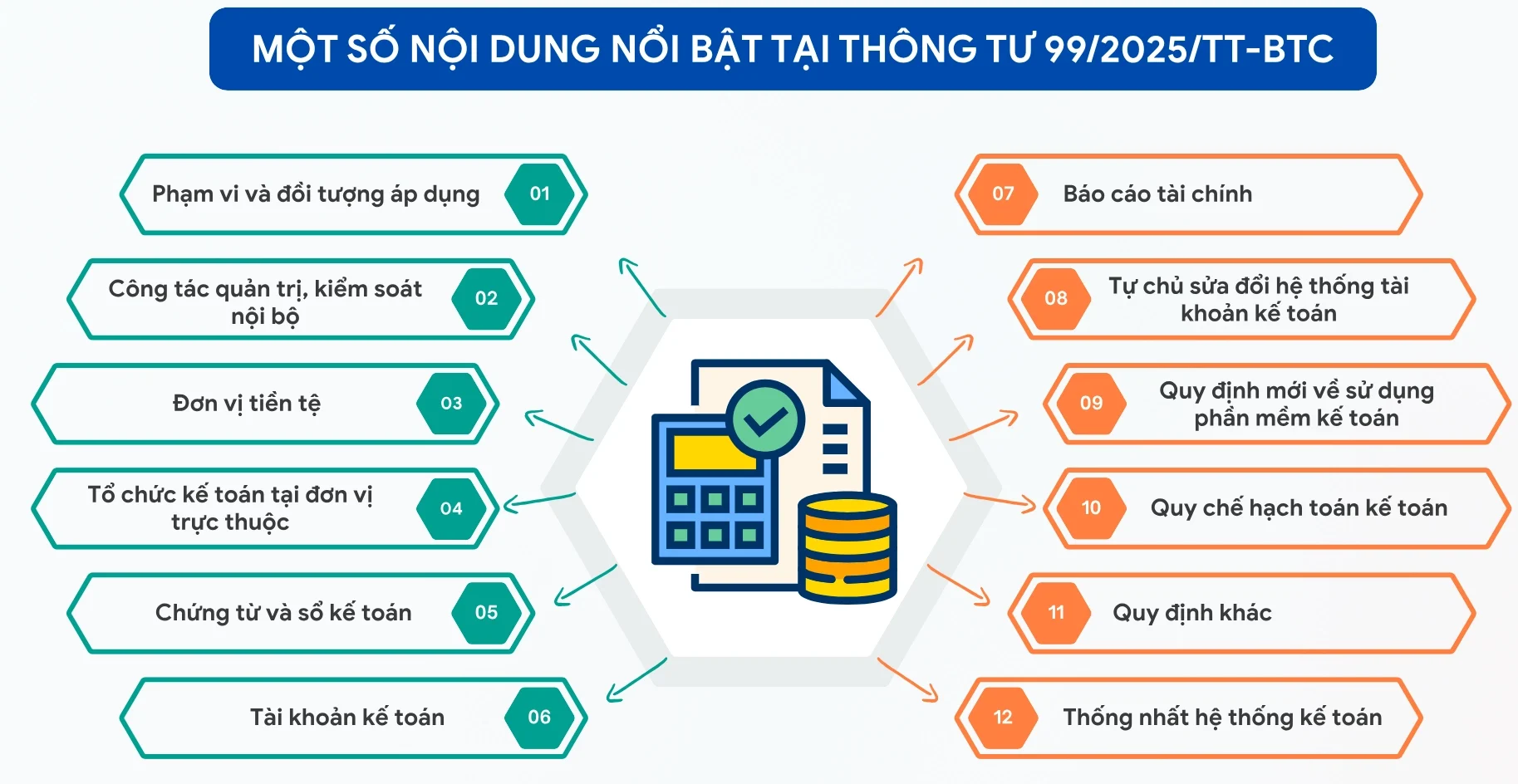

What accounting provisions are regulated by Circular 99/2025/TT-BTC?

Circular 99 amends the entire corporate accounting framework, including: accounting documents, accounting system, accounting books and financial report, while also granting businesses greater autonomy in designing their accounting systems.

These four pillars do not exist independently but are logically linked: documents are the data input, accounts are the classification structure, ledgers are the tracking tools, and financial statements are the output for management and settlement. Circular 99 allows businesses to design the details themselves, but within the limits of "controlled autonomy," meaning consistency, transparency, and traceability must be ensured.

Compared to the rigid approach of Circular 200, Circular 99 adheres more closely to the spirit of the 2015 Accounting Law: businesses are responsible for their own systems, rather than simply "following the template."

In this context, the biggest question for the CFO is: By what principles does Circular 99 replace Circular 200?

See more content Accounting document template according to Circular 99

According to what principles does Circular 99/2025/TT-BTC replace Circular 200?

Circular 99 completely replaces Circular 200 based on the principles of accounting modernization and increased enterprise autonomy, but requires stricter internal control, especially with electronic documents and self-designed chart of accounts.

Essentially, Circular 200 is no longer suitable for a digitized environment where data is generated from multiple sources and requires high traceability. Circular 99 shifts the focus from "correct record keeping" to controlling the nature of business operations and data quality.

For the CFO, this isn't a technical change, but a change in management philosophy: accounting is not just for settlement, but a data foundation for decision-making.

Based on this legal framework, businesses need to access and use the correct, original version of Circular 99.

Where can I download Circular 99/2025/TT-BTC to ensure I'm getting the original copy?

Businesses should download Circular 99/2025/TT-BTC from official legal sources such as the Ministry of Finance's portal or the legal document database to ensure that all content and accompanying appendices are available. A common risk is using a summary or file lacking the account system appendix, leading to misunderstandings or misapplication. A valid full-text document should include all terms, account appendices, and forwarding instructions.

After obtaining the original texts, the next step is to understand the substantive differences between Circular 99 and Circular 200.

| Text type | Circular |

| Number, symbol | 99/2025/TT-BTC |

| Issuing organization | Ministry of Finance |

| Date of issue | October 27, 2025 |

| Effective date | Effective from January 1, 2026, and applicable to fiscal years beginning on or after January 1, 2026. |

| Abstract | Circular 99/2025/TT-BTC provides guidance on accounting documents, accounting accounts, accounting entries, and the preparation and presentation of financial statements for enterprises. The determination of an enterprise's tax obligations to the State budget is carried out according to the provisions of tax law. |

| Download the circular | Link |

Comparing Circular 99 and Circular 200 from a CFO management perspective.

The difference between Circular 99 and Circular 200 lies not only in accounting techniques, but also in how businesses design internal controls, manage costs, and ensure that data accurately reflects the nature of their operations. Circular 200 focuses on compliance with templates; Circular 99 aims for data integrity and decision-support. For the CFO, accounting is no longer separate from cash flow and KPIs, but becomes the data backbone for management.

In this context, Bizzi acts as a bridge: standardizing expense and invoice data, establishing approval and audit trail workflows, and providing CFOs with reliable data for cost and cash flow analysis. The most significant difference between the two circulars lies in the accounting chart of accounts.

What changes are there in the accounting systems of Circular 99 and Circular 200?

The accounting system under Circular 99 is designed more flexible than TT200This allows for adding new accounts, removing some old accounts, and opening details according to administrative needs.

TT99 allows businesses to proactively design. chart of accounts, provided that they accurately reflect the nature of the data and serve the reporting purpose. Some new accounts include: Account 215, Account 82112 appeared, while Account 1562, Account 611 Eliminated.

The important point for a CFO isn't "which accounts they have," but rather... Impact on KPIs such as gross margin and cost allocation.Bizzi supports invoice classification according to the new account structure, helping to link expense data to the correct accounts and generate more accurate profit margin reports.

To implement the new accounting system, businesses must solve the following problem: data conversion.

How should businesses convert accounting data from Circular 200 to Circular 99?

The transition from Circular 200 to Circular 99 requires Mapping old and new accounts, checking balances, and ensuring comparability of historical data.. The biggest risk is a mismatch in gross margin or incorrect cost classification due to incomplete mapping. Businesses need to develop a proper mapping system. mandatory test cases Before going live, for comparison and reconciliation.

Bizzi supports the standardization of invoice data, reconciliation of accounts payable and historical expenses, helping CFOs reduce the risk of errors during conversion. In addition to the account system, TT99 also sets new requirements regarding... internal control.

What components are required for internal control regulations under Circular 99?

Circular 99 requires construction businesses to... internal control regulations to ensure the integrity and transparency of accounting data, especially with electronic documents and cashless payments. The regulations need to cover the checkpoints. before - during - after limbThis ensures that all transactions have approval, logging, and audit trail. Bizzi Expense supports the establishment of approval workflows, full tracking, and the creation of control evidence for the CFO during inspections or audits.

From this, many CFOs raised practical questions about the implementation of Circular 99.

Frequently Asked Questions from CFOs Regarding Circular 99/2025/TT-BTC

Below is a summary of answers to some questions related to Circular 99/2025.

Does Circular 99 apply to small and medium-sized enterprises?

Yes. Circular 99/2025/TT-BTC applies to all businessesRegardless of size, small and medium-sized enterprises (SMEs) are empowered to design their own accounting systems, but must still ensure principles of integrity, consistency, and internal control.

How does recording transactions in foreign currency according to Circular 99 affect corporate income tax?

Circular 99 allows bookkeeping in foreign currency if the conditions are met, but Corporate income tax is still settled in VND.The CFO needs to control exchange rate differences and ensure consistency between accounting and tax records to avoid discrepancies in taxable profits.

Will removing account 1562 distort the profit margin?

No, if the business Cost-effective mapping into the new account structure. Risks only arise when historical data is not reclassified, leading to a "distorted" gross margin after the conversion.

Will self-designed electronic documents be rejected by the tax authorities?

No, if the documents meet all the requirements of the Accounting Law and audit trail is retrievableThe focus is not on the form itself, but on its demonstrability and verifiability.

What criteria must accounting software meet according to Article 28 of Circular 99?

The software must ensure Data storage, access control, edit/delete control, and transaction tracing.CFOs should prioritize systems that support pre-recording control, not just post-recording.

When should we start preparing for the transition from Circular 200 to Circular 99?

Right in 2025. Account mapping, data standardization, and report testing require time; late preparation will create significant pressure when implementation begins on January 1, 2026.

Is it mandatory for businesses to change their ERP system when implementing Circular 99?

It's not mandatory. However, if the ERP system doesn't offer flexible support for the accounting system, approval workflow, and audit trail, businesses will find it difficult to leverage the "controlled autonomy" spirit of Circular 99.

Conclusion: What should CFOs prepare for before Circular 99/2025/TT-BTC?

Circular 99/2025 It is not simply a technical accounting document, but rather A shift from data recording to data control and decision support.. Job Download Circular 99/2025/TT-BTC Being true to the original is just the starting point; the real value lies in how the business understands and implements it.

Via Comparing Circular 99 and Circular 200It can be seen that the focus has shifted to autonomy coupled with accountability. In particular, Comparison of the accounting systems in Circular 200 and Circular 99 This shows that CFOs need to prepare thoroughly for data mapping, avoiding discrepancies in profit margins and management reporting.

In this context, Bizzi plays a pivotal role in supporting the CFO:

- Standardize expense data and input invoices.

- Establish a workflow for approval and audit trails in accordance with the spirit of Circular 99.

- Provides reliable data for analyzing costs, cash flow, and KPIs.

Preparing early not only helps businesses Comply with Circular 99, and also transform the accounting transformation process into Leveraging to upgrade financial management capabilities. For the CFO.