Decree 15/2022/ND-CP was one of the policies that had an "immediate impact" on the invoicing and VAT declaration activities of businesses, as it stipulated a reduction in the tax rate from 10% to 8% for certain groups of goods and services during the application period. In reality, the risk did not lie in "not knowing about the tax reduction," but rather in the fact that accountants easily confused eligible and ineligible items, incorrectly recorded the tax rate on invoices, or lacked the basis for consulting appendices when goods had complex descriptions.

This article provides an easy-to-understand summary of Decree 15/2022, guidance on identifying eligible entities for VAT reduction, how to properly issue invoices for each tax calculation method, common errors and how to handle them. It also compiles the necessary documents for further information. Download Decree 15/2022/ND-CP (PDF/Word) and download the appendix separately for quick lookup of product codes, helping businesses proactively comply and reduce risks when declaring goods.

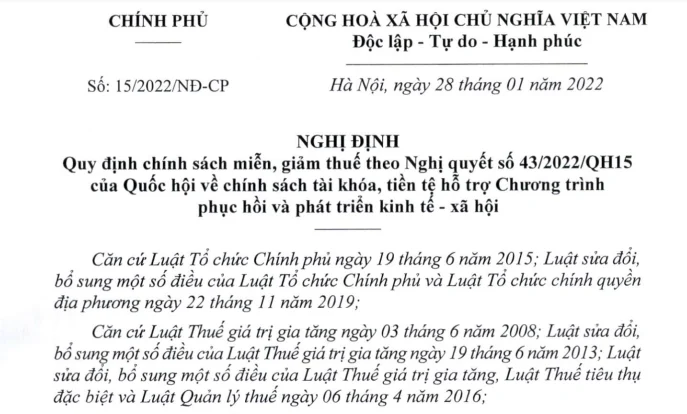

Introduction and download of Decree 15/2022/ND-CP

| Information | Content |

| Number of symbols | Decree No. 15/2022/ND-CP |

| Date of issue | January 28, 2022 |

| Validity period | From February 1st, 2022 to December 31st, 2022 |

| Issuing agency | Government |

| Content focus | Tax exemption and reduction policies (especially VAT reduction as per Article 1) |

| Scope of regulation | Detailed regulations on tax exemption and reduction policies (VAT and corporate income tax). |

| Download the official document | 📥 [Download Decree 15/2022/ND-CP – Word document (.doc)]

📥 [Download Decree 15/2022/ND-CP – PDF (.pdf)] 📥 [Download Appendices I, II, III, and IV separately to look up product codes] |

1. Overview of Decree 15/2022/ND-CP

Decree 15/2022/ND-CP, issued by the Government on January 28, 2022, is the most important legal document that concretizes Resolution No. 43/2022/QH15 of the National Assembly on fiscal and monetary policies to support the socio-economic recovery and development program.

For the business and accounting communities, this Decree brings about two direct and immediate impacts:

First, reduce financial pressure and costs. The policy of reducing VAT (from 10% to 8% for eligible groups) helps reduce tax costs on sales invoices, contributing to stimulating demand and improving price competitiveness. The details of the VAT reduction are stipulated in Article 1 of Decree 15/2022/ND-CP.

Secondly, businesses are required to change how they handle and file invoices. When tax rates are no longer uniform, accountants must correctly classify goods/services that are eligible for reduction and those that are not; configure the correct tax rates in the system; issue invoices correctly; and maintain explanatory records to reduce the risk of post-audit.

Text attribute information:

- Symbol number: Decree No. 15/2022/ND-CP

- Date of issue: January 28, 2022

- Effective date: From date February 1, 2022 until the end of the day December 31, 2022.

- Issuing agency: Government.

- Scope of application: Detailed regulations on tax exemption and reduction policies (VAT and corporate income tax).

2. Download the full text of Decree 15/2022/ND-CP (with Appendix)

For convenient storage, printing, and lookup of HS codes subject to tax rates 10% (non-reduced) or 8% (reduced), businesses and accountants can download the complete set of documents in .DOC (Word) and .PDF formats below:

The application package includes:

- Full text of the Decree: The regulations detail the terms of implementation.

- Appendices I, II, III: List of goods and services ARE NOT VAT tax reduction applied (Still using code 10%).

- Appendix IV: Sample declaration form for goods and services subject to excise tax that are not eligible for tax reduction.

Guidance on tax policy according to Decree No. 15/2022/ND-CP

1. Principles for determining eligibility for VAT reduction

The policy in Decree 15/2022/ND-CP on VAT reduction is implemented according to the following principles: Reduce VAT rate by 2% (from 10% down to 8%) for certain groups of goods/services currently subject to the 10% rate. apart from The groups listed in the attached appendix are excluded.

In practice, the biggest risk is "misclassification" due to the broad exclusion list and many easily confused groups. Groups frequently mentioned in guidelines/references include: telecommunications; finance-banking-securities-insurance; real estate business; metals and prefabricated metal products; mining (in some cases); coke, refined petroleum; chemical products; goods/services subject to excise tax… (accountants need to directly refer to the appendix according to the correct group name).

To reduce errors, the search process should be designed with two layers:

- Search by product/service group name in the appendix (prioritizing the nature of the goods).

- Use HS codes/industry codes only as a tool to assist in searching, and avoid making a final decision based on the code when the nature of the goods is different.

From a systems perspective, if a business standardizes its SKU/service catalog and maps tax rates from the outset (along with control rules), the accounting team will significantly reduce the risk of incorrect tax rates when entering data or receiving invoices.

- The stipulated reduction amount: Reduce the VAT tax rate by 2% (from 10% to 8%) for groups of goods and services currently subject to the 10% rate.

- Exclusion list (Not eligible for discount): It is necessary to clearly list the "sensitive" groups that accountants often misunderstand:

- Telecommunications, financial activities, banking, securities, insurance.

- Real estate business.

- Prefabricated metals and metal products, mining products (excluding coal mining), coke, refined petroleum.

- Chemical products.

- Goods and services subject to excise tax (IT).

- Search tool: Instructions on how to accurately verify the 7-digit industry code according to Decision No. 43/2018/QD-TTg (emphasizing the role of automatic lookup on the Bizzi system to reduce manual errors).

2. Regulations on invoicing for businesses calculating tax using the deduction method.

For businesses that claim tax deductions, when selling goods/services eligible for tax reduction, the invoice must show the correct tax rate. 8% Find the correct tax rate and calculate the corresponding tax amount.

A crucial point in practice is the separation of transactions: when selling items subject to different tax rates simultaneously, the invoice must clearly show the tax rate for each type of goods/services; failure to do so properly risks being charged the higher tax rate on the entire related revenue. (Businesses should check the rules displayed in their electronic invoicing software.)

How it's presented on the invoice

- How to issue an invoice: In the VAT tax rate section, clearly state the tax rate as "8%".

- Tax amount: Calculations are based on the 8% of the value of goods/services before tax.

- Total payment: Price excluding tax + Tax (8%).

Important note: line splitting/invoice splitting

When an invoice contains both goods under categories 8% and 10%, the accountant must clearly indicate each item and its corresponding tax rate. If combined without clear separation, there is a high risk of being subject to a higher tax rate for the unsubstantiated portion during a post-audit. The provisions regarding tax reductions and their application principles are stipulated in Article 1 of Decree 15.

3. Regulations for businesses calculating tax at a rate of 1% tax and 3% tax on revenue.

For household businesses or enterprises applying the direct method, Decree 15 stipulates a mechanism for reducing VAT based on a percentage. The principle is to clearly show the amount before the reduction and the amount after the reduction, and to make notes in accordance with regulations to serve as a basis for declaration and explanation.

- Reduction amount: Reduce the percentage rate for calculating VAT by 20%.

- How to issue an invoice:

- In the "Total Amount" column: Enter the full price of goods and services before any discount.

- In the line "Total amount for goods and services": Record the amount reduced by 20% at the rate of %.

- Mandatory note on the invoice: “Reduced… (amount) corresponding to 20% at the rate of % for calculating VAT according to Decree No. 15/2022/ND-CP”.

4. Calculating deductible expenses when determining corporate income tax.

In addition to VAT, Decree 15/2022/ND-CP also includes provisions regarding deductible expenses when calculating corporate income tax for donations and sponsorships to COVID-19 prevention and control activities (in the context of the recovery program). Businesses need to ensure they have the required documentation to be eligible for these deductions.

In practice, this group is prone to errors in recording inconsistent "total amount" and "reduced amount" between documents, ledgers, and declarations, leading to data discrepancies during reconciliation.

- Businesses are allowed to deduct expenses when determining corporate income tax for contributions and sponsorships to COVID-19 prevention and control activities.

- Required supporting documents: Confirmation of support/sponsorship in the prescribed format.

Advice: Businesses should proactively review their input and output product lists and set default tax rates in advance on their cost management systems, such as Bizzi ExpenseThe system will help alert you if an input invoice from a supplier has an unusual tax rate compared to historical data or industry regulations, helping accountants eliminate risks before filing taxes.

5 things to note when issuing invoices applying Decree 15/2022/ND-CP on VAT reduction.

During the period of application of Decree 15/2022/ND-CP, errors often did not stem from "not knowing about the VAT reduction," but rather from operational errors in invoice preparation: combining items under categories 8% and 10%, issuing incorrect tax rates due to system updates, or incorrectly determining the application time.

These errors can easily lead to invoice adjustments, supplementary declarations, and even the risk of tax arrears/assessments during post-audits. Below are 5 important points to note to help accountants create correct invoices from the start and minimize risks.

1. Regulations on splitting invoices for goods and services eligible for tax reduction.

According to Clause 4, Article 1 of Decree 15/2022/ND-CP, business establishments (using the deduction method) that sell goods or provide services applying different tax rates must clearly state the tax rate for each type of goods or service.

For the group of goods and services whose VAT is reduced to 8%, businesses A separate invoice is required.This is intended to:

- Transparency in reporting: This helps tax authorities and businesses easily classify and control taxable revenue under the 8% and 10% models.

- Avoid the risk of being assessed taxes: If a business does not issue separate invoices or combines invoices without clearly separating the tax rates, the tax authorities may require the application of the highest tax rate (10%) to the entire invoice value, causing losses to both the business and the customer.

- Note for Bizzi users: The splitting of invoices should be set up right from the order creation stage in the management software so that the system automatically generates accurate electronic invoices.

2. Instructions on how to handle situations where a business receives a tax reduction but has already issued invoice 10%.

This is the most common error in the initial phase of policy implementation. If a business eligible for the tax reduction to 8% has mistakenly issued an invoice under code 10% due to an error or system update, the following steps should be taken:

- Step 1: Both parties (buyer and seller) need to create a record documenting the error or reach a written agreement regarding the incorrect tax rate.

- Step 2: Seller established Adjustment invoice or replacement bill (depending on the regulations of the electronic invoicing software and Decree 123/2020/ND-CP currently in effect) to adjust the tax rate from 10% down to 8%.

- Step 3: Refund any excess tax collected to the buyer.

Without adjustment, the seller must pay tax 10% (suffering a loss), while the buyer is also not allowed to deduct tax 10% (due to the incorrect invoice) but can only deduct the actual amount of tax 8% or have the expense disallowed.

3. Determine the tax rate for goods sold before February 1, 2022, but invoiced in February 2022.

Accountants need to clearly distinguish between time when tax obligations arise and time of invoice.

- Principle: The tax rate is determined at the time of transfer of ownership or the right to use goods or services (completion of the service), regardless of the time of invoice issuance or payment.

- Analysis: If goods have been sold, services have been completed and accepted. before February 1, 2022If that transaction falls under the previous tax period, then it is considered a previous tax period.

Conclude: Even though the invoice was issued in February 2022 (when Decree 15 had already come into effect), the business still has to apply the old tax rate. 10%The 8% rate shall not be applied to transactions that occurred before the decree came into effect.

4. Procedures for handling invoices issued before February 1, 2022, that contain errors discovered after this date.

In cases where invoices were issued before February 1, 2022 (subject to tax code 10%) but errors are discovered after February 1, 2022, requiring correction or replacement:

- Applicable regulations: Comply with the regulations on invoices and supporting documents as stipulated in Decree 123/2020/ND-CP.

- Adjusted tax rates: Adjustment or replacement invoices must maintain the same tax rate as at the time the original transaction occurred.

Specifically: If the original invoice from January 2022 has a tax rate of 10%, then the adjustment invoice should be issued in February 2022 (or subsequent months). Tax rate 10% must still be recorded.Absolutely no adjustment to 8% is permitted because the nature of this transaction does not fall within the scope of Decree 15/2022.

5. Steps to rectify the situation when a business issues invoices with incorrect tax rates.

When an error in setting the tax rate is discovered (for example, item 8% is incorrectly recorded at a different rate or vice versa) and it does not fall under the transitional cases mentioned above, the accountant should handle it as follows:

- In cases where taxes have not yet been filed:

- The seller cancels the electronic invoice that was issued incorrectly.

- Issue a new electronic invoice to replace the old one, with the correct tax rate.

- For cases where taxes have already been filed:

- The seller and the buyer draw up a written agreement specifying the defects.

- The seller issued an invoice to correct the error.

- Both parties shall submit supplementary declarations (if errors affect the amount of tax payable/deductible) in accordance with the provisions of the Tax Administration Law.

Manually managing timelines and lists of goods eligible for tax reductions is prone to errors. Using automation solutions such as... Bizzi Expense This will help accountants automatically cross-check product codes and alert them if the tax rate on input invoices does not match current regulations, minimizing the risk of tax explanations later.

Comparing Decree 44/2023/ND-CP and Decree 15/2022/ND-CP

Below is the detailed content for this section. H2: Comparison of Decree 44/2023/ND-CP and Decree 15/2022/ND-CP, continues to be specifically designed for accounting and business users of Bizzi.

This content not only lists the differences but also delves into them. operational impact This is for accountants to take note of when converting between policy periods.

Comparing Decree 44/2023/ND-CP and Decree 15/2022/ND-CP

Although Decree 44/2023/ND-CP is considered a "successor" to the spirit of Decree 15/2022/ND-CP in reducing VAT from 10% to 8%, the actual implementation has involved significant adjustments. scope of objects and administrative procedures to resolve the issues from the previous period.

Below is a general comparison table and a detailed analysis of the new features:

| Comparison criteria | Decree 15/2022/ND-CP | Decree 44/2023/ND-CP |

| Applicable period | February 1, 2022 – December 31, 2022 (11 months) | July 1, 2023 – December 31, 2023 (6 months) |

| Coal | Coal mining sales are reduced. There are no clear regulations regarding the closed-loop process for corporations/companies. | Clearly defined: Corporations and groups that implement a closed-loop sales process are also eligible for tax reductions. |

| Handling erroneous invoices | Specific instructions are provided in Clause 5 of Article 1. | Remove individual instructions, implemented uniformly in accordance with Decree 123/2020/ND-CP |

| Corporate income tax expense | There are regulations regarding deductible expenses for Covid-19 support and sponsorship. | AbolishThis regulation no longer exists due to the changed context of the pandemic. |

| HS Codes & Categories | According to the old catalog. | Update HS code New according to the 2022 Import and Export Goods Classification List; Amendments to the final note in the Appendix for clarity. |

1. Expansion of tax-reduced items: New information regarding coal.

Decree 44/2023/ND-CP has resolved a major obstacle that Coal and Mineral Corporations faced under Decree 15.

- According to Decree 15: The regulation only stipulates that only "coal mined and sold" is eligible for tax reduction. This is controversial when applied to corporate models with a closed-loop process (Parent company assigns subsidiary to mine -> Processing -> Parent company buys -> Sells to external parties). In this case, the selling stage by the parent company is considered "commercial" rather than "mining," and is therefore often subject to Article 10%.

- According to Decree 44: Specify the cases Corporations and economic groups that implement a closed-loop sales process are also eligible for VAT reduction..

Note for Bizzi users: If your business is part of the coal supply chain or purchases coal from these entities, you need to update the input tax rate 8% for invoices issued after July 1, 2023, to optimize costs.

2. Standardize the process for handling invoices with incorrect tax rates.

This is the most significant change in terms of reducing the workload for accountants in terms of procedures.

- Previously (Decree 15): When an error is discovered (e.g., an invoice was issued under code 10% for goods under code 8%, or vice versa), the Decree requires a new invoice to be issued. Adjustment invoice or a replacement invoice with specific processing steps.

- Currently (Decree 44): There are no longer any specific regulations. The handling of invoices with incorrect tax rates is done entirely according to the regulations. Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC.

Impact: Businesses have the flexibility to choose between establishing Adjustment invoice or Replacement invoice It depends on the agreement between the buyer and seller, and is not as rigid as before.

3. Update HS Codes and Excluded Goods List

Accountants should pay particular attention to avoiding simply copying and pasting the inventory list from 2022 to 2023.

- Change HS code: Decree 44 updated the HS codes in Appendices I, II, and III to align with the latest Vietnamese Export and Import Goods Classification List (issued with Circular 31/2022/TT-BTC). Many product codes have changed their descriptions or codes compared to the time Decree 15 was issued.

- Reference notes: Decree 44 amends the Notes at the end of Appendices I and III, clearly stating: “The HS code in column (10) is for reference only. The determination of the HS code for actual imported goods is carried out according to the regulations on goods classification…”This emphasizes the priority nature of name and nature of goods It is better to use the HS code when considering tax reductions.

4. Abolish regulations on deductible expenses for corporate income tax (Supporting Covid-19)

Article 2 of Decree 15/2022 stipulates that businesses are allowed to include expenses for supporting and sponsoring COVID-19 prevention and control activities as deductible expenses when calculating corporate income tax.

However, Decree 44/2023/ND-CP focuses entirely on the policy of reducing VAT to stimulate consumer demand. no longer mentioned This content is relevant now that the pandemic is under control. Businesses need to be aware of this to avoid incorrectly accounting for charitable and donation expenses as deductible costs if they do not have complete documentation as required by the Corporate Income Tax Law.

The changes between the two decrees reflect the tax authority's trend towards "standardization." Specific guidelines are gradually being removed to return to the original regulations (such as Decree 123).

When setting up the system Bizzi Expense Or, for accounting software for the new period, prioritize reviewing it. Product Code (SKU) Instead of just looking at the names, especially for imported goods with complex HS codes, it's important to avoid the risk of being subject to tax arrears later.

Frequently Asked Questions (FAQs) regarding the implementation of VAT reduction under Decree 15

1. Can fuel invoices be reduced to tax rate 8%?

Answer: NO.

This is the most common misconception. Although gasoline and diesel are essential fuels, according to Appendices I, II, and III of Decree 15/2022/ND-CP, gasoline and diesel are subject to Special Consumption Tax (or belong to the group of mining products, refined petroleum). Therefore, this item is still subject to tax rate 10%.

When processing travel expenses and fuel costs, accountants should note that if a fuel invoice shows 8%, it is incorrect. The Bizzi system will warn users if they enter this tax rate incorrectly for this group of fuel suppliers.

2. How should invoices be issued for food and beverage services and hotels that serve alcoholic beverages?

Reply: We need to separate the lines or invoices.

- Food and beverage services, room charges: Reduced 8%.

- Alcohol, beer, and tobacco: As a commodity subject to excise tax, the tax remains unchanged. 10%.

If a restaurant combines "Food and Beverage Services" under the tax rate 8% for both food and alcoholic beverages, it is incorrect. The business needs to request that the supplier separate the lines for Food (8%) and Alcoholic Beverages (10%) on the same invoice or issue two separate invoices.

3. Do businesses need to submit an application for tax reduction to the tax authorities?

Answer: NO.

The tax reduction policy under Decree 15 is applied on a self-declaration and self-responsibility basis. Businesses do not need to go through the procedure of "applying" for tax reduction.

However, this also means a significant risk of post-audit inspection. If the tax authorities later inspect and discover that the business has arbitrarily reduced taxes for items not eligible for reduction, the business will be subject to back taxes and administrative penalties.

4. Which tax rate applies to construction projects that are partially accepted?

Reply: Based on the date of acceptance.

- Acceptance and handover items before February 1, 2022: Apply 10% (Even if the invoice is issued later).

- The acceptance and handover period for this item is approximately... February 1, 2022 – December 31, 2022: Apply 8% (For construction contracts that do not include the supply of goods subject to tax under Article 10%, such as furniture, refrigeration equipment, etc.).

- Troubleshooting tips: Accountants need to attach the Acceptance Certificate to the payment file in the Bizzi software as a basis for explaining the time of tax rate determination.

5. Can input invoices with incorrect tax rates (e.g., falling under category 8% but recorded as 10%) be deducted?

Answer: There is a risk.

According to guidance documents from several Tax Departments, if the seller has not yet adjusted the invoice:

- The seller must pay tax 10%.

- The buyer is only entitled to deduct 8% (in accordance with legal regulations) or risks having the entire input tax disallowed if they do not request the seller to make adjustments.

Therefore, the safest solution is to request the seller to issue an adjusted or replacement invoice that correctly reflects the 8% code.

Conclude

Application Decree 15/2022 This requires accountants to correctly classify goods and services; issue invoices with the correct tax rates; and maintain complete records for accountability purposes. The biggest risk doesn't lie in "not knowing the regulations," but in the large number of goods, inaccurate descriptions, and manual operations, making it difficult to control tax rate errors.

In practice, businesses often reduce risk by standardizing their product/supplier catalogs, establishing tax rate rules by product group, and implementing cross-checking mechanisms (document reconciliation, tax rate discrepancy alerts) right from the input stage—so that when it comes time to file tax returns, accountants don't have to "fix" hundreds of invoices.

👉 Sign up for a free Bizzi trial today to ease your stress during tax season!

Registration link: bizzi.vn/dang-ky-dung-thu

Follow Bizzi to quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam

- Youtube: https://www.youtube.com/@bizzivietnam