In the context of the strong financial digital transformation, businesses need not only to record past data, but also to forecast and operate future strategies. Two technology platforms play a central role in this journey: ERP (Enterprise Resource Planning) and EPM (Enterprise Performance Management).

If ERP is considered the "operational nervous system" of a business, then EPM is the "analytical brain" - helping managers look beyond current data to plan, forecast and make quick decisions.

This article will help you – especially the CFO, FP&A Manager and Finance Leader - clearly understand:

- How are EPM and ERP different?

- Can ERP replace EPM?

- And why? Sactona – EPM solution of Bizzi Vietnam – is becoming the top choice of modern CFOs.

What are ERP and EPM?

Before going into Compare EPM and ERP, let's take a look at the nature of these two concepts.

1. ERP – Enterprise Resource Planning

Before comparing, let's take a look at the core platform of most businesses today – ERP.

ERP is considered the “operational backbone” where all financial, inventory, human resources and supply chain transactions are recorded and synchronized.

ERP (Enterprise Resource Planning) is enterprise resource planning system, helps automate processes, ensuring data consistency across departments.

The main functions of ERP include:

- Recording and storing transactional data - All purchasing, sales and accounting operations are systematized.

- Financial management - accounting (GL, AP, AR) and operating cash flow.

- Manage production, supply chain, human resources and fixed assets.

- Provide reports that reflect reality (actuals) in the past and present.

In short, ERP is Operational recording and control tools, ensuring "businesses operate according to correct procedures".

2. EPM – Enterprise Performance Management

While ERP records the past, EPM helps draw the future. This is the platform that allows financial managers to plan, forecast, consolidate reports and evaluate business performance.

EPM (Enterprise Performance Management) focus on analysis, forecasting and strategic planning, helping management understand the impact of current decisions on future results.

Main functions of EPM:

- Budgeting & Forecasting according to many scenarios.

- Financial Consolidation multinational

- Performance Analysis and manage KPI, ROI, EBITDA.

- Integrate data from ERP and other systems to provide comprehensive management reporting.

If ERP answers the question “What happened?”, then EPM replied “What will happen, and what if…?”

Modern EPM platforms such as Sactona, Jedox, Anaplan, Oracle EPM Cloud Helps businesses build flexible financial models, connect data from multiple sources, and update scenarios in real time.

EPM vs ERP Comparison – How are EPM and ERP different?

Before diving into the role of EPM, let's take a look at the table. Compare EPM and ERP To better visualize the difference between these two platforms:

| Criteria | ERP | EPM |

| Target | Management & Operation Optimization | Performance Management & Strategic Planning |

| Target audience | Operational staff (Accounting, Purchasing, Warehouse, Human Resources) | CFO, FP&A, senior leadership |

| Data type | Transactional – real data | Analytical – planning & forecasting data |

| Time angle | Past & Present | Present & Future |

| Main applications | Transaction recording, basic reporting | Planning, consolidation, scenario analysis, decision support |

→ Conclude: ERP and EPM are not interchangeable. ERP helps “record accurately”, while EPM helps “make accurate decisions”. These two platforms additional each other, creating a comprehensive financial ecosystem for modern businesses.

Can ERP replace EPM?

The answer is Are not.

Before EPM, FP&A departments typically planned using Excel manually – prone to errors, poor version control, and taking weeks to compile data. While ERP helped standardize accounting processes, there were still significant gaps in planning and analysis.

ERP only stores Actual Values, it does not manage Planned/Forecast Values.

ERP does not support scenario analysis. – something that CFOs really need when building financial plans.

ERP lacks the ability to consolidate multi-unit, multi-region financial reporting.

EPM was born to fill this gap. Platforms like Sactona provide:

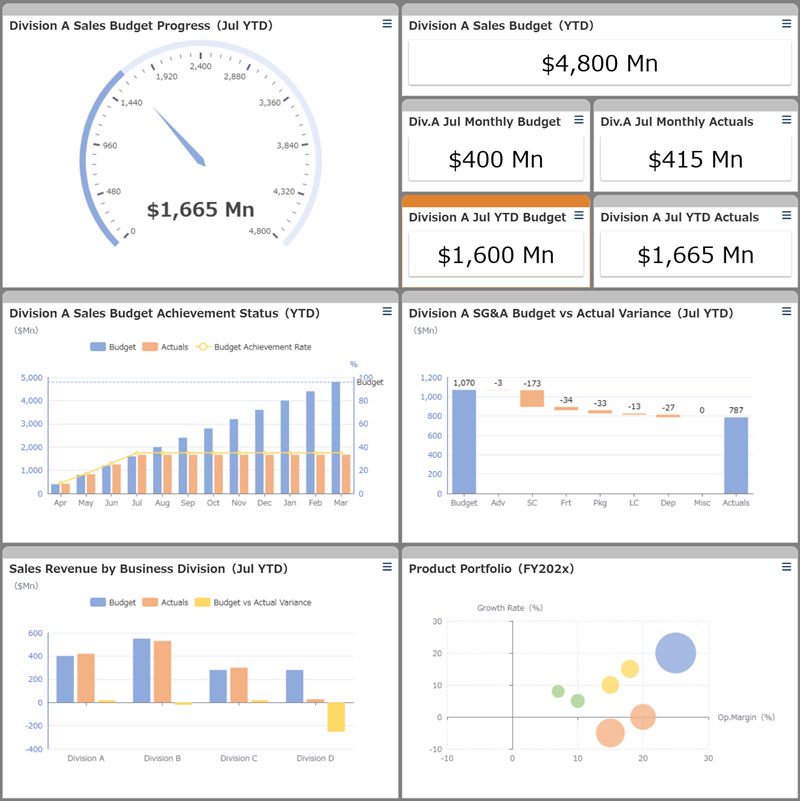

- Automate FP&A processes.

- Drill-down analysis, What-if scenario simulation, and real-time KPI reporting.

- Reduce planning, forecasting, and reporting consolidation time by 50-70%.

EPM Sactona Solution – Product of Outlook Consulting, exclusively distributed by Bizzi

In the journey of financial digital transformation, many CFOs in Vietnam are looking for a solution Flexible as Excel but powerful as Oracle. That's when Sactona – EPM platform from Japan, by Outlook Consulting development and Exclusive distribution by Bizzi Vietnam – become the top choice.

Likened to “CFO's trusted transformation partner”, Sactona is not just financial planning management software, but strategic brain help businesses make decisions faster, more accurately, and less dependent on Excel.

Product positioning

Sactona is developed by Outlook Consulting, Japan's leading EPM consulting and implementation company, with over 25 years of experience in financial performance management for large corporations.

In Vietnam, Bizzi To be exclusive distribution partner and official implementation support for Vietnamese businesses.

Target audience:

- Businesses have revenue >200 billion VND/year.

- The system has been deployed Large ERP such as SAP, Oracle, Microsoft Dynamics...

- Have FP&A team of 5 or more people, are looking to standardize and automate their planning & forecasting processes.

Sactona helps businesses reach a new level of financial management – where data is not just stored, but transformed into operational knowledge.

Core values

Every business can use ERP for management, but only with EPM like Sactona, they can planning and controlling the future. Below are three core values that make Sactona the trusted choice of global CFOs.

Value 1: Improve the quality of planning & forecasting

Before planning, CFOs often spend days collecting data from departments, editing Excel, and dealing with discrepancies between “Plan” and “Actual”. Sactona solves this problem thoroughly by Direct integration with ERP and Data Warehouse, help:

- Automatic data connection from accounting, sales, human resources, production systems...

- Variance Analysis between Planned – Actual – Forecast in real time.

- Data consolidation from multiple business units, markets, or regions in just minutes.

CFOs can create their own What-if scenario to check the impact of changes in revenue, costs, exchange rates… on business profits – without waiting for the IT team.

“Previously, planning took 2 weeks. With Sactona, it took only 3 days – and the data was accurate down to each branch.” – Panasonic CFO shared in an internal conference.

Value 2: Ease of use & high autonomy

Unlike complex platforms (e.g. Oracle EPM, Anaplan) that require technical support teams, Sactona is designed for FP&A teams to operate autonomously. – while maintaining enterprise-grade accuracy.

- Familiar Excel interface: FP&A staff do not need to learn additional programming languages.

- Drag and drop, create reports quickly: Just a few clicks to add rows, edit formulas, create charts.

- Flexible model customization: CFOs can change financial assumptions and create new models without IT intervention.

This is a great advantage to help Sactona is suitable for the characteristics of Vietnamese enterprises. – where FP&A departments are often small, multi-tasking, and need tools that are easy to implement right away.

“Sactona retains the soul of Excel – the flexibility – but adds the power of an EPM system.”

Value 3: Cost-effective & fast ROI

EPM implementation is often seen as a “long-term, expensive project”. However, Sactona proves otherwise.

- Implementation time: only from 2-3 months For basic projects, 60-70% faster than Oracle or SAP BPC.

- Lower cost 40-50% compared to international competitors.

- Fast ROI: Significantly reduce forecasting time, consolidate reporting and analysis.

For example:

- Panasonic – after applying Sactona, forecast time reduced to 5.5 days.

- Monex Group – shorten 60% data consolidation time, increase 40% time for analysis.

Thanks to its streamlined processes, Sactona helps CFOs “see business results sooner, to act sooner.”

Pain points Sactona resolves

Before Sactona appeared, many Vietnamese businesses encountered three typical problems:

- ERP only provides historical reports, not future planning.

→ Historical data is recorded accurately, but cannot answer the question “What if revenue drops by 10%?”. - FP&A relies on manual Excel:

→ Each department sends a different file, wrong formula, wrong version, difficult to merge. - Other international EPM software are too complicated & expensive:

→ Oracle, SAP BPC or OneStream are powerful but require specialized IT, deployment takes 6-12 months.

Sactona was born to Combine the flexibility of Excel with the power of a Japanese standard EPM system, helping Vietnamese businesses become more accessible while still achieving high efficiency.

“No more 'Excel on Excel', everything is now updated in real time, CFOs just need to open the dashboard.” – feedback from a customer in Tokyo after 3 months of implementation.

International Case Study

Sactona's success stories clearly demonstrate the value the platform brings to global CFOs.

Panasonic Corporation – Standardize data & shorten forecast cycle

Previously, each region of Panasonic used a different accounting system. Compiling global financial statements took an average of 15-20 days, and there are often discrepancies between plan and reality.

After deploying Sactona:

- The forecast cycle decreased from 15 days down to 5.5 days.

- Updated global consolidated report in real time.

- Branches can enter data directly into Excel forms that are synced with Sactona Cloud.

- CFO can Drill-down data down to each product line or region with just one click.

Result: Accelerate strategic decision making and standardize data across the entire group across 40 countries.

Monex Group – Shifting the FP&A Role from “Recording” to “Analyzing”

Monex – Japan's leading financial services group – once faced the problem: FP&A lost 70% input time, leaving only 30% for analysis.

With Sactona:

- Automated planning and forecasting processes 80%.

- Consolidate data from multiple branches in hours instead of days.

- FP&A can focus on analyzing fluctuations and simulating “what-if” scenarios to support the CEO in operations.

Result: Finance team moves from “reporter” to “business advisor” – in the true spirit of modern EPM.

Fujifilm – Accelerating Global Financial Reporting Consolidation

With more than 50 business units in the worldFujifilm has had difficulty manually consolidating data, causing delays in monthly consolidated financial reports.

After deploying Sactona:

- All reports are consolidated on the same platform.

- Reduce 65% data error, reducing report processing time 50%.

- CFOs can see consolidated results, forecasts, and variance analysis within hours of branch data entry.

Thanks to that, Fujifilm transformed itself into a data-driven enterprise real

Conclude

In short, Sactona is more than just EPM software, which is comprehensive strategic solutions for CFOs looking to elevate the role of the finance department – from “reporting” to “leading growth”.

With the companionship of Bizzi in Vietnam, Sactona is becoming the ideal choice for businesses wanting to Accelerating financial digital transformation without sacrificing the familiar flexibility of Excel.

In today's financial digital transformation landscape, How are EPM and ERP different? It is no longer an academic question, but a foundation to help businesses understand where to invest for sustainable development.

If ERP (Enterprise Resource Planning) play the role of operations management platform, helping businesses control transaction data, accounting, inventory and production processes; then EPM (Enterprise Performance Management) is strategic performance management platform, helping leaders plan, forecast and make decisions based on future data.

In other words, ERP helps businesses “run well today”, while EPM helps “make the right decisions for tomorrow”.

A modern business cannot stop at recording the past – it needs to proactively forecast, simulate and adjust plans in real time.

Therefore, Businesses should not view ERP and EPM as alternatives., but need to see this as strategic partner on the journey to improve financial and operational capacity.

Recommendations for CFOs and finance teams:

Integrate your existing ERP system with Sactona – Bizzi EPM solution, to:

- Completely eliminate dependency on Excel manually, reducing errors and saving time.

- Enhancing FP&A capacity, helping finance teams focus on analysis instead of data entry.

- Increase speed and accuracy in strategic decision making, thanks to its ability to forecast, analyze scenarios and simulate financial situations in real time.

In the data age, The CFO is not just a cost manager – but a value creator and strategic guide for the business.

And Sactona – EPM solution developed by Outlook Consulting, exclusively distributed by Bizzi in Vietnam is reliable assistant Helping CFOs make it happen: manage performance smarter, make decisions faster, and lead businesses more firmly into the future.