Enterprise financial management software is an indispensable tool in the digital age, helping organizations from startups, SMEs to large corporations to monitor, analyze and Cash flow management effectively. The application of a financial management system The right fit not only helps optimize performance but also provides accurate data for strategic business decisions.

This article will provide an overview of solution business software, key benefits, compare the business finance software popularize and give advice to help you choose financial management software most suitable

What is enterprise financial management software?

Enterprise financial management software is an application system designed to support core financial and accounting operations such as: managing revenue and expenditure, accounts receivable, fixed assets, inventory, creating electronic invoices, tax management, and creating financial reports.

Much online financial management software Modern also has the ability to integrate strongly with other systems such as ERP (Enterprise Resource Planning), CRM (Customer Relationship Management), sales software, or human resource management solutions, forming an ecosystem. business management solutions comprehensive on the platform cloud or on-premise.

Centralizing data into one cash flow management tools The only one that helps managers have a 360-degree view of financial “health”, ensuring accuracy, legal compliance and making quick, effective decisions.

6 benefits of businesses using financial management software

Implementing a suitable financial management software solution brings many practical benefits, gSoftware solutions to optimize business costs and improve overall operating efficiency. Below are the outstanding benefits of using the software such as: Bizzi:

- Improve management efficiency: Provides an overall view of accounts operating costs within the business, thereby making quick and accurate strategic decisions. Detailed reports help analyze costs from different departments, identifying areas for improvement.

- Increased transparency: Record and clearly classify all expenses, helping to ensure transparency in financial management.

-

Control cash flow and costs effectively: Provide an overview, track income, expenses, and debts in real time. Cost Control Tools Integration helps manage budget closely, avoiding waste.

- Save time: Automated reporting and features such as budget overrun warnings or invoice validity checks help businesses save time in data processing and report creation. Employees do not need to manually enter data or calculate.

- Make quick decisions: Financial reporting software provide multidimensional analysis (revenue, costs, net profit…), helping the management have a solid database to make timely strategic decisions, optimize corporate finance.

- Cost optimization: Corporate financial management software helps analyze and detect unnecessary expenses, thereby optimizing spending sources.

Try Bizzi for 6 months free to discover the optimal cost management solution for your business: https://bizzi.vn/dang-ky-dung-thu/

Top 10 best business financial management software

Today's market offers a wide variety of options. business financial management software. Below is Evaluate Overview of some typical solutions, including the accounting software specialized and Financial ERP System comprehensive:

Bizzi business financial management software

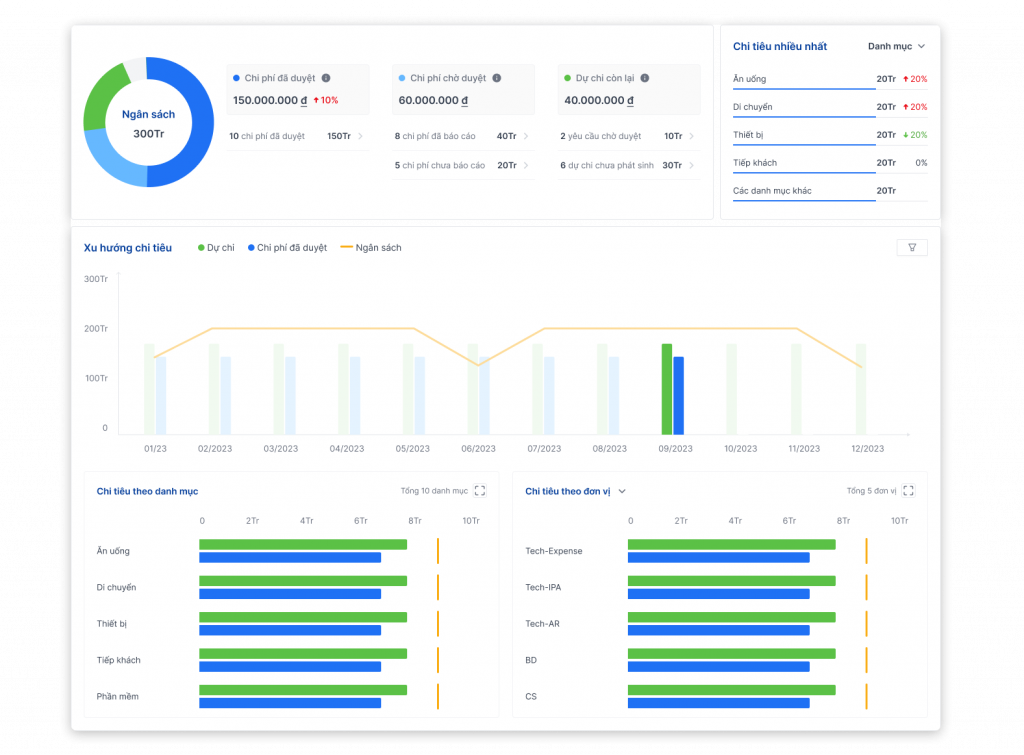

Bizzi is one of the leading expense management tools today, providing an automated solution for the business expense reporting process.

Outstanding features of Bizzi:

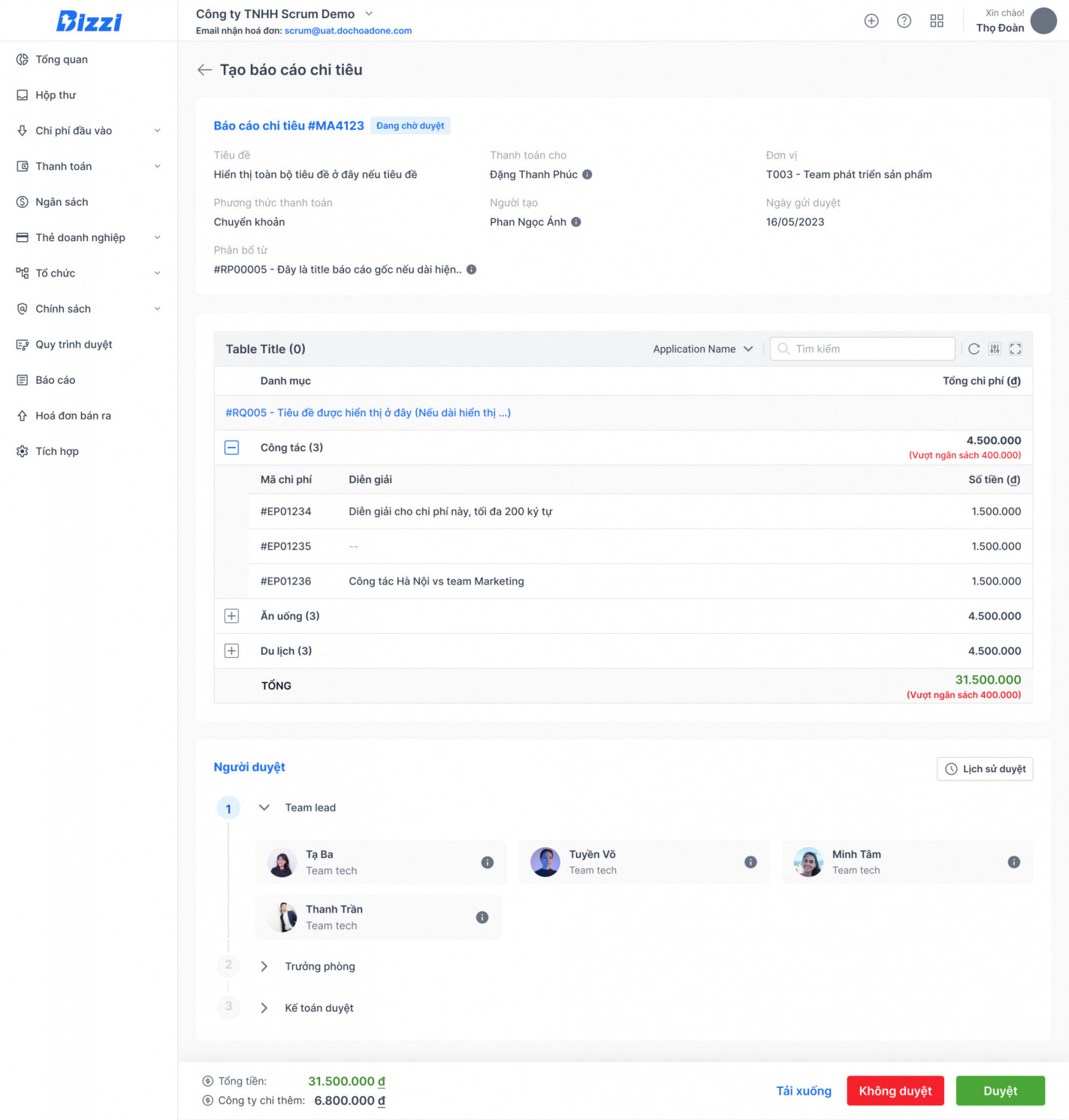

- Set up spending policies: Set up and customize budgets and policies for each department, project, or expense type with clearly defined spending limits. When there is an overspending or non-compliance with policy, the system will automatically warn.

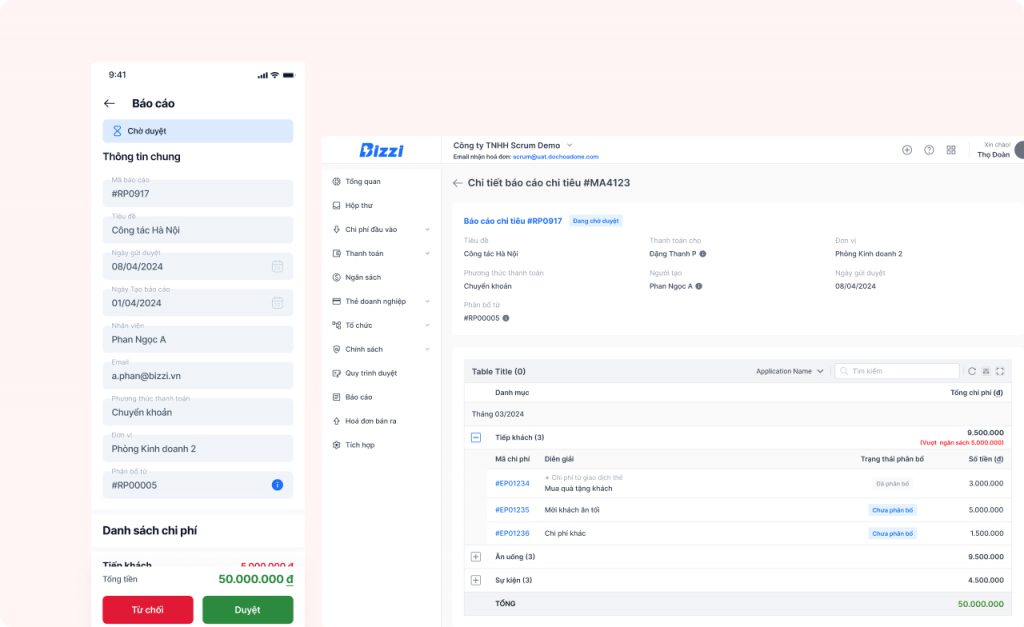

- Flexible expense approval process: Bizzi financial process automation, approve expenses, set up approval flows based on hierarchy and expense type. Users can easily configure approval steps to meet internal needs, ensuring the approval process is done quickly, anytime, anywhere.

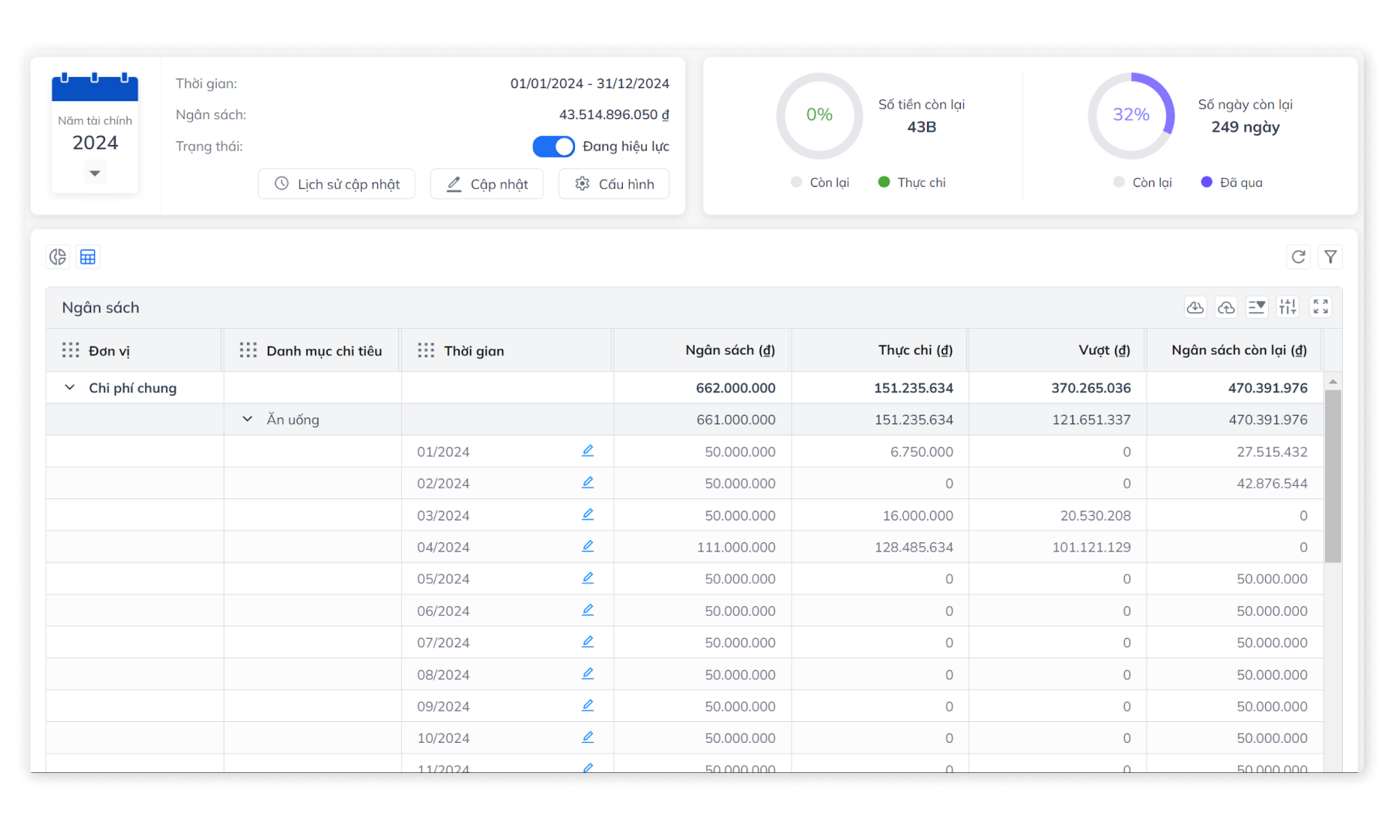

- Budgeting for departments and projects: Bizzi helps businesses allocate and manage detailed budgets for each department, project, or specific spending category.

- Track and Real-time cost management: The system updates transactions and expenses as they occur, helping managers stay on top of the company's financial situation in real time.

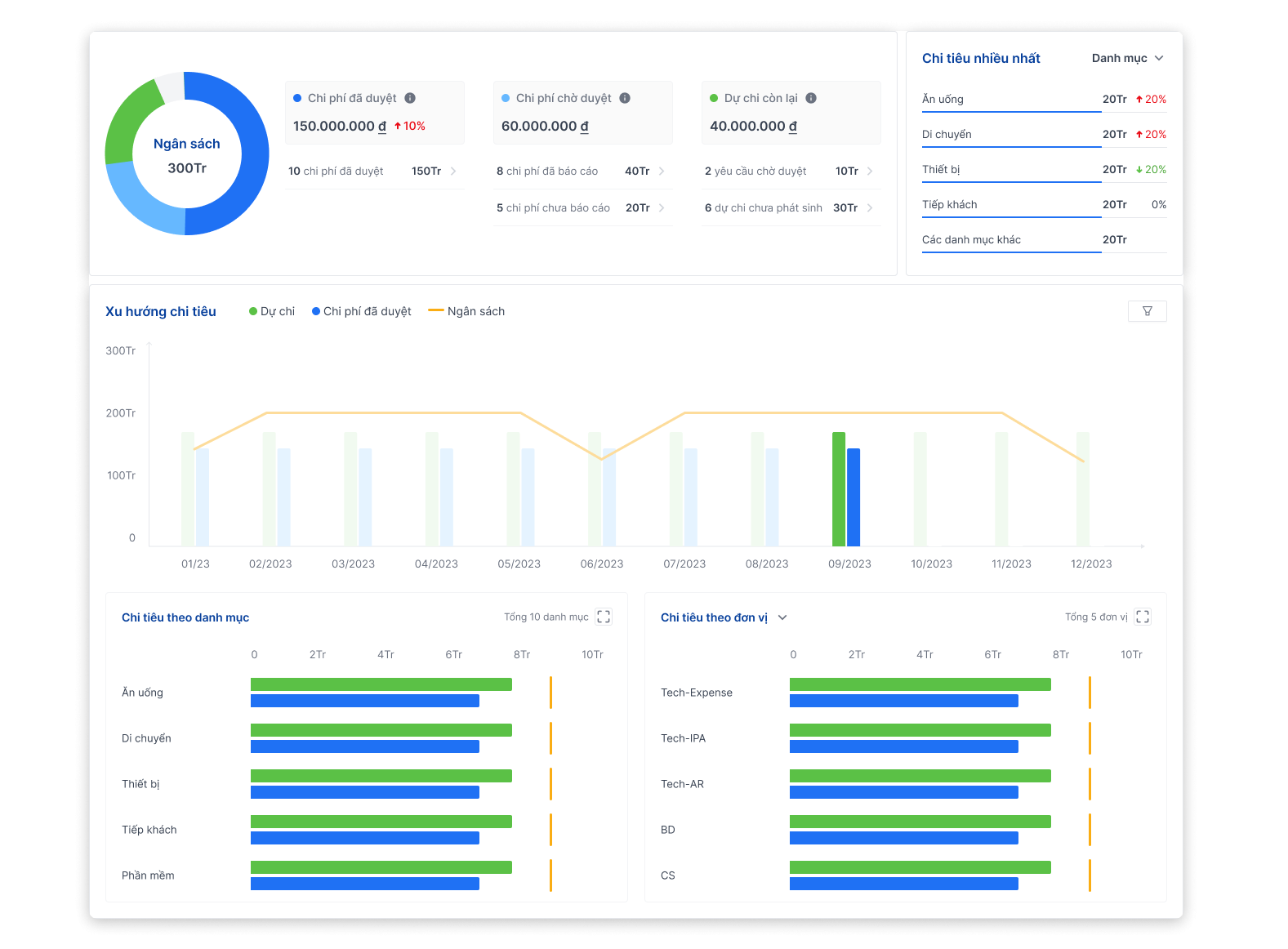

- Cost and budget reporting dashboard: Provides intuitive dashboards with detailed reports and easy-to-understand charts, helping users easily track costs and budgets at any given time. Automatic reports help managers gain an overview and insight into the efficiency of their business's resource use without the need for complicated operations.

- ERP integration: Bizzi integrates seamlessly with other ERP system large, helping to synchronize cost and budget data from multiple sources into one platform.

Advantages of using Bizzi business financial management software:

- Save staff time and effort when preparing expense reports.

- Minimize the risk of errors, ensure high accuracy for business expense reports.

- Quickly update spending reports in real time

- Management can easily make accurate and quick business decisions.

Sign up for a free trial now at: https://bizzi.vn/dang-ky-dung-thu/

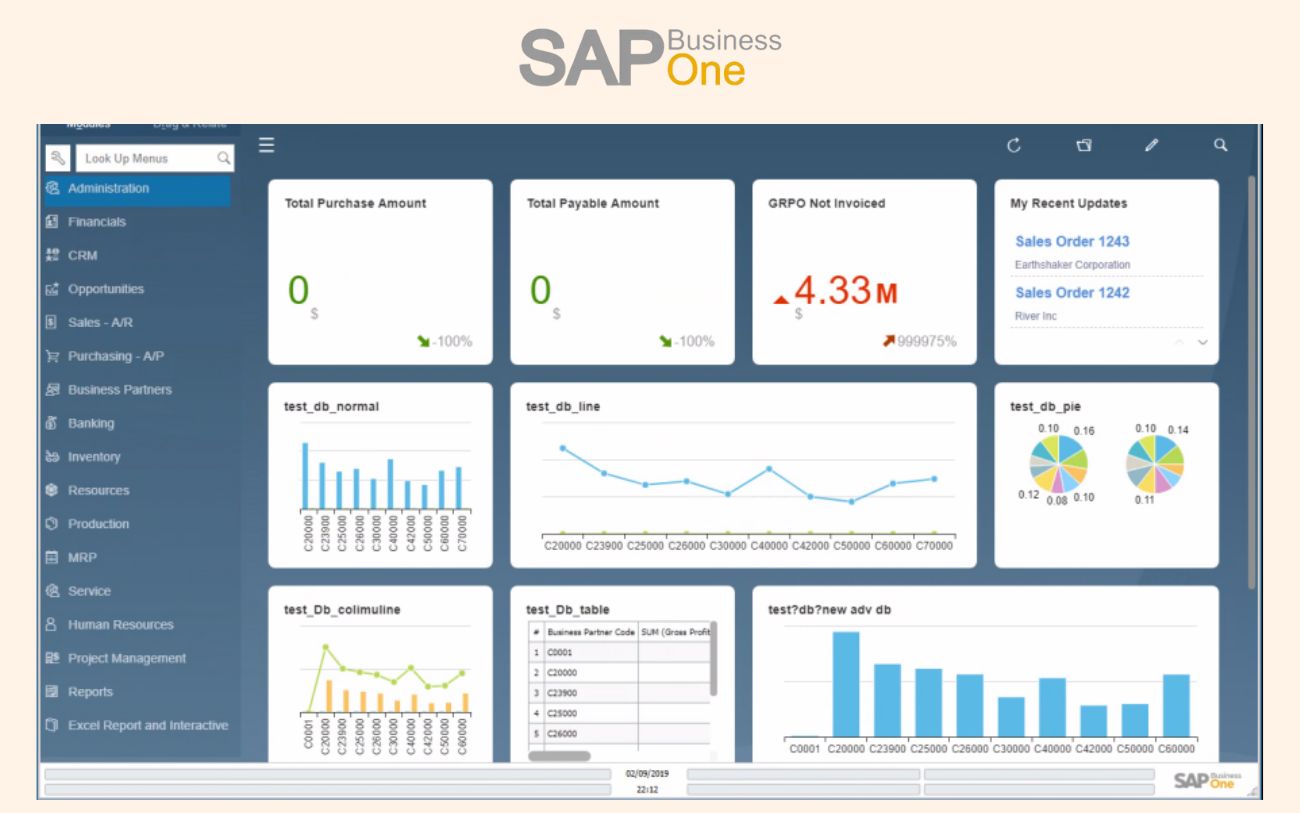

SAP Business One Enterprise Financial Management Software

Object: Medium and large enterprises (SMEs -> SMEs), FDI companies, businesses need a comprehensive ERP financial management system.

Strengths: ERP system Powerful, tightly integrated between finance and other subsystems (warehouse, manufacturing, sales, purchasing). Highly customizable, in-depth analytical reporting.

Main functions:

- Accounting, finance, warehouse, sales management

- Real-time data integration

- Detailed financial reports

Advantage:

- Powerful system, supporting overall management

- Integrate many extended features (ERP, CRM)

- Detailed reports, suitable for large-scale businesses

Disadvantages:

- High cost, need large investment

- Requires specialized personnel to deploy and use

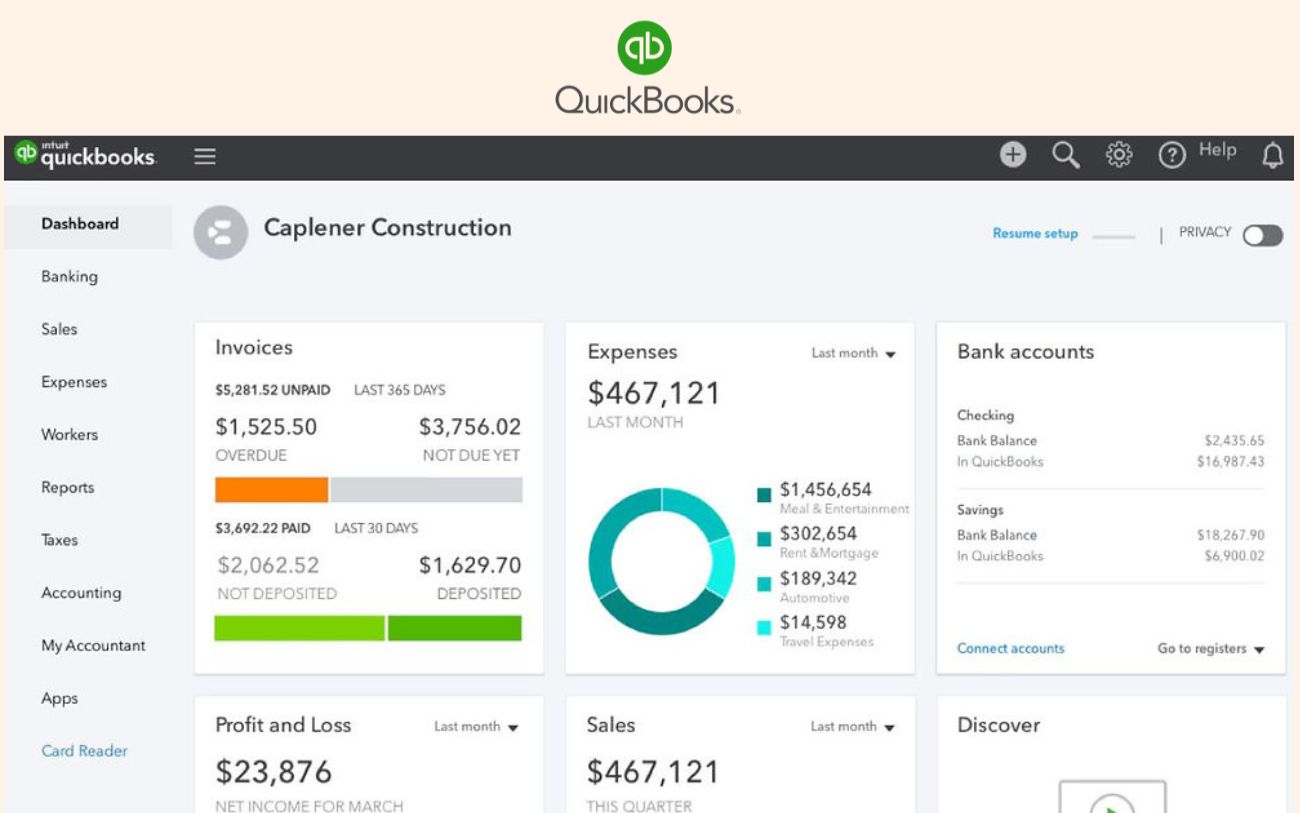

QuickBooks Software

Object: Small businesses, micro businesses, and freelancers, are especially popular in the North American and international markets.

Strengths: The interface is very friendly and easy to use even for non-accountants. Many service packages at reasonable costs. Large integrated application ecosystem.

Main functions:

- Manage company income and expenses, invoices, payroll

- Track debt, manage cash flow

- Integration with banking and other software

Advantage:

- Friendly interface, easy to use

- Affordability

- Convenient Cloud version available

Disadvantages:

- Limited advanced features for large enterprises

- Weak support for taxes according to Vietnamese standards

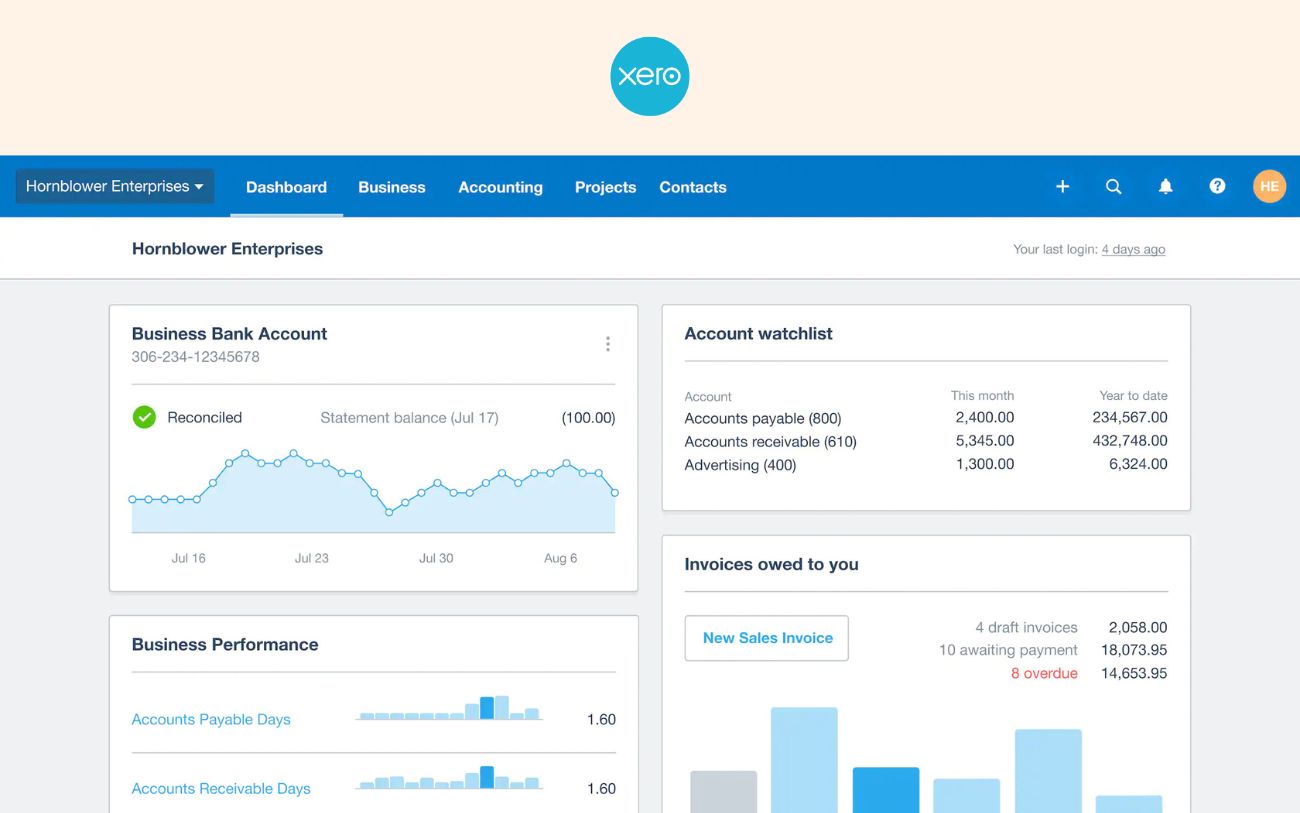

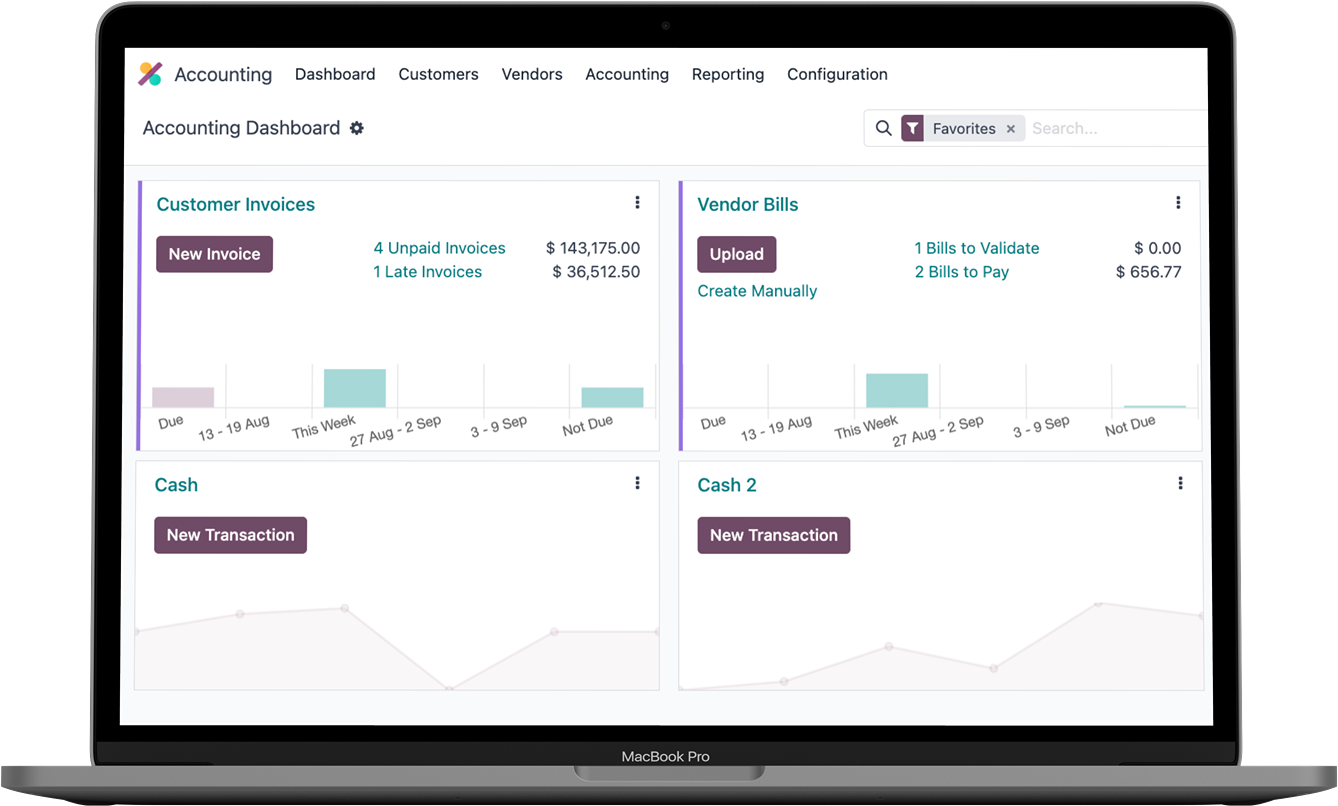

Xero business financial management software

Object: Small and medium businesses, especially those that need a modern, easy-to-use Cloud solution. Popular in Australia, New Zealand, UK.

Strengths: Beautiful, intuitive interface. Focus on Cloud user experience. Powerful integration with hundreds of third-party apps. Great bank reconciliation automation.

Main functions:

- Manage invoices, taxes, cash flow

- Real-time expense tracking

- Integrates with many other applications

Advantage:

- Easy to use, intuitive interface

- Diverse integration with other accounting software

- Automatically update bank transactions

Disadvantages:

- Not popular in Vietnam, tax support is limited

- Some advanced features require payment

Odoo Accounting Software

Object: Businesses of all sizes, from small to large, need a flexible, modular solution.

Strengths: Part of the open source Odoo ERP ecosystem (paid version available). Highly modular, businesses only pay for what they need. Strong customization capabilities.

Main functions:

- Manage income, expenses, invoices, cash flow

- Support multiple currencies and financial reporting

- Connect to Odoo ERP ecosystem

Advantage:

- Flexible, customizable to your needs

- Good support for businesses with complex models

- Multi-currency support, suitable for international businesses

Disadvantages:

- Requires technical skills to deploy, not suitable for small businesses

- Some premium features are paid

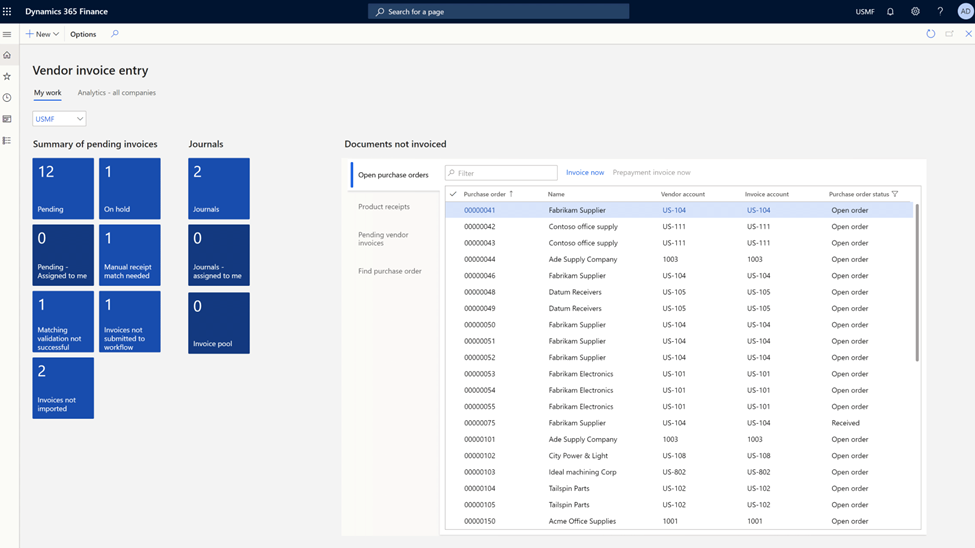

Microsoft Dynamics 365 Finance Software

Main functions:

- Financial management, taxes, payroll

- AI spending forecasting, financial analysis

- Integration with the Microsoft ecosystem

Advantage:

- Powerful system, suitable for large enterprises

- In-depth financial reporting

- Good integration with other Microsoft software

Disadvantages:

- High cost

- Difficult to implement if businesses want to use it pSmall and medium business financial management software.

Wave Accounting Software

Object: Freelancers, Financial solutions for startups and micro businesses with extremely limited budgets.

Strengths: Provides basic accounting features completely free. Simple interface, easy to get started.

Main functions:

- Financial, tax, invoice management

- Free for many basic features

- Online payment integration

Advantage

- There is a Free policy for small businesses

- Easy to use, no expertise required

- Full basic accounting support

Disadvantages:

- Not suitable for large businesses

- Limited customer support

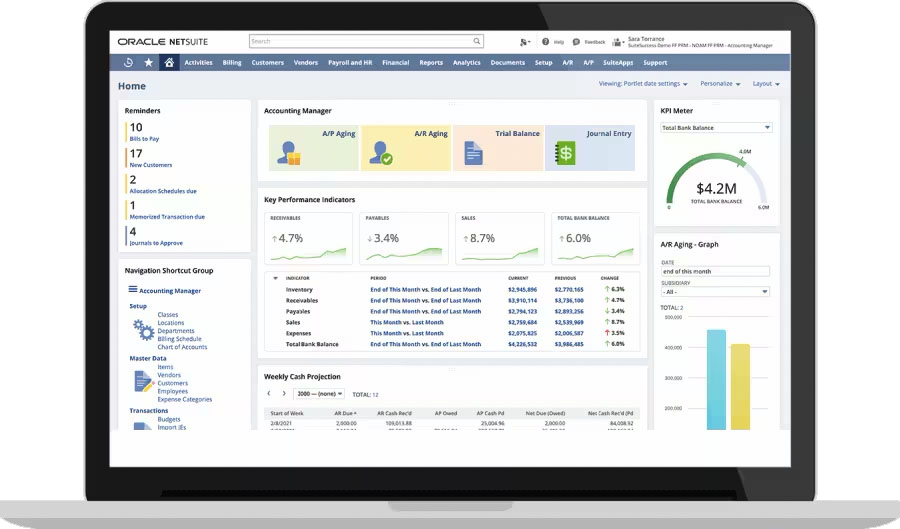

NetSuite ERP Software

Object: Medium to large enterprises need comprehensive Cloud ERP solutions, companies operate internationally.

Strengths: Leading Cloud ERP solution, integrating Finance, CRM, E-commerce. Flexible expansion, automatic updates.

Main functions:

- Financial, tax and debt management system

- ERP, CRM, HRM integration

- In-depth financial reporting

Advantage:

- Powerful ERP integration

- Comprehensive financial support

Disadvantages:

- High cost

- Long implementation time required

- Only suitable for large scale businesses

MISA AMIS software

Object: Businesses of all sizes in Vietnam, especially Financial software for SMEs.

Strengths: Very popular in Vietnam, fully meets Vietnamese accounting standards and tax regulations (VAS). Friendly interface, easy to use, diverse MISA ecosystem (AMIS HRM, CRM, Sales...).

Main functions:

- Business accounting software, accounting management, tax, invoice

- Support according to Vietnamese accounting standards

- Full financial statements

Advantage:

- Suitable for Vietnamese businesses

- Easy to use, supports Vietnamese

- Fully comply with domestic accounting regulations

Disadvantages:

- Limited if the business operates primarily in international markets.

- Some advanced features require payment.

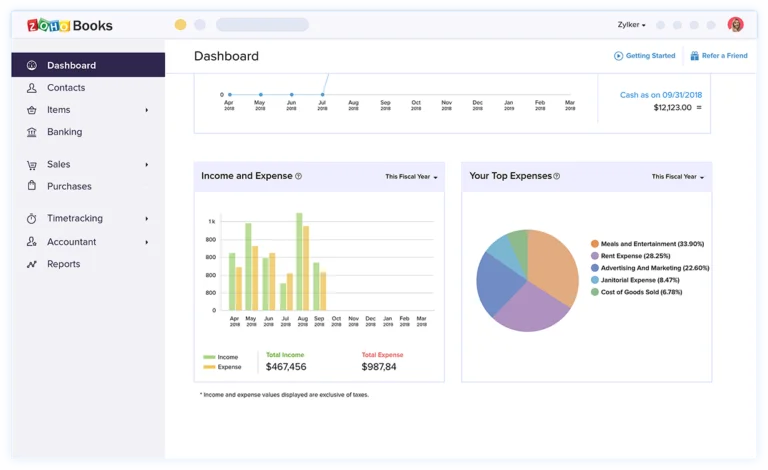

Zoho Books Software

Object: Small and medium businesses, especially those using other products in the Zoho ecosystem (CRM, Mail…).

Strengths: Seamless integration with the vast Zoho ecosystem. Simple, easy-to-use interface. Competitive pricing with lots of features.

Main functions:

- Manage income, expenses, invoices, taxes

- Integrate with other Zoho software

- Generate detailed financial reports

Advantage:

- Simple, easy to use interface

- Reasonable price

- Well integrated with Zoho ecosystem

Disadvantages:

- Not popular in Vietnam

- Some advanced features require payment

Consulting on how to choose business financial management software

How to choose business financial management software Suitability is an important decision that directly affects a business's operational efficiency, financial control, and decision-making ability. Here are the key factors to consider. When choosing business financial management software:

Determine the size and needs of the business

- Small Business & Startup: Usually prioritize simple, easy-to-use, low-cost software that focuses on basic operations (receipts, invoices, tax reports). financial solutions for startups Cloud-based is often a good choice.

- Medium Enterprise (SME): Need more advanced features such as inventory management, fixed assets, costing, detailed management reports, and the ability to integrate with other systems.

- Large Enterprise: Request Financial ERP System Powerful, highly customizable, multi-branch/multi-company management, multi-currency support, in-depth analytical reporting, tight internal controls.

However, businesses should not only look at current needs, but also project the business's development in the next 3-5 years to choose a solution with suitable scalability.

Check out the important features

- Make a list of must-have and nice-to-have financial and accounting features.

- Core modules typically include: General Accounting, Cash/Deposit Management, Receivable Management (Sales & Accounts Receivable), Payable Management (Purchases & Accounts Receivable), Inventory Management, Fixed Asset Management, Tax Filing, Financial Reporting.

- Consider advanced features if needed: Production costing, Budget management, Multidimensional management reporting, Financial report consolidation, Electronic invoice integration, Automatic bank connection…

Integration capabilities

- Is the software easy to connect with the systems you are using or will use (CRM, POS sales software, e-commerce website, human resource management software, warehouse system...)?

- Check out the availability of open APIs (Application Programming Interfaces) for custom integration if needed. Seamless integration eliminates duplicate data entry and ensures data consistency.

Real-life experience and user reviews

- Don't miss the Demo or Trial: Always ask for a product demo or take advantage of a free trial (if available). This is the best way to experience the interface, workflow, and evaluate user-friendliness and suitability for yourself.

- Consult: Search for the financial management software review from other users, real case studies, or ask for opinions from businesses in the same industry that have implemented it.

Data Security

- This is crucial. Find out about the provider's security measures: data encryption, security certifications (e.g. ISO 27001), data backup policies, detailed user access permissions.

- Ensure that the software complies with personal data protection regulations (if relevant) and accounting standards applicable to your business (VAS, IFRS…).

Cost and support policy

- Total Cost of Ownership (TCO): Don't just look at the monthly/annual license/subscription price. Consider implementation costs (consulting, installation, customization), user training costs, upgrade costs, and long-term technical support costs.

- Price model: Understand the service packages, user limits, storage capacity, and included features. Are there any hidden fees?

- Quality of support: Is the after-sales support service (via phone, email, chat, manuals…) fast, professional and effective? This is an extremely important factor in the operation process.

Summary

Invest in business financial management software Fit is a strategic decision, not just a cost one. It is a lever that helps optimize corporate finance, improve operational efficiency, enhance control and promote competitiveness in the market.

If your business is considering finding one of the advanced tools that helps record and track expenses in real time, optimize and improve management efficiency, then Bizzi is the top choice.

- Sign up for a free trial now at: https://bizzi.vn/dang-ky-dung-thu/

Read more: