Cost management reports are an internal financial management tool that helps businesses monitor, evaluate and control costs incurred during operations, production or project implementation. Unlike financial reports (for external use), cost management reports focus on internal decision making.

In this article, Bizzi will analyze in detail the types of cost management reports as well as introduce tools to create accurate cost management reports.

What is cost management reporting?

Cost management reports are an important tool for businesses to effectively control their business operations. This is a summary and analysis report:

- Types of costs (direct, indirect, fixed, variable…)

- Comparison between planned and actual budget

- Cost situation by department, project, product

- Reasons for overspending or saving

- Resource efficiency

Cost management reports can be broken down by day, week, month or project. Each cost item report involves the systematic collection, analysis and presentation of cost-related information to support decision making.

The Importance of Cost Management Reporting

Cost management reports play an extremely important role in business administration, as they help control finances, optimize operations, and support strategic decision making. Below is a specific analysis of the role of cost reports by item in each aspect of administration:

From a strategic perspective:

- Helps organizations track and control costs effectively.

- Allows to identify cost saving opportunities, optimize resource allocation.

- Improve overall operating efficiency.

- Support informed decision making to improve profitability and maintain competitive advantage.

From a financial perspective:

- Plays a vital role in budgeting, forecasting and financial planning.

- Provides insight into cost trends, cost drivers and cost variances.

- Allows businesses to accurately assess financial performance.

- Helps identify areas for improvement and take corrective action to achieve financial goals.

From an operational perspective:

- Helps businesses evaluate the effectiveness of processes and operations.

- Allows identification of cost overruns, bottlenecks and areas of waste.

- Support to streamline operations, eliminate non-value added activities and improve productivity.

Some types of cost management reports

Cost management reports are a core tool in a business's decision-making system. They not only help control spending, but also contribute to sustainable development, optimize resources and increase competitiveness.

Below are some common types of itemized cost reports that businesses often use to control finances, analyze performance, and support decision making:

Budget Report:

- Compare the projected budget with actual spending and show the variance.

- Helps track project progress and identify deviations from plan.

- May include forecasts of future costs and revenues, highlighting potential problems or risks.

- Example: Budget report for construction project.

Cost Performance Report:

- Measure project efficiency and performance by comparing EV, AC and PV.

- Helps evaluate project performance and determine schedule and budget.

- Can include KPIs such as CV, SV, CPI, SPI and recommendations for improvement.

- Example: Cost performance report for software development project.

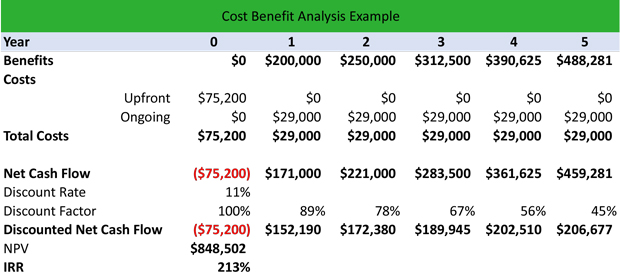

Cost Benefit Analysis report:

- Analyze the costs and benefits of a project or decision.

- Calculate NPV, IRR, payback period and BCR.

- Helps demonstrate feasibility and compare options.

- May include qualitative elements and address assumptions and limitations.

- Example: Cost-benefit analysis report for new product launch.

Cost summary management report:

- Show the paid value and remaining value to be paid for each item, project, and payment date visually using charts and tables.

Cost analysis management report:

- Analyze actual cost items against plan, paying attention to cost structure (fixed and variable costs).

Revenue and expenditure management report:

- Manage revenue, expenditure, capital, analyze cash flow and financial situation, build revenue and expenditure plan.

Budget management report:

- Track your business budget.

Key elements and principles of cost management reporting

Below are the main elements and principles that a cost management report needs to ensure to be effective in controlling, analyzing and making decisions in the business:

Elements of an itemized cost report:

Clear cost classification

- By nature: fixed, variable, mixed

- By function: production, sales, management

- By cost object: product, project, department

Time of cost incurred

- Clearly show costs by day, week, month, quarter

- Allows for phased evaluation of operations

Actual costs vs. planned budget

- Includes columns for initial budget, actual costs, and variances

- Easily detect errors and make adjustments

Resource users

- Attach costs to specific departments, individuals, and projects

- Helps assess accountability and effectiveness of spending management

Synthesis and analysis

- The report should include a summary of total expenses and an analysis of the proportion of each type of expense.

- Can be accompanied by charts, comparison tables, to help see overviews and trends

Principles of cost management reporting by item:

Accuracy

- Input data must be collected completely and accurately.

- Avoid rounding or missing numbers that can lead to errors in analysis.

Timeliness

- Reports should be prepared periodically on time (weekly/monthly/quarterly).

- Help managers detect problems early for adjustment

Transparency & Understandability

- Present clearly, logically, and visually (use colors, charts, and tables appropriately)

- Non-accounting readers can still easily grasp the main idea.

Comparability

- There must be elements for comparison over time or between different objects (departments, projects, etc.)

- Facilitate assessment of trends and relative performance

Focus on management goals

- Only include expenses/expense groups that serve decision making purposes.

Avoid listing information that causes confusion.

Common problems when preparing cost management reports and how to fix them

An effective cost management report not only records data but also analyzes it with a purpose, clearly showing the financial picture to help leaders take accurate and timely actions. However, in the process of preparing cost management reports, sometimes there will be obstacles. Below are common problems and specific solutions to ensure accurate, timely and useful reports for business management:

| Main issue | Detail | How to fix |

| Missing or incomplete data | Not recording all expenses (especially small expenses and cash expenses)

Lack of overhead costs in different departments and projects No clear distinction between fixed – variable – allocated costs |

Apply a clear cost recording process with a checklist

Use centralized accounting or cost management software (Google Sheets, Excel templates, or ERP) Specify who is responsible for recording costs in each department. |

| Misclassification of costs | Confusion between production costs and administrative costs

Combine indirect and direct costs Leads to inaccurate reporting, difficult to analyze |

Apply standard cost coding system

Train responsible personnel on how to properly classify costs Use clearly grouped ready-made report templates |

| Lack of comparison between actual and budgeted costs | Only record costs that have occurred, do not compare with plans Difficult to evaluate effectiveness |

Always have a projected budget column in every report

Use variance reports periodically Use visual charts (e.g. budget vs actual cost) |

| Report not updated in time | Late recording, or reporting long after costs have been incurred → out of control

Not keeping up with project progress or accounting periods |

Establish fixed reporting schedule (weekly/monthly/quarterly)

Assign KPI reporting deadlines to each department Integrate real-time expense recording software (e.g. use Google Form/Sheets for quick recording) |

| Confusing, difficult to read reports | Presentation lacks logic, no summary

No data visualization It takes time for readers to understand the main content |

Use standard layout: summary – table of figures – analysis – chart

Minimize information, keep only content that serves decision making Use color and formatting appropriately to emphasize important data |

| Do not link costs to output efficiency | Just list the costs without evaluating the results of those costs.

Do not measure ROI (Return on Investment) for each expense |

More “output efficiency” column or cost-related KPIs (e.g. ads cost / number of orders)

Build cost reports according to specific project/output for easy comparison |

Software to support creating and managing cost management reports

Cost management is one of the important vital issues for any business. For SME companies or startups, this is even more important because the smallest loopholes and losses can sink the ship.

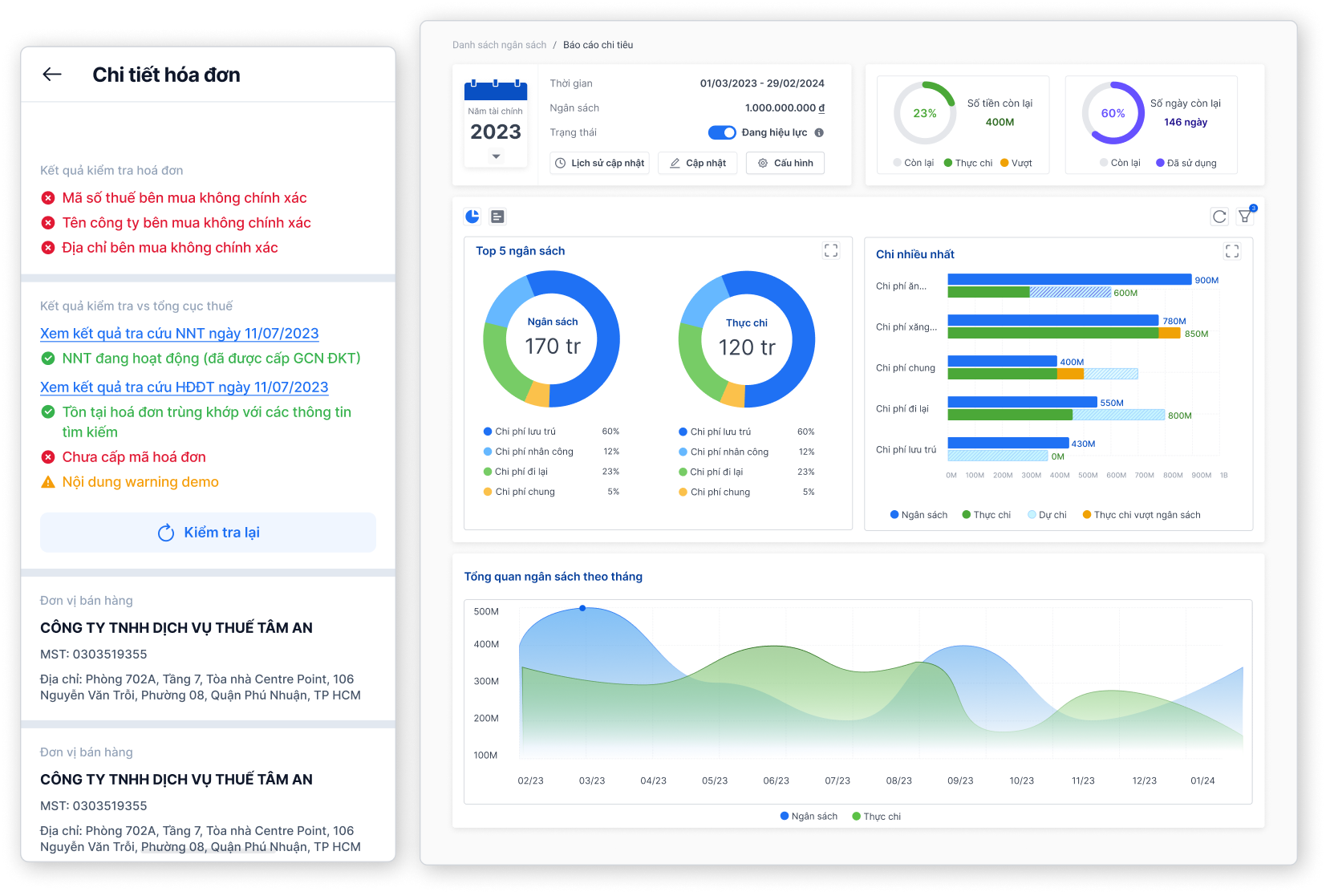

Application Bizzi Expense help leaders possess the “weapon” to tightly control costs

Automate the entire budget process

-

Create flexible budget plans by year, quarter, or project/department.

-

Automatically allocate budget by category, employee, and unit.

-

Reconcile and warn about expenses as soon as they exceed the budget, ensuring no spending is lost.

Intuitive budget dashboard – easy management

-

Get a real-time view of your budget: from expense categories, units, employees to spending status.

-

Quick comparison between estimated and actual expenditure on the same interface.

-

Immediate warning of any signs of overspending, discrepancies or unusual spending.

Accurate budget planning – Optimizing efficiency

-

Forecast accurate financial needs for the entire operation: from personnel costs, raw materials to payroll, marketing...

-

As a basis for estimating business results and analyzing plan implementation effectiveness.

-

Help make flexible budget adjustment decisions, closely following financial goals.

Thorough Cost Analysis – Accurate Financial Forecasting

-

Automatically summarize cost reports by period (day/month/quarter/year).

-

Compare costs from recent periods to determine increasing or decreasing trends.

-

Suggest budget adjustments and warn if there is a proposal to spend beyond the limit.

Strict cash flow control

-

Closely manage every expense – even the smallest one.

-

Automatically collect information from electronic invoices, receipts, reconcile with budgets and payment status.

-

CEOs can streamline, approve and track cash flows anytime, anywhere.

Close internal management – Standardizing cost management thinking

-

The entire internal process is digitized, streamlined, and easy to apply to all departments.

-

Track all internal financial activities in real time, broken down by region, product, business unit…

-

Attaching costs to each employee, department, and task helps create transparency and increase management responsibility.

Bizzi is proud to be a leader in providing comprehensive cost management solutions, helping Vietnamese businesses improve operational efficiency and optimize profits.

Conclude

Cost management reporting is an indispensable tool for effective cost control, supporting strategic decision making, optimizing resources and improving profitability. Applying the right principles and tools is essential to create accurate, useful and timely cost management reports.

Applying tools to create cost management reports is a mandatory trend if businesses want to improve financial management efficiency, control expenses and optimize profits. Bizzi Expense is one of the optimal solutions for Vietnamese businesses in the 4.0 technology era. With superior features and practical benefits, Bizzi will help businesses improve operational efficiency, optimize profits and increase employee satisfaction.

Register for a free experience of the Bizzi Expense Management system today!

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/