Ho Chi Minh City Tax Department issued Official Dispatch 8237/CTTPHCM-TTKT2 dated August 20, 2024 on reviewing and handling illegal invoices.

>> Download the document now here

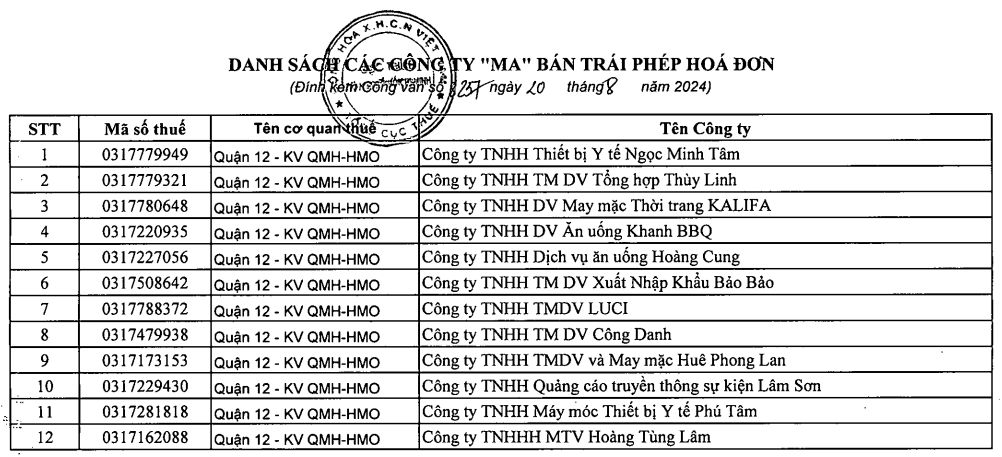

List of 12 ghost companies illegally selling invoices announced by Ho Chi Minh City Tax Department (Official Dispatch 8237)

Ho Chi Minh City Tax Department received Official Dispatch 5796/CQCSDT-CSKT dated October 12, 2023 from the Investigation Police Agency of District 12 Police regarding the review and handling of companies using illegal invoices.

Accordingly, the Investigation Police Agency of District 12 Police has initiated a criminal investigation into the criminal case of "Illegal trading of invoices for payment to the state budget" discovered on July 28, 2022, in An Phu Dong Ward, District 12, according to Decision to initiate criminal proceedings No. 191 dated May 16, 2023. As a result of the investigation, the Investigation Police Agency of District 12 Police has identified 12 companies as ghost companies established to sell VAT invoices.

Ho Chi Minh City Tax Department has the following opinion:

– Assign units under and directly under the Tax Department to review, inspect, and handle violations of tax and invoice laws for enterprises using VAT invoices received from 12 "ghost" enterprises according to the conclusion of the Investigation Police Agency of District 12 Police.

+ In case of signs of crime, it is recommended to transfer to the competent Police Investigation Agency for investigation and handling according to regulations.

+ In case there is no sign of crime, proceed with sanction and tax collection according to regulations.

– Assign the Tax Department of District 12 – Hoc Mon district to manage the tax of 12 “ghost” enterprises in coordination with the Investigation Police Agency of District 12 Police to exchange information of enterprises/individuals receiving invoices of 12 “ghost” enterprises and update detailed notifications of VAT invoices sold by 12 “ghost” enterprises into the invoice risk management system and invoice verification program system.

– Assign the Propaganda and Taxpayer Support Department to publicly disclose the list of 12 “ghost” enterprises according to the conclusion of the Investigation Police Agency of District 12 Police on the tax industry information page.

The results of the review, inspection and handling of the request from the units under and affiliated to the Tax Department are sent to: The Investigation Police Agency of District 12, Ho Chi Minh City, and at the same time sent to the Ho Chi Minh City Tax Department (through the Inspection - Examination Department No. 2 - Invoice Reporting Team) for monitoring and synthesis.

List of 12 ghost companies illegally selling invoices announced by Ho Chi Minh City Tax Department according to Official Dispatch 8237/CTTPHCM-TTKT2 dated August 20, 2024:

Acts of using illegal invoices and documents and illegal use of invoices and documents

Acts of using illegal invoices and documents and illegal use of invoices and documents according to Article 4 Decree 125/2020/ND-CP as follows:

– Using invoices and documents in the following cases is an act of using illegal invoices and documents:

+ Fake invoices and documents;

+ Invoices and documents that are not yet valid or have expired;

+ Invoices are suspended during the period of enforcement by the measure of suspending invoice use, except in cases where use is permitted according to the notice of the tax authority;

+ Electronic invoices are not registered for use with tax authorities;

+ Electronic invoices without tax authority codes in cases of using electronic invoices with tax authority codes;

+ Invoices for purchase of goods and services have the date on the invoice from the date the tax authority determines that the seller is not operating at the business address registered with the competent state agency;

+ Invoices and documents for the purchase of goods and services with the date of issuance on the invoice or document before the date of determining that the party issuing the invoice or document is not operating at the business address registered with the competent state agency or there has been no notification from the tax authority that the party issuing the invoice or document is not operating at the business address registered with the competent authority, but the tax authority or the police authority or other competent authorities have concluded that the invoice or document is illegal.

– Using invoices and documents in the following cases is an act of illegal use of invoices and documents:

+ Invoices and documents do not fully contain the required content as prescribed; invoices are erased or corrected in violation of regulations;

+ Fake invoices and documents (invoices and documents that record economic indicators and contents but the purchase and sale of goods and services are partially or completely unreal); invoices that do not accurately reflect the actual value incurred or create fake invoices or fake invoices;

+ Invoices with differences in the value of goods or services or discrepancies in mandatory criteria between copies of the invoice;

+ Invoices for circulation when transporting goods or using invoices of this goods or service to prove other goods or services;

+ Invoices and documents of other organizations and individuals (except invoices of tax authorities and cases of authorized invoice creation) to legalize purchased goods and services or sold goods and services;

+ Invoices and documents that the tax authority, police agency or other competent authorities have concluded are used illegally.

According to Law Library

Monitor Bizzi To quickly receive the latest information:

- Facebook: https://www.facebook.com/bizzivietnam

- Linkedin: https://www.linkedin.com/company/bizzi-vietnam/

- Youtube: https://www.youtube.com/@bizzivietnam