In a volatile economic environment, debt management is not only the responsibility of the accounting department but also a key factor in helping businesses maintain a healthy cash flow. An effective debt management process – including both receivables and payables – is a “shield” that helps businesses prevent risks, optimize working capital and improve financial capacity. So what are the steps in this process? How to apply it effectively in practice?

The following article will help you understand each step in the debt management process, thereby building a systematic debt control system that is suitable for your business.

1. What is debt and why is debt management important?

Accounts receivable management plays a key role in ensuring a stable cash flow and maintaining the financial health of the business. Tight control of receivables and payables helps to limit the risk of capital loss, while improving operational efficiency and solvency.

1.1. Definition of debt

Accounts receivable is the sum of all receivables and payables of a business at a given point in time. These amounts are usually short-term debts, expected to be paid or collected within one year. Specifically, accounts receivable include:

- Receivables from customers, partners or internal units;

- Amounts payable to suppliers, employees, tax authorities and other creditors.

2.2. Terms related to debt

To better understand how businesses handle debt, it is necessary to understand some common terms:

- Auditing account: The process of reviewing the accuracy of receivables and payables.

- Debt comparison: Compare actual figures and book data to ensure there are no discrepancies.

- Debt report: A synthesis tool to help monitor, control and analyze debt situations.

- Collecting debt: Steps and measures to collect money from customers and partners who owe money.

3.3. Classification of debts in enterprises

Depending on the nature, debts are divided into two main types:

- Accounts receivable: Is the amount that a business will receive in the future from transactions of selling goods, providing services, or loans/advances. Including:

- Uncollected revenue from sales of goods or services;

- Receivable under construction contracts;

- Internal receivables, advances, collections;

- Compensation or wage deduction.

- Accounts Payable: Is the financial obligation that a business must pay to related parties, including:

- Payment to suppliers;

- Pay salaries and benefits to employees;

- Pay taxes to the State;

- Repay loans or internal payables.

3.4. The role and importance of debt management process

One debt management process A systematic approach is the foundation that helps businesses control risks and optimize cash flow. Specifically:

- For accounts receivable:

- Helps closely monitor each customer's debt status;

- Collect debt on time, limit capital misappropriation;

- Contribute to increasing liquidity and ensuring financial resources.

- For accounts payable:

- Help businesses be proactive in payment, avoiding penalty interest;

- Maintain reputation and stable relationships with suppliers and partners;

- Support financial planning and effective cost allocation.

The process of managing receivables and payables is not only an accounting practice, but also a strategic tool to help businesses improve operational efficiency and minimize financial losses.

2. Accounts Receivable Management Process

The process of managing receivables plays a key role in maintaining a stable cash flow and limiting financial risks for the business. An effective receivables management system not only helps to collect receivables on time but also supports the assessment of customers' payment capacity, thereby optimizing sales policies. Below are 7 basic steps to help build a accounts receivable management process systematic and suitable for all business models:

- Step 1: Establish policies and assess debt: Businesses need to develop a clear debt policy, including payment terms, penalties for violations, and credit conditions. The accounting department and the sales department coordinate to assess the risk of each debt, classify customers according to priority or payment ability, and then have a reasonable collection plan.

- Step 2: Plan the recovery and assign responsibilities: Establish a debt collection roadmap for each group of customers: short-term debt, overdue debt, and bad debt. Identify a person in charge of working with each customer – ideally someone with in-depth knowledge of the transaction history and existing relationship with the buyer.

- Step 3: Record debt and send payment notice: Immediately after a transaction occurs, accountants need to record full debt information based on contracts and related documents. Sending invoices early via email or electronic channels helps shorten payment time and limit overdue debt.

- Step 4: Remind and negotiate flexibly: Proactively contact customers 7-10 days before the payment due date to remind them. In case of late payment, arrange a face-to-face meeting and negotiate flexible options such as extending the payment term, reducing interest or dividing the debt into smaller amounts to make it easier for customers to pay while still ensuring effective debt collection.

- Step 5: Handling bad debt and legal measures: If all conciliation measures are ineffective, the business can transfer the matter to a professional debt collection agency or initiate legal proceedings. However, careful consideration should be given as legal proceedings are often costly and can affect the business’s image if not handled skillfully.

- Step 6: Record collection and update total debt: After receiving payment, accountants need to account for the correct debt subject, and update the consolidated debt report to evaluate the collection efficiency by period and by customer group.

- Step 7: Adjust credit policy: Based on the collection results and payment reputation of the customer, the business can adjust the credit limit accordingly. In case the customer repeatedly violates the commitment, it is necessary to tighten or stop providing credit services to control the risk.

The above process not only helps businesses control well accounts receivable management process, but also creates a platform for effective coordination with Accounts Payable Management Process, ensuring comprehensive financial balance. For growing businesses, automating the debt management process through accounting software is a solution to save time, improve efficiency and minimize risks.

Explore solutions Automate the accounts receivable process Comprehensive with Bizzi – the leading digital accounting platform for modern businesses.

3. Accounts Payable Management Process

The accounts payable management process is a series of financial accounting activities to ensure that businesses pay their debts to suppliers on time, while optimizing cash flow and avoiding legal risks. Applying a systematic process helps businesses better control their financial obligations, limit disputes and increase trust with partners. Below are the basic steps in an effective accounts payable management process:

- Step 1: Receive and check debt payment request: Accounting receives payment requests from suppliers or internal departments. This process includes verifying order information, payment due dates, contract terms, and supply status to ensure validity before making payment.

- Step 2: Summarize and compare documents and invoices: All invoices, delivery notes, and related documents are collected and compared with the original purchase order. The accountant checks current liabilities, determines payments made, and remaining costs to avoid duplicate or missing payments.

- Step 3: Accounting, debt offset and payment plan: Based on the terms of the contract, the enterprise determines the amounts to be deducted (if any), performs accounting on the system and plans payment priorities. The plan needs to be based on the payment deadline, financial situation and importance of the supplier.

- Step 4: Create payment voucher, disbursement records and make payment: The accountant prepares the payment voucher and disbursement records with full information related to the transaction. The records must be approved by the authorized person before making payment in the agreed form. After payment, the enterprise sends a confirmation notice to the supplier.

- Step 5: Store debt payment records: All records related to payments (payment vouchers, invoices, confirmation minutes, etc.) are fully archived to serve auditing, tax settlement and data retrieval when necessary.

- Step 6: Monitor and update continuously: Accountants update payment status on the debt management software, track due amounts, and prepare periodic reports for management. Unbilled payables also need to be updated to avoid omissions.

- Step 7: Resolve issues and report: In case of disputes, errors or late payments, they need to be handled quickly. After reviewing and comparing data between departments, the accountant will compile a debt report to provide an overview to the parties involved.

Implementing an effective accounts payable management process not only helps businesses ensure financial obligations but also creates a solid foundation for accounts receivable management process, thereby optimizing cash flow and improving operational efficiency. Business owners should invest in an automated debt management system and train accounting staff to ensure this process runs smoothly and accurately.

Introducing Bizzi Expense

Bizzi Expense is a fully automated platform for managing accounts payable and business expenses. This is the ideal solution for finance and accounting departments, helping the process from receiving invoices to creating payment requests to be done quickly, accurately and save resources.

Outstanding features

Automatically receive and check invoices: The system automatically receives input invoices from multiple sources such as email or API, separates information and compares it with orders and warehouse receipts to ensure accuracy and validity.

Create and send payment requests quickly: Employees can easily create payment requests in just a few steps, attach complete documents, and submit them via a pre-configured approval flow according to internal regulations.

Flexible approval anytime, anywhere: Managers can approve payment requests on mobile devices, regardless of location or time, ensuring uninterrupted workflow.

Monitor, control and optimize budget: The system provides intuitive, real-time dashboards that allow for cost tracking by project or department, budget setting, and efficient overrun alerts.

Save business resources: Bizzi Expense significantly reduces invoice processing time, operating costs and accounting resources, allowing businesses to focus on higher value-added activities.

4. Important notes for effective debt management

To ensure debt management process To operate effectively, businesses need to focus not only on internal control systems but also invest in the capacity of the accounts receivable department and operating standards. Below are important notes to help improve the effectiveness of controlling receivables and payables.

4.1. Requirements for accounts receivable department/accounting

One Accounts Receivable and Payable Management Process Efficiency starts with a team of professionals with the right skills and expertise:

- Master professional knowledge and skills: Accounts receivable accountants need to understand accounting principles, tax regulations, and reporting standards to ensure accuracy and compliance with legal regulations.

- Proficient in computers and accounting software: Proficiency in accounting software and ERP systems helps automate invoicing, track payment deadlines, and analyze accounts receivable data.

- Advisory ability: Accounts receivable accountants not only perform operations but also act as consultants when detecting risks from long-term debts or customers with bad payment histories.

- Communication skills: Close coordination with sales, purchasing and customers is key to handling arising situations and maintaining cooperative relationships.

- Flexible situation handling skills: Dealing with situations such as overdue debt or payment disputes requires tact in analyzing the causes and coming up with appropriate solutions.

- Honest, meticulous, careful: Incorrect data entry or omission of invoices can lead to major discrepancies in the accounts receivable system, so caution is essential.

4.2. Measures to enhance the effectiveness of debt management

In addition to the human factor, businesses need to build standard processes and have an internal control system to ensure that all debts are monitored and handled promptly:

- Classify customers and establish appropriate debt policies: Grouping by payment risk helps businesses apply more flexible and appropriate credit terms.

- Regularly check invoices and analyze debt aging: Closely monitor due debts and bad debts to help accountants quickly develop solutions to avoid losses.

- Maintain positive relationships with customers and suppliers: Goodwill in communication helps to minimize disputes, while increasing the ability to collect debts effectively.

- Debt collection process needs to be clear and transparent: All receivables and payables should be continuously updated, checked and processed promptly to ensure stable cash flow.

- Secure, easy-to-access data storage system: Proper storage of debt documents makes it easy to audit, check and verify when needed.

- Separation of duties between accounts payable and accounts receivable: Adhering to the “non-concurrent” principle helps reduce the risk of fraud, while increasing transparency in financial reporting.

- Payment request requires full approval: Each debt transaction needs to be controlled through approval from relevant departments to ensure accuracy and basis.

5. Optimize debt management process with technology

Optimization debt management process is an important factor that helps businesses control cash flow effectively, minimize financial risks and improve accounting productivity. While many businesses still use manual methods such as Excel, switching to technology software applications brings outstanding advantages in managing receivables and payables.

5.1. Limitations of manual debt management (e.g. Excel)

Many small and medium-sized businesses still manage their debts using Excel spreadsheets or non-specialized internal tools. However, this approach has many weaknesses:

- Difficult to keep track as the number of customers and suppliers increases, errors in recording and reconciling data are likely to occur.

- Data is fragmented into many separate files, making it difficult to summarize and analyze financial reports.

- Accountants spend a lot of time on manual tasks like reconciling balances, checking for overdue or late payments.

- Lack of warnings and automatic reminder systems makes it easy for businesses to miss important debts, affecting cash flow.

5.2. Benefits of applying debt management software

Apply technology to accounts receivable management process and Accounts Payable Management Process Not only does it improve operational efficiency, it also helps businesses proactively forecast and balance finances:

- Automatically notify and remind customers: CRM integrated software can send emails or messages to remind customers to pay on time, reducing bad debt ratio.

- Support accurate and fast payment: Provide multiple secure payment methods, minimize transaction risks and shorten collection cycles.

- Detailed debt management by subject: Integrate data by customer, supplier, invoice and payment history, helping accountants easily track and handle debts.

- Generate automatic debt reports: Businesses can monitor debt indicators such as DSO, payment status by debt age, and identify high-risk debts.

- Reduce the burden on the accounting department: The system automates steps from recording, debt reminder, reconciliation to reporting, helping accounting staff focus on analysis and strategic consulting.

5.3. Debt management solution from Bizzi

As an AI assistant for the finance and accounting department, Bizzi provide comprehensive solutions to automate debt management process and business revenue and expenditure. With more than 30 smart features, the platform supports businesses:

- Automatic debt reminder: Set up email or message sending scenarios for each target and time, minimizing overdue debts.

- Effective debt management: Track receivables and payables, analyze key metrics such as DSO, debt aging reports.

- Track details of each customer and supplier: Automatically record new debts, track payment progress, and easily reconcile when needed.

- Debt due warning: The system sends early warnings about accounts that are about to become due or are at risk of being overdue, helping businesses handle them promptly.

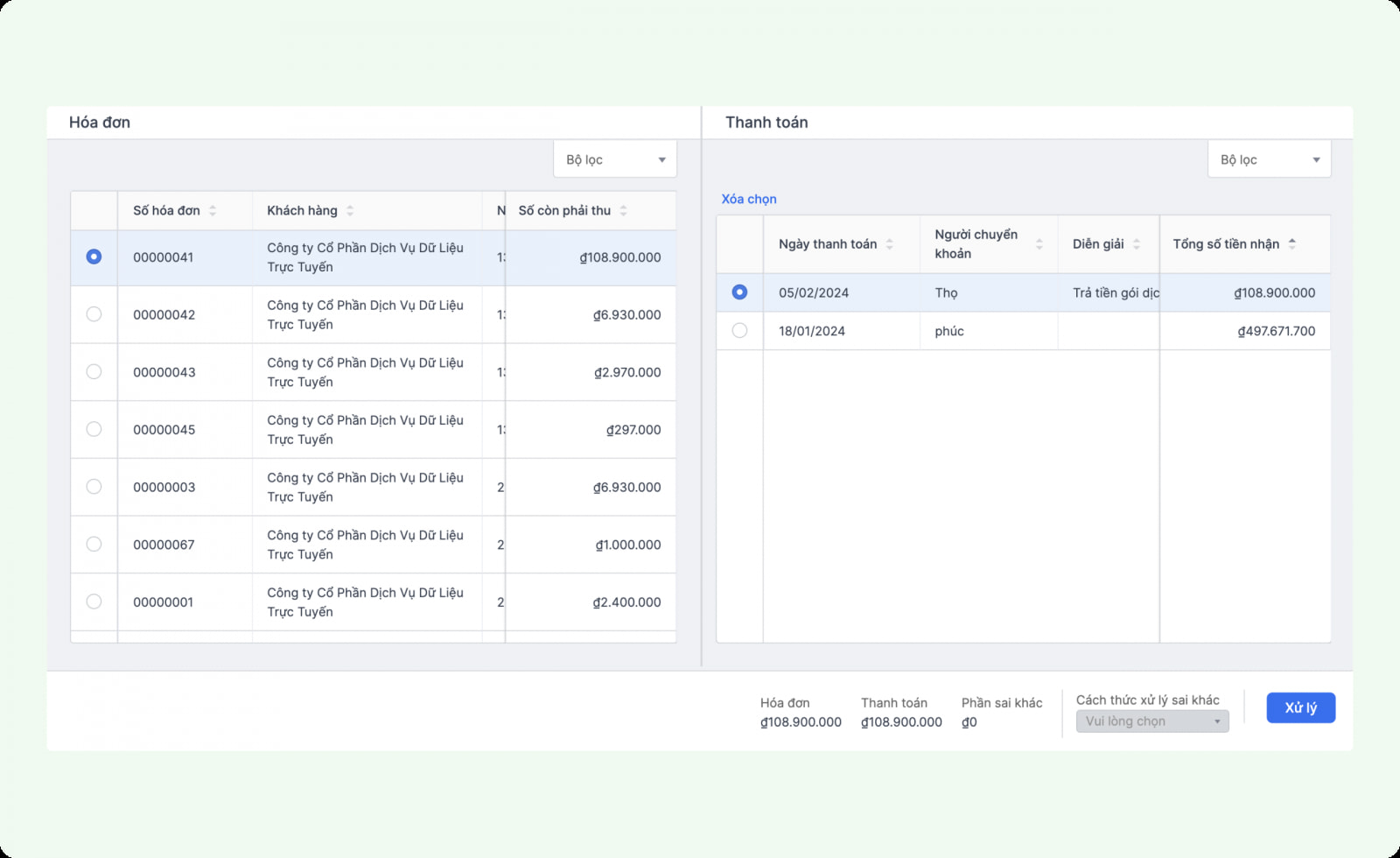

- Quick debt reconciliation: Compare and confirm debt balances between businesses and partners accurately and transparently.

- Flexible debt reporting: Create customized reports by period, by subject or debt type, serving financial management and control.

In addition, Bizzi also supports many other tasks such as processing input invoices using IPA + 3way matching technology, electronic invoice management (B-invoice), helps businesses optimize the entire accounting and financial process.

6. Conclusion

Effective debt management is an important key to ensuring financial stability and sustainable development for businesses. Building a standard debt management process - including both receivables and payables - not only helps to control cash flow tightly but also minimizes financial risks. When businesses apply appropriate accounting tools and software, and invest in improving the professional capacity of their staff, the efficiency of debt management will be significantly optimized. From there, businesses not only maintain good relationships with customers and suppliers but also create a solid foundation for long-term financial strategies.

To improve the efficiency of invoice management as well as automate the financial and accounting processes of the business. Register to experience Bizzi's comprehensive solution suite today!

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/