Electronic bill Whether a digital signature is required to ensure validity is still a question and a misunderstanding today. Electronic invoices are becoming more and more popular and becoming an important document for accounting. Meanwhile, digital signature (CKS) is considered one of the conditions to ensure the legality of electronic invoices.

This article will clarify the relevant legal regulations on whether electronic invoices need to be signed so that businesses can have a comprehensive view and avoid risks during business operations.

Digital signature and legal regulations related to Electronic Invoices

Below is a detailed summary of digital signatures and legal regulations related to electronic invoices, updated according to current regulations in Vietnam:

Concept of digital signature

A digital signature is understood as a form of electronic signature created by transforming a data message using an asymmetric cryptographic system. Accordingly, a person who has the original data message and the signer's public key can determine that the transformation was created with the correct secret key corresponding to the public key in the same key pair, as well as the integrity of the content of the data message since the transformation was performed.

Digital signatures are increasingly popular and known as one of the indispensable tools of businesses and units in current production and business activities, contributing to ensuring the legality and safety of electronic transactions.

Do electronic invoices require a digital signature? General regulations on digital signatures on electronic invoices

- Seller's digital signature:

- Normally, the electronic invoice must have the seller's digital signature.

- In case the seller is a business or organization, the seller's digital signature on the invoice is the digital signature of the business or organization; in case the seller is an individual, the digital signature of the individual or authorized person is used.

- However, the law also stipulates that there are some cases where it is not necessary to have a digital signature of the seller/buyer or both parties.

- Buyer's digital signature:

- Electronic invoices do not necessarily require the buyer's electronic signature, including cases of issuing electronic invoices when selling goods or providing services to customers abroad.

- Only in the case where the buyer is a business establishment and the buyer and seller have an agreement that the buyer meets the technical conditions for digital signature and electronic signature on the electronic invoice issued by the seller, the electronic invoice has the digital signature and electronic signature of the seller and the buyer according to the agreement between the two parties.

Do electronic invoices need to be signed? Non-mandatory cases are still valid

Cases where electronic invoices do not necessarily require the digital signature of the seller or buyer but are still valid are specifically regulated in Clause 14, Article 10, Decree 123/2020/ND-CP and Clause 2, Article 11, Decree 123/2020/ND-CP:

- Electronic invoices issued by tax authorities for each occurrence:

-

- In this case, the electronic invoice does not necessarily have to have the digital signature of the seller or buyer.

- Electronic invoice for selling gasoline to individual non-business customers

-

- For electronic invoices for selling gasoline to individual non-business customers, the invoice does not necessarily have to have the digital signature, electronic signature of the seller and electronic signature of the buyer.

- Electronic invoices are stamps, tickets, cards

-

- On electronic invoices such as stamps, tickets, and cards, it is not necessary to have the seller's digital signature (except in cases where stamps, tickets, and cards are electronic invoices with codes issued by tax authorities).

- In case stamps, tickets, and electronic cards have available face values, it is not necessary to have criteria for unit of calculation, quantity, and unit price.

- Electronic documents for air transport services issued via website and e-commerce system

-

- For non-business individual buyers, if the document is prepared according to international practice and identified as an electronic invoice, the invoice does not necessarily need to have the seller's digital signature.

- Invoices used for Interline payments between airlines are prepared according to the regulations of the International Air Transport Association, so the invoice does not necessarily have to have the buyer's digital signature.

- Invoices are generated from cash registers that are connected to electronic data transfer with tax authorities: This invoice does not require a digital signature. How to identify an electronic invoice generated from a cash register:

-

- Invoice symbol: The 5th character is 'M'.

- Tax authority code: Consists of 23 characters, with the first character C1 being the fixed letter 'M'.

- Seller Signature: It is usually not necessary to display the seller's digital signature information on the invoice.

- Invoices for construction and installation activities; house building activities for sale: When collecting money according to contract progress.

- Internal delivery note or delivery note for goods sent to agents for sale.

- Air freight company invoice issued to agent: When the invoice is issued according to the report that has been reconciled between the two parties and according to the summary table.

- Invoices for construction, installation, production, provision of products and services of defense and security enterprises serving defense and security activities, operating according to Government regulations.

Therefore, whether an electronic invoice requires a digital signature or not will depend on the regulations in each specific case.

Do electronic invoices need a digital signature and how to check their validity?

To ensure that the electronic invoice is valid - legal - accepted when declaring taxes, you need to check the following factors:

Requirements for availability and searchability of electronic invoices

- Electronic invoices and electronic documents must be ready to be printed on paper or looked up upon request.

- Preservation and storage must ensure safety, security, integrity, completeness, and no changes or deviations during the entire storage period and within the time limit prescribed by law (minimum 10 years).

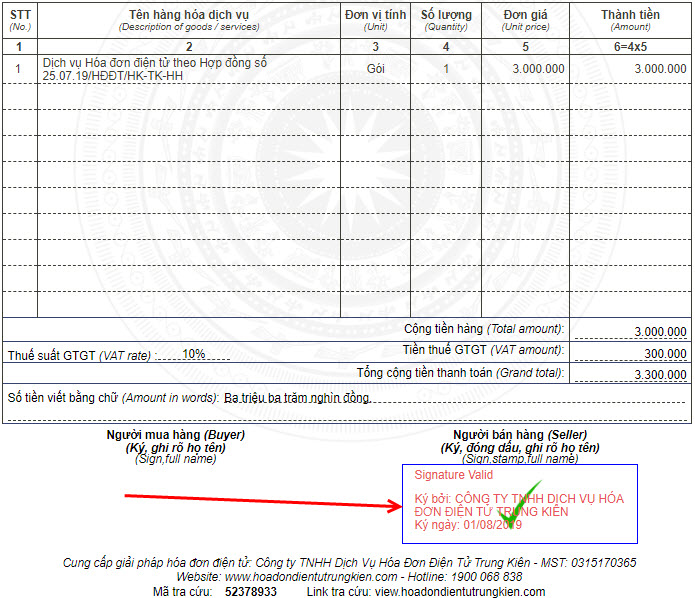

Do electronic invoices require a signature? How to check the digital signature on an electronic invoice?

- Method 1: Check on the website of the National Electronic Authentication Center (neac.gov.vn):

- Visit website neac.gov.vn.

- Select “Online Services” -> “Check digitally signed documents”.

- Upload the document with the signature to be checked to the system and click “Check digital signature” to see the result. The system will display information about the signature name, signature status (valid/invalid), data integrity and digital certificate status.

- Method 2: Check on NEAC Signer digital signature software:

- Search and install NEAC Signer software (developed by the Ministry of Information and Communications).

- Open the software, select “System” -> “Open file”, then select “Check signature” to view detailed information about the digital signature. This software supports checking and signing with many different formats such as PDF, XML, EXCEL.

Solution to support electronic invoice management for businesses: Bizzi

Bizzi is a comprehensive cost control system for businesses and is considered an AI assistant for the finance and accounting department in automating the revenue and expenditure process.

The platform integrates more than 30 features to help businesses streamline and automate their cost management, debt collection, and B2B payment processes.

In particular, Bizzi provides the "B-invoice electronic invoice" solution with outstanding features such as:

- Create electronic invoices according to tax authority regulations, in XML/PDF format.

- Allows customizing invoice templates with logos, t

Bizzi – AI assistant for finance and accounting department in automating revenue and expenditure process. corporate brand

- Support invoice Batch to issue multiple invoices at once.

- Connect directly to the tax authority system to authenticate invoices using authentication codes.

- Store invoices as prescribed (minimum 10 years), ensuring compliance with the law.

- Look up electronic invoices easily by many criteria such as number, issue date, customer, tax code.

- Download & print invoices anytime in PDF, XML, digital signature integrated.

- Manage invoice status (issued, sent, paid, canceled or adjusted).

- Integrate API with ERP & Accounting systems to synchronize data.

Conclude

Hopefully, through the above article, you can answer for yourself whether an electronic invoice requires a signature. In short, not all electronic invoices are required to have a digital signature of the seller or buyer. These special cases have been clearly stipulated in Decree 123/2020/ND-CP and related guiding documents.

It is important that businesses clearly understand and note the regulations on whether electronic invoices require digital signatures to ensure the validity and legality of invoices, and at the same time protect their interests in case of disputes or risks.

The application of modern technological solutions such as Bizzi with solution B-invoice will help businesses not only comply with regulations but also optimize invoice management processes, minimize costs and increase the efficiency of financial and accounting operations.

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/