In an increasingly competitive business landscape, effective financial management is more important than ever. Accounts payable reports, an integral part of a business's financial picture, play a key role in assessing liquidity, managing cash flow and making informed business decisions.

In 2024, with changes in accounting regulations and new technology trends, updating and improving accounts payable reports becomes an urgent requirement. This article will give you a comprehensive view of the 2024 accounts payable report

Special, Bizzi will share solutions to help you optimize the reporting process, save time and effort, and improve reporting accuracy and reliability.

What is an accounts payable report?

The accounts payable report is an important part of a company's financial statements, showing the debts that the company is obliged to pay to parties within a certain period of time. This report provides detailed information about the debts payable, including short-term and long-term debts, helping the company effectively manage debts and make the right financial decisions.

-

Accounts payable reporting, an integral part of the financial picture

Top 3 methods to improve accounts payable reporting

Improve data accuracy

Accurate accounts payable reporting is the foundation for making informed financial decisions. This session will explore best practices for ensuring data accuracy, including automating data entry, routine data audits, and vendor agreements.

Automate the data entry process

Automating the data entry process can significantly reduce manual errors. Data entry software can integrate with your accounting system, automatically extracting data from invoices and importing it into your system. This can also save you significant time and money.

Check data periodically

Periodic data checks are important to ensure data accuracy. You should review your data monthly or quarterly to look for any errors or anomalies. This can be done by comparing your data with other reports, such as bank reconciliation reports or sales reports.

A retail company discovered several data entry errors by checking their accounts payable data monthly. This helps them avoid incorrect payments and maintain accurate books.

Agreement with supplier

Supplier agreements can help improve data accuracy by ensuring that you receive accurate information about your invoices. When negotiating with suppliers, you should include terms regarding invoice format, payment terms, and discount terms. This will help reduce the number of invoice errors and ensure that you are receiving accurate information.

Optimize the process of recording and explaining payables

Accurate recording and accounting of accounts payable is critical to maintaining accurate books and complying with regulations. Consider establishing and simplifying the invoice capture process, establishing a clear invoice approval process, and tracking payables aging effectively.

Simplify the recording process bill

Complicated invoice recording processes can lead to errors and delays. You should simplify this process as much as possible. This includes digitizing data entry processes, automating approval processes, and establishing clear accountability processes.

Establish a clear invoice approval process

A clear invoice approval process is important to ensure that only valid invoices are paid. Your process should include a multi-level review process and a clear assignment of responsibilities. You should also establish guidelines on how to handle disputed invoices and incomplete invoices.

-

Businesses should simplify the process of recording and processing invoices

Track payables aging effectively

Tracking payables aging effectively is critical to managing credit risk and improving cash flow. You should set up periodic payables aging reports that track the balance and age of your payables. You should also track accounts payable aging metrics, such as average rate of late payments and average number of days paid.

Prepare for the future

Accounts payable reporting is constantly evolving due to advances in technology and new regulations. Businesses need to consider the latest technology trends, the impact of artificial intelligence (AI), and long-term strategies to improve accounts payable reporting.

Use technology to automate and improve efficiency

Technology can help automate many aspects of accounts payable reporting, improving efficiency and reducing errors. In this section, we will discuss accounts payable management software, automated data extraction, and smart reporting.

Accounts payable reporting is constantly evolving due to advances in technology and new regulations. New technologies such as artificial intelligence (AI) and machine learning (ML) are being used to automate various aspects of accounts payable reporting, improving accuracy and efficiency. Companies also need to be aware of new regulations, such as International Financial Reporting Standards (IFRS), which may affect how accounts payable are reported.

-

Use technology to automate and improve accounts payable reporting

The impact of artificial intelligence (AI)

AI is significantly impacting accounts payable reporting. AI solutions can be used to automate tasks such as data extraction, invoice reconciliation, and fraud detection. For example, a company can use an AI solution to extract data from invoices and automatically import that data into the company's accounting system. This helps reduce manual errors and saves time.

Long-term strategies to improve accounts payable reporting

To improve accounts payable reporting over the long term, companies should focus on automating processes, improving data accuracy, and implementing strong internal controls. They should also monitor new technologies and regulations that may affect how accounts payable are reported. By implementing these measures, companies can significantly improve their accounts payable reporting and make more informed decisions.

Conclude

Improving accounts payable reporting is critical to ensure bookkeeping accuracy, regulatory compliance, and improved cash flow. By using the best practices outlined in this article, companies can significantly improve their accounts payable reporting processes. This can help them reduce errors, save time and money, and make more informed decisions.

Bizzi encourages you to take steps to improve your accounts payable reporting. By doing so, you can improve your financial situation and position yourself for future success.

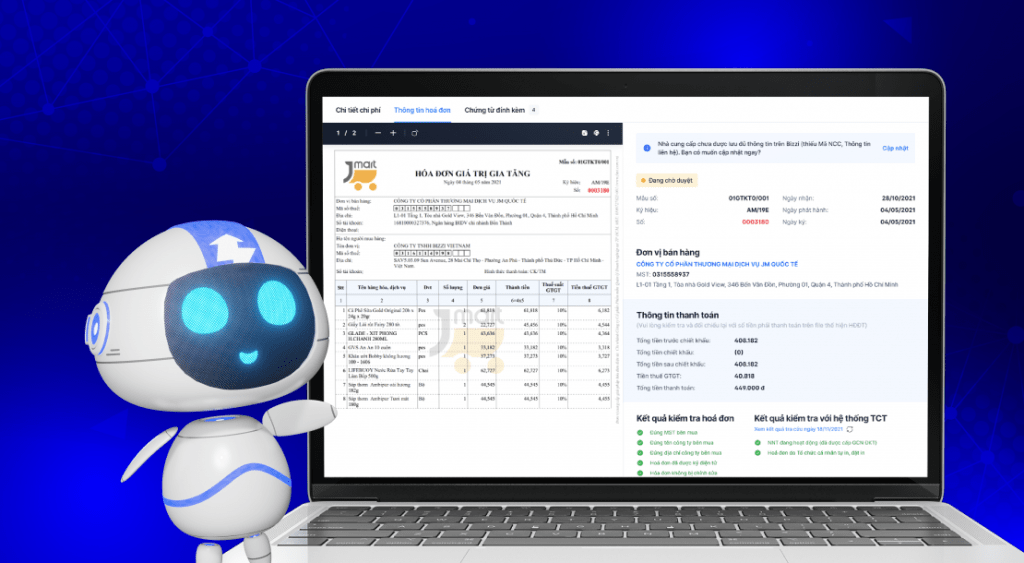

Bizzi – Comprehensive invoice processing solution that solves the "pain" of the accounting and finance industry

Automatically receive and store electronic invoices

- Give each business a unique email address.

- Bizzi bot automatically collects invoices and puts them into a platform for processing.

- Electronic invoices are stored in a single place with an intuitive display list for easy management and access.

Automate invoice processing with robots

- Bizzi bot checks the reasonableness and validity of invoices

- Criteria checked: electronic signature, tax code, supplier information and many other factors

- Automatically return results and report errors when invoices are invalid or have incorrect information

Automatically intelligent 3-way comparison: Invoices - Orders - Warehouse receipts

- Smart 3-way collation with more accuracy than 99%.

- Handle all reconciliation cases on the system: 1PO – 1INV – 1GR; 1PO – nINV – nGR; nPO – 1INV – nGR; nPO – nINV – nGR

- Detect deviations quickly and improve data accuracy.

- Automatically get PO number from invoice/email from supplier/invoice file.

Extract data to transfer to accounting software

Automatically processing electronic invoices and extracting data to Excel files is completely compatible with the accounting software the company is using to support the data entry process.

Easy integration with ERP systems: SAP, Oracle Netsuite, Odoo, Microsoft Dynamics 365,…

Bizzi's Invoice Processing solution is flexible and easily configurable to fit your existing ERP system and accounting processes.

Contact our team today to sign up for a free trial and discover how Bizzi can help you optimize your accounts payable invoice management process.