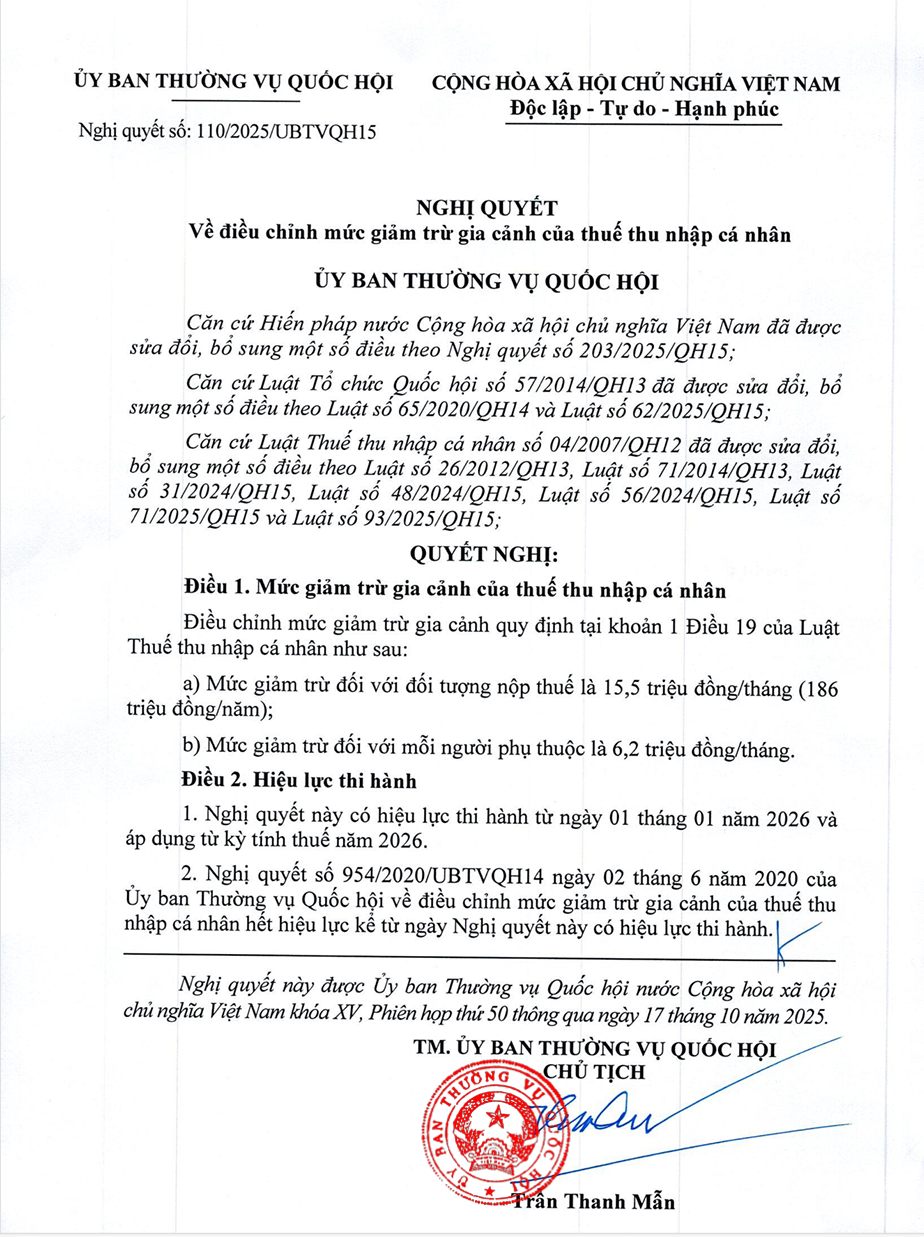

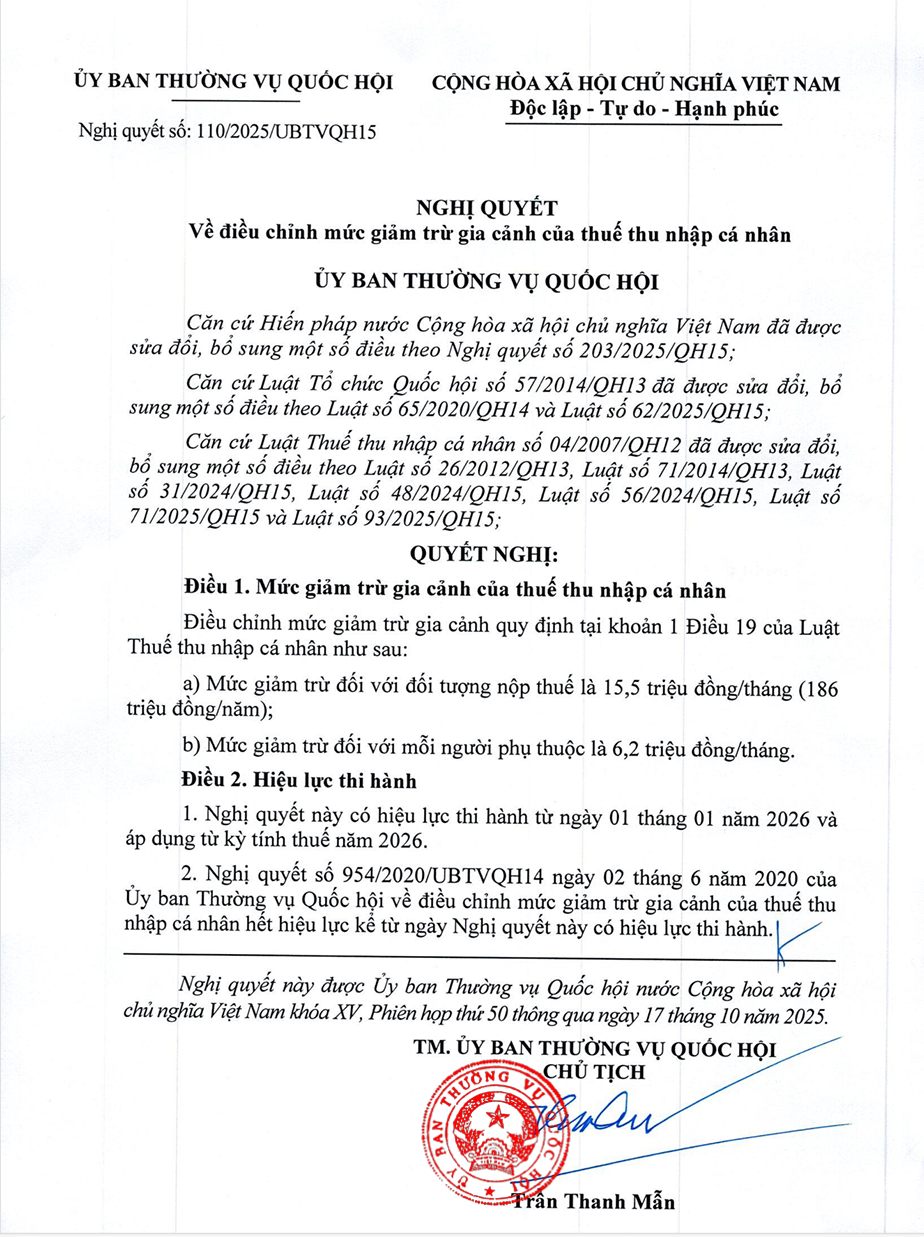

Resolution 110/2025/UBTVQH15 on adjusting the family deduction level of personal income tax

On October 17, 2025, the Standing Committee of the National Assembly passed Resolution 110/2025/UBTVQH15 on

A place where knowledge and solutions converge for CFOs, Chief Accountants and Business Owners. At Bizzi Finance Hub, you will find in-depth documents, industry reports, financial operations guides, and new technology trends to help businesses optimize cash flow, manage costs and effectively transform digitally.

On October 17, 2025, the Standing Committee of the National Assembly passed Resolution 110/2025/UBTVQH15 on

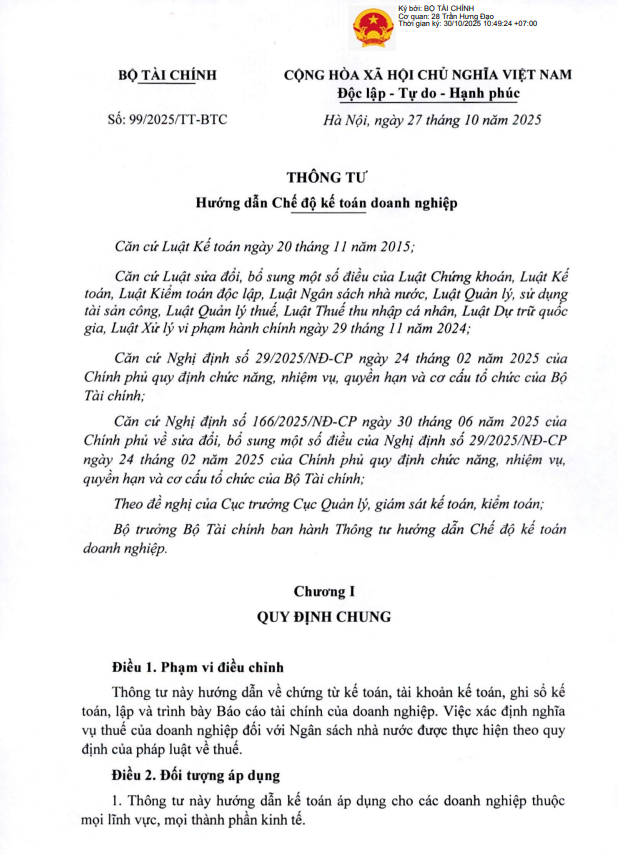

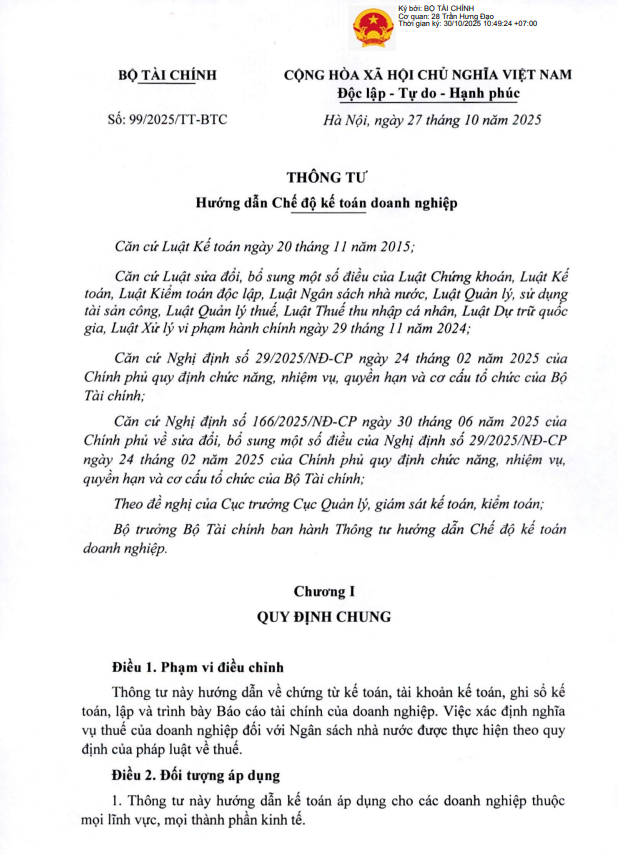

On October 27, 2025, the Minister of Finance issued Circular 99/2025/TT-BTC. Circular 99/2025/TT-BTC

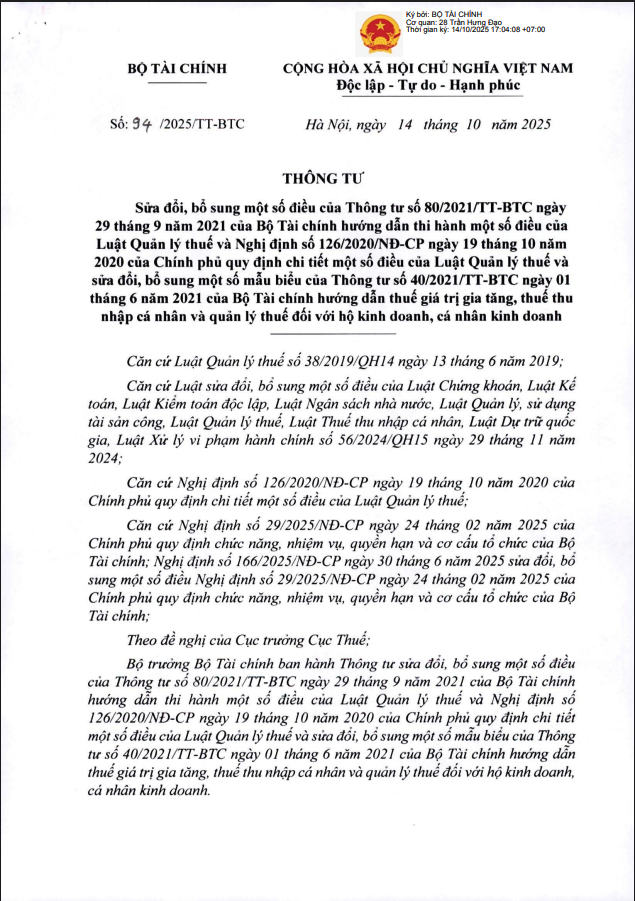

On October 14, 2025, the Minister of Finance issued Circular 94/2025/TT-BTC amending

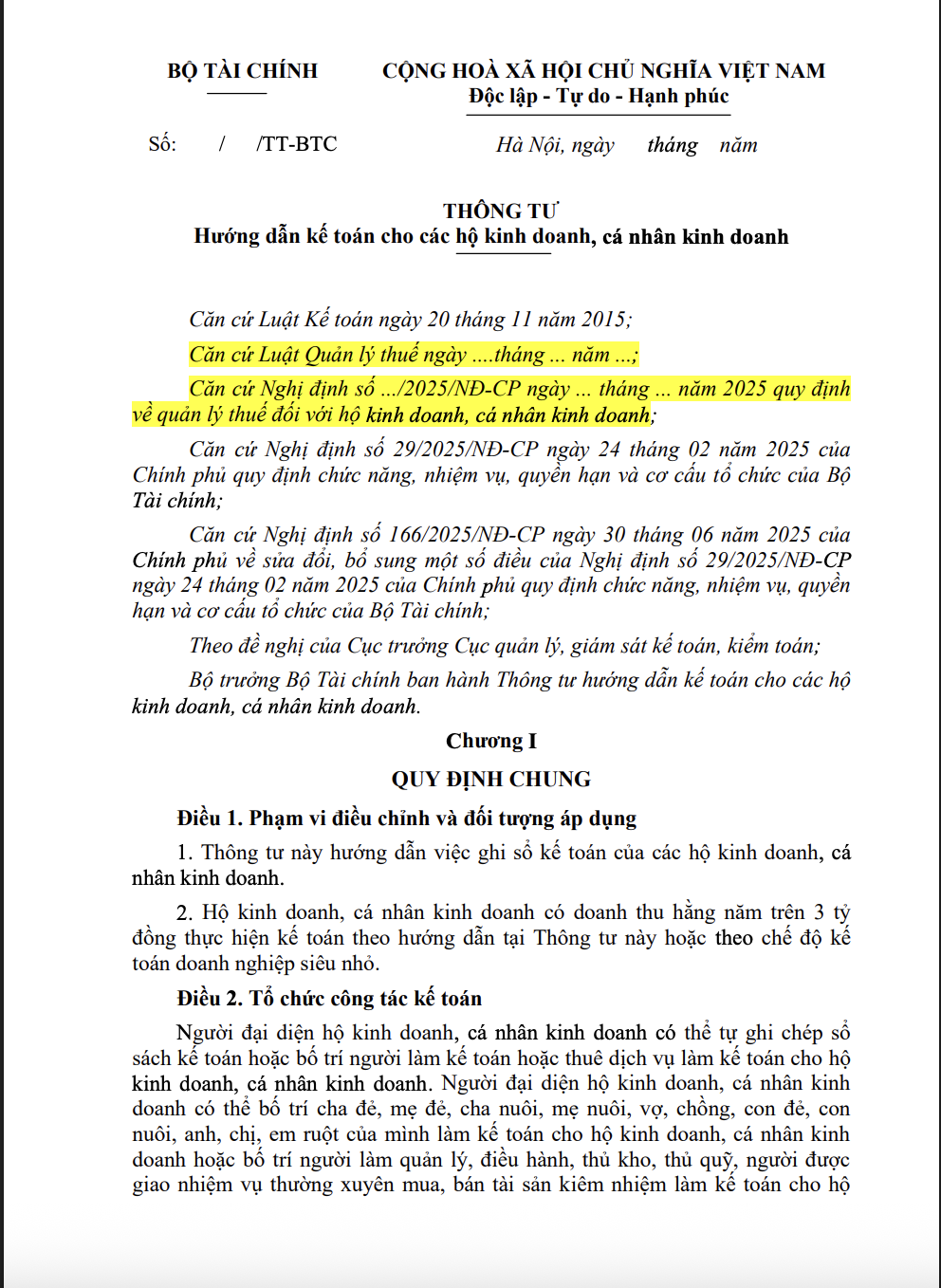

Draft Circular providing accounting guidance for Business Households and Individuals

Ebook “Shortening the cash cycle – Proactively seizing business opportunities”

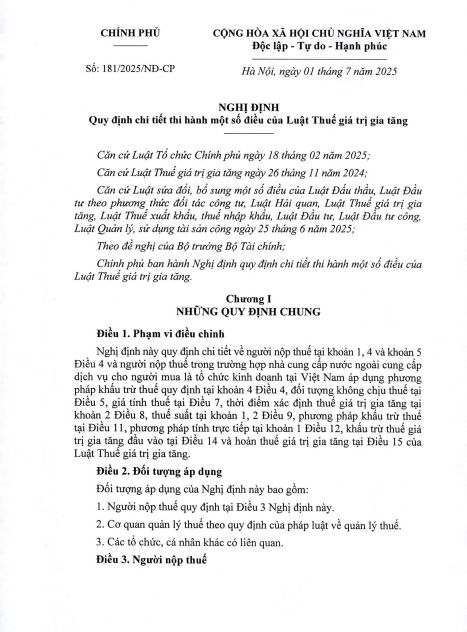

Recently, the Government issued Decree 181/2025/ND-CP detailing the Tax Law.

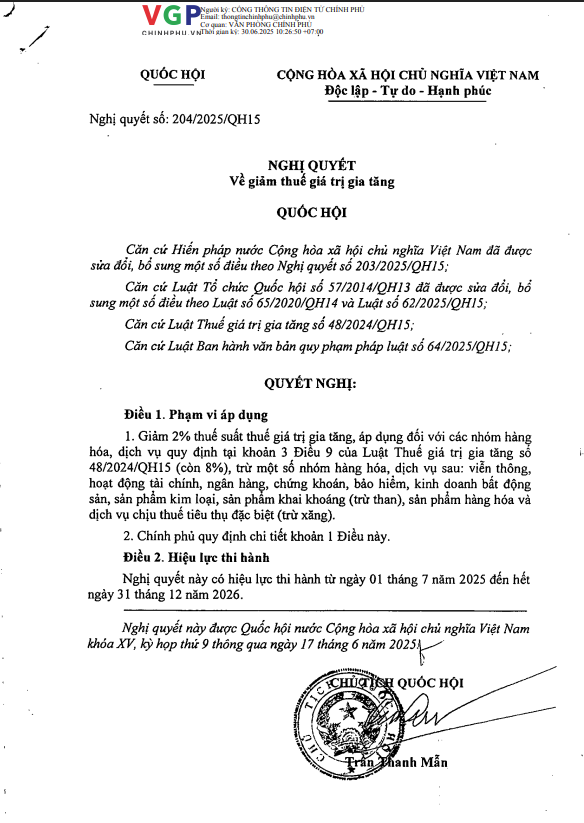

On June 17, 2025, the National Assembly passed Resolution No. 204/2025/QH15 at the 7th Session.

In-depth ebook on cost management in the FMCG industry – helping businesses

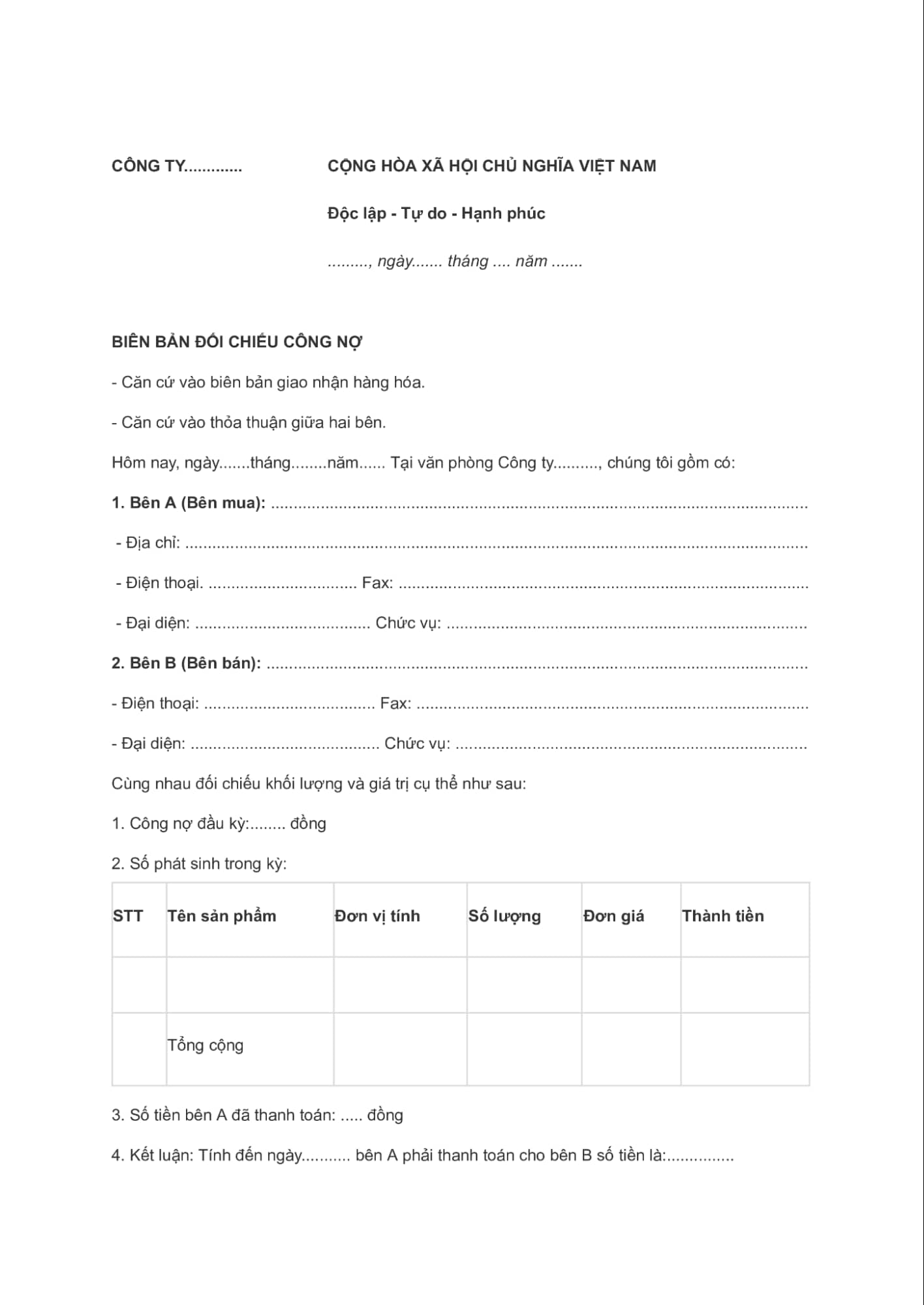

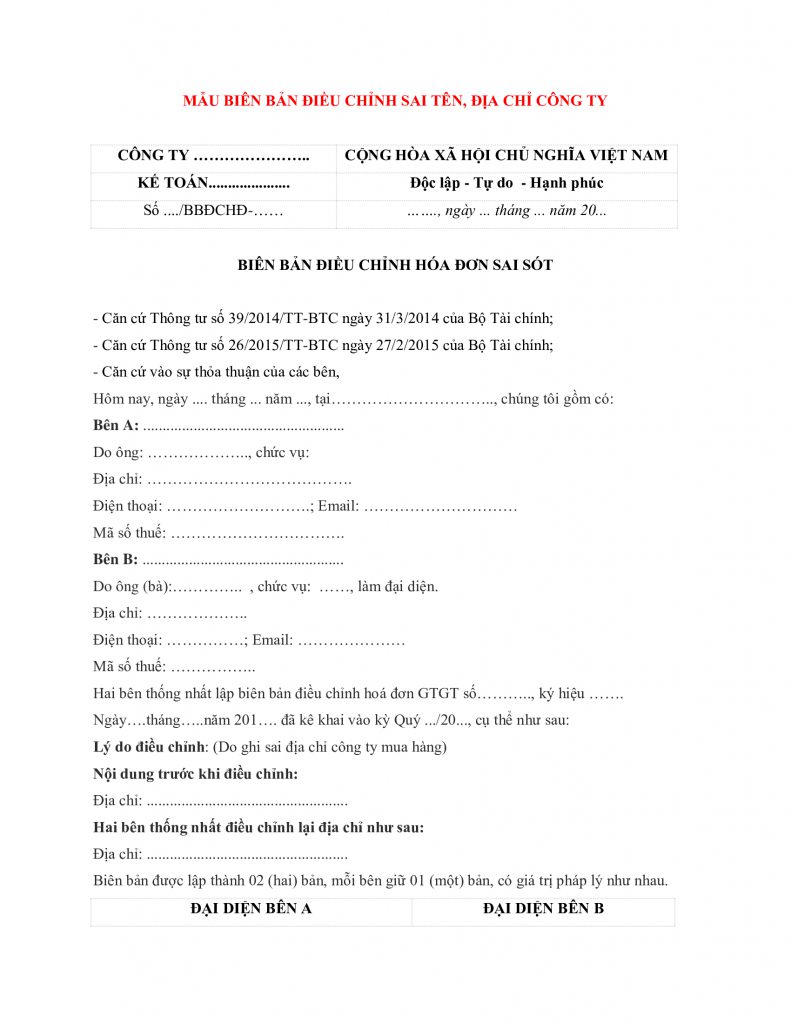

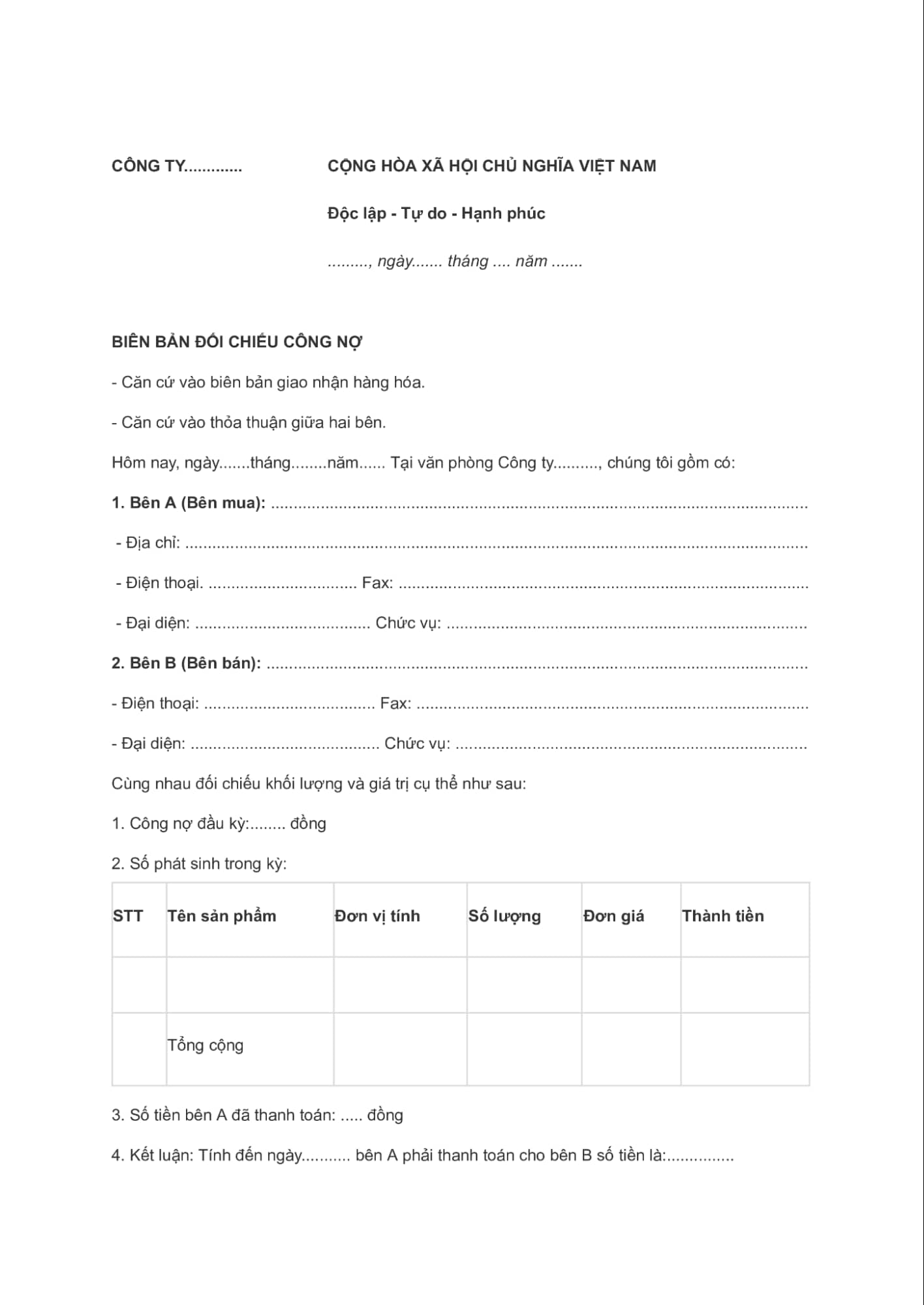

You need a debt reconciliation form to confirm the balance between

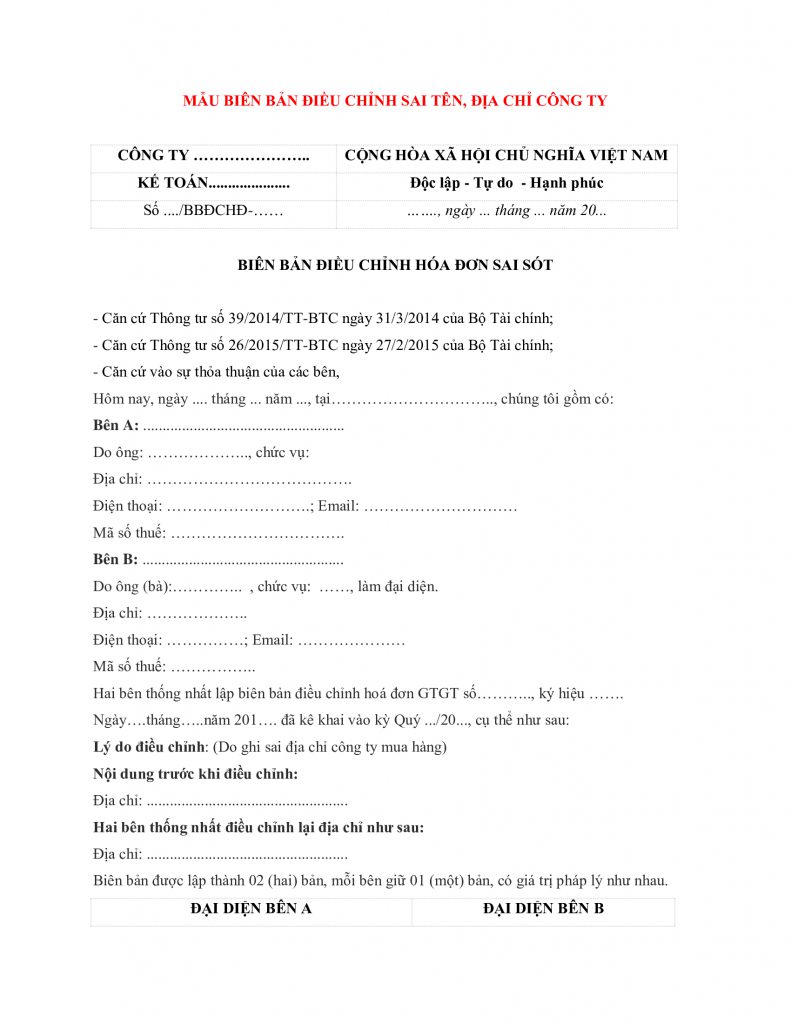

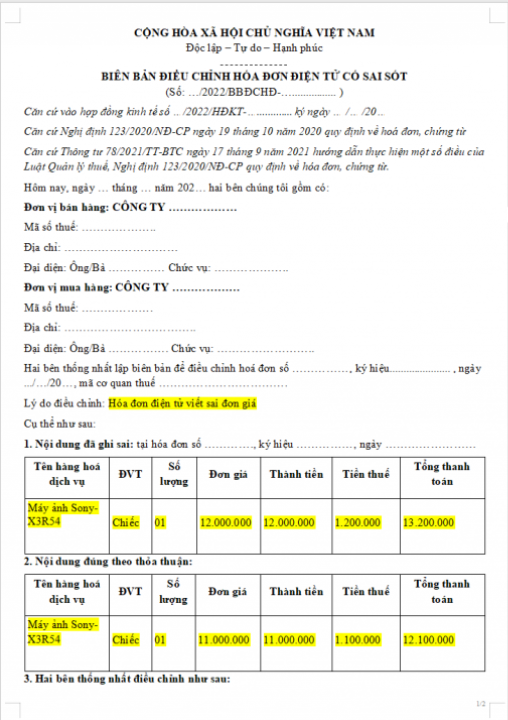

The electronic invoice was created and sent to the buyer, but it was discovered that

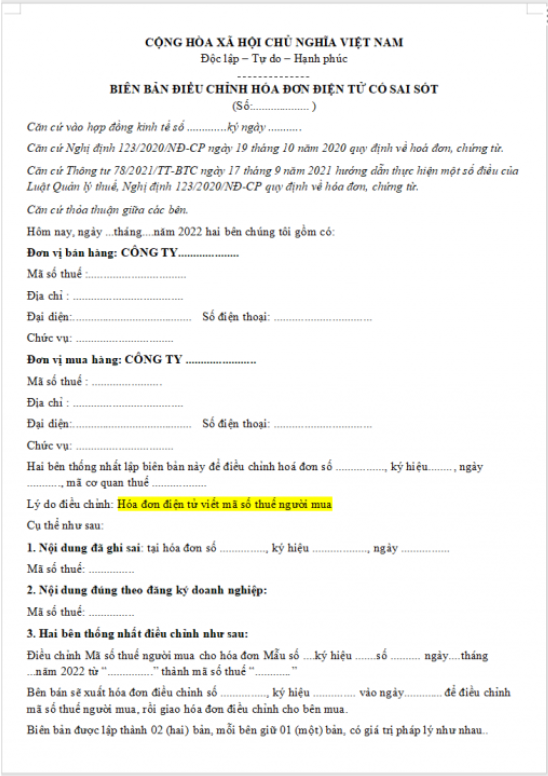

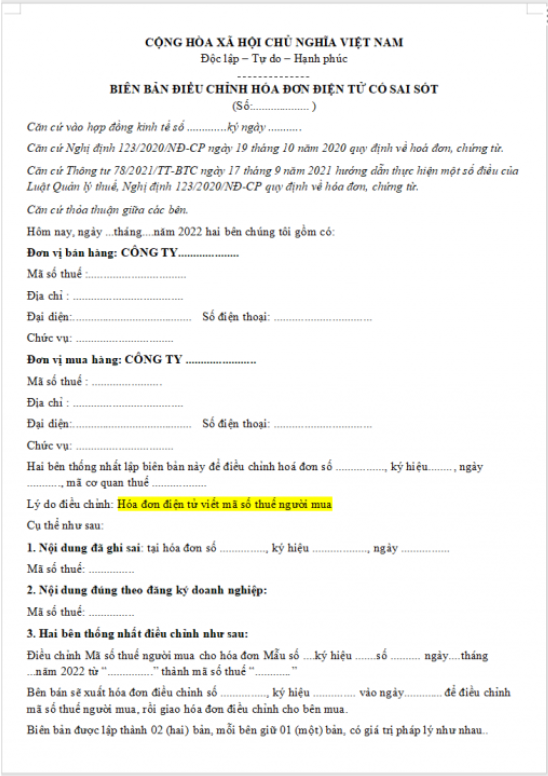

Invoice with incorrect tax code is a serious error, requiring adjustment minutes.

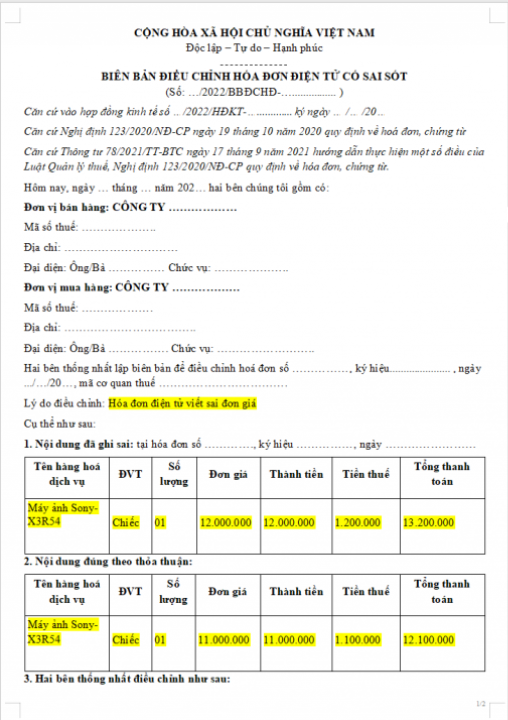

The electronic invoice was created and sent to the buyer, but it was discovered that

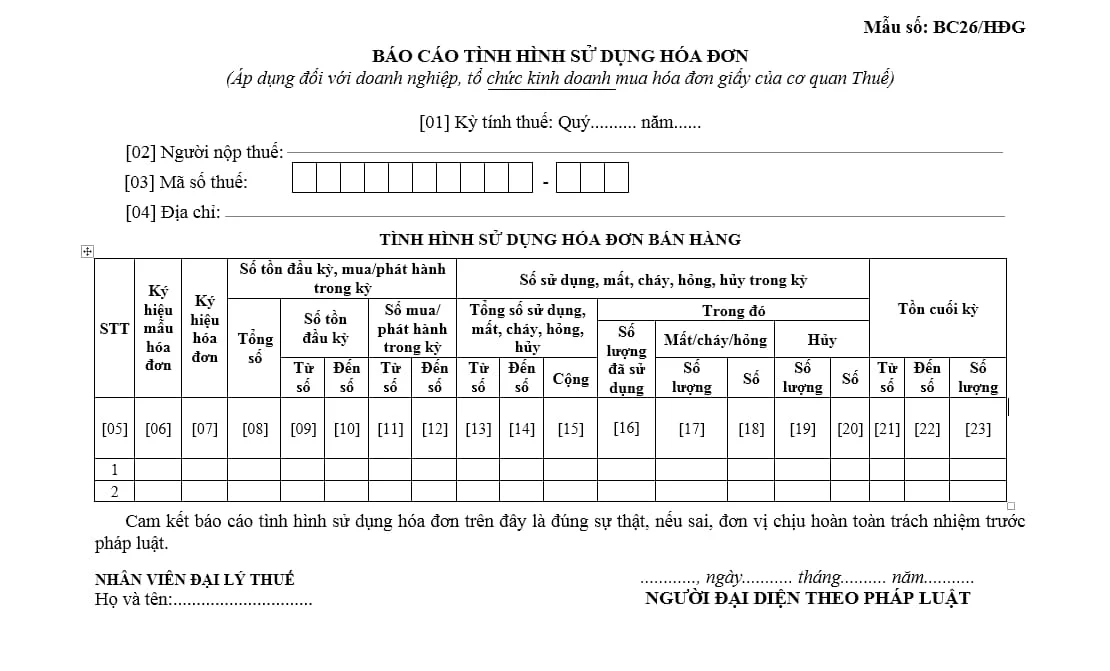

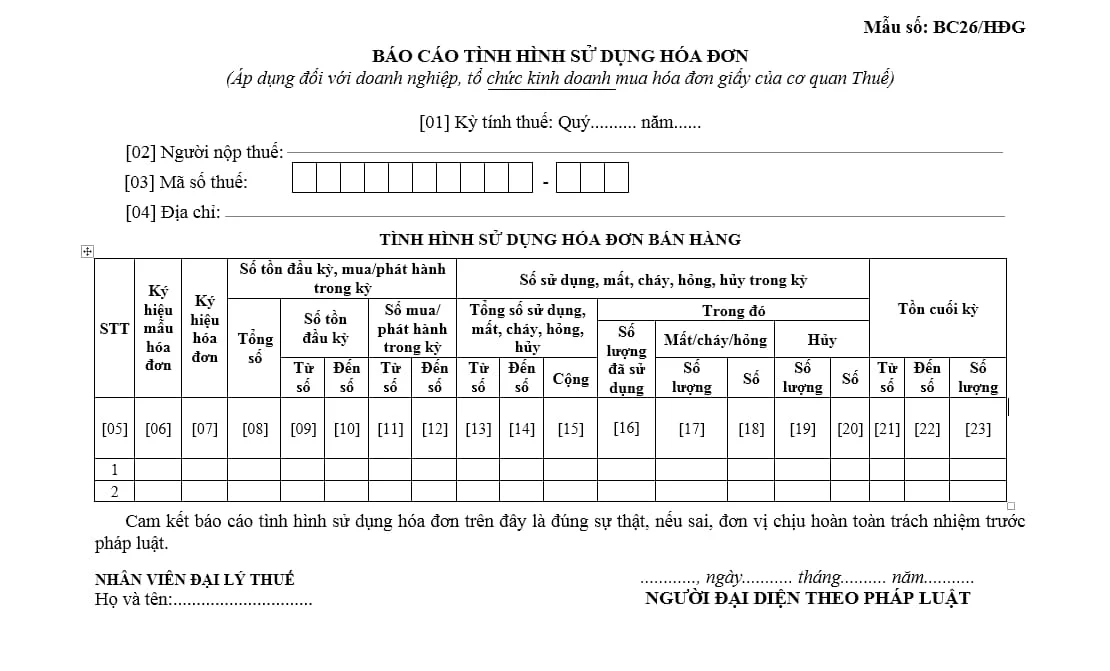

The form of quarterly invoice usage report is prescribed.

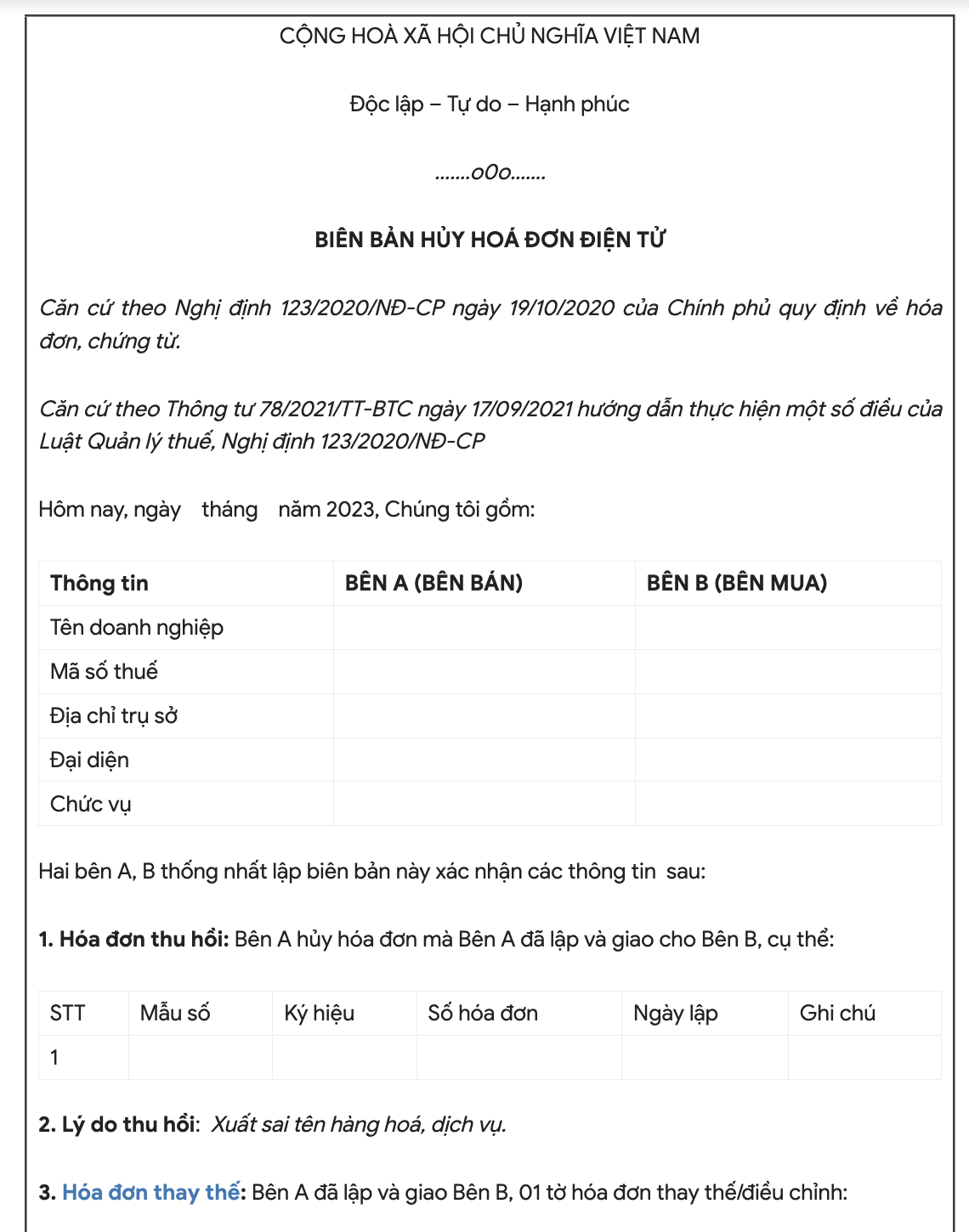

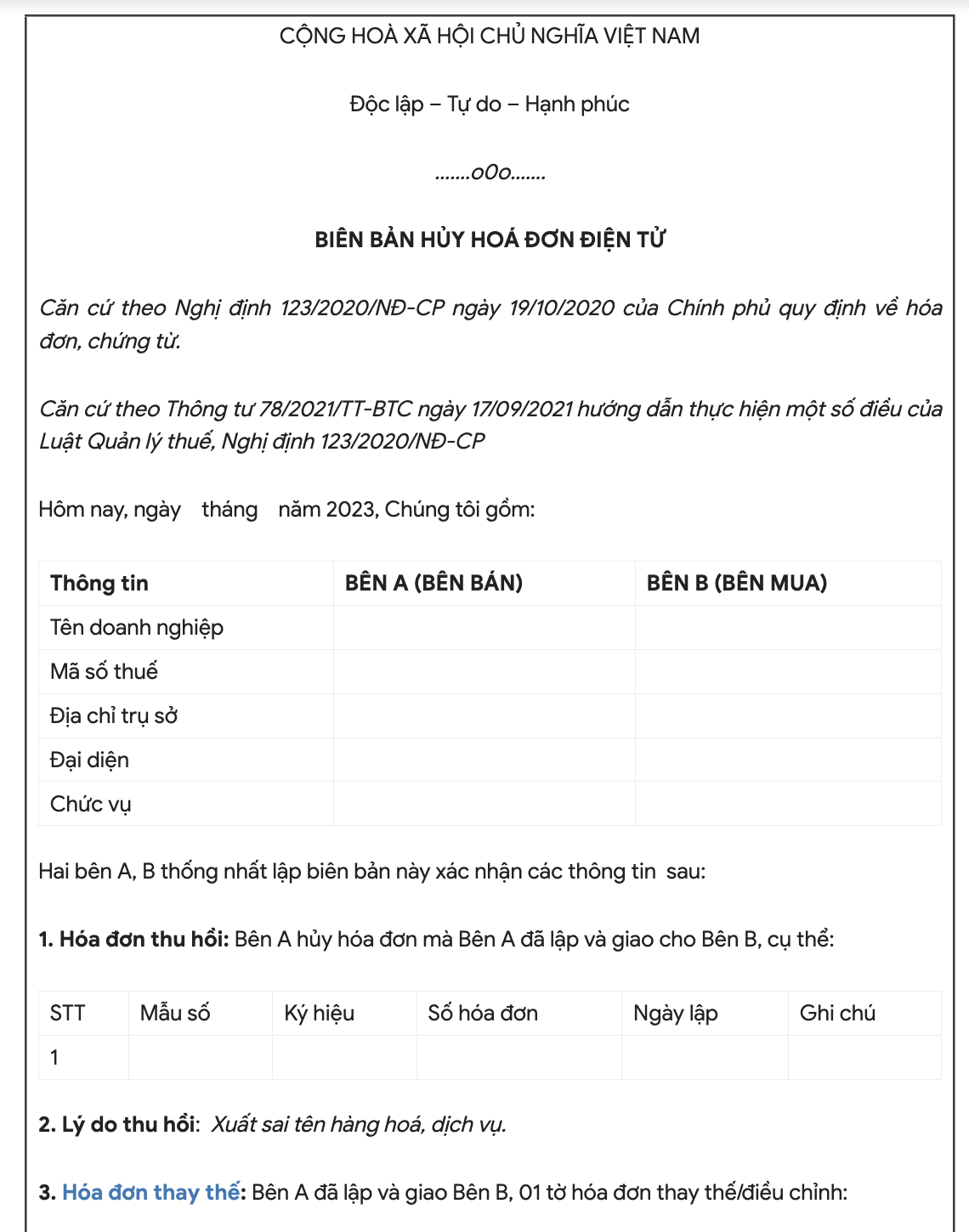

The VAT/electronic invoice cancellation record is an important document in the business.

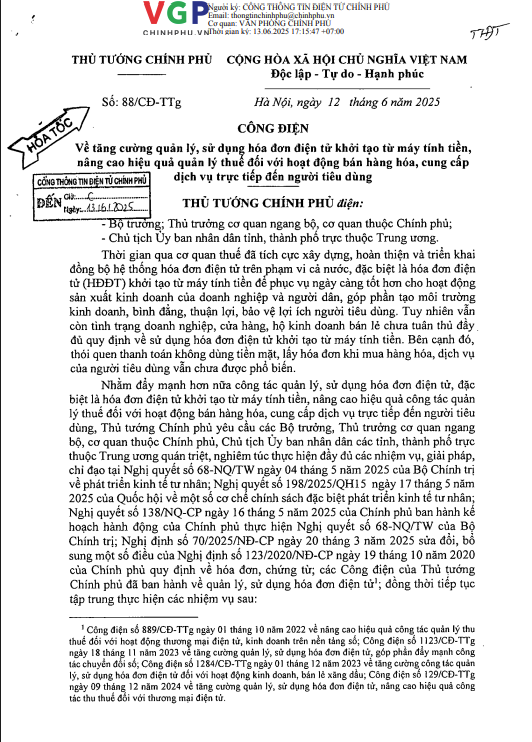

Telegram No. 88/CD-TTg of the Prime Minister: On strengthening management and use

Guidance on the implementation of a number of articles of the Law on Tax Administration dated January 13, 2013.

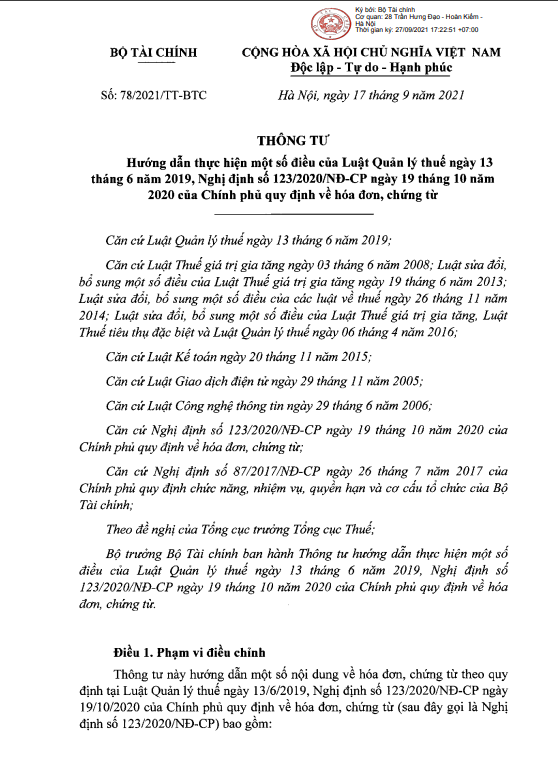

Circular No. 78/2021/TT-BTC of the Ministry of Finance: Guidance on the implementation of a number of articles of the Law on Tax Administration dated June 13, 2021

Telegram No. 26/CD-TTg of the Prime Minister: On strengthening measures

From 01/07/2025, all bills – even under 20 million – must be paid

Decree No. 70/2025/ND-CP of the Government: Amending and supplementing a number of articles of

Telegram No. 1123/CD-TTg of the Prime Minister: On strengthening the management and use of electronic invoices, contributing to promoting the

Telegram No. 1284/CD-TTg of the Prime Minister: On strengthening management work

The logistics industry is growing at a rapid pace thanks to e-commerce.

The construction industry is one of the fields with complex cost structures.

The tourism industry is booming at a rapid pace, but also facing challenges.

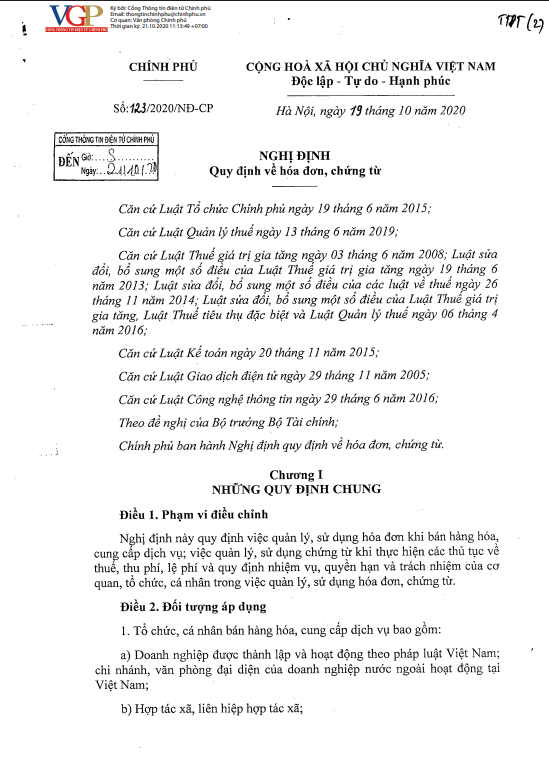

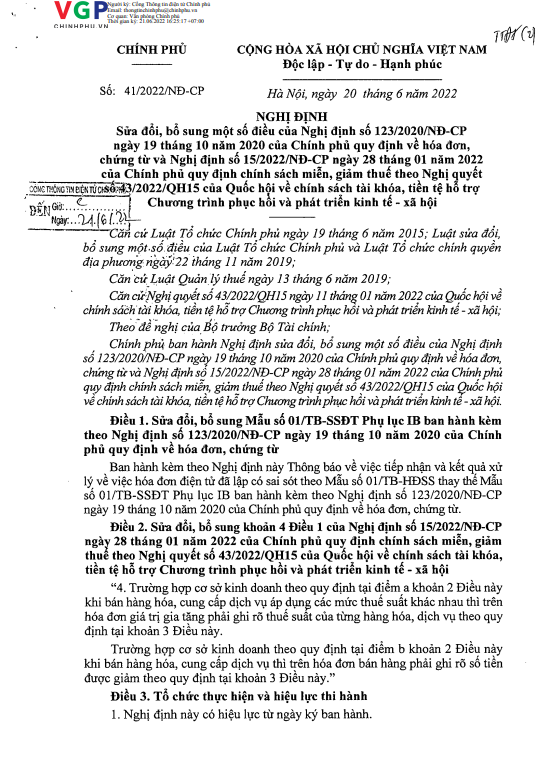

Decree No. 123/2020/ND-CP of the Government: Regulations on invoices and documents

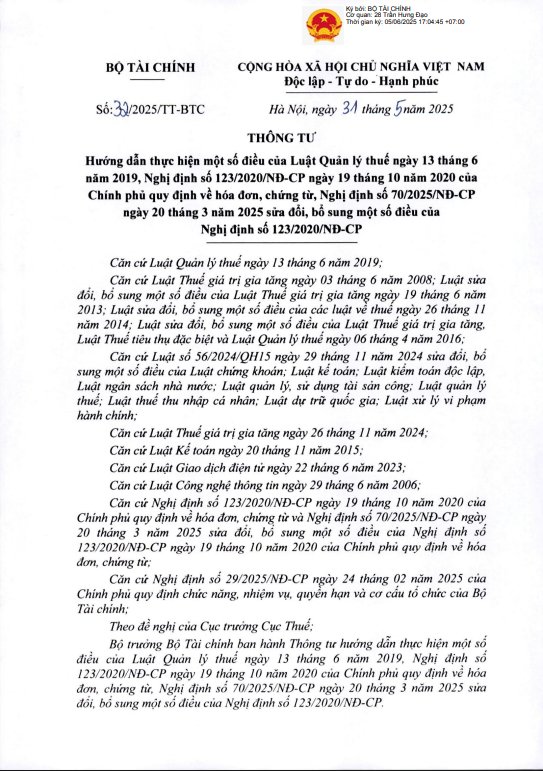

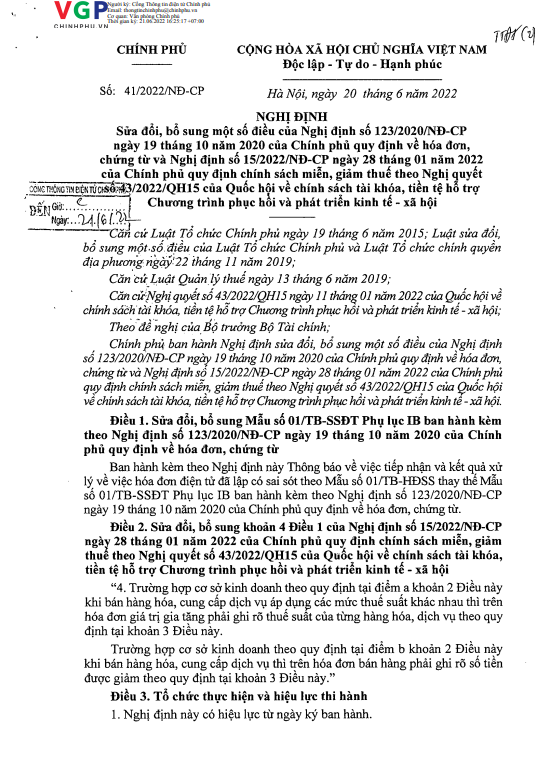

Amending and supplementing a number of articles of Decree No. 123/2020/ND-CP dated January 19, 2020.

On October 17, 2025, the Standing Committee of the National Assembly passed Resolution 110/2025/UBTVQH15 on

On October 27, 2025, the Minister of Finance issued Circular 99/2025/TT-BTC. Circular 99/2025/TT-BTC

On October 14, 2025, the Minister of Finance issued Circular 94/2025/TT-BTC amending

Draft Circular providing accounting guidance for Business Households and Individuals

Recently, the Government issued Decree 181/2025/ND-CP detailing the Tax Law.

On June 17, 2025, the National Assembly passed Resolution No. 204/2025/QH15 at the 7th Session.

Telegram No. 88/CD-TTg of the Prime Minister: On strengthening management and use

Guidance on the implementation of a number of articles of the Law on Tax Administration dated January 13, 2013.

Circular No. 78/2021/TT-BTC of the Ministry of Finance: Guidance on the implementation of a number of articles of the Law on Tax Administration dated June 13, 2021

Telegram No. 26/CD-TTg of the Prime Minister: On strengthening measures

Decree No. 70/2025/ND-CP of the Government: Amending and supplementing a number of articles of

Telegram No. 1123/CD-TTg of the Prime Minister: On strengthening the management and use of electronic invoices, contributing to promoting the

Telegram No. 1284/CD-TTg of the Prime Minister: On strengthening management work

Decree No. 123/2020/ND-CP of the Government: Regulations on invoices and documents

Amending and supplementing a number of articles of Decree No. 123/2020/ND-CP dated January 19, 2020.

Ebook “Shortening the cash cycle – Proactively seizing business opportunities”

In-depth ebook on cost management in the FMCG industry – helping businesses

From 01/07/2025, all bills – even under 20 million – must be paid

The logistics industry is growing at a rapid pace thanks to e-commerce.

The construction industry is one of the fields with complex cost structures.

The tourism industry is booming at a rapid pace, but also facing challenges.

You need a debt reconciliation form to confirm the balance between

The electronic invoice was created and sent to the buyer, but it was discovered that

Invoice with incorrect tax code is a serious error, requiring adjustment minutes.

The electronic invoice was created and sent to the buyer, but it was discovered that

The form of quarterly invoice usage report is prescribed.

The VAT/electronic invoice cancellation record is an important document in the business.

About Bizzi

Contact

Product

Newsletter

Sign up for our newsletter to receive news, updates and special offers.

BIZZI VIETNAM COMPANY LIMITED - Registered business address: No. 136-138 West Belt Road, Ward 4, An Khanh Ward, Ho Chi Minh City, Vietnam

© 2025 Bizzi. All rights reserved.