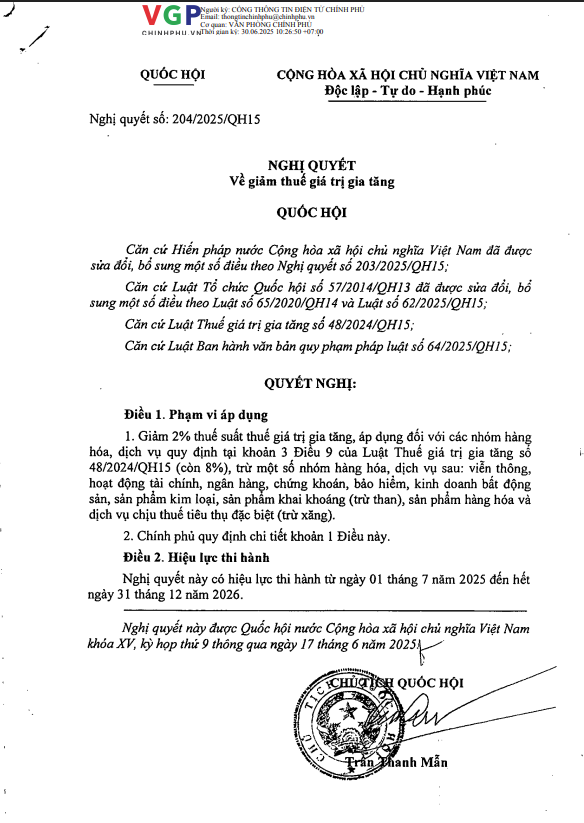

On June 17, 2025, the National Assembly passed Resolution No. 204/2025/QH15 at the 9th Session, XV tenure. Accordingly, from July 1, 2025, the tax rate value added tax will be reduced from 10% to 8% for most goods and services currently subject to the 10% tax rate.

| Number of symbols | 204/2025/QH15 |

| Date of issue | 17-06-2025 |

| Effective Date | 01-07-2025 |

| Text type | Resolution |

| Issuing agency | National Assembly |

| Signatory | Tran Thanh Man |

| Abstract | On VAT reduction |

The VAT incentive period lasts from July 1, 2025 to December 31, 2026. The Government is assigned the responsibility to provide detailed implementation instructions to ensure uniform implementation nationwide.

To be continued VAT reduction In the coming period, it is a fiscal solution to reduce consumer costs, support production and business and stimulate domestic consumption.