The electronic invoice was created and sent to the buyer, but then an error was discovered in the tax code of the buyer or seller. This is one of the serious mistakes because the tax code is an important legal identification information in every transaction. Incorrectly writing the tax code can lead to the invoice being rejected by the tax authority, causing difficulties for both the buyer and the seller in the process of declaring, deducting and refunding taxes.

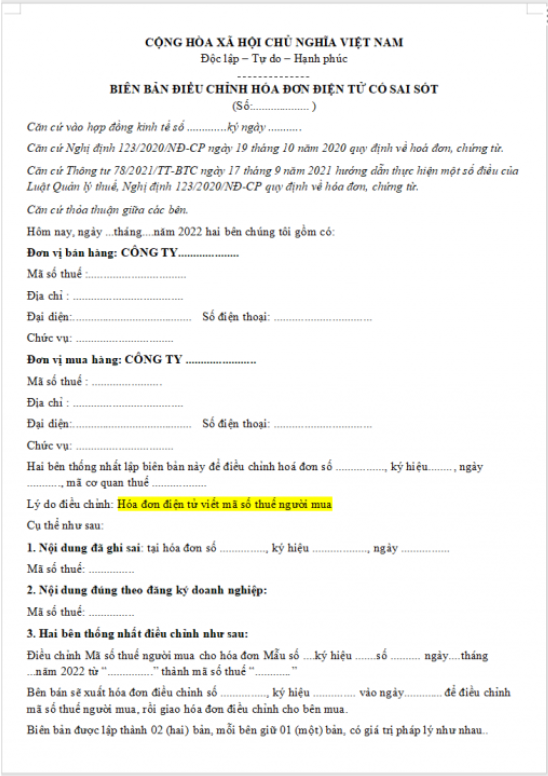

When detecting this error, the business is required to establish electronic invoice adjustment minutes to adjust the information according to regulations. The minutes must be signed by both parties and stored as a basis for adjustment on the electronic invoice system, ensuring the legality and consistency of accounting documents.

Download the free sample of Invoice Adjustment Form due to incorrect tax code now!