The VAT/electronic invoice cancellation record is an important document in the business of invoices and documents. Understanding the electronic invoice cancellation record helps accountants manage invoices and documents conveniently, ensuring compliance with legal regulations and avoiding risks.

According to current regulations, there is no common form of electronic invoice or VAT cancellation minutes. The form of minutes will depend on each specific case and business unit.

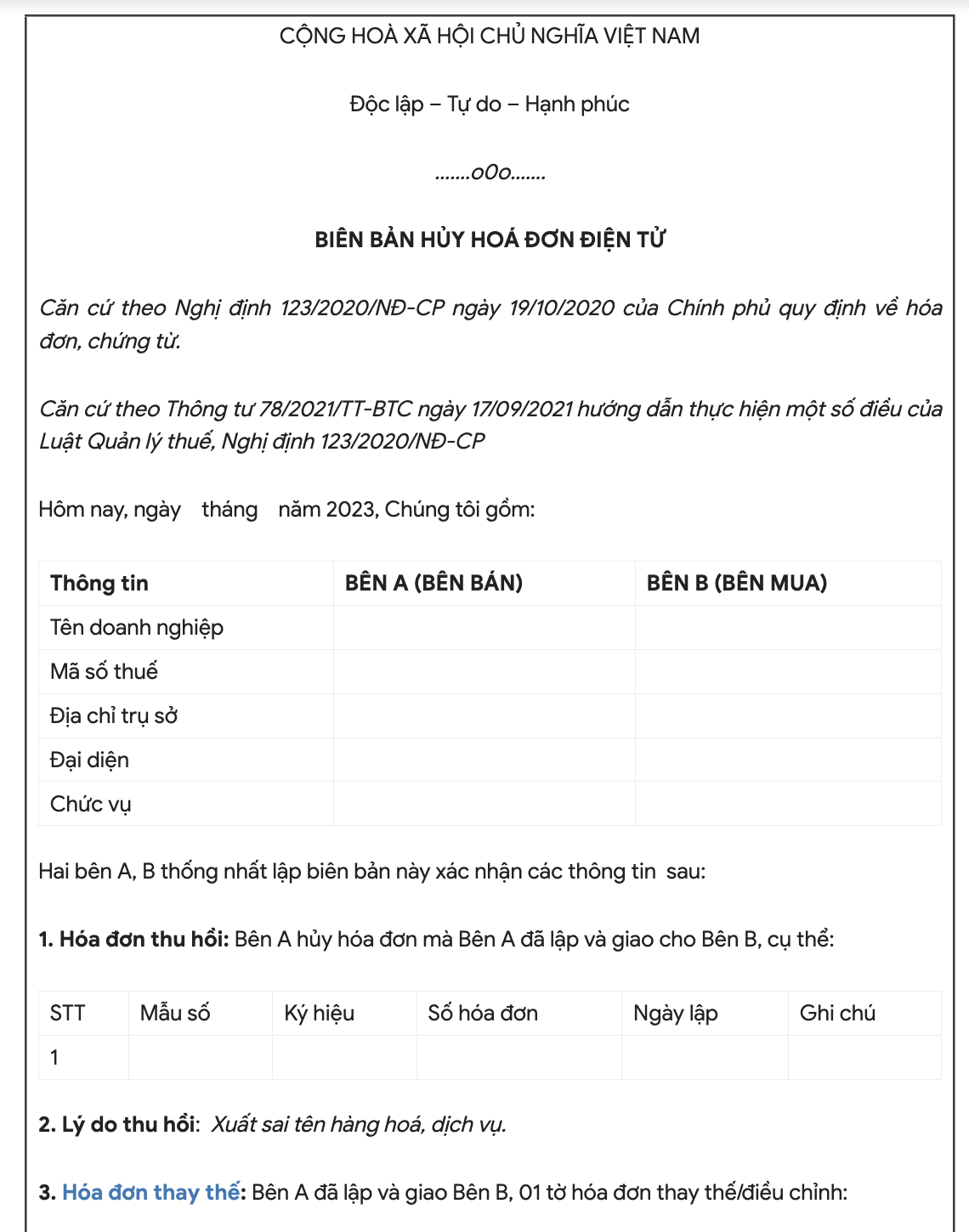

However, the main content of an electronic invoice cancellation record usually includes:

- Title: Minutes of cancellation of VAT/electronic invoice.

- Information of the parties: Name, address, tax identification number of seller and buyer. Representative and position.

- Canceled invoice information: Invoice number, symbol, invoice date, total invoice value (if any).

- Reason for canceling invoice: Explain the reason clearly. For example: Exported wrong name of goods or services.

- Replacement invoice information (if applicable): Invoice number, symbol, date of replacement invoice.

- Date of record: Date established.

- Other comments: (If any).

- Signature and Seal: Signatures and seals of representatives of the parties involved in the transaction.

Download free sample of electronic invoice cancellation form!