Creating a debt tracking table using Excel has been and is the choice of many businesses because Excel is an available tool, does not cost to buy specialized software, and can be customized according to needs. Besides the advantages such as simple interface, easy to use, the excel file template for debt management also has many disadvantages, causing difficulties in the comparison and tracking process.

The following article by Bizzi will provide some popular debt management excel file templates and an objective perspective on the advantages and disadvantages of customer debt tracking tables using Excel.

What is debt tracking?

Debts are divided into two types: receivables and payables.

- Accounts receivable: Amounts that customers owe to businesses after purchasing goods and services.

- Accounts Payable: Amounts that a business owes to suppliers after receiving goods and services.

Therefore, debt tracking is understood as the process of recording, managing and controlling receivables (customer debts) and payables (supplier debts) of the enterprise in each accounting period, to ensure timely payment and maintain stable cash flow.

Cash flow control can be done through a debt tracking table or debt tracking file. The debt management excel file template is a popular tool that many small businesses and start-ups choose for management.

Purpose of customer/business debt tracking table:

- Avoid forgetting or losing track of outstanding payments.

- Be proactive in debt collection and pay on time.

- Manage cash flow effectively.

- Limit the risk of bad debt and late payment.

What are the principles of creating a debt tracking file?

Creating an excel file template for debt management often depends on the management needs of each business. Below are some notes to help ensure that the debt tracking table reflects its true nature:

- Clear classification: Track receivables and payables separately, or divide by customer – supplier.

- Details of each transaction: Clearly state the date of occurrence, invoice, contract, amount, payment deadline.

- Real-time tracking: Continuously update the arising and payment amounts.

- There is a comparison column.: Need to show the amount collected/paid, remaining, debt status (on time, overdue).

- Archive relevant documents: Invoices, receipts/payments, contracts… for easy comparison when needed.

Summary of sample debt tracking using Excel

Below are sample suggestions to help businesses create a debt management file using Excel quickly and intuitively, meeting the needs of tracking and controlling basic receivables and payables in the business. There are 2 debt management file templates you need to pay attention to, including: Template for tracking arising, due and overdue debts; Template for tracking receivable and payable debts.

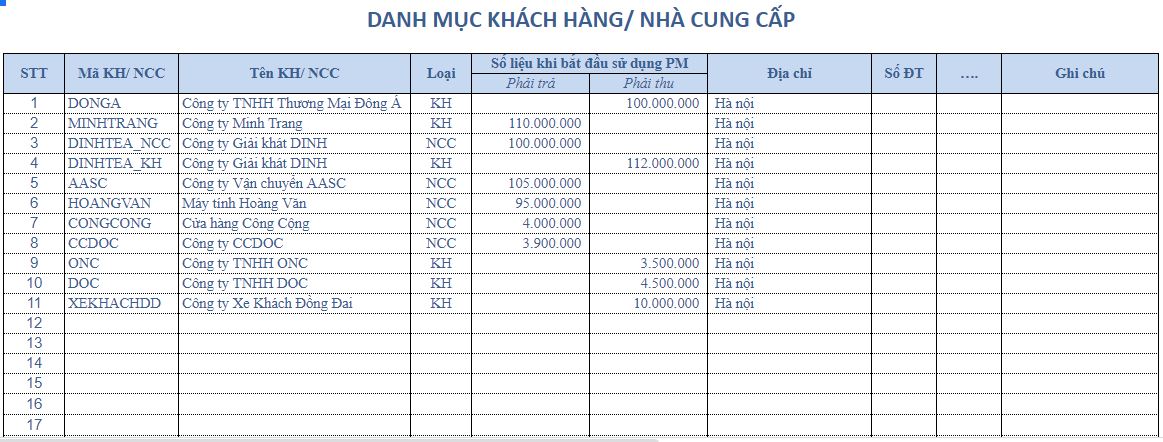

- Excel file template for managing receivables and payables: This debt tracking table is designed to manage customer/supplier catalog information including name, address, data when starting to use the software, customer/supplier code, phone number...

- Sample debt tracking in excel, manage arising - due - overdue: Use this template to manage detailed reports on sales and collection status of Sales staff; purchase and sale status of goods for customers and suppliers; debts for each customer, supplier, order and at each time.

- Detailed debt management excel file template: Debt tracking file This detailed debt book helps businesses closely monitor each customer's debt, which day the customer takes the goods, how much the total revenue is...

Advantages and disadvantages of creating a debt tracking table using Excel

Here's a detailed breakdown of the Excel debt tracking template, including its advantages, limitations, and recommendations for when businesses should switch to dedicated software:

| Advantage | Disadvantages |

| Low cost Excel is popular software, often pre-installed on computers, no additional software investment costs.Easy to use Accountants can easily enter data and calculate using basic formulas without requiring in-depth training. Flexible customization

Suitable for small businesses |

Easy to make mistakes in calculation A formula error or wrong cell can lead to serious discrepancies in accounts receivable data.No automation Excel does not have the feature of automatically reminding, reconciling or warning about due debts. Accountants have to do it completely manually. Data not synchronized

Difficult to scale

Not secure

No support for in-depth analysis reports |

When should you switch from Excel debt tracking templates to debt management software?

- When the business has 50 or more customers or debt transactions per month

- When you need to compare debt with PO, invoice, receipt, bank...

- When businesses want to optimize cash flow and increase debt collection rates

- When accountants must report quickly and accurately to management in real time

Bizzi – Specialized solution to help businesses manage debt professionally

With the limitations of Excel, many businesses tend to switch to using specialized debt management software.

Bizzi provides a comprehensive cost control system for businesses, acting as an AI assistant for the finance and accounting department in automating the revenue and expenditure process.

- Automatic debt reminder: Create debt reminder process according to script via email, text message.

- Debt control: Monitor, reconcile debt and indicators such as DSO, debt aging report.

- Track customer and supplier debt: Automatically record and track debts of each customer and each supplier.

- Debt due warning: Provides warnings when debts are nearing payment due date or show signs of overdue.

- Reconciliation of debts: Compare and confirm account balances with customers and suppliers.

- Create debt report: Create detailed reports on the company's debt situation.

Conclude

Debt management is an indispensable part of business operations of every organization and enterprise. The debt management Excel file is a useful and free tool, meeting the basic requirements of summarizing receivables and payables, especially suitable for small-scale enterprises.

However, when the amount of information is large or the business is complex, Excel reveals many limitations such as errors due to manual data entry, poor security, and difficulty in tracking debt age details. Therefore, consider switching from debt tracking tables to using professional debt management software such as Bizzi is a more optimal solution, helping businesses manage debt accurately, effectively, automatically and ensure data security, thereby maintaining financial stability and promoting growth.

If your business is looking for a specialized solution to solve the problems you are facing, contact Bizzi immediately for advice and product trial:

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo