Expenses that are not deductible when calculating corporate income tax in 2025 are those expenses actually incurred but do not meet the legal requirements or fall under the exclusion categories as stipulated in the Corporate Income Tax Law and the latest guiding documents (such as Decree 320/2025/ND-CP).

In this article, Bizzi will delve into an analysis of excluded expenses, how to account for them, and how to treat them in accordance with current tax regulations.

What are expenses that are not deductible when calculating corporate income tax? Why is it crucial for accountants to understand them?

Expenses that are not deductible when calculating corporate income tax are those expenses that have actually been incurred but do not meet the conditions under the Corporate Income Tax Law, and therefore cannot be included as reasonable expenses to determine taxable income.

Simply put: There's spending involved – but the tax authorities won't accept it.

Conditions for expenses to be deductible when calculating corporate income tax.

According to current regulations, an expense can only be deducted if it simultaneously meets three conditions:

- Issues arising in practice, related to production and business activities.

- We have all the necessary legal invoices and documents.

- Cashless payment is accepted for invoices of 20 million VND or more.

If any of the three conditions above are not met, the expense is not deductible.

Why do accountants need to have a thorough understanding of non-deductible expenses?

Accountants are the ones who sign documents and explain matters to the tax authorities. If accountants lack understanding, they will bear the greatest responsibility when risks arise. When accountants understand the nature of expenses that are not deductible when calculating corporate income tax, they will:

Avoid being charged back taxes, fines, and late payment interest.

When settling taxes, the tax authorities will:

- Non-deductible expenses

- Increase taxable income

- Collection of back taxes on corporate income tax + penalties + late payment fees.

A small mistake can cost a business hundreds of millions to billions of dong.

Avoid "false profits - real losses".

Businesses fail to anticipate tax payment cash flow, causing financial shock at the end of the year.

- Accounting records: expenses are recorded → perceived profit is low.

- Tax records: expenses disallowed → unexpectedly high profit

Reducing the risk of tax audits and inspections.

Unusual expenses, weak records, and risky invoices are first sign of being scrutinized During the audit, the accountant will have a clear understanding of the process. Proactive elimination – adjustment – early warning.

Compare deductible and non-deductible expenses.

- Deductible expenses = Includes expenses + Serves production and business + Valid invoice + Correct payment

- Non-deductible expenses = There is a cost, but Violation of a condition or exclusion by law

Here is a detailed comparison table:

| Criteria | Deductible expenses | Non-deductible expenses |

| Related to Production and Business | Yes, it can be proven. | Irrelevant or difficult to prove |

| Document | Invoice + contract + complete documentation | Missing invoice, invalid invoice |

| Pay | Amounts of 20 million or more must be transferred via bank transfer / no cash. | Amounts exceeding 20 million VND must be paid in cash. |

| Impact of corporate income tax | Reduce taxable income. | Being disqualified increases taxable income. |

37 types of expenses that are not deductible when calculating corporate income tax.

Below is 37 types of expenses that are not deductible when calculating corporate income tax., Okay divided into 5 major groups, with identifying characteristics of each group.

| Group | Nature of risk |

| Group 1 | Not for business/production purposes. |

| Group 2 | Incorrect – missing invoices or documents |

| Group 3 | Payment made in violation of regulations. |

| Group 4 | Being controlled, exceeding the permitted limits. |

| Group 5 | Completely excluded by law |

GROUP 1 – Expenses not related to production and business activities (8 items)

This group is characterized by actual expenses, but without verifiable links to taxable business activities. Taxes are often disallowed because they are considered personal – excessive welfare – or expenses paid on behalf of others.

List:

- Personal spending of business owners and executives.

- Expenses for activities unrelated to the registered business sector.

- Payments made on behalf of individuals but accounted for in the company's records.

- Employee benefits exceeding one month's average salary per year.

- Funding was disbursed to the wrong recipients or without proper documentation.

- Expenditures for internal operations not related to production and business activities.

- Personal entertainment expenses and gifts.

- Expenses for purchasing assets for personal use.

GROUP 2 – Expenses with incorrect/missing invoices and supporting documents (9 items)

This is the most common group of expenses that are not deductible when calculating corporate income tax during audits. Transactions exist, but the documentation is weak – risky invoices – and their authenticity cannot be proven.

List:

9. Expenses without invoices or supporting documents.

10. Illegal invoices (fake, fictitious, or invoices bought and sold)

11. Invoices with incorrect tax identification number, incorrect name, or incorrect content.

12. The invoice does not accurately reflect the actual transaction.

13. Invoices from businesses that have absconded or ceased operations.

14. Invoices from high-risk tax businesses.

15. Invoices issued at the wrong time according to regulations.

16. Incomplete internal documentation (contracts, minutes, etc.)

17. Expenses lacking sufficient documentation to prove the business relationship.

GROUP 3 – Expenses paid in violation of regulations (6 items)

This is the group Expenses that are not deductible when calculating corporate income tax. has gCorrect transaction and correct invoice. But the payment method is wrong. Accountants often become complacent because "the money has already been paid."

List:

18. Cash payment for invoices ≥ 20 million VND

19. Transferring funds to the wrong recipient.

20. Payment on behalf of someone else – using a personal account.

21. Offsetting debts in violation of regulations.

22. Payment without valid bank documents.

23. Payment not made in accordance with the method specified in the contract.

GROUP 4 – Excess and Controlled Expenses (7 items)

The characteristics of this group are not entirely excluded., But Any excess will be discarded; It's very easy to "slip through" during year-end settlement.

List:

24. Depreciation of fixed assets exceeding the prescribed limit.

25. Depreciation of fixed assets that do not meet the eligibility criteria.

26. Improper advance payment.

27. Interest rates exceed the permitted limit.

28. Interest on loans from ineligible borrowers.

29. Excess advertising and marketing expenses (if subject to limits)

30. Exceeding the permitted welfare spending limit.

GROUP 5 – Expenses Completely Excluded by Law (7 items)

The characteristic of group 5 is that even with a valid invoice and payment, they are still disqualified. Accountants need to identify these issues early on. no tax accounting

List:

31. Fines for administrative violations

32. Tax penalties and late payment fees.

33. Expenditures that violate the law.

34. Compensation payments not in accordance with regulations.

35. Illegally allocated funds.

36. Corporate income tax paid

37. Other expenses that are legally not deductible.

Can expenses without invoices ever be deductible? What are the exceptions?

The short answer is: YES – but very rarely and with strict conditions. Most uninvoiced expenses will be disallowed, however, the law provides for certain exceptions. exception It can still be deductible when calculating corporate income tax if the business prepares the correct replacement documents.

General principles to remember

Expenses without VAT/electronic invoices:

- Kno synonyms with "automatically eliminated"

- Still can be deductible If belongs to the group of exceptions permitted by law. and There are sufficient substitute documents.

EXCEPTIONAL cases – expenses without invoices are still deductible include:

Purchasing goods and services from individuals who are not engaged in business activities.

For example:

- Buy agricultural products directly from farmers.

- Buying scrap metal from individuals

- We purchase handicrafts, forest products, and natural seafood.

Required conditions:

- Set up Purchase order (according to the template - created by the business)

- There is a payment voucher.

- The purchase price is in line with market prices.

- VAT deductions are not applicable.

Deductible when calculating corporate income tax. if the application is complete

Payment to individuals providing services without issuing invoices.

For example:

- Hiring seasonal workers

- Hire individuals for minor repairs and loading/unloading.

- Hiring individuals for transportation without business registration.

Condition:

- Service/Collaboration Agreement

- Payment voucher

- Personal income tax deduction (if applicable)

- Have your personal ID card/citizen identification card.

No receipt. but it is still deductible.

Internal expenditure – no invoice generated.

For example:

- Travel allowance

- Telephone and fuel allowance

- Meal allowance

Condition:

- Have financial regulations / internal spending regulations

- There are decisions, time sheets, and payment records.

- Spending is directed to the right recipients and at the right rates.

No receipt needed → still deductible

This expenditure is mandatory according to government regulations.

For example:

- Social insurance, health insurance, and unemployment insurance contributions.

- Trade union funds

No receipt → fully deductible

Other specific expenses

These amounts are needed. complete alternative legal documents

- Depreciation expense of fixed assets (no invoices required for each period)

- Cost allocation for tools and equipment

- Contingency costs are calculated in accordance with regulations.

- The cost of paying wages in kind.

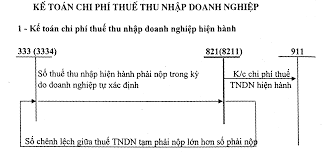

Accounting and treatment methods for expenses that are not deductible when calculating corporate income tax.

Non-deductible expenses are not written off from the accounting records, but are added to taxable income under item B4 on form 03/TNDN.

The key principle to remember: Expenses that are not deductible when calculating corporate income tax are still accounted for as usual. The "disqualification of expenses" is not recorded in the accounting books, but only performed during the corporate income tax final settlement.

Processing principle:

- Financial accounting: reflection accurate – complete – realistic all expenses incurred

- Tax accounting: adjustments as follows Corporate income tax regulations

How to create a cost adjustment appendix

Before preparing the 03/TNDN tax return, the accountant needs to:

- Create a list of non-deductible expenses.

- Classify them into groups, for example:

- Expenses without/invalid invoices

- Payments made in violation of regulations.

- Spending exceeds control limits.

- Fines, administrative violations, tax penalties…

This table is used for:

- Accumulate accurate data

- Explanation when the tax authorities conduct an audit.

How to enter data into the tax return form

- The total cost is not deductible.

- Enter this in item B4 – “Expenses not deductible when determining taxable income”

- On form 03/TNDN

The amount in B4 will increase taxable income and consequently increase corporate income tax payable.

Example of "Before - After Adjustment"

Suppose:

- Pre-tax accounting profit: 1,000,000,000

- Non-deductible expenses: 80,000,000

Before adjustment

- Taxable income: 1,000,000,000

- Corporate Income Tax (20%): 200,000,000

After adjustments

- Taxable income = 1,000,000,000 + 80,000,000

- = 1,080,000,000

- Corporate Income Tax (20%): 216,000,000

Additional tax: 16,000,000 due to non-deductible expenses.

5 common mistakes that lead to businesses having their expenses scrutinized during tax audits.

Below are the 5 most common mistakes that frequently lead to businesses being charged extra fees during tax audits and inspections, presented from a factual perspective – identifying the exact errors and consequences.

1. Thinking that "there is nothing that can be eliminated."

Businesses believe that as long as the money has been actually spent, the expenses will be accepted by the tax authorities. In reality, the tax authorities only accept expenses that meet legal requirements, regardless of subjective feelings about whether or not money was actually spent.

Consequence:

- A large number of costs were excluded.

- Collection of back taxes on corporate income tax + penalties + late payment fees.

2. Receive the invoice but do not check the seller's risk.

Many businesses Just check that the invoice "has all the necessary information," don't check:

- Is the issuing company currently operating?

- Are they on the list of high-risk or runaway businesses?

In practice, inspectors check invoices from businesses that have absconded or are high-risk businesses, and exclude expenses under code 100%, even if the transaction is genuine.

Consequence:

- Expenses excluded

- VAT is not deductible.

- Risk of being accused of using illegal invoices.

3. Making payments that violate regulations, even with a seemingly legitimate invoice.

Business I have a valid invoice, but:

- Cash payment ≥ 20 million

- Transfer to the wrong recipient.

- Borrowing a personal account to make payments.

Consequence:

- Expenses were discovered during the final settlement.

- There was no opportunity to "explain again".

4. Failure to separate accounting expenses and tax expenses.

Many businesses often have this habit:

- Remove the expense from the accounting records.

- Or, if you do not adjust the expenses, they will not be deductible on form 03/TNDN.

That's true:

- Accounting records: accurate and complete recording.

- Tax return form: adjusting taxable income upwards

Consequence:

- Inaccuracies in settlement figures.

- Easily accused of underreporting taxes.

5. Failure to prepare a summary of risk costs before the inspection.

Businesses make mistakes when Only gather supporting documents when requested by the tax authorities.

Reality, The tax authorities usually ask beforehand: "Has the business conducted a self-assessment and excluded any non-deductible expenses?"

Consequence:

- Passive when giving explanations

- It's easy to overcharge for expenses.

- Extend the inspection period.

Checklist for verifying valid expenses before finalizing the report.

Don't wait for inspectors to review your costs; businesses need to be well-prepared by following the cost audit checklist below.

| # | Content of the test | Requirements met |

| I | PURPOSE OF EXPENSES | |

| first | Do these expenses serve the business operations? | Directly/Indirectly related |

| 2 | Suitable for the registered business activities. | Have |

| 3 | Not for personal expenses. | Define clearly |

| II | INVOICES – DOCUMENTS | |

| 4 | There is a valid invoice. | Valid electronic invoice |

| 5 | Accurate invoice information | Name, Tax ID, content |

| 6 | The invoice accurately reflects the actual transaction. | In accordance with the contract |

| 7 | The seller is operating legally. | No fleeing/risk |

| 8 | Invoices are issued at the correct time. | According to regulations |

| III | ATTACHED DOCUMENTS | |

| 9 | A contract is required (if needed). | Correct content |

| 10 | There is an acceptance/handover report. | Full |

| 11 | There are statements and allocation tables. | Fit |

| son-in-law | PAY | |

| 12 | Invoices of 20 million VND or more must be paid without cash. | Transfer |

| 13 | Transfer the money to the correct recipient. | Name duplicated in contract |

| 14 | There is a valid bank statement. | Bank statement/UNC |

| V | SPECIFIC LIMITATIONS & REGULATIONS | |

| 15 | Costs will not exceed the limit. | Right ceiling |

| 16 | Depreciation of fixed assets in accordance with regulations. | Eligible |

| 17 | Interest rates will not exceed the permitted limit. | Correct proportions |

| 18 | Not subject to exclusion under the law. | No penalty, violation |

| VI | TAX RISK ASSESSMENT | |

| 19 | Clearly define the cost of risk. | There are notes |

| 20 | Deductible/non-deductible expenses have been categorized. | Clear |

| 21 | Prepare a summary table of non-deductible expenses. | Ready |

| VII | PREPARING FOR FINANCIAL SETTLEMENT | |

| 22 | Non-deductible expenses have been added to form B4-03/TNDN. | Correct number |

| 23 | Complete documentation is available. | Easy to search |

Utilize technology (Bizzi, ERP, etc.) to minimize non-deductible expenses when calculating corporate income tax.

Reducing disallowed expenses doesn't lie in the settlement process, but in how businesses control costs from the outset.

In the context of increasingly stringent tax regulations, the application of cost management platforms like Bizzi and ERP is no longer considered an "advanced" feature, but is gradually becoming a safe financial management standard for businesses.

1. Problems with manual cost control methods

In reality, many businesses still control costs using: Excel spreadsheets, paper documents, and manual visual inspection.

The biggest limitation:

- It's easy to miss out on risky invoices.

- Failure to detect payment errors early

- Lack of connection between invoices, contracts, and payments.

- The error was only discovered during the final settlement, by which time it was too late.

This is the main reason why expenses are often disallowed during tax audits.

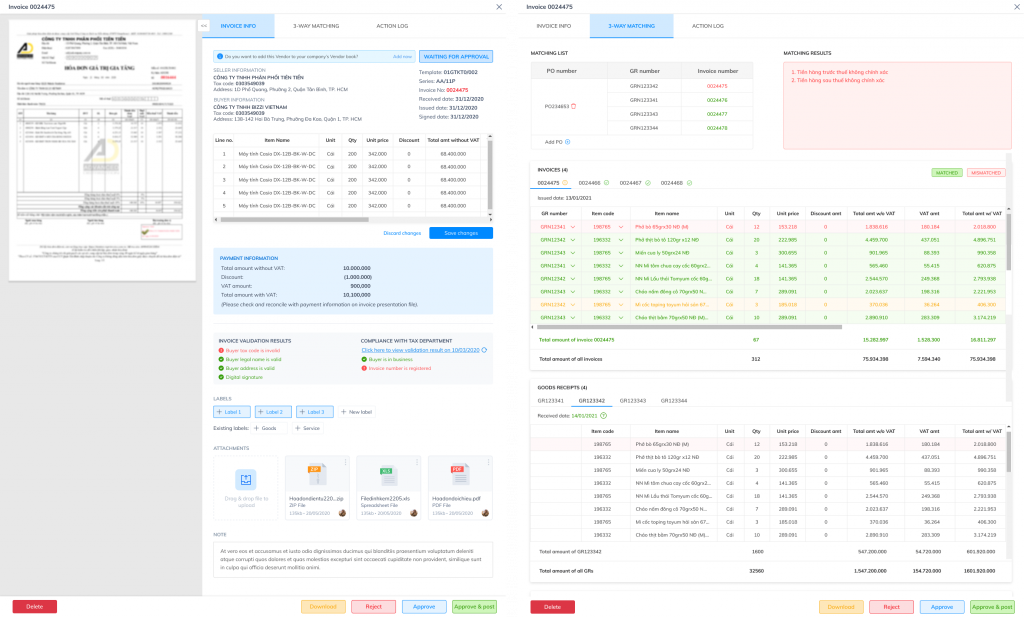

2. How is technology changing the way we control costs?

2.1. Automatically collect and verify input invoices.

Instead of accountants having to manually upload invoices or monitor each item, platforms like Bizzi allow:

- Automatically collect input invoices from multiple sources.

- Reading invoice data (OCR + AI)

- Verify the validity, completeness, and logic of the content immediately upon receipt.

Reduce the risk of incorrect invoices or invoices that are not eligible for deduction.

2.2. Early Warning for Risky Invoices & Suppliers

One of the biggest risks when settling accounts is: invoices that are formally valid but issued by risky or absconding suppliers, avoiding the situation where "the invoice is only discovered to be problematic during an audit."

Technology helps:

- Compare the supplier against the risk list.

- Early warning system for potentially dangerous bills.

- Proactively address, replace, or exclude expenses before filing.

2. 3. Attach invoices to each payment request, contract, or project.

Cost control is not just about "having invoices," but about:

- Which contract is this invoice associated with?

- Which project are you serving?

- Payment for which offer?

Cost management platforms allow for:

- Linking invoices – contracts – payment requests – projects

- Quickly trace all records when explanations are needed.

Increase the ability to prove the costs incurred in production and business activities, a decisive factor when being audited.

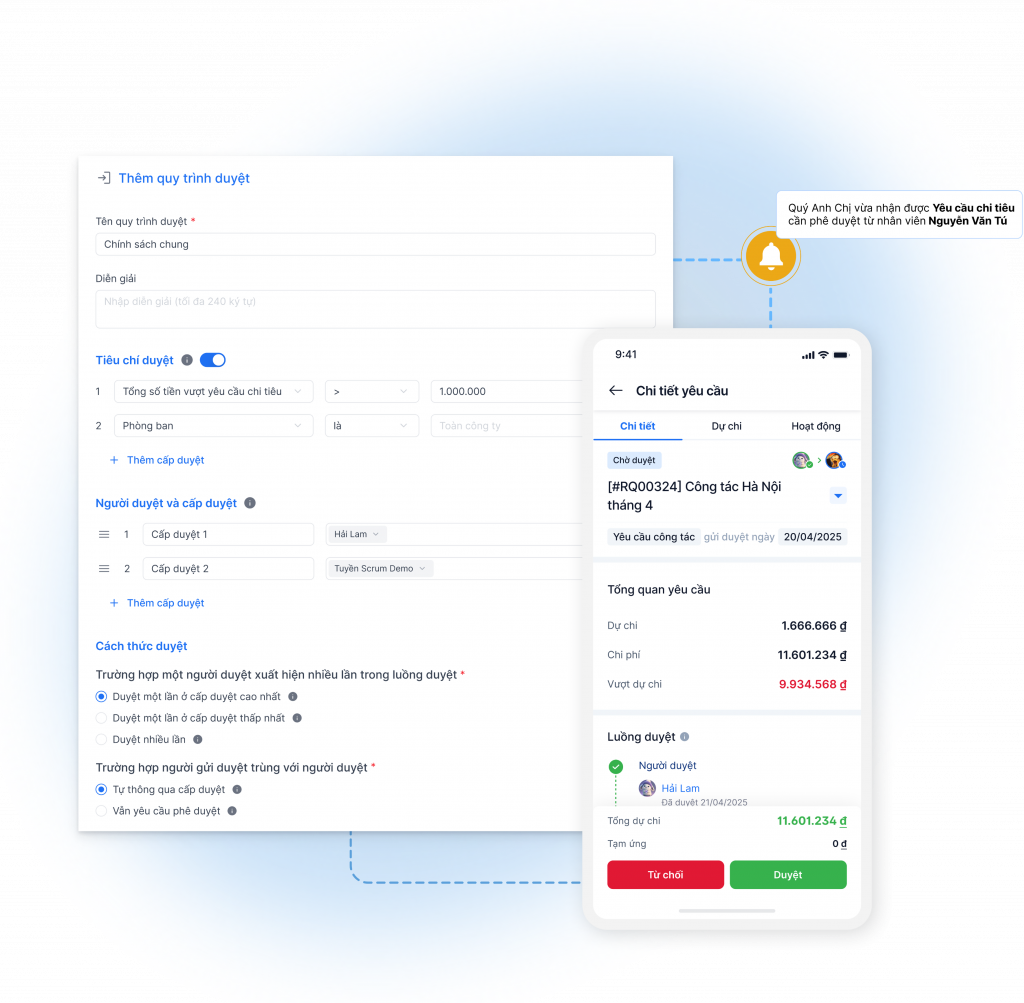

2.4. Control costs right from the approval stage – before payment.

Instead of: Pay first – process taxes later. The technology system forces:

- The file must include contracts, invoices, and supporting documents.

- The approval process was followed correctly.

- Correct payment method

Ineligible expenses will not be approved for payment, significantly reducing the number of expenses rejected later on.

2.5. Automatically classify deductible/non-deductible expenses.

When it's time for final settlement:

- Accountants often have to compile data manually.

- Easily overlooked or mistaken.

With the Bizzi cost management platform:

- Costs are automatically grouped according to tax criteria.

- Generate expense reports: Deductible, Non-deductible, Tax-risky.

Bizzi provides direct support for item B4 on form 03/TNDN, reducing time and risk during tax settlement.

3. Practical benefits for businesses

The application of technology not only helps:

- Non-deductible expense reductions are not allowed when calculating corporate income tax.

- Reduce the risk of back taxes, penalties, and late payment interest.

Moreover:

- Elevating the role of accounting from "bookkeeping" to controlling financial and tax risks.

- Helping leaders make controlled spending decisions.

Frequently Asked Questions about Non-Deductible Expenses When Calculating Corporate Income Tax

Below is a compilation of some frequently asked questions regarding expenses that are not deductible when calculating corporate income tax.

Are salary expenses incurred without a labor contract deductible?

The cost may be deductible, but sufficient supporting documentation is required. Deductible if applicable:

- Recruitment/Assignment Decisions

- Time sheet

- Payroll

- Salary payment vouchers

- Withdraw and declare personal income tax (if applicable).

Expenses are not deductible when calculating corporate income tax if:

- There are no records proving the employment relationship.

- No actual payment

Can interest on loans be deducted before the full amount of the registered capital is paid?

Interest corresponding to the unpaid portion of the registered capital cannot be deducted.

How to handle it:

- Determine the percentage of uncontributed capital.

- Corresponding type of interest expense

- The remaining amount (if conditions are met) will still be deducted.

How should we handle spending over 5 million VND on clothing?

Any amount exceeding 5 million will not be deducted.

Specifically:

- ≤ 5 million VND/person/year → fully deductible

- 5 million → excess amount will be disallowed during final settlement.

Note: This applies to monetary expenditures; there are no restrictions on in-kind donations of clothing as stipulated by regulations.

Should benefits exceeding one month's average salary be immediately excluded?

It is not immediately excluded from the accounting records; it is only excluded during tax settlement.

The correct way to handle it:

- The expenses are still accounted for as usual.

- When settling corporate income tax:

- Calculate the average monthly salary.

- Excess expenditure → Adjusting taxable income upwards at B4 – 03/TNDN

If a purchase invoice is invalid, can the expense still be deducted?

Invalid invoice. No deduction allowed. But if:

- Invalid invoice

- Invoices from businesses that have absconded pose a risk.

- The invoice does not accurately reflect the transaction.

The expense will be disallowed (100%) during final settlement.

Should non-deductible expenses be written off from the books or simply adjusted on the tax return?

ARE NOT.

The correct way to handle it:

- Full accounting records are still being maintained to accurately reflect actual costs.

- Do not delete or disallow from the ledger.

When settling accounts:

- Total non-deductible expenses

- Add these to taxable income under Item B4 – “Non-deductible expenses” on Form 03/TNDN.

Conclude

Expenses that are not deductible when calculating corporate income tax are not "incorrect expenses," but rather "tax-unacceptable expenses." The majority of the risk doesn't stem from excessive spending by businesses, but rather from improper spending conditions, weak documentation, and delayed oversight.

In practice, control using Excel and manual verification:

- It's easy to miss out on risky invoices.

- Missing document link

- The error was discovered too late.

Expense and invoicing management platforms like Bizzi help businesses:

- Automatically collect and read input invoice data.

- Verify the validity and issue warnings for risky invoices.

- Link invoices to contracts, payment requests, and projects.

- Require complete expense documentation before approving payment.

- Automatically aggregates expenses by deductible/non-deductible categories, directly supporting corporate income tax settlement.

Technology doesn't replace accounting decisions, but it helps accountants gain better, earlier, and more secure control. To receive personalized advice on solutions tailored to your business, register here: https://bizzi.vn/dang-ky-dung-thu/