Financial statements (FS) are a core set of legal documents, including 4 main reports (FS, BCKQKD, BCLCTT, TMBCTC). For CFOs and Chief Accountants, automating the input financial process (such as invoices, expenses and debts) is a key factor to ensure timely and accurate FS and serve strategic decision making. Let's join Bizzi to learn more about related information in the article below.

Overview of Financial Statements (FS)

Below are the concepts, purposes and roles of financial reports in businesses:

What is a financial report?

It is a system of documents that provide comprehensive information on the business and economic performance and profitability of an enterprise over a specific period of time (quarter or year). In addition, financial statements are also a system of economic and financial information of an accounting unit, presented according to the form prescribed in accounting standards and current accounting regimes.

Types of financial statements reflect the situation of assets, equity, liabilities, business results and the turnover of funds. cash flow in and out of the business during the period. Therefore, all businesses, regardless of size, must prepare and submit accurate financial reports on time, in compliance with legal regulations.

The main purpose of financial statements

- Provide information: On the financial situation, business and cash flows of the enterprise clearly and transparently.

- Meet management requirements: Of business owners, government agencies and the useful needs of users in making economic decisions.

- Details: Including Assets, liabilities, equity, revenue, other income, business expenses, profit/loss and division of business results, cash flows.

- Additional explanation: The accounting policies and indicators applied are further explained in the Notes to the Financial Statements.

The essential role of financial reports in business

- Reflecting the overall business situation: Current status of assets, debts, sources of assets, business results and financial situation.

- Provide data for planning and management: Support production and business planning, monitor and supervise capital usage, and formulate policies for asset management, capital mobilization and cash flow.

- Economic decision support for the following subjects:

- Business owners and managers: Rely on data in various types of financial reports to make important decisions, identify trends, potential barriers, monitor financial performance, optimize business.

- Investors, creditors, banks: Assess risk, financial potential, solvency and profitability to decide on investment, lending or expanding credit relationships.

- Workers: Understand the business's operating situation and growth potential to make appropriate decisions for the job.

- State management agencies: Perform the function of inspecting, checking, supervising compliance with the law and determining the amount of tax payable by the enterprise.

- Simplify Taxes and Ensure Compliance with the Law: Required for tax purposes, reduces errors, saves time, ensures company compliance.

- Financial transparency and building trust: Demonstrate financial integrity, creating trust with investors and potential customers.

- Types of financial reports that are the basis for detecting market potential: Predict operational trends to make effective strategic decisions.

Analysis of 4 types of financial statements according to Vietnamese accounting standards (VAS)

Financial statements are classified based on various criteria, providing a multi-dimensional view of a business's financial situation.

Financial statements according to the reflected content (Set of main financial statements)

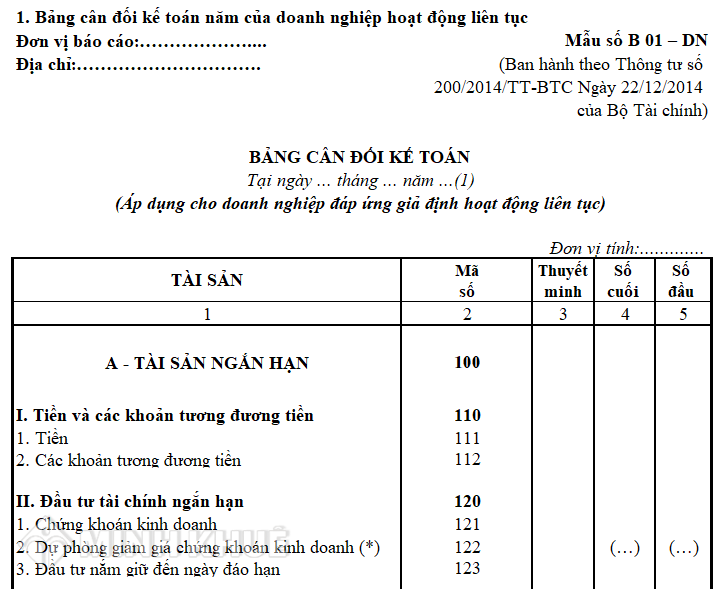

- Balance Sheet:

- Concept and meaning: Reflects the assets, liabilities and equity of a business at a specific point in time. Helps assess solvency and asset and capital structure.

- Main ingredients:

- Asset: Cash, fixed assets, inventories, receivables, financial investments, investment real estate, construction in progress and other assets.

- Liabilities: Payables to suppliers, salaries to employees, prepayments from buyers, amounts payable to the State, welfare reward funds, provisions for payables and other payables.

- Equity: Owner's equity, funding sources and other funds.

Income Statement / Statement of Profit or Loss:

-

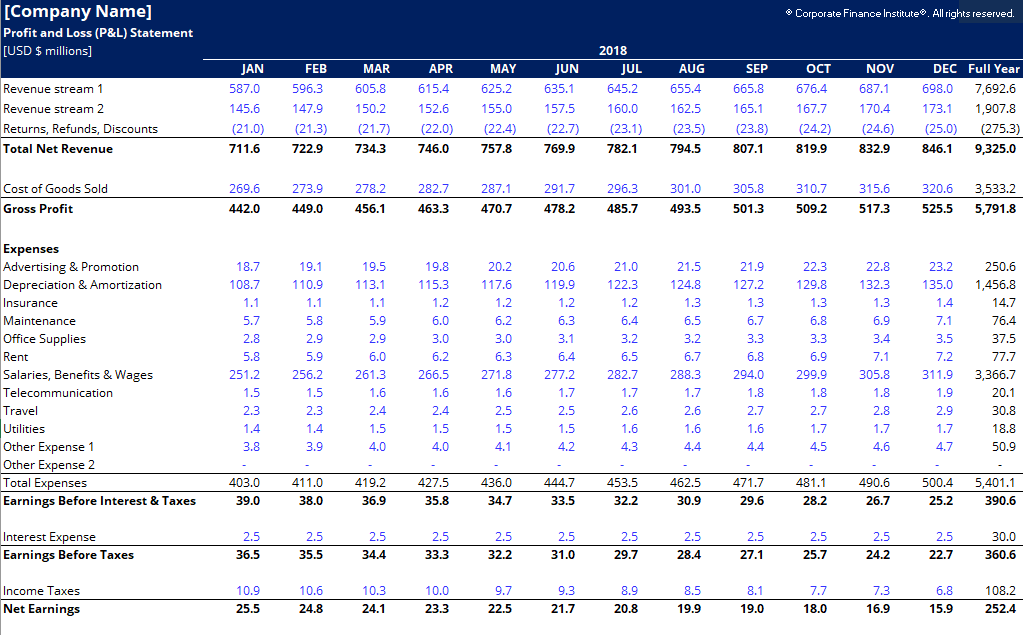

- Concept and meaning: Shows the revenue, expenses and profit (or loss) of a business over a certain period of time (month/quarter/year). Shows the financial performance of the unit.

- Main ingredients: Revenue/net revenue from sales, service provision, cost of goods, gross profit, financial expenses, selling expenses, administrative expenses, total accounting profit before tax, corporate income tax expense, profit after corporate income tax, other income, other expenses, other profits. Tight control of costs (financial, sales, administrative) is the key to optimizing Net Profit and is the basis for investment decisions in automation.

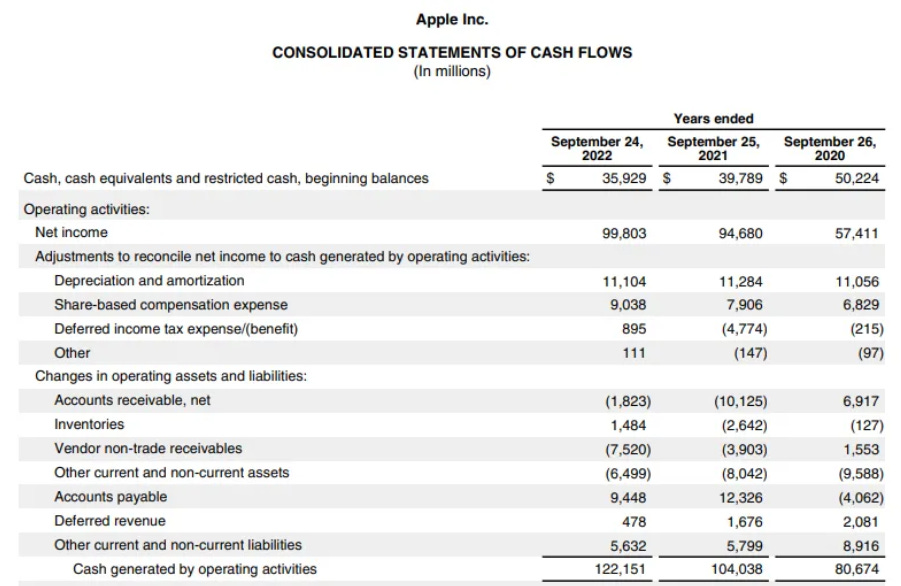

Cash Flow Statement:

Cash Flow Statement:

- Concept and meaning: Shows the cash flows in and out of a business over a given period of time. Provides information about the business's ability to generate cash, its ability to pay, and its ability to use cash to invest and expand its operations.

- Types of cash flows: Cash flow from operating activities, cash flow from investing activities, cash flow from financing activities. Cash flow from operating activities is directly affected by the performance of debt management and input invoice reconciliation. Having real-time data helps forecast and manage the cash flow statement more effectively.

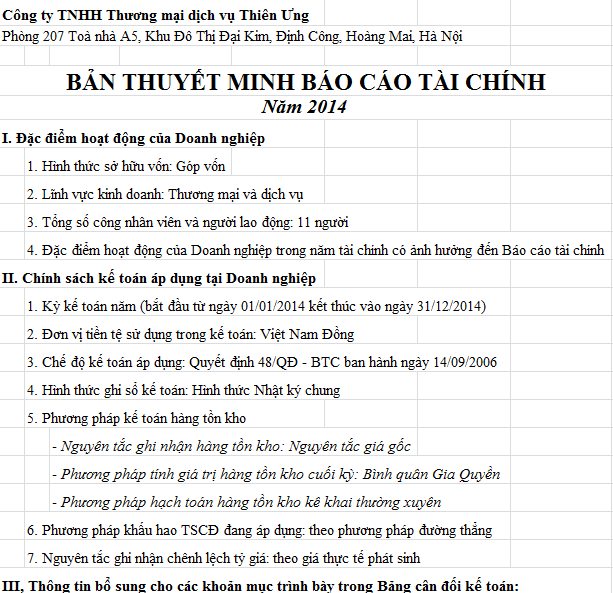

- Notes to Financial Statements:

- Purpose and main content: Explain and provide additional details on indicators that other financial statements do not clearly or fully reflect. Including business characteristics, applied accounting policies (accounting period, accounting regime, recording method, valuation, depreciation, etc.), additional information on items.

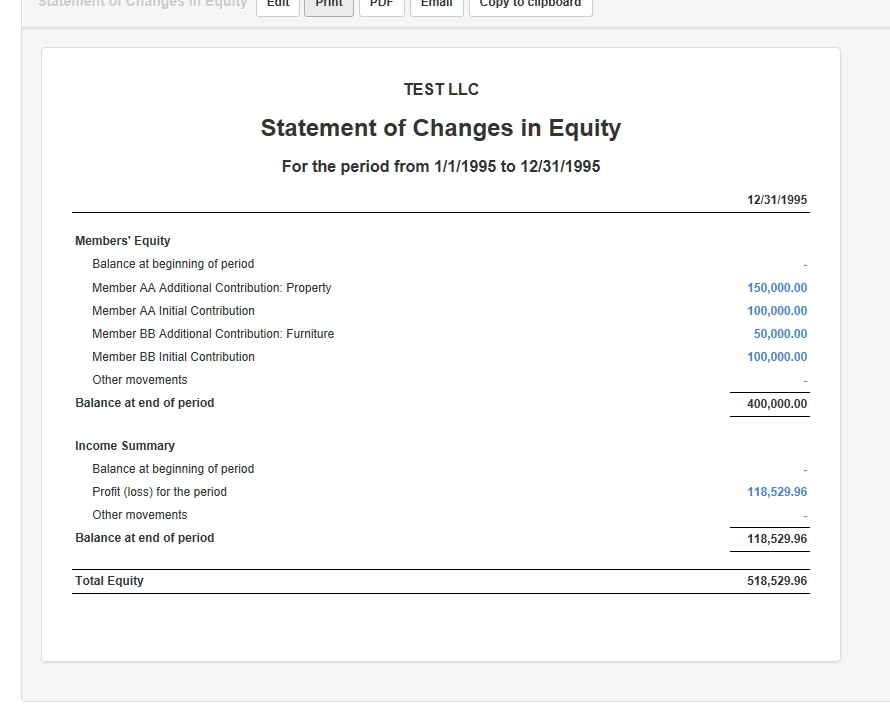

- Statement of Changes in Equity:

- Concept and meaning: Shows the change in equity in a given period in the most concise and specific way.

- Factors that increase/decrease equity: Increase due to owners' investment and net profit increase during the period; Decrease due to owners' withdrawal of capital or from net loss during the period.

Financial statements by preparation time

- Annual financial report: Prepared at the end of the calendar year or 12-month accounting period, mandatory for all businesses.

- Interim financial report: Prepared for each quarter of the fiscal year (except the fourth quarter) and semi-annual reports. Required for state-owned enterprises and listed companies; may be prepared in full or summary form.

Financial reporting by information coverage (Business model)

- Stand Alone / Separate Financial Statement: Reflects general information of an independent business or parent company.

- Consolidated Financial Statement: Summarizes the entire financial and business situation of the entire group (including parent company, subsidiaries and associated joint ventures), presented as the report of a single enterprise.

- Explanation of subsidiaries (controlling over 50% of capital/shares) and joint ventures/associates (significant influence, ownership 20-<50%).

- Specific indicators only available on consolidated financial statements such as Goodwill and Non-controlling Interest.

- Consolidated financial statements: Established by superior units to synthesize information of the entire system including affiliated units (for example, a state-owned corporation has no subsidiaries).

Core Legal Regulations on Preparation and Submission of Financial Statements (VAS and IFRS)

Standards: Financial statements must strictly comply with legal regulations. Specifically, for large enterprises in Vietnam, financial statements are prepared according to Circular 200/2014/TT-BTC; meanwhile, small and medium enterprises (SMEs) apply Circular 133/2016/TT-BTC.

Mandatory principles:

- The preparation of financial statements must comply with basic accounting principles such as the Accrual Basis, Going Concern and especially the Timeliness principle. Financial statements are only truly valuable when they are prepared and presented at the right time, accurately reflecting the financial situation at that time.

Submission Deadline:

- According to the provisions of the Accounting Law, the deadline for submitting financial statements varies depending on the type of enterprise and the accounting period. Normally, for other accounting units, the deadline for submitting annual financial statements is a maximum of 90 days from the end of the annual accounting period. For quarterly reports, the deadline is 45 days from the end of the quarter.

Place of submission:

- Financial statements are submitted to state management agencies such as the Tax Department, the Statistics Department, and the Department of Planning and Investment. In particular, for companies listed on the stock market, submitting financial statements to the State Securities Commission (SSC) is mandatory to ensure transparency and provide information to investors.

Technology solutions support the creation and management of all types of financial reports effectively.

Below is a summary of modern technology solutions that help create and manage all types of financial reports effectively, suitable for internal documents, accounting - finance training, or corporate communications:

The Importance of Software in Modern Corporate Financial Management

Applying technology is a smart choice for businesses to save time in processing invoices and reports, minimizing the risk of fraud or manual errors.

- Automate, increase speed and accuracy: Accounting software helps automatically synthesize data and extract financial reports, ensuring timely and accurate submission of reports. Minimize the risk of errors and save time.

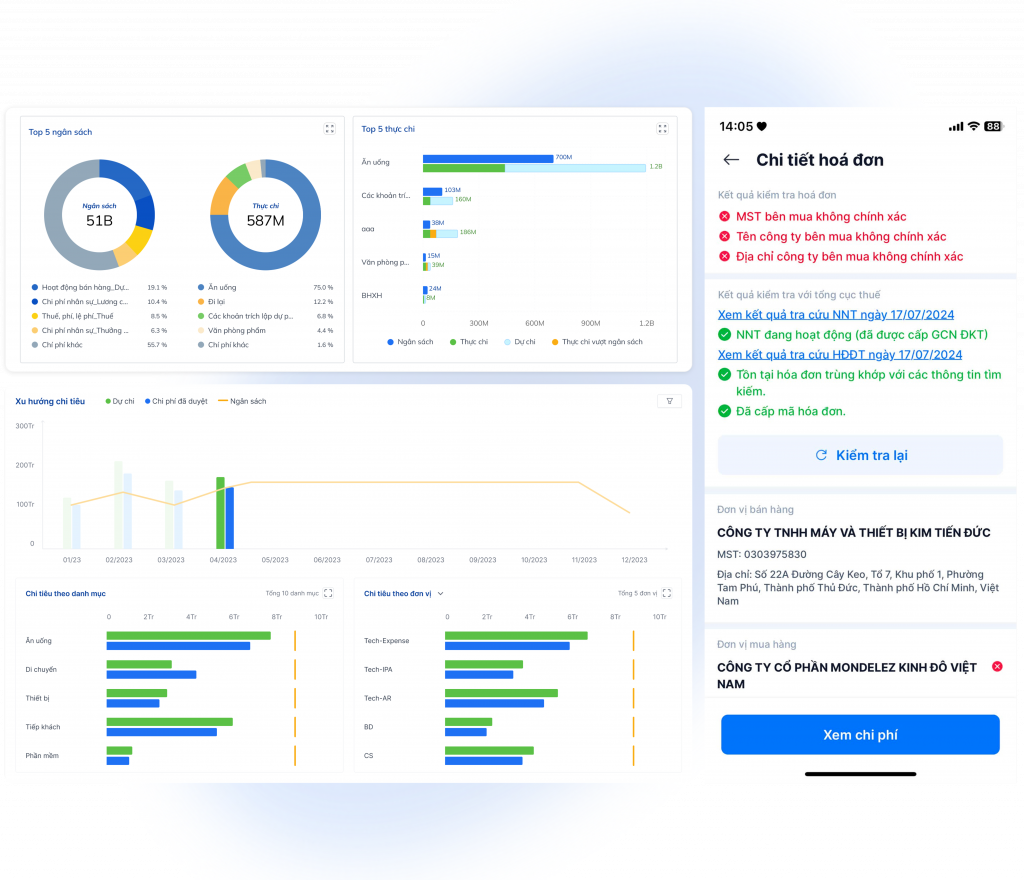

- Optimize input data management: Bizzi solutions like Invoice Processing Automation (IPA) help automate real-time 3-way validation and reconciliation (invoice, PO, warehouse receipt), vendor verification, risky invoice alerts, and API integration with ERP & Accounting systems.

- Manage expenses and debt effectively: To simplify expense management, budgeting, automatic approvals, real-time tracking, expense reporting, features Bizzi Expense and Bizzi Travel will automatically provide accurate input data for the report. At the same time, based on the updated data from the accounts receivable management (ARM), managers can automatically monitor, remind debts, and reconcile customer and supplier debts.

- Ensuring legal compliance and financial transparency: Businesses need software to help ensure compliance with government regulations on invoices and input processing to avoid counterfeiting. B-invoice is the solution. This solution from Bizzi helps create electronic invoices according to regulations, store invoices, and connect directly to the tax authority system for authentication.

- Provide instant data for strategic decision making: Data from various financial reports will be fully aggregated and displayed on the system, helping managers have an accurate and quick view to make timely economic decisions.

Conclude

In short, Financial Statements are a set of accounting reports that reflect the financial situation, business performance, and cash flow of an enterprise in a certain accounting period (month, quarter or year). This is the core data source for businesses, investors, tax authorities, banks and other stakeholders to assess financial health and make strategic decisions. Therefore, it is necessary to master the principles of preparing financial reports accurately and promptly.

At the same time, the application of modern technological solutions such as Bizzi.vn to automate financial processes, improve efficiency and accuracy in financial reporting, thereby optimizing management and making effective business decisions in an increasingly competitive market. Many large enterprises such as GS25 and La Vie have applied Bizzi to optimize the reconciliation process and ensure that financial statement data is always accurate and timely. This proves the experience and reputation of Bizzi's solution in the market.

To get advice and design a financial management solution specifically for your business, register for consultation here:https://bizzi.vn/dat-lich-demo/

Cash Flow Statement:

Cash Flow Statement: