Not only accountants – but also directors, investors, banks, shareholders… all need to understand and rely on financial reports to make accurate decisions. Therefore, understanding and analyzing corporate financial reports is an important and indispensable step in the process of corporate governance – whether it is a startup, small and medium-sized enterprise or large corporation.

This article by Bizzi will provide useful information on how to analyze corporate financial reports, helping leaders have a comprehensive view of the financial situation of the enterprise to make accurate and timely decisions.

Financial Statement Analysis: Turning Accounting Data into Practical Action Strategies

More than just “looking at numbers,” analyzing a company’s financial statements helps turn accounting data into actionable strategies. If an accountant only prepares reports without analyzing them, he or she has only completed 50% of financial work.

Definition of Corporate Financial Statement Analysis

Corporate financial reports is the process of reviewing, evaluating and interpreting information presented in financial statements to measure the performance, profitability, financial position and potential risks of an enterprise.

This process is based on data in basic financial reports (Balance Sheet, Income Statement, Cash Flow Statement, Notes to Financial Statements) combined with analytical methods (comparison, financial ratios, trends, structures, etc.) to provide objective assessments and support management, investment or credit decisions.

The Importance of Corporate Financial Statement Analysis for Every Position in a Company

Analyzing corporate financial statements is not only the job of the accounting department but also a strategic tool for all departments and leadership levels. Each position in the organization has a different perspective and need to exploit financial information, thereby forming accurate and timely decisions.

1. For administrators

Financial statements are “maps” that help management determine the current position and future direction of the business. Through analysis, managers can:

- Evaluate the performance of each department, project or product.

- Identify strengths to promote, and identify weaknesses that need improvement.

- Detect early signs of risk such as declining profits, cash flow imbalances or increasing debt burden.

- Make strategic decisions: expand markets, restructure operations, cut costs or raise capital.

2. For investors

Investors need a comprehensive picture of a company’s profitability and growth before investing. Financial statement analysis helps them:

- Evaluate profit potential and profitability.

- Compare performance with other businesses in the same industry.

- Determine financial risk to consider investment ratios and stock holding strategies.

3. For banks and credit institutions

- Lending institutions use financial statements as a tool to assess a business's reputation and ability to repay its debts. The analysis helps them:

- Determine short-term and long-term solvency.

- Assess cash flow stability and ability to generate profits to repay debt.

- Minimize credit risk and set appropriate lending limits.

4. For suppliers

When providing goods or services, suppliers need to ensure that their partners are able to pay on time. Financial statement analysis helps them:

- Assess financial health and affordability.

- Decide on trade credit terms.

- Maintain a sustainable partnership based on trust.

5. Modern technology – the “right arm” of financial analysis

In the era of strong AI development, the application of technology solutions helps businesses process data faster, more accurately and more transparently than ever. A comprehensive financial management platform like Bizzi brings many outstanding benefits:

- Transparent financial data, updated real-time: All reports and data are synchronized as soon as a transaction occurs.

- Automatically collect – check – classify invoices, documents, and expenses: Minimize manual errors, save data entry time.

- AI assistant analyzes and visualizes data: Support management and departments to make quick and accurate decisions.

- Ensure compliance with accounting standards and tax regulations: Minimize legal risks and costs of handling violations.

Bizzi not only serves the accounting department but is also the platform for the entire business to operate based on. Accurate, transparent and easily accessible financial data, creating sustainable competitive advantages in the market.

Prepare for Analysis: Define Objectives and Check Reliability

For an effective financial statement analysis process, thorough preparation is the first and most important step. This includes clearly defining the analysis objectives and especially checking the reliability of the financial data.

In particular, the auditor's opinion is an extremely important indicator of the reliability of the numbers in the financial statements. Before delving into the analysis, you need to understand the meaning of each type of audit opinion and its impact.

There are four main types of audit opinions:

- Full acceptance opinion (Unqualified Opinion): This is the best opinion, showing that the financial statements honestly and fairly reflect the financial situation, business performance, and cash flow of the enterprise according to current Accounting Standards. Investors and banks can completely trust these numbers to make decisions.

- Partial Acceptance/Exception (Qualified Opinion): The auditor discovers one or more issues that are inconsistent with accounting standards but do not materially affect the entire report. This opinion warns users to carefully review the excluded items, as they may partially distort the overall view of the business.

- Opinion not accepted (Adverse Opinion): This is the most serious opinion, indicating that the financial statements contain material and pervasive misstatements that are unacceptable. This opinion is a big red flag, warning investors/banks that the financial statements are unreliable and should not be used to make any important decisions.

- Refused to comment (Disclaimer of Opinion): The auditor is unable to express an opinion because he has not obtained sufficient and appropriate audit evidence, or because there are too many limitations in the scope of the audit. Like an adverse opinion, this opinion also indicates that the financial statements are not reliable because there is no assurance of truth and fairness.

Checking the auditor’s opinion at the outset will help you assess the “quality of the raw data” you are analyzing. A financial statement with an adverse or disclaimer opinion is almost worthless in making investment or lending decisions.

Core Financial Statements to Understand

Financial statements are not just a collection of dry numbers prepared according to accounting regulations, but a tool that reflects the “health” and “blood” of a business. They allow managers, investors, banks, suppliers, etc. to understand the overall picture of the financial situation, thereby making accurate decisions.

According to Vietnamese Accounting Standards (VAS), a basic set of financial statements includes four components: Balance Sheet, Income Statement, Cash Flow Statement and Notes to Financial Statements. Of these, the first three are the backbone of the analysis process.

Here is the full summary types of financial reports in the enterprise, including mandatory reports according to Vietnamese accounting standards (VAS):

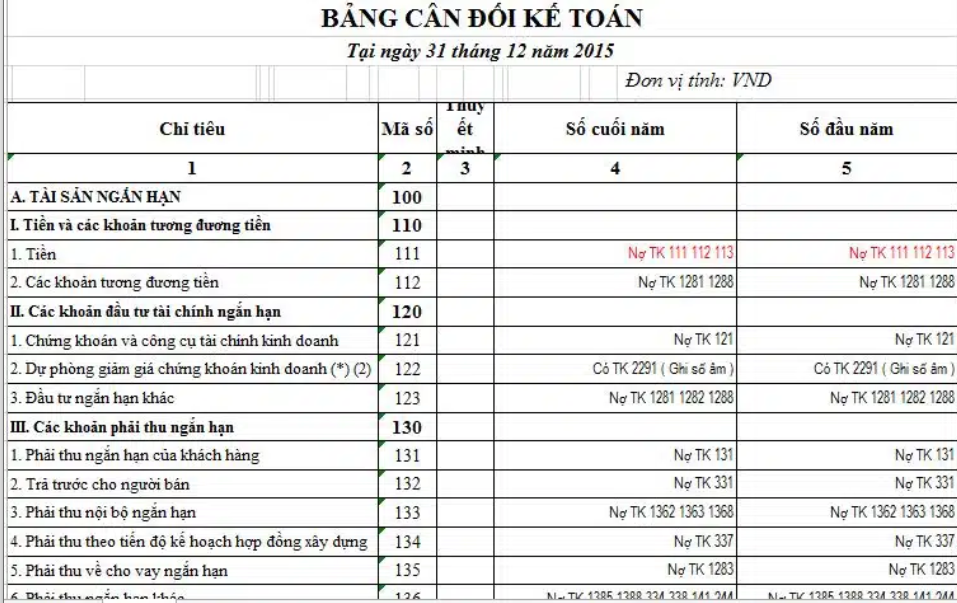

Balance Sheet (BSC): A Snapshot of Financial Health

The balance sheet shows all the assets a business owns and the capital used to create those assets at a specific point in time (for example, December 31 of the fiscal year).

- Structure:

- Asset – Includes short-term assets (cash, inventory, receivables…) and long-term assets (factories, machinery, real estate, intellectual property rights…).

- Capital – Including liabilities (short-term, long-term) and equity (contributed capital, undistributed profits…).

- Analysis objectives:

- Assessment of short-term solvency: Compare current assets with current liabilities to see if a business has the ability to pay its debts as they come due.

- Determine capital structure: How much % of borrowed capital is the business using compared to its own capital? Is the financial leverage ratio safe?

- Measuring stability: A healthy balance sheet usually has a balance between profitable assets and stable capital sources, limiting too high short-term debt.

- Real life example:

A company A has short term assets 200 billion, short-term debt 150 billion → Current ratio = 200/150 = 1.33This shows that the company has enough short-term solvency but the margin of safety is not too high.

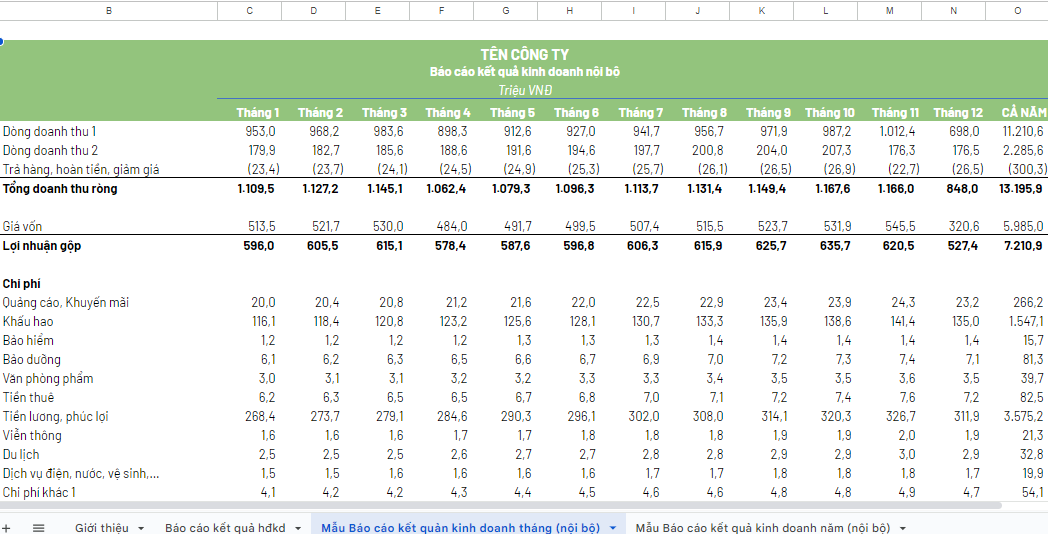

Business performance report (BCKQHDKD): Assessing profitability

This report reflects revenue, expenses, and profits over an accounting period (month, quarter, or year).

- Main structure:

- Sales and service revenue

- Cost of goods sold → create gross profit

- Selling expenses, business management expenses

- Net operating profit

- Financial expenses, other income

- Profit before and after tax

- Analysis objectives:

- Profitability assessment: Calculate gross profit margin and net profit to see how effectively a business manages costs and selling prices.

- Identify growth trends: Compare revenue and profit over periods to detect expansion or decline trends.

- Cost structure analysis: How do selling, general, and administrative expense ratios affect profits?

- Real life example:

Company B has revenue 500 billion, cost price 350 billion → gross profit 150 billion → Gross profit margin = 150/500 = 30%. If this ratio is higher than the industry average (25%), it indicates good cost control or premium product positioning.

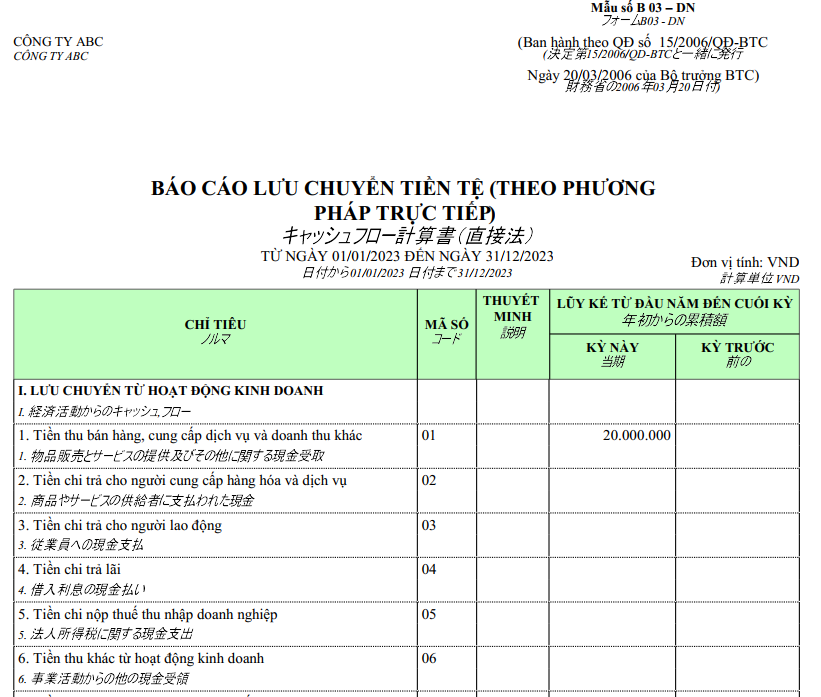

Cash Flow Statement (BCLCTT): Live Cash Flow Analysis

- BCLCTT said actual cash flow in and out of a business in a period, classified into three groups of activities:

- Business Operations (CFO): Money collected from customers, paid to suppliers, paid salaries, paid interest on loans...

- Investment Activities (CFI): Buying/selling fixed assets, contributing investment capital, recovering investment...

- Financial Activities (CFF): Borrowing, repaying debt, issuing shares, paying dividends…

- Analysis objectives:

- Assess the ability to generate cash from core operations: A sustainable business needs a consistently positive CFO.

- Track investment strategy: A large negative CFI may indicate that the business is investing in expansion, while a positive CFI is usually an asset sale or capital return.

- Determine debt repayment and dividend payment capacity: Financial cash flows help predict debt repayment capacity and dividend policy.

- Real life example:

Company C has CFO = +80 billion, CFI = -50 billion, CFF = -20 billion → net cash flow = +10 billion. This shows that the company generates money from operations, uses most of it to invest and pay down debt, and still has cash left over.

Notes to financial statements: The “handbook” that explains the numbers

With the above problem, Bizzi's solution helps automate and streamline the process of managing costs, invoices, and debts, ensuring that input data for these reports is always accurate and updated in real time. Specifically:

- With the Input Invoice Processing, Reconciliation and Management feature (IPA + 3way), Bizzi Bot uses RPA and AI technology to automatically upload, check and reconcile invoices (PO, GR) in real time, warn of risky invoices, and integrate API with existing ERP & Accounting systems.

- Bizzi Expense allows you to set budgets by department/project, monitor spending against budget, and alert you when you exceed your limits. The automated expense approval system speeds up the approval process, tracks expenses in real time, and generates detailed reports.

- Automate electronic invoice management together B-Invoice is able to integrate with enterprise resource planning (ERP) systems. At the same time, B-Invoice provides a diverse invoice template warehouse, meeting the needs of all businesses. In addition, businesses can also design invoices according to their own requirements; store invoices for 10 years according to the law, helping businesses save on invoice storage costs.

Professional methods and techniques for analyzing corporate financial statements

To comprehensively assess the performance and financial health of a business, financial professionals, management accountants, investors, banks and auditors often apply many different methods and techniques of financial statement analysis. Each method has its own advantages and is often combined to ensure a multi-dimensional perspective.

Methods of financial statement analysis

- Comparative method

- Purpose: Determine the variation of financial ratios over time or compared to industry standards.

- How to do:

- Compare data between consecutive periods to identify trends (growth, decline, stability).

- Compare with businesses in the same industry to assess competitive position.

- For example: Compare this year's gross profit margin with last year's or with the industry average to see production and business efficiency.

- Ratio method

- Purpose: Analyze the relationship between financial ratios to evaluate aspects such as solvency, capital efficiency, and profitability.

- How to do: Calculate and compare ratios such as:

- Liquidity ratio: Current Ratio, Quick Ratio

- Profitability ratio: ROA, ROE, Net profit margin

- Operating ratio: Inventory Turnover, Accounts Receivable Turnover

- For example: If ROE is high but ROA is low, further analysis is needed to see if the business is relying heavily on financial leverage.

- Factor analysis method

- Purpose: Separate and measure the impact of each factor on a specific financial indicator.

- How to do: Apply models such as DuPont to analyze the impact of profit margin, asset turnover, and financial leverage on ROE.

- For example: If ROE is decreasing, it could be due to falling profit margins, slowing asset turnover, or a change in the debt/equity ratio.

Financial statement analysis techniques

- Horizontal Analysis

- Concept: Compare financial ratios over multiple periods to determine whether they are increasing, decreasing, or stable.

- Application: Track revenue growth over 3–5 years; analyze whether expenses are growing faster or slower than revenue.

- Concept: Compare financial ratios over multiple periods to determine whether they are increasing, decreasing, or stable.

- Vertical Analysis

- Concept: Convert each indicator to a percentage of a base figure to make it easier to compare between periods or between businesses of different sizes.

- Application: In the income statement, show selling expenses, administrative expenses, and cost of goods sold as a multiple of revenue to evaluate the cost structure.

- Ratio Analysis

- Concept: Calculate key financial ratios and compare against industry benchmarks or internal targets.

- Application:

- Profitability: Compare ROE, ROA with competitors

- Liquidity: Assessing the ability to meet short-term obligations

- Financial leverage: Analyze debt/equity ratio to see the level of financial risk.

Guide to analyzing important financial indicators

Below are detailed instructions on how to financial ratio analysis important in corporate financial reporting, applicable to both finance and accounting students and managers who want to understand the business performance.

Solvency Analysis – Can the Business Pay Its Debt?

- Current Ratio

- Recipe: Current Assets / Current Liabilities

- Meaning: Indicates the extent to which short-term obligations are covered by current assets.

- Interpretation:

- > 1: The business has the ability to pay short-term debts.

- < 1: Potential risk of working capital imbalance.

- Interest Coverage Ratio

- Recipe: EBIT / Interest Expense

- Meaning: Measures the ability to pay interest from earnings before interest and taxes.

- Reference threshold: > 3 is considered safe, below 1.5 is a warning sign.

- Receivable Turnover Ratio

- Recipe: Net Sales / Average Accounts Receivable

- Meaning: Reflects the speed of collecting money from customers. High turnover means fast collection, low risk of bad debt.

If your business is looking for the optimal solution to the problem of debt management and wants to improve work efficiency, Bizzi is a reliable choice with modern technology and diverse features, helping you to confidently develop a sustainable business.

Bizzi provides a smart debt management solution with comprehensive features such as accurate debt control, automatic debt reminders, detailed management of customers and suppliers, multi-dimensional reports on debt status and debt age. With Bizzi, debt management is no longer a burden but becomes a competitive advantage for businesses.

Bizzi's automated debt management platform for businesses helps solve all problems in debt processing and collection, effectively controls cash flow, minimizes financial risks and improves the productivity of the accounting department.

- Increase overdue debt collection efficiency thanks to automatic reminder system, periodic emails, ensuring no late paying customers are missed.

- Save time & costs, limit risks arising from long-term debt, shorten debt collection process, avoid procedural hassles.

- Comprehensively monitor your employees' debt collection process, easily track debt collection history for each customer.

- Flexible debt tracking by invoice, contract or customer, easy to retrieve and classify.

- Automatically reconcile payments with bank statements, manage pending payment lists clearly and transparently.

- Notify debt and payment status to relevant departments, helping to synchronize processing procedures and make timely decisions.

Performance Analysis – Is the business running well?

- Inventory Turnover Ratio

- Recipe: Inventory Turnover = Cost of Goods Sold / Average Inventory

- Meaning:

- High rotation: Fast selling, low inventory → reduce storage costs, reduce the risk of obsolete goods.

- Low RPM: Slow-selling, stagnant goods → risk of price reduction or product cancellation.

- For example:

- Company A has a turnover of 12 → on average, the entire warehouse is rotated once a month.

- Enterprise B only = 4 → takes 3 months to rotate, capital is "locked" for a long time.

- Debt to Equity Ratio

- Recipe: D/E = Total Liabilities / Owner's Equity

- Meaning: Reflects the level of debt used. High ratios increase expected returns but also increase financial risk.

- < 1: Safe, mainly using own capital.

- 1 – 2: Make good use of financial leverage.

- > 2: High risk, easy to lose the ability to pay when revenue decreases.

-

- Analysis: It is advisable to compare with the industry average, as each sector has a different capital structure (for example construction is usually higher than services).

Profitability Analysis – Is the business making a profit?

This group of indicators answers the question “How much profit does the business generate for each dollar of revenue or assets or capital invested?”

- Gross Profit Margin

- Recipe: GPM = (Net Revenue – Cost of Goods Sold) / Net Revenue

- Meaning: Indicates the ability to control cost of goods sold.

- For example: If the enterprise's GPM = 40%, it means that for every 100 VND of revenue, the enterprise retains 40 VND to pay for sales, management and profit costs.

- When analyzing the Business Plan, accurate control of Cost of Capital and Operating Expenses is a decisive factor. To ensure this, the business needs to have a system

- Net Profit Margin (ROS)

- Recipe: ROS = Profit after tax / Net revenue

- Meaning: Reflects the final profit remaining after deducting all expenses and taxes

- Threshold: High ROS often indicates a business has a competitive advantage or good cost control.

- Return on Assets (ROA)

- Recipe: ROA = Profit after tax / Average total assets

- Meaning: Measures how effectively assets are used to generate profits. The higher the ROA, the better the company is utilizing its resources.

- Return on equity (ROE)

- Recipe: ROE = Profit after tax / Average equity

- Meaning: Indicates the efficiency of capital use by shareholders.

- Reference threshold: ROE > 15% is considered attractive to investors, but needs to be compared with the industry average.

By analyzing each of these components, managers can accurately determine the reasons for the increase or decrease in ROE, thereby developing more effective improvement strategies (for example, focusing on increasing ROS, boosting asset turnover, or adjusting debt structure).

Cash Flow Analysis – Is the cash flow stable and sustainable?

Cash flow is the "blood" of a business. Many companies report profits on paper but still go bankrupt due to lack of cash.

- Net Cash Flow from Operations (CFO)

- Meaning: Shows the ability to generate cash from core operations.

- Analysis:

- Positive and steadily increasing CFO → business is generating real money.

- Continuous negative CFO → need to consider the cause (increased inventory, slow customer payment…).

- Free Cash Flow to Equity (FCFE)

- Recipe: FCFE = CFO – Capital Expenditures + Net Debt

- Token:A stable positive FCFE is a sign that the company has the ability to finance growth and pay dividends to shareholders without having to borrow more.

The challenge of input data and the solution of master data automation (Bizzi)

Core mistake: Inaccurate and untimely analysis of financial statement data

In the age of technology, financial statement analysis is no longer limited to calculating indicators. The biggest challenge that many businesses face is “input data quality”.

If the source data (from invoices, documents, costs, debts) is incorrect, lacks transparency, or is not updated in a timely manner, no matter how sophisticated the analysis method is, the results will still lead to wrong decisions. Specifically, there are two core problems:

Manual input data is prone to errors:

- Manually entering invoices, expense management, accounts receivable and other documents often leads to unnecessary errors such as errors, duplications, or omissions. These errors directly distort basic financial indicators such as revenue, expenses, profits, and assets/equity items on the Balance Sheet. As a result, analyses of profitability, payment or operating efficiency become unreliable, leading to wrong decisions in management or investment.

Lack of real-time data and timely updates:

- Especially for businesses that still rely on manual processes or basic tools like Excel, there is often a large delay in updating financial data. By the time management receives reports, the data no longer accurately reflects the current state of the business. This hinders the ability to make quick decisions, respond promptly to market fluctuations, and build strategies based on the latest information.

Bizzi: Automation platform ensures data quality according to Accounting standards

To thoroughly address the challenges of input data quality and ensure the timeliness of financial reports, Bizzi offers a comprehensive automation platform that helps businesses from small to large operate based on accurate and transparent information.

- Input invoice processing: Bizzi Bot uses RPA and AI technology to automatically download, check, and reconcile invoices (PO, GR) in real time. This ensures that all purchases and expenses are recorded accurately, eliminating manual errors and ensuring that Revenue, Cost of Goods, and Expenses in the Income Statement are accurate from the start.

- Automatic cost and debt management: Bizzi's platform allows for budgeting, expense monitoring, and automatic debt reminders. As a result, important items on the Balance Sheet such as Accounts Receivable, Accounts Payable, and Inventory are always tightly controlled, transparent, and updated promptly. This also directly affects the stability of Cash Flow from business operations.

- Deep integration with existing ERP & Accounting systems: Bizzi is not only a standalone tool but also a powerful extension to your business management system. API integration enables continuous data synchronization, providing real-time financial information. This allows management and other departments to make decisions based on the most up-to-date financial picture, supporting immediate and effective trend analysis.

Conclude

In short, analyzing a company's financial statements is not just an accounting task, but the foundation for making smart and strategic business decisions. Mastering this skill helps businesses continuously develop and maintain their competitive position.

Applying automation technology solutions like Bizzi will help the financial management and analysis process become more efficient, accurate and transparent than ever. Bizzi provides a comprehensive cost control system and AI assistant for the finance and accounting department, helping businesses have real-time, accurate data to support analysis and make quick, reliable decisions.

Don't let your financial statement analysis be affected by manual data, errors and delays. Discover Bizzi Financial Automation Solution now to have real-time, accurate data and turn information into sustainable competitive advantage. Register for consultation here: https://bizzi.vn/dat-lich-demo/