Startup budgeting (or financial planning) is a detailed outline of how a startup will manage its capital, forecast costs and revenues through each stage of development. This is not just a simple financial management job, but also a vital strategy to optimize costs, orient growth and create trust with investors. The following article by Bizzi will guide you through the steps in detail. budgeting for startups, and at the same time point out common mistakes in the above financial management process.

The Importance of Budgeting for Startup Survival

A financial plan or startup budget is a detailed outline of how a startup will manage its capital, forecasting costs and revenues through each stage of development.

Benefits of budgeting for startups include:

- Clear strategic direction: Helps identify needed resources and allocate capital effectively.

- Risk mitigation and control: Predict costs and financial risks to have timely contingency plans.

- Attract potential investors: Detailed, transparent financial plans create trust and increase the likelihood of successful fundraising.

- Business Performance Measurement: Helps track and evaluate financial performance.

Core Components of a Startup Budget Plan

Budgeting for startups is incredibly important, not only to help control cash flow but also to lay the foundation for strategic decision making, fundraising, and sustainable growth. Here are the core components that should be included in a startup budget plan:

- Revenue forecast: Estimate how much money the startup can make from the product/service. It should be based on market analysis, customer base and technology trends.

- Cost Forecast: Includes all expenses required to operate the business.

- Startup costs/one-time: Initial costs are one-time payments such as office space, inventory, legal fees.

- Fixed costs: Expenses that do not vary with volume of activity (rent, employee salaries, insurance, software maintenance fees).

- The variable costs: Varies by product/service volume (marketing, raw materials, product research and development).

- Cash Flow Forecast: Forecast cash inflows and outflows to ensure your startup budget has enough capital to sustain operations and avoid budget shortfalls.

- Analyze expected profit and break-even point:

- Profit: Evaluate business performance and growth potential (total revenue minus total costs).

- Break-even point: The level of revenue needed to cover total costs and start making a profit.

- Plan for capital use and allocation: Identify investment categories (product development, marketing, human resources, technology) and allocate appropriately to optimize efficiency.

- Financial risk control plan & reserve fund: Plan for contingencies (failed revenue, increased costs, capital shortages) and develop alternative plans. 10-20% total budget for reserve fund.

- Runway (Capital maintenance period): It is the period of time a startup can continue operating with its current capital before running out. The simple formula is: Current Capital / Burn Rate. A long Runway will increase investor confidence.

- Burn Rate: It is the rate at which a startup burns through cash each month. It is important to distinguish between Gross Burn (total expenses) and Net Burn (total expenses minus revenue). Understanding Burn Rate helps control costs and forecast Runway accurately.

- Working Capital: It is the difference between current assets and current liabilities. Positive working capital ensures that the startup has enough capacity to pay daily operating expenses and maintain a stable cash flow. You can refer to 5 working capital management mistakes to avoid

Advanced Budgeting Methods for Startups

In addition to the basic process, startups can apply advanced budgeting methods to optimize costs and make cash flow transparent:

- Zero-Based Budgeting (ZBB): Instead of adjusting old budgets, ZBB requires every expense to be justified from zero each period. This method is especially effective for startups to cut unnecessary costs and allocate resources optimally.

- Activity-Based Budgeting (ABB): This method allocates budget based on specific activities, projects, or milestones. ABB helps startups control costs by section, ensuring that each activity is funded in line with the value it delivers.

6 Steps to Effective Startup Budgeting

Below is 6 steps to effective startup budgeting, helping businesses control cash flow, optimize spending and prepare for growth – especially important in the early stages of starting a business:

- Step 1: Identify specific financial goals: Set short-term and long-term goals (revenue, profit, break-even time).

- Step 2: Collect data and forecast revenue and costs:

- Collect accurate financial data: Consolidate revenue from channels, expenses from departments, data from previous financial reports.

- Revenue and growth forecast: Analyze market, competitors, customer behavior, trends.

- Make a list of specific expenses: Classify fixed and variable costs to control cash flow.

- Step 3: Calculate cash flow, profit and break-even point:

- Prepare cash flow forecast table: Track cash inflow/outflow monthly/quarterly.

- Create professional projected financial reports: Profit and loss statement, Balance sheet, Cash flow statement.

- Step 4: Plan capital allocation: Divide budget for each category (product, promotion, personnel, operations) and optimize costs.

- Step 5: Develop a risk contingency plan: Prepare contingency funds and alternative scenarios for unexpected fluctuations.

- Step 6: Check, compare and update the plan periodically:

- Regularly compare expected data with actual to detect variances and causes.

- Update financial projections periodically (at least once a month) to reflect the situation and adjust strategies promptly.

Common Mistakes When Budgeting for Startups and How to Fix Them

When budgeting for a startup, many founders – whether they are experts or not – are prone to making some common mistakes. These mistakes can derail finances, leading to cash flow shortages, misdirected spending, and even collapse in the first year. Here are the most common mistakes and how to fix them effectively:

- Overly optimistic revenue forecast: Overestimating growth potential.

- Fix: Based on market data, customer behavior, and results from similar businesses.

- Not fully calculating the costs incurred/Forgetting to reserve for financial risks: Overlooking small expenses or not preparing for unexpected fluctuations.

- Fix: List all expenses in detail, including emergency and contingency costs. Set aside a contingency fund of 10-20% of your total budget.

- Lack of cash flow management plan/Failure to prepare periodic financial reports: Loss of control over cash flow, failure to promptly detect financial problems.

- Fix: List all expenses in detail, including emergency and contingency costs. Set aside a contingency fund of 10-20% of your total budget.

- Lack of flexibility in financial management/Not updating and adjusting plans: Plans become obsolete due to rapidly changing markets.

- Fix: Ensure financial projections are flexible, periodically reviewed and adjusted in a timely manner.

The secret to optimizing budget for startups and the advantages of applying technology

To optimize budgeting for startups, businesses can apply the following suggestions to control spending - maintain cash flow - sustainable growth, especially in the early stages when there are many risks.

- Focus on cash flow instead of just profits: Cash flow is the lifeblood of a business. Prioritize debt collection, cost control, and maintaining positive cash flow.

- Set specific and achievable financial goals (SMART): Help startups have clear and measurable direction.

- Diversify investment sources: Do not depend on a single source of capital to ensure stability.

- Periodically review and adjust your financial plan: Conduct quarterly financial reporting and track key metrics.

- Use financial management software Modern and automated solutions: Popular tools: Excel, QuickBooks, Zoho Books, Google Sheets, Dogoo Office.

Applying technology to budgeting brings many outstanding advantages, especially for businesses that are expanding in scale, need to optimize performance and make quick decisions:

- Save time and reduce manual errors

- Real-time budget tracking

- More accurate financial analysis & forecasting

- Easy multi-department coordination

- Increase transparency when working with investors or partners

- Easily customizable – scale to your business

Optimize performance measurement with in-depth financial KPIs

To accurately evaluate performance and attract investors, startups need to track financial indicators important:

- CAC (Customer Acquisition Cost): Cost to acquire a new customer. This is an important indicator to evaluate the effectiveness of marketing campaigns.

- LTV (Lifetime Value): The lifetime value of a customer to a business. Comparing LTV and CAC helps evaluate a sustainable business model.

- MRR/ARR (Monthly/Annual Recurring Revenue): Monthly/annual recurring revenue, especially important for SaaS startups or subscription models. This is a measure of stability and growth potential of the business.

Applying technology to automate is an indispensable step forward. Tools like Excel only help with planning; but for real-time control and seamless integration with ERP (SAP, Odoo), startups need specialized FinTech solutions.

Automate budget and cash flow management with Bizzi

Bizzi is not only a tool to automate accounting and financial processes, but also a Smart budgeting and management platform, especially useful for startups that want to control spending from the very beginning.

Flexible budget setup & allocation

Bizzi Expense allows CFOs to set up fiscal year budgets and automatically allocate them flexibly to each department or project/timeline, ensuring pre-approval control, minimizing manual burden on Excel. You can:

- Enter your budget monthly, or

- Use the “repeat monthly” or “split budget across months” options to simplify the allocation process.

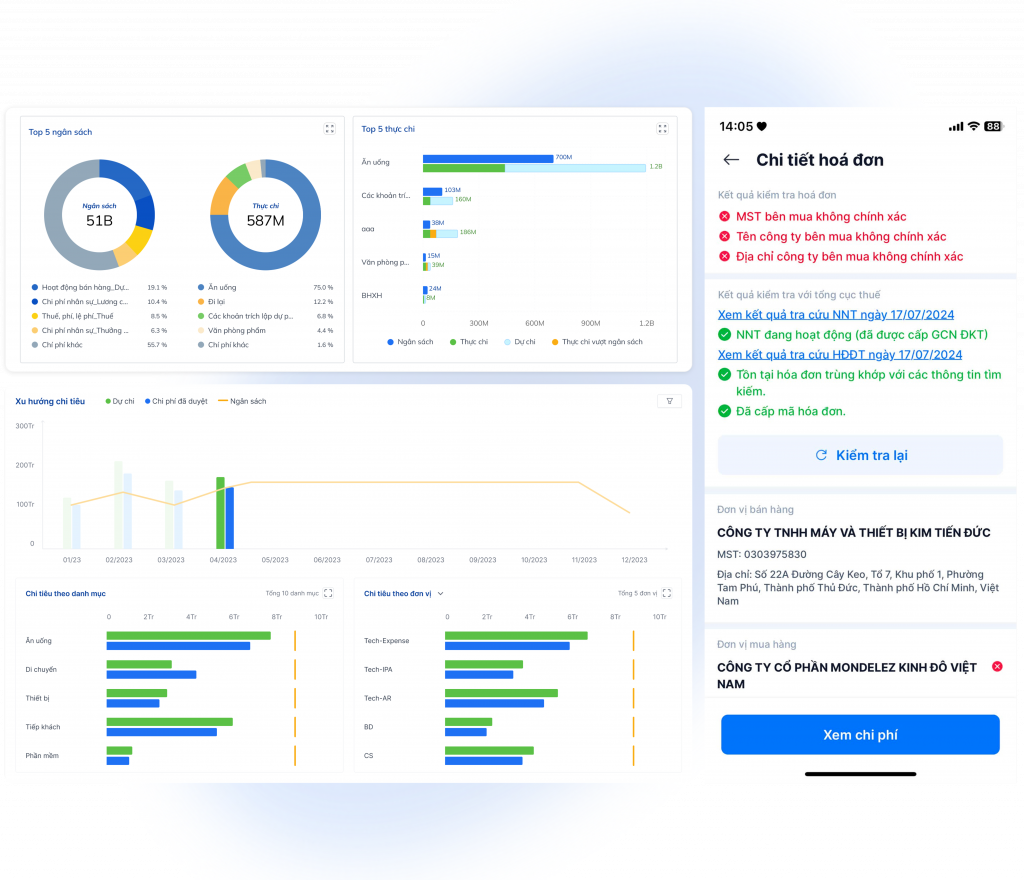

Track budget & spending in real time

Display board supply system monthly budget/actual budget, helping you easily compare between estimates and reality. This feature helps control spending transparently, promptly assessing when there is a risk of exceeding the budget.

Custom over budget warning

Bizzi offers three warning modes when spending goes over budget:

- No warning,

- Warn but still allow to create payment request,

- Warn and block actions to create proposals or reports that go over budget.

Attach budget to department/project spending

Users can select the corresponding budget for each spending request by department, project and expense type. This helps ensure compliance with internal budgets and financial laws.

Transparent reporting and dashboards

Bizzi provided intuitive dashboard with real-time “estimated and actual expenditure” reports. Clearly present remaining expenditures and budgets by department, project or expense category.

Fully integrated process from proposal to approval

Fully integrated budgeting process from payment request creation, validation, flexible approval to budget overrun control. All are digitized and run smoothly on the Bizzi Travel & Expense system.

Budgeting and management features Bizzi Travel & Expense helps businesses control spending flexibly, transparently and in real time. From budget allocation by department/project to overspending warnings, all are seamlessly integrated with the organization's spending digitization process - perfectly meeting the management needs of CFOs, chief accountants and SME business owners.

In addition to budgeting and management, Bizzi also includes:

- Processing, reconciling and managing input invoices (IPA + 3way): Automatically process, check, reconcile invoices with PO/GR, verify suppliers, warn of risky invoices, store for 10 years, integrate API with ERP & Accounting. Helps reduce errors, save time and ensure cost validity.

- Business Travel Management (Bizzi Travel): Automatically book flights according to budget, manage business expenses (airfare, hotel, transportation, food), spending limits, business approval process and detailed expense reports. Help startups effectively control employee travel and business expenses.

- Electronic invoice (B-invoice): Create standard electronic invoices, custom invoice templates, batch invoice issuance, tax authority authentication codes, 10-year storage, easy search and download, invoice status management, integration with accounting & ERP software. Simplify the invoice issuance process and ensure legal compliance.

- Accounts Receivable Management (ARM): Automatic debt reminders via email/text, debt tracking and reconciliation (customers, suppliers), due/overdue debt warnings, debt reporting. Ensure stable cash flow by optimizing debt collection.

- Integration with ERP & Accounting systems: Helps synchronize data, improve accuracy and transparency in financial reports, which is a great advantage when working with investors.

With Bizzi, startups are not just a tight budget plan but also Continuous monitoring tool, helping to optimize costs, avoid risks and be ready to scale.

Conclude

Proper budgeting for startups is the key to not only survival but also sustainable development of startups. Cost optimization, effective cash flow management and risk control are the factors that determine success.

Modern solutions like Bizzi will provide powerful tools and automation features, helping startups overcome initial financial challenges, save resources and focus on core business development. Startup budgeting features in particular and budget management in general of Bizzi Travel & Expense helps businesses control spending flexibly, transparently and in real time. From budget allocation by department/project to overspending warnings, all are seamlessly integrated with the organization's spending digitization process - perfectly meeting the management needs of CFOs, chief accountants and SME business owners.

Start building a budget today to turn your startup idea into reality and achieve sustainable success. Register here to receive free advice from our team of experts: https://bizzi.vn/dat-lich-demo/