What is a value added invoice? This is one of the important types of invoices in the financial and accounting management of enterprises, helping to prove the origin of goods and services and supporting accurate tax declaration. For business owners and accountants, understanding what a VAT invoice is and when to use a VAT invoice will help ensure compliance with legal regulations, while optimizing the tax management and accounting process effectively.

This article will explain in detail about value added invoices and the cases where this type of invoice is required.

1. Concept of Value Added Tax Invoice

Value Added Tax (VAT) Invoice, also known as VAT invoice, is an important document in accounting and financial management activities of enterprises. Understanding what a value added tax invoice is will help enterprises fulfill their tax obligations and optimize accounting processes, thereby improving transparency and legality in business operations.

General definition of invoice

An invoice is a document issued by a seller to record information about the sale of goods or provision of services in accordance with the law. An invoice is considered legal when it fully meets the requirements on content and form issued by the competent authority.

Definition of Value Added Tax (VAT) Invoice

A VAT invoice, or VAT invoice, is a type of invoice specifically used by organizations, businesses, and business households that apply the tax deduction method. This is a tool to record details of sales transactions and the VAT incurred.

This type of invoice clearly shows:

- Value of goods or services excluding tax

- Output VAT amount to be paid to the State budget

- Total payment price includes tax

VAT invoices are also commonly known as “red invoices” because they were previously printed on red paper. In addition, the phrase “issuing invoices” is often used to refer to the act of creating and issuing invoices in business transactions.

Value added tax is an indirect tax, levied on the added value of goods and services during the process of production, circulation and consumption. VAT is made up of:

- Input tax: when a business buys goods and services

- Output tax: when a business sells goods or services

Features of VAT Invoice

- Has a distinctive color (usually red if printed on paper), helping to distinguish it from other types of invoices

- Applicable to businesses and organizations declaring VAT using the deduction method.

- Must be prepared in the correct form, at the correct time, and in accordance with the regulations of the Ministry of Finance.

- Has high legal value, is the basis for cost accounting, tax declaration and tax settlement.

- Before using, businesses need to notify the tax authority directly managing the invoice issuance.

Understanding what a value-added invoice is not only helps businesses comply with tax laws but also contributes to improving efficiency in financial management and controlling legal risks.

2. Subjects using Value Added Tax Invoices

After understanding clearly What is a value added invoice? (also known as What is a VAT invoice?), the next important thing is to clearly identify who are the users of this type of invoice. Below are the common groups used in business activities and tax management:

- Organization of VAT declaration according to deduction method

This is the main group of subjects using value added invoices for all transactions of buying and selling goods and providing services in production and business activities. They need VAT invoices as a basis for accounting, deducting input tax and fulfilling tax obligations in accordance with regulations. - Seller of goods and services

Sellers use VAT invoices to record sales revenue and service provision accurately and transparently. This is an important basis for:- Manage cash flow into the business

- Determine tax liability arising

- Support for auditing and financial settlement

- Buyer of goods and services

For buyers, VAT invoices are legal proof of the origin of products and services spent. In addition, invoices also help:- Basis for input VAT deduction

- Control and analyze cash flow

- Meet the requirements of transparency in accounting records

- Tax authority

VAT invoices are one of the important management tools of tax authorities. Through invoices, tax authorities can:- Check, compare and inspect tax obligations of enterprises

- Detect tax evasion and invoice fraud if any

- Ensuring transparency and compliance with the law in commercial activities

If you are looking for a way to manage invoices more effectively, ensure compliance with regulations and save time for accountants, Bizzi provides a smart electronic invoice solution, fully integrated with operations suitable for each VAT invoice user.

3. Cases where Value Added Tax Invoices must be used

After understanding clearly What is a value added invoice? good What is a VAT invoice?, businesses need to accurately determine the cases where this type of invoice is required. Compliance with regulations not only ensures the legality of business operations but also supports optimizing input tax according to the deduction method.

3.1 According to the provisions of Article 8 of Decree 123/2020/ND-CP

According to Article 8 of Decree 123/2020/ND-CP, value added invoice (VAT invoice) applied to organizations and businesses that declare taxes according to Deduction method, specifically in the following cases:

- Selling goods and providing services domestically;

- Export of goods and services abroad;

- International transport activities;

- Providing goods and services to duty-free zones or cases considered as exports according to the provisions of the law on value added tax.

3.2 Activities using Value Added Tax Invoices

Below are specific activities that businesses need to use. VAT invoice When a transaction occurs:

- Selling goods and providing services domestically: Enterprises providing products and services to customers in Vietnam that are subject to VAT must issue VAT invoices.

- International transport operations: Including freight and passenger transportation services from Vietnam to foreign countries or vice versa, VAT invoices must also be used if the enterprise applies the deduction method.

- Export to duty free zone: Transactions providing goods and services to enterprises in duty-free zones or export processing zones require value-added invoices.

- Exporting goods and providing services abroad: Direct export activities or through consignment, if meeting the legal conditions, will be subject to tax rate 0% but still need to use VAT invoices to record the transaction.

Correctly identifying the subjects and activities that need to use VAT invoices helps businesses avoid violating regulations and creates favorable conditions when declaring and deducting input tax.

4. Time of issuing Value Added Tax Invoice

Determining the correct time to issue VAT invoices is an important factor in helping businesses declare taxes accurately, avoid violating regulations and limit financial risks. Below are detailed regulations according to Decree 123/2020/ND-CP, helping businesses understand clearly What is a value added invoice?, What is a VAT invoice?, and when they are needed to ensure compliance with the law.

4.1 General provisions according to Article 9 of Decree 123/2020/ND-CP

According to Article 9, the time of invoice issuance depends on the type of business:

- For the sale of goods: The time of transferring ownership or right to use goods to the buyer, regardless of whether the money has been collected or not.

- For service provision: The time of completion of service provision. If payment is collected before or during provision, invoice shall be issued at the time of payment (except for some consulting services).

- In case of multiple deliveries or handover of each item or stage: Invoice must be issued for each delivery or handover corresponding to the volume and value of the implementation.

4.2 Time of issuing value added tax invoices for specific cases

Some specific business activities have specific invoice issuance times specified in Clause 4, Article 9:

- Services that arise frequently and in large quantities require data reconciliation (such as telecommunications, television, information technology, air transport).

- Construction, installation, real estate activities.

- Sell through website or e-commerce platform.

- Exploitation and processing of oil, gas and minerals.

- Retail stores, restaurant chains (generate total invoices at the end of the day or as requested by customers).

- Selling electricity and gasoline at the store (set up for each sale).

- Services through agents such as air freight, insurance.

- Financial services: banking, securities, insurance, e-wallet (generate total invoice at the end of the day/month for individuals who do not take invoices).

- Taxi uses billing software (invoice at the end of the trip).

- Medical services with management software (end of day total or on demand).

- Non-stop electronic toll collection service (invoice generated on the day the vehicle passes the station or at the end of the month).

4.3 Points to note when determining the time of invoice issuance

To issue VAT invoices on time, businesses need to note:

- Correctly classify business activities according to the prescribed group.

- Understand international practices (especially with import-export and transportation services).

- Always update new legal documents.

- Check information carefully before creating an invoice to avoid errors.

- Applying electronic invoice software helps control effectively and save time.

- In case of wrong timing, it is necessary to issue an adjustment invoice or replace it according to regulations.

- Consider influencing factors such as type of goods/services, payment method, contract terms.

4.4 Why is it necessary to determine the exact time of issuing VAT invoices?

Determining the correct time to issue VAT invoices brings many benefits:

- Help declare taxes on time, avoid errors, arrears or fines.

- Optimize cash flow and financial management efficiency.

- Ensure compliance with legal regulations and avoid legal risks.

- Is the legal basis for resolving disputes if they arise, protecting the rights of the parties in the transaction.

5. Required content on Value Added Tax Invoice

To ensure legal value and rights to input tax deduction, businesses need to note that value added invoice Not only is it a sales document, it is also an important basis for financial and tax management. When issuing a VAT invoice, the required information must be complete and accurate according to the provisions of Circular 78/2021/TT-BTC and related documents. Below are the indispensable components on a What is a VAT invoice?:

- Buyer and seller information: Including the seller's name, address, tax code; the buyer's name, address, tax code (if any).

- List of goods and services: Clearly state the name of the goods or services provided, unit of measure, quantity, unit price and total amount.

- Invoice issue date: Is the date of recording the transaction and issuing the invoice, usually the time of completion of the provision of goods/services.

- Total value of goods and services before tax: Shows total amount excluding VAT.

- Value for VAT calculation: Is the basis for calculating the amount of VAT payable or deductible.

- Applicable VAT rate: Can be 0%, 5% or 10% depending on the type of goods/services.

- VAT amount: Is the tax calculated based on the taxable value and the applicable tax rate.

- Total payment: Is the total amount the buyer must pay, including the value of the goods/services and VAT.

- Signature of legal representative or authorized person (if any): For electronic invoices, it can be replaced by a digital signature.

VAT invoices not only show the actual value of goods but also reflect the added value - a key factor for tax deduction and refund in businesses. Creating complete and correct invoices helps avoid tax errors, protect legal rights and demonstrate professionalism in business activities.

6. Compare Value Added Tax Invoice and Sales Invoice

Value-added tax (VAT) invoices and sales invoices are two important types of accounting documents in business operations. Understanding the differences between them helps businesses comply with legal regulations and optimize accounting work.

6.1 Basic differences

| Criteria | Sales invoice | Value Added Tax (VAT) Invoice |

| Target audience | Organizations and individuals declare VAT by direct method or in duty-free zones | Organizations and individuals declare VAT using the deduction method. |

| VAT information | There is no tax rate and VAT amount line on the invoice. | There are tax rates and VAT amounts; total payment includes VAT. |

| Intended use | Confirm purchase transactions and store product/service information | Confirm sales transactions and collect VAT; is the basis for tax deduction |

| Tax management | Enterprises do not have to collect VAT from buyers; declare output invoices or do not need to declare on Form 01/GTGT | Need to calculate and collect VAT from buyers; declare full output and input invoices on Declaration Form 01/GTGT |

| Legal requirements | No need to comply with strict legal regulations such as VAT invoices | Must comply with numerous regulations and legal rules regarding release, storage and reporting |

6.2 About the users

Each type of invoice is designed to suit different tax payer groups, helping to ensure accuracy and efficiency in tax management.

- Sales invoice: For organizations and individuals declaring VAT using the direct method or operating in non-tariff zones. Often used in transactions that do not require VAT information on invoices.

- VAT invoice: For organizations and individuals declaring VAT using the deduction method. Used in transactions between businesses and requests for VAT information.

6.3 VAT information

The obvious difference between the two types of invoices lies in the way VAT is presented and handled. This directly affects tax deduction and transparency in transactions:

- Sales invoice: There is no VAT rate and amount line on the invoice. VAT information (if any) is managed outside the invoice.

- VAT invoice: There are VAT rate and amount lines. Please provide detailed information about VAT, including tax amount and tax rate. The total payment on the VAT invoice includes VAT.

6.4 Intended use

The two types of invoices have in common the confirmation of a purchase transaction, but the big difference lies in their role in relation to VAT and tax deduction rights.

- Sales invoice: Used to confirm sales transactions and store product/service information.

- VAT invoice: In addition to confirming the purchase transaction, it also has the purpose of collecting VAT and is the basis for tax deduction.

6.5 Tax administration

There are clear differences in tax management between the two types of invoices, which directly affect the way businesses declare and pay VAT.

- Sales invoice: Enterprises do not have to collect VAT from buyers (applying the direct method). Only need to declare output invoices or do not need to declare indicators on Form 01/GTGT.

- VAT invoice: It is necessary to calculate and collect VAT from the buyer, then submit it to the tax authority (applying the deduction method). It is necessary to fully declare both output and input invoices, and fully declare the indicators on Form 01/GTGT.

6.6 Legal requirements

The two types of invoices differ in the level of strictness in compliance with legal regulations, affecting the issuance and management process.

- Sales invoice: Usually does not need to comply with strict legal regulations such as VAT invoices.

- VAT invoice: Requires compliance with numerous regulations and legal rules regarding release, storage and reporting.

A clear distinction between value-added invoices and sales invoices helps businesses and accountants choose the appropriate type of invoice, ensuring compliance with the law and optimizing accounting work. In particular, for businesses applying the VAT deduction method, the use of VAT invoices is mandatory to ensure tax deduction rights and avoid legal risks.

7. Report on VAT invoice usage

Reporting on the use of VAT invoices (value added invoices) is an important obligation of businesses and business individuals to ensure compliance with legal regulations on invoices, while helping tax authorities manage and control the issuance and use of invoices accurately. Below is detailed information on responsibilities, frequency, purpose and reporting cases related to VAT invoices.

7.1 Responsibility for submitting reports

Every quarter, organizations, business households, and individuals selling goods and services (except for those directly issued invoices by tax authorities) are responsible for submitting a Report on the use of VAT invoices to the tax authority directly managing them. Even in cases where there is no use of invoices during the period, businesses must still submit a report to ensure transparency and avoid the risk of administrative sanctions.

7.2 Reporting Frequency

Normally, businesses submit reports quarterly. However, there are some special cases such as newly established businesses, businesses that violate regulations on using self-printed or ordered invoices, or businesses that are assessed as having high tax risks, will have to submit monthly reports on invoice usage. If businesses submit monthly reports, they do not need to submit quarterly reports.

In case a business uses both self-printed/ordered invoices and invoices purchased from the tax authority, the report must be summarized in a single report to ensure comprehensiveness and accuracy.

7.3 Reporting Objectives and Purpose

Reporting on the use of VAT invoices has many important purposes in business management and tax management, including:

- Compliance with the law: Help businesses comply with regulations on issuing, storing and reporting invoices, thereby avoiding risks of being penalized for violations.

- Tax management: Provide detailed information on transaction quantity and value, helping tax authorities calculate, collect and pay VAT accurately and on time.

- Financial transparency: The report helps businesses monitor and control VAT-related revenues and expenditures, ensuring transparency and efficiency in financial management.

- Testing and auditing: Create a database for tax authorities to check the validity of paid taxes, support tax inspection and audit work.

- Financial forecasting and planning: Reporting data helps businesses forecast cash flow, plan finances effectively, and make smarter business decisions.

7.4 Cases where it is not necessary to report each invoice number in detail

Some types of invoices such as telecommunications service bills, electricity bills, water bills, bank service bills, passenger transport tickets, stamps, tickets, and cards do not require detailed reporting of each invoice number. Instead, businesses can summarize and report by invoice quantity (total number) according to form 3.9 Appendix 3 issued with Circular No. 39/2014/TT-BTC. This method helps simplify the reporting process but still ensures full information for tax authorities.

8. Forms of Invoice

Invoices are important documents in business activities, reflecting the process of selling goods, providing services and tax management. Depending on the characteristics of the activities and legal regulations, invoices have many different forms of expression, meeting the needs of businesses and tax authorities. Below are the common types of invoices today:

8.1 Self-printed invoices

This is a type of invoice that business organizations print themselves on information technology devices such as computers, cash registers or other types of machines. Self-printed invoices help businesses take the initiative in managing and using invoices according to the scale and nature of their operations. (From July 1, 2022, according to state regulations, businesses are required to use electronic invoices and completely stop using paper invoices)

8.2 Electronic invoice

Electronic invoices are a collection of electronic data messages related to the sale of goods and provision of services, which are created, created, sent, received, stored and managed in accordance with the provisions of the Law on Electronic Transactions and related guiding documents. This is a popular form of invoice, encouraged and required to be used to improve management efficiency, save printing costs and protect the environment.

8.3 Printed invoice

Printed invoices are invoices that organizations order to print according to available templates for use in selling goods and providing services. In addition, tax authorities can also order to print and issue or sell to businesses according to regulations to ensure legality and transparency. (From July 1, 2022, according to state regulations, businesses are required to use electronic invoices and completely stop using paper invoices)

8.4 Electronic invoices generated from cash registers with tax authority codes

This is a new form of electronic invoice, complying with the provisions of the 2019 Tax Administration Law, Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC. This invoice is generated directly from the cash register and has a tax authority code, supporting businesses in managing sales and linking data directly with tax authorities, increasing transparency and efficiency of tax management.

8.5 Other types of invoices and management documents such as invoices

In addition to the above types of invoices, there are other documents used, printed and managed similarly to invoices. These include stamps, tickets, cards with the form and content specified in the Decree; air freight receipts; international freight receipts; banking service fee receipts according to international practices and relevant legal regulations. These documents also contribute to the management and monitoring of financial transactions of the enterprise such as internal delivery and transport receipts, delivery receipts for sale to agents.

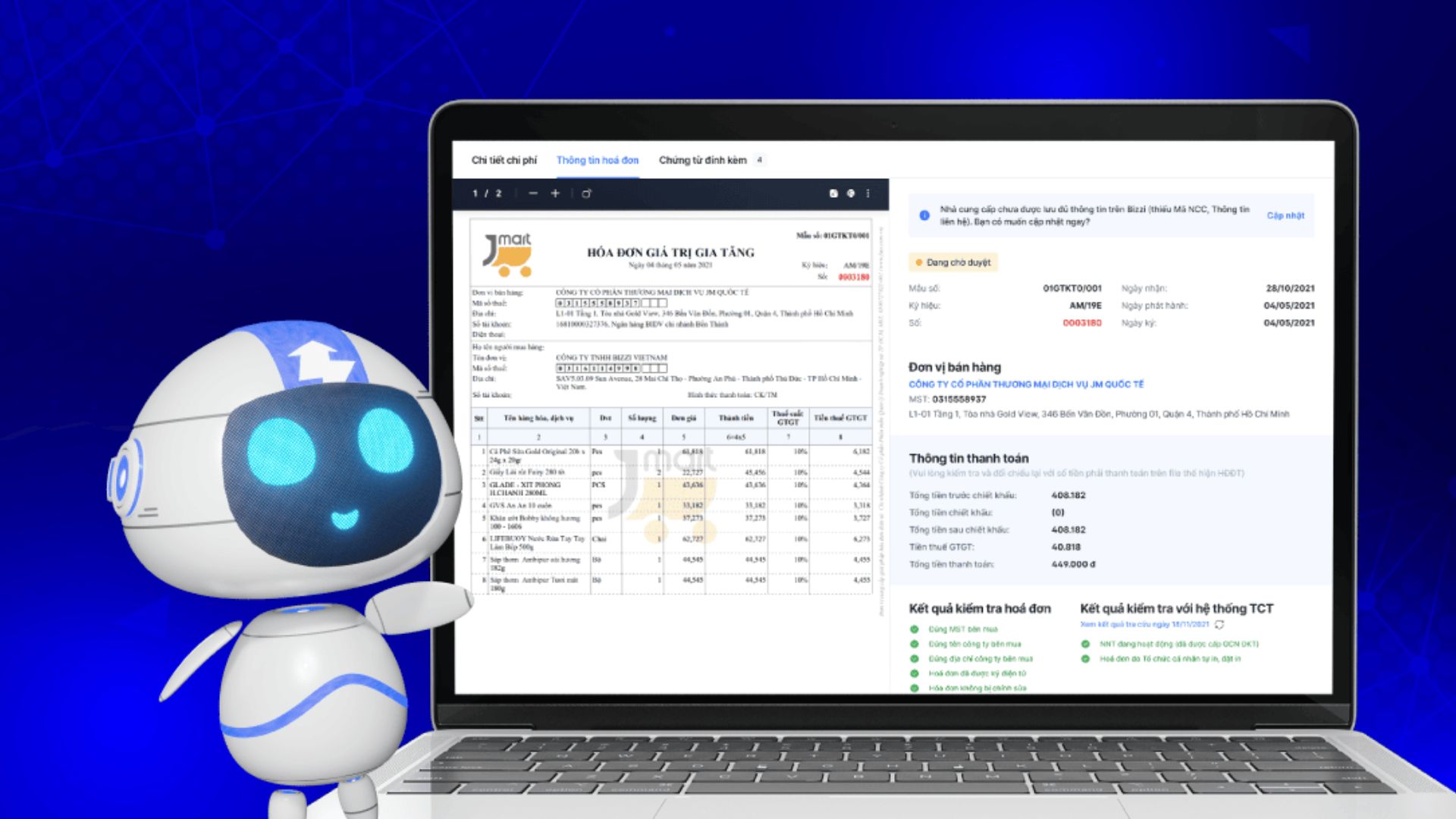

9. Bizzi: Technology Solution to Optimize the Whole VAT Invoice Life Cycle

Bizzi provides comprehensive automation solutions, helping businesses optimize invoice processing from input to tax reporting, ensuring efficiency and legal compliance.

9.1 Issue output electronic invoices

B-Invoice is an electronic invoice solution recognized by the General Department of Taxation, fully meeting the professional requirements as prescribed by law. This solution supports businesses in issuing electronic invoices quickly, accurately and legally.

Types of electronic invoices supported by B-Invoice:

- Regular electronic invoices: Fully comply with current regulations of the Ministry of Finance on electronic invoices.

- Electronic invoice created from cash register (POS): Easily issue electronic invoices from sales transactions at the point of sale when B-Invoice integrates with popular cash registers (POS) on the market.

- Electronic ticket: Businesses can manage ticket sales and create electronic ticket invoices effectively.

Benefits of using B-Invoice:

- Cost optimization: Printing and distribution costs are zero; saving on shipping and invoice storage costs.

- Reliable: Contains business identification information such as logo, digital signature, etc. for easy lookup to authenticate invoices.

- Save time: Quick registration and use; minimizes time for issuing, processing and storing invoices.

- Safe and accurate: Cannot be counterfeited; no fear of writing incorrect information; no fear of losing invoices – compensation guaranteed.

- Minimize administrative procedures: All procedures are created and sent via the Internet; customers do not have to wait for invoices.

- Various methods of sending invoices: Send by Email, SMS, Viber, Zalo…; print on paper and send by express delivery.

In addition, B-Invoice supports exporting invoices to many different formats such as PDF, HTML, Excel; has a QR Code for quick checking; easy to search and retrieve original invoices; diverse invoice template warehouse, easy to customize; safe and secure invoice storage for 10 years at an international standard data storage center; supports digital signatures and digital signature methods.

9.2 Automatically Receive Input Invoices

Bizzi integrates with the business's email system and accounting software to automatically receive VAT invoices from suppliers. Optical character recognition (OCR) and artificial intelligence (AI) technology help extract data on invoices accurately, minimizing errors due to manual data entry.

9.3 Automatic Three-Dimensional Matching

One of Bizzi’s standout features is its three-way automatic reconciliation between invoices, purchase orders, and warehouse receipts. The system uses RPA (Robotic Process Automation) technology combined with AI to handle complex situations such as:

- One PO has multiple invoices.

- In case there is no PO.

- Product names vary between suppliers.

This helps accountants save time and minimize the risk of errors during reconciliation.

9.4 Flexible Integration With ERP Systems

Bizzi supports integration with many popular ERP systems such as SAP, Oracle, Microsoft Dynamics 365, Odoo and Lark. Synchronizing VAT invoice data into the accounting system helps businesses manage finances more effectively and accurately.

9.5 Legally Compliant Electronic Storage

All invoices after processing are stored electronically on Bizzi's cloud platform, ensuring safety and easy retrieval. The system complies with the provisions of Circular 78/2021/TT-BTC and Decree 123/2020/ND-CP, helping businesses meet the inspection and audit requirements of tax authorities.

9.6 Automatic Reporting and Statistics

Bizzi provides real-time reports and statistics on VAT invoice status, helping managers promptly grasp the financial situation and make accurate decisions.

9.7 Cost Savings and Productivity Increase

Automating the invoice processing process helps businesses save up to 80% of time and 50% of costs compared to manual methods. At the same time, the productivity of the accounting department is improved, reducing workload and increasing work efficiency.

9.8 Optimal Solutions For Businesses

Bizzi is not just an electronic invoice processing software, but also a comprehensive technology solution that helps businesses optimize the entire VAT invoice life cycle. From receiving invoices, reconciling, storing to reporting, Bizzi supports businesses in managing finances effectively and in compliance with the law.

Conclude

Understanding chemistry What is value added tax?In cases where it is mandatory to use VAT invoices, it not only helps businesses comply with the law but also improves the efficiency of financial, accounting and tax management. Business owners and accountants need to regularly update regulations on invoices to avoid legal risks and optimize business operations. With Bizzi's electronic invoice management solution, businesses can easily create, store and look up VAT invoices quickly, accurately and in full compliance with State regulations. Bizzi.vn accompanies businesses in simplifying accounting processes, minimizing errors and optimizing tax management, helping you focus on developing sustainable business.

Businesses register for trial at: https://bizzi.vn/dang-ky-dung-thu/