Direct invoice is a familiar and popular concept in business, especially for businesses using the direct declaration method on revenue. This article by Bizzi will provide a comprehensive and comprehensive overview of the concept of direct billing as well as important related content.

Direct Billing Definition

What is a direct invoice? A direct invoice is essentially a sales invoice or a regular invoice, a type of document created by a seller to record information about the sale of goods or provision of services. The special feature of a direct invoice is that value added tax (VAT) is not applied directly to the invoice. Users of direct invoices must calculate and pay taxes directly to the tax authority.

A legal direct invoice is usually the type of invoice issued by the Tax Department to an individual/business organization. Through this invoice, information about the transaction value becomes transparent, helping to manage taxes and ensure compliance with regulations.

Subjects using direct invoices

Direct invoices are used by the following entities:

Main target groups

- Direct invoices are often applied to small businesses or individual businesses that do not use value-added tax (VAT) invoices.

- The users are usually businesses and individuals who do not apply the deduction method of calculating VAT.

- Individuals or business households have VAT rates based on revenue and choose to use the direct method to calculate and pay taxes.

Specific cases

- Small businesses: Small businesses whose revenue does not meet the requirements or do not choose to apply the VAT deduction method. Newly established businesses that do not have large revenue and have not registered to declare VAT using the deduction method.

- Individual business households: Individual business households, small business households, do not need to use VAT invoices. Households, individual businesses.

- Self-employed individuals: Operating in the service sector, irregular trading and do not need to use VAT invoices.

- Organizations and enterprises that do not have to pay VAT under the deduction method: Organizations and enterprises operating in tax-exempt fields or with low revenue.

- Organizations that are not enterprises but have business activities: Including cooperatives, foreign contractors, project management boards.

- Organizations and individuals declare and calculate value added tax using the direct method for activities such as selling goods, providing domestic services, international transportation, exporting to duty-free zones, and exporting abroad.

- Organizations and individuals in duty-free zones when selling goods and providing services domestically or between organizations and individuals in duty-free zones.

- Businesses using self-printed or ordered invoices are at high tax risk.

- Enterprises using self-printed or ordered invoices that violate invoice regulations will be administratively sanctioned for tax evasion and tax fraud.

Notes on using direct invoices:

- Direct invoice users often do not use electronic invoices and are not able to pay taxes online.

- However, business households and individuals who use direct invoices and pay taxes according to the lump-sum tax method are still allowed to use electronic invoices with tax authority codes when selling goods and providing services.

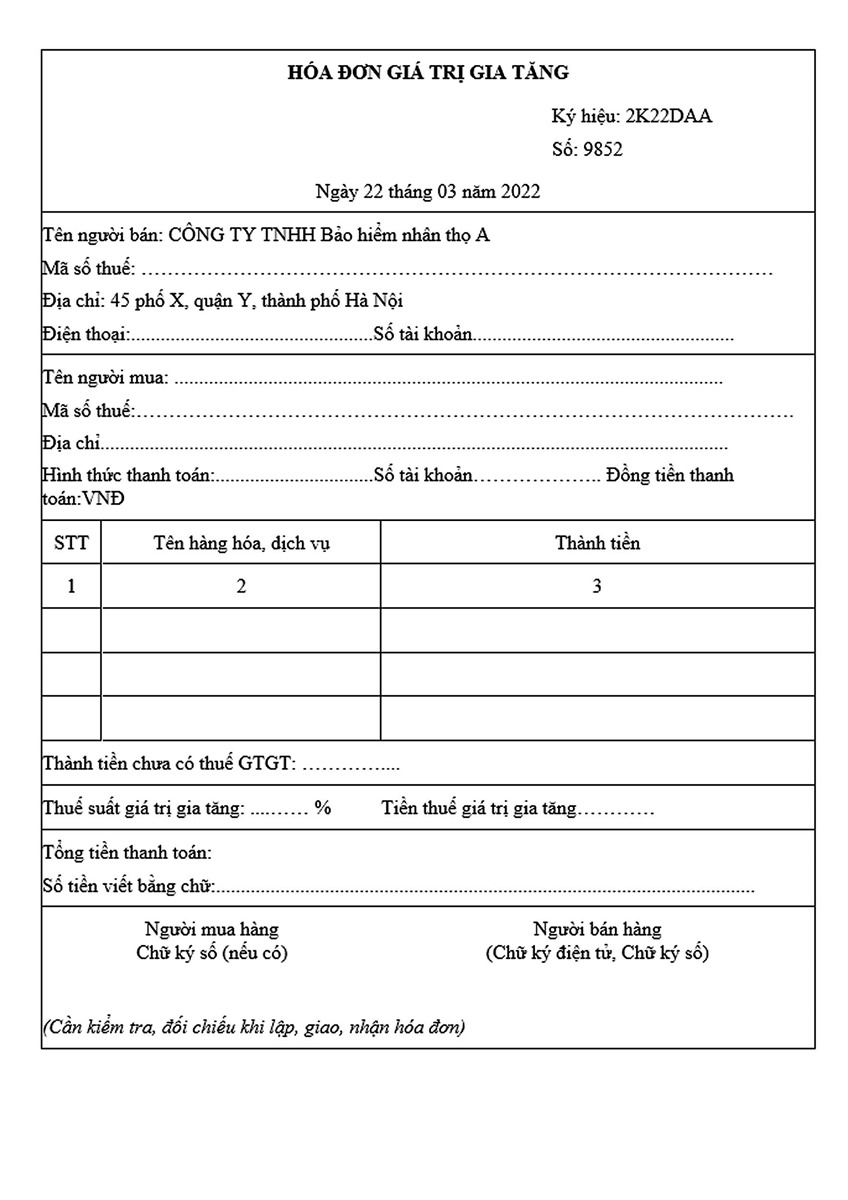

Most popular direct invoice content and templates

Direct invoices (also known as direct sales invoices or retail invoices) are a common type of invoice used by individual businesses, retail stores, restaurants, salons, etc. when they are not required to use electronic invoices according to Vietnamese law.

Below are the basic contents and the most popular direct invoice templates today.

What are the mandatory contents on a direct invoice?

Direct invoices must ensure that they have the following contents:

- Name and tax identification number of the seller.

- Buyer's name and tax identification number (if applicable).

- Describe the goods or services provided.

- Quantity, unit price, and total amount.

- Total amount to be paid.

- Signature of seller and buyer (if any).

- Invoice time.

- For printed invoices, the name of the organization that prints the invoice must be stated.

Direct invoice sample reference

- The direct invoice form is mentioned in Appendix I of Circular No. 68/2019/TT-BTC. Download here.

- Invoice form No. 3 is specified in Appendix II issued with Circular 78/2021/TT-BTC.

- Reference form No. 2 in Appendix II, Circular 78/2021/TT-BTC.

Compare direct invoice and VAT invoice

Not only do you need to understand what a direct invoice is, but you also need to distinguish the difference between a direct invoice and a VAT invoice. Below is a detailed comparison table between a direct invoice (sales invoice) and a VAT invoice – helping you easily visualize the differences and appropriate applications in your business:

| Criteria | Direct Billing

(Sales invoice) |

Value Added Tax Invoice

(VAT invoice) |

| Target audience | Small businesses, individual business households, self-employed individuals, and organizations are not subject to VAT declaration using the deduction method. | Enterprises registering to declare VAT according to the deduction method, organizations and enterprises with large revenue. |

| Invoice content | There are no tax rate and VAT amount lines. The total amount is the final value. | There is a VAT rate line (0%, 5%, 10%), clearly showing the tax amount and total value after tax. |

| Tax rate | Tax rate not shown. | Tax rates are shown. |

| Tax deduction | Input VAT cannot be deducted. | Input VAT is deductible, helping to reduce the amount of tax payable. |

| Tax declaration | Only need to declare output invoices, no need to declare input invoices. Only declare revenue. No requirement to declare VAT periodically. | Fully declare output and input invoices. Declare both revenue and input tax. Periodic declaration and payment of VAT required. |

| Usability | Simple, easy to use, suitable for small transactions. Limited in large, professional transactions. | More complex, requires periodic VAT declaration and payment. Widely accepted in large, professional transactions. |

| Form | Usually simpler in structure, no specific VAT information required. Has a square stamp. Can have many variations in form. | Must contain mandatory VAT information such as tax code, value added tax, VAT, etc. No square stamp. |

| Where to buy | Can be purchased at the tax office or created by the business (self-printed, licensed printing). | Must be issued by tax authorities after business registration. |

In short:

- Direct invoices are suitable for individuals, business households, and small businesses that do not deduct taxes.

- VAT invoices are suitable for businesses that need to deduct, refund taxes, or transact with other business partners.

What are the regulations and notes when using direct invoices?

Below are the regulations and important notes when using Direct Invoices (Sales Invoices) that business households, individual businesses or small businesses need to understand:

Periodic tax declaration

- Direct invoices do not require periodic VAT declarations, but must still comply with tax authority regulations on archiving and issuing invoices.

- Users of direct invoices do not have to declare VAT on the List of invoices, documents of purchased goods and services in form 01-2/GTGT.

Input VAT deduction

- Direct invoices do not allow input VAT deduction.

- Enterprises declaring VAT using the deduction method when purchasing goods/services from companies declaring tax using the direct method and receiving direct invoices will not be able to deduct VAT, but will only be able to account for it as an expense when calculating corporate income tax (CIT).

Use for international transactions

- Direct invoices are typically used for domestic transactions only. International transactions typically require VAT invoices or other appropriate invoices. However, some sources mention that direct invoices can be used for international transportation and export.

Payment for bills from 20 million VND

- For direct invoices with a value of VND 20 million or more (price including VAT), when making payment, there must be a non-cash payment document (bank transfer) to be considered a reasonable expense when determining corporate income tax.

- Note: There are some cases where the purchase and sale of goods and services over 20 million VND does not require a bank transfer and can be received in cash, such as defense/security expenses, expenses to support the Party/socio-political organizations, or expenses to purchase goods with a list according to regulations.

How to buy invoices directly legally

Purchasing invoices directly (i.e. sales invoices) must comply with legal regulations to ensure validity in business operations and tax settlement. Below is how to legally purchase invoices directly and detailed implementation steps:

Identify the correct subject to purchase invoices directly

According to the provisions of the Law on Tax Administration and Decree 123/2020/ND-CP, the following subjects are allowed to purchase invoices directly from tax authorities:

- Business households, individual businesses (not using electronic invoices).

- Enterprises and organizations that are not enterprises (for example: non-profit organizations, projects, research institutes...) use sales invoices but do not meet the conditions or have not yet switched to electronic invoices.

- Organizations in special cases permitted by tax authorities (newly established, currently handling violations, no digital signature...).

Where to buy invoices directly

- Buy invoices directly at the tax office where the business or individual business is registered.

- Invoice printers are licensed by the tax authorities.

- Register to purchase invoices directly through the electronic invoice provider to transmit information to the Tax Department according to Circular 78/2021/TT-BTC.

Procedures for purchasing invoices directly for the first time

Individuals, businesses/organizations need to prepare documents including:

- Application for purchase of invoice (Form No. 3.3 Circular 39/2014).

- Commitment form No. CK01/AC Circular 39/2014.

- Copy of business license.

- Identity card or citizen identification card of the representative or buyer.

- Business seal (if any).

- Other relevant documents as required by tax authorities.

Procedure for purchasing invoices directly from the second time

Need to prepare more documents than first time purchase:

- Business invoice purchase book is issued upon first purchase.

- The adjacent pre-purchase invoice book that the business is using.

Where to apply

- Submit application and related documents to the direct tax authority.

- Individuals or organizations need to submit their application at the Stamp Office of the Tax Department directly managing their business.

What should I note when buying a direct invoice?

- Before purchasing an invoice, individuals/organizations must stamp their name, address and tax code on copy 2 of each invoice to confirm valid use.

- The number of direct sales invoices issued shall not exceed one book of fifty for each type of invoice.

- It is advisable to purchase invoices directly from tax authorities to ensure compliance with the law and avoid legal risks. Buying and selling fake or invalid invoices is a violation of the law.

How to calculate tax for users of Direct Invoice

Tax calculation for users of direct invoices (also known as sales invoices) is applied according to the direct tax calculation method on revenue, not the deduction method as with VAT invoices. Below are specific instructions:

Direct method on VAT (for gold, silver, precious stones)

- Applicable subjects: Foreign businesses and organizations without permanent establishments in Vietnam but having income in Vietnam, not fully implementing the document regime; Activities of buying and selling gold, silver, and precious stones.

- Formula for calculating VAT payable: VAT = (Selling price – Purchase price corresponding to the sold part) x 10%.

Direct method on revenue (% ratio)

- Applicable subjects: Enterprises and cooperatives with annual revenue of less than 1 billion VND; Newly established enterprises and cooperatives, registered by direct method; Business households, business individuals; Other economic organizations that are not enterprises or cooperatives.

- Formula for calculating VAT payable: VAT = Sales revenue x Rate %.

- The % rate applied depends on the business sector: Distribution, supply of goods (1%); Services, construction excluding raw materials (5%); Transportation, production, construction contracting raw materials (3%); Other business activities (2%).

Currently, tax authorities encourage switching to electronic invoices to:

- Reduce invoice purchase procedures.

- Transparent management, easy to store, easy to look up.

- In line with the digital transformation roadmap of the financial industry.

What are the benefits of taking advantage of support from direct Invoice management software?

Utilizing direct invoice management software brings many practical benefits to individual businesses, business households and small businesses, especially in improving work efficiency, reducing risks and ensuring compliance with legal regulations. Below are the outstanding benefits:

- Easily manage finances and comply with tax regulations.

- Control costs and increase financial management efficiency by integrating accounting functions, helping.

- Connect and synchronize data with other management software (HR, CRM, etc.), creating a comprehensive management ecosystem.

- Security and confidentiality of financial data.

- Easy to use with friendly interface, flexible management on multiple devices

- Transfer data to tax authorities quickly.

Bizzi – Comprehensive invoice management solution, meeting tax standards, optimizing performance

Solving invoices is no longer a burden but the first step for businesses to digitize - accelerate - break through. Saving time and optimizing costs but increasing efficiency, Bizzi is a powerful assistant for modern accounting, finance and business administration with solutions:

Correct profession - Comply with legal regulations

Bizzi supports the entire process of issuing and processing invoices according to Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC, ensuring:

- Legality - validity - reasonableness of all electronic invoices.

- Support VAT invoices, sales invoices, and conversion invoices.

- Keep up to date with any changes from tax authorities.

Comprehensive Management – Flexible anytime, anywhere

- Issue, manage, adjust, cancel invoices... all done on a cloud-based platform, accessible anytime - anywhere - any device.

- Invoice usage reports and issuance status are instantly aggregated, helping accountants and managers grasp the exact financial situation.

Standardize Tax Operations – Absolute Confidentiality

- Apply multi-layer encryption technology, store data on international standard infrastructure.

- Integrate authentication code from tax authorities, ensuring invoices are not forged or changed after issuance.

Easy integration – Connects to existing systems

- Multi-platform compatibility: from accounting software, ERP to POS sales software.

- Open APIs help businesses integrate quickly without disrupting existing operations.

Fast deployment and support – Vietnamese team, market knowledge

- Developed and operated by Bizzi Vietnam team, ready to support 24/7.

- Fast deployment, dedicated training, accompanying businesses throughout the usage process.

Conclude

The above article by Bizzi has provided all the information about the concept, regulations and purpose of using electronic invoices. Hopefully through the above information, readers will understand the nature of electronic invoices, thereby knowing how to process and manage invoices accurately and scientifically.

Direct invoicing may be suitable for small businesses. However, as the scale and financial and tax requirements increase, it will become a major barrier in terms of cost, transparency and scalability. The solution of switching to VAT electronic invoices and applying invoice management software such as Bizzi will help businesses increase professionalism, optimize taxes and support long-term growth.

With the development of AI technology in the current context, direct invoice management software and electronic invoices are important digital assistants that help businesses and enterprises manage neatly - calculate taxes accurately - work more effectively.

No more worries about entering wrong, missing, or lost invoices, using Bizzi means that your business owns a diligent and meticulous "assistant"; scientifically managing all paper invoices and electronic invoices for you in one place. To experience Bizzi's solution set for invoice processing and direct invoice management, electronic invoices, register to experience today!

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/