Issuing electronic invoices is an important step in the accounting process, helping businesses comply with legal regulations and optimize financial operations. However, with changes from Circular 78/2021/TT-BTC and Decree 123/2020/ND-CP, many accountants and business owners still have difficulty in following the correct procedures.

In this article, Bizzi will provide detailed instructions on how to issue electronic invoices according to the latest regulations, and provide important notes to avoid errors and ensure legal compliance. Find out now!

Index

Toggle1. Introduction to electronic invoices

An electronic invoice (E-invoice) is an invoice expressed in the form of electronic data, created by an organization or individual selling goods or providing services using electronic means to record information about the sale of goods or provision of services.

Using electronic invoices brings many benefits to businesses, including:

- Cost savings: Reduce printing, storage and shipping costs compared to paper invoices.

- Increase management efficiency: Easily look up, manage and store invoices, minimizing errors and loss.

- Meet legal requirements: Comply with legal regulations on invoices and documents, helping businesses avoid legal risks.

- Environmentally friendly: Reduce paper usage, contribute to environmental protection.

The General Department of Taxation of Vietnam has deployed an electronic invoice system to support businesses in implementing and managing electronic invoices effectively.

2. Legal regulations related to electronic invoices

Electronic invoices (E-invoices) are a collection of electronic data messages on the sale of goods and provision of services, which are created, created, sent, received, stored and managed electronically. Using E-invoices helps businesses save costs, increase management efficiency and meet the requirements of modernizing accounting and tax work.

Overview of Circular 78 and Decree 123 related to electronic invoices

To provide detailed guidance on the implementation of e-invoices, the Ministry of Finance issued Circular 78/2021/TT-BTC dated September 17, 2021, guiding the implementation of a number of articles of Decree 123. This Circular specifically regulates the content, format, sample number symbols, e-invoice symbols, handling of erroneous e-invoices, as well as the conversion from paper invoices to e-invoices.

According to Circular 78, the electronic invoice must ensure mandatory contents such as: name, address, tax code of the seller and buyer; name of goods and services; unit; quantity; unit price; total amount; value added tax rate; total payment amount; digital signature of the seller and buyer (if any). In addition, the electronic invoice must be presented in Vietnamese; if there is a foreign language, it must be placed after Vietnamese and have a smaller font size.

The implementation of electronic invoices according to Circular 78 and Decree 123 is an important step in modernizing tax management, contributing to creating a transparent and favorable business environment for enterprises.

>> See more: Circular 78 on Electronic Invoices: Regulations, Implementation & Solutions

3. Prepare before creating electronic invoices

Before creating an electronic invoice, businesses need to perform the following preparation steps:

Register to use electronic invoices with tax authorities: Businesses need to notify the first issuance of electronic invoices online. This process will include preparing registration documents and submitting them to the direct tax authority.

Choose the right e-invoicing software: Choosing the right e-invoicing software helps businesses manage and issue invoices effectively. Businesses should consider factors such as features, cost, and the ability to integrate with existing systems.

Ensure the necessary technical requirements: Before implementing electronic invoices, businesses need to ensure that they meet technical requirements such as:

- Use a valid digital signature: Enterprises must register and use digital signatures in accordance with legal regulations. At the time of preparing the electronic invoice issuance dossier, the digital signature must still be valid.

- Device and internet connection: Businesses need internet access devices and stable transmission lines to perform operations such as declaring, issuing and storing electronic invoices.

- Database storage: Businesses need to build a large enough database to store electronic invoices for 10 years as prescribed or choose a reputable storage service provider.

- Sales and accounting software: Businesses should have software for selling goods and services connected to accounting software to ensure that e-invoice data is automatically transferred to the accounting system at the time of invoice creation.

Carefully preparing the above steps will help businesses deploy electronic invoices effectively and in compliance with legal regulations.

4. Detailed instructions on the process of creating and issuing electronic invoices

Creating and issuing electronic invoices is an important part of modern business operations, helping businesses comply with legal regulations and improve management efficiency. Below is a detailed guide to two popular methods for implementing this process:

Method 1: Import data from Excel file

This method is suitable when businesses need to create multiple invoices at the same time, helping to save time and minimize errors.

Steps to follow:

Prepare Excel file:

- Use the sample file provided by the electronic invoice software or create an Excel file with necessary information columns such as: order number, customer name, tax code, address, product/service name, quantity, unit price, tax rate, total amount.

- Ensure data is entered accurately and completely.

Import data into the software:

- Log in to the electronic invoice software.

- Select function “Import” or “Import” from menu.

- Upload the prepared Excel file.

- Identify the sheet containing the data and the column header rows in the Excel file.

- Match the data columns in the Excel file with the corresponding fields in the software.

- Check and confirm the import.

Invoice issuance:

- After the data is successfully imported, check the information of each invoice again.

- Sign and issue electronic invoices.

- Send invoices to customers via email or agreed communication channels.

Method 2: Create directly on B-Invoice software

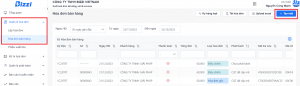

Step 1: On the Menu bar, select “Manage invoices”, then select “Create invoices” or “Sales invoices”. The system displays a list of sales invoices and click “Create new”.

Step 2: On the Invoice interface, customers need to note the following:

– Symbol section: Select the invoice symbol according to the created invoice template.

– Buyer Tax Code: Enter the buyer's tax code.

– Unit name field: Enter the buyer's name.

– Address field: Enter the buyer's address.

– Payment method section: select the corresponding payment method such as TM/CK, cash, bank transfer, etc.

Note: information such as Buyer, email, phone number, account number, bank can be filled in or omitted.

– Enter information about goods and services, select currency, exchange rate and other value fields appropriate to the business.

Step 3: Select “Send Draft Invoice” to the customer or “Preview” the created invoice. Then click “Create New” to save the created invoice.

Step 4: Select the newly created invoice, click “Issue invoice” to sign and send the invoice to the Tax Authority. Wait for the Tax Authority to issue the CQT code.

Note: Before signing, the enterprise needs to open the digital signature software and log in with the Pin code.

Note: The specific steps may vary depending on the software used. For example, the software B-Invoice Provides detailed instructions on invoicing directly on the system.

5. How to manage and store electronic invoices

Managing and storing electronic invoices not only helps businesses operate effectively but also ensures compliance with current legal regulations. Below are regulations on storing electronic invoices and effective management methods:

5.1 Regulations on storing electronic invoices

According to Clauses 1 and 2, Article 6 of Decree 123/2020/ND-CP, the storage of electronic invoices must ensure:

- Storage media: Electronic invoices must be stored electronically, in accordance with the specific operations and technological application capabilities of the enterprise.

Integrity and Confidentiality: Ensure safety, security, integrity, completeness, and no changes or deviations during storage. - Accessibility: Electronic invoices must be ready to print on paper or be looked up upon request.

- Storage period: According to Article 13 of Decree 174/2016/ND-CP, electronic invoices are accounting documents and must be stored for at least 10 years.

5.2 How to effectively manage electronic invoices

To manage electronic invoices effectively, businesses can apply the following methods:

- Use electronic invoice management software: Specialized software helps automate the process of receiving, checking and storing invoices, minimizing errors and saving time.

- Set up dedicated email: Create a separate email address to receive and manage electronic invoices, helping to focus and easily track.

- Cloud storage: Use cloud storage services to ensure data security and flexible access.

- Regular backups: Perform periodic backups of electronic invoice data to prevent loss due to technical problems.

- Employee training: Ensure employees clearly understand the process of managing and storing electronic invoices, and comply with relevant legal regulations.

Complying with regulations on electronic invoice storage and applying effective management methods will help businesses operate smoothly, minimize risks and ensure legal compliance.

6. Handling special situations when issuing electronic invoices

Error handling and adjustment of electronic invoices is an important part of accounting, helping to ensure accuracy and compliance with legal regulations. Below is a detailed guide to common types of errors and the handling process:

6.1. Common types of errors

- Incorrect customer information: Company name or tax code is entered incorrectly.

- Wrong amount, tax rate: Due to incorrect data entry, resulting in incorrect amounts or applicable tax rates.

- Invoice issued incorrectly but not sent to customer: In this case, it is necessary to cancel the invoice and create a new one.

- Invoice sent but error detected: Must issue adjustment or replacement invoice to correct.

6.2. Error handling process

In case of minor errors (name, address): No need to create a new invoice, just notify the buyer of the adjustment.

In case of incorrect important content (amount, tax rate, tax code, quantity of goods):

- Create adjustment invoice: If only adjusting the amount, tax rate or other important indicators.

- Create a replacement invoice: If the error is serious and the old invoice needs to be canceled, a new invoice must be created to replace it.

- Notice to tax authorities and customers: In all cases, it is necessary to promptly notify the tax authorities and customers about the adjustment or replacement of invoices.

Understanding and properly implementing the process of handling electronic invoice errors not only helps businesses comply with the law but also ensures rights and transparency in business operations.

7. Important notes when using electronic invoices

To ensure compliance with legal regulations and avoid errors during use, businesses need to note the following important points:

Comply with legal regulations on electronic invoices

- Roadmap for applying electronic invoices: According to Circular 78/2021/TT-BTC, from July 1, 2022, all enterprises, economic organizations, business households and business individuals are required to use electronic invoices. Non-compliance may result in penalties as prescribed.

- Register to use electronic invoices with tax authorities: Before using, businesses must register and be approved by the tax authority. This process includes sending a notice of electronic invoice issuance and the expected invoice sample to be used.

Choose and use appropriate electronic invoice software

- Selection criteria: The software must meet the prescribed technical standards, ensure safety, information security and be integrated with the enterprise's existing accounting system.

- Employee training: Ensure that accounting staff and relevant departments are fully trained in how to use the e-invoice software to minimize errors in the process of creating and issuing invoices.

Check information before issuing invoice

- Buyer Information: Make sure information such as company name, tax code, address and other relevant information is correct.

- Product/service details: Double check quantity, unit price, tax rate and total value to avoid errors.

Handling errors on invoices

- Case not sent to buyer: If an error is discovered after the tax authority has issued a code but has not yet sent it to the buyer, the enterprise must notify the tax authority according to Form No. 04/SS-HDDT and issue a new invoice to replace it.

- Case sent to buyer: If an invoice has been sent and an error is discovered, the business needs to make a record of agreement with the buyer to cancel the erroneous invoice and issue a new invoice to replace it.

Storage and security of electronic invoices

- Storage time: Electronic invoices must be stored for at least 10 years as prescribed.

- Information Security: Ensure that the storage system has security measures in place to prevent unauthorized access, loss or corruption of data.

Regularly update legal regulations

- Follow information from authorities: Regulations on electronic invoices may change, therefore, businesses need to regularly update information from the Ministry of Finance, General Department of Taxation and relevant agencies.

- Participate in training courses and seminars: To keep up with the latest changes and guidelines, businesses should participate in training programs and seminars on electronic invoices.

Periodically check the electronic invoicing system

- Performance Evaluation: Conduct periodic checks to ensure the electronic invoice system operates stably, meets business needs and complies with legal regulations.

- Troubleshooting in a timely manner: When an incident or error is detected, immediate corrective action must be taken to avoid affecting business operations and comply with the law.

8. Close cooperation with tax authorities

- Timely reporting: In case of errors or incidents related to electronic invoices, enterprises need to notify and coordinate with tax authorities to resolve.

- Comply with inspection and testing requirements: When the tax authority conducts an inspection, businesses need to provide full information and cooperate so that the process goes smoothly.

Ensuring the integrity and authenticity of electronic invoices

- Digital signature: Electronic invoices must be digitally signed by authorized persons to ensure legality and authenticity.

- Check verification code: For electronic invoices with tax authority codes, it is necessary to check the authentication code to ensure the invoice is valid.

Handling special situations

- Power outage, internet outageEnterprises need to have a backup plan to ensure that the creation and issuance of electronic invoices is not interrupted in these situations.

- Change business information: When there is a change in information such as address or tax code, businesses need to promptly update the electronic invoice system and notify the tax authorities.

Thus, electronic invoices help businesses save costs, reduce errors, ensure legal compliance and promote digital transformation. This is not only a mandatory requirement but also an opportunity to improve performance, increase competitiveness and modern management. Businesses need to quickly adapt to develop sustainably in the digital age. Businesses can choose B-Invoice - a comprehensive electronic invoice solution, fully meeting the needs of businesses. With the outstanding advantages as mentioned above, B-Invoice is the right choice for businesses looking for a reputable, quality and cost-saving electronic invoice solution.