Many CFOs expect IFRS 16 to help businesses "reduce rental costs" by changing accounting methods. However, in reality, IFRS 16 does not reduce rental cash flowThis can make rental costs even more difficult to control if contract, invoice, and payment data are not tightly managed.

This article helps CFOs understand the true nature of IFRS 16, clearly distinguish between accounting costs and economic costs, and thereby build a sound accounting system. How to optimize rental costs according to IFRS 16 Based on control over contracts, invoices, cash flow, and operational decisions – rather than just looking at accounting metrics.

Does IFRS 16 help businesses reduce rental costs?

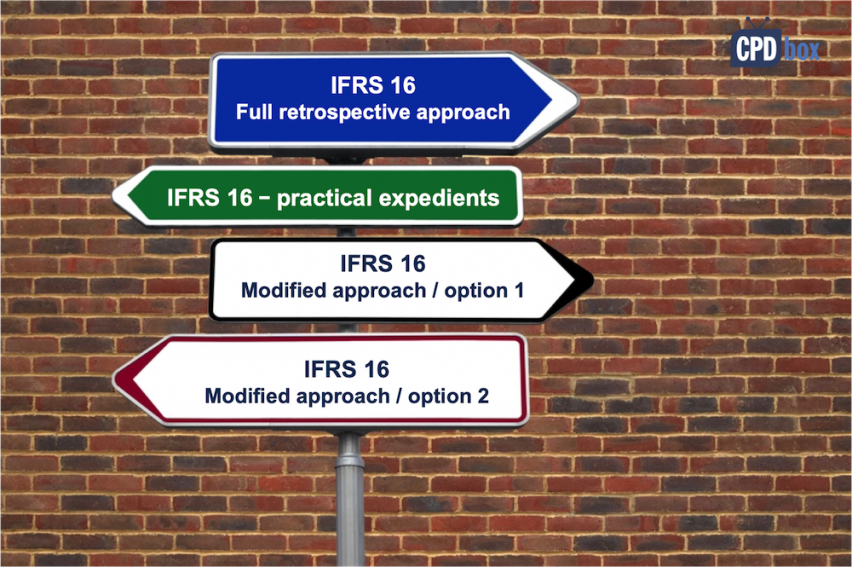

IFRS 16 does not reduce actual rental costs.This standard only changes the accounting treatment by bringing lease agreements onto the balance sheet. The cash flow from lease payments remains unchanged, unless the CFO proactively optimizes the lease and operations.

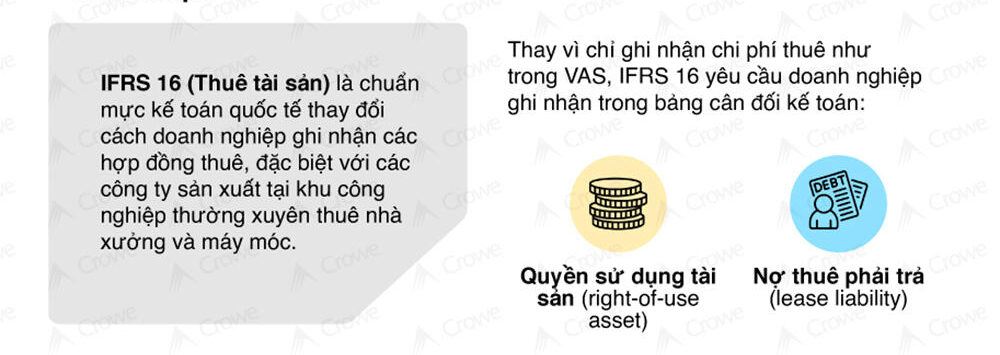

In essence, IFRS 16 requires businesses to recognize ROU Asset (Right-of-Use Asset) – property rights – and Lease Liability – the obligation to rent – for most lease agreements.

ROU Assets reflect the right to use an asset for the duration of a lease and are depreciated gradually. Lease Liability reflects future lease payment obligations, recognized as a liability and with interest amortized over time.

The problem arises when multiple CFOs see it. EBITDA increased Following IFRS 16, it was assumed that rental costs had been optimized. In reality, the increase in EBITDA was solely due to the separation of rental costs into depreciation and interest expense. does not reflect the rental cash outflow.If decisions are based on P&L rather than cash outflow, businesses may misjudge the effectiveness of leasing, leading to suboptimal long-term leasing or lease extension decisions.

Therefore, the right decision under IFRS 16 needs to be based on: Actual cash outflow and total lifetime cost of the lease contract.Instead of just looking at the business performance report.

- See more content analyzing what International Financial Reporting Standards (IFRS) are. here

How do the costs of hiring an accountant differ from the costs of hiring an economic services provider?

Accounting fees reflect the recognition method under IFRS 16, while economic fees reflect... total amount the business actually has to pay over the lifetime of the lease agreement.CFOs can only optimize costs by focusing on an economic perspective.

According to IFRS 16, rental expenses on the profit and loss statement are shown as follows: ROU Asset depreciation and interest expensebut these two amounts does not represent the total rental cost..

From a management perspective, the CFO needs to focus on the entire rental cash flow generated over time, including fixed rent, rent adjusted for price indices, associated service costs, and other contractual expenses.

One correct approach is to look at Lease Lifecycle CostThis is determined by the total cash outflows for each period throughout the contract's lifespan. Relying solely on accounting reports, businesses can easily fall into the trap of long-term leases with unfavorable terms or contract renewals without fully assessing the actual costs.

Once the correct cost optimization needs to be understood, the next question is: where can the CFO intervene?

What are the real levers that help reduce rental costs under IFRS 16?

IFRS 16 does not inherently create leverage for reducing rental costs. Strategy for reducing rental costs according to IFRS 16 This includes contract negotiations, lease term management, invoice control, and cash flow management throughout the contract lifecycle.

Lease agreements are a major determinant of lease costs. IFRS 16 merely reflects what has already been agreed upon, rather than automatically optimizing. If lease terms are long, inflexible, involve unfavorable service bundles, or have unclear price adjustment mechanisms, costs will continue to escalate regardless of accounting standards.

The CFO's role here is to coordinate between Finance, Procurement, and Legal to reassess contract structures, consider renegotiating terms, separate services from lease agreements, or terminate contracts that no longer generate value.

In reality, many rental cost increases are not due to contracts, but rather to operational deviations.

Why do rental costs often increase after IFRS 16 due to poor control?

Following IFRS 16, businesses have to manage more lease contracts with complex payment terms. Without proper control over invoices and payments, lease costs can easily increase due to incorrect payments, duplicate payments, or non-compliance with terms.

Common discrepancies include incorrect billing periods, incorrect unit prices, misapplication of adjustment indices, or services outside the contract. As contract volume increases, manual reconciliation is no longer sufficient to detect these discrepancies in a timely manner. As a result, Overpayments that have lasted for many years.This directly impacts cash flow and rental efficiency, but is often only discovered during an audit.

At this stage, Bizzi Acting as an operational control layer, the system automatically collects and standardizes rental invoices, cross-referencing them with contracts and approval flows, helping CFOs detect discrepancies before spending money – rather than dealing with the consequences afterward.

Invoice control is just one part of a larger data chain that needs to be closed-loop.

What are the steps involved in an effective lease cost control chain under IFRS 16?

To Cost-effective rental solutions according to IFRS 16 To be effective, businesses need to maintain control throughout the entire supply chain. Contract → Invoice → Payment → Report, ensuring all rental payments are in accordance with terms, on time, and supported by data for decision-making.

A broken lease data chain can prevent CFOs from detecting unusual expenses, even if accounting reports appear "up to standard." Investing in a control system connects operational data with financial reporting, creating a foundation for effective lease cost management.

Bizzi supports this control chain through Bizzi Bot for reconciling rental invoices, Bizzi AP/AR for monitoring accounts receivable and ensuring timely payments, and Bizzi Expense for tracking rental budgets in real time.

From operational control, CFOs need to measure performance to make strategic decisions.

What metrics should a CFO use to measure the effectiveness of optimal leasing cost performance under IFRS 16?

Following IFRS 16, many businesses continue to measure the effectiveness of leasing based on accounting metrics such as EBITDA, depreciation of assets used as leases, or interest income from lease obligations. However, these metrics primarily serve reporting and compliance purposes, and do not answer the most important question for CFOs: Is the business effectively managing its leasing costs? Whether or not rent is paid correctly, in full, and at the right time.Without a system of indicators reflecting actual hiring costs, CFOs can easily make flawed hiring decisions even if the financial statements look good.

- The first metric CFOs need to monitor is The level of budget utilization for rental expenses is based on actual cash outflows.Instead of allocating costs on the income statement, comparing total rental cash outflows to the approved budget helps CFOs identify overspending early, especially since rent can fluctuate due to price indices, contract adjustments, or additional services. This is the foundation of optimizing rental costs under IFRS 16 from an economic perspective.

- A more alarming indicator is miscalculation of rental expenses, This reflects the portion of money a business has spent that is not in accordance with the contract terms. In reality, many rental expenses are inflated not due to increased rental prices, but due to incorrect billing periods, incorrect unit prices, or the wrong adjustment mechanism being applied. Without measuring this rate, businesses may accept prolonged overpayments for many years without realizing it, even though IFRS 16 has been fully implemented.

- At the operational decision-making level, the CFO needs Standardize rental costs by property or location.When costs are converted to a comparable unit, the CFO has a basis for assessing which contracts are creating value and which should be renegotiated or terminated. This approach shifts the focus from "correct recognition" to "effective hiring," in line with the spirit of the IFRS 16 cost reduction strategy.

- Finally, the most strategically important indicator is total rental cost over the contract lifecycleThis is calculated based on the total actual cash flow that has been and will be spent. Tracking lifecycle costs helps CFOs avoid the trap of contracts with low initial leases that increase sharply later, and supports decisions on renewing, terminating, or replacing leases. This is also an indicator that IFRS 16 accounting reports cannot provide on their own without operational data.

In reality, the biggest challenge for a CFO isn't identifying which metrics to track, but rather... There is a lack of actual data that is detailed and timely enough to measure.This is where Bizzi plays its role as a layer of control before the accounting system.

By automatically collecting, standardizing, and comparing lease invoices with contracts and budgets, Bizzi helps CFOs see real-time lease cash flow, detect discrepancies before payment, and build a reliable data foundation for management metrics. This allows cost optimization KPIs under IFRS 16 to truly become decision-making tools, rather than just existing on reports.

The question relates to how to optimize rental costs according to IFRS 16.

Does IFRS 16 increase total rental costs?

No, IFRS 16 does not increase the total cost of economic leasing, but it may make the cost appear "larger" because it is shown on the balance sheet.

Should businesses renegotiate lease agreements after IFRS 16?

Yes, especially with long-term contracts or unfavorable terms where the full lifetime cost of the lease is clearly visible.

Which rental costs are most easily overlooked when using manual control?

Index adjustments, bundled service fees, and incorrect billing periods are common risks.

How does IFRS 16 affect the decision to lease or buy?

IFRS 16 clarifies lease costs on the balance sheet, helping CFOs compare lease-purchase based on actual cash flow and financial leverage.

What risks do auditors typically uncover regarding rental costs?

The most common issues include prolonged overpayments, invoice discrepancies, and a lack of supporting documentation for contract verification.

Should services be separated from a lease agreement?

Therefore, it helps to make costs more transparent, easier to negotiate, and more controllable under IFRS 16.

Should CFOs monitor rental costs on a monthly basis or over their lifetime?

Throughout the contract lifecycle, incorporate periodic monitoring to avoid missing long-term cost trends.

- See also Common mistakes when applying IFRS 16 here

Conclusion: What should CFOs do to optimize hiring costs under IFRS 16?

In essence, IFRS 16 does not automatically help businesses reduce rental costs.This standard only requires the CFO to clearly see all existing lease obligations on the balance sheet. The crucial question is no longer... "Does IFRS 16 help reduce rental costs?" but Does the business have sufficient data and control capabilities to leverage IFRS 16 to optimize costs?.

In fact, How to optimize rental costs according to IFRS 16 The most effective approach lies in accurately measuring the financial impact of each lease agreement, and then developing strategies accordingly. Rent reduction strategy according to IFRS 16 Based on data rather than emotion, CFOs need a clear view of leasing costs per business unit, per term, and per renewal clause to proactively renegotiate, restructure the leasing portfolio, or adjust operating strategies.

However, as the number of lease agreements increases and data is dispersed between accounting, purchasing, and operations, manual tracking will turn IFRS 16 into a compliance burden rather than a management tool. This is where businesses need a solution. Cost-effective rental solutions according to IFRS 16 It is systemic in nature.

Bizzi acts as a pre-ERP cost and contract control layer, enabling CFOs to centralize leasing data, track cash outflows, alert on impending lease obligations, and provide reliable input for IFRS 16 recording. Instead of simply "recording for compliance," CFOs can use Bizzi to proactively and effectively analyze, compare, and make optimal leasing cost decisions.

In the context of increasing cost pressures and financial transparency, IFRS 16 only truly delivers its value when combined with a smart cost control framework.For CFOs, investing in a solution like Bizzi is not just about compliance, but a strategic move to turn IFRS 16 into a long-term management advantage.

To receive a one-on-one consultation and experience Bizzi's solutions, register here: https://bizzi.vn/dang-ky-dung-thu/