Properly handling input invoices after output invoices brings many important benefits to businesses, both in terms of tax, accounting and operations. This not only protects VAT deduction rights, optimizes costs, reports transparently and stabilizes cash flow.

In this article by Bizzi, learn how to handle input invoices issued after output invoices to ensure compliance with current laws.

What is an input invoice issued after an output invoice? (Concept – Situation – Risk)

Understanding the nature helps find out how to handle input invoices after output invoices more accurately and easily.

1. Easy to understand concept

This is a situation where a business has purchased goods, stored them in the warehouse, sold them to customers, and even issued an output invoice, but the input invoice from the supplier is issued later than the actual transaction time. Simply put: The goods have arrived at the warehouse - sold to customers - but the documents (input invoices) have not arrived yet.

Typical example: On March 1, 1,000 products were imported from Vendor, resold to customers on March 3 and issued output invoices. But the supplier did not issue input invoices until March 15.

2. Why does the input invoice come after the output invoice?

The occurrence of such situation is often due to the following reasons:

- Vendor exports late due to forgetting, waiting for acceptance report, waiting for contract signing, or invoice issuance system error.

- The purchasing process lacks time control, there is no deadline for requesting invoices.

- There is no or non-compliance with PO/GRN (Goods Receipt Note) so the accounting department does not know when to request an invoice.

- Lack of information connection between operations - purchasing - accounting.

- Urgent order, delivery first, documents later (common in F&B, event, retail businesses).

3. Potential risks

Finding a way to handle input invoices issued after output invoices is very important because the consequences will affect all parties involved.

| Stakeholders | Possible risks |

| Vendor | Can be fined 4-8 million for issuing invoices at the wrong time according to Decree 125/2020 |

| Buyer (Enterprise) | Worry about input VAT and expenses being excluded when settling corporate income tax |

| Both sides | Risk of lost documents, difficulty proving transactions with tax authorities |

| Internal management | Financial statements do not reflect the true situation → incorrect cost of goods sold and profits |

Legal regulations on the time of invoice issuance (Decree 123 - Circular 219 - Circular 79)

It is necessary to pay attention to the legal regulations on the time of invoice issuance (Decree 123 - Circular 219 - Circular 78/79) because it is directly related to tax compliance, risk of administrative fines and VAT deduction rights.

1. Invoice time (required)

According to Decree 123/2020/ND-CPEnterprises must issue invoices at the correct time when the obligation to sell goods or provide services arises:

| Transaction type | Invoice time |

| Selling goods | At the time of transferring ownership and right to use goods to the buyer. |

| Providing services | At the time of completion of service provision, regardless of whether payment has been collected or not. |

| Payment collection service before or during delivery | Set up when collecting money, except in some special cases. |

2. Wrong timing = administrative violation

According to Decree 125/2020/ND-CP on invoice penalties:

| Level of violation | Form of punishment |

| Wrong timing but does not affect revenue and tax payable | Warning |

| Invoice at the wrong time as usual | Fine of 4-8 million VND |

| Deliberate delay to adjust revenue/cost price/tax payable | May be prosecuted for tax evasion |

3. How is tax considered?

- Seller → will be penalized if invoice is issued late / at the wrong time.

- The buyer → is still entitled to deduct VAT and calculate corporate income tax expenses, if:

- The transaction is real.

- Have contract, PO, delivery note, warehouse receipt (GRN), payment documents.

- Invoices are fully issued before tax settlement time.

Meaning: If the timing is wrong, the seller will be fined, but the buyer will not be automatically disqualified.

5 common situations and how to handle input invoices issued after output invoices

Below is a summary of some of the most common and frequent cases when there is a time difference between two invoices.

1. Input arrives late but at the same tax period

The easiest way to handle this is to have the accountant declare VAT normally during the period of occurrence. Just ensure that the contract, GRN, delivery note, warehouse receipt, and payment documents are complete.

2. Input carried forward to next period (next month/quarter)

VAT is declared at the time of invoice receipt, according to the new regulation, there is no longer a 6-month limit as before. The most important factor: must prove the transaction is real (documents + procedures + debt reconciliation).

3. Late invoice due to vendor

Accountants record provisional liabilities (temporary import / provisional cost price) to ensure correct reporting of data. When the official invoice arrives → adjust the data according to actual value → does not affect tax obligations.

4. Declared output – unclaimed input

This is a fairly common case: “sell first – buy later” and is completely legal if the business can prove:

- Real goods (inventory, imported, pre-purchased…)

- Have a contract/order

- There is a delivery receipt.

- Have cash flow to pay or debt to pay

Tax will consider the nature of the transaction → if real, will no cost and no VAT.

5. Issue input invoices after 3–6 months

VAT can still be deducted and expenses can be recorded if:

- Real deal

- Full administrative documents

- Invoices issued before tax settlement date

Late shipment by the seller may be subject to administrative penalties, but the buyer's right to deduction is not affected.

Instructions for handling VAT when input invoices are issued after output invoices

When input invoices arrive late, VAT handling plays a crucial role, as it directly affects tax deduction rights, eligible expenses, and legal compliance.

1. Conditions for VAT deduction

Core principles: Tax on economic substance assessment – if the transaction can be proven to be real, it is still deductible. To be able to deduct input VAT in case of late invoice, the enterprise needs to ensure sufficient 3 groups of conditions as prescribed:

- Legal and valid invoice

- Electronic invoices must follow the correct form and contain all required content according to Decree 123/2020.

- No errors in tax code, business name, value, tax rate...

- Real transactions – actual occurrence

- Have contract, PO, delivery/acceptance record, GRN, warehouse receipt.

- Reconcile debt with suppliers.

- Cashless payment for the bill from 20 million VND or more

- Bank transfer or payment with valid documents.

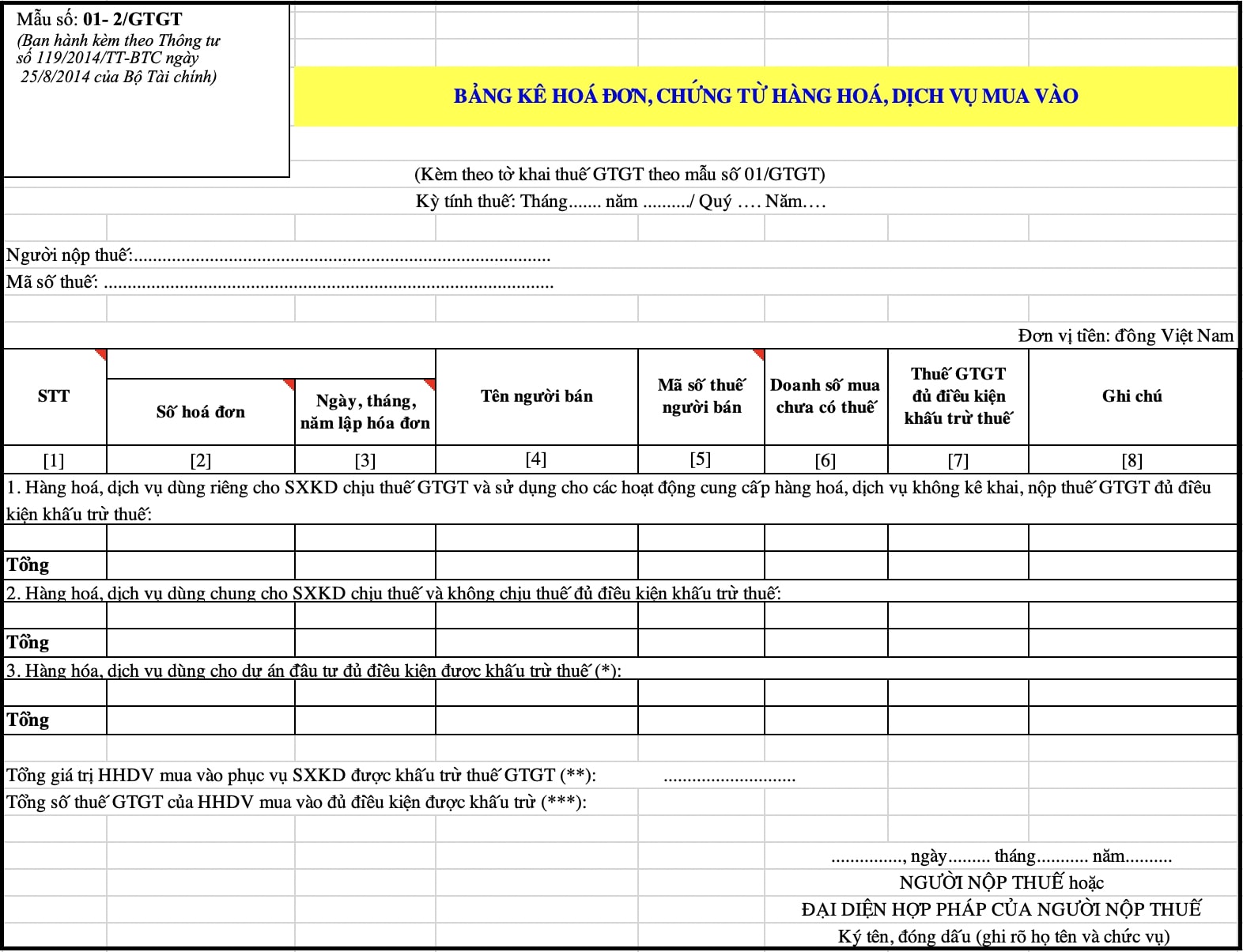

2. Additional declaration form 01/KHBS when the period is incorrect

Business just do KHBS (01/KHBS) in case:

- Previous period declared incorrectly and need to adjust deductible VAT value.

- Want to adjust the increase or decrease of incorrectly declared deductible VAT.

Practical notes:

- When making additional declarations, do not adjust the revenue or output VAT of the current period, but adjust the difference in form 01/KHBS.

- If you simply receive a late invoice and have not declared it, then you do not need to declare it, just declare it when you receive the invoice.

3. Cases where deductions are not allowed

Enterprises will be excluded from input VAT if they fall into the following situations:

- Unable to prove actual transaction

- No delivery documents, no contract, no payment documents.

- Supplier absconded, closed tax code, stopped operations

- Taxes may assess fictitious transactions.

- Virtual transactions, buying and selling invoices

- No actual goods or services, no cash flow.

If the tax concludes that the transaction is not real, both VAT and corporate income tax expenses need to be excluded.

Accounting when input invoices arrive late

When input invoices arrive late, accountants need to note the following important points to ensure correct accounting, transparency and tax compliance:

1. Pre-stock – no invoice

When the goods have arrived at the warehouse but the invoice from the supplier has not been received, the accountant records them at the provisional price (price according to contract / PO / quotation), ensuring correct reflection of inventory and payable debts on the financial report.

Debit 152/156 – Raw materials / Goods

Credit 331 – Payable to suppliers

2. Receive the actual invoice

When the supplier sends the official invoice, the accountant:

- Adjust inventory value at actual price

- Recording input VAT

Debit 152/156 (increase/decrease according to actual unit price)

Debit 1331 – Deductible input VAT

Credit 331 – Payable to suppliers

3. Vendor debt suspension

While waiting for the invoice, the business records the payable portion based on the provisional price / contract / delivery note, ensuring transparency of debt between the two parties. At the same time, this helps the financial report not to have any errors in payable debt, even though the invoice has not arrived.

4. Adjust the difference

When the provisional price is different from the actual price on the invoice, the accountant proceeds adjust up or down:

| Case | How to handle the difference |

| Price increase compared to provisional | Adjust increase in cost of goods / costs |

| Discount from provisional | Adjust cost reduction / cost reduction |

Entry:

Debit 632 / 642 (increased difference)

Yes 152/156 (inventory adjustment)

Common mistakes when invoices are late and how to avoid penalties

Input invoices issued after output invoices often arise from the following reasons:

1. Vendor issues invoice at wrong time

Most common error, often due to late contract signing, waiting for acceptance, or poor coordination process:

- Risk: The seller was fined. 4–8 million, affecting trade relations.

- How to avoid: Set up SLA for invoice issuance time, send automatic reminders, and bind contracts.

2. Export output before entering into warehouse

Businesses sell goods without recording inventory → sound warehouse, easily assessed by tax authorities as risk of fraud/tax evasion.

- How to avoid: Standardize the process PO → GRN → Invoice → Delivery, real-time inventory control.

3. Missing input invoices

Not tracking purchase records, not reconciling debts leads to:

- Wrong period and wrong cost declaration

- Must do 01/KHBS, waste time and effort

- How to avoid: Centralized invoice management, weekly debt checklist, clear division of responsibilities.

4. Save missing documents

Missing contract, GRN, delivery receipt, payment documents → cannot prove real transaction

- Consequence: VAT and corporate income tax expenses may be excluded.

- How to avoid: Store documents in a set of files (contract – PO – GRN – invoice – payment – reconciliation)

5. Not reconciling debts on time

Not periodically reconciling with the vendor causes:

- Detect late invoices after closing the books → passive handling, risk of reporting errors

- How to avoid: Reconcile debts monthly/quarterly, send a signature comparison table for both parties.

How to prevent late invoices with automation (Bizzi IPA + 3Way Matching)

Automation not only helps avoid tax risks and errors, but also improves operational efficiency, protects cash flow and provides transparent financial reporting. Here are five benefits of using automated software for invoice management:

1. Automatically receive invoice as soon as vendor issues

No more risk of receiving invoices late due to human error, the automated Bizzi Bot system will help accountants:

- Scan – download – classify – read OCR invoices 24/7

- Automatically record invoices into the approval process

2. Automatic PO – GRN – Invoice reconciliation

Automatic comparison order – receipt – invoice by row to block the situation sound warehouse before it happens:

- Detect price deviation, quantity deviation, period deviation immediately

- Warning when selling goods but no input yet

3. Check the validity of invoices and suppliers

The automated system protects businesses from the risk of VAT and cost overruns by:

- Verify tax code, operating status, tax risks

- Detect wrongly timed invoices, unusual invoices

- Self-warn and block risky invoices

4. Limit stock sound → limit incorrect output

Continuous and real-time status monitoring purchase - import - export to reduce the risk of being assessed for fraud by tax authorities.

- Get early warning before output is released

- Instant inventory sync

5. Synchronize data with ERP/Accounting

Direct integration with SAP, Oracle, Odoo, Bravo, Misa, Fast…

- Avoid slow manual data entry

- Avoid lost invoices and reporting errors

- Declare and record on time

Software End-to-end automation – no delays – no missing documents.

FAQ – Most searched user questions about how to handle input invoices issued after output invoices

Below is information related to the topic of the article, providing additional important perspectives.

1. Are late input invoices subject to VAT deduction?

Have. As long as real deals and legal – valid – reasonable invoice.

2. Is there a penalty?

- Seller Invoices issued at the wrong time will be penalized. administrative sanctions.

Buyer no penalty, but tax risk if the documents are incomplete.

3. How long is VAT deductible?

Declaration at the invoice receipt period (according to current regulations) no 6 month limit as before).

4. Is it a violation to issue an output invoice before it is in stock?

Have. This is behavior. wrong time, easily leading to sound warehouse → be considered tax fraud risk.

5. Is there any problem with input invoices coming after 3-6 months?

VAT is still deductible if:

- Have full documents to prove the transaction

- Invoices issued before tax settlement date

Conclude

Understanding how to handle input invoices after output invoices needs to be focused on, however this is not a serious problem if businesses firmly grasp the 3 safety principles:

- Proof of transaction authenticity: Full guarantee contract – delivery note – warehouse receipt – payment to demonstrate the nature of the business.

- Declare on time / fill in the correct form: Late invoices are still acceptable. VAT deduction, just declare at the invoice receiving period, no longer limited by 6 months as before.:

- Automate controls to eliminate risk: Bizzi IPA + Solution Application 3-Way Matching (PO – GRN – Invoice) to avoid missing invoices, warning of risky invoices & automatic reconciliation; No wrong import - export time

Instead of trying to process input invoices after output invoices have occurred, prevent the above errors by applying automatic control software. Register now here to experience a demo and receive specialized solution advice specifically for your business!