In an age where data is at the heart of every decision, budgeting is no longer just about “spending money wisely” – it becomes a process. data-driven forecasting, planning, and strategic decision making.

With the support of EPM (Enterprise Performance Management), businesses can Flexible financial planning, cost control and investment efficiency optimization.

This article will guide you in detail how to budget management with EPM – from processes, methods, benefits to implementation tools suitable for Vietnamese businesses.

What is the important role of EPM in budget management?

Before we learn how EPM helps set a budget, let's understand this concept correctly and why it has become the "backbone" of modern financial management.

EPM (Enterprise Performance Management) also known as CPM (Corporate Performance Management) is a system that helps businesses plan, forecast, analyze and report financial performance.

EPM is used in activities such as budgeting & forecasting, FP&A (Financial Planning & Analysis) and strategic planning.

One point of confusion is between ERP and EPM:

- ERP (Enterprise Resource Planning) stores and processes actual transactions (invoices, salaries, inventory…).

- EPM uses that data to plan, forecast, and analyze operational performance.

| Criteria | ERP | EPM |

| Main function | Transaction recording, accounting management | Planning, forecasting, performance analysis |

| Data | Historical data | Future data (planning, simulation) |

| Main users | Accounting, operations | CFO, FP&A, strategic management |

| Target | Manage daily operations | Support strategic decision making |

In other words: ERP records the past – EPM predicts the future.

Budget management process using EPM

Before implementing EPM, businesses need to understand the comprehensive budget management process — from data collection to KPI monitoring and reporting.

Step 1. Collect data from ERP/CRM and other systems

EPM automatically connects to ERP, CRM, HRM, POS or BI tools to aggregate operational data. The goal is to create a “Single Source of Truth”, ensuring all numbers in the report are synchronized.

Step 2. Plan budget by department, project, branch

Businesses can choose:

- Top-down budgeting:The board of directors assigns the total budget target, and the departments reallocate it.

- Bottom-up budgeting: Departments make their own plans, then synthesize them into the entire enterprise budget.

EPM allows both methods to work in parallel, helping budget consistent with strategic objectives and reflect business practices.

Step 3. Set up a general and detailed budget

EPM budget classification:

- Operating budget (OPEX) – regular operating costs.

- Capital expenditure budget (CAPEX) – purchasing, expansion, R&D costs.

The system also allows Track financial KPIs (such as EBITDA, ROI, Cost per Project) to evaluate the effectiveness of each expense.

Step 4. Budget forecast & variance analysis

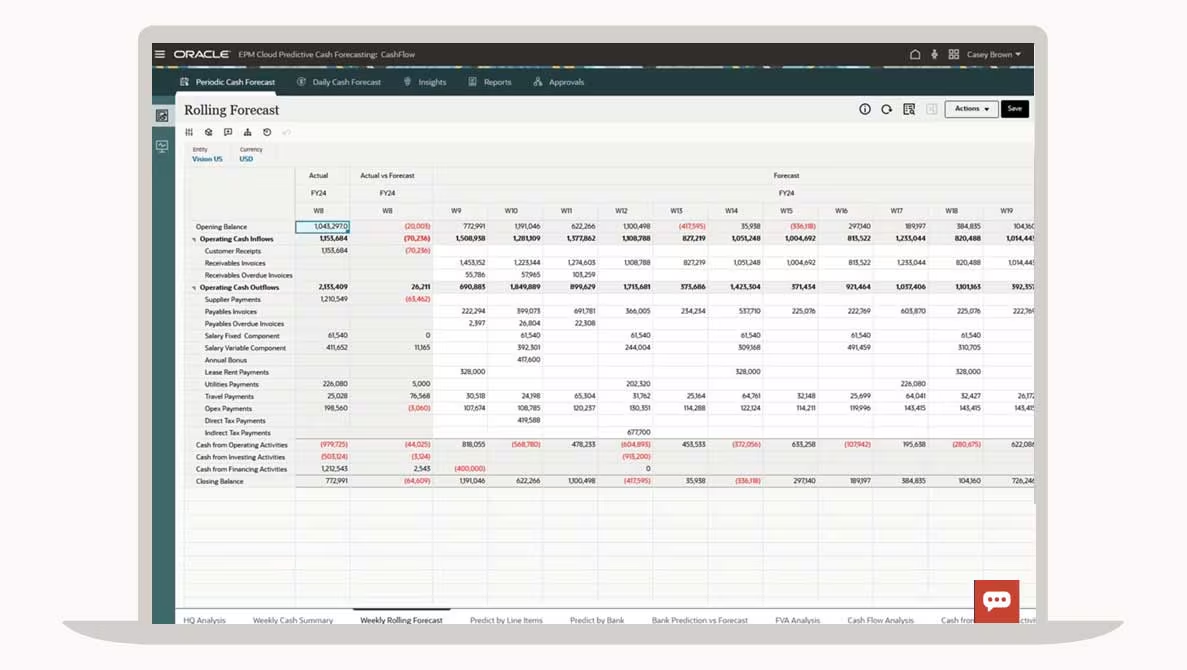

One strong point of EPM budgeting is the ability to create Rolling Forecast – dynamic forecasts, continuously updated every quarter. CFOs can analyze Actual vs Budget vs Forecast to detect deviations early and adjust plans immediately.

Step 5. Approve and monitor the budget

EPM provides automated approval workflow, helping to reduce budget review time between management levels. Departments can track spending status in real time, ensuring costs are always within approved limits.

Step 6. Reporting & analysis by KPI

EPM aggregates data into management reporting with intuitive dashboard. Managers can track KPIs such as:

- Forecast Accuracy

- Budget Variance (%)

- Planning Cycle Time

- Cost-to-Revenue Ratio

Budget management methods in EPM

In the EPM (Enterprise Performance Management) system, businesses can apply many different budget management methods depending on their development stage, business strategy and maturity level of the financial system.

The three most popular methods include Zero-Based Budgeting (ZBB), Incremental Budgeting, and Rolling Forecast.

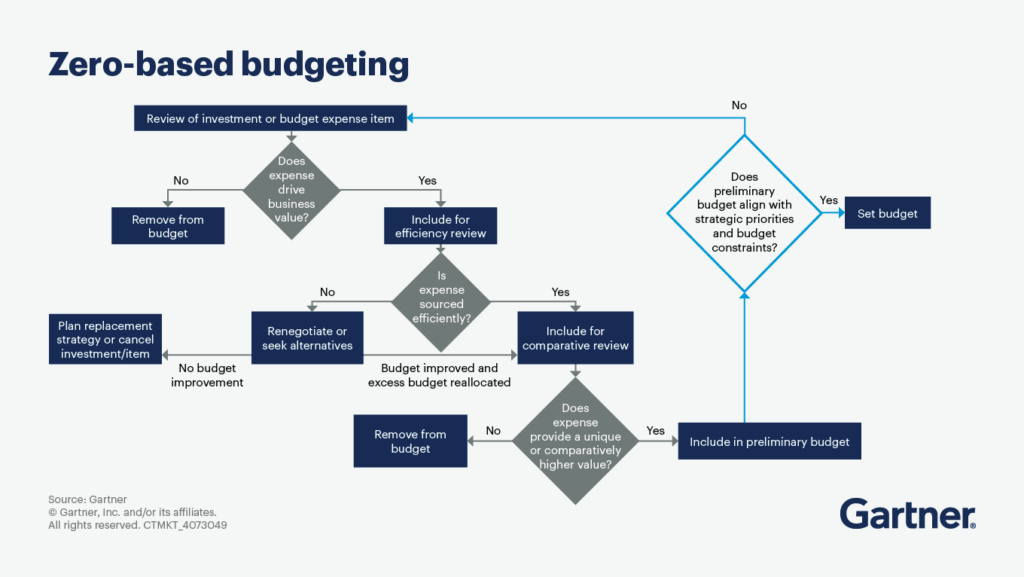

Zero-Based Budgeting (ZBB)

Zero-Based Budgeting is a method of creating a budget from scratch, rather than relying on the previous year's figures. Each department must justify spending on each item and clearly define the value it brings to the organization.

Characteristic:

- Each budget period starts completely over.

- All expenditures must be assessed based on actual needs and priorities.

- Increase accountability and transparency in resource allocation.

When to apply:

- The business is in the process of restructuring or needs to cut unnecessary costs.

- When it is necessary to review all expenses to ensure investment efficiency.

Advantage:

- Helps optimize costs, eliminate wasteful expenses.

- Enhance transparency and accountability in budget management.

Limit:

- It takes a lot of time and effort to evaluate each expense.

Incremental Budgeting

Incremental Budgeting is a traditional budgeting method in which a business adjusts the new budget based on the previous period's figures, usually increasing or decreasing by a fixed percentage.

Characteristic:

- Simple, easy to implement and does not require major changes in processes.

- Departments rely on the previous year's budget as the basis for calculations for the next period.

For example: If the Marketing department was allocated 1 billion VND last year, this year it can increase by 10%, equivalent to 1.1 billion VND.

Advantage:

- Easy to apply, suitable for businesses with stable operations.

- Reduces budgeting time compared to other methods.

Limit:

- Easily creates conservative mentality, lack of innovation.

- Ineffective spending can continue if not carefully reviewed.

Rolling Forecast

Rolling Forecast is a dynamic forecasting method that allows businesses to update and adjust their budgets regularly (monthly or quarterly), instead of keeping them fixed for the entire fiscal year.

Characteristic:

- Forecast continuously for 12 months or more, depending on the business's management cycle.

- Use the latest real-world data to update forecasts, keeping plans in line with market conditions.

How it works:

- Every quarter, businesses update their forecasts for the next 12 months.

- Data from ERP, CRM, HRM systems are integrated into the EPM platform to automatically update and recalculate financial indicators.

Benefit:

- Help management respond quickly to market fluctuations.

- Increase the accuracy of financial planning.

- Support flexible and timely strategic decision making.

Limit:

- Requires centralized data systems and EPM technology to support automated processing.

- Need FP&A team with analytical skills and regular forecast updates.

Benefits of budget management using EPM

Businesses cannot rely solely on static budgets to manage their finances. Applying EPM (Enterprise Performance Management) in budget management helps businesses not only control costs but also proactively forecast and adjust financial plans in real time.

Here are four core benefits that EPM budgeting brings to modern businesses.

Cash flow optimization

One of the most prominent benefits of EPM in budget management is the ability cash flow forecasting with high precision.

Unlike manual planning on Excel, EPM systems allow businesses to connect data from ERP, CRM, HRM to model the entire future cash flow.

Specifically:

- EPM helps businesses track cash flow in real time, including projected revenue, operating costs, liabilities, and investments.

- From there, CFOs and FP&A departments can detect cash flow shortage risks early, adjust spending plans or find alternative sources of finance in a timely manner.

- Accurate forecasting also helps businesses reduce short-term borrowing costs and optimize overall financial costs.

For example: A manufacturing enterprise applying EPM can predict negative cash flow cycles (cash gap) during low months, thereby renegotiating payment schedules with suppliers to maintain stable liquidity.

Increased transparency and cost control

Financial transparency is the foundation of effective governance. EPM helps with financial planning according to a hierarchical structure – from department, project to branch – and record each expense with a clear origin.

Outstanding benefits:

- EPM system allows tracking of actual vs budget in real time.

- Data is recorded and displayed centrally, making it easy for CFOs to spot discrepancies or cost overruns.

- Managing budgets with automated approval workflows also minimizes the risk of fraud and manual errors.

Result:

- Each department can monitor its own spending, increasing autonomy and responsibility.

- Management has a holistic view, ensuring spending is always linked to investment performance.

Compared to Excel, where data is fragmented and error-prone, EPM budgeting provide a “single source of truth” – a unified and transparent source of data for the entire organization.

Support strategic decision making

Besides EPM helps in financial planning, it is also strategic analysis tools powerful. Through dashboards and real-time reporting, businesses can transform data into insights for decision-making.

EPM helps management:

- Compare actual performance to plans across multiple dimensions (department, product, region, project).

- Develop scenario planning to assess the impact of market fluctuations, raw material prices or revenue changes.

- Quickly analyze financial indicators such as ROI, EBITDA, Gross Margin to support investment strategy adjustment.

Real life example: A retail company can use EPM to simulate the impact of increased marketing spending on sales and net income. These predictive models help CFOs make quick and accurate decisions, instead of manually aggregating data from multiple Excel files.

Reduce manual errors and processing time

For businesses that are still managing budgets using Excel, updating data, checking formulas, and compiling reports often takes up the majority of the FP&A team's time.

EPM helps Automate the entire budgeting and forecasting process, significantly reducing errors and processing time.

Specific benefits:

- Automatically aggregate data from multiple sources (ERP, CRM, HRM).

- Error warning system, data logic check, manual error elimination.

- Budget approval and forecast workflows help operations run smoother.

Actual impact:

- Budgeting time is reduced from weeks to just days.

- Finance staff can spend more time on strategic analysis rather than crunching numbers.

Popular EPM Tools & Software for Budget Management

Choosing the right EPM software is a decisive factor in helping businesses improve the effectiveness of planning, forecasting and financial analysis. Below is a summary of the Most popular EPM solution on the market today, trusted by many large corporations in the world and in Vietnam.

Oracle EPM Cloud

Oracle EPM Cloud is a comprehensive enterprise performance management platform, supporting everything from budgeting and forecasting to consolidation and reporting.

- Provides dynamic forecasting and what-if scenario simulation capabilities.

- Integrates well with Oracle ERP and BI systems.

- Suitable for large corporations that need to standardize global financial management processes.

SAP BPC (Business Planning and Consolidation)

SAP BPC is a powerful EPM solution that integrates directly within the SAP ecosystem.

- Support financial planning, consolidation and reporting.

- Flexible configuration, suitable for businesses using SAP ERP.

Advantages: high security, large data processing capability.

Disadvantages: initial investment and implementation costs are quite high.

IBM Planning Analytics (TM1)

IBM TM1 is an OLAP-based performance planning and analysis tool.

- Allows for detailed budgeting and forecasting model customization.

- Real-time connection with Excel, making it easy for users to operate.

- Suitable for medium to large sized businesses with complex data modeling needs.

Anaplan

Anaplan is a cloud-based EPM platform that features cross-departmental connectivity and collaboration.

- Support budgeting, analysis and strategic planning.

- Allows for intuitive, customizable financial modeling.

- Suitable for businesses that need a flexible, fast collaboration environment.

Workday Adaptive Planning

Workday's EPM solution focuses on user experience and high automation capabilities.

- Intuitive interface, easy to use.

- Supports rolling forecasts and real-time reporting.

- Integrates well with Workday's HR and financial systems.

OneStream

OneStream is aimed at large enterprises that need to consolidate complex financial data.

- Integrate budgeting, forecasting, consolidation, and reporting in one platform.

- Reduce the need for multiple separate tools.

- Strengths: centralized management, suitable for multi-company corporations.

Sactona (distributed in Vietnam by Bizzi)

Sactona is an EPM solution designed specifically for Finance and Accounting Department of Medium and Large Enterprises, focusing on FP&A process optimization, budgeting and forecasting.

- Friendly interface like Excel, helps users convert easily without depending much on IT.

- Support multidimensional budget planning (by department, project, branch).

- Provides real-time management reporting and variance analysis.

- Implementation and operating costs are much lower than international solutions.

- Fast deployment time, clear ROI and suitable for the Vietnamese market.

Frequently Asked Questions (FAQ – schema FAQ)

Below are common questions that businesses often ask when learning about Budget management using EPM (Enterprise Performance Management).

1. How to manage budget with EPM?

Enterprises can manage budgets with EPM by integrating data from ERP, CRM, and HRM systems to plan, allocate budgets, and track spending in real time. EPM allows creating a budgeting process with a clear approval workflow, while supporting variance analysis to help control financial performance.

2. Does EPM help with budgeting by department or by project?

EPM supports both budgeting models: department and by projectBusinesses can set up a flexible budget structure to properly reflect the specific characteristics of their operations, for example: creating a marketing budget, a human resources budget, or an investment budget for each specific project.

3. What are the benefits of budget management using EPM compared to Excel?

Compared to Excel, EPM helps:

- Automate the entire process of budgeting, approving, and tracking.

- Reduce errors due to manual data entry.

- Support multidimensional data analysis and KPI reporting.

- Allows multi-user collaboration and real-time data updates.

4. Does EPM support budget forecasting?

Yes. Current EPM tools support rolling forecast – dynamic budget forecasting, which continuously updates according to actual market fluctuations and business operations. This helps CFOs and management quickly adjust financial plans when changes occur.

5. Are there any real-life examples of businesses applying EPM to manage budgets?

Many large enterprises have successfully applied EPM, for example:

- Multinational corporations such as Unilever, Coca-Cola, and IBM Use Oracle EPM or Anaplan to optimize planning and forecasting processes.

- In Vietnam, many medium and large enterprises are implementing Sactona (distributed by Bizzi) to manage budgets, helping to shorten planning time from weeks to days.

6. Which EPM modules are used for budget management?

Common modules in the EPM system include:

- Budgeting & Forecasting: financial planning and forecasting.

- Financial Consolidation: consolidated financial statements.

- Profitability & Cost Management: cost and profit analysis.

- Management Reporting: KPI management report.

- Scenario Planning: simulate financial scenarios.

Conclude

In the context of businesses strongly transforming in the direction of data-driven (data-driven decision making), budget management using EPM is no longer an option – it is an essential requirement to maintain competitiveness.

EPM helps businesses Standardize planning - forecasting - analysis processes, increasing transparency in cost management, while optimizing investment efficiency. From there, CFOs and management can make Make faster, more accurate decisions based on reliable data.

With the characteristics of Vietnamese enterprises - solutions are needed Flexible deployment, cost-effective and easy to use, Sactona is exclusively distributed by Bizzi in Vietnam. is a worthy option. This solution offers:

- Fast deployment time, in just weeks instead of months.

- Clear ROI, helping businesses optimize investment costs.

- Friendly interface like Excel, suitable for internal finance team.

Vietnamese businesses can refer to Bizzi's Sactona solution to start their EPM application journey - building solid financial capacity, improving forecasting capabilities and accelerating digital transformation in budget management.

👉 Learn about Sactona EPM solution now to experience fast, efficient data management, planning and forecasting for your business.

Registration here