IFRS 16 does not automatically increase “lease payables,” but it changes how businesses recognize lease expenses on their financial statements: from rent expense luxurious Depreciation + InterestThis change directly impacts EBITDA, debt ratio, cash flow classification, and the resulting consequences. Compliance costs – system costs – data operation costs during implementation.

This article explains the nature What is IFRS 16?, answer clearly Does IFRS 16 increase or decrease rental costs? and Does applying IFRS 16 increase costs?, from the CFO's perspective.

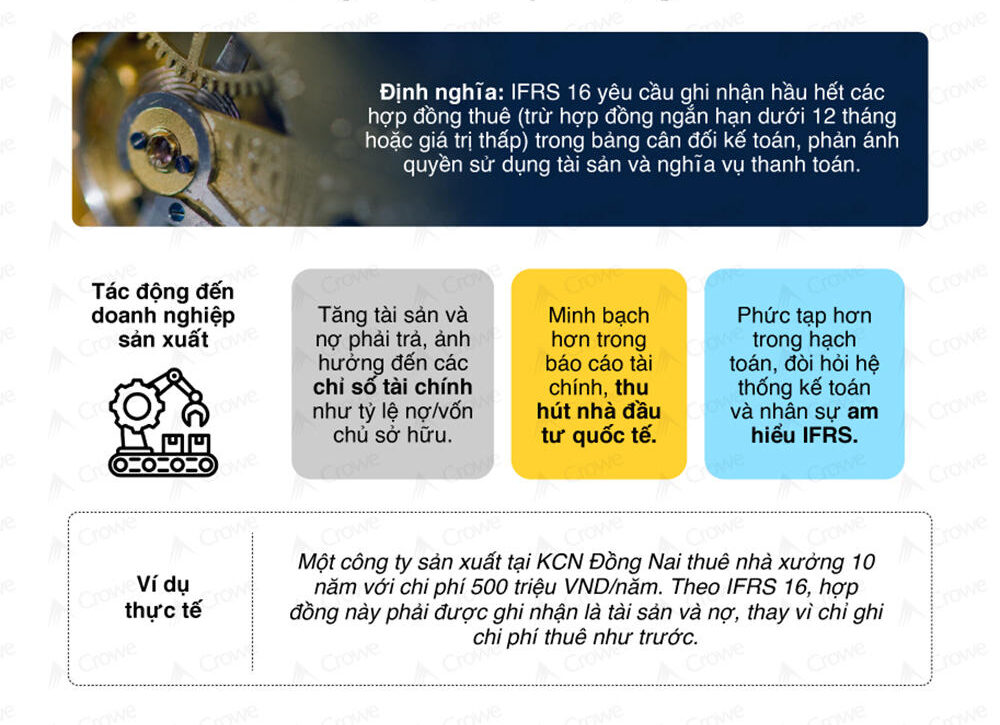

What is IFRS 16 and how does IFRS 16 change the nature of “rent expenses” on financial statements?

IFRS 16 This is a standard lease requirement that the lessee must acknowledge. Right-of-Use Asset (ROU Asset) and Lease Liability for the majority of lease agreements. This makes "rent cost" no longer a separate expense. rent expense Linear as before, but transformed into ROU Asset depreciation and interest on Lease Liability.

Prior to IFRS 16, many operating leases were only recognized. off the balance sheet, with rental costs being accounted for directly as operating expenses.rent expenseIFRS 16 eliminates this approach and replaces it with a single lessee accounting model.

In essence, IFRS 16 does not create new costs, but Change the cost structure from rent expense to depreciation and interest expense.This leads to changes in KPIs, financial structure, and covenant risks.

Therefore, CFOs cannot interpret IFRS 16 as a mere accounting change, but must view it as a whole. Shifts in how unit performance is measured, budget allocation is made, and financial leverage is assessed..

The core change is the "on-balance sheet" mechanism: previous lease agreements that might not have been fully reflected on the balance sheet (depending on classification) will now increase. total assets and total debtOn the P&L, instead of a single lump-sum lease payment, the business records:

- Depreciation (usually linear with lease term)

- Interest (decreases gradually over time as lease debt decreases)

Quantitatively, IFRS 16 begins with determining the present value of a lease obligation:

- Lease Liability (original) = PV (present value) of future lease payments, discounted according to Discount Rate/IBR

- ROU Asset (original) It is usually determined based on the initial lease availability and adjusted for additional costs such as initial direct costs, dismantling/restoration costs, and lease incentives (if any).

Why do CFOs need to read this section carefully? Because "rental costs" don't increase in cash, but "transform" in the reporting and increase recognized debt, this leads to changes in KPIs, budget limits, unit performance evaluation methods, and covenant risks.

In practical implementation, the problem often lies not in the PV formula, but in the scattered contract and lease documentation data: inconsistent payment periods, outdated terms and conditions, and invoices that don't match the contract. When a business has a standardized layer of lease documentation (invoices/receipts/payment terms) by supplier – payment period – cost center, the process of creating input data for IFRS 16 becomes "lighter" and reduces errors. At this stage, Bizzi can support the centralization and standardization of lease expense documents so that CFOs and the finance team have sufficiently clean operational data before inputting it into the IFRS 16 engine.

The core formula in IFRS 16: What CFOs need to understand to correctly interpret costs.

1. Determine the initial lease liability (Lease Liability)

The initial lease liability is recorded as Present Value of future lease payments:

Lease Liability₀ = Payment₁ / (1 + r)¹ + Payment₂ / (1 + r)² + … + Paymentₙ / (1 + r)ⁿ

In there:

- Lease Payment: Lease payment at the current payment period.

- rrr: drug rate (usually IBR – Incremental Borrowing Rate)

- nnn: lease term

👉 Here's the first point where IFRS 16 can make costs appear higher: The higher the IBR → the larger the initial lease debt → the higher the interest expense at the beginning of the period..

Which contracts are covered by IFRS 16, and what exceptions help businesses reduce compliance costs?

IFRS 16 applies when the contract grants the lessee the right to... control usage one identified assets for a period of time in exchange for payment. Two quick identification questions:

- Have "de asset" or not?"

- The lessee has "right to control use" or not (benefiting economically and deciding how/for what to use)?"

Businesses can apply certain exceptions to reduce computational load and operating costs:

- Short-term lease: Short-term rental (less than 12 months) (and no purchase option).

- Low-value assets: low-value assets (standards do not set fixed thresholds; businesses establish consistent and well-founded internal policies).

One often overlooked risk is infected ledger (Hidden outsourcing in service contracts). CFOs need to pay special attention to this.substantive substitution rights": If the supplier has a genuine right to replace the asset (with the ability and economic benefit to do so), the contract may not be a lease under IFRS 16, even though it may appear to be a lease."

When contract catalogs are scattered across departments and invoices arrive through multiple channels, embedded leases are easily overlooked or misclassified. In practice, an effective approach is to centralize data by vendor and payment pattern to narrow down the contracts requiring review.

Bizzi can act as a centralized data center for vendor-based rental costing, helping finance teams identify transaction groups with signs of "hidden leasing" and classify them early, reducing the risk of misreporting and future compliance costs.

Does IFRS 16 increase or decrease rental costs? The correct answer: "Accounting costs are front-loaded, but rental cash flow does not increase on its own."

Does IFRS 16 increase or decrease rental costs? Typically, the total cost recorded on the P&L (depreciation + interest) tends to... Higher in the early stages and lower towards the end of the period. (effect front-loading), because interest is calculated on the lease balance and decreases over time. However, actual rent paid according to the contract does not increase on its own simply because the business applies IFRS 16.

Therefore, if a business only looks at one accounting period, it might see "increased expenses" and misunderstand IFRS 16 as an increase in rental costs. The correct way for a CFO to read it is to look at it from the perspective of IFRS 16. contract lifecycleAccording to the amortization schedule:

- ROU depreciation is typically relatively stable over time.

- Interest on the loan decreases over time as the lease liability is repaid.

During implementation, payment period data and invoice values need to match the contract; if there is a discrepancy, the allocation schedule and comparison between cash and P&L will be incorrect from the outset. To reduce data errors, businesses should standardize payment periods and map contracts, invoices, and cost centers.

Bizzi can help centralize rental invoices, attach metadata by period and related contract, enabling CFOs to reconcile "actual rent paid" with IFRS 16 accounting data on a monthly/quarterly basis, avoiding disputes due to fragmented data.

How does IFRS 16 affect business costs through EBITDA, EBIT, net profit, and debt ratio?

How does IFRS 16 affect business costs? This is most often demonstrated through KPIs:

- EBITDA typically increases. Because rent expenses decrease/disappear from operating costs, replaced by depreciation and interest (which are below EBITDA).

- EBIT and net profit This can fluctuate over time due to the front-loading effect, especially in the early stages of the contract.

- Total assets and total liabilities increased. due to the recognition of ROU Asset and Lease Liability (gross-up effect).

- Leverage ratios and covenants More sensitive: Debt/Equity, Net Debt/EBITDA, Interest coverage...

The key area for CFOs to prepare is a "bridge" explaining KPI fluctuations before and after IFRS 16, as stakeholders (CEO, banks, investors) may see increased EBITDA but also increased leverage. To build a good bridge, businesses need consistent data on lease commitment by unit/cost center, payment schedules, and contract classifications.

From a management perspective, if rental data is linked to the cost center and budget right from the operational stage (instead of just being aggregated at the end of the period), the CFO will be more proactive in managing run-rates and assessing the impact of IFRS 16 on a unit-by-unit basis. Bizzi can support this step by standardizing rental cost data by cost center/budget owner, creating a data base for FP&A to simulate scenarios on EPM/Excel and prepare explanatory documents for stakeholders.

Three variables determine whether IFRS 16 will increase costs: Lease Term, IBR, and Lease Payments.

Will adopting IFRS 16 increase costs? IFRS 16 does not create additional costs from "air," but the assumptions can cause accounting costs and KPIs to fluctuate significantly if the wrong ones are chosen. Three key variables:

- Lease term: especially the renewal/cancellation terms and the "reasonably certain" clause.

- IBR (Incremental Borrowing Rate)The discount rate reflects the amount a business must pay if it borrows to acquire similar assets; it depends on the term, the level of collateral, and the credit risk.

- Lease paymentsDistinguish between fixed, variable, and index-linked expenses; identify which items are recorded as liabilities and which are directly recorded as expenses for the period.

Incorrect assumptions lead to two risks: (i) lease debt becomes inflated, worsening leverage, and (ii) interest/depreciation expenses do not accurately reflect actual commitments, distorting the unit's KPIs. CFOs should establish clear governance, for example, an IBR matrix based on (tenor × asset type × coverage level), instead of using a single number.

For effective governance, contract data must have complete attributes: term, price increase clause, index, renewal option, payment structure, cost center, etc. This is where operations often break down when contracts are in procurement, invoices are in accounting, and budgets are in FP&A. A layer of document data standardization and tagging based on contract attributes will help reduce operating costs later on. Bizzi can support standardization and attach metadata directly from the lease expenditure document line, helping CFOs reduce the risk of "choosing policies in data blindness."

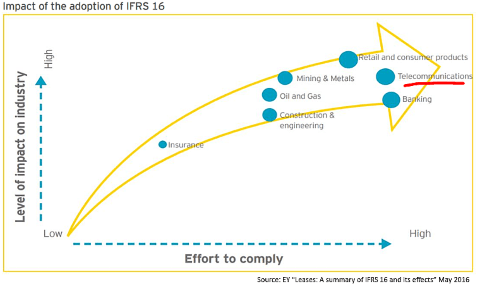

What impact does IFRS 16 have on operating costs: increased data workload, contract change control, and payment schedule reconciliation?

What impact does IFRS 16 have on operating costs? This often increases sharply in businesses with many leasing contracts (retail, logistics, manufacturing) because they need to maintain the data lifecycle:

- Contract inventory and data standardization.

- Monitoring changes to terms and conditions remeasurement (index, area, term, renewal terms...).

- Handle to sell and periodic reassessment.

- Reconcile invoices, contracts, and payment schedules.

- Audit trails are used for auditing and control testing.

Common "breakdown points" include scattered invoices by unit, contracts changing but not updated in time, and a faulty cost center leading to skewed management reports. This results in increased operating costs not only due to the personnel handling the data, but also because errors lead to multiple rounds of corrections and the risk of being questioned by auditors.

In an optimal operating model, lease invoices are collected centrally, linked to the relevant contract and payment period, and then reconciled before being included in reports. Bizzi can assist at this level: centralizing lease invoices, linking metadata by vendor–period–contract, tracking payable obligations, and supporting payment schedule reconciliation. Once operational data is controlled, IFRS 16 operating costs are significantly reduced due to decreased manual reconciliation and increased traceability when accountability is required.

Does adopting IFRS 16 increase costs? Distinguishing between “accounting costs” and “implementation/compliance costs”

questionWill adopting IFRS 16 increase costs?" needs to be separated into two classes:

1) Accounting impact:

Rental costs are converted into depreciation plus interest and may front-load over time. This is a change in the form of the expense on the P&L, not necessarily an increase in actual rent paid.

2) Implementation and compliance costs:

Businesses may incur both one-time and recurring expenses, including:

- IFRS 16 system/engine and ERP integration.

- Standardizing contract data, internal controls, and training.

- Consulting, auditing, reconciliation operations, and audit trail services.

If layer (2) is not well managed, the business will actually “increase costs” in personnel and implementation effort, even if the rent remains unchanged. Therefore, before discussing tools, CFOs should prioritize standardizing the data source of rental documents and designing the contract-invoice-payment reconciliation flow.

During the transition phase, centralizing invoice and rental cost data significantly reduces the effort required to collect and clean data, which often drives deployment costs. Bizzi can support this by centralizing rental expense documentation by vendor/cost center, facilitating reconciliation and audit trail creation, helping project teams reduce rework loops and lower the personnel costs associated with "data gathering."

How IFRS 16 can increase the cost of capital through Covenants: why do CFOs need a bank negotiation plan?

IFRS 16 increases the amount of debt recorded, potentially worsening leverage ratios and bringing them closer to the covenant threshold. If the covenant is affected, businesses may have to adjust loan terms or add collateral, increasing the cost of capital. Therefore, CFOs need to prepare:

- Bridge KPIs before/after IFRS 16 (especially Net Debt/EBITDA, Debt/Equity, Interest coverage).

- Logical explanation: rent did not increase; the change is recorded.

- Policy on lease term/IBR and safe “buffer” scenarios.

Unit/cost center lease commitment data is crucial input for covenant simulation. When lease data is centralized and standardized according to a governance structure, building KPI bridges and simulating scenarios becomes faster and more verifiable. Bizzi can assist CFOs in standardizing lease operations data for covenant simulation and preparing bank exchange documents.

How does IFRS 16 impact taxes and the risk of tax recovery when "accounting expenses" differ from actual rental invoices?

IFRS 16 recognizes expenses based on depreciation and interest, while deductible expenses for tax purposes depend on domestic regulations and actual documentation. When businesses do not closely monitor contracts, invoices, and payment schedules, common risks include:

- Missing supporting documents for each period or mismatched payment periods.

- The variable rent/price adjustment lacks justification.

- Discrepancies between IFRS records and tax returns increase the effort required for explanation.

The CFO should establish a reconciliation mechanism between the IFRS ledger and tax records, while ensuring sufficient evidence: contracts, appendices, invoices, payment documents, and control logs.

In operations, if rental invoices are reconciled by vendor–contract–payment period and payments are consistently tracked, accountability is significantly improved. Bizzi can support the centralization of rental invoices and reconciliation with payment schedules/accounts payable, creating audit trails for post-audit purposes.

IFRS 16 Implementation Cost Checklist: What additional costs will businesses incur?

| Cost group | Typical content | When will it increase sharply? | Suggestions for control based on CFO standards. |

| Compliance & Policy | Develop lease/low-value/short-term policies, approval processes, and internal guidelines. | Multiple units/branches, diverse contracts | Standardize policies and clearly define permissions (owner of rented data). |

| Systems & Integration | IFRS 16 engine, integrated ERP/EPM/BI, COA mapping | Fragmented ERP, multiple systems | Designing a “one data flow” and SSOT for leased data. |

| Data & Operations | Create a list of contracts, collect appendices, standardize payment terms, and track modifications/remeasurements. | Scattered contracts, invoices sent through multiple channels, and frequent changes to terms. | Prioritize the centralization of document data and regular reconciliation. |

| Internal audit and control | Controls testing, audit trail, assumption explanation (IBR, lease term) | Audits require high levels of tracing and the data is inconsistent. | Increase audit trail, and ensure complete and consistent evidence storage. |

| Human Resources & Training | Accounting/FP&A/procurement training, assignment of outsourced data operations. | Missing data owner, personnel changes | Set KPIs for data operations and provide role-based training. |

| Cost of capital (indirect) | Covenant renegotiation, capital buffer, loan term adjustment | Leverage is approaching the Covenant threshold. | Prepare bridge KPIs before/after IFRS 16 and buffer scenarios. |

In most IFRS 16 projects, the cost overrun lies not in the formula but in the data: inconsistent contracts, invoices, payment periods, and cost centers lead to prolonged reconciliation and difficulties in accountability. When businesses have a centralized layer and standardized tax documentation from the operational stage (for example, through Bizzi), the volume of data cleaning and reconciliation is often significantly reduced before data is incorporated into the IFRS 16 system.

How does IFRS 16 force a change in the “Lease vs. Buy” strategy when off-balance-sheet advantages disappear?

When IFRS 16 brings the majority of leases onto the balance sheet, the decision lease vs buy It's necessary to base the comparison on total lifecycle costs and KPI impact, rather than just looking at Opex vs. Capex. CFOs should compare them using the following framework:

- TCO (Total Cost of Ownership) and life-cycle cost.

- Operational flexibility vs. long-term commitment.

- Impact on leverage/covenants.

- Cash flow impact according to the scenario.

To make good decisions, businesses need leasing data by asset group, term, user, and payment schedule. When operational data is properly categorized according to governance structure, FP&A can simulate lease vs. buy scenarios faster and with less debate. Bizzi can support the aggregation of lease costs by cost center/asset group to provide a basis for comparing TCO and analyzing scenarios.

Consolidating corporate reporting when the parent company applies IFRS 16 and the subsidiary uses VAS 06: where are the expenses incurred and how are they controlled?

If the parent company adopts IFRS 16 but the subsidiary continues to follow domestic standards, the group typically incurs costs related to standardization and consolidation:

- Standardize COA and map between reporting standards.

- Reconciliation and audit trail procedures.

- Ensure consistency in vendor/cost center and lease contract data across all units.

Cost overruns often stem from data issues: inconsistent contracts and invoices, non-standardized reconciliation processes leading to multiple rounds of corrections and increased audit risk. A more effective approach is to standardize operational data by vendor/cost center first, then address the mapping/consolidation layer. Bizzi can support the centralization of cross-unit lease expense and lease liability data under a single governance structure, reducing reconciliation effort during consolidation.

Before vs. After IFRS 16 Table: How have rental costs and KPIs changed?

| Category | Prior to IFRS 16 (operating leases – old practice) | After IFRS 16 (recognition of ROU Asset & Lease Liability) | Meaning for CFO |

| Rental cost based on P&L | Rent expense (usually linear over the period) | Depreciation (ROU depreciation) + Interest (interest on lease debt) | "Rent costs" change structure, not necessarily cash. |

| EBITDA | Often reduce The rent expense is included in the Opex. | Often increase Because rent expenses decrease/disappear, they are replaced by D&A + Interest (below EBITDA). | An EBITDA uplift could make KPIs look better, but a bridge explanation is needed. |

| EBIT | Affected by rent expense | Affected by Depreciation (usually stable) | EBIT may fluctuate differently than before depending on how it is allocated. |

| Net profit | Less front-loading | Maybe front-loading because Interest is higher at the beginning of the period | Compare across the contract lifecycle, avoiding conclusions drawn from a single period. |

| Total assets | Usually lower (less/no recorded usage rights) | Increase due to ROU Asset recognition | "Gross-up effect" causes the balance sheet to swell. |

| Total balance | Usually lower (lease obligations are not reflected as liabilities) | Increase due to Lease Liability | Leverage and covenant are more sensitive. |

| Debt/Equity | Usually lower | There is a tendency increase | The buffer covenant needs to be evaluated, and communication with banks/investors is necessary. |

Frequently Asked Questions (FAQ) about IFRS 16 and the cost for CFO/Accountant

Does IFRS 16 increase rent payable?

No. IFRS 16 primarily changes the recognition and classification (ROU, Lease Liability, Depreciation, Interest), it does not automatically change cash payments as per the contract.

Why does applying IFRS 16 increase EBITDA?

Because rent expenses are typically included in OEX and affect EBITDA; IFRS 16 converts rent into D&A + interest, so EBITDA usually increases even if total costs may be front-loading.

What does "front-loading" mean in IFRS 16 and how does it affect costs?

Front-loading is a phenomenon where total costs (depreciation + interest) are higher in the initial period due to high interest on lease debt, then gradually decrease as the debt decreases.

Where does the borrowing interest margin (IBR) for calculating IFRS 16 come from?

IBR reflects the interest rate a business would have to pay if it borrowed to acquire similar assets, depending on the term, collateral, and credit risk; therefore, IBR policies should be segmented rather than a single general figure.

Can a service contract contain an “embedded lease”?

Yes. If the contract grants control over a defined asset and the supplier does not have substantive substitution rights, the lease portion may fall under IFRS 16.

How does IFRS 16 affect the cash flow statement?

The classification often changes: the principal portion of the lease repayment is in the financing cash flow; the interest portion may be in the operating cash flow according to policy; the total outflow does not necessarily change.

Does IFRS 16 increase the risk of covenant violations?

Possibly. Lease availability increases recognized debt and sensitizes leverage ratios; CFOs should prepare bridge KPIs and a covenant renegotiation plan.

What additional costs do businesses incur when implementing IFRS 16?

Costs include system/integration, consulting, auditing, contract data standardization, training, and periodic audit trail/controls testing.

What support does Bizzi provide to businesses when implementing IFRS 16?

Bizzi does not replace the IFRS 16 engine, but it helps standardize lease invoice data, control lease costs according to budget, and automate accounts payable/payment schedule reconciliation, thereby reducing errors and increasing accountability.

Conclusion

IFRS 16 doesn't automatically increase rent costs, but it alters the structure of rental expenses on the P&L, increasing recognized debt and making KPIs/covenant more sensitive. In practice, businesses often "increase costs" in data implementation and operation: centralizing contracts, standardizing documents, reconciling payment schedules, and maintaining audit trails.

Therefore, to control IFRS 16 costs and risks according to CFO standards, start from the data foundation: normalize invoices – contracts – payment periods – cost centers and design a periodic reconciliation flow.

At this operational level, Bizzi can support the centralization of lease documentation, budget-based lease cost control, and accounts payable/payment reconciliation, helping businesses implement IFRS 16 "correctly and sustainably" instead of spending effort on adjustments later.