Regulations on input and output invoices are an important part of a business's financial and accounting management. Understand clearly What is output invoice?, as well as output invoice principles will help business owners and accountants follow the correct procedures, ensure legal compliance and optimize business operations. This article will provide the most detailed information on current regulations, helping you easily apply them in practice.

1. Overview of Input and Output Invoices

Input and output invoices are two important types of accounting documents reflecting the purchase and sale transactions of goods and services in the enterprise. Proper management and accounting of these types of invoices helps ensure compliance with legal regulations and optimize financial and tax efficiency.

1.1 What is an input invoice?

Input invoices are documents used to prove the purchase of goods and services for the production, business and maintenance of the organization's operations. The common term is also known as purchase invoice. This is an important basis for businesses to account for valid expenses, deduct input VAT and accurately settle taxes with tax authorities. In addition, input invoices help businesses calculate business costs, thereby supporting decisions on selling prices, distribution, sales promotion and effective communication.

1.2 What is an output invoice?

An output invoice is a type of invoice that records the sale of goods and services by a business or organization during the period. Also known as a sales invoice, an output invoice is an accounting document created by an organization or individual selling goods or providing services to serve as a basis for accounting for revenue. According to regulations on input and output invoicesThe creation and issuance of output invoices must fully comply with principles and regulations, ensuring transparency and accuracy in tax management.

1.3 Distinguishing between Input Invoices and Output Invoices

| Criteria | Input invoice | Output invoice |

| Source | Businesses receive when purchasing goods and services from the seller | Enterprises export to buyers when selling goods and services |

| Tax Implications | Basis for cost accounting, input VAT deduction and tax settlement | Basis for accounting for revenue, calculating output VAT and paying tax |

| Meaning in business | Based on input costs to make financial decisions, selling prices, promotion | Basis for determining revenue to evaluate performance and make strategic decisions |

| Accompanying documents | Sales contract, delivery note, acceptance report | Delivery note, purchase order, sales contract |

1.4 Principles of output invoice issuance

According to current regulations, when issuing output invoices, businesses must comply with basic principles such as:

- Invoice at the time of revenue generation or upon customer request

- Information on the invoice must be complete, accurate, and reflect the true content of the transaction.

- Comply with invoice forms and invoice issuance methods as prescribed by law.

- Record the correct tax code, name and address of the seller and buyer.

- Do not arbitrarily change or delete information on invoices to avoid violating tax laws.

Understanding and properly implementing regulations on input and output invoices, as well as mastering what an output invoice is and the principles of issuing output invoices are important steps to help businesses optimize financial management, ensure compliance with the law, and at the same time create favorable conditions for production and business activities and tax settlement.

2. Regulations on Input Invoices

Input invoices are important accounting documents that help businesses account for costs, declare VAT and manage finances effectively. Full compliance with regulations on input invoices not only helps businesses ensure legality but also avoid the risk of being penalized. Below are important contents to know about regulations on input and output invoices for businesses to operate legally.

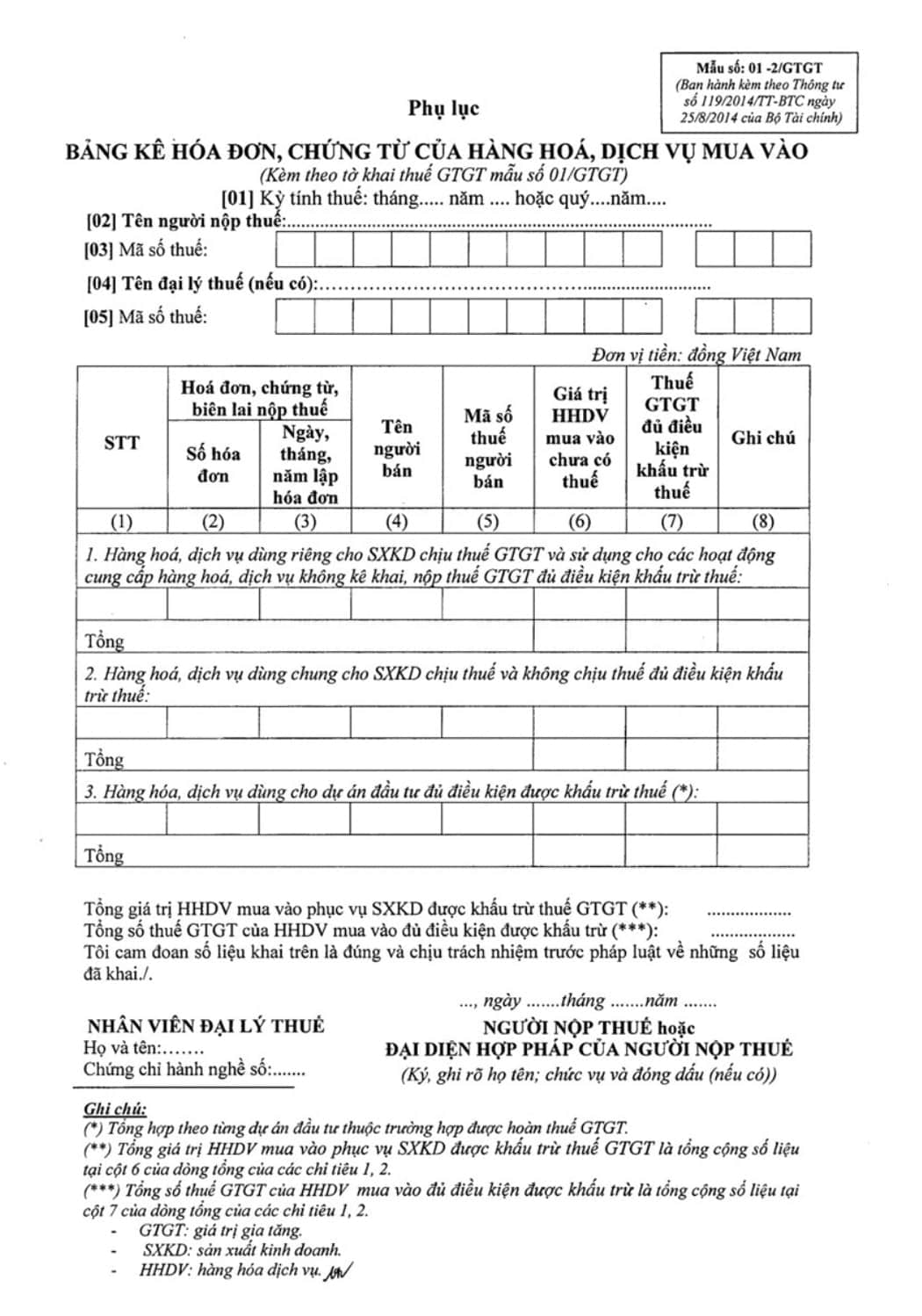

2.1 Required content on Input Invoice

According to Article 10 of Decree 123/2020/ND-CP and Decree 119/2018/ND-CP, input invoices must fully show the following contents:

- Invoice name, invoice symbol, invoice template symbol, invoice number.

- Seller and buyer information: Full name or company name, address, tax code, payment account (if any).

- Invoice issue date/month/year.

- Payment method (cash or bank transfer).

- Information about goods and services: Name, quantity, unit, unit price, price, tax rate, VAT, total payment.

- Signature of buyer and seller, seal of the unit providing goods and services.

- Tax authority code (for electronic invoices).

Note: Invoices that do not include all of these details will be fined from 4,000,000 to 8,000,000 VND.

2.2 Time of creating Input Invoice

According to Clause 1 and Clause 2, Article 9 of Decree 123/2020/ND-CP and Decree 119/2018/ND-CP:

- For sales invoices: Invoice is issued when transferring ownership or right to use goods, regardless of whether payment has been collected or not.

- For service invoices: Invoice upon completion of service provision or at the time of invoice issuance, regardless of whether payment has been collected or not.

- In case of multiple deliveries or handover of each service item: Invoice each delivery or handover corresponding to the volume and value.

Note: Invoice issuance at the wrong time can be fined from warning to 8,000,000 VND depending on the severity of the violation.

2.3 Documents accompanying Input Invoice

To ensure accuracy when accounting for costs and settling taxes, businesses need to keep the following documents with input invoices:

- Contract for the sale of goods (with detailed appendix if any).

- Warehouse receipt for purchased goods.

- Receipt, receipt recording money transaction.

- Minutes of liquidation of sales contract (if any).

2.4 Processing Input Invoices with value over 20 million VND

According to regulations, businesses must pay via bank to deduct VAT on input invoices with a value of over 20 million VND.

- If the bill is paid multiple times, all payments must be made by bank transfer.

- In case of purchases on the same day with a total value of over 20 million, cash payments cannot be divided to be deducted from tax.

- The remittance account must be in the business name.

- Enterprises need to make payments before the settlement deadline to ensure tax deduction rights.

2.5 Storage and Archiving of Input Invoices

Pursuant to Article 6 of Decree 123/2020/ND-CP, enterprises are responsible for storing input invoices:

- Ensure safety, security, and no changes or distortions during storage.

- Minimum retention period is 10 years from date of issue.

- For electronic invoices, they can be stored electronically, printed on paper, saved on dedicated emails, hard drives, cloud services or electronic invoice management software.

2.6 Handling of lost, burned, or damaged Input Invoices

In case of lost, burned or damaged invoices, the enterprise will be fined from 4,000,000 to 8,000,000 VND. The steps to handle include:

- Make a record of the incident.

- Make a report on lost invoices according to form BC21/AC and submit it to the tax authority.

- Contact the seller to obtain a signed and stamped copy to replace the lost invoice.

Understanding the regulations on input invoices not only helps businesses optimize accounting processes but also avoid serious legal risks. At the same time, when combined with knowledge of what an output invoice is and the principles of issuing output invoices, business owners and accountants will ensure comprehensive legal and financial aspects, contributing to promoting effective and sustainable business operations.

3. Regulations on Output Invoices

Output invoices are important documents in business activities, helping businesses record revenue and fulfill tax obligations according to legal regulations. Understand clearly regulations on input and output invoices, as well as output invoice principles is a necessary condition for business owners and accountants to ensure legality and accuracy in accounting and tax operations.

A. Required content on Output Invoice

According to Clause 1, Article 6 of Decree 119/2018/ND-CP and Decree 123/2020/ND-CP, output invoices must ensure the following mandatory criteria:

- Invoice name, invoice symbol, invoice template symbol, invoice number.

- Name, address, tax identification number of seller and buyer.

- Detailed information about goods and services, including description, quantity, unit price, total amount before tax.

- Applicable tax rate, VAT amount, total payment amount (including tax).

- Digital signature, electronic signature of seller; may have buyer signature if agreed.

- The time of electronic invoice creation is clear and in accordance with regulations.

- Tax authority code (for invoices with codes).

- Other relevant information as prescribed (if any).

B. Time of creating Output Invoice

The time for issuing output invoices is determined based on Decree 119/2018/ND-CP and Decree 123/2020/ND-CP as follows:

- For sales invoices: The time of creation is the time of transferring ownership or right to use the goods to the buyer.

- For service invoices: The time of issuance is upon completion of service provision or according to the agreed invoice issuance time.

- In case of multiple deliveries or service handovers: Create an invoice for each delivery or handover.

- For electronic invoices without tax authority codes: The time of creation is when the seller digitally or electronically signs the invoice.

- For electricity, water, telecommunications and television supply industries: Invoices must be issued within 7 days from the date of meter reading or the end of the agreed period.

- In real estate business, infrastructure construction, houses for sale, payment is collected according to progress: The time of invoice creation is the payment collection date.

Strict compliance regulations on input and output invoices as well as correct application output invoice principles Not only does it help businesses avoid tax risks, it also contributes to transparency in business transactions.

4. Check the validity of Input Electronic Invoices

Checking input electronic invoices is an important step to help businesses verify the legality of documents, thereby ensuring proper accounting and tax deduction, avoiding risks when settling taxes.

4.1 Why is validity checked?

Checking the validity of input electronic invoices helps ensure that invoices are legal and serve as an accurate basis for cost accounting, tax deductions and tax settlement. This helps businesses avoid the risk of legal disputes and errors when working with tax authorities, while complying with the law. regulations on input and output invoices.

4.2 Ways to check the validity of input electronic invoices

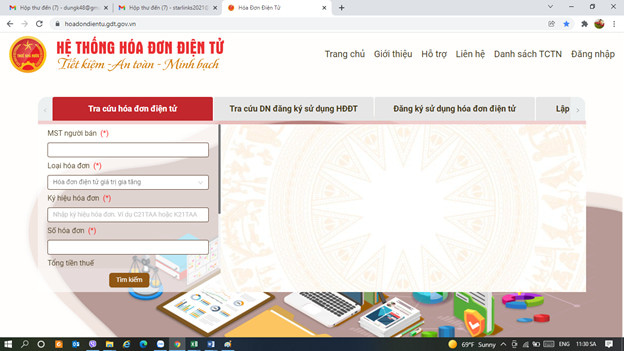

Method 1: Look up on the General Department of Taxation website:

- Visit website tracuuhoadon.gdt.gov.vn

- Select the search type: one invoice or multiple invoices

- Enter details: Tax code, Symbol, Model number, Invoice number, Authentication code

- Click search to validate invoice

Method 2: Use invoice checking software:

- Use accounting software with the feature of checking input electronic invoices.

- Software automatically checks for validity and legality

- Test results are clearly displayed, helping accountants process quickly and accurately.

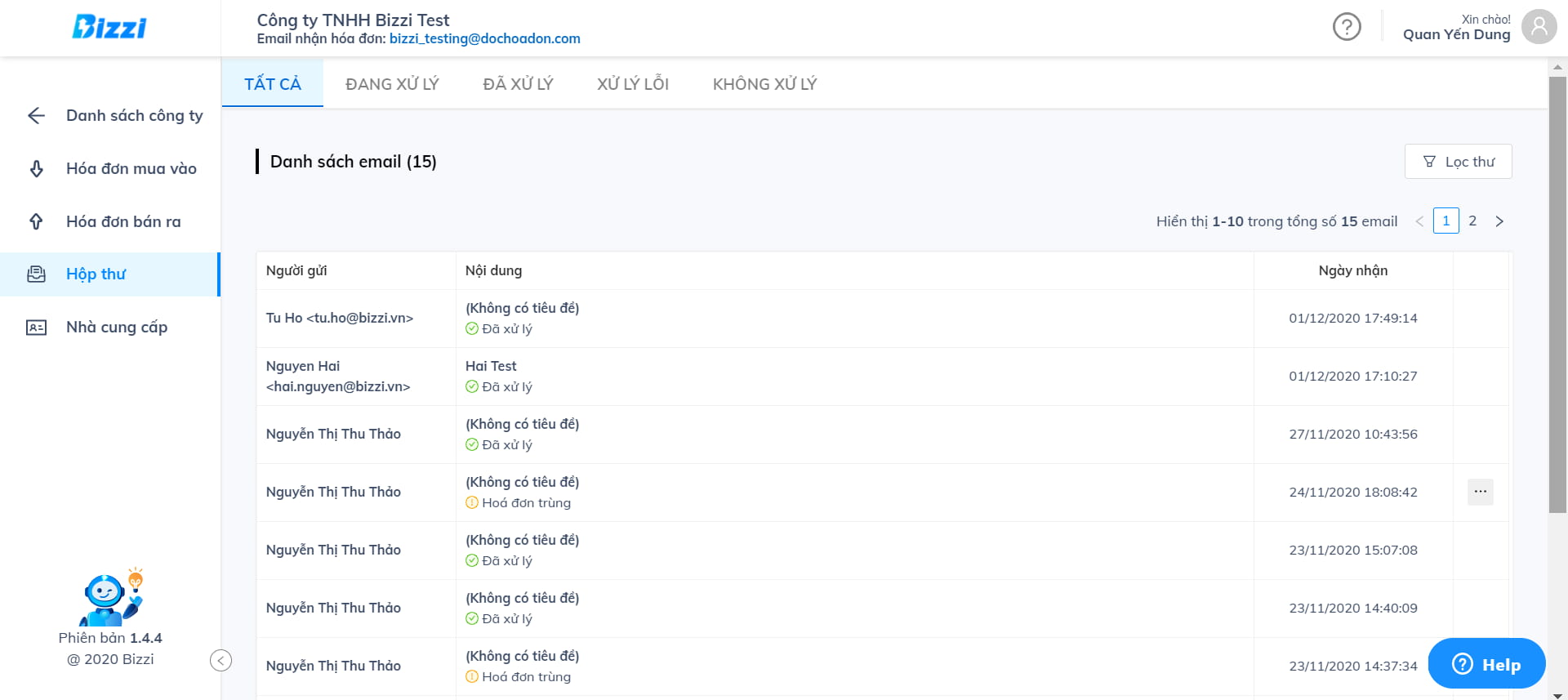

Method 3: Check the validity of electronic invoices with Bizzi

- Push electronic invoice to Bizzi's email address with the suffix @dochoadon (xml invoice file to check validity)

- After receiving the email, the system automatically reads the invoice, checks and compares the invoice with information from the General Department of Taxation.

- The system returns the results of checking the invoice to see if it is valid.

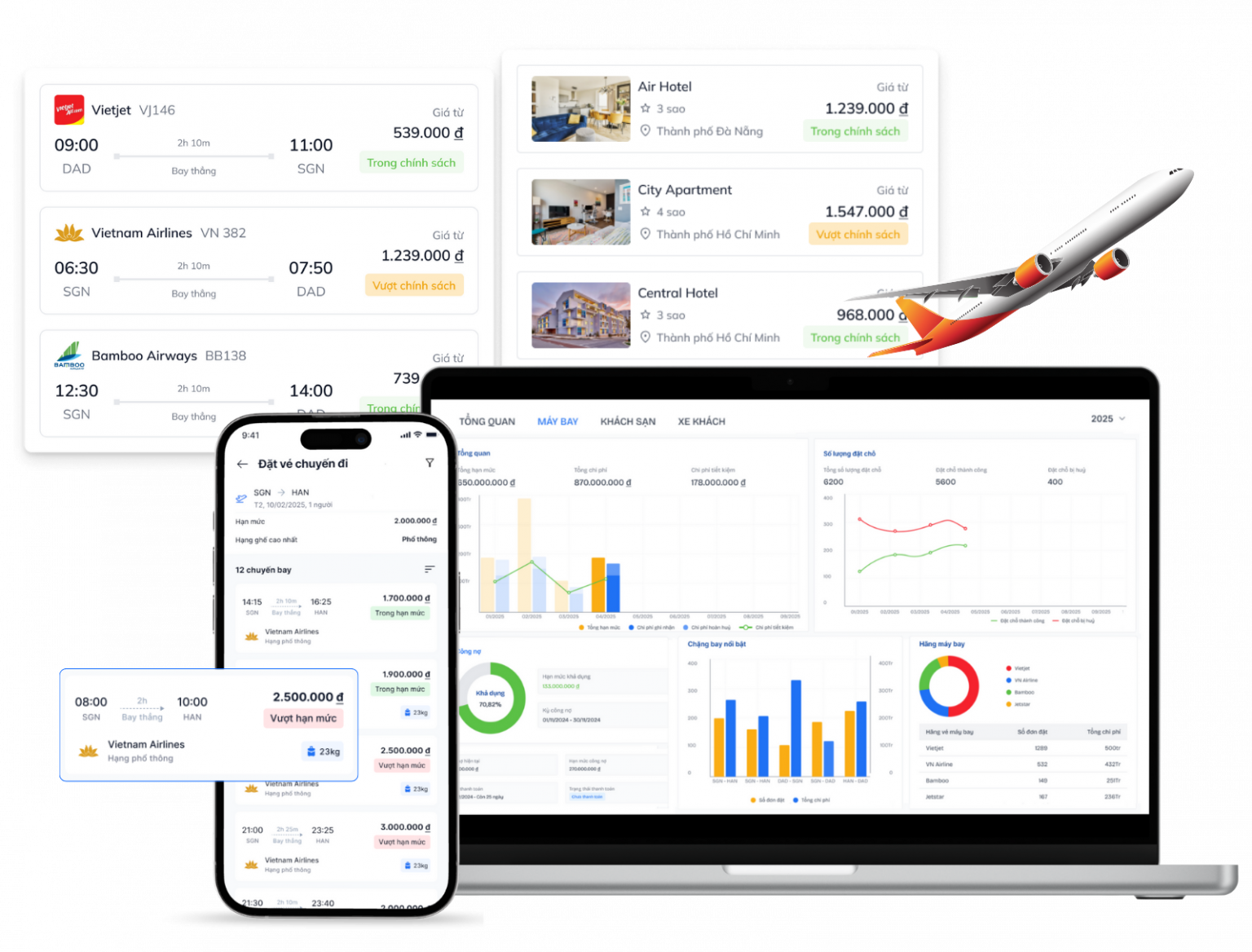

5. Applying Technology in Invoice and Cost Management

In the context of strong digital transformation, the application of technology in invoice and cost management becomes a key factor to help businesses improve operational efficiency, while ensuring compliance. regulations on input and output invoices of the law. Modern platforms like Bizzi not only help automate processes but also help control costs and minimize risks in financial management.

5.1 Automate Input Invoice Processing

Platforms like Bizzi leverage Robotic Process Automation (RPA) and Artificial Intelligence (AI) to automate the entire lifecycle of incoming invoices. The ability to instantly download, review, and reconcile invoices helps businesses process and extract data in less than 30 seconds.

In particular, the automatic reconciliation feature compares each line of the invoice with the Purchase Order (PO) in real time, helping to quickly detect discrepancies. This is an important step to improve accuracy and prevent incorrect payments, while ensuring compliance. output invoice principles when related business arises.

5.2 Effective Business Cost Management

The financial automation platform also helps digitize the process of generating payment requests and approving business expenses such as business travel, hospitality, and purchasing — all based on input invoice documentation.

The budget management feature helps set and control budgets for each department or project, comparing actual spending with the budget in real time. CEOs and accountants can then track cash flow and manage costs more effectively.

5.3 Compliance with regulations on Electronic Invoices

Electronic invoice solutions like Bizzi's B-Invoice are precisely designed according to current Vietnamese regulations such as Decree 123/2020/ND-CP and Circular 78/2021/TT-BTC.

Enterprises can be completely assured of the legal aspect when issuing, storing and managing electronic invoices, ensuring that they do not violate regulations on What is output invoice? as well as accounting and tax standards.

5.4 Integration with other systems

Bizzi and similar platforms have the ability to seamlessly integrate with popular ERP systems like Oracle NetSuite, SAP, Microsoft Dynamics 365 Finance or Odoo.

This helps synchronize financial and accounting data, minimize manual data entry and errors, and diversify integration methods (APIs, files) to suit different IT processes and infrastructures.

5.5 Effective storage of electronic invoices

Storing electronic invoices via specialized software not only ensures safety but also fully meets the requirements for preservation according to legal regulations. The backup system helps minimize the risk of losing important invoice data, protecting business interests during reconciliation or auditing.

5.6 Overall benefits of applying technology in invoice and cost management

- Cut the cost: Significantly save on printing, shipping and storing paper invoices, while reducing physical storage space.

- Save time, increase efficiency: Automating invoice processing helps shorten data entry and control time, improving work productivity.

- Increased control and transparency: Digitalization helps make management more transparent, tracking spending and budgets in real time.

- Reduce compliance risk: Ensure compliance with invoice and tax regulations, limit the risk of loss, damage or burning of traditional paper invoices.

If you are looking to learn more about regulations on input and output invoices or want to deploy automation solutions in your business, Bizzi is always ready to accompany you to optimize your financial and accounting management.

Conclude

Full understanding and compliance regulations on input and output invoices is an indispensable factor for businesses to perform accurate accounting, manage taxes effectively and avoid serious legal risks. A clear understanding What is output invoice? and apply correctly output invoice principles helps businesses be transparent in their business operations, ensuring that transactions are recorded accurately and legally. This is the foundation for businesses to develop sustainably and maintain their reputation in the market. In addition, the development of technology has brought financial automation software solutions to help optimize the management of input and output invoices.

Bizzi is one of the pioneers in providing tools to support businesses in doing this quickly, accurately and in full compliance with current legal regulations. Choosing the right technology solution, based on the actual needs and infrastructure of the business, will help optimize financial processes, save time and operating costs, thereby improving overall business efficiency.

Businesses register for trial at: https://bizzi.vn/dang-ky-dung-thu/