Making Excel financial reports is a popular method in many businesses, especially small and medium enterprises; business households, start-ups. This article by Bizzi will provide information not only on how to make Excel financial reports but also analyze the advantages and disadvantages of this method, as well as introduce some of the most popular report templates.

Introduction to Financial Reporting and the Role of Excel

How to create an Excel financial report is a method of synthesizing data from many sources: journals, ledgers, balance sheets, etc. For businesses that do not have specialized accounting software, Excel is an ideal starting tool.

What is a financial statement?

Is a collection of important accounting documents that generally and systematically reflect the financial situation, business performance and cash flows of an enterprise in a certain accounting period (usually a quarter or year).

Financial statements are not only a tool for compliance with legal regulations but also a core source of economic and financial information, helping stakeholders such as management, investors, banks, and tax authorities accurately assess the operating situation, make wise and timely management, operation or investment decisions. It provides a comprehensive view of the financial health of the enterprise.

Why is Excel financial reporting still a popular method?

- Easy to install and free to use: Excel is a familiar software, integrated into the Microsoft Office suite, easy to install and use without significant additional licensing costs, especially suitable for small and micro businesses with limited budgets.

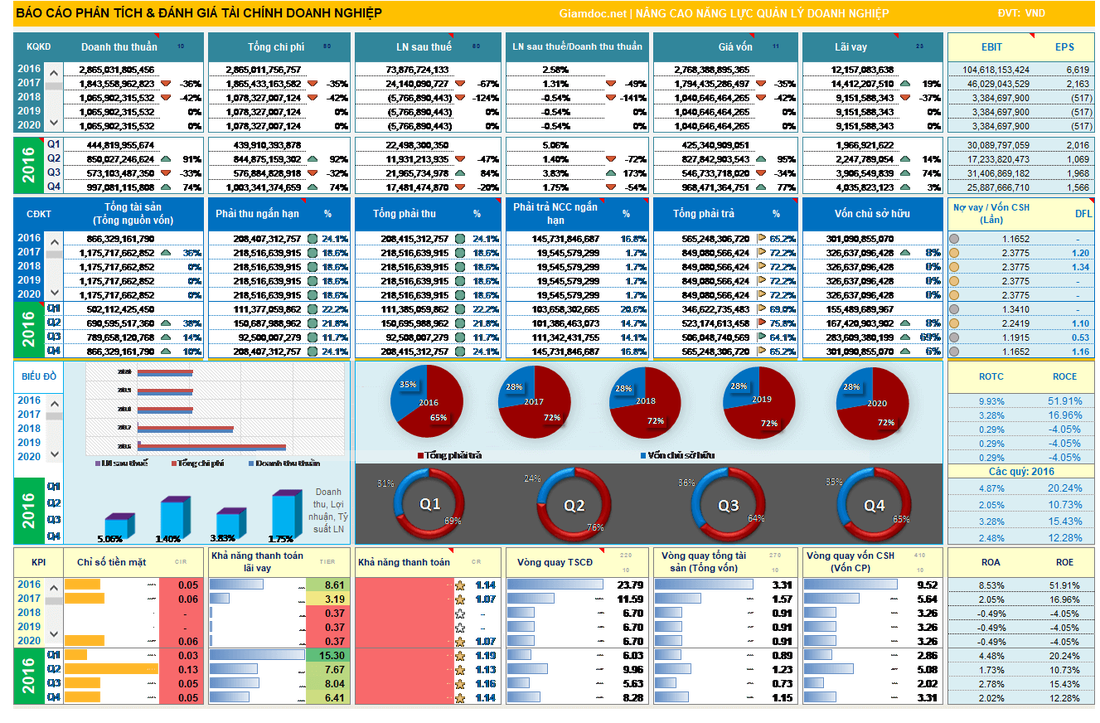

- Effective data control and statistics: How to create financial reports Excel allows accountants to present data clearly and visually in spreadsheets. With a series of available calculation functions such as SUM, AVERAGE, COUNT, SUMIF, VLOOKUP, INDEX MATCHExcel simplifies, automates, and increases the accuracy of complex calculations, thereby minimizing manual errors. The ability to create charts and pivot tables also helps to analyze data more effectively.

- Flexibility to add, remove data and customize: Accountants can flexibly edit, add or remove data, rearrange columns, rows, or create new sheets for easy tracking and evaluation. This high level of customization allows businesses to adjust report templates to suit industry specifics or internal management requirements without being constrained by the rigid structure of specialized accounting software.

What are the limitations of Excel financial reporting?

- Time consuming and low productivity: The process of synthesizing data from many different sources (paper books, PDF files, emails, separate systems) is extremely time-consuming and prone to errors in formula placement and data linking between sheets. Detecting and correcting these errors is often very difficult, significantly reducing the work efficiency of accountants if choosing to prepare financial reports in Excel.

- Difficult to detect errors for correction and risk of data corruption: A small discrepancy in the initial data or an error in formula links between sheets can propagate and cause major errors across the entire report. Finding the root cause of the error can take a lot of time, even half a day to a week for businesses with large amounts of data, causing great delays and pressure.

- Time consuming to create and edit report templates manually: Choosing to prepare financial reports using Excel means that there is no feature to automatically update data into the latest regulatory reporting templates. This requires accountants to regularly check for new circulars and decrees and manually adjust and update reporting templates, wasting time and potentially posing a risk of non-compliance.

- Deadline Pressure and Compliance Risk: Having to search, read, understand and correctly apply the latest legal documents and accounting guidelines is a big challenge. The risk of misapplying or omitting regulations can lead to invalid reporting, causing difficulties when tax authorities inspect and possibly facing administrative fines.

- Low data security and risk of loss: Data in Excel is susceptible to loss due to hardware failure, viruses, or accidental deletion/overwriting. Furthermore, sharing Excel files via email or USB poses a risk of leaking sensitive financial information, as Excel does not have the same strong security layers as professional accounting systems.

Types of financial reports required by regulations

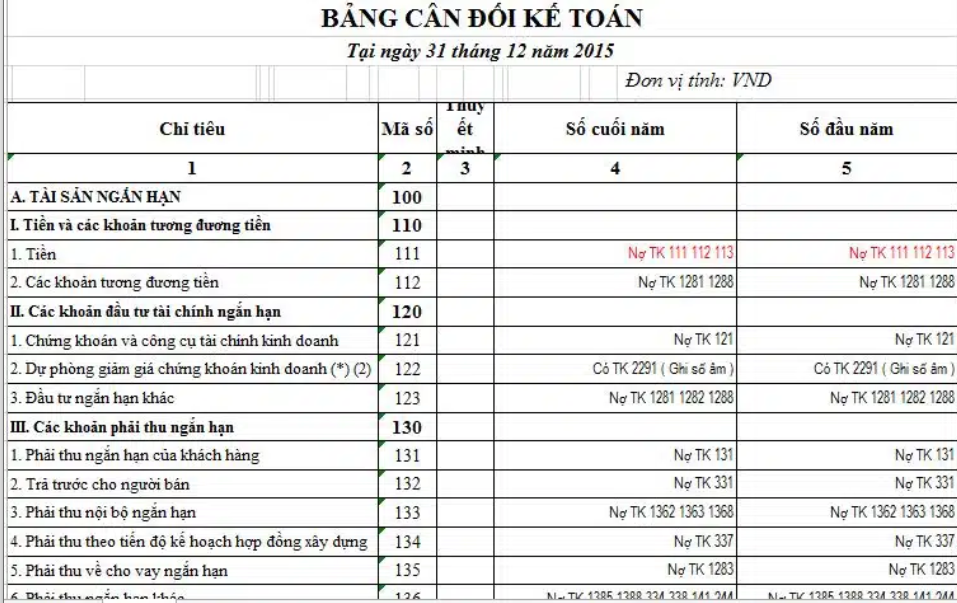

Before learning how to prepare Excel financial reports, accountants need to clearly understand that according to Vietnamese law, Excel financial reports, whether for small or large businesses, must include four main parts to ensure completeness and transparency:

- Balance Sheet: This is a “snapshot” of a business’s financial position at a specific point in time, usually the end of an accounting period (e.g. December 31 of each year). It reflects total assets (what the business owns), total liabilities (what the business owes), and owners’ equity (what’s left over after debts are deducted). It follows the balance sheet principle: Assets = Liabilities + Owners’ Equity.

- Income Statement/Profit and Loss Statement: This report shows the performance of a business over a given period of time (e.g. a quarter or a year). It shows the revenue earned, the expenses incurred to generate that revenue, and finally the business's net profit or loss. This report helps evaluate profitability and cost management efficiency.

- Cash Flow Statement: This report provides a detailed look at a business's cash inflows and outflows during an accounting period, categorized into three main activities:

- Business activities: Cash flow from core business operations (revenue, operating expenses).

- Investment activities: Cash flows related to the purchase or disposal of long-term assets (buildings, machinery, investments in other companies).

- Financial activities: Cash flow involves borrowing, repaying debt, issuing shares, or paying dividends. This report is extremely important in assessing the liquidity and cash-generating ability of a business.

- Notes to the Financial Statements: This is a supplementary and detailed explanation of the figures presented in the three main statements. The notes provide information about the accounting policies applied, significant assumptions, more detailed items (e.g. detailed analysis of receivables, payables, fixed assets), and events after the balance sheet date. This section helps readers better understand the nature of the figures and the factors that affect the financial position of the enterprise.

These statements are closely related: The balance sheet at the end of the previous period will provide the opening balance for the current period's statements. Profit from the income statement will affect the owner's equity on the balance sheet. Cash flows from the cash flow statement will also affect the cash balance on the balance sheet.

What to prepare before making Excel financial reports?

To ensure the accuracy and completeness of financial reports, the data preparation stage is extremely important and needs to be carried out meticulously.

Collect complete accounting data

This is the fundamental step, requiring accountants to collect and organize all documents and accounting books arising during the period when preparing Excel financial statements. This data includes but is not limited to:

- General journal: Record all economic transactions in chronological order.

- Ledger accounts: Summarize transactions according to specific accounting accounts (cash, bank deposits, customer receivables, vendor payables, revenue, expenses, etc.).

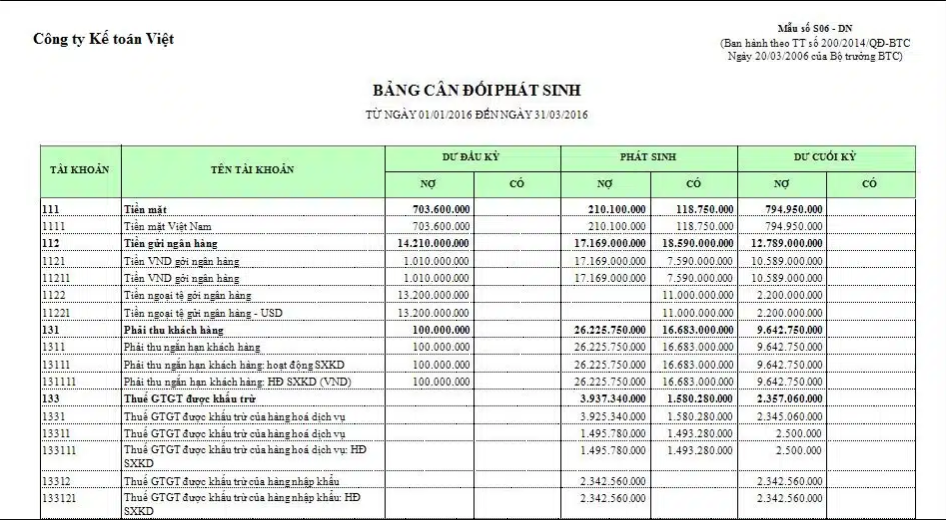

- Balance sheet of arising numbers: Summarize the opening balance, total debit/credit occurrences during the period, and closing balances of all accounts.

- Input/output invoice list: Details of purchase (expense) and sales (revenue) invoices.

- Payroll and documents related to personnel costs.

- Loan contracts, debts, bank payment documents, cash receipts/payments.

- Other documents: Delivery notes, warehouse receipts/deliveries, etc.

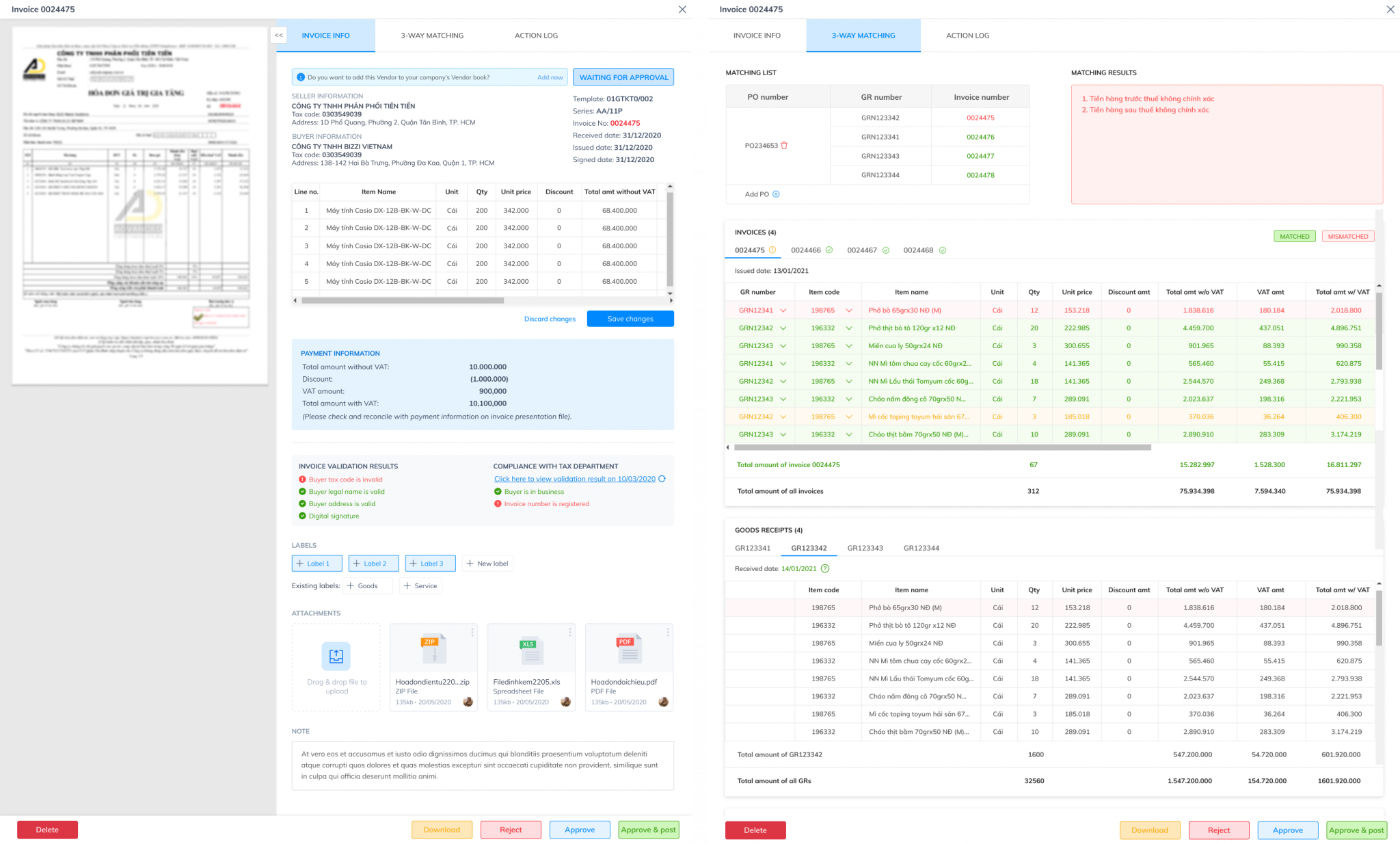

To minimize errors and save time for accountants, businesses should consider using support tools. Bizzi is a comprehensive financial management solution, providing a Comprehensive cost control system and AI assistant for finance and accounting department, help automate the revenue and expenditure process and Streamline and automate cost management, debt collection and B2B payments processes. This helps to completely solve the challenges of manual data collection and processing:

- Processing, reconciling and managing input invoices (IPA + 3way): Bizzi Bot uses RPA (Robotic Process Automation) and AI technology to automatically download invoices from tax portals, check their validity, and automatically reconcile invoices with purchase orders (POs) and warehouse receipts (GRs) in real time. The system also automatically verifies supplier information, immediately alerts about risky invoices (fake invoices, incorrect information), and automatically stores input invoices securely for 10 years. This ensures input invoice data accurate, complete and valid Before implementing Excel financial reporting, significantly reduce errors and manual time.

- Electronic invoice (B-invoice): Bizzi supports businesses in creating, exporting in bulk, looking up and managing the status of output invoices according to the standards prescribed by the Ministry of Finance. The system integrates electronic digital signatures and automatically stores invoices for 10 years. This ensures that revenue data and output invoices are always accurate, legal and ready to perform Excel financial reporting without complicated manual operations.

Check opening balance

This is an extremely important step to ensure the continuity and accuracy of accounting data between periods. Accountants need to compare the ending balance of the previous period's Financial Statement with the opening balance in the current period's ledger. Any discrepancies must be found and promptly adjusted before starting to prepare the report for the new period. This helps to avoid cumulative errors and ensure the consistency of data over the years.

With Debt Control and Management feature (ARM – Accounts Receivable Management), Bizzi supports businesses to automatically record and track details of receivables from customers and payables to suppliers. The system automatically warns when debts are due or overdue, supports debt reconciliation with related parties and creates detailed debt reports for each subject.

This helps to keep a tight control on accounts receivable, providing accurate and up-to-date data for opening and closing balances on the balance sheet, minimizing the risk of errors and disputes related to accounts receivable.

Instructions on how to prepare Excel financial reports of some types of financial statements

Mastering Excel functions is key to automation and efficiency when preparing financial reports. Functions such as VLOOKUP (to look up and link data between tables), SUMIF (to aggregate data based on conditions), MAX (to get the largest value, often used in calculating remainders), SUBTOTAL (to sum the displayed values after filtering) are indispensable tools to synthesize and calculate data accurately and flexibly.

Balance sheet

- Purpose: Reflects the assets and capital situation at the end of the period.

- Making:

Final balance set of accounts:

- Assets: 111, 112, 131, 152, 211, 241, etc.

- Accounts payable: 331, 341, 315…

- Equity: 411, 421, 431…

Create a 2 column layout:

| Asset | Value | Capital | Value |

| Cash (111) | =Remainder 111 | Liabilities | =Total 3xx |

| Inventory (156) | =Remainder 156 | Equity | =Sum 4xx |

Check balance:

- Total assets = Total liabilities + equity

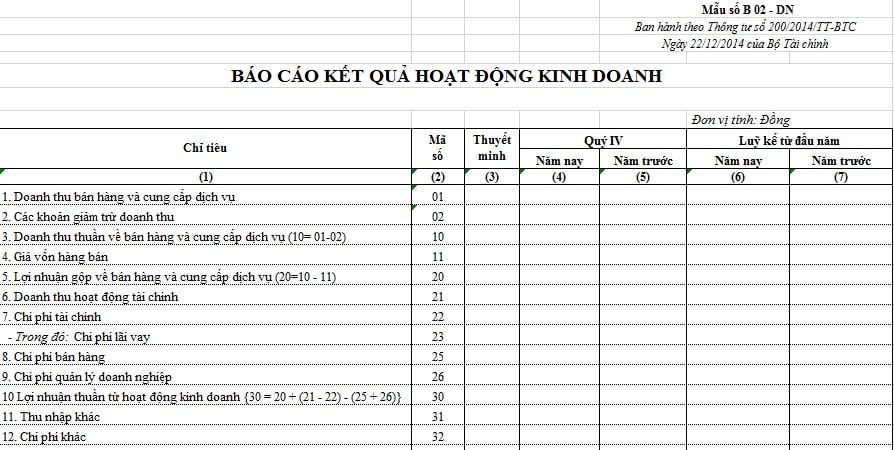

Business performance report (KQKD)

- Purpose: Shows profit/loss for the period.

- Making:

Summary of revenue and expense accounts:

- Revenue: 511

- Cost price: 632

- Cost of sales: 641

- Management cost: 642

- Other profits: 711, 811

Sample formula:

| Target | Recipe |

| Net revenue | =Revenue (511) – Deduction (521) |

| Gross profit | =Net revenue – Cost of goods sold (632) |

| Profit before tax | = Gross profit – Sales expenses – Management expenses |

| Profit after tax | = Profit before tax – Corporate income tax |

Note: use formula =SUMIF() or =VLOOKUP() to automatically fetch data from a pivot table.

Cash flow statement (LCTT)

- Purpose: Adjusted from accounting profit

- Making:

| Content | Recipe |

| Profit before tax | From the business results report |

| ± Non-cash adjustments | + Depreciation (214), – Profit/loss from sale of fixed assets |

| ± Working capital fluctuations | + Decrease inventory, – Increase receivables… |

| = Net cash flow from operating activities | Total |

| ± Investment activities | Buy fixed assets (negative record), sell fixed assets (positive record) |

| ± Financial activities | Borrowing, repaying debt, paying dividends... |

| = Increase/decrease cash | Total 3 activities |

Conclude

It can be seen that the method of preparing financial reports in Excel is always the method chosen by many businesses because of its advantages of ease of use and flexibility in adjusting data. Using Excel to prepare financial reports is an economical, flexible and popular solution. However, as the business grows, the volume of data and the need for financial control increase, upgrading to specialized software (such as accounting software, ERP) is a necessary step.

Bizzi is a technology platform (SaaS) that helps automate the electronic invoice processing process, considered a powerful "assistant" for businesses, especially the accounting department. Bizzi uses AI and automation technology to minimize manual work, saving time and costs for businesses. If your business is having problems in the financial management process, contact us immediately for specialized solution advice.:https://bizzi.vn/dat-lich-demo/