Internal spending rules is the backbone document that helps businesses, agencies, and units manage and control cash flow effectively. Building a Internal spending rules Strict accounting not only ensures transparency and savings but also serves as the foundation for financial autonomy and prevention of waste and corruption risks. Based on legal regulations such as the 2015 Accounting Law, this is an essential financial management tool. However, the development of regulations is only the first step; consistent implementation and monitoring of compliance is the biggest challenge, requiring the support of modern management tools.

The following article by Bizzi will give detailed instructions on how to build a Internal spending rules complete and how to apply technology to manage it effectively, helping businesses proactively allocate resources flexibly, in accordance with operational practices and optimize performance.

Internal spending rules What is it? Overview of roles and objects

To build effectively, it is first necessary to clearly understand the nature, role and scope of influence of this important document.

Concept and role

Internal spending rules is an internal legal document, stipulating all principles, standards, norms and procedures for expenses arising in the enterprise, from administrative management costs to production and business activities. This document concretizes state regulations on financial management into the practice of the unit.

The core role of Internal spending rules include:

- The Foundation for Financial Independence: Empower the Board of Directors and department heads to be proactive in managing and using assigned budgets to complete tasks.

- Cash flow transparency: Publicize spending norms and standards to help every individual and department clearly understand their rights and responsibilities, thereby preventing negative behaviors.

- Optimize cost efficiency: Helping businesses use public assets and budget resources for the right purposes is an important part of business cost management Overall, thrift, anti-waste and anti-corruption.

- Boost work performance: A clear and reasonable spending policy will motivate and improve workers' lives and contribute to streamlining the operating apparatus.

- Legal basis for eligible expenses: Is the basis for tax authorities to determine deductible expenses when calculating corporate income tax.

Subject and scope of regulation

- Scope of application: Internal spending rules applied uniformly throughout the entire agency, unit or enterprise.

- Subject of adjustment: Including all cadres, civil servants, and employees who have employment contracts and receive salaries from the unit's salary fund.

- Special cases: Employees from other agencies who are seconded to work are also entitled to benefits from the savings fund as prescribed in the Regulations, corresponding to the working time.

Principles and legal basis for construction Internal spending rules

The development of regulations must comply with certain principles and be based on a solid legal foundation.

Construction principles

One Internal spending rules Effectiveness must ensure the following principles:

- Prioritize task completion: All expenses must directly serve the unit's operating goals.

- Efficient and economical: Manage and use funds reasonably and optimally to avoid waste.

- Public, democratic: All regulations must be widely disseminated and ensure the legitimate rights of workers.

- Compliance with the law: Must not be contrary to the spending policies and regimes issued by the State. Spending norms may be higher or lower than general regulations but must be reasonably explained and proven to serve business activities.

- Valid documents: All expenses (except for lump sum expenses) must have full invoices and legal documents according to regulations. This is a mandatory requirement, especially with the popularity of Electronic invoice Nowadays.

Legal basis for construction

Enterprises must rely on the following legal documents to establish Internal spending rules:

- Accounting Law 2015: Providing legal basis for spending regulations and regulations on accounting documents.

- Decree 174/2016/ND-CP: Detailed guidance on a number of articles of the Law on Accounting.

- Circulars of the Ministry of Finance: Regulations on business trip expenses, conference expenses, reception expenses and other expenses. (Note: These rates may change, businesses need to update regularly).

- Budget and actual financial situation of the business.

Content required in a template Internal spending rules complete

Below are common spending categories that need to be specified in detail in the regulations, applicable to both administrative units and enterprises.

1. Regulations on business trip expenses

- Payment terms: Clearly define cases of business trips, approval procedures and cases that are not eligible for payment.

- Travel costs: Payment standards for air and train tickets. Regulations on fixed costs for self-funded personal vehicles (e.g. by km).

- Room rental: Regulations are based on a lump sum (specific levels for each level and locality) or on actual invoices (with ceiling limits).

- Accommodation allowance: Set a fixed daily spending level. (For reference: 200,000 VND/day, however this level needs to be updated according to the latest regulations of the Ministry of Finance).

- Monthly fee work: Applicable to employees whose work requires frequent travel (over 15 days/month).

- Manually managing these items is not only complicated but also poses a risk of losing documents. Therefore, a system per diem management Automation is a solution that digitizes the entire process from request to payment.

2. Regulations on reception and conference expenses

- Hospitality fee: Clearly define the spending norms for each type of guest (domestic and international), including the cost of drinks and intimate meals. The principle is formality and economy.

- Conference and meeting organization: Expenditure norms for internal meetings, inter-sectoral meetings (drinking water, documents). For conferences, clearly define the expenses (venue rental, equipment, food and accommodation support for unpaid delegates).

- See more: Detailed guide to accounting for hospitality costs from AZ.

3. Regulations on management and use of assets and office expenses

- Stationery: Apply the form of fixed-rate allocation for each department/individual on a quarterly basis or allocate according to approved actual requirements.

- Use of public cars: Clearly define the subjects allowed to use the vehicle, vehicle dispatching procedures, fuel standards and driver responsibilities.

- Use of electricity, water, telephone, internet: Clearly state the responsibility of saving for all employees. Can apply fixed cost of telephone and postage for each department.

- Purchasing and asset management: Comply with the provisions of law on public asset management and the company's spending policy, procurement, repair and liquidation procedures.

4. Regulations on expenses for employees

- Salary, bonus, allowance: Clear regulations on calculation, payment time and payment method (mainly through personal accounts).

- Overtime: Enterprises must stipulate conditions, approval procedures and overtime payment levels, ensuring that they do not exceed the number of hours prescribed by the Labor Law.

- Welfare expenses: Expenses such as funerals, weddings, sickness, maternity, holiday gifts, vacations, etc. need to have clear norms for each case.

- Payment of leave: Regulations on payment of travel expenses and travel allowances for employees returning home on leave as prescribed.

5. Use the saved funds

- Determine savings: Is the difference between the assigned budget and the actual expenditure after completing the task.

- Usage: Enterprises clearly define the allocation rate of savings funds to:

- Supplement income for workers (based on work efficiency, not equal).

- Expenditure on collective welfare activities.

- Provision for reward fund and income stabilization fund.

Construction and issuance process Internal spending rules

The construction of regulations needs to be carried out systematically through the following steps:

- Establishment of the Editorial Board: Including representatives of the Board of Directors, Accounting - Finance Department, Human Resources Department and employee representatives (Union).

- Information Collection: Research current legal regulations, analyze the actual spending situation of the business in the last 2-3 years.

- Drafting: The drafting committee proceeded to write a draft regulation with all the contents stated above.

- Get feedback: Send the draft to all departments and divisions for public and democratic feedback. Organize meetings to discuss and receive feedback.

- Finalize and browse: Edit the draft based on comments, then submit to the Director/Board of Directors/Board of Members for approval.

- Issue and disseminate: After being approved, the regulations must be officially issued and disseminated to all employees in the enterprise for application.

Frequently Asked Questions (FAQ)

1. Do internal spending regulations need to be registered with the tax authorities?

Are not. Businesses do not need to register. Internal spending rules with the tax authority. However, this is an important legal document that the tax authority will request when conducting an inspection to determine the validity and reasonableness of deductible expenses when settling corporate income tax.

2. Who has the ultimate authority to approve the charter?

The person with the highest authority to sign and issue Internal spending rules is the legal representative of the enterprise (Director/General Director), or Chairman of the Board of Directors/Board of Members, depending on the company's charter.

3. What are the risks when a business does not develop internal spending regulations?

If not Internal spending rules, businesses will face many risks:

- Expenses incurred: Tax authorities may remove expenses deemed invalid or not serving business operations, leading to increased corporate income tax payable.

- Waste, loss: Lack of clear standards and control procedures can easily lead to wasteful spending. In particular, the lack of control tools, Automate budget forecasting real-time makes it impossible for management to grasp the situation and make timely decisions.

- Internal conflict: Spending without common rules can cause discontent and comparison between individuals and departments.

4. How do the regulations apply differently between SMEs, large enterprises and state-owned entities?

- SME Business: Usually build simple, flexible regulations, focusing on essential expenses such as salaries, business expenses, and entertainment. Streamlined approval process.

- Large Enterprise: The regulations are very detailed, complex, and cover all activities. The approval process is multi-level and strict to manage financial risks.

- State unit: Must strictly comply with the norms and standards issued by the state (Circulars, Decrees). The expenditure level usually cannot exceed the prescribed ceiling.

Optimize management Internal spending rules by technology with Bizzi

Management and compliance Internal spending rules Manual methods often face many challenges such as slow processes, difficulties budget control real-time and error-prone. Technology solutions such as Bizzi Travel & Expense was born to thoroughly solve these problems.

Set up flexible spending rules on a digital platform

Bizzi enables businesses to easily digitize and automate their entire spending policy mine:

- Develop detailed policies: Set up separate spending limits for each category (business, hospitality, shopping, etc.), by individual, department or level.

Decentralize and automate approval processes

Businesses can customize multi-level approval flows based on spend value or type, helping to reduce bottlenecks and clarify responsibilities.

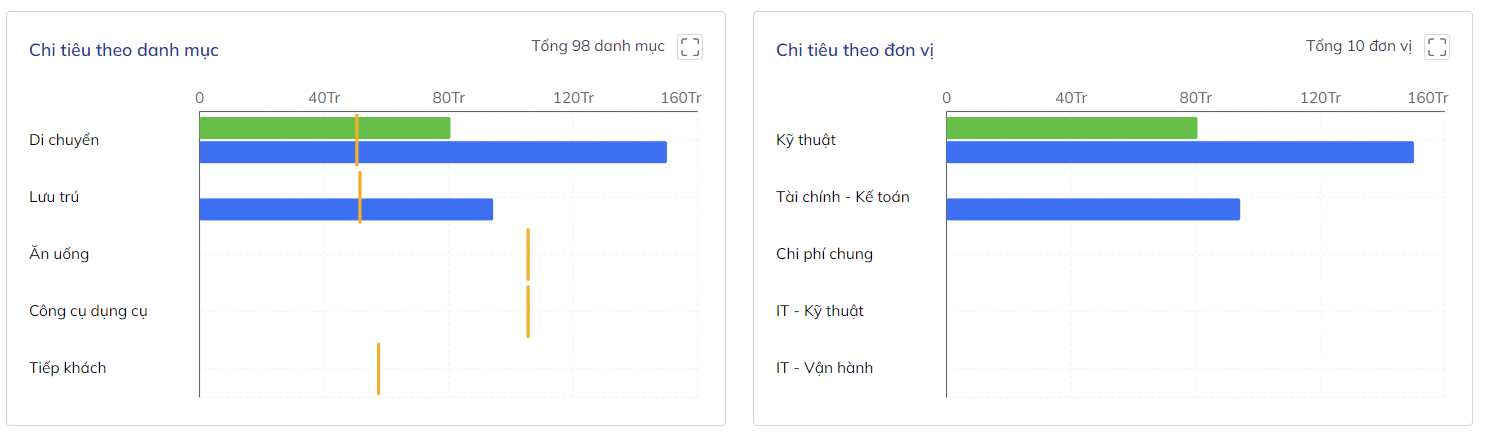

Real-time budget monitoring and overspending alerts

Bizzi automatically compares actual spending with the allocated budget and sends immediate alerts when spending exceeds the limit, helping the finance department stay on top of cash flow.

Control cash flow effectively and do not exceed allowed resources.

Conclude

Build and execute a Internal spending rules Being systematic and transparent is a crucial task for every organization. It is not only a tool to ensure reasonable spending but also a foundation for sustainable development, improving financial efficiency and enhancing autonomy.

In the digital age, adopting technology solutions like Bizzi not only helps automate and optimize the expense management process but is also a strategic step in Digitalize financial processes, helping businesses save time, reduce risks and improve management efficiency. This is an inevitable trend that helps businesses break through in a competitive environment.