Leadership styles are not just about "how to manage people," but rather about the operational mechanisms that determine decision-making speed, execution discipline, financial transparency, and hidden costs. This article systematizes nine common leadership styles, identifying their appropriate contexts, common risks, and how to measure effectiveness using operational and financial indicators (OpEx, cash-in, DSO, cycle time, compliance). It also suggests ways to use technology to compensate for the weaknesses of each style in financial and accounting management.

What are leadership styles?

Leadership style is the way a manager acts. decision-making, delegation, communication, and control. To achieve the goal, choosing the right style helps ensure fast, disciplined, and safe operation; choosing the wrong one can easily lead to problems. hidden costsSlow decision-making and control risks.

A leadership style is typically expressed through five main axes:

- Decision-making methods

- Centralization of power or decentralization?

- Communication style

- One-way direction or two-way dialogue?

- How to create motivation

- Rewards and punishments, inspiration, or coaching?

- How to manage performance

- Strict control or empowerment and trust?

- How to deal with people

- Results-centered or people-centered?

Learn more about how to build a business performance management process. here

Common leadership styles and appropriate contexts for application.

There are nine common leadership styles: autocratic, democratic, delegative, transformational, transactional, coaching, servant, bureaucratic, and lead. Each style suits different levels of risk, decision-making speed, and team capabilities.

| Leadership style | Characteristic | Fit | Limit |

| Leader Arbitrary (Autocratic) | Concentrated decision, clear orders. Tight control |

High risk, requires quick decisions (crisis, incident) The team is young and inexperienced. |

It's not suitable when creativity is needed and talent retention is a priority. |

| Leader Democracy (Democratic) | Consultation Encourage discussion and consensus. |

Medium risk A capable team with diverse perspectives. Quality should be prioritized over speed. |

|

| Leader Authority (Laissez-faire / Delegative) | Empowering people with high levels of power and minimal intervention.

Trust the self-governing team. |

A highly autonomous team of experts. Low to medium risk Parallel deployment speed is needed. |

It's easy to "lose control" without KPIs and monitoring. |

| Leader Conversion (Transformational) | Inspiration, long-term vision

Promoting change and innovation |

Growth and restructuring phase

We need a change in mindset and culture. |

It is impractical if it is not linked to the operating system. |

| Leader Transaction (Transactional) | Management using KPIs, rewards and penalties. Focus on short-term results. |

Stable operating environment

Sales, production, finance |

Low long-term human development |

| Leader Train (Coaching) | Developing personal capabilities Continuous feedback |

Building a succession team Improve medium- to long-term performance. |

Quick decisions needed, high pressure. |

| Leader Serve (Servant Leadership) | Leaders are those who support their teams. People-centered |

Corporate culture emphasizes teamwork. Mature team |

Being perceived as "weak" if boundaries are not clearly defined. |

| Leader Bureaucracy (Bureaucratic) | Strict adherence to procedures and regulations. Less flexible |

High legal risk environment Finance, accounting, compliance, government |

Slow to innovate, prone to rigidity. |

| Leader Lead by example. (Pacesetting) | Leaders set the example and establish high standards. Expect the team to keep up with the pace. |

A talented team, high pressure. We need to increase speed in a short period of time. |

Prone to burnout, difficult to scale up. |

In short, there is no "absolutely right" leadership style, only the "right style in the right context." Effective leaders are those who:

- Risk identification & objectives

- Understand the team's level of maturity.

- Style changes are flexible and not rigid.

How do leadership styles affect operating expenses (OpEx) and profitability through “hidden costs”?

Creative leadership style hidden costs When errors increase, processing times are prolonged, budgets are exceeded, or employee turnover increases, these costs accumulate in OpEx and erode profits, even though the business may still "meet KPIs on the surface."

1. Autocratic

Hidden cost mechanism

- Employees are afraid to voice their opinions → wrong decisions are not corrected promptly.

- Low motivation → increased hidden turnover

Financial impact

- ↑ Recruitment costs – onboarding

- ↑ Rework, late correction cost

P&L isn't immediately visible, but the margin gradually decreases.

2. Democracy

Hidden cost mechanism

- Too many meetings → slow decision-making

- Consensus bias → choose the "safe" option

Financial impact

- ↑ Opportunity cost (missed revenue)

- ↑ SG&A (meeting hours × headcount)

Suitable for stable environments, not suitable for rapidly fluctuating markets.

3. Delegative

Hidden cost mechanism

- Empowerment without KPIs and control.

- Dispersed, deviant decision-making

Financial impact

- Budget variance between cost centers

- ↑ Post-audit and fix costs

4. Transformational

Hidden cost mechanism

- Invest heavily in change (training, systems).

- "Vision over execution" is impossible without discipline.

Financial impact

- Short-term OpEx increase

- ROI decreases if the initiative is not measurable.

Good for the long term, but risks burning cash if there's no stage-gate.

5. Transactional

Hidden cost mechanism

- Employees only meet their KPIs.

- Not optimal outside the measurement framework.

Financial impact

- ↑ Bonus inflation

- Innovation declines, leading to a loss of long-term competitive advantage.

6. Coaching

Hidden cost mechanism

- Time-consuming to manage.

- The effect is not immediate.

Financial impact

- ↑ Short-term cost per FTE

- ↓ Turnover & ↑ Long-term productivity

The "hidden" cost, but a profitable investment.

7. Servant

Hidden cost mechanism

- The decision was delayed because emotions were prioritized.

- Avoid confrontation with the underperformer.

Financial impact

- ↑ Costs of retaining inefficient personnel

- ↑ Hidden payroll cost

8. Bureaucratic

Hidden cost mechanism

- Too many processes → friction

- "Process over outcome"

Financial impact

- ↑ Cycle time (approval, payment)

- ↑ Working capital is stuck (DSO/DPO)

9. Lead by example (Pacesetting)

Hidden cost mechanism

- High pressure → burnout

- The best people leave early.

Financial impact

- ↑ Costs of replacing key personnel

- Knowledge retention

What is the correlation between leadership styles and the risk of insider fraud in finance and accounting?

Leadership style determines the level of delegation and discipline. When delegation is lacking... SoD and audit trailThis increases the risk of fraud. When controls are too tight, organizations are more likely to develop "shadow processes" to avoid bottlenecks.

1. Autocratic

Risk mechanism

- Power is concentrated, with little dissent.

- Employees are afraid to report wrongdoing.

Fraud risk

- Organized and prolonged fraud

- Concealing data at the "boss's request"

Fraud is often discovered late, resulting in significant damage.

2. Democracy

Risk mechanism

- Decentralized decision-making, ambiguity of responsibility.

- "Everyone participates, but no one takes responsibility."

Fraud risk

- Circumventing procedures, petty fraud.

- Overriding control through "unspoken agreements"

3. Delegative

Risk mechanism

- Empowering individuals with high levels of authority but lacking oversight.

- The SoD (Segregation of Duties) has been broken.

Fraud risk

- Opportunity fraud

- Fake vendor, fictitious payments, fictitious reimbursements.

4. Transformational

Risk mechanism

- The pressure to "succeed" for a grand vision.

- Control is easily overlooked due to the "spirit of innovation."

Fraud risk

- Adjusting figures to make reports look better.

- Capitalize costs inappropriately.

5. Transactional

Risk mechanism

- KPIs are closely linked to rewards and penalties.

- Short-term target pressure

Fraud risk

- Manipulate cutoff, early revenue recognition.

- "Make the numbers"

6. Coaching

Risk mechanism

- Close relationship → deference

- Reluctance to address violations

Fraud risk

- Covering up minor fraud

- The "Gray area" extends

7. Servant

Risk mechanism

- Prioritize people over control.

- Avoid conflict

Fraud risk

- Tolerating repeated violations

- Policy override due to "circumstances"

8. Bureaucratic

Risk mechanism

- Too many procedures → employees find ways to circumvent them.

- Form control

Fraud risk

- Fraud that followed the proper procedures but was fundamentally flawed.

- Fake complete profile

9. Lead by example (Pacesetting)

Risk mechanism

- Extreme speed and performance pressure

- "There's no time for control."

Fraud risk

- Skip approval

- Shortcut to the financial process

In short, leadership style doesn't create fraud, but it can create the "ideal conditions" for fraud to occur. A financially sound business needs:

- Identifying stylistic risks

- Combining internal control + data + technology

- Do not let fraud depend on the "personal ethics of leaders."

Crisis management: How should emergency approval processes be designed to suit different leadership styles?

A crisis demands quick decision-making, but without sacrificing control. An emergency approval process needs clear limits, exceptions, and traceability mechanisms to prevent "emergency actions from becoming arbitrary."

1. Autocratic Leadership

Main risks

- Overriding control

- A hasty decision, but lacking critical thinking.

Suitable design

- Single-approver (CEO/CFO)

- Obligatory:

- Clearly state “Emergency reason”

- Log override

Protection mechanism

- Mandatory post-audit auto-trigger

- Independent review (Finance/IA)

2. Democratic Leadership

Main risks

- Delayed decision due to the need for consensus.

Suitable design

- Fast Quorum (2/3 of the people on the list)

- Time-box approval (e.g., 30–60 minutes)

Protection mechanism

- If the time runs out → auto-escalate

- Note the user who did not respond.

3. Delegative Leadership

Main risks

- Decentralization but lack of control.

Suitable design

- Pre-approved limit by role

- Clear price threshold

Protection mechanism

- Log all transactions exceeding the threshold.

- Post-inspection based on sampling

4. Transformational Leadership

Main risks

- Vision > control

- Burning the budget for a big goal.

Suitable design

- Approval initiative code

- Link crisis spend with OKR/initiative.

Protection mechanism

- Stage-gate post-audit

- Burn-rate report

5. Transactional Leadership

Main risks

- KPI-driven → legitimizes costs

Suitable design

- Approval linked to KPIs and policies

- Conflict of interest warning

Protection mechanism

- Exception dashboard

- Separate the beneficiary from the approver.

6. Leadership and Coaching

Main risks

- Respectful, gentle

Suitable design

- Dual approval (manager + finance)

- Mandatory risk checklist

Protection mechanism

- Standardize the reasons for emergency.

- Review decision-making skills

7. Servant Leadership

Main risks

- Prioritize people over principles.

Suitable design

- Approval is policy-first.

- Overrides are not allowed due to "circumstances".

Protection mechanism

- Whitelist emergency reasons

- Log all exceptions.

8. Bureaucratic Leadership

Main risks

- Rigid processes → slow crisis handling

Suitable design

- "Fast-track" in a simplified form.

- Pre-approved crisis SOP

Protection mechanism

- Automated approval

- Full Audit Trail

9. Leadership (Pacesetting)

Main risks

- Ignoring controls to speed

Suitable design

- Parallel Approval

- Auto-log + auto-alert

Protection mechanism

- Real-time dashboard

- Mandatory post-audit

How do leadership styles affect cash flow through accounts receivable management and DSO?

Leadership style creates discipline (or lack thereof) in debt collection, reconciliation, and aging tracking. Organizations with standardized processes and transparent data will have more consistent collection, better debt settlement (DSO), and reduced risk. overdue debt.

1. Autocratic

Mechanism

- Instructions to "collect the full amount"

- Little attention to process details.

Impact

- Short-term: quick returns through pressure.

- Long term: customer avoidance, increased disputes.

2. Democracy

Mechanism

- Sales and Finance are constantly negotiating.

- Debt collection is dependent on consent.

Impact

- Slow escalation of overdue debt

- Many "exceptions due to relationships"

3. Delegative

Mechanism

- Let Sales/Customer Service handle AR themselves.

- No central dashboard

Impact

- Money is collected unevenly from individuals.

- Losing track of small but numerous debts.

4. Transformational

Mechanism

- Invest in the system, change the method of collection.

- Standardizing the AR process

Impact

- Short term: Slow due to transition

- Medium to long term: DSO will decrease significantly.

5. Transactional

Mechanism

- Sales KPIs are linked to revenue collection.

- Rewards and penalties based on DSO

Impact

- Fast cash collection

- Risk of pressuring customers → excessive discounts

6. Coaching

Mechanism

- Training in collection and reconciliation skills

- Continuous feedback

Impact

- Sustainable revenue collection

- Reduce conflict

7. Servant

Mechanism

- Prioritize relationships.

- Avoid bringing up strong debt issues.

Impact

- Uncontrolled extension

- Overdue debtors are a familiar sight.

8. Bureaucratic

Mechanism

- Rigid process

- Delayed reconciliation

Impact

- Guests are delayed due to procedures.

- Prolonged debt disputes

9. Pacesetting

Mechanism

- Speed pressure

- Urgent debt collection, lack of standardization.

Impact

- Receive large sums quickly.

- Missing the long-tail

In short, cash flow doesn't come from revenue, but from the discipline of collecting money.

Leadership style is key:

- Do you remind them of the debt regularly?

- Check if the comparison is accurate, complete, and timely.

- Is the age of the debt tracked and processed according to rules?

This then determines the DSO, overdue debt, and cash flow stability.

How to identify the leadership style that suits you and your organization using the Risk-Cost-Speed framework.

There is no “best” leadership style. The most effective approach is based on financial risk, cost objectives, and required decision speed. When data is transparent, you can empower more while maintaining control.

| Axis | Core question | If the answer is "high" |

| Risk | What are the serious consequences of making a mistake? | Strict control is needed. |

| Cost | How much will it cost for an error/delay? | Discipline is needed for spending. |

| Speed | How quickly do we need to make a decision? | Speed is the priority. |

Identify a style that suits YOU (Self-fit)

Step 1: Self-assessment (1–5)

- I risk tolerance At what level?

- I cost sensitive Where are we going?

- I Speed is the priority. Is it better than perfect?

Example: Risk 2 | Cost 4 | Speed 5

Step 2: Map to a "natural" style.

- High speed → Autocratic / Pacesetting

- High cost → Transactional / Bureaucratic

- High risk → Democratic / Coaching

Determine a style that suits the ORGANIZATION (Context-fit).

Step 1: Assess the current organization

- Occupation (regulatory or freelance?)

- Team maturity

- Cash flow pressure

- Stages (startup / growth / stability / crisis)

Step 2: Assign R–C–S scores to each major decision.

Don't rate the "company," rate it. decision.

Comparison of leadership styles based on financial risk, decision speed, and measurement tools.

Leadership style is the driving force, not personality. Choose the right style for the right situation, plus... appropriate processes and tools, which will help businesses Optimizing risk, cost, and speed..

Below is Comparison table of 9 leadership styles according to Financial risk – Decision speed – MeasurabilityThis table helps in choosing a leadership style based on the "real-world situation": whether a fast-paced or controlled approach is needed, whether the team is mature enough, and which KPIs accurately reflect operational efficiency.

| Style | When should it be used? | Financial risk | KPI measurement | "Compensation points" through processes | Suggestion tool |

| Autocratic | Crisis, incident requiring immediate attention. | Override control, large-scale misjudgment. | Cycle time determines the cost of error. | Mandatory post-audit, log override | Approval workflow, audit trail |

| Democracy | High risk, requires multiple perspectives. | Delayed decision, opportunity cost. | Decision-making time, % consensus | Time-box meeting, Quorum clear | Decision log, collaboration tool |

| Delegative | A talented team, juggling multiple tasks. | Cost deviation, SoD breakdown | Budget variance, exception rate | Role-based limits, post-audit | Role-based approval, dashboard |

| Transformation | Restructuring, digital transformation | Burn cash, ROI unknown. | ROI initiative, burn rate | Stage-gate, OKR with budget allocation | PMO tool, OKR dashboard |

| Transactional | Sales, cash collection, standard operations. | Short-term KPIs distort behavior. | DSO, cost per unit, hit rate KPI | Separate KPIs – Approval | AR/KPI dashboard |

| Coaching | Developing capabilities, inheriting legacy. | Time-consuming and slow to yield results. | Productivity/FTE, turnover | Feedback cycle, clear objectives | Performance management tool |

| Servant | A culture of unity, a stable team. | Tolerating underperformers | Retention, hardship | Underperformance processing standard | HR analytics, policy tracking |

| Bureaucratic | Finance, legal, compliance | Long cycle time, slow cash-in. | DSO, approval cycle time | Fast-track SOP, automation | Workflow excavation |

| Pacesetting | Short-term acceleration, a skilled team. | Burnout, high turnover | Output/person, attraction | Time limit applies | Capacity & workload tracking |

FAQ – Frequently Asked Questions about Leadership Styles

Which leadership style is best?

There is no single "best" leadership style.

Style Fit depends on decision-making context, include:

- Level acceptable risk (risk appetite)

- Decision lag allow (decision latency)

- Team maturity level

This is the spirit of accidentalThe same leader may have a different style (and style) depending on the situation.

How can we control hidden costs when implementing a delegation style?

Delegation style is prone to problems. hidden costs If power is granted but there are no "checking and controlling mechanisms," the correct approach is:

- Design policy & spending limits by role

- Monitor budget variance according to cost center/manager

- Measure compliance rate to detect deviations early

- Obligatory audit trail for every decision

Effective delegation = Empowerment + Measurement + Post-audit.

What digital tools can help reduce the bottleneck in autocratic leadership?

The problem with authoritarian style lies not in decisiveness, but in... approval bottleneckThe solution is:

- Use consent matrix Clearly (who approves what)

- Automated workflow for:

- Quickly review standard accounts.

- Only push exceptions. to senior leadership

- Monitor cycle time and approval bottlenecks

Leaders make quick decisions, but Don't review everything..

How does leadership style affect internal fraud in Finance Operations?

Leadership style has a direct impact on fraud risk through control design:

- Empowering those lacking SoD and audit trail → increased opportunity for fraud

- Overly strict control → arises shadow process (underground process)

Fraud is not only caused by humans, but also by The way leadership allows (or inadvertently creates) loopholes..

How can we maintain financial transparency when transitioning from bureaucracy to agile?

Switch to agile This does not mean abandoning control.The correct way to do it:

- Hold Data standards & audit trail

- Automate routine steps

- Focus human resources on exception management

Agile is Faster in terms of accuracy, not more nonsense.

How does real-time data help leaders avoid burnout during pacesetting?

The pacesetting style can easily become overwhelming because:

- Rework multiple times

- Prioritizing the wrong issues.

Real-time data helps:

- Early detection exception backlog

- Reduce rework through standardization and automation.

- Focus on the most important issue, not the most noisy thing

Burnout usually comes from Lack of priority data, not just from the intensity of the work.

How can we measure the effectiveness of different leadership styles using data instead of intuition?

Instead of measuring "good/bad leadership," measure operational results:

- Cycle time (decision-making, expenditure approval)

- miracle rate

- Exception rate

- Budget variance

- DSO & cash-in

Compare the before and after results of the style or process change to see the actual impact.

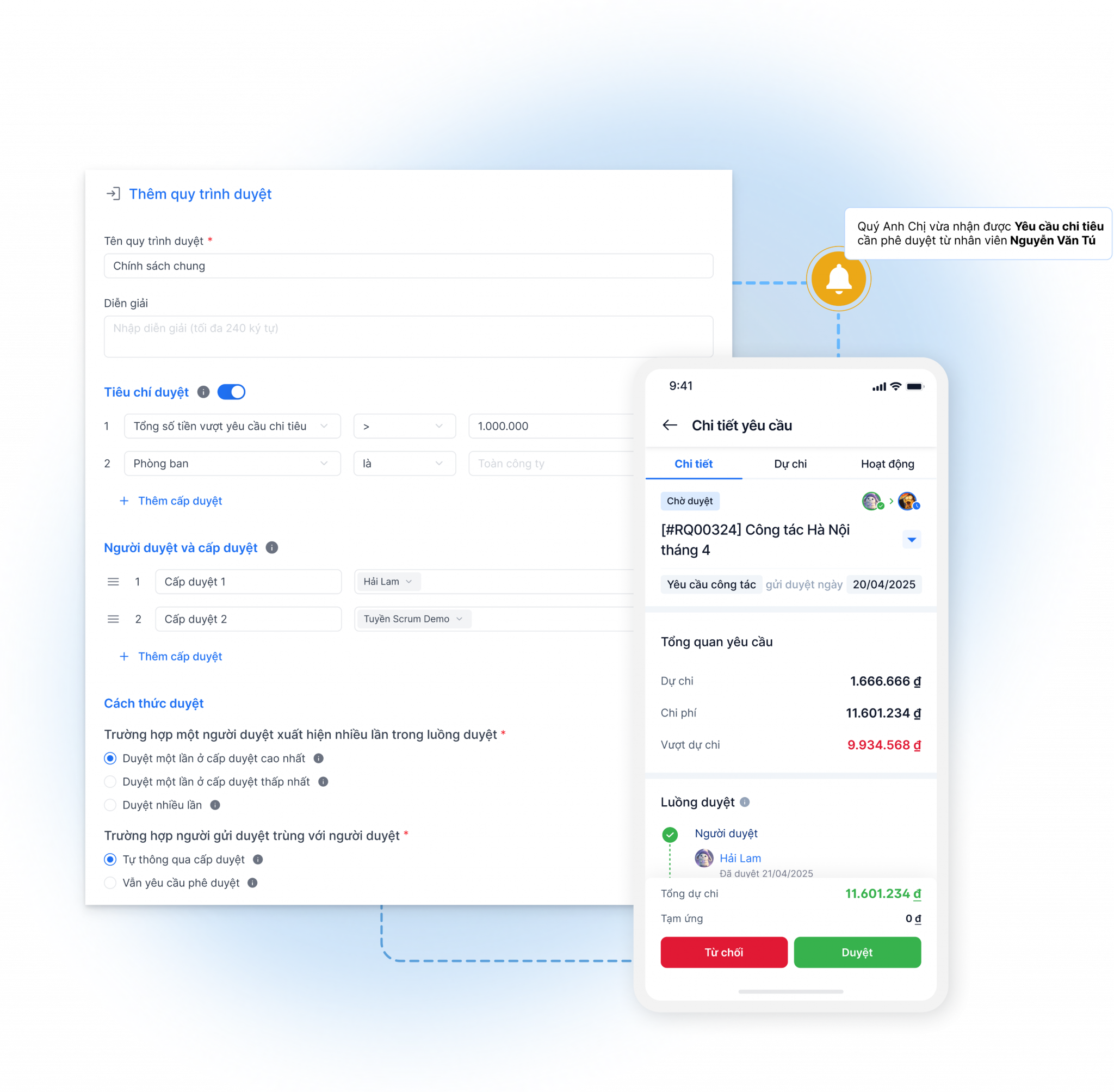

How does Bizzi support a data-driven leadership style?

Bizzi serves as the operational data infrastructure, helping leaders to:

- We have real-time data on expense approvals, invoices, and accounts receivable.

- Create audit trails and ensure transparent compliance.

- Monitor DSO, exceptions, and cycle time to make data-driven decisions.

When the data is good enough, leadership is less dependent on personality, and the organization operates more stably.

Conclude

The above is a summary of the nature of leadership styles. In general, leadership styles are tools, not identities. Strong organizations are those where leadership style is supported by processes, data, and technology.

Essentially, leadership style answers three questions:

- Who makes the decisions? (Centralized or decentralized)

- How fast can you make a decision? (speed / decision latency)

- What methods are used to control risk? (people – processes – data)

Therefore, there is no "best" style, only the style that best suits the risks, costs, and level of maturity of the organization at a given time.

Using technology to "package" leadership discipline into processes and data. Bizzi doesn't replace leaders in making decisions, but supports them:

- Standardize the expenditure approval and payment process.

- Create audit trail and real-time data.

- Rapid decision separation – post-control

- Reduce reliance on leadership personality.

To receive personalized solutions tailored specifically to your business, register here: https://bizzi.vn/dang-ky-dung-thu/