Checking input invoices is an important task for every business, especially after applying electronic invoices according to Circular 78/2021/TT-BTC and Decree 123/2020/ND-CP. This process helps businesses check the validity and legality of purchase invoices, serving tax declaration and internal financial management accurately and effectively.

The following article by Bizzi will provide complete information about input invoices as well as introduce ways to look up input invoices of businesses.

What is a business's input invoice lookup?

Before learning how to look up input invoices, you need to understand the nature of the concept of input invoices. Simply put, input invoices are the type of invoices that businesses receive when purchasing goods or services from suppliers.

Electronic invoice (E-invoice) will include invoices with or without tax authority codes, created electronically.

Look up input invoices is the process of checking the information of the invoice that the business receives from supplier, to verify:

- Legality, validity, reasonableness of invoice.

- Invoice status: has it been coded or not, has it been canceled or adjusted?

- Invoice information: invoice number, date, tax code, name of sales unit, value of goods – tax, etc.

Important notes when looking up input invoices

After understanding what an input invoice is, when looking up an input invoice, you need to pay attention to some important things as follows:

| Note | Explain |

| Check tax code | Ensure seller's tax code exists and operates legally. |

| Invoice has been assigned a tax authority code | With electronic invoices with codes, an authentication code is required. |

| Invoice information matches actual transaction | Check product name, amount, date of creation, supplier. |

| Unable to search = risk warning | Invalid invoice may be rejected during tax settlement. |

| Keep all invoices and accompanying documents | To serve audits, tax inspections, debt reconciliation. |

| Do not declare unverified invoices | Avoid being charged withholding VAT. |

Popular methods of looking up input invoices

There are many ways to look up input electronic invoices, the most popular of which are on the General Department of Taxation's Information Portal and through specialized electronic invoice software.

Look up on the General Department of Taxation's Electronic Invoice Portal

Look up information on a specific invoice (no login required): This method helps to quickly check the existence and status of a particular invoice.

- Step 1: Access the link to look up online electronic invoices of the General Department of Taxation: https://hoadondientu.gdt.gov.vn/.

- Step 2: Fill in the search information completely according to the instructions, fields marked with a red * are required. Information includes:

– Seller's tax code: Enter the tax code of the seller issuing the invoice.

– Invoice type: Select the type of invoice to look up (for example: value added tax invoice, sales invoice).

– Invoice symbol: Enter the 6-character invoice symbol (excluding the original invoice type symbol).

– Invoice number: Enter the invoice number to look up.

– Total payment: Enter the total payment amount on the invoice in numbers (required field, except for adjustment invoices).

– Captcha Code: Enter the exact security code displayed on the screen (uppercase or lowercase letters are fine).

– Total tax amount (optional): You can enter the total VAT amount if any on the invoice, or skip it.

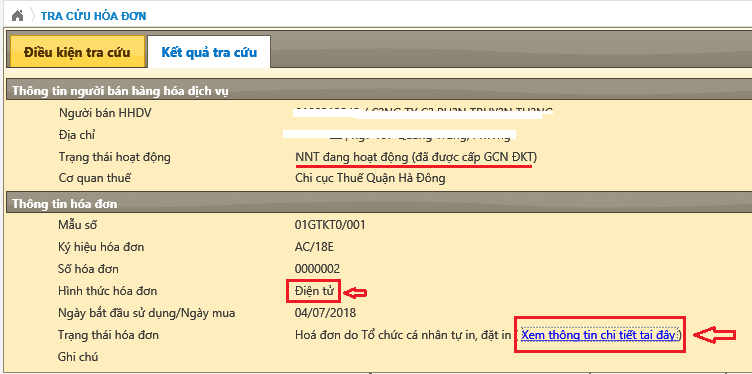

- Step 3: After entering all the information, click on the "Search" button to display the search results:

– If the result shows “Invoice exists with matching information… Invoice processing status: Invoice code issued”, the invoice to be looked up is valid and has been issued a code.

– If the result shows “No invoice with matching information exists…”, you need to check the information entered or contact the seller. It is important to check the invoice status (whether it has been deleted/cancelled, replaced, or adjusted).

Look up list of input invoices by period (login required): This method helps businesses view a list of purchase invoices recorded by the General Department of Taxation's system within a certain period of time.

- Step 1: Visit website https://hoadondientu.gdt.gov.vn/ and proceed Log in according to the account information provided by the tax authority when registering to issue electronic invoices.

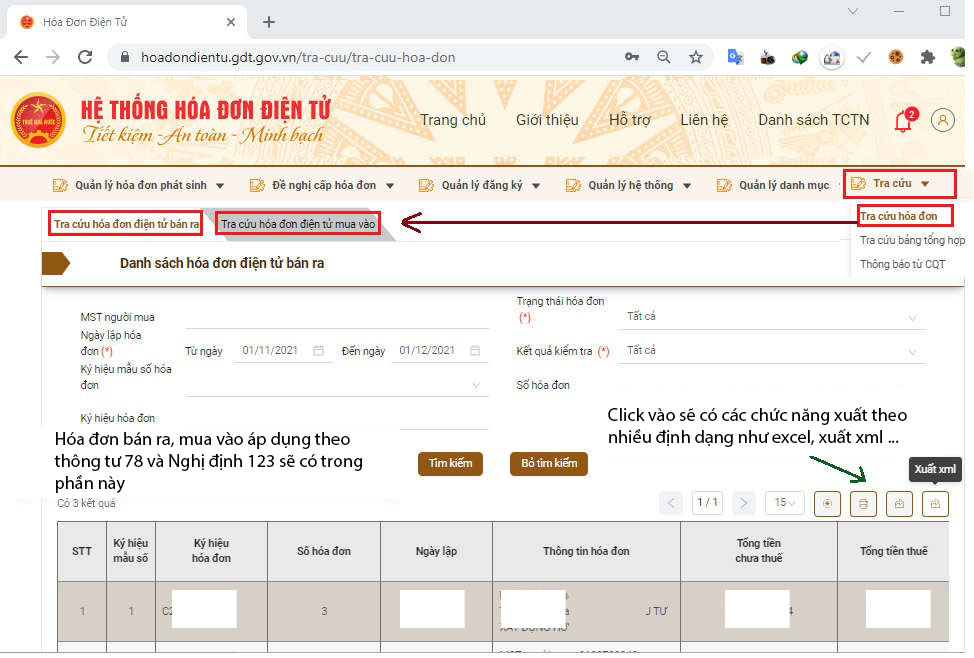

- Step 2: On the menu “Lookup”, select “Invoice lookup”.

- Step 3: At the search screen, select Tab “Look up electronic purchase invoices”.

- Step 4: Enter search criteria according to your purpose:

– Seller's tax code: Enter the tax code of a specific supplier if you only want to look up invoices from that unit. Leave blank if you want to look up all input invoices.

– Invoice status: You can select “All” or specific statuses such as New Invoice, Replaced/Replaced Invoice, Adjusted/Adjusted Invoice, Canceled Invoice.

– Test results: Important: To look up all input invoices (including invoices with and without tax authority codes), you need to look up each value in this field in turn:

“Invoice has been coded”: To look up electronic invoices with codes.

“The General Department of Taxation has received no code”: To look up uncoded electronic invoices (usually applied to specific industries such as electricity, petroleum, banking...).

"The General Department of Taxation has received an invoice with an initialization code from the cash register": To look up invoices from cash registers connected to CQT.

– Invoice date: Select the time period to look up. The system only allows selection within a maximum time period of 31 days. If you need to look up several months, you have to do it multiple times.

– You can choose more Invoice number symbol and Invoice symbol if you want.

- Step 5: Click on "Search" for the system to display the results. View results: The results are displayed in the “Electronic Invoice” and “Invoice with code generated from cash register” tabs. You can view the invoice details by selecting the invoice and clicking “View invoice”.

Data rendering: You can download the list of invoices to your computer as an Excel file (“Invoice”) or download each invoice as an XML file (“Export xml”) for internal storage and reconciliation. The Excel file "List of Invoices" exported from the system helps to synthesize data for quick tax declaration.

- See more about Invoice regulations in Vietnam here

Look up input invoices with Bizzi

Bizzi is the most popular electronic invoice management solution integrated with POS machines. The Bizzi system supports users to automatically fill in invoice information and export it in many formats. Users are flexible and convenient in using and sharing invoice information.

With Bizzi, you can check the validity of electronic invoices using the *.xml file of any electronic invoice provider. The steps to look up electronic invoices on Bizzi's website are specified as follows:

- Step 1: Access the page and Upload electronic invoice informationBizzi e-invoice system (file with extension *.xml to check the validity of the invoice.

Bizzi, you can check the validity of the electronic invoice with the file with the extension *.xml

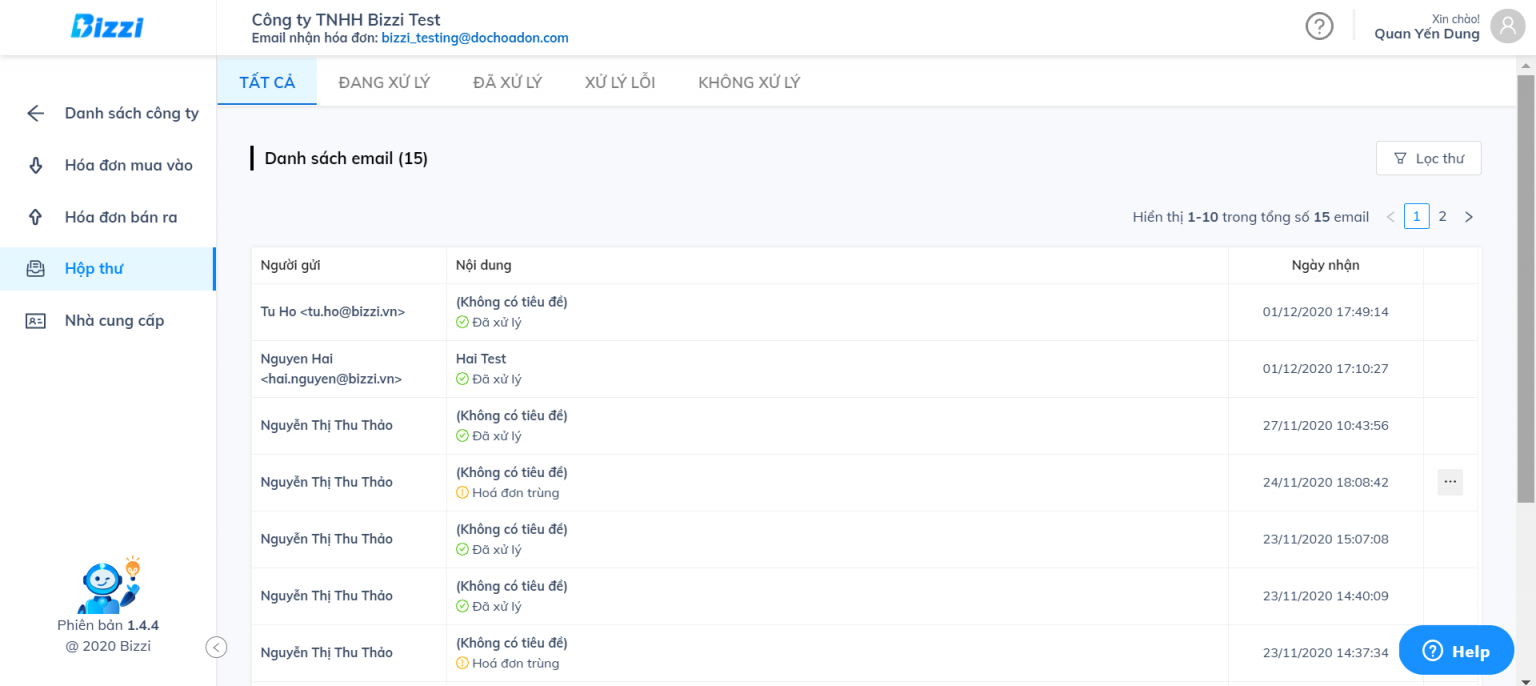

After receiving the invoice information, Bizzi will automatically process it, including reading the invoice, checking the invoice information with the General Department of Taxation, checking the seller information and other related information. The processing time of an electronic invoice will take from 10 to 30 seconds instead of 5 to 10 minutes for manual processing.

After processing Bizzi will notify the user of the invoice status: Processed, Duplicate Invoice, Error Invoice (Unable to download XML invoice, invalid XML file, no lookup information,…)

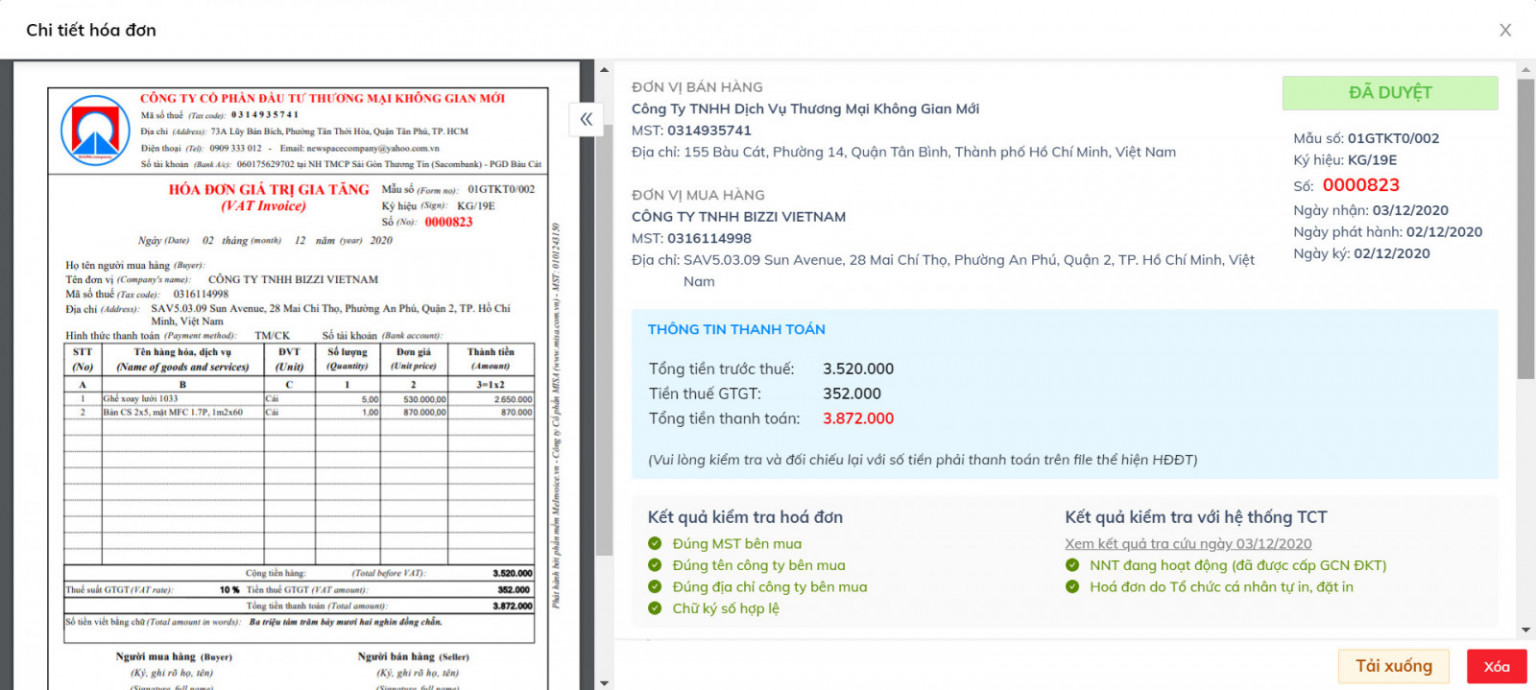

- Step 2: Check invoice information.

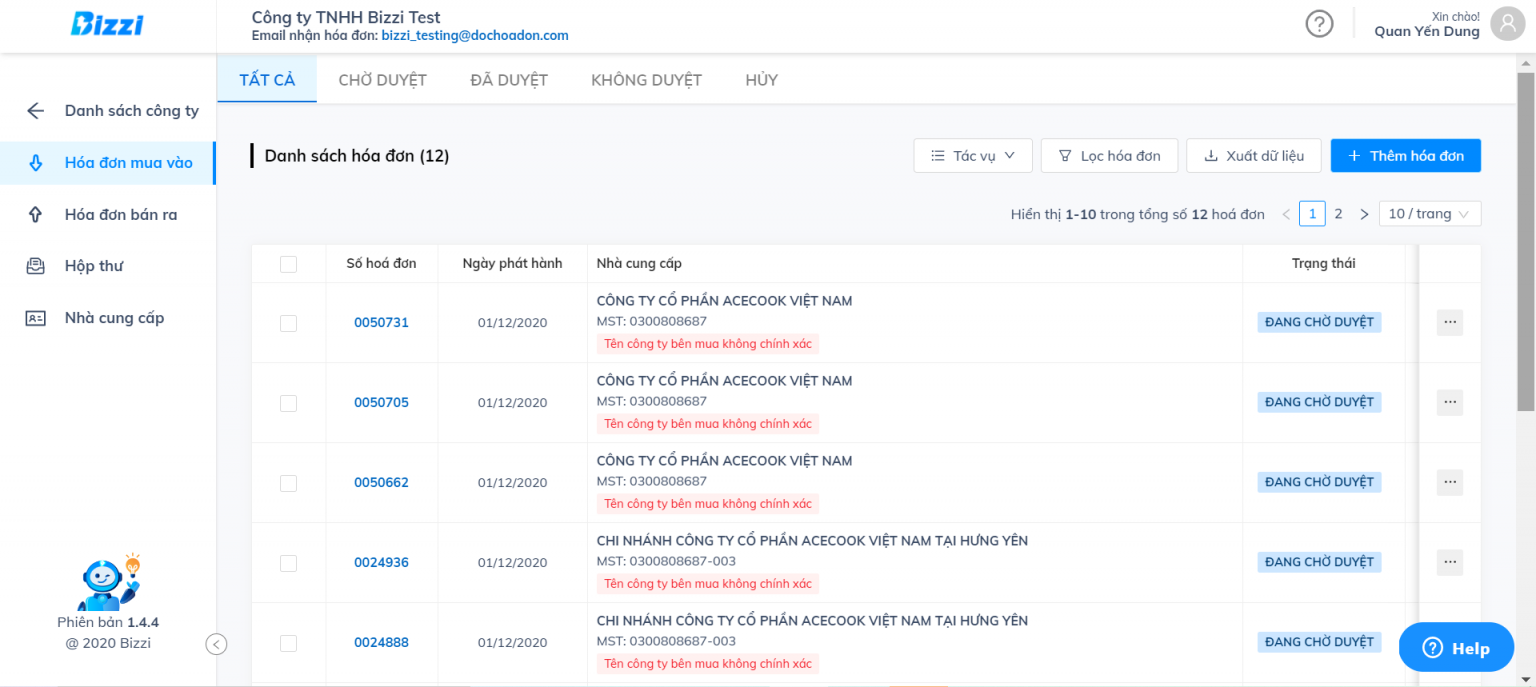

Processed invoices will be automatically pushed to the Purchase Invoice menu. Users can view invoice details by clicking on the invoice number.

– Invoice details:

In addition to checking invoice information, users can also label and attach other information such as contracts, documents, notes, etc. to this invoice.

You can attach other information such as contracts, documents, notes... to the invoice.

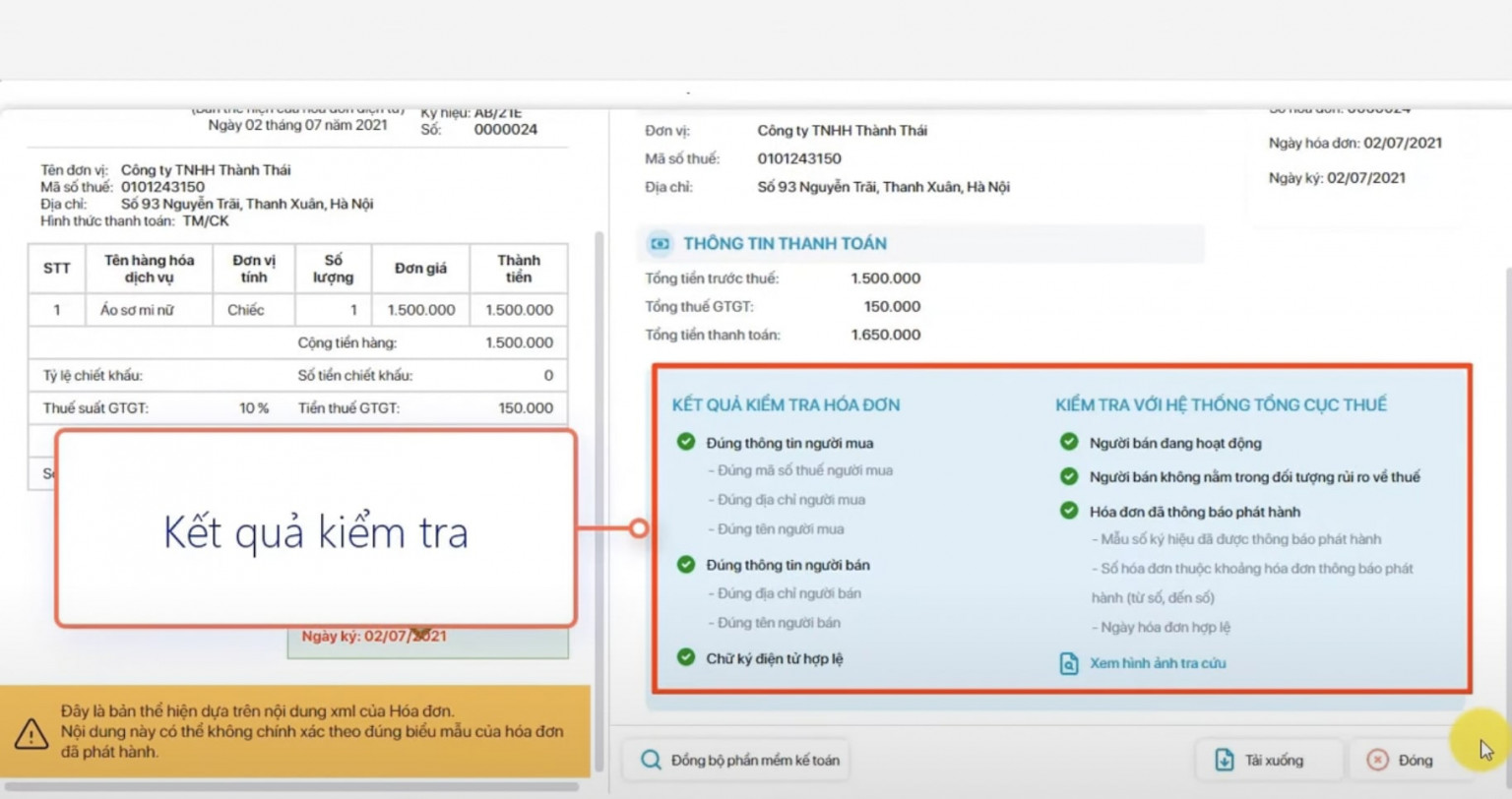

- Step 3: The system returns the invoice check result:

| Invoice check results | Check with the General Department of Taxation system |

| Is the buyer information correct? Buyer's tax identification number, Address of person, Buyer Name

Correct seller information: Seller's address, Seller name Is the electronic signature valid? |

Is the seller active?

Is the seller at tax risk? Has the invoice been announced for release? |

Step 4: Export data.

Invoice information is rendered in popular formats on the market such as MISA, FAST, SmartPro. To export this data file, click the button in the upper right corner of the screen in the Purchase Invoice Menu, then select the format according to your needs.

Formatted options for exporting electronic invoice data on Bizzi

What is the importance of looking up input invoices in corporate financial management?

Checking and controlling input invoices is not only a tax compliance requirement but also an essential part of effective financial management, especially cost management.

Ensure validity for cost accounting and tax declaration: Only valid input invoices can be used to calculate deductible expenses when calculating corporate income tax and deducting input VAT. Check to confirm that invoices have been coded (for invoices with codes) or received by the General Department of Taxation (for invoices without codes), ensuring the legal basis for business expenses.

Detect and handle errors promptly: Through the lookup, businesses can detect invoices with incorrect information, canceled, replaced or adjusted. This helps to promptly handle with suppliers (make a record of cancellation/adjustment/replacement of invoices) to ensure accurate data for accounting and tax purposes.

Support data reconciliation and anomaly screening: Exporting a list of input invoices from the General Department of Taxation system allows businesses to compare them with internal accounting books, expense reports and VAT declarations. This process helps to screen suspicious invoices (for example, purchase invoices that do not actually generate transactions, invoices from suppliers that show signs of tax risks).

Platform for Financial Automation: In Expense Management or Accounts Payable Automation systems like Bizzi.vn, data from incoming invoices is an important input. Manual or automatic invoice lookup and verification (if the system supports integration and lookup) helps the invoice processing, PO Matching, and payment approval process to be more accurate and efficient. Automating this process helps reduce manual data entry, errors, and saves significant time for the accounting department.

What is the impact of errors in input invoice lookup?

Errors in the processing of input invoices can cause serious consequences for businesses in terms of finance, law and reputation. Here are the specific impacts:

VAT not deductible

- Invoice with incorrect information, invalid, not authenticated with tax authority → input tax not deductible.

- Directly affects tax payable, increasing operating costs.

Legal risks, penalties

- Using illegal and inaccurate invoices → businesses may be subject to: Administrative sanctions according to the provisions of Decree 125/2020/ND-CP, Tax arrears, fines and late payment interest.

- Serious cases → may be held criminally liable for using fake invoices or false invoices.

Financial reporting discrepancies – Inaccurate tax declarations

- Entering the wrong invoice value → affects: Cost and profit/loss reports; VAT and corporate income tax declaration.

- Easily leads to expense exclusion and increased tax payable.

Difficulties in auditing and inspection

- Input invoices are missing, incorrect or not stored properly → encounter difficulties when: Internal audit, independent audit or tax inspection by authorities.

- Causes delays and affects the professional image of the business.

Time consuming and labor intensive to reprocess

- Time consuming to contact supplier again to adjust invoice.

- Prepare adjustment/cancellation records and update accounting and management systems.

Disrupts payment processes, affecting cash flow and work performance.

Outstanding advantages of Bizzi in managing and looking up input invoices of enterprises

To limit errors and counterfeiting in the input invoice lookup stage, businesses should consider applying smart invoice processing software like Bizzi because of advantages such as:

- Automatically check invoice validity (tax code, authentication, status).

- Attach invoices to specific transactions, departments, and expenses

- Warning of incorrect, duplicate, and unusual invoices.

- Scientific storage, quick retrieval for testing.

Not only saving time by minimizing administrative procedures, Bizzi also helps the finance department improve performance and optimize costs thanks to the intelligent and automated solution system:

Anti-invoice counterfeiting – Ensuring absolute legality

- Apply multi-layer security technology and connect directly to the General Department of Taxation system.

- Each invoice is authenticated with a unique code, helping to detect and prevent counterfeit and illegally edited invoices.

- The system warns when detecting duplicate invoices or invoices without authentication codes – reducing legal risks in tax declaration.

Fully meet the invoice business requirements as prescribed

- Compatible with Decree 123/2020/ND-CP, Circular 78/2021/TT-BTC and the latest regulations of the Ministry of Finance.

- Support: Issuing, adjusting, replacing, canceling electronic invoices, creating conversion invoices, print lookups, managing output and input invoices, and debts related to invoices.

- Meets both large, medium and small business models with different business needs.

Flexible integration with management systems and sales software

- Multi-platform compatibility, easy to integrate with: Accounting software (MISA, Fast, Bravo...), ERP system (SAP, Odoo, Oracle...), POS software - sales, CRM, internal systems of the enterprise.

- Helps synchronize data automatically, reduces manual input, saves time and limits errors

Conclude

Through the information that Bizzi has provided above, you have gathered knowledge related to what an input invoice is and how to look up electronic invoices quickly and effectively. Input invoices are legal - accounting - tax documents, helping businesses clarify expenses, legalize business transactions, and optimize tax obligations if used correctly.

It can be said that looking up input invoices of a business is the first step to ensure the legality of accounting documents, reduce risks during inspection and improve internal management. Accompanying hundreds of Vietnamese businesses to effectively manage automatic invoices and receive prestigious awards, Bizzi is proud to bring a comprehensive solution to solve the problem of fake invoices.

Don't miss the opportunity to receive free consultation on Bizzi Invoice here:

- Link to register for a trial of Bizzi products: https://bizzi.vn/dang-ky-dung-thu/

- Schedule a demo: https://bizzi.vn/dat-lich-demo/