In accounting, managing asset depreciation costs contributes to the reasonable allocation of assets over periods, avoiding recording large losses in purchasing periods, and creating financial resources to invest in replacing old assets. Let's dig deeper into the above topic to understand why managing fixed asset depreciation costs is an important key for businesses.

What is fixed asset depreciation expense?

Depreciation is the process of systematically calculating and allocating the original cost of fixed assets to business expenses over their useful life. This is the decrease in value of tangible assets (such as property, vehicles, machinery) due to natural wear and tear or technological obsolescence.

In which, fixed asset depreciation cost is the cost that a business uses to gradually allocate the value of a fixed asset over its useful life.

To put it simply: when a business purchases a large asset (for example: machinery, factory, truck, etc.), the value of that asset is not fully recorded as an expense in the purchase period, but is divided into smaller parts and recorded gradually over many periods, called depreciation.

Simple example:

- The business bought a machine at a price 120 million VND, expected usage time 5 years.

- Depreciation by straight-line method → Each year allocates:

120 million ÷ 5 years = 24 million/year - These 24 million are recorded as depreciation costs of fixed assets in the annual financial statements.

Meaning of asset depreciation cost:

- Reflects actual depreciation value of assets over time.

- Contribute to determining the correct profit during the period (if depreciation is not taken into account, profit will be "virtually" higher).

- Help businesses accumulate capital to reinvest or replace assets at the end of their useful life.

- Compliance with accounting and tax regulations (Reasonable depreciation is included in valid expenses when determining taxable income of corporate income tax)

The significance of fixed asset depreciation costs in business cost optimization

The significance of fixed asset depreciation costs in optimizing business costs is very important, because it is not only an accounting number but also directly affects the efficiency of capital use, profits and reinvestment plans.

- Financial implications:

-

- Reflects the depreciation value in money, which is a component of production cost business and product pricing.

- Contribute to the formation of depreciation funds (basic depreciation to regenerate assets and major repair depreciation to maintain and upgrade) for reinvestment, business expansion, increased labor productivity and reduced product costs.

- Accounting meaning:

- Helps reconcile asset costs with revenue generated in the same accounting period, ensuring accuracy and consistency of financial reporting.

- Increase access to loan sources for businesses.

- Tax implications:

- Depreciation is a reasonable expense deductible when calculating corporate income tax (CIT), helping to reduce the tax burden payable.

Popular methods of calculating fixed asset depreciation costs and how to choose the right one to optimize costs

Here is a complete overview of common methods of calculating fixed asset depreciation and how to choose the optimal method for each situation:

- Recipe: Average annual depreciation rate = Original price of fixed assets / Depreciation period.

- Characteristic: Stable annual depreciation rate, easy to calculate and track.

- Fit: For businesses whose revenue generated from fixed assets is stable throughout their useful life.

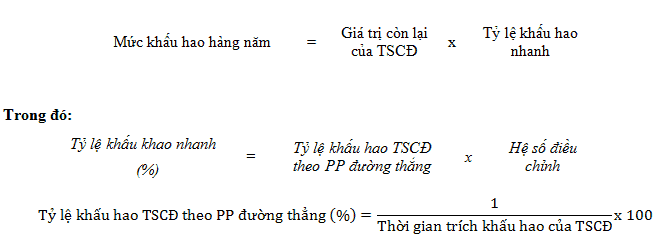

Adjusted declining balance depreciation method:

- Recipe: Annual depreciation rate = Residual value of fixed assets x Accelerated depreciation rate. Accelerated depreciation rate = Straight-line depreciation rate x Adjustment factor (depending on depreciation period).

- Characteristic: Depreciation is higher in the early years and decreases later.

- Fit: For businesses in the technology sector with rapid changes, efficient operations, or for new, unused fixed assets such as machinery and experimental measuring equipment.

Depreciation method based on quantity and volume of products:

- Recipe: Monthly/annual depreciation rate = Number of products produced in the month/year x Average depreciation rate calculated for 1 product unit. Average rate = Original price of fixed assets / Output according to designed capacity.

- Characteristic: Accurately reflects the level of usage of fixed assets.

- Fit: For fixed assets directly related to production activities, it is possible to determine the total volume/quantity of products produced and the actual capacity used is not lower than 100% of the design capacity.

Choose the optimal method:

Enterprises need to base on expected revenue and expenses, as well as the characteristics of assets and fields of operation to choose the appropriate method of calculating asset depreciation costs, while complying with the appropriate principles in accounting. Specifically as follows:

| Business goals | Appropriate method | Reason |

| Stable profits, easy to plan | Straight line | Steady costs, little fluctuation in profits |

| Tax optimization, fast capital recovery | Decreasing balance or Total years of use | High costs at the beginning → early tax reduction |

| Accurate reflection of output | By output | Variable cost according to performance, cost optimization |

| Businesses with assets that are prone to obsolescence | Rapid depreciation | Avoid "holding" assets when they are no longer of use. |

Bizzi – A solution to optimize asset depreciation cost management in particular and business costs in general

To optimize business costs, including costs related to fixed assets (FA) and depreciation management, the application of technological solutions, especially cost management software is very necessary.

Rethinking the landscape of fixed asset cost and depreciation management

Depreciation of fixed assets (FA) is an important element in the financial management and accounting of enterprises. Depreciation helps to systematically allocate the original cost of assets to business expenses during the period of use, and is considered a reasonable expense deducted from taxable income, thereby reducing the tax burden.

Not only ensuring the appropriate principles in accounting, depreciation also creates a basis for enterprises to recover initial investment costs, and at the same time plan for reinvestment and major repairs. Through the depreciation fund, enterprises have resources to regenerate all fixed assets, maintain and upgrade existing assets to meet long-term production and business requirements.

In fact, many systems Enterprise Resource Planning (ERP) has built-in Finance - Accounting module with fixed asset management function and automatic depreciation calculation. This not only helps accountants reduce manual work but also provides accurate and consistent data for cost management and financial planning.

Enterprise solution to support cost optimization and indirect support in asset depreciation cost management – Bizzi

Bizzi.vn is a technology platform specializing in digitizing and automating financial - accounting - cost management processes in businesses. Although not a software specializing in calculating fixed asset depreciation, Bizzi still plays a role as indirect but important support tool, helping businesses optimize costs, increase operational efficiency and have accurate financial data to make investment and reinvestment decisions.

Notable solutions include:

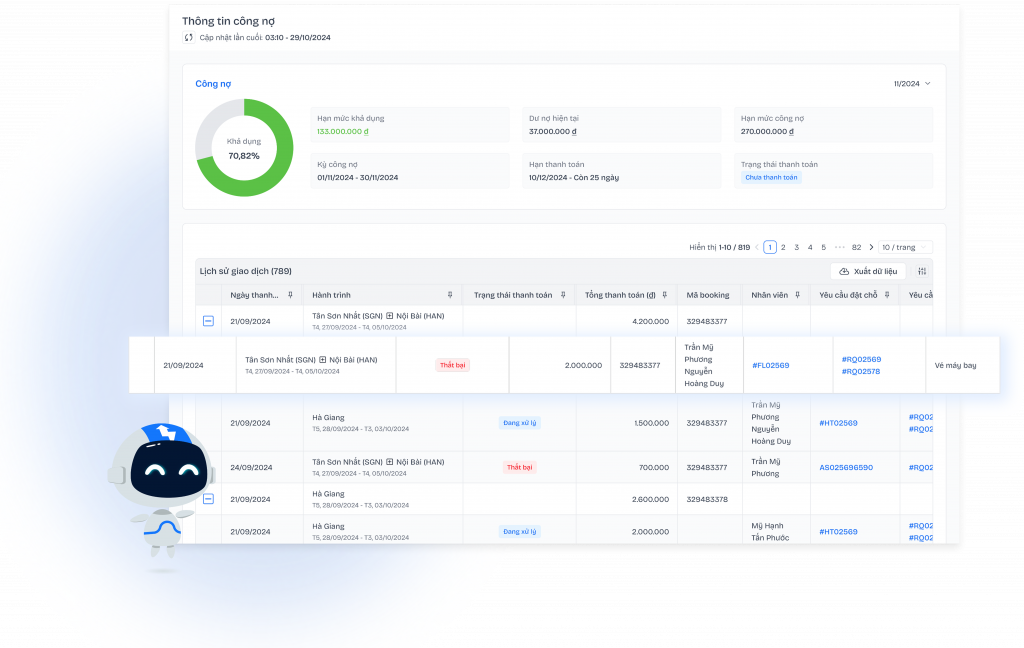

- Bizzi Expense: expense/cost management – from recording invoices, classifying expenses, approving expenses, comparing budget vs actual expenses.

- Automate input invoices (Bizzi IPA) – receive, process, compare, store electronic invoices, reduce manual data entry, reduce errors.

- Business management cost report - has standard form, has clear expense tracking, budget, and cost classification.

Although it is not a specialized fixed asset depreciation software (i.e. it does not directly calculate depreciation prices, methods, useful life, depreciation by balance...), Bizzi is a tool that helps businesses automate all operations related to financial management, and is a powerful assistant for modern accounting:

- Financial Automation Focus: Bizzi.vn is a specialized financial automation platform with a deep focus on streamlining and automating financial back-office operations such as input invoice processing, cost management and debt control. Although Bizzi.vn does not have direct modules to calculate fixed asset depreciation like a comprehensive ERP system, its functions can contribute significantly to optimizing the overall costs of the business.

- Through integration, Bizzi.vn can help Synchronize cost and budget dataThis indirectly supports businesses in having a more comprehensive and accurate view of their financial situation, creating a solid foundation for making decisions related to investment and asset depreciation effectively.

- Manage expenses effectively with Bizzi Expense: Bizzi Expense offers features that help businesses Set up budgets by department/project and monitor spending against budget in real time, and alerts when overspending. The system also has an automated and flexible spending approval process. This efficient management and control of operational spending helps businesses minimize waste and optimize cash flow, creating better resources to reinvest in fixed assets when they are fully depreciated and need to be replaced or upgraded. Bizzi Expense also claims to help businesses save up to 80% in costs compared to other solutions.

- Automate input invoice processing: Bizzi.vn uses RPA and AI technology to automatically download, check and reconcile invoices with purchase orders (POs) and warehouse receipts (GRs) in real-time, detect discrepancies and verify valid suppliers. This helps Significantly reduces manual processing time and costs, while minimizing errors. Reducing administrative costs and ensuring the accuracy of input data is an important factor in managing the overall costs of the enterprise, which may include costs related to the purchase, maintenance and operation of fixed assets, thereby indirectly affecting the effectiveness of depreciation cost management.

With the above effective support, Bizzi has solved difficult problems in businesses related to the shortage of human resources, time constraints and difficulty in controlling costs in general, and asset depreciation costs in particular.

Conclude

Managing fixed asset depreciation costs accurately and effectively is key to helping businesses optimize financial operations, ensure legal compliance, and create a solid foundation for development.

With the above methods of calculating asset depreciation costs, if you are a new business or want to optimize taxes, you should choose accelerated depreciation (decreasing balance or total number of years) to reduce tax pressure and optimize initial cash flow. If the business is stable and wants to have a "beautiful" financial report, choose a straight line to keep profits stable. If your industry has a lot of fluctuating output, use output to reflect the exact cost.

In addition, applying technology solutions such as Bizzi.vn will be a smart choice to automate and streamline financial processes, thereby improving productivity and cost management efficiency for businesses. For more detailed advice on suitable solutions for businesses, register here to schedule a demo: https://bizzi.vn/dat-lich-demo/