Circular 99/2025/TT-BTC not only changes the form form accounting documentsThis forces businesses to review their entire process of creating, signing, storing, and verifying documents in the context of digitalization. For CFOs, this is no longer a matter of "downloading and using forms," but a time for effective management. Accounting document templates according to Circular 99 as a series of data points for controlling risks, costs, and legal liabilities.

What are the accounting document templates according to Circular 99/2025/TT-BTC and why should CFOs be concerned?

The accounting document templates under Circular 99/2025/TT-BTC are a system of 33 standard forms issued by the Ministry of Finance, applicable from January 1, 2026, used to record, control, and substantiate economic transactions arising in accordance with the Accounting Law.

From a CFO's perspective, accounting documents are not simply "forms to fill out," but rather legal evidence confirming responsibility, cash flow, and management decisions. Every business transaction follows a logical chain: transaction occurs → document → accounting → reporting. If the document is incorrect, the entire subsequent chain, even if compliant with standards, still carries the risk of being rejected during inspections or audits.

Circular 99 clarifies the role of documents in the internal control system, directly linking them to the personal responsibility of the preparer, approver, and legal representative. This is why CFOs need to approach the Circular 99 2025 TT-BTC forms as input data for financial control, not as administrative paperwork.

From an implementation perspective, Bizzi helps CFOs identify which documents require high-risk control (cash disbursements, inventory receipts, expense allocation), thereby standardizing them from the outset into digital data with clear metadata and approval flows, instead of processing them manually at the end of the period.

Circular 99/2025/TT-BTC specifies how many accounting document forms there are and how they are classified.

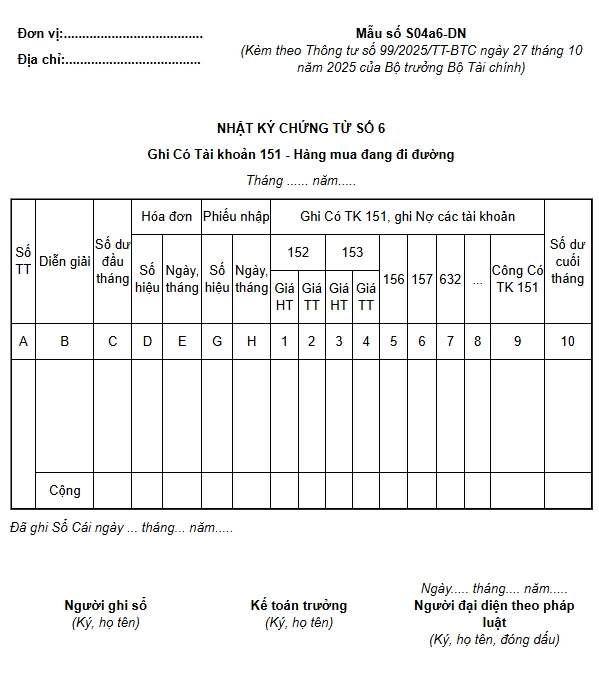

Circular 99/2025/TT-BTC promulgates 33 accounting document templates, divided into 5 groups of transactions: Labor - wages, Inventory, Sales, Currency, and Fixed assets.

A key point for CFOs to note is that the classification logic of Circular 99/2025/TT-BTC no longer follows purely accounting principles but closely reflects the actual business transaction chain. This directly impacts how the documents are applied:

- internal process organization

- Methods for controlling risks that arise before accounting.

- and how to compile data for management reports.

For example, consider the same purchasing operation:

- Accountants often only focus on invoices.

- However, with the accounting document template according to Circular 99, the CFO must ensure sufficient control: purchase request → approval → inventory receipt → reconciliation → payment

If documentation is missing or used incorrectly at any stage, the risks are not just "wrong form," but:

- Expenses that lack sufficient justification

- Individual responsibility cannot be traced.

- and difficult to defend against tax audits.

Unlike articles that simply list 33 templates, CFOs should approach Circular 99/2025/TT-BTC as a risk control map by business operation. Each group of documents corresponds to a control chain (P2P, O2C, Payroll, Asset), and each chain needs to have clearly defined responsibilities. Bizzi assists CFOs in attaching each accounting document template according to Circular 99 to the correct business module, thereby tracking document status by cash flow and expenses, instead of by individual files.

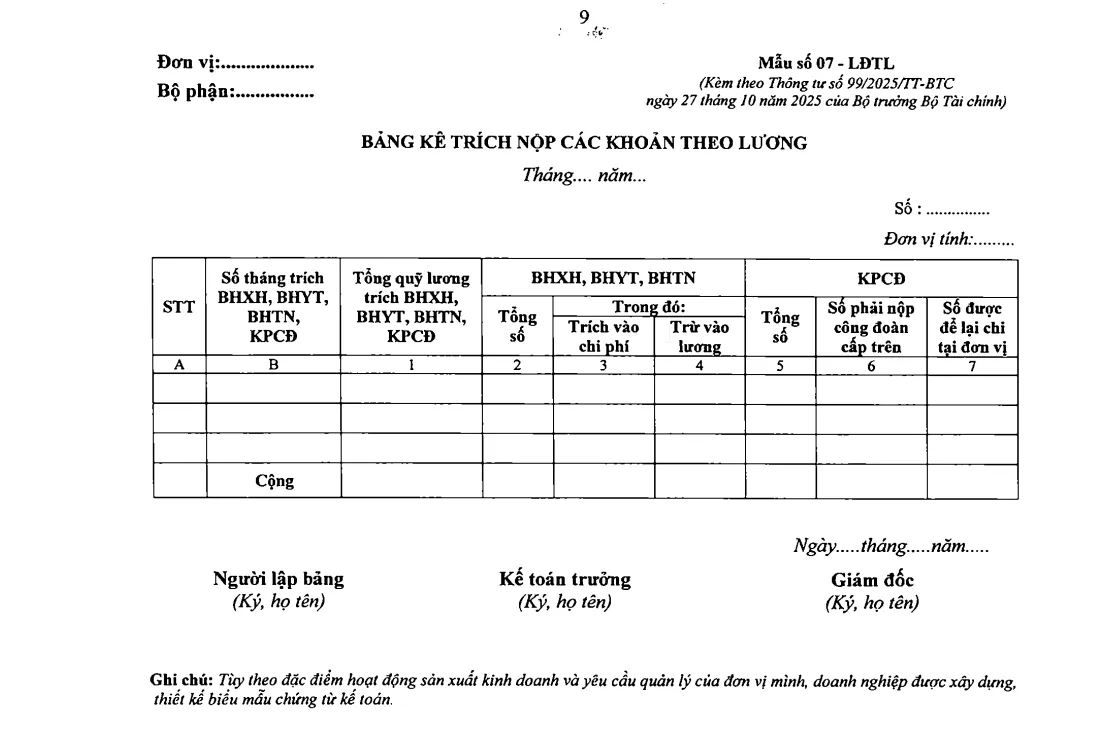

In what cases are the Labor and Wage documents in Circular 99 used?

The Labor and Payroll documentation group is used to record transactions related to recruitment, timekeeping, payroll calculation, bonuses, outsourcing, and allocation of personnel costs.

Typical examples include employment contracts, time sheets, payroll records, and payroll cost allocation sheets. For CFOs, the allocation sheet not only serves accounting purposes but also provides input for FP&A, helping to analyze personnel costs by department, project, or product. The payroll allocation formula, seemingly simple, directly impacts profit margins and management KPIs.

Bizzi allows HR-related expenses to be recorded and allocated in real time, rather than being processed at the end of the month. This helps CFOs see the HR cost picture earlier and make timely adjustments.

What risks does the Inventory Documentation Group under Circular 99 help CFOs control?

Inventory documents under Circular 99 help control the import, export, and inventory of materials, and also serve as a basis for comparison with invoices and payments to avoid cost discrepancies.

Documents such as warehouse receipts, warehouse delivery notes, and inspection reports are links in the tripartite reconciliation mechanism (PO – receipt – invoice). If one link is missing, the expense may be disallowed during tax settlement or disputes may arise with the supplier.

Bizzi automatically reads invoices and compares them with inventory documents, alerting to discrepancies at the time they occur, helping CFOs control risks before money leaves the business.

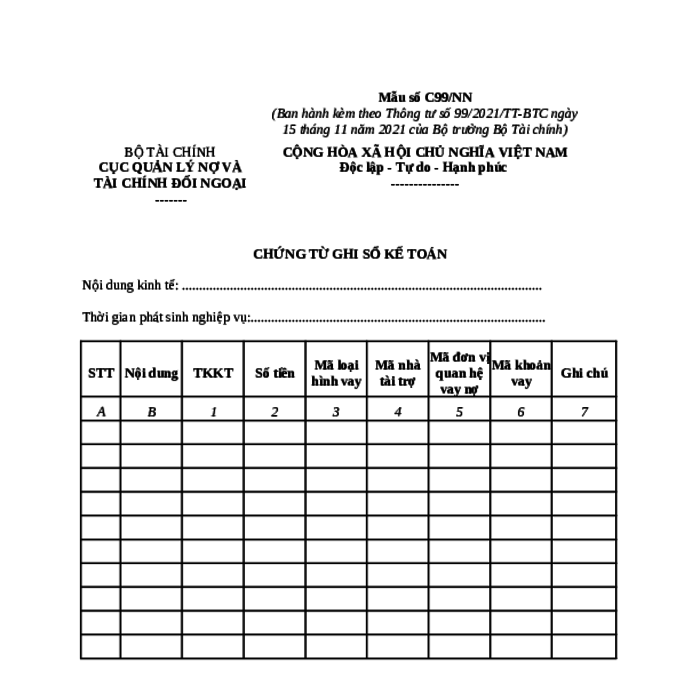

How do monetary documents under Circular 99 control internal cash flows?

The group of monetary documents in Circular 99 is used to control revenue, expenditure, advance payments, and settlements, ensuring that all cash inflows and outflows are justified and approved by the appropriate authority.

In reality, internal fraud and financial losses under the 80% scheme all stem from monetary transactions: prolonged advances, misuse of funds, duplicate payments, or overspending with later documentation to legitimize expenditures.The accounting documents in Circular 99 belonging to the monetary category (payment vouchers, advance payment requests, payment requests, etc.) are pre-accounting control points, not post-accounting audit procedures.

If the CFO only controls the ledger or end-of-period reports, then: money has already been spent, risks have already occurred, and the documentation only serves as "formalization".

The key point of Circular 99/2025/TT-BTC's form is that it allows businesses to design approval flows based on limits, budgets, and expenditure purposes, provided they are clearly stipulated in the accounting regulations.

Bizzi assists the CFO:

- Linking monetary documents to the budget in real-time.

- Separate control of the proposer – approver – implementer (SoD).

- Maintain a complete approval record to protect against personal liability.

As a result, the accounting document template under Circular 99 is no longer just a "request for money," but a tool for controlling strategic cash flow.

How does the Fixed Asset Documentation group under Circular 99 cover the entire asset lifecycle?

According to Circular 99, fixed asset documentation covers the entire asset lifecycle, from recognition, use, repair to disposal.

Receipts, reassessments, and liquidation records are mandatory documents during audits and tax settlements. CFOs need to ensure that all documents related to Capex are consistently stored over the years.

Bizzi allows for the storage of complete fixed asset records along with associated costs and data connectivity to management reports, helping CFOs track investment performance over time.

Are businesses required to use the exact document templates as stipulated in Circular 99?

Businesses are not required to use the exact same template, but if modifications are made, they must issue accounting regulations and ensure compliance with the Accounting Law.

For CFOs, accounting regulations are not just a legal formality but a "shield" protecting personal liability during audits. Bizzi supports tracking approvals and signing authority, creating a comprehensive audit trail for businesses to demonstrate compliance.

Strategy for digitizing and archiving documents under Circular 99 for 10 years for businesses.

Businesses can digitize all documents according to Circular 99 by switching from paper-based to controlled electronic storage, which helps reduce costs and increase traceability.

A common mistake many businesses make when applying accounting document templates according to Circular 99 is:

- Scan documents to PDF

- Save to Google Drive / server

- To consider that as "digitalization"

For the CFO, this approach fails to address three core issues:

- Documents not found by transaction type (only search by file name)

- The approval and accountability flow cannot be traced.

- Unable to connect documents with expense data – KPIs – management reports.

Meanwhile, Circular 99/2025/TT-BTC requires a minimum retention period of 10 years and must ensure integrity and accessibility during inspections.

A proper strategy involves converting documents from "files" to "data," in which:

- Each document has metadata (transaction, department, project, tax code, accounting period).

- Each approval step has a timestamp and a responsible person.

- Each document is directly linked to cash flow, expenses, or assets.

Bizzi enabled the CFO to implement this strategy by:

- Attach the accounting document template according to Circular 99 right at the point where the transaction occurs.

- Controlled cloud storage

- Instant access to multi-dimensional data when needed for audits or management analysis.

Frequently Asked Questions (FAQ) regarding accounting document templates according to Circular 99

- How many accounting document templates are included in Circular 99?

Circular 99/2025/TT-BTC There is no fixed number of accounting document templates., which issued framework of formsBusinesses are allowed to redesign the document template, provided that all required information fields are included as per regulations.

For the CFO, the important thing isn't "how many samples," but that... How many variations are businesses using for the same type of operation?In practice, audits show that the more different internal forms there are for the same transaction (e.g., inventory receipt, payment request), the higher the risk of data discrepancies and fraud. Therefore, when applying the forms in Circular 99/2025/TT-BTC, CFOs should standardize them accordingly. The principle of one business process – one core template., then digitize to avoid the creation of "unofficial versions".

- Is it necessary to print internal documents after they have been digitally signed?

In accordance with the spirit of Circular 99, Electronic documents with valid digital signatures do not need to be printed on paper.However, many businesses still print documents out of habit or because they lack confidence in their existing record-keeping systems.

From a management perspective, the CFO needs to clearly distinguish between:

- Printing documents just for "peace of mind" doesn't add any value to the control mechanisms.

- Important is Electronic documents must ensure data integrity, be unalterable after signing, and have a traceable approval history..

If a business hasn't digitized its approval process and is still relying on scan-and-sign documents, the risk remains whether printed or not. Implementing accounting document templates according to Circular 99 on a digital platform helps CFOs reduce their reliance on paper documents while still meeting legal and audit requirements.

- Will amending the warehouse receipt result in the expense being disallowed?

Amending the Warehouse Receipt This does not automatically result in the expense being disallowed.However, it would become a major risk if:

- Make corrections directly on the original document without creating an adjustment document.

- Do not save the change history.

- No valid approval

In practice, during tax audits, expenses are often disallowed. It's not because of an incorrect document template.because loss of audit trailCircular 99 requires businesses to have a clear mechanism for adjusting and supplementing documents. For the CFO, what needs to be controlled is: who has the right to make corrections, when to make them, how to make them, and whether the data before and after can still be compared.

- How long are electronic documents considered valid for storage?

According to current regulations, Accounting documents must be retained for a minimum of 10 years.This applies to both paper and electronic documents within the accounting document template system as stipulated in Circular 99.

However, the common problem CFOs face isn't "how long," but rather:

- After 3–5 years, Is the data still readable?

- Are the documents properly formatted when required by an audit or inspection?

- Guaranteed digital signature Is it still legally valid?

Therefore, archiving is not just about "keeping files," but about Preserving the ability to verify and reconcile data throughout the accounting lifecycle..

- How are internal documents different from electronic invoices?

This is a very common mistake when businesses implement the Circular 99/2025/TT-BTC form.

- Electronic invoices are legal documents for external parties and are directly managed by the tax authorities.

- Internal documents (payment vouchers, warehouse receipts, payment requests, etc.) are internal control tools used for accounting and management.

CFOs need to understand that valid invoices cannot replace internal documentation. Without complete internal documentation, businesses can still incorrectly record expenses, use the wrong period, or fail to control fraud, even if the invoices are perfectly legal.

- When is the CFO held personally responsible?

According to the Accounting Law and related regulations, the CFO may be held personally liable when:

- Establishing a documentation system that does not comply with Circular 99.

- Allows recording expenses based on invalid documents.

- The ability to modify/delete documents is not controlled.

The key point is: the CFO doesn't need to sign every single document, but must demonstrate that the company's accounting document system, based on Circular 99, is controlled, has authorization, and is traceable. If that system doesn't exist or is merely a formality, the risk of personal liability is very real.

- Is it possible to integrate documents into the FP&A system?

It is entirely possible, and this is precisely the trend in modern management. When documents are standardized according to Circular 99 and properly digitized, the data generated from these documents can become input data for FP&A.

This allows the CFO to:

- Real-time cost analysis

- Comparison of budget – actual expenditure – forecast

- Detect discrepancies right from the documentation stage, instead of waiting until the closing date.

Conversely, if the documents remain scattered in Excel files, PDFs, or on paper, the FP&A is merely a "post-audit report," losing its early warning value.

Conclude

Application Accounting document templates according to Circular 99 and system Circular No. 99/2025/TT-BTC Form This isn't simply about updating to new legal regulations; it's a crucial shift in how businesses organize financial data, control costs, and mitigate risks for CFOs. If businesses only resort to downloading templates, editing Excel files, and storing them haphazardly, it will be very difficult to ensure consistency, traceability, and long-term audit readiness.

In this context, document digitization and digitalization solutions are becoming increasingly important. Electronic invoice It has become the "backbone" of the modern accounting system. Bizzi plays a role as a Pre-control layer before accounting and ERP systemsThis helps businesses centrally manage electronic invoices, reconcile data with internal documents, and ensure that all expenses have valid documentation from the outset. When electronic invoices are received, checked, and closely linked with documents according to Circular 99, accountants no longer waste time manually correcting errors, and CFOs gain transparent data for decision-making.

More importantly, Bizzi doesn't just provide support. accounting operationsFurthermore, it helps upgrade the role of the finance department from "recording" to "controlling and analyzing." Standardized invoice and document data can serve management reporting, cash flow forecasting, and connect with FP&A activities, instead of just being used for closing the books at the end of the period. This is a key factor in helping businesses sustainably implement Circular 99/2025, reducing pressure on accountants and protecting the long-term management responsibility of the CFO.

- To receive advice and experience the features of Bizzi's solution suite, register for a demo appointment here: https://bizzi.vn/dang-ky-dung-thu/